by California Casualty | Homeowners Insurance Info |

You worked hard, saved your money and bought a home. Now you want to protect the largest investment you have ever made with homeowners insurance. You’ll sleep better knowing that your insurance will help you rebuild if there’s a fire, tornado or a tree falls onto your home. What you may not know are the many things it might not cover. Your sweet dreams of protection could turn out to be a nightmare because you don’t have the coverage you thought you did.

Here are five things not covered by most home insurance policies:

- Earthquake and land movement. As landslides and earthquakes have become more common in many states, many people are surprised to learn that earthquake or land movement damage is not covered by standard homeowners insurance. You need to purchase separate earthquake and landslide insurance protection.

- Floods. Multiple surveys have found a majority of homeowners and renters thought their property insurance protected them from flooding; it doesn’t. If a river overflows its banks or storm surge sends tides into your home, you’ll need to purchase separate flood insurance, provided primarily by the federal government. Keep in mind there is a 30 day waiting period before any flood policy can go into effect.

- Sewer backups. The sludge can do serious damage and make your home unsafe until it’s properly cleaned up, but it’s not covered under most homeowner insurance policies. Your insurance company can provide a special endorsement to cover sewer or sump pump backups. What you may not know is that homeowners are responsible for the maintenance of sewer and water lines through their property up to the sewer main, and many cities and utility departments will deny responsibility for most sewer incidents.

- Maintenance issues. Insurance companies can dispute payment of damage or injuries if you fail to repair a broken step or other obvious hazards, or for mechanical breakdown of an appliance. In most cases, you will also need a special rider to cover food that might be lost due to a power outage or failure of a freezer or refrigerator.

- Expensive jewelry, fine art, firearms, musical instruments, furs and collectables. Many people learn after a fire or tornado that their precious items only had minimal coverage. You’ll need special scheduled personal property coverage, often called a “floater,” to make sure they are protected for their full value.

And, if you have a swimming pool, trampoline or certain types of dogs, you need to call your insurance company to make sure you are protected. Many insurance companies are starting to exclude them from policies or refusing to insure homes that have one or more of these.

The Property Casualty Insurers Association of America (PCI) also warns that as many as 60 percent of America’s homes are underinsured because owners:

- Didn’t update insurance after remodeling or adding on

- Only purchased enough insurance to cover the mortgage

- Underestimated costs associated with updated building codes

- Didn’t factor in building material inflation in replacement costs

Another important step many homeowners fail to take is to do a home inventory. Nobody can predict when a fire or tornado might strike, but you can make sure your possessions are properly protected. A survey by the National Association of Insurance Commissioners found 60 percent of homeowners have not documented all the things they own. What does that mean to you? Completing a home inventory can speed up your claim and help you determine how much coverage you need. The Insurance Information Institute has created an easy to use home inventory brochure. Items to include are:

- Electronics

- Personal care items

- Jewelry

- Art

- Kitchen items

- Furniture

- Carpeting

- Beds and linens

- Holiday ornaments

- Lawn and yard equipment and tools

by California Casualty | Homeowners Insurance Info |

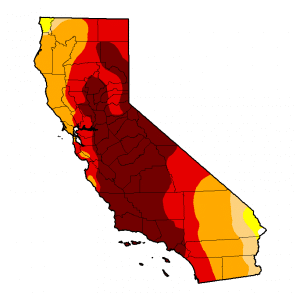

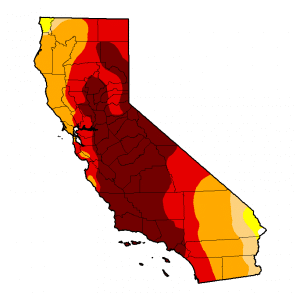

California is parched, and bracing for another scary fire year. Once again, much needed rain and snow has eluded the state. The snow pack is a paltry six percent of normal and this January through March was the driest ever in recorded history. The U.S. Drought Monitor has much of the Golden State in extreme or exceptional drought.

In many areas the unprecedented drought has reduced the greenery to dried sticks and CAL FIRE is warning that moisture content in fuels like trees and grasses are at extremely low levels – leaving them tinder dry and susceptible to wildfire.

2015 Exceptional Drought-U.S. Drought Monitor

The National Interagency Fire Center is predicting above normal wildland fire potential for much of California, starting in May and June and continuing through fall.

It is imperative that you take steps NOW to protect your home and property.

That’s why California Casualty has prepared this important fire prevention information, because we have a stake in keeping you, your family and your most important asset as safe as possible.

