by California Casualty | Homeowners Insurance Info, Safety |

You’re used to seeing fire extinguishers in public buildings such as offices and schools in case of an emergency. But would you be prepared if a fire broke out at home? Almost 400,000 home fires happen every year in the U.S., causing thousands of deaths and millions of dollars in losses, but still,1 in 4 Americans say they don’t have a fire extinguisher in their home.

While you may not be able to predict a house fire, you can protect your family by being prepared. That includes owning fire extinguishers, knowing how to use them, checking your smoke alarms, and having a family disaster plan.

If you are one of the families that currently doesn’t own any fire extinguishers – we strongly recommend purchasing one as soon as you can. Don’t worry, there are other steps you can take to safely contain a small home fire. Here are some helpful home fire safety tips and guidance.

Know not all fires are the same.

Some fires are oil-based. Others are sparked by electricity or chemicals. Still, other fires are non-chemical. The way you put out a fire depends upon the type. It’s very important to know the kind of fire. In some cases, if you choose the wrong way to try to extinguish a fire, it could make it even worse.

Here’s how to put out a cooking fire.

Kitchens are common places for home fires. When you turn on your stove, you ignite a flame. If that flame combines with cooking grease, a fire can erupt. Fires also can easily start if you leave a stove unattended and the food or liquid in the pan or pot starts to burn.

Water will not work on kitchen fires- which are oil or grease-based. Upon contact with the oil, the water molecules quickly heat to steam and cause the oil to explode in all directions.

The best way to put out a cooking fire is to “snuff it out”. You want to cut the flow of air to the fire. Here are some options:

-

- If the fire is small enough, cover it with a metal cooking lid or cookie sheet. Keep it covered until it has cooled.

- Cover the fire with a fire blanket, a large piece of fire-resistant material such as fiberglass.

- Don’t swat at the flames. This could create airflow and make the fire worse, or ignite your clothes.

- Pour a large quantity of salt or baking soda over the fire. Make sure it is salt or baking soda and not flour. Flour adds fuel to the fire and will cause it to burn (or even explode).

- Turn off any heat source.

- If your fire is in the oven or microwave, keep the door shut. While it may look scary, the lack of air will eventually extinguish the fire.

Here’s how to put out a chemical fire.

Many common household items are chemical-based and highly flammable. This includes alcohol, rubbing alcohol, hand sanitizer, products in aerosol cans, nail polish and remover. Exposing any of these chemicals to an open flame is dangerous. Even doing your nails near a lit candle can spark a chemical fire.

Chemical fires are similar to cooking grease fires. You never want to use water to put out a chemical fire. It could cause the fire to spread.

Here’s how to handle a chemical fire:

-

- Cover the fire with a fire blanket.

- Pour a large quantity of baking soda or sand on the fire.

Here’s how to put out an electrical fire.

There are many possible causes of electrical fires. They can start due to overloaded circuits, faulty electrical outlets, and outdated appliances. Worn or frayed cords can cause heat to reach flammable surfaces in your home such as curtains and rugs. Installing a light bulb with a wattage that is too hot for the fixture can ignite fires. Electric space heaters also are known for starting fires when their coils are placed too close to couches, curtains, bedding, and rugs.

Never use water to put out an electrical fire. Water conducts electricity, and if you douse an electrical fire with water, you could be electrocuted.

Here’s some guidance on how to put out an electrical fire.

-

- If it is safe to do so, unplug the device causing the fire.

- Turn off the electricity on the house’s breaker box.

- Smother the flames by pouring baking soda onto them.

Here’s how to put out ordinary fires.

Ordinary fires involve paper, wood, clothing, trash, or plastic. This type of fire may occur if you knock over a candle or get a spark from the fireplace.

Unlike the other fires, these do respond well to water.

-

- Grab a bucket and fill it with water. Douse the flames.

- If you’re dealing with a wood-burning fireplace, you may wish to skip the water. That will create a mess and spread ashes throughout the room. Consider spreading out the logs and embers, and covering them with sand or baking soda.

