by California Casualty | Auto Insurance Info |

From hail to high winds, flooding, and more, spring storms can do some real damage — and not just to your home and property. These intense storms can also take their toll on your car.

Here are some ways you can protect your vehicle from spring storms.

Take cover – and cover-up — during hailstorms.

Hailstorms do billions of dollars of damage each year, according to the Insurance Information Institute. If you live in one of the states that typically receives a lot of hail, your car could be at even greater risk. But even if you don’t, it only takes one bad hailstorm to dent your vehicle or crack your windshield.

-

- If you have a garage or barn, park your car inside. Being in an enclosed structure will help protect your car from hailstones and flying debris.

- It may be a bit inconvenient but you can find covered parking in malls or parking garages. Park above the ground floor to minimize contact with water in case there is flooding.

- If you cannot park inside, move your car away from trees. Park near the side of a building or your house for some protection.

- Cover your vehicle with a car cover. You can buy one or make your own with blankets. Secure the blankets with duct tape; while it may leave a sticky residue, it will not damage your paint.

- If you’re driving when a hailstorm hits, pull over. Hailstones fall at a pretty good speed. When you add your car’s forward motion, that actually increases the impact.

Stay far from trees and other cars in high winds.

High or straight-line winds can leave destruction in their wake, from downed trees to flying debris. Check with your local weather service on wind speeds and know what wind can do. Winds traveling at 50 mph can move patio furniture. At 60 mph, they can pick up a car and shatter windows.

-

- Park away from trees, which could potentially fall or drop heavy branches on your vehicle. Stay away from power lines, too.

- Park inside if space is available. Reinforced garage doors are helpful if you’re in a place with frequent high winds.

- If time permits, trim your tree branches in advance of the storm. Also, remove any items that could potentially impact your car.

- Remove valuables from your car that could be blown away if winds hit high speeds and shatter your windows. Don’t tape your windows; it’s a myth that tape will help contain the glass and prevent tiny shards from flying around.

- If you’re driving in strong winds, consider pulling over. If you continue driving, keep plenty of space between you and the cars around you.

Stay high and dry when it rains and floods.

Rain and flooding can cause serious problems with your car. Water can damage your engine, electrical components, and interior. Its effects may not even show up immediately. You may have trouble starting your car, or notice premature rusting.

-

- Make sure your windows are rolled up, and your sunroof is closed before a rainstorm. If water gets inside your car, it can cause mold to grow.

- Store important documents for your car in a water-tight bag.

- Park on high ground if possible, or in a garage.

- You can purchase a flood cover that may help to protect your car.

- Avoid driving through pools of water. The water could reach your car’s undercarriage.

- Stay off the roads if you can. Floodwaters can rise quickly and you want to avoid contact with your car.

- If your vehicle stalls in a flooded area, do not remain with your car. Exit your vehicle and get to high ground. It takes just 12 inches of rushing water to carry away a small car and 2 feet of rushing water can carry away most vehicles, according to AAA.

Know what to expect and plan ahead.

Your local town or your state will likely issue severe weather alerts. Getting a heads up on impending storms will help you make the proper preparations ahead of storms this spring.

-

- Download a weather app on your phone for advance notice.

- Research places in case you need to take shelter, including where to park your car.

- Check your tires and make sure they are fully inflated.

- Check your windshield wipers and replace blades that leave streaks.

- Make sure that you have a full tank of gas in case you need to evacuate.

Make sure you have the right insurance coverage to protect your vehicle.

Despite your best efforts to protect your vehicle, sometimes damage happens. But if you have the right insurance coverage, you’ll likely be able to repair or replace your vehicle without large out-of-pocket costs.

-

- Comprehensive coverage is for natural disasters, fires, vandalism, theft, and animals that damage your vehicle. Think of it as “bad luck coverage.” Comprehensive coverage is not usually required unless you’re leasing a vehicle or paying a car loan. However, it’s valuable to protect your car from spring storm damage.

- If your car needs to stay in the shop, an insurance policy with rental car coverage will be most helpful.

