by California Casualty | Homeowners Insurance Info |

You want to take good care of your house. Not only does it provide shelter and a cozy environment for you and your family, it’s also your largest investment and you want to make sure it to holds up over time.

That’s why it’s important to avoid these unfortunately common and costly mistakes made by homeowners. Doing these things to your house could cost you big time now – or in the future, if you decide to sell.

Home Improvements

You should never…

Remove architectural features.

You may be tempted to remodel but make sure in doing so, you don’t destroy the charm of your home. That quaint tin ceiling, the chair rail molding along the wall and that detailed millwork are selling features to future buyers. Architectural details offer curb appeal and help distinguish your home.

Get rid of a bedroom or a bathtub.

Bedrooms sell homes, and similarly, so do bathtubs. Families are looking for both when buying a new house. That’s why you should never remove a bathtub in favor of a new shower. You’ll discourage families with kids and pets who need the tub. Similarly, taking down a wall to merge two bedrooms into one large one may be good for you, but it will detract from your home’s future sale price.

Cover wallpaper with water-based paint.

Water-based paint reacts with wallpaper glue, causing it to peel. So, if you paint over wallpaper with water-based paint, you’ll have a peeling mess on your hands. Instead, use oil-based primer to provide a protective barrier. Let it dry fully and then apply latex paint.

Leave cabinet doors on when you’re painting.

Painting your cabinets is an easy way to give your kitchen a facelift without spending tons of money. Just make sure that when you do, you remove the cabinet doors. That way, you won’t paint over hinges and hardware. It will turn out to be a much more professional job. Remember to keep track of which doors go in which spots. Label them with numbers under the hinge locations or back where it won’t be visible.

Do your own plumbing or electrical.

You may know a bit about plumbing or electrical. That doesn’t mean that you should add a bathroom or rewire your house. DIY projects are great when they match your experience. Hire a professional for jobs that are beyond your skill level to avoid costly mistakes.

Daily Living

You should never…

Flush flushable wipes.

They may say flushable, but they really aren’t if you want to keep water flowing through your pipes. Flushable wipes are made from synthetic materials that don’t break down. As a result, they can get stuck in your pipes or make their way to the sewer system and clog it up. The best choice always for toilets is toilet paper.

Let ceiling fans run.

You may think ceiling fans cool down your home. In reality, they move air around which helps your sweat evaporate more quickly. That’s what makes you feel cooler. It makes sense to run a ceiling fan in the room where you are; however, running it in every room when people are not present just doesn’t make sense. It just increases your energy bill.

Leave a brick in the toilet.

It used to be common for people to put a brick in their toilets to displace the amount of water used. That would ultimately save them money. But water causes bricks to crumble over time and those pieces can really damage or clog your pipes. Instead, try filling a half-gallon milk carton with sand and put it in the tank. That will save you a half-gallon of water for each flush. Or you could replace your toilet with a new model that uses less water.

Put starchy food down the disposal.

Starchy foods clump up when they come in contact with water. That’s great for cooking but terrible for garbage disposals, which can get easily clogged. Instead, put the potatoes, rice and oatmeal in the trash or compost pile.

Pour bleach or drain cleaner down the drain.

Diluted bleach is great for cleaning surfaces but not so great for pipes. That’s because this harsh chemical can damage them. Bleach also kills the good bacteria that break down waste. In that way, bleach can actually cause clogs. Drain cleaner also is hard on pipes. If you’re trying to clear a drain, use a pipe snake instead.

Outdoors

You should never…

Plant trees too close to your house.

Trees enhance our property and provide beauty and shade. But having trees too close to our homes can be dangerous. Branches can break off during storms, and in heavy winds, and limbs or trees can fall on your house. In addition, their large root systems can grow into your foundation, weakening it. Always take care to plant trees far enough away from your house: at least 30 to 50 feet away for medium and large trees and 10 feet away for smaller trees (less than 30 feet tall when full grown).

Plant invasive species.

You may love the Rose of Sharon, but if you plant it in your garden, you could find more than you bargained for. This pretty plant is an invasive species, meaning that it will easily take over your garden and your lawn. It’s tough to get rid of invasive species, so do yourself a favor. Don’t plant them in the first place and remove them as soon as possible.

Skip the last mow of the season.

Long grass provides a place for critters to hide. It also means that they will have a safe path to get into your home during the winter months. Keep your lawn short and you’ll be less likely to have these unwanted guests, plus your grass will be healthier.

Leave your hoses connected in winter.