Don’t try to put out a large fire by yourself.

If the fire becomes larger or out of control, you do not want to try to contain it. Your safety comes first. Get out of the house and call 9-1-1.

A fire extinguisher is a good investment for your home.

Finally, if your home does not have a fire extinguisher, you should invest in one. Fire extinguishers use either water, foam, dry powder, CO2, and wet chemicals to extinguish fires. Some use a combination. The basic classifications for home use include:

-

- Class A – This type is used on any fire that may be extinguished with water.

- Class B – This type is used for flammable liquids and grease fires.

- Class C – This type is used for fires involving electrical equipment.

Review your coverage with your homeowner’s insurance to know how you are covered in the event of a fire.

To help prevent fires in your home, see our blog on home fire safety tips.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info, Safety |

Hurricanes are natural disasters that bring demolishing winds and massive amounts of rainfall to land from the ocean. Coastal towns and cities across the world have been torn apart by hurricanes, but they aren’t the only ones who are usually affected. Hurricanes can cause significant damage to towns over 100 miles inland! September, is the most active month of the year, so now is the time to protect yourself and your family from these deadly natural disasters.

The relative lack of storms so far this hurricane season is bringing both good and bad news. While we are all taking a sigh of relief that there has yet to be a major storm, it could also be bringing a false sense of security. Many people in states where hurricanes usually hit may be “dropping their guard.” A new survey finds only a quarter of those living in hurricane-prone states think they are prepared if a monster storm hits, and nearly half of the respondents say they have yet to make any preparations this year.

Remember all hurricanes, no matter what size, have the potential to cause significant damage and life-threatening situations. Looking back at the destruction previous hurricanes like Harvey, Sandy, and Katrina have caused, it is essential that you make sure your family, home, and belongings are completely protected.

Important Hurricane Coverages:

- Flood Insurance. A regular home insurance policy will not pay for damages caused by flooding, but when you add flood insurance to your policy it will cover all damages that happen to your property, even if you rent! Be aware that when you add flood insurance there is a 30-day waiting period until it goes into effect, so that means it is often too late to purchase it when a hurricane or tropical storm is approaching.

- Scheduled Personal Property Insurance (Floater). Many people find that after a natural disaster their insurance coverage is limited on expensive personal items (ex. jewelry, furniture, technology, firearms, collectibles, furs, instruments, etc.). Floaters protect your personal items for their full value.

Steps to Protect Your Home & Family

- Heed evacuation notices and keep your car’s gas tank full in case of evacuations

- Stock up on essentials like bottled water, non-perishable food items, toilet paper, and pet food

- Make sure pets are kept inside, safe, and have a spot to do their “business”

- Have a family evacuation and communication plan

- Prepare an emergency kit (ex. flashlight, medicines, cash, and important documents)

- Get a NOAA Weather Radio

- Sign up for National Weather Service storm texts at https://www.weather.gov/subscribe-hurricaneinfo

- Charge cell phones and other devices and have charged spare batteries

- Install storm shutters or purchase 5/8 exterior grade or marine plywood to cover windows or doors

- Add straps or additional clips to roofs to reduce damage

- Bring in or secure anything that can be propelled by wind (ex. grills, bicycles, lawn furniture, play equipment, etc.)

- Know how to turn off propane tanks and gas lines

After a Hurricane Strikes

- Make sure you, your family, and pets are safe and secure

- Register yourself as “safe” on the Safe and Well website

- Follow all city boil and curfew orders

- Secure the property from further damage or theft

- Contact your insurance company as soon as possible

- Keep or document receipts and other expenses if you are evacuated or forced to find another place to live because of damage to your home or apartment

- Be wary of unscrupulous contractors following a natural disaster

It’s important to know that flooding and storm surge are the biggest threats to life when hurricanes hit. Leave low-lying areas, never drive or cross through running water, and avoid rivers, streams, and creeks; which could flash-flood.