Home Wildfire Prevention Tips:

- Create a 30-foot defensible space around your home by removing as much flammable material as you can. Replace flammable vegetation with fire resistive plants.*

- Reduce the number of trees in heavily wooded areas by spacing native trees and shrubs at least 10 feet apart. On trees taller than 18 feet, prune lower branches six to ten feet off the ground.

- Remove branches overhanging the roof or coming within 10 feet of the chimney. Clean all dead leaves and needles from the roof, gutters, and yard.

- Install a roof that meets a fire classification of “Class B” or better. Cover the chimney outlet and stovepipe with nonflammable screening no larger than half-inch mesh.

- Install dual- or triple-paned windows, and limit the size and number of windows that face large areas of vegetation.

- Put woodpiles and liquid propane gas tanks at least 30 feet from all structures and clear away flammable vegetation within 10 feet of those woodpiles and propane tanks.

*California Casualty has a free “Reducing Wildfire Risk” pamphlet available here. You can also find additional helpful information linked from our home insurance page.

Help Firefighters Save Your Home!

- Make access easy. Roads need to be wide enough to accommodate fire trucks with room for them to turn around. Driveways and bridges must be strong enough to carry heavy emergency vehicles and equipment. Identify at least two ways to and from your house and make sure they are clearly marked. All access routes should be free of low hanging tree branches and cleared of flammable vegetation at least 10 feet from roads and five feet from driveways.

- Maintain an emergency water supply that meets fire department standards, such as a community water hydrant system, or a cooperative emergency storage tank with neighbors. If your water comes from a well, consider an emergency generator to operate the pump during a power failure. Clearly mark all water sources and create easy access to your closest emergency water source.

If You’re Forced to Evacuate:

- Know the best routes to safe areas and practice them with your family.

- Prepare an evacuation kit ahead of time.

- Know where and how you and your family will reconnect if you become separated.

In case of possible evacuation, your kit should contain the following items:

- Social Security cards

- Driver’s licenses

- Credit cards

- House deed

- Copies of vehicle titles

- Marriage license

- Birth certificates

- Copies of insurance policies

- Home inventory list / photos

- Health insurance cards

- Prescription medications

- Baby food or formula (if you have little ones)

- Important personal computer information downloaded to disk

- Valuable jewelry

- Photographs

- Home videos

- Items with sentimental value, such as wedding dress or baby keepsakes

- One week’s worth of clothing

- Pets with ID tags, carriers, and pet food

FEMA has more information about evacuation kit and plans at https://www.ready.gov/build-a-kit

Insurance Tips if You’re Impacted:

- Residents evacuated from their homes should contact their insurance agents or companies immediately and let them know where they can be reached. As adjusters are allowed into the burned-out areas they will want to go in with their policyholders to assess the damage. Many companies will set up 24-hour emergency hotlines.

- Keep receipts. Out of pocket expenses during a mandatory evacuation are reimbursable under most standard homeowner policies.

- Be prepared to give your agent or insurance representative a description of your damage.

- Take photos of the damaged areas. These will help with your claims process and will assist the adjuster in the investigation.

- Prepare a detailed inventory of all damaged or destroyed personal property. Be sure to make two copies-one for yourself and one for the adjuster. Your list should be as complete as possible, including a description of the items, dates of purchase or approximate age, cost at time of purchase and estimated replacement cost.

- Make whatever temporary repairs you can. Cover broken windows, damaged roofs and walls to prevent further destruction. Save receipts for supplies and materials you purchase. Your company will reimburse you for reasonable expenses in making temporary repairs.

- Secure a detailed estimate for permanent repairs to your home from a reliable contractor and give it to the adjuster. The estimate should contain the proposed repairs, repair costs and replacement prices.

- Serious losses will be given priority. If your home has been destroyed or seriously damaged, your agent will do everything possible to assure that you are given priority.

Don’t forget to make a complete inventory of all the items in your home before disaster strikes – doing so will help if you have to make a claim.

Here’s a List of Fire Prevention Resources:

www.calfire.ca.gov/fire-prevention

www.nfpa.org

www.disastersafety.org

https://www.redcross.org/images/MEDIA_CustomProductCatalog/m4340149_Wildfire.pdf

https://www.ready.gov/build-a-kit

https://www.knowyourstuff.org/iii/login.html

A defensible space pamphlet from California Casualty can be found on our resource page, www.calcas.com/resources.

by California Casualty | Helpful Tips, Homeowners Insurance Info |

If clutter has crept into every corner of your home, spring is your golden opportunity to clear it out and start fresh. This season isn’t just about cleaning—it’s about creating space for what truly matters. Whether you’re dreaming of tidy shelves, organized closets, or just a little more breathing room, these smart decluttering tips will help you reduce the mess and refresh your mindset.