Leaving your hoses attached can trap water which can freeze your pipes and damage them. Don’t make that mistake. Disconnect your hoses when you put away your lawnmower for the winter.

Park your car on your lawn.

It seems like common sense to park in the driveway or on the street and not on your lawn. After all, you could ruin your grass that way. But there’s another important reason. You could create a fire hazard from a hot engine on dry grass. You also may leak harmful chemicals onto your lawn. For these reasons, many local ordinances make it illegal to park on the lawn.

Luckily, home insurance covers repairs from most mistakes like these. An annual review of your homeowner’s policy will ensure you are fully covered. Talk to your insurance agent to see what’s covered under your current policy.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Consider This, Homeowners Insurance Info |

We don’t think much about our heat, electrical, or plumbing until they stop working…

Like a regular health checkup, a home system checkup includes routine maintenance that can help prevent costly repairs and future emergencies.

Homeowners, follow our checklist to keep your home systems running smoothly all season long.

HVAC (Heating, Ventilation and Air Conditioning) System

The HVAC system is responsible for heating and cooling your home. Regular maintenance can help lower your utility bills, increase your system’s lifespan, and ensure you are breathing healthy air.

-

- Check the air filter. If it’s dirty, it will make your furnace work harder. Clean or replace the filter every three months.

- Clean the air vents. You can vacuum the vents to help prevent blockages. If you suspect there’s a buildup of dirt and grime, consider scheduling an air duct cleaning.

- Vacuum lint from the clothes dryer vent that leads to the outside of your house.

- Adjust your programable thermostat for heat rather than air conditioning. If your thermostat takes batteries, replace them at this time.

- Cover the outdoor air conditioning unit once you no longer are using it for the season. That will protect it from the weather, dirt, and debris.

- Rotate your ceiling fans’ blades clockwise in cool months and counterclockwise in warm months to keep heat moving in a direction that minimizes the effort of your HVAC system.

- If you haven’t done so this year, schedule an annual professional checkup to make sure your HVAC system is in good working order.

- Even the best furnaces don’t last forever. You may need to replace your furnace after 10-25 years.

Plumbing System

A plumbing system delivers fresh water to your sinks, bathtubs, toilets, and other fixtures. It also takes away water and waste to a sewer or septic tank. Regular maintenance will help prevent issues such as leaks, clogs, and frozen pipes, which can be disruptive and costly.

-

- Clean drains in your sinks and tubs by pouring half a cup of baking soda followed by half a cup of white vinegar.

- Remove mineral deposits from your showerheads by filling a plastic bag with vinegar. Secure it with a rubber band over the showerhead and leave it overnight. In the morning, you should be able to wipe any buildup away.

- Clean your garbage disposal to prevent it from hosting harmful bacteria or growing mold. This Old House suggests this approach: Pour a half cup of baking soda in the disposal. Wait 30 minutes, then pour in one cup of white vinegar. Let the mixture foam for 3 minutes, then rinse with hot water. Finally, grind up two cups of ice and a cup of salt while running cold water. You also can grind lemon peels at the end for a fresh scent.

- Flush your water heater to remove any mineral buildup. You can find instructions online or call a professional.

- Check your faucets inside and outside to make sure they are not dripping or leaking.

- Check under the sink for any leaks or stains, which could signal water damage or mold.

- Check any exposed pipes in your home for leaks and seal them. Insulate pipes in places that aren’t heated.

- Disconnect outside water hoses to prevent them from freezing. Turn off underground sprinkler systems.

- Clear debris from your

- Call a plumber if there are issues.

Electrical System

An electrical system powers your lights, appliances, and more. Working around electricity requires knowledge and skill to take the proper safety precautions. If you’re unsure of how to do something, consult a trained professional.

-

- Inspect your breaker panel. Check for signs of corrosion. Flip the breakers on and off to make sure they move easily and do not stick. (Make sure first to alert members of your household that you are switching off electricity so they can prepare accordingly.)

- Test your outlets. You can buy a cube or block tester at any hardware store. You simply plug it in, and it lights up to indicate common issues. Also, test each outlet for tightness. Outlets may wear out over time. Finally, consider installing tamper-resistant outlets in any areas where children may be able to reach.

- Place your hand on outlets and light switches to check for excessive heat. Also be aware of any “hot wire” smell when a light is on or an appliance is plugged in, or popping and cracking sounds. These indicate that you may need to replace that outlet or switch.

- Look at exposed wires and cables in your basement and other areas of your home. If you notice damage, replace them.