For more information visit:

https://www.ready.gov/hurricanes

https://mycalcas.com/?s=hurricane

https://www.iii.org/article/preparing-hurricane

https://www.cdc.gov/features/hurricanepreparedness/index.html

https://www.redcross.org/get-help/how-to-prepare-for-emergencies/types-of-emergencies/hurricane.html

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info |

Having extra cash on hand is always appreciated. One unexpected place you might find it is with your home insurance.

We’ve compiled some well-known — and lesser-known — ways that you can save money on home insurance. Follow these tips to lower your bills.

Raise your deductible.

The deductible is the amount that you pay before the insurance company pays a claim. Higher deductibles mean lower payments. According to NerdWallet, you could save 20 percent by raising a $500 deductible to $1,000. If you do increase your deductible, make sure that you can cover the costs of repairs should something happen.

Ask about discounts.

You may qualify for insurance discounts for being part of a professional association, such as groups for teachers, nurses or first responders. There are also discounts for being retired, for paying via automatic bank payments, and for paying in full upfront. You may qualify for a new home discount, or a discount if you have updated your utilities (electrical, plumbing, heating, cooling) in an older home. There are discounts for a new roof and an automatic sprinkler system. You can even be rewarded for being a loyal customer.

Remove attractive nuisances.

You may be paying extra for high-risk items. These attractive nuisances are potential dangers that could attract kids and cause injuries. Examples include trampolines, swimming pools, and playground equipment. If you are willing to get rid of these items, it may lower your payments.

Skip a payment.

Some insurance companies allow you to skip payments. At California Casualty, you have the option to skip payments in either the summer or the winter!. Ask your agent for details.

Take care of minor repairs.

Your home insurance policy can take care of both major and minor damage from a covered loss. But sometimes it’s easy enough to take care of those minor repairs on your own, out-of-pocket. That way you’ll avoid filing a claim and if you remain claims-free for a period of time, that qualifies for a discount, too.

Buy home and auto insurance from the same company.

When you bundle your home and auto insurance, you can often qualify for reduced rates, saving hundreds of dollars.

