by California Casualty | Auto Insurance Info, Helpful Tips, Safety, Travel |

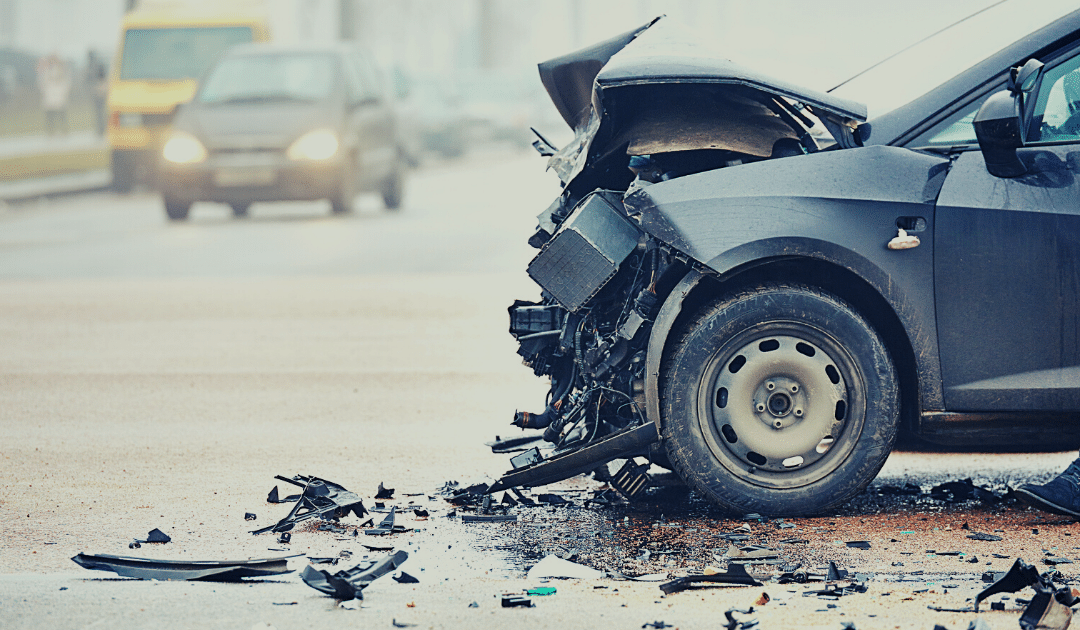

The car ahead suddenly collides with another vehicle, forcing you to brake hard to avoid the crash. Your heart races, adrenaline kicks in, and as the dust settles, you realize you’re not just a passerby—you’re a witness. But what happens next? Knowing your role in that critical moment can make all the difference.

While it’s not a legal requirement to stop at the scene of an accident, many people do. As a witness, you’re often the first to arrive and can play a crucial role in calling for help. You may also provide key information that helps clarify what happened and determine liability. If you witness an accident, here are the steps to follow.

Find a place on the side of the road near the accident that is about 100 feet away. Stay

away from broken glass, leaked fuel, downed power lines, and other hazards. You don’t want to put yourself or your car in danger. Once you’ve parked, shut off your car and put on your flashers.

2. Call 9-1-1.

Don’t assume someone else is doing it—unless you see and hear them doing it. Notify the police about the accident, which can be more serious than it looks. Be prepared to give your location. Look for the nearest cross street, a mile marker, or nearest off ramp. The operator will ask how many people need help, and if they are conscious, breathing, or bleeding. Now is the time to step out of your car to check.

3. Exit safely if you can.

Only leave your vehicle if it is safe to do so. Be careful of cars whizzing by and of debris on the road, including broken glass and twisted metal. Be aware of smoke, odd smells or fluids that could signal a potential fire danger. Your safety is your priority.

4. Offer comfort and, if needed, first aid.

Approach the vehicles with the accident victims. Ask if they are okay. Let them know that first responders are on their way. Importantly, do not move an injured individual unless there is an immediate danger of fire. You can bind wounds and stanch bleeding; ask the 9-1-1 operator for direction if you’re unsure.

5. Stabilize the scene.

Make sure all vehicles are in park and turned off. If cars are still on, and fuel is leaking, that could cause a fire. If you need to, and if you can, move the damaged car off the road. Otherwise, set up warning flares (only if there are no fuel leaks) or traffic triangles. You can keep these in your trunk for just this purpose.