- Make sure exterior outlets are covered so that they are not damaged by the weather and animals.

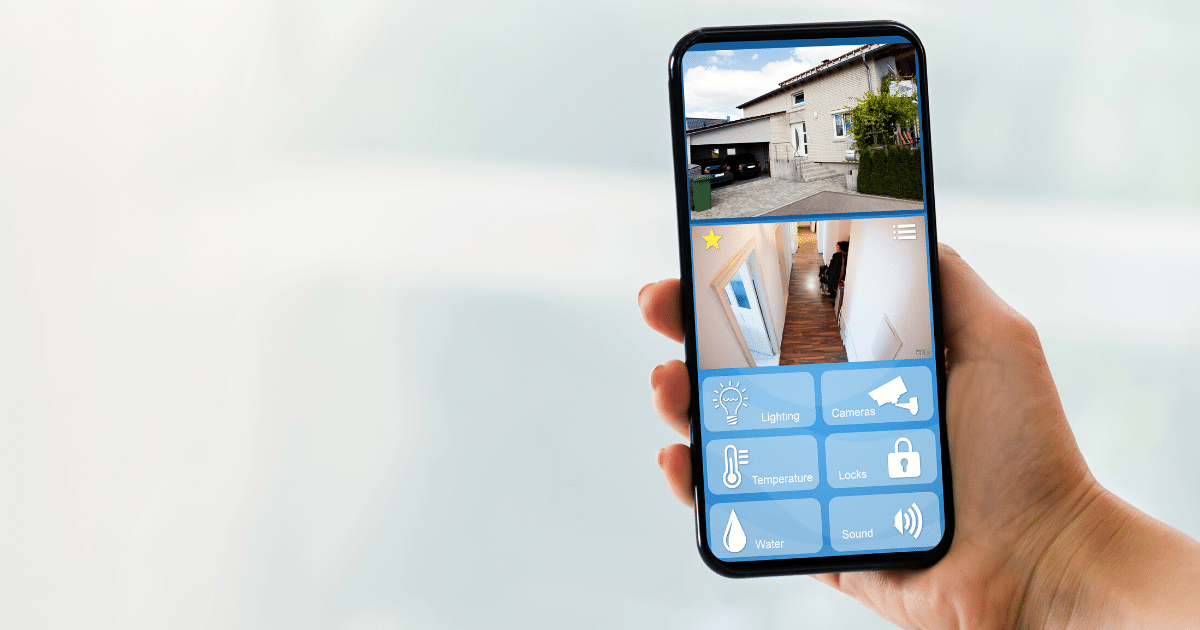

Security System

Your home security system protects you from threats. No matter what system you have, a semi-annual check can keep it in top working order.

-

- Inspect your sensors. Make sure they are firmly attached to windows or doors. Try to set off a motion sensor to ensure it is working properly.

- Replace batteries if your system uses them.

- Check lighting and replace bulbs as needed.

- Make any adjustments needed to the camera angles. This is a good time to clean the lens.

- Trim bushes that have overgrown and might provide cover for a thief.

- Tighten loose screws in gates, door hinges, knobs, and locks.

- Check your warranty or contract to see if you qualify for an upgrade.

Home fires spike in the fall and winter. Being prepared is key and could save your life if you are the victim of an unexpected house fire.

-

- If you have not done so already, purchase smoke alarms that also function as carbon monoxide detectors. Carbon Monoxide is a poisonous, odorless gas that claims over 400 lives each year.

- Install detectors on every level of your home, including inside of bedrooms and in common rooms.

- Test and change batteries in older detectors or alarms.

- Replace them after 10 years.

- Have a disaster plan in case of a home fire and keep all other fire safety materials, like fire extinguishers, in well-working condition.

Take the proper precautions to avoid winter home hazards and keep your home in good working order this season.

For more fall maintenance tips click here.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

You know the basic coverage that comes with your health insurance, car insurance, and home insurance policies. But did you know there are other special insurance policies and add-ons that you could be missing out on?

If you’re traveling to Mexico, own an older home, a classic car, or have precious family heirlooms, etc., you should increase your protection by looking into purchasing these lesser-known insurance policies and options.

Planning to travel south of the border? Mexico does not recognize U.S. auto insurance. If you’re driving to Mexico from the U.S. in your own car or a rental, you will need to purchase a tourist auto policy.

-

- A Mexico auto policy will allow you to cover damages if you’re involved in an accident.

- If you cannot show proof of Mexican insurance, you can be heavily fined and even arrested. This is true even if you are not at fault for the accident.

