by California Casualty | Auto Insurance Info, Homeowners Insurance Info, Safety |

When the temperatures dip low, wind speeds hit high, and precipitation is in the forecast, you could be in the path of a winter storm. These powerful acts of nature have the potential to cut off power and trap you and your family in your home for days, and that’s not all… Winter storms have also been associated with hypothermia, frostbite, carbon monoxide poisoning, and even heart attacks.

Being well prepared is your best defense. Follow this guide so you can weather winter storms safely.

Know what to expect when

The National Weather Service issues severe weather alerts for winter storms. While the exact amounts of snow vary based on where you live, here are some general definitions.

-

- Winter storm watch – Conditions are right for hazardous winter weather within 48 hours. It doesn’t mean it will occur, but a winter storm is possible.

- Winter storm advisory – Usually issued within 36 hours of an expected storm, an advisory lets you know to anticipate snow, sleet and/or freezing rain.

- Winter storm warning – Expect snow, sleet, ice, freezing rain and/or hazardous winter conditions within the next 12-24 hours.

Get ready

Your primary concerns during a severe winter storm are the loss of heat, power, and communications, having enough food and supplies, and protecting your home from possible storm damage. Stock up on supplies, take protective measures for your home and create a disaster plan to share with everyone in the family. That may include planning for evacuation if needed.

Stock up and charge up- Building your emergency kit.

-

- Stock up on food that requires no cooking or refrigeration. Make sure you have a manual can opener if you’re planning to open cans.

- Include baby food and diapers if needed.

- Buy cases of bottled water to use in case the pipes freeze. You can use this for brushing teeth, flushing toilets, and bathing. Make sure you have at least 3 gallons of water per person. You can also fill the bathtub with water as an extra source.

- Make sure you have enough prescription medications, and any toiletries needed.

- If you have pets, stock up on food for them.

- Gather your flashlights and extra batteries. Collect candles and matches.

- Pull out the battery-powered radio for weather updates. You can also use it to play music to pass the time.

- Make sure you have lots of blankets and warm clothes for each member of the household.

- Charge all of your devices ahead of the storm. Charge any portable battery backups. Determine how you will charge your phone during a power outage.

Protect your home

-

- Make sure your home’s furnace is in good working order.

- Check for drafts and use these winter window hacks to keep your home warm and toasty.

- Know how to turn off your utilities, such as gas lines or water, in an emergency.

- Consider buying emergency heating equipment such as a wood or coal-burning stove or electric or kerosene heater. Review all safety precautions, and be careful of fire hazards when storing fuel.

- Consider installing a portable generator. Review generator safety and never run a generator in an enclosed space.

- Make sure your smoke detector and carbon monoxide detectors are working. If you’ll be using your fireplace or wood stove for heat, they should be near that area. Have a fire extinguisher nearby just in case, or try this way to put out fires without an extinguisher.

- Test your snow blower and have it serviced if necessary.

- Take a walk around your house and identify any trees that could fall. If there’s time, trim them back.

Be prepared to leave if needed

-

- Service your vehicle and make sure you’re prepared for winter. Have a mechanic check your antifreeze, windshield-washer fluid, defroster, wipers, battery, brakes, and tires.

- Keep your car’s gas tank full for emergency use.

- Stock your car with these must-carry items.

- Research local shelters and warming stations in your area in case you need to evacuate your home.

- Prepack a bag for each member of the family, including pets.

Once the Storm Arrives

During the storm…

-

- Limit your time outside. Hypothermia and frostbite are real dangers.

- Do not attempt to travel during treacherous conditions. You could find yourself in an accident or stranded on the road.

- Stay tuned to emergency weather alerts.

- Check on neighbors if they’re older or have young children who are more at risk in extreme cold.

After the storm…

-

- Avoid driving until conditions have improved. Follow winter driving safety guidelines.

- Keep a supply of kitty litter and/or ice melt to clear sidewalks.

- Be careful to not overexert yourself. It’s common for heart attacks to be brought on by overexertion from shoveling or clearing snow.

