by California Casualty | Homeowners Insurance Info |

Looking for affordable Homeowner’s or Renter’s Insurance, but don’t know where to start?

We sat down with California Casualty Sales Team Manager Mike D. and found out all of the important questions you should be asking when you call your agent for a quote.

1. Is homeowner’s insurance required?

If you have a home mortgage, then maintaining homeowner’s insurance is generally a requirement of your loan agreement. Even if you own your home outright, it’s recommended that you protect your equity in the home by maintaining homeowner’s insurance.

2. How are homeowner’s insurance rates calculated?

While there’s no way to predict the future, home insurance providers do their best to charge a rate that’s based on both the coverage limits and the likelihood of future losses occurring.

They may consider things such as previous loss history for both the homeowner and the actual home or surrounding area, the physical characteristics of the home, the age of some critical components of the home such as the roof, plumbing, and electrical systems, and even the types of weather activity in the area.

3. What is the dwelling coverage limit and how is it calculated?

One of the most critical coverages on your policy is the Dwelling Coverage. This is the maximum amount of money your insurance provider will pay to rebuild your house. Especially in periods of economic inflation and building supply or labor shortages, the true rebuild cost of your home may be substantially higher than the market value and even much higher than the cost of building a new house on an empty lot.

If your insurance provider hasn’t recalculated the cost to rebuild your home recently, then you may be at risk of running out of coverage if you experience a total loss.

California Casualty is committed to providing policies that will truly indemnify our group members after a loss. When you speak with a California Casualty agent, he or she will have a conversation with you about the details of your home’s construction to ensure your home is protected.

4. What’s the difference between replacement cost and actual cash value?

Some components of the structure of your home and all of your Personal Property within it may be covered for either Actual Cash Value or Replacement Cost at the time of a loss.

For example, if you own a refrigerator that’s now 10 years old that originally cost $1,500 when it was new, the current market value of your fridge may now only be $500. A policy that insures your Personal Property for Actual Cash Value would only pay you $500 if your fridge is destroyed by a covered loss.

However, a policy that insures your Personal Property for Replacement Cost would pay the full amount required to replace the fridge with a reasonably equivalent new fridge.

5. What is liability coverage?

Personal liability coverage on a home insurance policy pays for damages and legal defense if you’re legally responsible for injuries to others or damage to their property. It generally follows the insured when they’re both at and away from their home.

6. When do I need an umbrella policy?

An umbrella policy provides additional personal liability insurance that starts to pay after your underlying limits of liability on your home insurance policy have been exhausted after a covered loss.

While there’s no way to know for sure how much liability coverage you may need, understanding what you stand to lose is a good place to start. If you’re being sued, it’s possible that equity in your home, your personal savings, and your income may be at risk. If the value of two years of your annual income, the equity in your home, and your savings exceed the liability limits on your auto or home insurance policies, then you should consider an umbrella policy to protect your net worth.

7. What should I set my deductible at?

There’s no single right answer. Generally, the higher your deductible, the lower the cost of your insurance premium. Since the deductible is the amount your insurance provider will subtract from an insurance payout, you’ll have to select a deductible that you’re comfortable paying out-of-pocket after a loss.

There can be diminishing returns if you set your deductible much higher than average, so as a consumer, you need to balance the premium savings against the amount you’d be required to pay after a loss.

8. What are endorsements, and how do they affect my policy?

Endorsements modify your coverage, meaning they may increase or decrease your coverage. They may also remove restrictions to your coverage or add restrictions to your coverage.

For example, at California Casualty we provide coverage enhancements to our group members that are tailored to their needs based on occupation or professional association. However, some companies only offer a standard suite of options for home insurance commodifying the product.

9. Is homeowner’s insurance tax-deductible?

Home insurance is not tax-deductible on your primary dwelling. However, home insurance may be tax-deductible for rental properties.