6. Document the accident.

The victims may not be able to take photos of the crash. Go ahead and do so and add notes so you will remember what happened. Get contact information so you can get the pictures to the people involved in the accident. Pay special attention if it was a hit and run. Any details you remember could help police track down that car.

7. Talk to the police.

When the police arrive on the scene, they will want to talk with you. Simply share the facts. Don’t speculate on fault if you are unsure who caused the accident. Do not feel pressured to answer every question and do not guess at the answers. “I’m not sure” and “I don’t know” are valid responses. It’s possible that you may be called to testify in a court of law. Don’t ignore a subpoena if you get one. That is against the law, and you could be fined or go to jail.

Some final thoughts…

- Witnessing any kind of accident is upsetting. Seeing a fatal accident can be traumatic. Make sure to talk to your pastor, doctor or a therapist to help process the experience.

- Did you see the accident occur or did you come by after it happened? If you didn’t see it, then you’re not a witness. You can still stop and help but let the police know that you do not have any information on the crash.

- Finally, make sure your own vehicle is protected with the right insurance. This will help add peace of mind if you should get in an accident.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Helpful Tips |

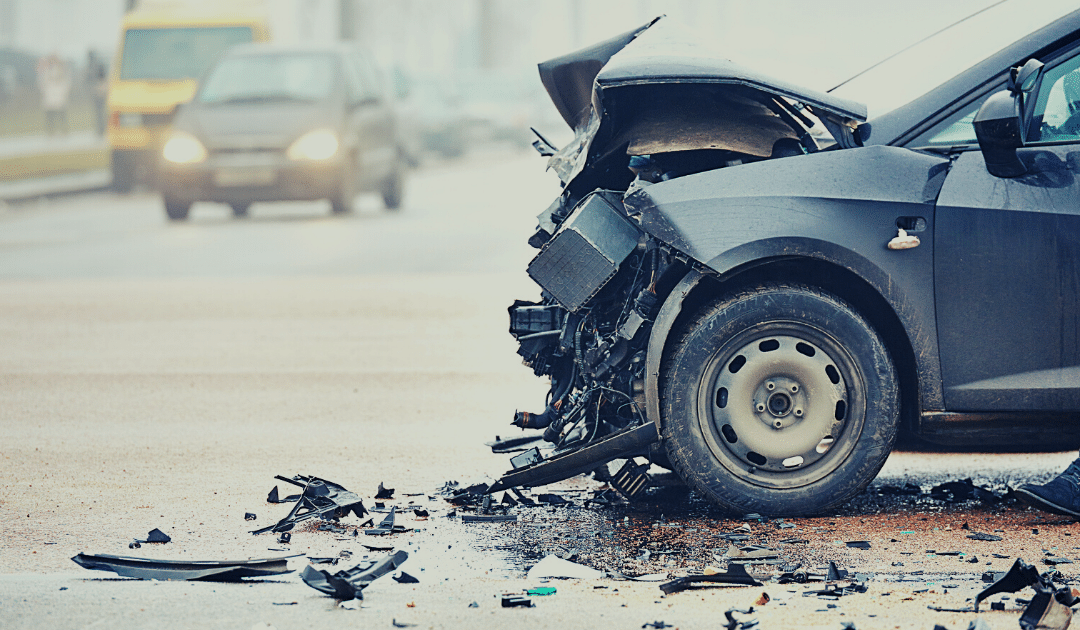

Your best friend wants to borrow your car. He wouldn’t ask unless he really needed it. So even though you know about his past fender benders, you give in. What happens if your friend gets into an accident in your car? Read on to find out.

Car insurance follows the car, not the driver.

You may assume that your friend’s insurance will cover him, since he got into the accident. That’s not the case. Car insurance covers the car rather than the driver. You don’t even have to be in the car. If your car is in an accident, and the driver is at fault, your insurance will be used to cover damages to the vehicles involved. If you carry collision coverage, it will take care of damage to your car, less your deductible. If your coverage isn’t enough to pay all the damages, your friend’s auto insurance may act as secondary coverage.

Interesting sidenote: While car insurance follows the driver, that’s not the case with tickets. If your friend gets a ticket while in your car, that only affects his record.

Permissive use vs. non-permissive use

The fact that you gave permission to your friend is important. Most auto policies allow you to lend your car to a person for occasional, short-term use. If they are driving your car on a more regular basis, you need to add them to your policy. It’s worth noting that coverage limits may vary under permissive use.