- If spring storms damage your car to the extent that it is totaled, your insurance policy will likely pay you for the actual cash value of your car.

- Talk to your insurance agent to see what is covered under your auto policy before spring storms hit!

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

Daylight savings may not only be affecting your sleep routine, research shows that daylight savings also has a connection with a surge in fatal car crashes.

During daylight savings time in the spring our clocks “spring forward” one hour, changing the amount of light we receive at certain times of day. Now we are experiencing the sun rising later in the morning and setting later in the evening. Although it’s just an hour difference, it can really take a toll on your body. “The sudden change in clock time can disrupt your sleep pattern, leading to a decrease in total sleep time and reduced sleep quality. This sleep disruption can reduce daytime alertness,” says Dr. Kelly Carden, the president of the American Academy of Sleep Medicine.

Drowsy driving along with now making the morning commute to work in the dark, are why researchers believe the spike in car accidents happen. Let’s look further into why that is.

Drowsy Driving

Drowsy driving is a form of distracted driving – the leading cause of car accidents in the United States. It’s a dangerous combination of fatigue and sleepiness that often happens when the driver has not gotten enough sleep, however drowsy driving can also be a side effect of sleep disorders, medication, drinking, or shift work.

Drowsy driving is responsible for more than 6,400 U.S. deaths annually. Remember, when you drive drowsy, you are not only putting yourself at risk, but you are also putting everyone else on the roadway at risk if you fall asleep, are unable to react in time, or lose control.

Drowsy Driving…

…makes you less able to pay attention to the road.

…slows reaction time if you must brake or steer.

…affects your ability to make good decisions.

The best way to avoid driving drowsy is to make sure you are getting enough sleep at night (the recommended amount for adults is 7 hours) by practicing good sleeping habits. And to avoid any substances that may make you more tired before getting on the road.

Driving in the Dark

With the time change, it’s likely that your morning commute is now entirely in the dark. And while that may not seem like a major change, depth perception and peripheral vision can be compromised in the dark, and the glare of headlights from an oncoming vehicle can temporarily blind or disorient you.

Visibility is also limited to less than 500 ft, meaning there is less time to react in case of an emergency or if something is in the middle of the roadway, like a tire or deer. Because of this, the number of road fatalities triples when it’s dark.

Unfortunately, for those who in situations where drowsy and night driving are unavoidable, like workers with irregular hours or parents of newborns, etc. here are a few tips that you can do behind the wheel to help prevent a crash.

-

- Be aware of your surroundings – watch for other drivers, animals, or obstructions in the roadway that could be hidden by the darkness

- Slow down – don’t be afraid to reduce your speed when visibility is low

- Stay alert to the best of your ability – turn on the air conditioner or some loud music to help you focus and stay awake.

- Don’t look directly into headlights – avoid bright headlights by starting at the white line on the right-hand side of the road when other cars are passing.

- Avoid common distractions– like food or your phone

- Limit your night driving – if it’s not necessary, stay in!

- Always follow the rules of the road– never speed or break the law to get to your destination quicker

- If you know you cannot drive– ask someone for a ride or call a rideshare

And in the case of an accident make sure you are covered, by having the proper auto insurance protection.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Homeowners Insurance Info, Safety |

There’s a reason why a tornado strikes immediate fear for those in its path. These violent storms can flip cars, uproot trees, and destroy entire properties. Their powerful winds can even lift objects hundreds of feet off the ground and leave complete devastation in their wake.

Here’s what you need to know to keep your home, your vehicle, and your family safe from tornadoes and high winds.

What is a tornado?

A tornado is a spinning, funnel-shaped cloud usually formed as part of a thunderstorm. Tornadoes can be over a mile wide and as much as 50 miles long. Their narrow funnel shape extends from sky to ground with winds that can reach speeds up to 300 mph. (To put that in context, the average car can be moved by a 90-mph wind.)

While certain regions of the country have been dubbed “Tornado Alley,” it’s not true that tornadoes are prone to occur in those places. Tornadoes can occur anywhere and anytime and have been reported in all 50 states.

