by California Casualty | In Your Community |

NEA Member Benefits recently added siblings to the list of family members eligible to access the NEA Auto and Home Insurance Program provided by California Casualty. Referred to as an NEA Member’s “Extended Family,” parents, in-laws, adult children, and now siblings can take advantage of the special rates, deep discounts, and personalized service available through the NEA Auto and Home Insurance Program.

California Casualty offers policyholders special benefits, such as:

-

- Rates good for a full year, not six months like many insurers offer

- Auto insurance that covers $500 for non-electronic items taken from your vehicle

- $0 deductible for accidents in a rental car

- Broad policy protection for anyone they allow to drive your vehicle

- Free ID defense

- Free pet injury coverage up to $1,000

- Holiday or summer skip payment options

- Exceptional towing and roadside assistance availability

Plus, as an NEA Member, you have more exclusive benefits, including:

-

- Waived/reduced deductible for collision or vandalism while parked on school property

- Educators excess liability coverage for protection in the classroom

- Fundraising coverage with $0 deductible for goods/funds valued up to $500 while under your care at school

- And more!

Tell your family (and colleagues) about the NEA Auto and Home Insurance Program. Members who switch see an average of $423 in savings.

This article is furnished by California Casualty, providing auto and home insurance to teachers, law enforcement officers, firefighters, and nurses. Get a quote at 1.800.800.9410 or www.calcas.com.

by California Casualty | Good to Know, Homeowners Insurance Info |

An attractive nuisance is anything on your property that is attractive to children, but in turn, could also put them in danger.

Examples of common backyard attractive nuisances include:

-

- Pools

- Hot tubs

- Trampolines

- Swingsets

- Firepits

- Fountains

- Treehouses

- Playgrounds

While these nuisances all serve as great ways for children to get outdoors and enjoy the summer sun, without the proper precautions, they can become problematic. In fact, attractive nuisances cause so many injuries when kids are out of school that summer is also known as “trauma season” among public health officials in the U.S. This is because unintentional deaths and serious injuries increase dramatically among children in the summertime.

Not only will these objects of entertainment put your own child at risk for serious or fatal injury, if one of their friends comes over to play one day and gets hurt on an attractive nuisance in your yard, you will be held liable for their injuries.

How to Minimize Your Risk

An attractive nuisance isn’t just limited to objects of entertainment like pools; they can also be anything that is on your property that draws curiosity like construction, weapons, grills, landscaping, lawn equipment, ponds, old cars, or appliances, etc.

This doesn’t mean that you will have to go and give all of your nuisances away, instead take the proper precautions to prevent the nuisances from causing harm.

Minimize the risk of an accident or injury by understanding what you have on your property that could be considered an attractive nuisance and take the necessary steps to safeguard against any future accidents.

-

- Keep your property clean. Pick up dangerous debris and clean up after projects that you have completed. If you have old items that you are using anymore, sell or get rid of them.

- Make dangerous items inaccessible. Keep dangerous weapons locked away in a safe, equipment, and vehicles in a garage or shed, and put a cover on pools, fire pits, grills, and hot tubs.

- Install a gate and lock system. If there is no way to make items in your yard inaccessible try installing a fence or locked gate with a no trespassing sign to help keep curious children out.

- Always supervise. If you have an attractive nuisance in your yard, never let your children or their friends play outside without adult supervision.

- Have adequate coverage. Make sure you have enough liability coverage with your homeowner’s insurance. Talk to your insurance agent and review your policy.

If you fail to minimize the risk of injury and a child in your neighborhood harms themselves (or worse) on your property, you may be subject to legal action. Read your local laws and use good judgment, if you feel like you have an item of concern in your backyard, use the steps above to help prevent an accident.

How an Attractive Nuisance Affects Your Insurance

Insurance agents look at your property to determine your home insurance rate. Certain features of your home or property could impact your rate because of their degree of danger. For instance, if you have an in-ground pool in your backyard you will likely have a higher rate because a pool increases the risk of danger.

When you speak to your home insurance agent you will need to disclose if you have any attractive nuisances on your property to protect you from getting future claims rejected, if an accident were to happen on your property.

Many people assume that their homeowner’s insurance will provide them the protection they need if someone gets injured at their home, but this isn’t always true. If you have an attractive nuisance, protect yourself and your family, talk to your insurance agent and ask about increasing your liability protection or about adding a personal umbrella policy to your homeowner’s insurance.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Calcas Connection, Consider This, Safety |

It’s no secret that spring storms can bring heavy rainfall in short amounts of time. This not only can cause rivers and lakes to rise outside their banks, but it can also cause flooding in city streets and near homes.