10. What natural disasters does homeowner’s insurance typically not cover?

Some of the more notable natural disasters that homeowner’s insurance typically does not cover include flood and earth movement (for example earthquakes, landslides, mudslides, etc.). Typically flood and earth movement must be added independently.

11. Do I need flood insurance? Do I need earthquake insurance?

Flood Insurance may be required depending on the requirements of your home mortgage. Earthquake Insurance isn’t generally required but is recommended if you live in an area where earth movement is more prevalent.

12. Do I need extra coverage for my home-based business?

Most home insurance policies have restrictions for losses related to a home-based business. It’s important to speak with your agent about the nature of your business in order for them to determine what coverage options are available.

13. Should I increase my coverage when I make updates to my house?

Generally, home updates increase the rebuild cost of your home. Since it’s the job of the insurance provider to have enough coverage to rebuild your home after a total loss, you should discuss anything that may increase the rebuild cost of your home with your home insurance agent.

14. What’s the easiest way to reduce my monthly premium?

Keep in mind that in some cases the premium is inversely related to the quality of service and coverage you can expect to receive from an insurance provider. With that being said, the easiest way to reduce your monthly home insurance premium is generally to increase your deductible. But as mentioned above, there may be diminishing returns on premium reduction, the higher you go with your deductible.

15. Am I eligible for any discounts?

It’s rare that a customer and their home would be ineligible for all discounts. If you’re eligible for a discount, then your agent should have proactively explored those options with you to provide you with the best price possible from your first day as a customer. Talk to your agent and ask what discounts you may qualify for.

If your agent confirms that you’re receiving all discounts available, but you still feel that your insurance rates are too high, reach out to California Casualty to see if you can get more for your money with your policy.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info |

Who doesn’t love a sunny day? …But when those beautiful rays shine down on your home, you might not love what happens; from faded furniture to deteriorating roof shingles, the sun’s ultraviolet (UV) rays can cause quite a bit of damage over time.

UV rays happen even on a cloudy day, and just as we wear sunscreen to protect our skin, we need to take action to protect our homes.

Here’s what you can do.

Use window shades.

Regular window glass only blocks a portion of those damaging UV rays. Using window shades can help. Invest in solar shades designed to block UV rays and still let in light. These shades are rated by percentage in terms of how much light they block. A 1% shade has a tighter weave and blocks 99% of UV rays. By contrast, a 14% shade blocks just 86%.

Apply window films.

Whether or not you use window shades, you can protect your home from light with window films. These translucent vinyl or polyester strips will cling to window glass, and chances are you won’t even notice them. Plus, they can block 99 percent of UV rays! You can get them professionally installed or do it yourself (DIY). Just know that over time, these films might become scratched or damaged and will need to be replaced.

Replace your window screens.

You may have window screens that are there to prevent bugs from entering your home. Replace them with ones that also block or filter harmful UV rays. That way, if you open a window, the screen is there as a barrier.

Install tinted windows.

A more expensive option is to replace your window glass with low emissivity (low-e) glass. This type of glass protects against UV rays due to its special coating. It also helps insulate your home so your rooms stay warmer in winter and cooler in summer.

Rearrange your furniture. Cover your floors.

A little redecorating can help to protect your furniture and floors. If your couch is in the direct path of sunlight from the window, consider moving it to a shadier spot. Try a slipcover, which can be more easily replaced than a couch when it fades. Similarly, you can cover sunny spots on the floor with area rugs and replace them as needed.

Choose the right fabrics and colors.

Lighter colors show the effects of fading less than darker ones, especially on those outdoor furniture cushions. Some fabrics also wear better. When choosing furniture or fabrics for your home, look for synthetic blends. Nylon and polyester will fade more slowly than cotton.

Spray your furniture and treat your floors.

Hardwood is very sensitive to sunlight but may be treated with stains and finishes that have UV protection. For furniture, consider UV protection sprays. Reapply every 6 months or so. If you have leather furniture, you can apply a leather conditioner to help prevent fading and cracking. You can treat your furniture and floors even after fading begins. It won’t take the fading away but it will help slow the process for the future.