How do we predict tornadoes?

Tornados, and their paths, are notoriously difficult to predict. Even meteorologists who study the weather don’t know for sure how they form. However, the National Weather Service is able to track conditions that can contribute to tornadoes—and issue tornado watches and warnings as needed.

A tornado watch means to prepare for severe weather. A tornado warning means that a funnel cloud has been reported by spotters or indicated by radar.

What are the warning signs of a tornado?

By the time you see warning signs, that means a tornado is well on its way. You’ll need to act fast. Here are just some signs to look for:

-

- Large hail without rain

- Dark or greenish sky

- An approaching cloud of debris

- A loud roar like that of a freight train

- How do you prepare for a tornado?

You can take the steps to protect your home, your car, and your family right now.

1. Sign up for severe weather alerts. You can get critical and timely information from local media broadcasts and the emergency alert system on your TV or desktop and mobile devices. In addition, your local utility company, township, city, or state may offer free alerts. Check with your electric or gas company, and with city hall or municipal government.

2. Develop a family disaster plan. Your plan of action will identify where you and your family will shelter in place, and what to do if you get separated. It also will address any special needs of family members and your pets.

3. If there is not a safe space in your home to wait out a tornado, research local public shelters. For example, if you live in a mobile home, tornadoes can easily turn over mobile homes. Plan to go to a public shelter.

4. Gather emergency supplies in case you need to shelter in place. Keep them together in an easily accessible place. Include water, nonperishable food, and medication. Pack a first aid kit.

5. If there is a tornado watch, store items like outdoor furnishings that could become flying debris. Make sure cars are parked well away from trees.

How do you stay safe during a tornado?

If you’re home…

-

- Go immediately to a safe place such as a basement, storm cellar, center hall, or small interior room in your home. Choose the lowest floor possible and avoid windows. Also, avoid places where heavy items like refrigerators may be directly above you. If a tornado strikes, it could come crashing down.

- For added protection, get under a table. Cover yourself with thick padding such as blankets or even a mattress. This will help in case the ceiling falls in.

- If the power goes out, use flashlights rather than candles if you need a light. An open flame can create a fire hazard if gas lines are damaged by severe weather.

- Have a weather radio or your phone tuned into local weather. Tornadoes can be accompanied by flooding. Know when the tornado is gone and it is safe to emerge.

If you’re driving…

-

- Do not try to outrun a tornado in a car. Pull over.

- Tune into your local weather radio station, or if you are traveling, call the weather emergency number listed on the signs along the highway.

- Park in a low, flat location. Avoid bridges or overpasses.

- If you can, leave your car and get to safety inside a sturdy building.

- If you cannot find adequate shelter, then stay in your car with your seat belt buckled. Put your head down below the windows. Cover your body with a coat or blanket and your head with your arms.

What do you do after a tornado?

Once it is safe to venture out, it’s time to inspect the damage. Wait until daylight and make sure to look around safely. Stay clear of fallen power lines. Stay out of damaged buildings. Make a plan to clear away debris and downed trees from your yard.

If your home, car, or property suffered damage from the tornado, you will want to take the following steps:

-

- Secure your property from further damage.

- Take photos to document what has happened.

- Alert your insurance company, determine if you are covered for the damage, and file a claim.

You have home and car insurance for a reason. Put it to work if you need it. Make sure you and your family are fully protected in the event of a tornado, and any damage that follows, such as flooding. Call a California Casualty agent today at 1.866.704.8614 or visit our website www.calcas.com.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

You’re ready for a new car—or a new used one. But starting your car search at the dealership puts you at a serious disadvantage. Before you start the process to make such a significant purchase, do your due diligence.

Here’s what you need to do before you look for your next car.

1. Know what you want.

Chances are you already know what you’d love in a new (or new to you) car. You also know what you need. Separate those into two columns: the list of essentials and the list of “nice-to-have” features. Do you drive long distances? You need a car with good gas mileage. Do you have a family of 7? You need enough seating. Do you drive in the snow? All-wheel drive could be a necessity. Do you have the latest smartphone? Bluetooth could be important to you. Knowing what you want in a car is the first step in your car buying journey. Knowing what you need gives you a baseline for your search.