Sometimes a family member or friend borrows your car without permission. If they cause an accident, you are not responsible for the damage. However, it can be difficult to prove that you did not grant them permission. Plus, you will still need to get your car repaired and file a claim with your insurance company. A good tip is to keep your keys secured away from others if you have concerns with them taking your vehicle.

When insurance won’t pay

There are very few instances where insurance will deny coverage of an accident. These include:

- If the person is specifically excluded from your policy

- If the person was intentionally breaking the law

- If the person borrowed your car to offer a commercial service, like a rideshare

How coverage works

For those times when insurance does pay, here is a breakdown of the coverages that typically apply in a car accident:

- Collision: Your collision coverage will pay for repairs to your car minus the deductible. Collision coverage is not required unless you’re leasing a car or paying off a loan on a vehicle. However, it may be good to have, especially in the event of an accident.

- Liability: Liability covers damages to the other vehicle. This coverage is required by law in most states. The two main types of liability coverage are bodily injury and property damage.

Bodily injury: This coverage helps pay for medical expenses, lost wages, and pain and suffering for the driver and passengers in the other In no-fault states, your own injuries are typically covered by your auto policy through a Personal Injury Protection (PIP) claim. (It differs from state to state.)

Property damage: This coverage helps pay for repairs for the other vehicle or for repair/replacement of property, such as a fence, that is damaged or destroyed by the collision.

- Uninsured/Underinsured Motorist Property Damage: If the other driver is at fault and is not insured or is underinsured, UMPD coverage will help pay for repairs. These are optional coverages in most states. In some states, you are not allowed to carry collision and UMPD at the same time. Also, sometimes UMPD has a policy maximum, or cap on the amount it will pay.

Lending your car can be an expensive favor.

Think carefully before you lend your car to anyone. Even though you didn’t cause the accident, your insurance rates can go up at the next policy renewal.

Before you lend your car, it’s a good idea to review your auto policy and the policy of your friend or family member. Your insurance provider can help to answer any questions you may have.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Safety |

Less traffic has been hitting the roads, but cities and states across the country are actually seeing an increase in accidents- in adults and in teens. Fatal accidents involving teenagers has already hit an all-time high. Preliminary data from The National Safety Council indicates a 14% increase nationwide in fatal miles driven in the spring of 2020, compared to 2019.

While many people across the country stay inside and continue their “new normal” – working from home and only leaving the house when necessary, drivers on the less crowded roadways may be prone to take advantage of open lanes of traffic by driving recklessly, resulting in fatal accidents.

States all across the country have experienced increases in roadway deaths including California, Arkansas, Connecticut, Illinois, Louisiana, Nevada, New York, North Carolina, Oklahoma, Tennessee, and Texas.

If you have to get back on the road, follow these safety tips to avoid a deadly collision.

Brush Up on Traffic Rules & Regulations

It’s never a bad idea to re-familiarize yourself with traffic laws, especially if it’s been a while since you’ve been behind the wheel. Before you get back on the road, take some time to go over basic traffic rules and regulations for your state, and minimize the risk of getting in an accident.

Don’t Speed

Speeding is a bad habit that most of us are guilty of, and when traffic is light the urge to speed increases (especially on the interstate). Not only is speeding against the law, but it also makes the road extremely dangerous for everyone on it. Speeding alone causes over 100,000 deaths every year. With clear roadways during the pandemic, more drivers are speeding to get to their destination causing fatal accidents. Avoid injuring yourself and/or others, and don’t speed.

Drive Defensively

It’s more important than ever to stay alert and aware when you are on the road. Defensive driving is a set of driving skills that allow you to defend yourself against possible collisions caused by other drivers. These skills include: preparing to react to other drivers, avoiding distractions, and planning for the unexpected. You should always drive defensively, even if you are obeying all of the traffic laws, because other drivers may not be.

Watch Out For Pedestrians

In the early months of the pandemic, we saw more and more people turn to walking and biking for socially distant exercise, and many people have kept up with these healthy habits. When you are behind the wheel stay alert and keep an eye out for pedestrians that may be biking in streets or using crosswalks.