Contrary to what many may think is covered under their insurance policy, a Home or Renter’s insurance policy will not cover a flood. If you live in an area prone to flooding, you need to also purchase flood insurance. Floods are one of the most dangerous disasters in the United States, and if you don’t purchase flood insurance, they can cost you big time. The National Flood Insurance Program (NFIP) estimates that just one inch of water in a 2,000 square foot house will result in $23,000 in damage.

Flood season has arrived. Here are five reasons you need flood insurance now:

1. It’s not just for homeowners and businesses.

Flood coverage is available for renters. Condo owners can also purchase it. It will cover damage to your possessions from a flood.

2. Flooding is not covered under your standard policy.

Homeowners and renters need to purchase separate flood policies. Umbrella insurance does not usually cover flooding, either.

3. Floods aren’t limited to flood plains.

Every state has experienced flooding, and it can happen anywhere. The NFIP estimates that 25 percent of flood claims come from areas outside of high-risk flood zones.

4. Flood insurance doesn’t take effect immediately.

There is a 30-day waiting period from the date you purchase the insurance until you are covered, in most cases.

5. It’s often not as expensive as you think.

The average policy costs about $700 per year. The higher your risk, the higher your premium. Costs do vary depending on your flood risk and the year and type of construction. Keep in mind, the average residential flood claim amounted to more than $38,000.

Don’t delay, there is a 30-day waiting period before flood coverage goes into effect. Call a California Casualty advisor today at 1.877.652.2638 to make sure you’re covered. Or, contact our Agency Services department at [email protected].

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Behind the Scenes, Calcas Connection |

Each year the California Casualty Partner Relations Department recognizes employees for their commitment and dedication to serving our group partners by developing and nurturing relationships and creating leader advocates. In a year of so much uncertainty, the efforts of these individuals shined as they adapted to a virtual environment. Nominated by their fellow managers or their peers, the 2020 Partner Relations Advocate Award recipients were Angela Morgan (WA), Bonnie Harber (NJ), Brandon Watson (TX), Inez Morales (CA), Justine Sallee (IL), Michelle Hawkins (WA), Norma Alfaro (CA) and Stephanie Whitmore (CA). Read on to learn more about each award recipient and why they were nominated.

With nearly six years of experience, Bonnie Harber has become a permanent fixture at events throughout her territory in New Jersey and is well respected by association staff, leadership, fellow business partners, and her colleagues. Her dynamic personality, teamwork, and dedication have generated exceptional production results and strong relationships internally and externally.

Michelle Hawkins’s manager noted that she is simply the best. She completely understands advocacy and how leveraging her relationships publicly affects her field access, retention, business growth, and overall marketing plan. It’s all intertwined and she knows exactly what she is doing.

Stephanie Whitmore moved at the start of the pandemic from Iowa to California. She used her tenacity and creativity to introduce herself to group leaders in her new territory while she continued to be present virtually in her previous territory of Iowa and Nebraska. It was written of her, “The great thing is about her tenacity and creativity, is that she does not keep it to herself. She constantly shares what she is doing with her teammates and department”.

Countless hours were dedicated by Norma Alfaro to ensure her fellow California field team members staff and our partner, the California Teachers Association, had all they needed to make it through 2020 successfully. Norma was nominated from two different Partner Relations employees, with one noting, “With every challenge comes an opportunity to adapt, persevere and demonstrate one’s inner strengths. In 2020, Norma proved that she could not only weather the storm but thrive.”

Inez Morales’s sense of responsibility towards her customers and her groups is amazing. Although she works with all our group partners in California, Inez was specifically nominated for her work as a PORAC Back-Up Account Manager. Inez has a gift with relationships that have helped her to keep doors open to new opportunities and the ability to quickly address policyholder and group concerns.

Brandon was nominated for his attitude of service and advocacy as a representative in Texas, New Mexico, and Arizona. Since he started with California Casualty in 2011 he has exhibited great advocate qualities. He cares for the members of the associations we serve and it is welcomed, respected, and appreciated by the leaders and members of these associations.

As one of our field representatives in Illinois since 2012, Justine Sallee’s, ability to develop and maintain relationships has served her well. She recognizes the value of service and care for the leadership and members of our partner associations. This has enabled her to leverage these relationships to gain access, maintain visibility and generate policyholder growth in her territory. She is a well-rounded field marketing manager and is liked and respected by her association leadership and members.