Protect your artwork.

Artwork and photos also can fade over time. Canvases may be treated with UV protection sprays. For framed art, replace the glass with UV-blocking acrylic or the pricier museum-grade glass.

Protect your siding.

Older house siding can actually melt or warp when windows from your neighbor’s home focus sunlight on a small portion of your home’s siding. Protect against this by planting trees and shrubs, which also add more shade to your landscape. You can also buy products that put a coating on your siding to help protect it. If you’re ready to redo your siding, choose one that reflects harmful UV rays away from your home. Not only will it help prevent fading, but it will also keep your home cooler.

Repaint with UV-resistant products.

The paint or stain on your deck, front door, and shutters can fade over time. Repaint using a product that helps resist UV exposure. Check with your local home improvement or hardware store for options.

Treat your roof.

The sun’s rays beat down on your roof, causing shingles to deteriorate. Over time, UV rays dry out the natural oils in your asphalt shingles, and can even crack or weaken the roof underneath. To protect against this, there are special coatings that you can apply. Get a professional to do it if you’re not comfortable working on your roof. The coating will create a waterproof barrier to reflect light, draw heat away and keep the surface cooler. Such coatings generally last about 10 years.

Your home is your greatest investment. Review the impact UV rays are making as part of your regular summer home maintenance. Protect your home with the right homeowner’s insurance, and you’ll continue to enjoy it for years to come.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Homeowners Insurance Info, Safety |

Summertime was made for fun-from beach vacations to family barbecues, road trips, and dips in the pool. But unfortunately, sometimes during all that fun, there’s a mishap or two….

Make sure that your home and property are fully protected in case anything happens. Use this guide as a reference on how to insure yourself and your family for summer fun.

Swimming Pools

Your swimming pool is probably covered under your homeowner’s policy. That being said, you’ll want to make sure that you have enough to cover the following situations.

If someone is hurt or drowns in your pool, you are responsible. It doesn’t matter whether or not you gave them permission to swim. Your personal liability coverage is designed to cover these instances. Typical homeowner’s policies carry $100,000 of liability protection. If you have a swimming pool, you need considerably more. Experts suggest either increasing your personal liability (with the maximum being $500,000 or $1,000,000 depending upon the state) or adding a personal umbrella policy. Umbrella policies start at $1,000,000 in coverage. In addition, take steps to prevent these tragedies by securing your pool with a fence and self-latching gates. Make sure children never swim unattended. Install alarms that alert you if someone is entering the water.

Pro Tip: Make sure your pool meets the local municipal code. We’ve seen some insurance companies refuse to pay if the pool is not up to code.

- Tree falls into your pool

Summer storms can be intense, and could cause your tree to fall on your house or into your in-ground pool. If a tree falls into your pool, your homeowner’s insurance could cover a reasonable expense to remove it if it was felled by a covered peril and if it struck a covered structure (like your pool) and damaged it. No more than $500 will be paid for any one tree and no more than $1,000 total for any one claim.

Trampolines and Swing Sets

Trampolines and swing sets are considered attractive nuisances, places on your property that can attract children but also put them in danger. (Swimming pools are, too.) You will need to safeguard them, such as by making sure they are in a fenced area.

Trampoline injuries or deaths are covered under your personal liability insurance as part of your homeowner’s policy. Check with your insurance agent to see if you have enough coverage for a trampoline accident. Also, check to see whether there are any individual limits to that coverage. Protect against these accidents by installing an enclosure to secure the trampoline so there are no unsupervised guests. Always supervise children while they are using the trampoline and enforce the rule that only one person uses it at a time.

Swing set accidents also are covered by personal liability. Make sure your homeowner’s policy has adequate coverage. Supervise children whenever they are using the swing set. Inspect your set regularly and cover sharp corners or protruding nails that could cause injury. Check that there is a minimum of 22 inches between swings and that the slide is no longer than 10 feet. Also, make sure there’s at least 10 feet of clearance around the swing set.