2. Know what you can afford.

A car out of your price range is the wrong car, no matter how many boxes it checks. You need to be able to afford not only the cost of the car but the cost beyond the sticker price. This includes car insurance, registration, taxes, and fees, as well as gas and regular maintenance. Take some time and do a budget on what you can comfortably afford to spend monthly on a car. A good guideline is to spend no more than 20% of your net monthly income. Importantly, keep this number in mind, but keep it to yourself. A car salesman can tempt you with payments stretched out over a longer-term in order to meet your monthly number, but you’ll end up paying more over time.

3. Used or new?

There are pros and cons of buying a new versus a used car. A new car offers the latest technology, including safety features. It’s also under warranty, so if something goes wrong, it’s covered. However, new cars quickly depreciate in value. Used cars depreciate more slowly and are less expensive to start. With a used car, you’ll likely to get outdated technology and less fuel efficiency. There also is the potential for costly maintenance and repairs. If you’re buying a used car, look into pre-certified used options which will come with a manufacturer’s warranty.

4. Buy vs. lease?

Owning your vehicle is the goal for most people; after all, you have something to show for your payments over time. However, leasing can be the right option in some circumstances. A lease is a rental agreement where you pay for use of the car for a specific period of time and then return it or have the option to purchase it. Leasing allows you to drive a car under factory warranty and have the newest technology every few years. It also comes with a lower monthly payment. However, there are mileage restrictions with leases and fees if you end the agreement early. You also don’t have a car to show for it at the end of the leasing period. Buying not only ensures you have a car, but it also allows you to resell it. Plus, after finishing the financing obligation, you’ll be in the coveted spot of having no car payment—at least for a while.

5. Find your current car’s trade-in value.

If you’re going to be trading in your car, knowing its worth will put you in a stronger bargaining position. Check the Kelley Blue Book. Type in your car’s year, make, mileage, and get an estimate of your car’s worth in your region. Use this amount in your negotiations with dealerships and private parties when you trade-in your car as part of the sale.

6. Find potential new and used cars.

There are only so many makes and models in your price range that will fit your needs and wants list. Preview the list before buying so you can start to narrow down your top choices. Read expert reviews, recalls, and road tests. Check out articles like popular cars for parents or if you know your teenager will also be spending time behind the wheel, best cars for teens. Look for used cars within your budget on sites like J.D. Power, Carvana, or CarMax. Note that while you can buy a used car online, you can only buy a new car at a dealership. In the U.S., dealers have the exclusive right to sell them.

7. Think about the best time to buy a car.

You may need a car now. But if you have the luxury of time, you may be able to wait for special pricing, rebates, or promotions—including student or veteran discounts. If you’re not in a hurry, a good time to buy a car is generally between October and December. That’s when dealerships need to make space for new models. They also have year-end quotas to meet. No matter what time of the year, avoid weekends when dealerships are most busy. A weekday will give you more attention and more time to negotiate.

8. Know your financing options.

You may have enough saved to buy your car outright. If not, you have two choices for financing it: direct lending and dealership financing. Independent lenders like your bank may offer a lower interest rate. Dealers however could offer incentives like 0 percent financing. (You may need to qualify with a good credit score.) To put yourself in the strongest possible position to bargain, get preapproved for a car loan. Then, dealerships will treat you as a cash customer rather than a monthly payer.

9. Check your credit score.

Your credit score could determine the interest rate on your loan. Check your score so there are no surprises. You can get a free credit report from each of three nationwide credit bureaus: Equifax, Experian, and TransUnion.

10. Research dealerships.

Just as you will research your car, you’ll also want to learn about the places where you might buy it. Read dealership reviews to get a sense of how happy customers are. Ask family and friends for recommendations. Identify a few dealerships in your region, not just one. That way you can compare prices and experiences.