To round out the 2020 Partner Relations Advocate Award recipient is Angela Morgan. Angela has embraced and led the way in building sustainable business practices to market throughout her territory. She is consistent and relentlessly couples short-term and long-term wins throughout her day. She understands the need for the immediate while teeing up future relationships and opportunities to leverage.

Congratulations to all the recipients!

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Calcas Connection, Good to Know, Homeowners Insurance Info |

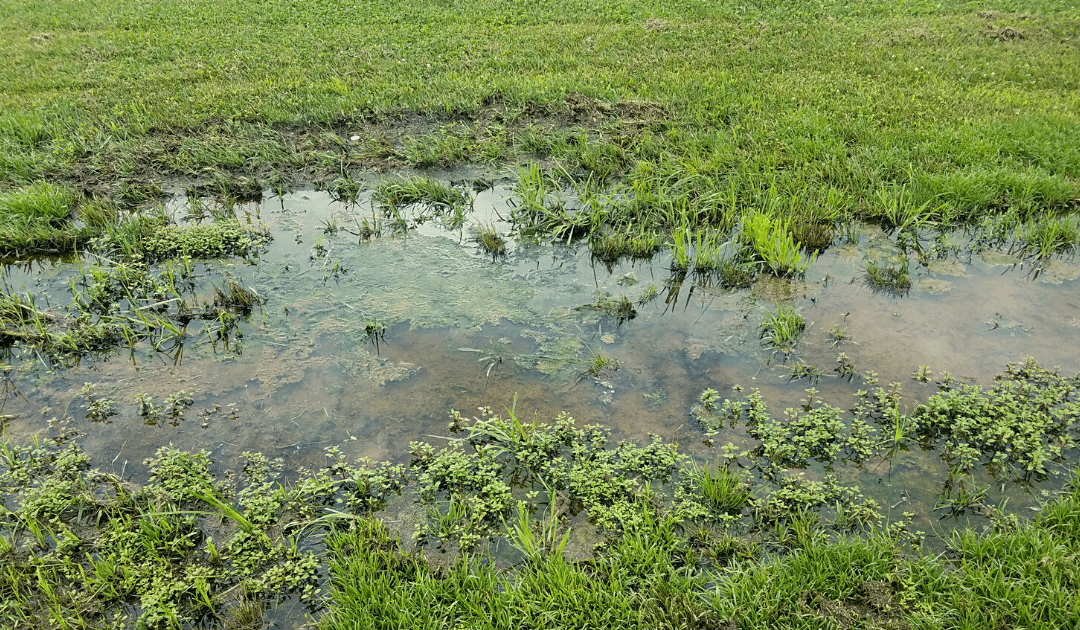

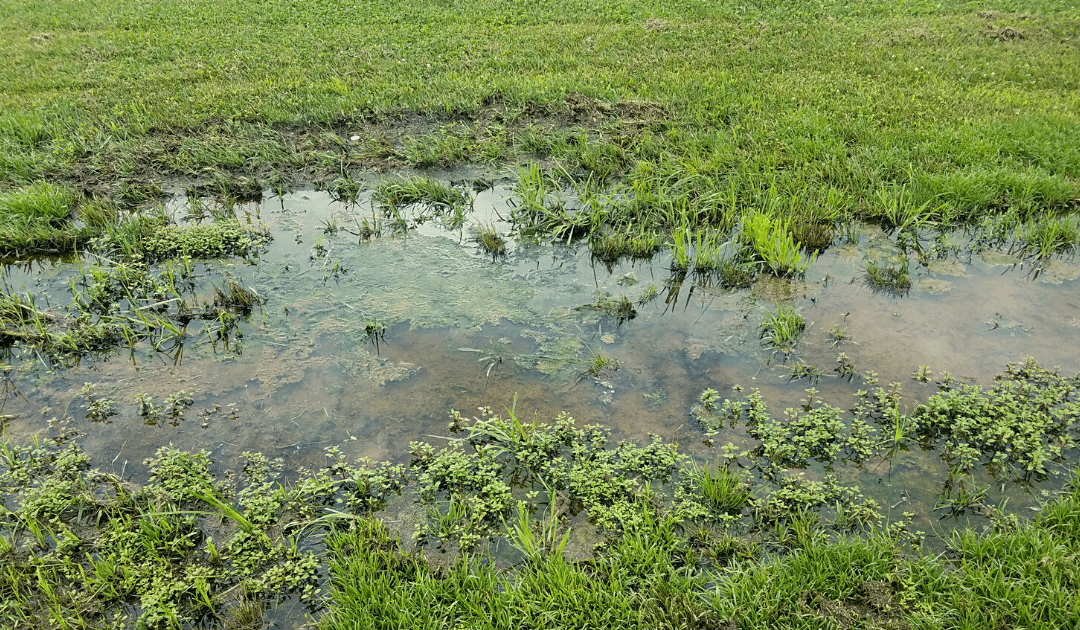

Spring is here! And so are spring storms, but spring showers don’t just bring flowers, they can also bring more water than what your yard can hold. And this standing water around your house can cause water damage to your home- costing you more than you think.

By definition, standing water is a body of water that does not move or sink into the ground. It can be caused by a number of factors: heavy rain, over-watering, poorly draining soil, improper grading, incorrect landscaping, low areas in your yard, and even water line leaks or bursts.

If you have standing water in your yard for multiple days, it can cause serious damage to your home. Not only will it be an eyesore that can ruin your grass and draw unwanted bugs, but stagnant water on the side of your home can also seep into small cracks or pores in your home’s foundation and get into your crawl space or basement, which can lead to water damage & more.

Here’s why you should address the standing water near your home now, and how you can prevent it from happening in the future.

Standing Water Can…

Ruin your basement. Water can cause cracks in your home’s foundation. This is how water enters your basement or your crawl space. Once inside it can create a musty odor and add dampness that will completely ruin flooring, drywall, furniture, electronics, etc.

Produce mold & mildew. High levels of condensation and humidity inside of your basement or crawl space create an environment for mold and mildew to thrive. This could not only affect your home, but it could also cause major health issues for you and your family.

Breakdown your home’s foundation. Over time, standing water that has made its way into your cement foundation will start to cause shifting and bowing of your structure. This is the beginning of the breakdown of your home’s foundation. If not taken care of- doors will no longer close, floorboards will start to squeak, steel beams may have to be inserted, and it could even lead to structural collapse.

Cost you thousands of dollars in repairs. A homeowner spends over $3,000 on average to repair damages to their home and property caused by water. Preventive maintenance and early detection are key to helping you save your home and your wallet.