Dog Bites

Dogs spend time outside with us in the summer. Sometimes that can lead to circumstances where dogs can bite. If your dog bites a third party, you are responsible. Liability coverage protects you in this instance. It pays for the bite victim’s medical expenses and covers your legal fees if they sue you.

-

- Make sure that your dog’s breed is not restricted by your insurance policy. Some policies will not cover breeds such as Pit Bulls, Doberman Pinschers, or Rottweilers. California Casualty does not currently have such restrictions.

-

- If your dog is a victim of a bite, pet insurance can help cover that emergency vet visit. You also may be able to be reimbursed by the other dog owner’s liability coverage.

BBQ Grill Fires

Backyard barbecues are a favorite summertime activity. We may not think about them being dangerous, but they can be. Practice summertime fire safety. Keep your grill away from the house and any other structures. Store your charcoal or propane safely and away from the heat. Keep a fire extinguisher handy. Always supervise young children when around a grill.

-

- If a grill fire spreads to your home or property, and causes costly damage, your homeowner’s policy will likely cover repairs, minus the deductible.

-

- If a guest is injured by a fire on your property, and you are legally responsible for that bodily injury, your liability insurance will cover that person’s medical expenses. If you are not liable, but your guest was injured through his/her own fault, then Coverage F – Medical Payment to Others may cover your guest’s medical bills.

Boats and Personal Water Craft

Small boats like kayaks and canoes may be covered under your homeowner’s policy as personal property. If you have a boat, you will need a separate boat insurance policy. You also need one for personal watercraft such as jet skis.

- Boats – The costs of insurance will vary depending on the value of your boat and where you keep it. For a California Casualty property contract, the policy will cover up to $1,500 for boats and a trailer for 16 named perils but not for theft away from the residence.

- If you’re transporting your boat on a car trailer, your auto insurance will likely cover any accidents.

o If you are at fault for a car accident, your auto liability will extend coverage but there will be no physical damage coverage for the boat or trailer.

- If you want physical damage coverage for the trailer, it needs to be added to the auto policy. If you want physical damage coverage for the boat, it needs to be included on the boat policy.

- If your boat is parked at your house and is damaged, your homeowner’s insurance may cover it. Otherwise, your boat policy will cover accidents on the water.

- Personal Watercraft – Your jet ski or other personal watercraft will need its own policy to protect you from vandalism, accidents, and liability for injuries to people riding your personal watercraft. This type of policy is available through the Agency Services division of California Casualty.

Rental Car Accidents

If you’re heading on vacation this summer, you might be driving a rental car. Your own auto insurance may cover a rental car, minus your deductible, or the credit card that you used to book the car may come with insurance. If not, you will want to make sure that you are covered by purchasing rental insurance through the rental car company. Here’s what you will need to think about.

- Collision Damage or Loss Damage Waiver – Optional in many states, this type of coverage pays for the rental car if it is damaged or stolen. There usually is a deductible, for which you’re responsible. If your auto policy covers collision damage, make sure that it also covers “loss of use.” For a rental company, getting a car repaired in the shop means it loses the income it could be getting from renting the car. The rental company can charge you the daily rental rate for each day the vehicle is out of service.

- Personal Accident Insurance – This optional policy covers you, the driver, in the event of an accident, including ambulance transportation and medical bills.

- Supplemental/Additional Liability Insurance – This optional policy covers the other driver and passengers whom you may injure in an accident. It also covers any property damage. You likely have liability on your own auto policy. Check to make sure the liability limit is enough. You can purchase supplemental liability insurance with the rental car company or get an umbrella policy from your current insurer.

- Personal Effects Coverage – This optional policy covers your possessions if they are damaged, lost, or stolen, something your homeowner or renter’s policy may already cover.

Have a great, fun-filled summer!