Where to Start

The clutter didn’t happen overnight—and it won’t disappear overnight either. That’s okay! Decluttering is a process, not a race. Here’s how to get started:

- Pick one clutter hotspot—a shelf, drawer, or closet. Starting small builds momentum.

- Set a timer for 15, 30, or 60 minutes—whatever works for you. This helps keep you focused and prevents burnout.

- Take before-and-after photos. You’ll be amazed at the progress, and it’ll keep you motivated.

- Enlist help. A friend or family member can make the process more fun—and help you decide what stays and what goes.

- Create a home inventory. As you declutter, jot down big-ticket items or anything valuable. It can come in handy for insurance purposes.

Want a broader strategy? Check out our blog on Easy Ways to Declutter Your Home. For now, here are room-by-room tips to guide your spring-cleaning mission.

General Decluttering Tips

Use the Four-Box Method: Label boxes or bins as Trash, Give Away, Keep, and Relocate. Sort items accordingly.

- Clear surfaces: Flat spaces attract clutter. Find permanent spots for items or consider letting them go.

- Ditch the broken stuff: If it’s beyond repair (like a broken umbrella or snapped sunglasses), it’s time to toss it.

- Let go of guilt items: If you’ve been holding on to something out of guilt—not love—donate it.

Entryway

Clear the catch-all zone: This area often becomes a drop zone. Use bins, hooks, or a small table to keep it tidy.

- Sort the mail daily:

- Open and sort as soon as you walk in.

- Create a system for bills, items to respond to, and recycling.

- Avoid the dreaded mail mountain!

Kitchen

Spices: Toss any older than a year. No scent = no flavor.

- Refrigerator and freezer: Discard expired or mystery items.

- Cookbooks: Keep only your go-to favorites. Donate the rest.

- Takeout menus and condiments: Menus are online; sauces don’t last forever—ditch the extras.

- Appliance manuals: Recycle any available manuals online. Organize your appliance warranties.

- Specialty appliances: If you haven’t used it in the past year, it may be time to let it go.

- Under the sink:

- Organize essentials within reach.

- Relocate overflow items to a closet or garage shelf.

- Drawer clutter: Use dividers for utensils, tools, and gadgets.

- Mugs: Keep your favorites. Donate duplicates.

Bathroom

Clear containers: Transparent acrylic bins let you see what you have.

- Sort by category: Hair, dental, skincare, first aid—group like with like.

- Makeup:

- Mascara: Replace every 3 months

- Foundation/Concealer: Replace annually

- Lipstick, eyeshadow, blush: Replace every 2 years

- Donate unused items in good condition.

- Medications:

- Dispose of expired or unidentifiable meds safely. Local police stations often have drop-off bins.

- Eyewear: Donate old prescription glasses and frames.

Bedroom

Clothing

- Organize by type: Lay out all jeans, skirts, or shirts. Keep what you love, donate the rest.

- One-year rule: Haven’t worn it in a year? It’s probably time to part ways.

- Donation bin: Keep a labeled bin in your closet so it’s easy to add items as you go.

Shoes and Socks

- Toss worn-out or single shoes.

- Donate pairs you haven’t worn in a year.

- Bye-bye, lonely socks! Toss any that don’t have a match.

Playroom

- Toys:

- Donate those your child has outgrown.

- Toss games with missing or broken parts.

- Crafts:

- Contain supplies to a shelf or bin.

- Use small containers or drawer organizers for easy access.

- Prevent duplicate purchases by taking inventory.

- Artwork:

- Display your child’s favorites.

- Repurpose others as wrapping paper or recycle.

Office

Receipts:

-

- Scan important ones and toss the rest.

- Remember: thermal paper isn’t recyclable.

- Cords and chargers:

- Sort, label, and get rid of the mystery wires.

- Make sure your extension cords are in good working order.

- Files and papers:

- Shred what you no longer need.

- Store important documents in labeled folders.

Books: Keep the ones that hold sentimental value or that you plan to reread. Donate the rest.

- Remote controls: Recycle the ones you no longer use.

- Media: Donate or sell CDs, DVDs, and other outdated formats.

Old paint: If it’s dried out or more than a few years old, it’s probably time to toss it (check local disposal guidelines).

- Tools:

- Hang them on utility racks or pegboards.

- Organize by type and label for easy access.

- Boxes: Go through those mystery boxes—keep what matters, recycle the rest.

Keep Clutter from Coming Back

One-in, one-out rule: For every new item you bring in, donate or discard one.

- Daily donations: Give away one item per day—365 things gone in a year!