But that’s not all, standing water can also draw unwanted pests: mosquitoes, roaches, termites, ants, silverfish, and other pests thrive in moist environments. They will seek damp areas and make your home their home if you don’t address the issue quickly.

Here’s how you can prevent standing water from getting into your home this spring.

How to Prevent Standing Water

1. Check for Proper Roof Drainage

Make sure every drop of rain will drain off of your roof correctly- starting at your gutters. Make sure they are free of leaves and sticks and that you have an attached downspout that is also clear of debris. It is also important to make sure your downspout has a downspout extension that will move water away from the foundation of your home.

2. Monitor Your Sprinkler Usage

If you see standing water, make sure to check that your sprinklers are not overwatering your lawn. First, check to make sure the sprinkler heads are functioning properly and not broken. If there is no issue, you will likely just need to reset your sprinklers to run at a less-frequent timespan. After resetting, if you are still seeing patches of barren or muddy lawn, you may have a leaky valve. Valves are responsible for distributing the water throughout the entire system, and if damaged they will need to be replaced right away.

3. Make Sure Your Yard is Correctly Graded

Grading, also referred to as lawn leveling, is the process of leveling your lawn to allow for the proper drainage of water. If you have water that is pooling around your foundation or your house is sitting on a low level, you may need to look into re-leveling your yard. Grading involves the moving of topsoil onto the yard. You will then even out the low spots with the soil and form a downward slope (around 2%) from your home’s foundation. Leveling is an intricate process, and if your yard needs re-leveled, you may need to hire a professional.

4. Aerate Your Lawn

Aerating your yard means to perforate the soil with holes (4 – 6 inches deep) to allow water, air, and other nutrients to better absorb into the soil. Not only will aeration lead to a greener, healthier lawn, but it will also alleviate soil compaction and allow water to better absorb during rainstorms. The best time to aerate your lawn is during spring and fall.

5. Mind Your Landscaping

Improper landscaping can cause water to sit at the base of your home’s foundation and ultimately make it into your home. When landscaping, avoid making any changes that will block drains or downspouts. Make sure that all of your landscaping slopes downward to create runoff and that all downspout extensions or drainage systems extend beyond your planting beds leading the water away and far from your foundation.