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Educators |

Written by Casey Jeffers, Owner of Fair Winds Teaching & MSEA Second Grade Teacher

The hustle and bustle of the end of the school year is like no other. It comes so quickly; in March I think about all the awesome things I still want to accomplish for the school year. I think I have all the time in the world. Then in the flash of an eye, May is here and I am running around thinking I have no idea how I will be able to fit it all in.

My to-do list grows as the weeks shorten and for me, it’s very bittersweet. I want to be excited about summer and the things I can accomplish during my time off, but I also recognize that most of my students rely on their school home for a sense of security and aren’t very excited for summer to come. I try to calm their fears by letting them know it’s okay to be nervous and excited about summer all at the same time.

This is where I kick into gear! I want to give my students resources to make their summer as enjoyable as possible. Each year I try to think about the students in my class and what they enjoyed. This year my students were OBSESSED with my V.I.P. chair (which they could earn with completed work and outstanding behavior).

One of the highlights of this special seat was the access to limited edition school supplies. The multi-colored changing pen was by far the most popular. They thought it was cooler than sliced bread and this year’s class was full of artists! I knew this was the first thing I needed to buy them to kick off their summer at home. I knew I was sending home their leftover notebooks and sketchbooks so I knew this pen would make a great gift!

You can grab this colorful kid gift tag FREEBIE here and check a list of all my favorite end-of-the-year school gifts here!

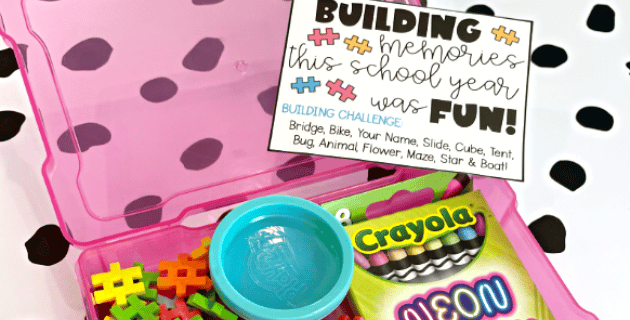

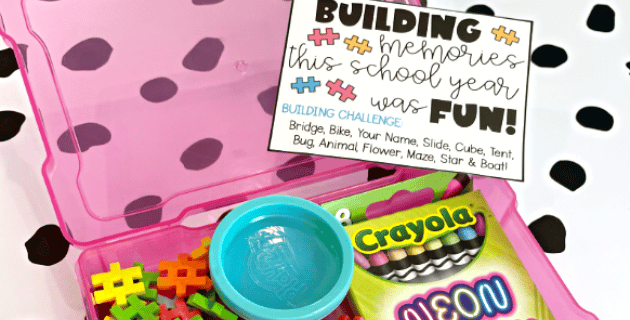

Next up, the most popular thing in my room has been the morning STEAM bins! They couldn’t get enough of the building with these materials each morning. If you want to learn more about setting up your own Starting with STEAM bins, check out this blog post I did for California Casualty last summer. They engage your learners and allow them to be super creative. Most of them love the hashtag building blocks I got from Target the most! So when I saw them in little $1 personal tubes, I knew I needed to set them up with a little STEAM station at their houses.

I grabbed 4 x 6 plastic photo boxes, a mini play-doh, a pack of 8 fun glitter crayons, and hashtag building blocks and got to work. The mini play-doh fits perfectly into the plastic bin to close shut. I made these little labels to add a building challenge for them to complete. I told them my email address to take pictures of their creations and send them to me over the summer.

These personal-sized bins also make for a great stress reliever. My students know a lot of peace corner strategies and this is a great way to allow them a break if they are feeling blue.

My students have been very careful about washing their hands all year long and also love any type of yummy-smelling hand sanitizer! Berries, cookies, flowers, linen, and even fresh-cut grass! The kids would bring in the new smells they would find and use them all day long. You can never be too safe and clean. I found some yummy smelling mini kid-safe hand sanitizers that completed our end-of-the-year gifts.