- Assess any damage to your home or property and alert your insurance company. You have home insurance for a reason. Put it to work if you need it.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

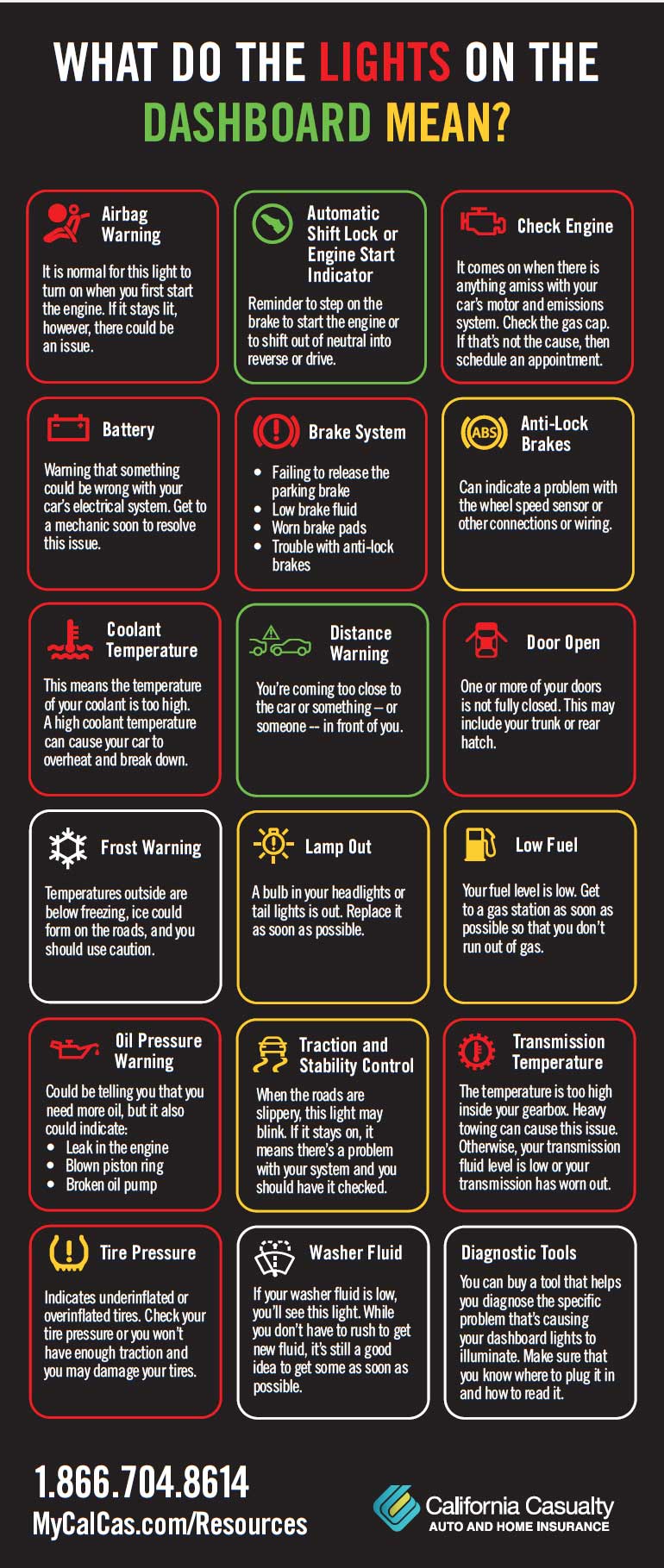

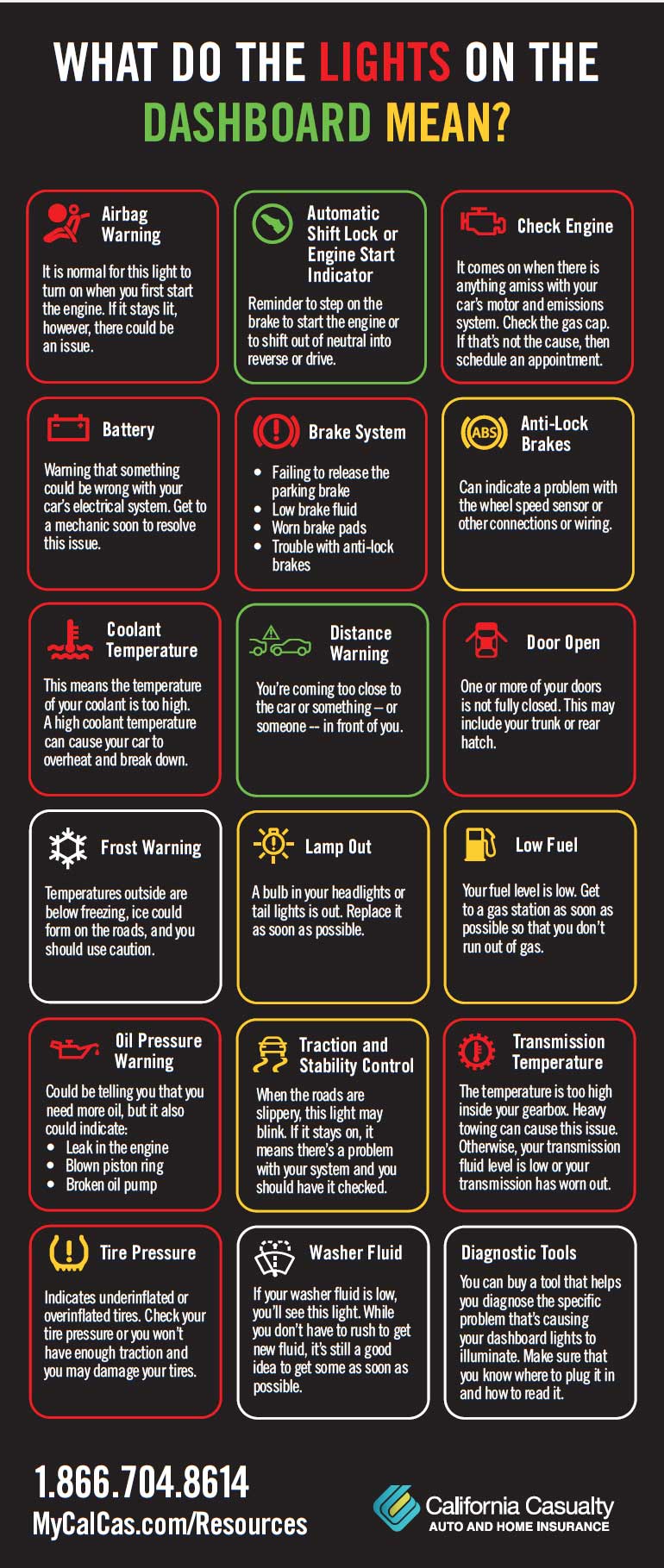

Whether it’s a minor problem or a major issue, you can count on that light on the dashboard illuminating. Our cars warn us when something isn’t right, and that’s good because there are some warning signs you shouldn’t ignore.

Knowing the meaning of your dashboard lights will help you know if it’s a situation that requires immediate attention—or if it can wait. Here are some important lights and what they mean.

Airbag Warning

The airbag warning light looks like a passenger with a large ball on his/her lap. It is normal for this light to turn on when you first start the engine. If it stays lit, however, there could be an issue. Your car is safe to drive, but you will want the airbag checked so that it will deploy during an accident.

Automatic Shift Lock or Engine Start Indicator

Today’s newer cars require that you step on the brake to start the engine. You also need to step on the brake to shift out of neutral into reverse or drive. This foot-shaped light is a reminder.

Check Engine

This light looks like a miniature engine. It comes on when there is anything amiss with your car’s motor and emissions system. Some cars have two stages of a check engine light: illuminated (less serious) and flashing (serious warning). It could mean:

-

- Loose gas cap

- Faulty oxygen sensor

- Catalytic converter issues

- Mass airflow sensor

- Worn-out spark plugs

- Loose wire

If you’re driving and everything seems fine, don’t panic. Pull the car over and check the gas cap. If that’s not the cause, then schedule an appointment as soon as possible. If the check engine light is on, and the car starts making strange noises or driving erratically, pull over and get it towed to your mechanic. That could indicate a more serious issue.

Battery

This light that resembles a battery is a warning that something could be wrong with your car’s electrical system. It doesn’t necessarily mean that there’s an issue with your battery. It could be:

-

- Corroded cable or wire

- Alternator

- Battery

- Electrical components

Get to a mechanic soon to resolve this issue. A battery light is a warning that your car could break down.

Brake System

This light is usually an exclamation point in a circle. It illuminates for several reasons.

-

- Failing to release the parking brake

- Low brake fluid

- Worn brake pads

- Trouble with anti-lock brakes

An illuminated ABS (anti-lock brake) light can indicate a problem with the wheel speed sensor or other connections or wiring. If your brake light is lit, and the parking brake is not the issue, bring your car in for a professional checkup as soon as possible.

Coolant Temperature

This light resembles a thermometer and if it comes on, it means the temperature of your coolant is too high. There are several possible causes.