Educate Your Young Driver

Every May – September is considered the “100 Deadliest Days” for young drivers, as many hit the road for the first time (even during the pandemic). Teens are inexperienced behind the wheel, which makes them more susceptible to reckless and distracted driving – the number one killer of teens in America. Pair inexperience and reckless driving with an increase in fatal accidents and you have a recipe for disaster. Before your young driver gets behind the wheel this summer, educate them on following the rules of the road, even when there is no traffic. For more tips on teaching your teen driver click here.

Lastly, Make Sure You Have the Proper Coverage. Although this will not help you avoid a collision, it will save you time and money in the event you do get into an accident. While collision rates are on the rise, it’s important, now more than ever, to have the right auto insurance protection for when you get back on the road. This will not only help with out-of-pocket expenses due to an accident, but it will also give you peace of mind knowing that your insurance is one thing you don’t have to worry about during these trying and uncertain times.

Drive smart and stay safe. For more auto insurance tips click here.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Safety |

In 2018, the U.S. Coast Guard counted 4,145 recreational boating accidents that caused 633 deaths. That’s a fatality rate of 5.3 deaths per 100,000 recreational vehicles. There were also just over 2,500 injuries and about $46 million dollars of property damage.

The weather’s beautiful. Your boat’s ready. The rivers, lakes, and shores are calling. We get it! But here’s a reminder to keep safety top of mind while enjoying excursions with friends and family.

Here are the top 6 causes of boating accidents, as reported by the U.S. Coast Guard.

- Alcohol

By far, the leading known contributor to accidents is alcohol use, which contributed to 19 percent of deaths. Remember that blood alcohol content laws are the same for drivers of cars and boats. Underage drinking laws and penalties also still apply. Alcohol use while boating can lead to reckless boating, excessive speed, and other avoidable risks.

- Operator Inattention

The boating vibe is definitely one of relaxation and fun. But it’s imperative that drivers remain attentive to their surroundings. Rocks, swimmers, submerged trees, floating debris, other watercraft and changing weather can quickly turn conditions hazardous.

- Improper Lookout

Besides the driver, every vessel must have an appointed lookout — someone who monitors for boat traffic; nearby vessels; and risks of collision, stranding and grounding. If anyone in the group is doing water sports, the lookout must alert nearby boats that someone’s in the water. Accidents in this category were due to there being no designated lookout or the lookout was not doing their job. For every boat trip, make sure you appoint someone and that they understand and fulfill their duties.

- Operator Inexperience

Safely operating a boat is not only about knowing how to drive and handle that specific vessel, but also knowing the relevant boating laws and regulations (including locale-specific rules). Boater education classes are a great first step to gain experience and know-how. Anyone driving a boat must also know how to handle emergency situations.

- Equipment Failure

Just as with cars, boats need regular maintenance, repairs, and upkeep. Make sure your boat is “water-ready” before taking it out for the season. This includes the engine and mechanical parts, as well as life preservers, flares, navigation lights, and other safety items. Do a test run of the safety equipment so you don’t have an unexpected failure out on the water.

- Excessive Speed

High speeds make debris, hazards, swimmers and other boats harder to see, and decreases reaction time. Be mindful of posted speed limits and speed laws, which should be followed at all times. Also, inexperienced drivers sometimes forget that boats don’t have brakes like cars, which can get them into trouble quickly in an emergency or unexpected situation.

Some Final Reminders…

Although related to the above top causes, we’d be remiss if we didn’t mention the following 4 boating risks to keep in mind.

-

- Busy Summer Days — Beautiful weather translates to crowded waters. More traffic means the driver and lookout must remain vigilant and attentive to hazards.

- Reckless Boating — This encompasses any risky or unsafe driving behavior, and exponentially increases with alcohol consumption and/or operator inattention and inexperience.

- Weather Conditions — Inclement weather such as strong winds, heavy rain, or sudden lightning is a hazard in itself but can also cause swells and large waves that threaten to capsize boats.

- Hydration —It’s easy to become dehydrated when out in the sun and the elements — and paradoxically, when surrounded by water. Remember to always have enough water on board and hydrate, hydrate, hydrate!

Many crashes can be avoided by knowing the risks and following safety guidelines. With precautions in place, you’ll have peace of mind to enjoy those beautiful summer days and sunsets on the water.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Safety |

It could happen at school, the mall, or even at a nearby restaurant – a parking lot accident. If it happened to you, do you know what you should and should not do? Whether it’s not seeing a car as you back out of a parking spot, coming around a corner and hitting...