- Avoid unnecessary freebies: Don’t bring home samples or giveaways unless you’ll use them.

- Think before bulk buying: Only stock up on what you actually use regularly.

- Reusable bags: Store them in your car so you don’t keep collecting new ones.

- Evening reset: Take five minutes before bed to clear surfaces and put things back where they belong.

Spring is the perfect time to not only declutter but to reevaluate your protection at home. A clean, organized home paired with the right insurance coverage provides the ultimate peace of mind.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Helpful Tips, Safety |

When there’s a wildfire near your home, every second counts. Leaving quickly can help you steer clear of thick smoke, dangerous conditions, and even traffic jams as everyone heads to safety. The key to a quick exit lies in preparation—having a well-thought-out plan and essential items ready to go.

Pre-Evacuation Prep

Follow this general guide to know what to pack. Keep this as a checklist and refer to it as you assemble everything that you need.

Food and Water

- Put together a 3-day supply of food for everyone in your family (unless you’re going to a relative’s or friend’s home who lives far away from the fire zone).

- Bring 3 gallons of water per person.

- Pack utensils and bowls, as you don’t know what might be available in emergency shelters.

Pet Supplies

- Pack kibble, bowls and bring water for pets.

- Bring a leash, collar, pet bed, crate or carrier, litter box, and litter as needed for your pet. Include treats and toys.

- Pack pet medications.

- Check that your pet’s microchip details are up to date.

- Bring contact information for your pet’s vet and/or your pet’s vaccine records.

Medicine and Hygiene

- Bring prescription medications and any medicines that your family may use on a regular basis: pain relievers, allergy medicines, contact lenses and solution, inhalers, etc.

- Pack hygiene items such as shampoo, soap, deodorant, toothbrushes, toothpaste, disposable razors, shaving cream, and towels.

- For infants and toddlers, bring diapers and baby wipes.

Safety

- Keep a first aid kit in your car should you need it.

- Include N95 masks if available to limit your exposure to smoke.

- Pack flashlights and batteries.

Clothing and Bedding

- Pack for practicality and safety. Layer clothes for a range of temperatures. Don’t forget PJs, socks, and underwear, as well as a raincoat or all-weather jacket.

- Comfortable, closed toed shoes work best in emergency situations.

- Bring sleeping bags, pillows and blankets. Include a portable crib for infants and toddlers.

Electronics

- Bring chargers for smartphones, laptops, and devices. Include a solar charger if you have one.

- Keep your devices well charged before you leave so you won’t have to search for a place to charge.

- Pack a battery powered radio and spare batteries in case the power goes out.

Special items

- There are some things you that you cannot replace. If you have the room, and they are easy to carry, plan to bring up to 3-5 of these special items.

- Your planning time is a good time to do a home inventory of all your possessions. Take pictures and notes of big items. This will help if your home is partially or completely destroyed by a wildfire, and you need to file a claim.

Documents

- Prepare a binder with key documents: mortgage or rental agreement, insurance policies, birth certificates, passports, bank information, and investments.

- Make sure your wallet or purse has your driver’s license, registration, health insurance cards, debit and credit cards.

- Complete a cell phone list for neighbors, family. Designate a person outside the wildfire area who can be the main contact should family members get separated or have trouble with cell service.

- Make copies of everything and keep them in a secure password protected digital space.

Prepare Your Home & Vehicle

During a wildfire, embers can travel quickly and ignite your home and property. Here are some steps to take to prepare your home and vehicle.

- Keep the vehicle that you’ll be leaving in fully gassed and well maintained. Park it in the direction it needs to go when you leave.

- Make sure that you know how to manually open the garage door in case you lose power.

- Make sure everyone in the household knows what to do to quickly evacuate.

- Close all windows. Close all interior doors.

- Take down flammable window treatments like curtains and store them out of the way.

- Turn off the gas and pilot lights. Shut off propane tanks.

- Turn off your air conditioning.

- Leave lights on to allow firefighters to see your home in the dark.

- Bring potentially flammable outside furnishings, toys and doormats inside or place them in your pool.

- Attach garden hoses to outside taps for firefighters to use. Placed filled buckets of water around your home.

- Listen to first responders and be ready to act when they recommend evacuation.

Pro Tip: California Casualty policyholders may be able to get immediate help if they are evacuated by fire. Evacuation expenses, such as hotel or other temporary housing, and meals are reimbursable with most policies.

Review your wildfire evacuation plan often. Keep it updated as your family grows and needs change. Finally, protect your home with the right insurance for added peace of mind.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

Nearly 60% of Americans are underinsured or don’t understand what is covered by their policies.