11. Organize your paperwork.

When you’re ready to buy a car, you’ll need your driver’s license, payment method, and proof of insurance. If you’re financing through a dealership, you’ll also need proof of income and employment. Make sure these papers are in order and ready to go when you need them.

12. Call your insurance company,

When you buy your new car, your dealership often calls your insurance company during the purchase process. That doesn’t give you time to consider the rates for the make and model that you’ve chosen. Give your agent a call ahead of time. Get a cost quote. That way, there will be no surprises when you’re ready to buy.

Happy searching!

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info |

Have you spent years dreaming about a home makeover? Or find yourself sitting on social media watching others DIY thinking ‘why can’t I do that?’ You CAN! Believe it or not, you don’t have to be a design expert to create a cozy corner, a relaxing vibe, or a stylish space in your home. Here are some quick and easy DIY room makeovers for your home that you can do this spring to give your space a nice little refreshing update- on a budget.

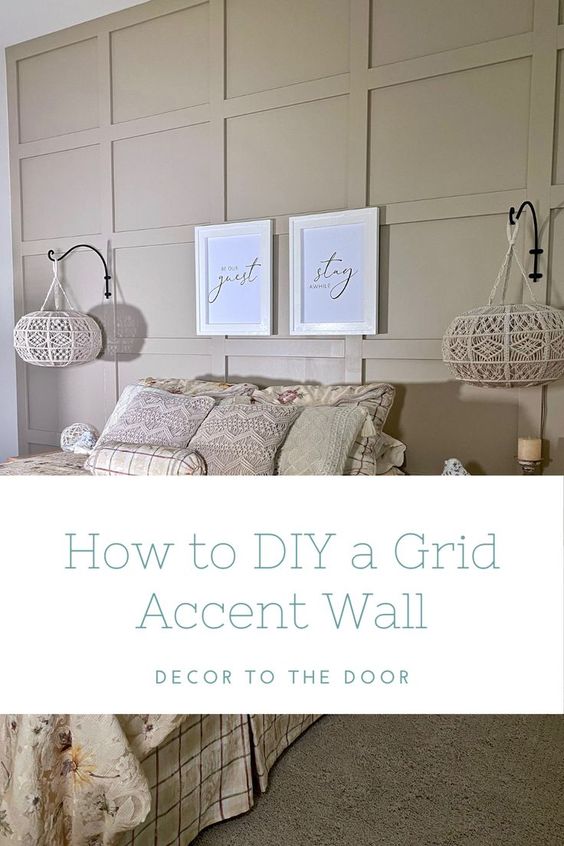

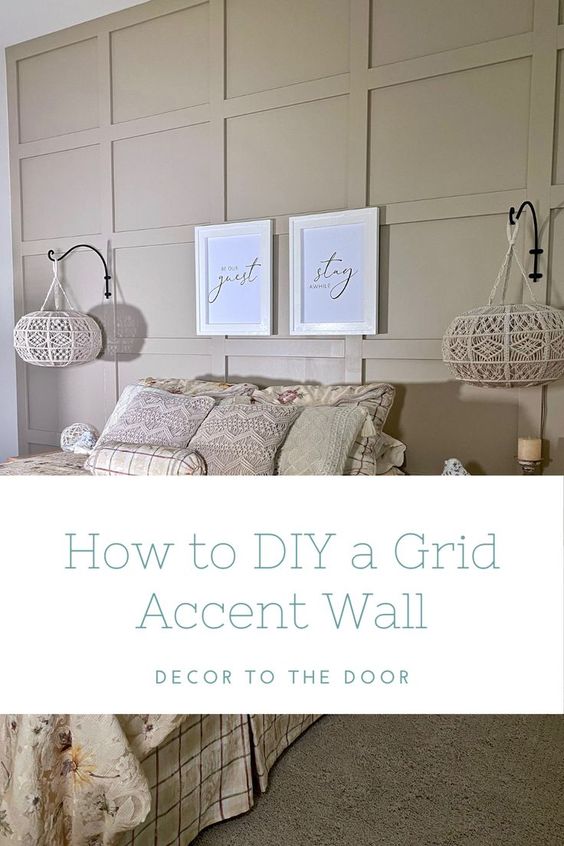

Bedroom

– Choose a color scheme. Pick two main colors and use them to choose varying textures and patterns which will add visual interest. This will help tie together the look of your room, whether it’s a bedroom or other room in your home. Best colors for bedrooms are cool, relaxing tones. Think shades of blue and muted greens.