- You can get coverage for the duration of your trip: a few days, a few months or longer.

2. Homes Built Before 1986

Homebuilding has changed over the years. If you’re living in a home built before 1986, it’s likely your house has outdated materials or old-fashioned types of construction. You can get a policy option that helps bring your house up to date if it is damaged.

-

- With this type of policy, in the event of a loss, your insurance covers repairs and/or replacement of outdated materials and construction methods.

- As a result, losses will cost less to settle.

- Those repairs and updates will reduce the coverage amount that you need to protect your home.

- This will ensure you have enough insurance to rebuild.

3. Special Computer Coverage

With everyone working remotely this past year, computers have become our lifeline. Consider a special computer coverage option to ensure you are covered for all of your devices: desktop computers, laptops, tablets, and smartphones. While homeowner policies typically cover possessions, special computer coverage offers more coverage.

-

- If you accidentally spill a glass of water on your computer, and your computer is damaged as a result, it would be covered.

- With this coverage, you will receive more money for your devices if they are damaged than with traditional homeowner’s.

Personal Property, also referred to as “contents coverage,” is the term insurance companies use to collectively define the things you own inside your home. Scheduled Personal Property (SPP) Coverage is for items that have higher values above your personal property coverage limits. This includes:

-

- Heirlooms

- Watches

- Jewelry

- Instruments

- Furs

SPP offers much broader coverage for your precious items – if you misplace a set of earrings, they are covered; if a diamond falls out of a ring, or a guitar neck breaks, they’re covered. There is no deductible if the covered items are stolen, lost, or damaged. SPP provides a replacement for the actual appraised value of the item.

Spending time and money on your classic car? Don’t let it go to waste. Make sure it’s protected with classic car insurance coverage. With this coverage, you will pay less than standard auto insurance coverage and you can determine the value, the deductible, and the policy options that work best for you including towing and coverage for lost or stolen parts. There are mileage plans that cover everything from cruising on the weekends to driving to attend auto shows.

-

- Classic Car Coverage is for all types of collectibles – collector trucks, classic and custom motorcycles, kit cars, fire engines, military vehicles, and more.

6. Refrigerated Property Coverage

When there is a power outage, the food in your refrigerator could spoil. A standard homeowner’s policy may cover the costs of replacing some of the food. A refrigerated property policy provides additional coverage.

- A refrigerated property policy adds up to $500 of coverage for property, such as meat that spoils because of a power outage or equipment failure.

7. Other Members of Your Household Coverage

Do you have someone living with you who is not a relative, guest, or tenant? You may consider this policy for other members of your household.

-

- If a boyfriend moves in, and he’s not on the lease, it may make sense to add this coverage.

- This policy adds personal property, liability, and additional living expense coverage for that person.

Our pets are like family and we want to keep them as healthy as possible. Pet insurance can help to offset those veterinary expenses.

-

- Depending on your policy, pet insurance may cover exams, prescriptions, lab tests and x-rays, surgeries, emergency visits, and even cancer.

- You make the initial payment and then are reimbursed depending upon the deductible and limits that you have selected.

9. Sump Pump Endorsement

If your home is prone to flooding, chances are that you have a sump pump to remove the water. A sump pump/water backup endorsement covers damage if your sump pump fails or something happened to cause water to back up into your home. This damage is not covered under standard homeowner policies.

-

- Just a couple of inches of water backup can cause thousands of dollars in damage – ruining carpets, destroying appliances, and crumbling drywall.

- This could happen to any system, and especially ones where sewer pipes are old.

10. Permitted Incidental Occupancies – Residence Premises (for Home-Based Businesses)

Do you have a home-based business? You may wish to add an endorsement to your homeowner’s policy.

-

- This policy covers limited activity for business that takes place in your home or in a detached garage or other building on your property.

- It protects entrepreneurs, such as teachers offering in-home tutoring or music lessons.

Ninety percent of Americans live in areas that are seismically active. If you live in an area that is prone to earthquakes, you may want to consider this additional coverage.

-

- Homeowner, condo, and rental insurance policies typically do not cover earthquakes.

- Earthquake insurance can help pay for some of your losses.

Floods are expensive. Just a couple of inches of water could cost thousands of dollars in damage to your home and belongings. There are a lot of myths about flood insurance; it’s important to know the facts.

-

- Flooding is America’s most common natural disaster.

- One in four homeowners will experience a flood during a 30-year mortgage.

- A flood insurance policy can protect your home and its contents.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.