Watching their excitement opening all three little gifts with their tags was sooo much fun! They knew I got things I knew they loved.

Each year it’s important to pick out gifts that reflect what they loved through the school year, it’s fun to stay current and trendy.

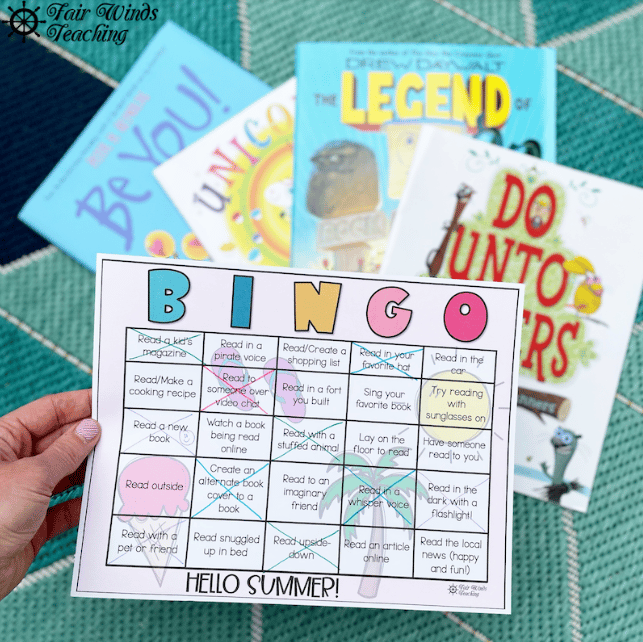

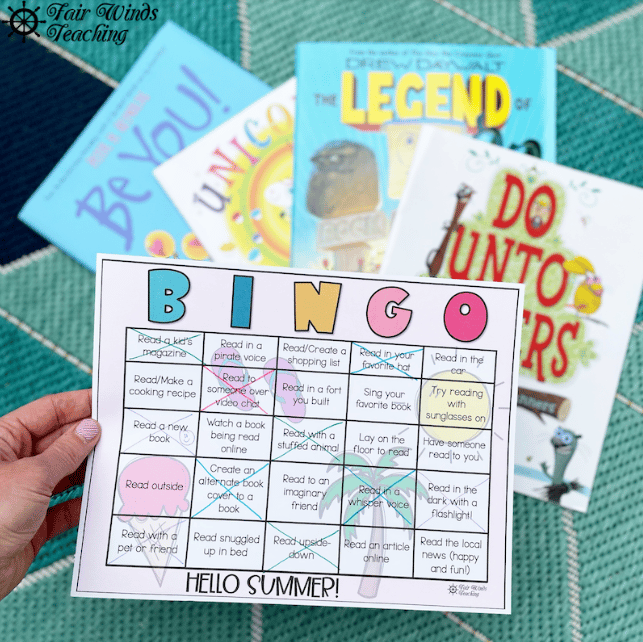

In years past, I have had students that were really into a certain read-aloud at school so I would see if it came available through Scholastic books at a discounted or class bundles rate. Then you can add this FREE summer bookmark and challenge your students to finish this Summer Reading Bingo challenge.

Other fun (out-of-the-box) gift ideas:

- Local Coupon – Find a local fun kid-safe activity like an ice cream shop, bouncy house, arcade, theme park, painting class, etc., and ask their business if they have any coupons or would be willing to donate certificates for a free session. I always make sure it’s within walking distance or accessible by the local bus so I know my students and their families would be able to access the location.

- Summer Meetup – Send out an email/letter to families telling them that you will be doing a summer meet-up at a fun kid movie that is playing at the theaters or a local outdoor movie, or pick a local (close to the school) park to have the kids play at. Anyone that comes, I treat some popcorn or icy pops. I make sure I wait until about mid-summer so the kids get to see their classmates and catch up.