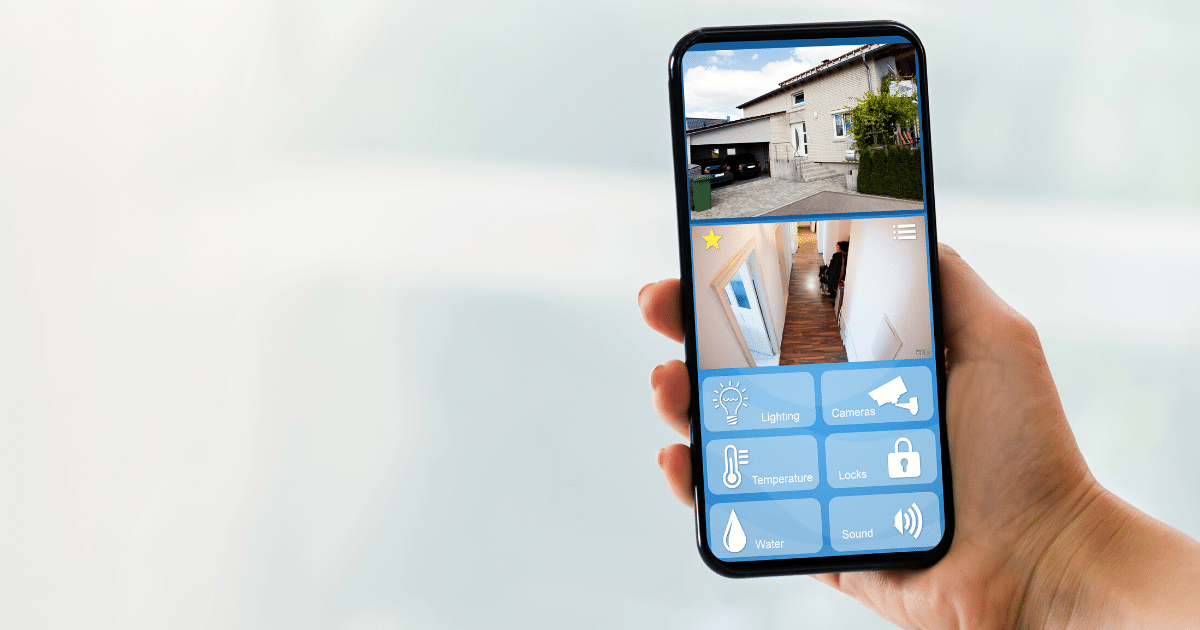

Make your home secure and disaster-resistant.

The better protected your home is, the less chance that there will be a claim. That’s why disaster-proofing and securing your home can save you in insurance premiums. To protect against disasters, consider storm shutter, impact-resistant roofing. Having a fire extinguisher could earn you a discount. For enhanced security, a burglar alarm and deadbolt locks can earn you discounts. While some of these repairs and updates are expensive, they will pay off in the long run. Remember that flood and earthquake insurance are not included in standard homeowner’s coverage. However, you can make home improvements that reduce their cost as well. Importantly, you will need a new home inspection before new rates can take effect, and you may need to pay for it.

Check your credit score.

Your credit score indicates your ability to pay your debts. Missing payments, not having a long credit history, and high credit card balances could create an unfavorable credit score. A credit score under 630 could increase your insurance rates, according to NerdWallet. You can get a free credit report once a year from the three credit agencies, TransUnion, Experian, and Equifax. Check your score, and take actions to improve it.

In addition, in some states, you can get your credit-based insurance score, which indicates how likely you are to file an insurance claim. If you are eligible for that report, you can find it at CLUE (Comprehensive Loss Underwriting Exchange) from LexisNexis

Review your insurance limits annually.

If your insurance is billed to your mortgage bank, you may not think much about your annual premiums. But it’s a good idea to review your policies annually to make sure you’re not paying for coverage that you no longer need.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Consider This, Homeowners Insurance Info |

We don’t think much about our heat, electrical, or plumbing until they stop working…

Like a regular health checkup, a home system checkup includes routine maintenance that can help prevent costly repairs and future emergencies.

Homeowners, follow our checklist to keep your home systems running smoothly all season long.

HVAC (Heating, Ventilation and Air Conditioning) System

The HVAC system is responsible for heating and cooling your home. Regular maintenance can help lower your utility bills, increase your system’s lifespan, and ensure you are breathing healthy air.

-

- Check the air filter. If it’s dirty, it will make your furnace work harder. Clean or replace the filter every three months.

- Clean the air vents. You can vacuum the vents to help prevent blockages. If you suspect there’s a buildup of dirt and grime, consider scheduling an air duct cleaning.

- Vacuum lint from the clothes dryer vent that leads to the outside of your house.

- Adjust your programable thermostat for heat rather than air conditioning. If your thermostat takes batteries, replace them at this time.

- Cover the outdoor air conditioning unit once you no longer are using it for the season. That will protect it from the weather, dirt, and debris.

- Rotate your ceiling fans’ blades clockwise in cool months and counterclockwise in warm months to keep heat moving in a direction that minimizes the effort of your HVAC system.

- If you haven’t done so this year, schedule an annual professional checkup to make sure your HVAC system is in good working order.

- Even the best furnaces don’t last forever. You may need to replace your furnace after 10-25 years.

Plumbing System

A plumbing system delivers fresh water to your sinks, bathtubs, toilets, and other fixtures. It also takes away water and waste to a sewer or septic tank. Regular maintenance will help prevent issues such as leaks, clogs, and frozen pipes, which can be disruptive and costly.

-

- Clean drains in your sinks and tubs by pouring half a cup of baking soda followed by half a cup of white vinegar.