-

- Broken water pump

- Low coolant levels in the radiator

- Leaking or burst coolant hose

- Damage to the radiator

A high coolant temperature can cause your car to overheat and break down. It also can permanently damage your engine. Pull over and let the car cool down. Adding coolant can temporarily fix the problem but get your vehicle checked by a mechanic before you drive it further.

Distance Warning

If you’re driving a newer vehicle, you may see this light when you’re coming too close to the car or something – or someone — in front of you. The light resembles two cars about to hit each other and is a warning to slow down.

Door Open

An image of a car with doors open indicates that one or more of your doors is not fully closed. This may include your trunk or rear hatch. Closing the door should make the light go out, and have you on your way.

Frost Warning

This light, which resembles a snowflake, comes on when temperatures outside are below freezing. It will stay on as long as it’s cold, to remind you that ice could form and you should use caution.

Lamp Out

Resembling a sun with an exclamation mark, this light comes on when a bulb in your headlights or tail lights burns out. Replace it as soon as possible so your car is visible to other drivers.

Low Fuel

A gas tank appears when your fuel level is low. Get to a gas station as soon as possible so that you don’t run out of gas.

Oil Pressure Warning

This light that resembles an oil can could simply be telling you that you need more oil. But it also could indicate something more serious:

-

- Leak in the engine

- Blown piston ring

- Broken oil pump

If the light doesn’t go off after you’ve added oil, then get your car checked out professionally. Do not ignore this light and drive for an extended period of time—or you could damage your engine.

Traction and Stability Control

When the roads are slippery, your car’s traction control light may blink. That simply means that it’s doing its job and there’s no cause for concern. This light, which looks like a car with skid marks, can stay on. If that happens, it means there’s a problem with your system and you should have it checked. Also, if this light turns on during dry, sunny conditions, there may be a repair or adjustment needed.

Transmission Temperature

This gear wheel image with a thermometer lights up when the temperature is too high inside your gearbox. Heavy towing can cause this issue. Otherwise, it’s likely that your transmission fluid level is low or your transmission has worn out. Get your car to a mechanic as soon as possible.

Tire Pressure Monitoring System

When any one of your tires is low, your TPMS system kicks in. The light looks like a tire that’s a bit deflated with an exclamation mark. Don’t drive on severely underinflated or overinflated tires; you won’t have enough traction and you can damage your tires. Adding air to deflated tires should get the light to go off, but if you have persistent problems, have your tires checked by a professional.

Washer Fluid

If your washer fluid is low, you’ll see this light, which resembles a windshield being squirted. While you don’t have to rush to get new fluid, it’s still a good idea to get some as soon as possible. Dirt, snow, and ice can quickly build up on your windshield, making it hard for you to see.

Car Diagnostic Tools

You can buy a tool that helps you diagnose the specific problem that’s causing your dashboard lights to illuminate. Auto Zone offers this Fix FinderSM Service for free. If you are doing it yourself, make sure that you know where to plug it in and how to read it. Some car diagnostic tools require you to enter your car’s make and model, VIN, and other information. You can then decide if it’s something you can fix or an issue that your mechanic needs to address.

Importantly, you will want to address any issues in a timely manner. Ignoring them can create more expensive repairs and dangerous conditions down the road.

Check our other blog for maintenance mistakes that can cost you. Your car is one of your greatest investments. Keep it well maintained and protect it with the right car insurance.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

Nearly 60% of Americans are underinsured or don’t understand what is covered by their policies.

Make sure you are properly covered going into the new year with these 6 New Year’s insurance resolutions

1. Make sure you have the correct amount of auto coverage

Have your driving habits changed in the past year? Maybe you accepted a new job and your commute is longer or smaller, or you added a new driver to your policy. These life changes will all affect your insurance coverage and premium costs.

Making sure you have the right amount of auto coverage is crucial in case of an accident, so you don’t have to end up paying the majority of your costs out of pocket. For example, make sure you have enough liability coverage on your current policy. If you cause an accident, you are responsible for damages (and if it is a serious accident loss of wages of the victim/their family). Liability coverage is used to pay for those damages that you caused.

Your insurance will only pay for the amount that you’ve designated for liability. The rest comes from your pocket, so don’t skimp on this important coverage.

2. See if you qualify for any additional discounts

Did you know that if you have a teen driver they can take a driver’s safety or education course to qualify for discounts on your auto insurance? You can also turn in their report card for a ‘good student discount’.