Make sure you are properly covered going into the new year with these 6 New Year’s insurance resolutions

1. Make sure you have the correct amount of auto coverage

Have your driving habits changed in the past year? Maybe you accepted a new job and your commute is longer or smaller, or you added a new driver to your policy. These life changes will all affect your insurance coverage and premium costs.

Making sure you have the right amount of auto coverage is crucial in case of an accident, so you don’t have to end up paying the majority of your costs out of pocket. For example, make sure you have enough liability coverage on your current policy. If you cause an accident, you are responsible for damages (and if it is a serious accident loss of wages of the victim/their family). Liability coverage is used to pay for those damages that you caused.

Your insurance will only pay for the amount that you’ve designated for liability. The rest comes from your pocket, so don’t skimp on this important coverage.

2. See if you qualify for any additional discounts

Did you know that if you have a teen driver they can take a driver’s safety or education course to qualify for discounts on your auto insurance? You can also turn in their report card for a ‘good student discount’.

You may qualify for insurance discounts for being part of a professional association, such as groups for teachers, nurses, or first responders. There are also discounts for being retired, for drivers turning 25, for paying via automatic bank payments, and for paying in full upfront. You may qualify for a new home discount, or a discount if you have updated your utilities (electrical, plumbing, heating, cooling) in an older home, or added a security system. There are also discounts for a new roof and an automatic sprinkler system. You can even be rewarded for being a loyal customer!

3. Create a home inventory checklist

A home inventory is a list of all of your possessions and their values. While creating one may sound like a waste of time, it’s important to have an updated list of all of your possessions so that you can get fully compensated if there was a disaster like a fire or a tornado, or a burglary. Without a home inventory, you may have difficulty pinpointing all of your belongings and lose out on their value and it can even delay the claims process. Start fresh with all of your new belongings after the holidays and put the checklist in a safe space, in the event of an unexpected loss, you’ll be glad you did.

4. Do you need additional coverage?

Did you know your home and/or renter’s insurance doesn’t include flood coverage? If you live in a flood-prone area you need to have Flood Insurance. The same goes for Earthquakes and Earthquake Insurance.

Do you have a pet that you love like a child of your own? While they will be covered if you are both in an accident in a covered vehicle thanks to Pet Injury Protection from California Casualty, make sure you will get reimbursed for any emergency surgeries, x-rays, labs, prescriptions, and more by adding Pet Insurance.

Need some extra coverage in case of an accident or disaster to ensure your family and belongings are safe? Ask your insurance agent if Umbrella Insurance or Scheduled Personal Property Coverage is right for you.

Umbrella Insurance is an extra layer of coverage that protects you and your family by covering additional damage costs that extend beyond the limits of your homeowner’s, auto, or watercraft policies. This additional coverage ensures your personal assets are safe. The primary purpose of this coverage is to protect you if you’re found liable for causing bodily injury to others or damage to their property. It also protects against incidents involving slander, libel, false arrest, and invasion of privacy, as well as any legal defense costs – even if you’re not found liable.

Personal Property Coverage, also referred to as “contents coverage,” is the term insurance companies use to collectively define the things you own inside your home. Scheduled Personal Property Coverage, or rider, is additional coverage for more special and/or expensive items such as jewelry, watches, heirlooms, furs, collectibles, etc. that have values above your personal property coverage limits. Both coverages are invaluable to make sure your personal belongings are covered in the event of a disaster or burglary.

5. Know what benefits are available to you

At California Casualty we offer our insured exclusive benefits like:

-

-

-

- Affiliate Group Rates & Generous Discounts

- FREE ID Defense Resolution

- Summer or Holiday Skip Payment Options

- Waived / Reduced Deductible for Collision or Vandalism While Parked on School Property – for Educators

- Personal Firearm Coverage & Fallen Hero Benefits – for First Responders

- No Charge Personal Property Coverage Up to $500

- 24 x 7 Towing & Roadside Assistance

- $1,000 Free Pet Injury Protection Coverage

And more! Speak to your insurance agent and ask which benefits are available immediately to you.

6. Schedule your annual free policy review

When’s the last time you took a look at your Insurance policy? Chances are if you haven’t had an accident or a loss, it’s probably been a while. And knowing more about your insurance could even save you money on your premiums. That’s why it is recommended to speak to your insurance agent at least once a year for your annual policy review. They will answer all of your questions and make sure you have the correct amount of coverage.

We know understanding your insurance coverage can be confusing, but we’ve got you covered! There is no better time to start getting the most out of your insurance protection than the new year. Call your California Casualty agent today to make sure you are taking advantage of your coverage and benefits all year long.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.