- Remove mineral deposits from your showerheads by filling a plastic bag with vinegar. Secure it with a rubber band over the showerhead and leave it overnight. In the morning, you should be able to wipe any buildup away.

- Clean your garbage disposal to prevent it from hosting harmful bacteria or growing mold. This Old House suggests this approach: Pour a half cup of baking soda in the disposal. Wait 30 minutes, then pour in one cup of white vinegar. Let the mixture foam for 3 minutes, then rinse with hot water. Finally, grind up two cups of ice and a cup of salt while running cold water. You also can grind lemon peels at the end for a fresh scent.

- Flush your water heater to remove any mineral buildup. You can find instructions online or call a professional.

- Check your faucets inside and outside to make sure they are not dripping or leaking.

- Check under the sink for any leaks or stains, which could signal water damage or mold.

- Check any exposed pipes in your home for leaks and seal them. Insulate pipes in places that aren’t heated.

- Disconnect outside water hoses to prevent them from freezing. Turn off underground sprinkler systems.

- Clear debris from your

- Call a plumber if there are issues.

Electrical System

An electrical system powers your lights, appliances, and more. Working around electricity requires knowledge and skill to take the proper safety precautions. If you’re unsure of how to do something, consult a trained professional.

-

- Inspect your breaker panel. Check for signs of corrosion. Flip the breakers on and off to make sure they move easily and do not stick. (Make sure first to alert members of your household that you are switching off electricity so they can prepare accordingly.)

- Test your outlets. You can buy a cube or block tester at any hardware store. You simply plug it in, and it lights up to indicate common issues. Also, test each outlet for tightness. Outlets may wear out over time. Finally, consider installing tamper-resistant outlets in any areas where children may be able to reach.

- Place your hand on outlets and light switches to check for excessive heat. Also be aware of any “hot wire” smell when a light is on or an appliance is plugged in, or popping and cracking sounds. These indicate that you may need to replace that outlet or switch.

- Look at exposed wires and cables in your basement and other areas of your home. If you notice damage, replace them.

- Make sure exterior outlets are covered so that they are not damaged by the weather and animals.

Security System

Your home security system protects you from threats. No matter what system you have, a semi-annual check can keep it in top working order.

-

- Inspect your sensors. Make sure they are firmly attached to windows or doors. Try to set off a motion sensor to ensure it is working properly.

- Replace batteries if your system uses them.

- Check lighting and replace bulbs as needed.

- Make any adjustments needed to the camera angles. This is a good time to clean the lens.

- Trim bushes that have overgrown and might provide cover for a thief.

- Tighten loose screws in gates, door hinges, knobs, and locks.

- Check your warranty or contract to see if you qualify for an upgrade.

Home fires spike in the fall and winter. Being prepared is key and could save your life if you are the victim of an unexpected house fire.

-

- If you have not done so already, purchase smoke alarms that also function as carbon monoxide detectors. Carbon Monoxide is a poisonous, odorless gas that claims over 400 lives each year.

- Install detectors on every level of your home, including inside of bedrooms and in common rooms.

- Test and change batteries in older detectors or alarms.

- Replace them after 10 years.

- Have a disaster plan in case of a home fire and keep all other fire safety materials, like fire extinguishers, in well-working condition.

Take the proper precautions to avoid winter home hazards and keep your home in good working order this season.

For more fall maintenance tips click here.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info |

It’s time to make a move. Whether you’re heading across town or going cross-country, moving yourself or hiring movers, you want an organized, stress-free experience.

What’s the secret to a smooth move? Avoid these common moving mistakes.

Mistake #1: Choosing the wrong moving company

There are reputable companies, and there are ones that put out misleading information. There are even plenty of moving scams. Choosing a sketchy moving company not only won’t save you money but it could end up costing you plenty. Know the warning signs. Avoid moving companies that only give phone estimates and/or require large deposits. Skip the ones that only offer non-binding estimates (a quote based on estimated weight of your things). That means they could be planning a much higher bill at the end. Be suspicious of moving companies that have similar names to well-known national brands but are not them. Finally, avoid any mover without an address.