You may qualify for insurance discounts for being part of a professional association, such as groups for teachers, nurses, or first responders. There are also discounts for being retired, for drivers turning 25, for paying via automatic bank payments, and for paying in full upfront. You may qualify for a new home discount, or a discount if you have updated your utilities (electrical, plumbing, heating, cooling) in an older home, or added a security system. There are also discounts for a new roof and an automatic sprinkler system. You can even be rewarded for being a loyal customer!

3. Create a home inventory checklist

A home inventory is a list of all of your possessions and their values. While creating one may sound like a waste of time, it’s important to have an updated list of all of your possessions so that you can get fully compensated if there was a disaster like a fire or a tornado, or a burglary. Without a home inventory, you may have difficulty pinpointing all of your belongings and lose out on their value and it can even delay the claims process. Start fresh with all of your new belongings after the holidays and put the checklist in a safe space, in the event of an unexpected loss, you’ll be glad you did.

4. Do you need additional coverage?

Did you know your home and/or renter’s insurance doesn’t include flood coverage? If you live in a flood-prone area you need to have Flood Insurance. The same goes for Earthquakes and Earthquake Insurance.

Do you have a pet that you love like a child of your own? While they will be covered if you are both in an accident in a covered vehicle thanks to Pet Injury Protection from California Casualty, make sure you will get reimbursed for any emergency surgeries, x-rays, labs, prescriptions, and more by adding Pet Insurance.

Need some extra coverage in case of an accident or disaster to ensure your family and belongings are safe? Ask your insurance agent if Umbrella Insurance or Scheduled Personal Property Coverage is right for you.

Umbrella Insurance is an extra layer of coverage that protects you and your family by covering additional damage costs that extend beyond the limits of your homeowner’s, auto, or watercraft policies. This additional coverage ensures your personal assets are safe. The primary purpose of this coverage is to protect you if you’re found liable for causing bodily injury to others or damage to their property. It also protects against incidents involving slander, libel, false arrest, and invasion of privacy, as well as any legal defense costs – even if you’re not found liable.

Personal Property Coverage, also referred to as “contents coverage,” is the term insurance companies use to collectively define the things you own inside your home. Scheduled Personal Property Coverage, or rider, is additional coverage for more special and/or expensive items such as jewelry, watches, heirlooms, furs, collectibles, etc. that have values above your personal property coverage limits. Both coverages are invaluable to make sure your personal belongings are covered in the event of a disaster or burglary.

5. Know what benefits are available to you

At California Casualty we offer our insured exclusive benefits like:

-

-

-

- Affiliate Group Rates & Generous Discounts

- FREE ID Defense Resolution

- Summer or Holiday Skip Payment Options

- Waived / Reduced Deductible for Collision or Vandalism While Parked on School Property – for Educators

- Personal Firearm Coverage & Fallen Hero Benefits – for First Responders

- No Charge Personal Property Coverage Up to $500

- 24 x 7 Towing & Roadside Assistance

- $1,000 Free Pet Injury Protection Coverage

And more! Speak to your insurance agent and ask which benefits are available immediately to you.

6. Schedule your annual free policy review

When’s the last time you took a look at your Insurance policy? Chances are if you haven’t had an accident or a loss, it’s probably been a while. And knowing more about your insurance could even save you money on your premiums. That’s why it is recommended to speak to your insurance agent at least once a year for your annual policy review. They will answer all of your questions and make sure you have the correct amount of coverage.

We know understanding your insurance coverage can be confusing, but we’ve got you covered! There is no better time to start getting the most out of your insurance protection than the new year. Call your California Casualty agent today to make sure you are taking advantage of your coverage and benefits all year long.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Pets, Safety |

For many of us, winter weather means it’s time to put down that layer of salt. After all, you don’t want to hurt yourself or be liable if anyone slips on your sidewalk!

Ironically, in your effort to keep everyone safe, you might be endangering the very ones you want to protect. That’s because ice melt is dangerous for pets. And it’s not just the ice melt on your property. Ice melt that is universally used on roadways and walking paths is usually not pet-friendly and can cause serious harm and even death.

Here’s what you need to know to keep your pets safe this snowy season.

Know the chemicals.

Ice melt is made up of chemicals like sodium chloride (the same as table salt) and calcium salts (calcium carbonate, calcium magnesium acetate, and calcium chloride). Sometimes it also contains potassium chloride, magnesium chloride and/or urea (carbonyl diamide). These chemicals lower the freezing point for water, causing the ice to melt and turn to slush. In addition to having an effect on ice, they also cause damage to concrete, cement, soil, and water, as well as plants and animals.

