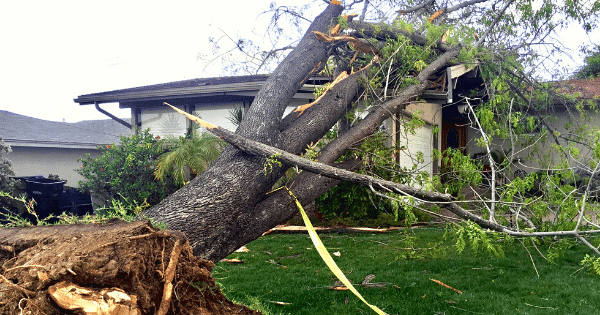

When storms and high winds take down trees, it can be frightening. If you’re not covered for the damage- the bill can be pretty scary, too.

If a tree fell on your home tomorrow, would you be covered by your insurance policy? Whether or not a fallen tree is covered depends on what caused the tree to fall and where it fell. Here’s everything that you need to know.

If a healthy tree falls on your home…

Strong winds can cause even healthy trees to fall. When a tree hits your house, your garage, your deck, your shed, or your fence, your homeowner’s policy usually covers the costs of repair. That also includes the cost of tree removal. Of course, you have to first pay your deductible. Check your property contract to see what is covered. There may be a cap – a maximum paid per tree. Finally, an annual policy review is a good time to review your coverages, before anything happens.

If an unhealthy tree falls on your home…

It’s a little different with diseased or dying trees. They’re more likely to fall—with or without a storm. As a homeowner, your responsibility is to check the trees on your property, trim the branches, and make sure the trees are healthy. If a diseased or dying tree falls on your home as a result of a severe storm or high winds, your policy most likely will not cover it.

If a tree falls but does not hit your home…

If a tree falls and doesn’t damage anything, that’s great (and lucky) news! However, a downed tree is considered a hazard and you are still responsible for removing it from your property. Unfortunately, in this case, your homeowner’s insurance does not cover that tree removal. The only exception is if the fallen tree is blocking a driveway or a ramp for someone who is handicapped. But proceed with caution – before you remove the tree, check with your local regulations. There are laws that govern tree removal in some states, and you may need a permit.

If your neighbor’s tree falls on your home…

It’s not uncommon for a tree in your next-door neighbor’s yard to fall on your home. If it’s a healthy tree that got knocked over in a storm, your policy will likely pay for damages just as if the tree fell from your own property. However, in this case, your insurer may go through your neighbor’s insurance provider for payment, and if that’s what happens, you will be reimbursed for your deductible. One word of warning: If a tree falls because your neighbor cut it down incorrectly, that’s on him to pay for damage and tree removal. Insurance does not cover that.

If a tree falls on your car…

It makes sense if you think about it. Homeowners’ policies do not cover trees that fall on cars. Car insurance policies do—but only those policies with comprehensive coverage. Check to make sure that you have comprehensive coverage so that you will be covered in the event of a fallen tree.

What To Do If A Tree Falls

-

- Assess the damage. Be careful and watch for fallen power lines as you do so.

- Determine who may be liable for the damage.

- Contact your insurance company if you believe you have a claim or if you are unsure.

- If you have a claim, make sure not to move anything until you have spoken with your agent. Take and submit photos or videos of the damage from all angles. Your insurer will guide you through the process.

- If you do not have a claim, you may still be responsible for removing a tree. Before contracting with a tree removal service, ask for proof of insurance. The company will then be responsible for any further damage they may cause.

Avoid a Disaster By Keeping Your Trees Healthy

-

- Water your trees regularly but don’t overwater. Consult a garden reference to determine how much water your species needs.

- Add mulch around the base of your trees. This will help protect the roots from weather conditions. It also will keep your mowers from bumping into the roots or the trunk.

- Visually inspect your trees for signs of disease. Look for discoloration and stunted growth or signs of pests. Mushrooms growing at your tree’s roots also can indicate decay.

- Remove any dead branches or large limbs that look like a liability. Prune your trees during the winter months.

- If you are removing a tree- be careful where you dig, as root systems of large trees can extend two to three times farther than the branches.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

- Graduation – When to Remove Your Child from Your Auto Policy - May 18, 2023

- How to Prevent Catalytic Converter Theft - May 17, 2023

- How Much Does Home Insurance Cost? - May 17, 2023