All moving companies that move across state lines must have a DOT number. Ask for it and then look it up in the Federal Motor Carrier Safety Administration database. Make sure their information matches what they told you.

Mistake #2: Not getting an estimate in writing

It’s hard for a mover to give you an accurate estimate without seeing your belongings in person. That’s why a mover that only provides a phone estimate is probably not reputable. Insist on a mover who visits your home and gives an estimate in writing. It’s always best to get three estimates. Make sure to read the fine print, and think twice about choosing the lowest bid. If possible, choose a mover that offers a binding not-to-exceed estimate. That means you won’t be charged more than the estimate and may be charged less.

Mistake #3: Not giving yourself enough time to pack—and/or not packing boxes correctly

Packing is going to take more time than you think. If you leave it to the last minute, you will be tempted to throw things into boxes without organizing them, which could make unpacking difficult. According to movers.com, it takes 3-5 days full-time to pack a three-bedroom house. If you’re working around a job and other responsibilities, give yourself additional time.

Pack your boxes so they are filled to the top but not overfilled or underfilled. Underfilled boxes can collapse under the weight of others on top of them. You should be able to tape boxes closed so the top is flat. A standard moving box will have a weight limit printed on the bottom. But being able to lift the box is also a consideration. Limit the weight of your boxes to 50 lbs. and you should generally meet the box weight requirements and keep it manageable to lift.

Mistake #4: Moving unnecessary items

It may be tempting to bring everything to a new home, and sort it out there. However, moving is a great time to take stock of what you really use and what you don’t. Why spend the time and money moving things that you’ll just end up storing, giving away, or throwing out? Hold a yard sale or donate items before you start packing. This will help lighten the load. Keep track of your donations; you can expense them on your taxes.

Mistake #5: Not knowing the obstacles at your new location

Are there narrow roads or restricted access at your new home? Is there no parking for an 18-wheeler? If so, your moving company may need to get a smaller truck and shuttle your stuff—at an extra charge. Also, if your furniture doesn’t fit through the doorways or hallways of your new home, it may need to be disassembled. You’ll be charged for these extra services, so be aware. Note also that many cheap pieces of furniture are made from particleboard. It’s not meant to be moved and is easily broken.

Mistake #6: Not preparing for your pets

Your pets are part of the family, but moving day will be particularly stressful for them. After all, they won’t understand why strangers are taking their furniture. With all of the commotion, it’s also easy for a pet to get lost in the shuffle, or have a scared animal run away or hide. Consider having relatives or friends take care of your pets or board them in a kennel for moving day. Also, make sure that you have your pet’s records for easy access when you need them.

Mistake #7: Choosing to move your valuables with the moving company

You may not care much if you have to replace the IKEA artwork from your living room, but the picture painted by your grandfather is irreplaceable. Therefore, if it’s sentimental and it can’t be replaced with money, plan to move that valuable item yourself.

Mistake #8: Not having enough insurance

Who covers your valuables if your mover drops something and breaks it? Surprisingly, it may not be the moving company. Homeowner’s and renter’s policies cover your personal property while at your home and in storage—but not while they are being transported by movers.

Your moving company should offer insurance, as listed in your contract. Options include: full value protection, released value protection, and separate liability coverage. You’ll pay for full value but will also be reimbursed the full value if anything breaks. For released value protection, you’ll typically get just 60 cents on the dollar per pound (so a 30-lb. flat-screen TV would be an $18 reimbursement).

If you’re moving yourself, you can arrange for trip transit insurance, special perils contents coverage, or a floater for valuables with your insurance company. Protect your possessions so they make it safely to your new home.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info |

You’ve bought a house. Congratulations! Now the fun begins. As a new homeowner, you’re going to be responsible for a lot more than when you were renting.

Follow these 7 money-saving tips to set up your new home like a pro.

Tip #1: Wait to spend on nonessentials. Fix things first.