That’s where your pet comes in. It may be tempting for your dog or cat to sniff around at ice melt because of its salty taste. Or they may walk on it and get it on their paws, and then lick it off. But even table salt is dangerous for them in large quantities.

If ingested, ice melt can cause anything from mild indigestion to severe vomiting, diarrhea and dehydration, and even death. Just 4 g/kg of sodium chloride can be deadly, according to the Pet Poison Helpline. According to Pet MD, ethylene glycol-based ice melts contain the same active ingredient as antifreeze. They are deadly if ingested. Calcium chloride also can cause mouth ulcerations and irritation. So, what do you need to look out for in your pet? An abnormally high body temperature, a racing heart, and rapid breathing are all signs of elevated blood sodium levels. Keep reading for more signs and symptoms.

Ice melt is also a skin irritant. It can cause irritation, dryness, and even burns on your fur babies’ paws or between their pads. If they scratch or rub their face, the ice melt can get in their eyes. If a small piece of salt makes its way in between your pet’s pads, it can be highly uncomfortable and have a chance of being swallowed.

If you’re thinking you can just check the package and make sure these ingredients are not listed, think again. Unfortunately, not all ice melt packages provide a full list of ingredients.

Are there any ice melts that are safe for pets?

You can buy ice melts that are labeled ‘safe for pets’, but even these are not completely safe, according to the Pet Poison Helpline. They are simply safer options. If ingested, they can still cause gastric distress. Also, while safe for dogs, ice melt with propylene glycol can be damaging to cats’ red blood cells, according to PetMD.

Products safe for pets usually are urea-based. They are some of the safest options for dogs and cats, but if you have goats or cows, beware. Urea can cause ammonia toxicosis in animals that have that type of digestive tract.

How to Prevent Exposure

An ounce of prevention is worth a pound of cure. Keeping your pet away from dangerous ice melts is your first defense.

-

- Avoid areas that are slushy or where it looks like ice melt has been applied.

- Don’t let pets sniff or eat road salt, ice melt, etc.

- Don’t let pets run and play in an area that looks like it has been treated with ice melt.

- Wipe your pet’s paws with a damp cloth to remove any ice melt as soon as you come in from outside. This way, your fur baby won’t accidentally ingest it when licking his/her paws.

- Store the ice melt package far out of reach of curious pets.

- If you want to protect your fur baby’s paws, consider paw wax or doggie booties.

- Instead of ice melt, try products intended to provide traction, such as sand, gravel, kitty litter, and wood ash.

Watch for these signs and symptoms.

Keep a close eye on your fur baby, If you notice him/her walking gingerly or licking his/her paws, there could be a problem. Also, look for these signs of possible exposure to ice melt:

-

- Skin irritation/burns

- Mouth ulcers

- Increased urination

- Excessive drooling

- Nausea/gastrointestinal upset/vomiting

- Body and muscle weakness

- Seizures

Call your veterinarian right away if you believe your pet has ingested ice melt and is exhibiting symptoms. The ASPCA Animal Poison Control Center also is available 24/7 to answer your questions. A consultation fee may apply.

Pet health insurance can help cover the costs if anything should happen to your fur baby. Make sure you are fully covered in event of an emergency.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

Winter driving presents its share of challenges, from icy road conditions to car batteries that strain due to the cold. If you live in a region where the temperatures dip down low, you could be sitting in a freezing car for hours if it breaks down.

Thankfully, some forethought and preparation can help. Make sure you’re fully prepared for whatever winter throws at you and stock up on these must-carry items for your emergency winter car kit this season.

#1: Ice scrapers, snow brushes, and a foldable shovel

It’s important to clear your whole car before you drive. Snow and ice can slide from your vehicle’s roof and obstruct your view while driving. It also could fly off and hit another car. Choose scrapers and brushes with long handles that allow you to reach the top of your vehicle. Stock several and the kids can help, too! Get a portable snow shovel too, one that folds so it takes up less space. Then use it to dig your car out as needed.

Tip: You can also use the shovel to add fresh snow or dirt around your tires to help them grip.

#2: A bag of sand or kitty litter

Your car may get stuck in the snow or be unable to move past an icy spot. Pour some sand or kitty litter over your tires and/or on the ground for extra grit to help with traction.