– Showcase your headboard. The bed is the focal point in your room. Give it a little drama with the right headboard. For an easy fix, use a curtain behind your bed as the headboard. Make your own fabric headboard with material that matches your color scheme.

– Remember the fifth wall. Who said ceilings need to be white? In bedrooms, we spend our share of the time staring at the ceiling. Paint the ceiling a color, and see how it transforms the space.

– Hang drapes from floor to ceiling. Go a few inches above your window to add height, and have the drapes go down to the floor for an elegant feel.

– Get fancy with hardware: Chances are that your nightstands and dressers have traditional knobs. Change them out for tassel hardware or other fancy options.

Living Room

– Create a gallery wall. Choose the photos that represent wonderful moments in your life, and images of the people who are most important to you. For a cohesive look, choose the same color frames. Make it a statement wall by painting it a color that’s different from the other three walls.

– Include a hobby piece. Do you love to travel? Perhaps you play guitar. See if you can incorporate some of your favorite past times in the décor. A surfboard shelf, framed albums, a world map, or a guitar hung on your wall not only is a decoration, but a reminder of your happy place.

– Wallpaper a wall. Removable wallpaper lets us change our style without the long-term commitment. Choose a vibrant pattern in your color scheme for one focus wall. The wallpaper becomes the art and sets the tone for the space.

– Add wainscoting to your wall. This decorative trim transforms a room with its elegant accent pieces. You can even use the trim as a guide and paint the wall different colors above and below.

– Conceal the clutter. Use baskets or decorative boxes to store magazines, electronics, and loose items that you use regularly. Place them on a bookshelf to keep them out of the way.

– Add an area rug. It doesn’t matter if you have a carpet already in your living room. You can still add an area rug on top. Choose a pattern in your color scheme and it becomes artwork for your floor.

Kitchen

– Add a backsplash. It creates a beautiful focal point behind the stove and in other places above the counters. There are so many options available, from glass mosaics to tile to peel-and-stick. You can find online tutorials on how to install a backsplash from the major retailers and home improvement sites.

– Upscale your knobs and handles. Give your drawers and your cabinets a fresh look by changing out the knobs and handles. It’s a lot easier than painting cabinets, though you can do that, too.

– Install a pot rack on your wall. It’s an easy way to display your cookware while freeing space in your cabinets for other utensils.

– Add under cabinet lighting. You don’t need to be an electrician to install this type of lighting, which is self-adhesive and comes in strips that can be trimmed to fit your space. It plugs into a standard outlet and some models come with dimmer switches.

Bathroom

– Upgrade that mirror. You don’t have to spend a fortune to switch out your plain bathroom mirror for one that will be a focal piece. You can add your own frame. You can also reimagine the space with a find from the local thrift shop. Don’t hesitate to add paint for that special look.

– Paint your bathroom vanity. A little paint can transform an old vanity into a beautiful piece. Switch out the knobs and drawer hardware for an even newer look.

– Change out your towel rack. You can find many towel racks at your local home improvement store. If you have the time, consider making your own to highlight your own personal style.

Not sure where to start?

– Create a mood board. Collect images of items that you like. You can do this on Pinterest or on a PowerPoint or Word document. You can even do it old school and paste the pictures on a board.

– Find your color scheme in a favorite piece of art. See if those colors will work for your room, and of course, make sure that the art piece is part of the décor.

– Move furniture around. Take out a piece of furniture. See what works and what doesn’t for your space.

For more spring DIY décor inspo, check out our Pinterest Board- Staycation DIYs! Be sure to follow us for every new DIY we discover.

Happy decorating! 🙂

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.