Don’t worry about buying furniture, changing your cabinets, decorating or personalizing your home right away. Right now, your focus should be on repairing and replacing.

-

- Take care of any maintenance and repairs that you can do yourself, such as painting walls and replacing doorknobs and locks.

- Hire a qualified contractor for electrical work, plumbing, roof repair, gas appliances, and to handle any toxic materials like mold or asbestos.

- When choosing a contractor, get cost estimate quotes from three different providers. This will help you find the one that is most cost-effective.

- Make sure any contractors you use are licensed to work in your state. Ask for references and talk to some of their past clients.

Tip #2: Seal your home. Check your insulation and look for small air leaks.

Insulation is the material that keeps the heat in your home during the winter and the cool in during the summer. When you have the right amount of insulation, and no air leaks around openings like doors, it will help to lower your heating and cooling bills

-

- Check to see that you have at least six inches of insulation in your attic. You will need more in colder climates.

- Don’t forget to insulate around the attic opening. That’s a common place to lose heat.

- Wrap any exposed water pipes in insulation. This will help prevent frozen pipes.

- Caulk and weatherstrip to seal small air leaks around doors, windows, and electric outlets. These are all places where air can get in and out.

Tip #3: Regulate the temperature in your home.

Your home’s heating and cooling systems work to keep things comfortable—at a cost. You can help reduce those bills with a few simple adjustments.

-

- Install a programmable thermostat. This allows you to raise the heat while you’re at work and cool down when you are home during the summer months and vice versa for the winter.

- Lower the temperature on your hot water heater to 120 degrees F. Not only will it help with your energy bill, but it will also help prevent scalding burns.

- Install ceiling fans. This is a great way to move air around, and help reduce the amount of air conditioning you need.

- Close the blinds to block the sun which can heat up your house.

Tip #4: Watch for standing water or water leaks.

A sudden increase in your water bill is a sign that you probably have a leak. Keeping on top of these repairs is an easy way to prevent this unnecessary cost.

-

- If you have a dripping faucet, repair or replace it as soon as possible.

- Check under the sinks for wet spots that may indicate leaky pipes.

- If your toilet is constantly running, that could raise your water bill as well. You may need to replace a part such as a flapper, fill valve or chain.

- Check for a leaky toilet. Remove the tank lid and put a few drops of food coloring in the back of the tank. Wait 30 minutes without flushing your toilet. If you see the color in the toilet bowl within that time, you probably have a leak.

Tip #5: Take advantage of tax benefits and incentives.

As a homeowner, you may qualify for tax benefits and incentives if you itemize deductions on your tax return. Consider hiring an accountant to help you maximize your refund.

-

- Mortgage interest is deductible.

- Home equity loan interest is deductible if you spent the money on home improvements.

- You may get a tax break for paying property taxes.

- If you work at home, you can deduct home office expenses.

Tip #6: Pay off your mortgage early.

You can reduce the amount of interest that you pay if you budget correctly and pay off your mortgage early.

-

- Switch your mortgage to a biweekly payment. If your monthly payment is $1,000, pay half, $500, every two weeks. You will pay the same amount that you would, but will end up making 13 full payments instead of just 12 in a year. You also will rack up less interest, which is calculated daily. Overall, this will end up saving you thousands of dollars.

- Make extra principal payments when you send your monthly payments.

- Consider using any windfalls, such as your tax refund, as payments toward your principal.

Tip #7: Update your insurance.

Your home is likely your largest investment. Make sure it is protected with the right insurance.

-

- Your mortgage lender requires homeowner insurance. Many homeowners pay the mortgage lender who in turn pays the insurance company through an escrow account.

- Consider bundling your car insurance and homeowner insurance to save money.

- Make sure that you have disability income insurance so that you can continue to pay for your home in the event you are unable to work.

- If you live in an area that floods, consider adding flood insurance. Similarly, there is earthquake insurance.

- Consider an umbrella policy for extra coverage beyond your homeowner policy.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.