Tip: You can put your car’s floor mats down in front of your tires to get your car out of slippery situations. Watch the video from Firestone.

#3: Hazard triangles and LED flares

When you break down on the side of the road, you want to be seen—by other vehicles and by emergency personnel who can assist you. That’s the purpose of the hazard triangles and LED emergency flares. These are especially important when there is reduced visibility such as at night or during snowstorms.

Place the reflective hazard triangles behind your vehicle starting at 10 feet and going as far as 100 feet. Road flares have traditionally been used to mark sites for emergency responders. Rather than the traditional flares that light like a match and ignite, choose the modern version—a LED safety flare. They are designed to be waterproof, shatterproof, and crushproof and some are even magnetic and can stick right to your car.

Tip: To reduce the drain on your battery, use your car’s emergency flashers only if you hear vehicles approaching.

#4: A flashlight (and some extra batteries)

A flashlight can help you find things in the dark. It also can be used to signal passing cars. Choose an LED flashlight that offers plenty of light. If you can, pack several flashlights so that everyone in the family has one. Store batteries backward in the flashlight to prevent the light from accidentally switching on and burning out. Keep a spare set of batteries on hand just in case.

Tip: Pack some glow stick necklaces for the kids. They’re also great fun and an easy way to find everyone in the dark.

#5: Jumper cables and a battery charger

Low temperatures put an additional strain on your car’s battery. In fact, the freezing cold can turn a weak battery into a dead one overnight. If your car breaks down due to a dead battery, jumper cables can help. These cables allow you to charge your car’s battery from another car’s. You also may want to invest in a portable battery jump starter. These devices jump your battery without another car. They also can power your other devices such as cell phones or tablets.

Tip: Find out much battery life you have left with a free battery test at Firestone.

#6: A cell phone charger and portable power bank

Your cell phone is your connection to the world—and to help. Keep it as charged as possible by having a charger in your car. However, if your car doesn’t start, the car charger won’t do much good. Be sure to pack a portable battery or power bank.

Tip: If you’re stuck and your cell phone is losing power, change your outgoing message to your current location, time and date, and any other important details. That way, if your cell phone stops working, callers will get that message.

#7: Blankets and cold weather clothes

Keep a few blankets or sleeping bags in your trunk. If you want to save on room, choose pocket-size heat-reflective blankets. Then, stock some warm clothes for every member of the family: old sweatshirts, thick pants, warm socks, boots, mittens, and warm hats. Add some hand or feet warmers, which could provide much-needed warmth in an emergency.

Tip: Don’t run your car’s engine unless you are sure the exhaust pipe is free of snow. Snow can plug your vehicle’s exhaust system and cause deadly carbon monoxide gas to enter your vehicle.

#8: Snacks and water

If you’re spending any significant time in your car, you’ll want food and water. Keep water bottles and non-perishable snacks in your car through the winter. Consider these ideas: prepackaged trail mix or nuts/seeds, dried fruit, granola bars, chocolate, dry cereal, crackers, cookies, peanut butter (or other nut butters), rice cakes, pretzels. Choose kid-friendly snacks in case the kids are with you; you’ll enjoy them even if they’re not there.

Tip: For a more substantial snack, pack canned food that can be eaten cold and a can opener. Don’t forget the plastic utensils.

#9: Entertainment

Keep the kids busy with some games and activities. This will help keep them from feeling stressed and it will help pass the time. Pack a travel game bag. Include decks of cards, puzzles, coloring books and crayons or paper for older kids, and travel games. Sing songs, tell jokes, and keep the time as light-hearted as possible.

Tip: Make it a game. Take a poll on how long it will take to get home or what the tow truck driver will look like.

#10: First Aid Kit

A first aid kit is especially needed in winter because emergency response times may be longer due to icy or snowy conditions. You can buy one or make your own. Include bandages, gauze, adhesive tape, antibiotic ointment, scissors, saline solution for eye washing or cleaning wounds, aloe vera to treat minor burns, an antihistamine for allergic reactions, and anything else your family may need.

Tip: Add baby wipes, which will help if you or the kids have to go to the bathroom outdoors in nature. A garbage bag can also be a makeshift toilet if need be.

You can save some steps and buy emergency roadside safety kits that combine many of the items on this list.

Finally, should you have a winter-related accident or incident, know that your collision and comprehensive insurance will help protect you.

Safe travels.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.