- Virtual Yearbook – If you didn’t have time before school ended to do anything, you still have time! If you are a teacher that takes pictures throughout the school year, you can create a virtual yearbook and email out the finished product to your families. It is something they will cherish for a long time. See an example and grab it here. If you weren’t able to take any pictures this school year, bookmark this to think about next year! It is so fun to start at the beginning of the year and add to it slowly as events happen.

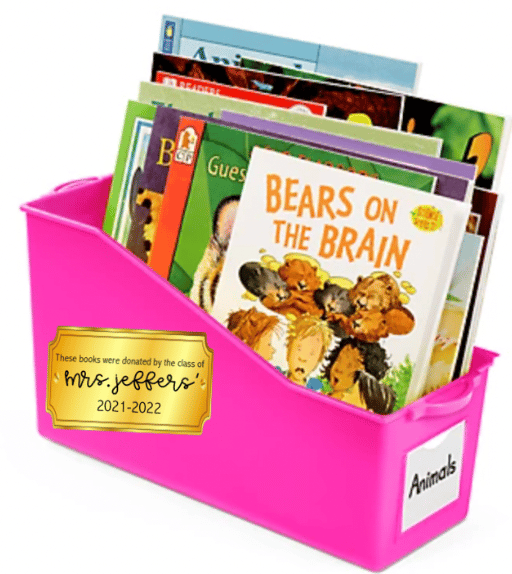

- Class Gift – My last favorite idea for end-of-the-year gifts is a class gift for your room to share for years to come. If you don’t like the idea of spending money on smaller items for your students that you don’t think they will love for the long haul, think about spending the same amount of money on a class gift.

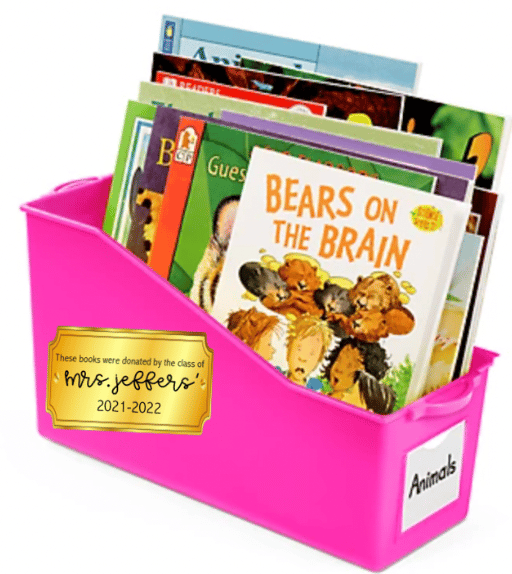

You can save $3 per kid (upwards of $75) on smaller stuff and spend less on some good-quality classroom materials. I have done class sets of clipboards, new reading group bags, indoor recess board games, a collection of books, and much more.

Then I created a little golden paper plaque label to place on the item and show the classes years after them that this classroom material is donated in their name. The book boxes of their favorite books with the plaque are so adorable. They are proud and tell the students below them that this is a gift to them.

I make sure I show them that the indoor recess games they play with were donated by kids that are now in 8th grade, they get so excited. As teachers, we spend so much in our classroom, this is a great way to make gifts meaningful and useful for years to come.

Whatever you decide to do for your students, they know they are loved and that they were in good hands this school year. Thank you for doing everything you can to keep them safe and happy. You are an incredible educator!

Casey Jeffers is a second-grade teacher at Butterfly Ridge Elementary in Frederick County, Maryland. She was recently recognized as the national winner of the NEA Foundation’s 2021 Teaching in Excellence Award. Casey is the proud owner of the Education Resource Blog, Fair Winds Teaching, and loves to connect with her education community through her TeacherPayTeacher’s business.

by California Casualty | Educators |

No flights. No long travel days. No hefty price tag. More and more people are trading in their vacations for staycations- vacations at home or close to home.