6. Install a Drainage System

If you are constantly struggling with standing water in an area of your yard, it may be best to look into installing a yard drain. Yard drains act like shower drains. They prevent flooding and move the water away from your yard through hidden pipes to a dry well. The dry well will then collect the water underground and slowly percolate to the soil around it

Standing water is a serious, yet largely overlooked, issue that can have serious consequences. If water has been in your yard for multiple days and won’t drain, don’t neglect it. Look for the cause of your problem or reach out to a professional. Acting today will save you time, money, and headache tomorrow.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Calcas Connection, Homeowners Insurance Info |

The real estate market is usually deemed “hot” when inventory is low and competition is high. Hot markets often mean quick turnover, crowded open houses, bidding wars, and sales that close above asking (and sometimes all in cash). To the surprise of many, we’ve been in a hot market nationwide throughout the pandemic, and there are few signs it’s cooling down.

If you’re planning to buy (or sell!) soon, you’ll want to position yourself well by doing some extra prep work and research than you would in a neutral market. That way, you’ll be able to make smart decisions fast and strike when you see the right opportunity. Follow these pointers to come out ahead.

For buyers and sellers

-

- Get a good agent – An experienced agent who knows your local market will be worth their weight in gold. If you’re a buyer, they should know about listings before they come on the market and know how to make your offer stand out. Ask for referrals from your network and social circles.

- Be patient – Especially for buyers, patience is a virtue in a hot market, when you can make many offers before your winning one is accepted. Try not to get discouraged – rather, stay focused on your goal! And if you’re a seller, patience will help you find the right buyer.

- Know what’s going on in your local market – Your agent will know what market trends and events mean for your goals and priorities, but it’s smart to follow the market movements yourself too.

- Don’t get emotional – Letting emotions influence the buying or selling process can lead to bad or regretful decisions. Practice mindfulness or other techniques to stay grounded in those stressful moments of the journey. It’s good to have some thresholds and decisions made ahead of time so you have some “guardrails” at the ready.

- Have your paperwork ready – Whatever papers and documents you’ll need for the process, get as many of them ready as possible beforehand. That way, you won’t lose precious time when the clock is ticking.

- Be ready to move quickly – Speed is the name of the game in hot markets. Things can change overnight, and the perfect opportunity might present itself out of nowhere. When the conditions meet your pre-determined criteria, move quickly.

- Keep your insurance until you close – Don’t make changes to your insurance or cancel it prematurely – no matter how sure a deal seems.

If you’re a buyer

-

- Be very clear on your budget. The absolute first step is to know how much home you can afford. Knowing your range is good too but be sure you know where your ceiling is – and stick to it once you start putting in offers.

- Know your must-haves and where you can be flexible. Have a clear understanding ahead of time what attributes your new home must have and what things can be changed, renovated, or aren’t all that important in the grand scheme of things.

- Window shop – Get a handle on the local market by touring homes that would be in your price range and meet your requirements. This way, you’ll gain a sixth sense and sharp instincts for when you start making offers.

- Get financing and a pre-approval letter. Make sure your financing is lined up and you have a pre-approval letter. You’ll want to go with a lender that delivers on their promises and has a track record of closing loans quickly.

- Leverage your agent. Your agent has ways to make you stand out from the rest of the bidders. For instance, they can find out what the seller wants by calling the listing agent or gleaning information from the multiple listings service (MLS), which has more information than public listings.

- Read our guide. If you haven’t already, check out our top tips for your home-buying journey (good for any market, including hot markets!)

If you’re a seller

-

- Prep your property. Sellers in a hot market will have more luck selling their home “as is,” but it can pay off to make any needed fixes before listing. This will help you attract more interest and multiple offers (which usually means a better sale price in the end).

- Consider staging. Staging is probably one of the best ways to position your property to sell quickly and at a good price. It puts your home in its best possible light and gives potential buyers a great first impression and good feeling in the space. It will also differentiate your property from others.

- Get the “pre-work” done. Go over what you might need with your agent ahead of time. They might suggest getting an inspection done before listing, lining up a title company, and other due diligence items.

- Manage your expectations. A hot market doesn’t guarantee that you’ll get multiple offers over asking. Each sale is the product of lots of different variables, which is why it’s worth taking extra steps to give your property every advantage.

With the right tools, knowledge, and strategies, you can do well in a hot market. Above all, remember to get a good agent, have patience and get the prep work done before hitting “GO.” Good luck!

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.