For teachers, taking time to relax and recharge is important, and a staycation offers the same benefits as a traditional vacation with less stress and at less cost! Intrigued? Let’s get started planning your perfect staycation.

Choose your staycation style.

Whether you’re a foodie, a history buff, a hiker, or a spa-goer, you can find the activities that you enjoy close to home. You might even try something you’ve always wanted to do but never made time for, or opted out due to cost. Now is the time to consider it. When you plan your itinerary locally, you can feel good that you’re supporting local businesses. Following are some thought starters to help you plan.

Pro Tip: Ask about local discounts or during-the-week specials. Many hotels and attractions offer them.

Be a local tourist.

Discover the beauty of your city and region. Book all of the tours and experiences you might enjoy if you were traveling here as a tourist. From museums and cultural experiences to nightlife and entertainment, your local area likely offers plenty of options. You’ll have the added advantage of being a local, and knowing all the good spots to eat.

Indulge in a gourmet adventure.

On a traditional vacation, you’d be eating out. Plan to eat out as much as your budget allows—or else create your own special meals at home. Picnic in the park. Book an afternoon tea. Try that new gourmet place or find a food truck festival. The options are endless and delicious!

Hit the beach or pool.

If you’re lucky enough to live near a beach, that’s a natural destination. But if not, consider a staycation at a local hotel or lodging with a pool (or even a jacuzzi tub!). Bring your swimsuit, grab a favorite beach read and soak up those rays.

Relax at the spa.

There’s nothing like a spa day to relax and unwind. Go ahead and get that facial and massage. Spend some time in the hot tub or sauna. Many spas let you spend the day if you book a service, and some offer food and other amenities.

Take a hike.

Put on your hiking shoes. If you’re a nature lover, you’ll enjoy exploring your local trails and other outdoor adventures. Spending time in nature is great for your mental health, and the exercise is great for your physical health. Not to mention that the scenery is definitely photo-worthy!

Take a course.

If you’ve always wanted to learn how to make pottery or you love to get your hands dirty in the garden, chances are that there’s a course you can take to explore this interest. Find out what’s offered in your local region. Check your local community college and township recreation schedule. Airbnb also has many local experiences that you could book for an hour or more.

While not strictly a staycation, you can carve out time during break to redecorate a room or spot in your home. Do-it-yourself makeovers can be plenty of fun. Just keep them manageable, and plan some time away from the work to create a relaxing staycation feel.

Try virtual tourism.

You may not be able to travel the world but you can bring the world to you with some virtual tourism activities. Expedia offers some online tours and activities from cooking classes to video chats with locals, and museum tours.

For other ideas, check out our blog on ideas for your spring break staycation.

Avoid self-sabotage.

The point of a staycation is to get away. That’s a little harder to do when you are home and tempted by housework or work. (That’s especially true since our homes have doubled as workspaces over the past several years.) Here are some tips to help you fully disconnect.

-

- Set boundaries. If school is in session, plan work coverage. Make sure everyone who is part of your staycation plans coverage, too.

- Hire a dog walker. If you have fur babies at home but you’ll be out and about, make arrangements for their care.

- Unplug. Turn off your phone notifications and email. Make sure that work and family obligations do not interrupt your time off. (However, give family a way to reach you in the event of an emergency.)

- Plan each day fully so there’s no downtime to worry about day-to-day responsibilities. Note the time, upon your return, when you will address these.

Remember that you don’t have to stay home during a staycation. Consider one or two nights at a local hotel or other lodging. And be sure to ask for local discounts!

Don’t forget that Educators & ESPs can win a $10,000 Staycation Giveaway from California Casualty! Let us help you escape the every day with $10,000 to spend your way.

Get that hot tub you’ve always wanted, create your dream kitchen, turn your backyard into an oasis, add a media room the whole family can enjoy. Or just take the money and do what YOU want. The possibilities are endless!

Click HERE to enter.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.