by California Casualty | Auto Insurance Info |

You’re looking forward to your family get-together, but you could do without the drama. How do you keep harmony in the house, including talking to loved ones who have drastically different viewpoints than yours?

Follow these tips to create a more harmonious and enjoyable gathering for all.

The bigger the gathering, the greater potential for friction.

Chances are your family or friends will venture into discussions about politics, religion, marriage, dating, and other potentially controversial topics. This can be stressful. Remember that you are not obligated to talk about them. Follow these strategies to stay away from conversational landmines. (If you do want to engage, there’s advice later in this blog.)

- If someone brings up the topic, gently remind them that there are 11 other months in the year to have the conversation. Today is for celebrating family and the holidays.

- Change the subject. Brief a few family members beforehand so that they can do that as well.

- Set up a quiet corner or room for those who need to withdraw from the larger gatherings. Use it to relax and recharge.

- Children’s quarrels can sometimes set off adults. Make sure there is a teenage cousin to help keep kids safe and entertained or hire a babysitter.

Fun is a great buffer.

It’s hard to get into controversial topics when you’re singing, playing games, or exchanging gifts. Put fun on the agenda and everyone is sure to have a great time.

- Sing carols. Put on a talent show. Watch a movie. Enjoy family holiday traditions.

- Play games but keep them noncompetitive so everyone can enjoy them.

- Host a Secret Santa or White Elephant gift exchange for fun and funny moments.

- Supply everyone with funny hats or themed props. Take plenty of photos.

- Put on some music and dance.

Set the stage for thoughtful conversation.

Interactions with family and friends are opportunities to stretch your perspective. When you’re ready to discuss one of those controversial topics, do it out of the way of the main gathering. Importantly, you don’t want to create tension or start an argument. Before you discuss something controversial, set up a friendly environment.

- Start with topics that reinforce your relationship. Talk about how good it is to see each other. Compliment the food.

- Remember that most people’s opinions are shaped by their past experiences, their culture, and their religious beliefs. These shape a person’s opinion more than actual knowledge of the topic.

- Before you engage in controversial conversation, tell the person that you care about them. Tell them you appreciate their perspective.

Engage in next-level listening.

If you’ve ever felt misunderstood, you know the importance of really listening to someone. Active listening is an art. So, when you’re ready to engage in a potentially controversial topic, ask, “What do you think of…x, y, z?” Then, don’t say a thing. Simply listen.

- Be conscious of your body language. Don’t cross your arms, which can convey a sense of disagreement. Keep your body open, relaxed, and attentive. If sitting, lean forward.

- Keep regular eye contact. Do not stare, however; keep it natural.

- Use simple gestures to encourage the other person to talk. Use an occasional head nod or “mm-hmm.”

- Offer the other person uninterrupted time to talk for a few minutes.

- Then, reflect. Summarize what you heard. If you’re off target, it gives the other person a chance to correct you.

Be curious. Ask questions.

You just listened to the other person’s point of view. After you summarize what you’ve heard, ask the questions that popped up in your mind.

- Ask open-ended questions rather than ones that require a yes or no.

- Stay neutral in your tone and content.

- Avoid judgment, opinion, and sarcasm.

- Don’t call them names or curse at them.

- Don’t be condescending.

- Put yourself in the shoes of the other person. Try to understand why they see the world that way.

- Assume the other person has good intentions. Make a point of saying that their intentions come from a good place.

Share thoughts with compassion and kindness.

Don’t think of the conversation as a win or lose. Leave your ego at the door and avoid putting down the other person’s beliefs as you discuss yours.

- Use “I” statements to share your beliefs.

- Avoid citing facts and trying to change the other person’s mind.

- Personal stories are often more powerful than facts.

- Find the places where you agree. For example, “I really think my friend should be able to have healthcare.” You don’t have to get into how that could happen.

- Know when it’s time to call it quits. If the conversation can’t get beyond a certain point, that’s a good time to agree to disagree.

- Thank them for their time and attention. Offer to revisit the topic in the future.

Make sure the conversation doesn’t take up the bulk of the party. Get back to the fun and make some memories.

Happy holidays from our family to yours.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Safety |

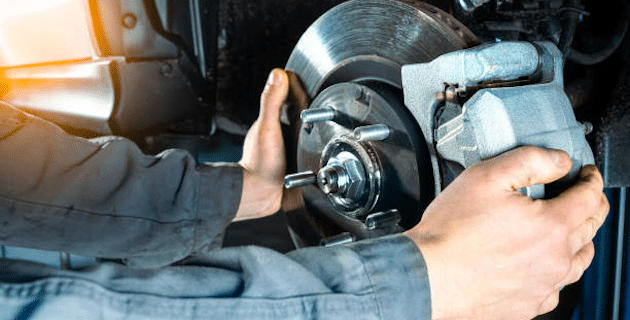

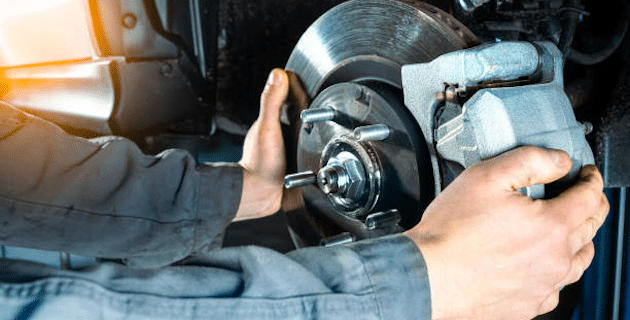

When to get your brakes checked

Your car could be trying to tell you something. Every screech, squeal, or grind could be its way of asking for new brakes.

First, a word about how brakes work…

Most vehicles today have disc brakes. When you press the brake pedal, the car pushes pressurized fluid through its brake lines. The fluid goes into a pair of calipers (clamps) lined with brake pads. They start to squeeze the rotors (metallic discs) from either side. The rotors are located behind each wheel and so the resulting friction slows the spinning, and eventually stops the car.

This constant squeezing and release causes wear and tear. Cars will need new brake pads every 25,000 to 65,000 miles, and new rotors between 30,000 and 70,000 miles. The actual mileage depends on your driving habits. Frequent braking, braking at high speeds, and driving a heavier car will take their toll on your brakes.

How to tell when you need new brakes

The good news is that your car gives you warning signs when brakes begin to wear out. If you notice any of the following, it’s time to get your brakes checked.

Squealing or screeching sound

Brake pads are built with a small piece of metal that becomes exposed as the pads wear down. The metal vibrates against the rotors, causing a high-pitched squeal or screech. That usually happens when the thickness of the pad is at the lowest possible level while still being considered safe to drive. So, if you hear the squeal, you will want to act soon. If you let it go too long, it will become a heavy grinding sound and it can start damaging other parts.

Pro Tip: Know that brake squeaks and squeals can happen if a car has been sitting for a while. That’s because the pads are covered with moisture, rust, and grime. Those noises go away after a few uses of the brakes.

Low brake fluid warning light

Your brakes use hydraulic fluid and cannot function without it. If you see a low brake fluid light, that means something is going on. There could be a leak in the system. Or it could be you’re your brake pads have worn down, causing the fluid to fill the space that’s lower in the reservoir.

Pro Tip: Look for a driveway puddle after your car has been parked for a bit. This type of fluid ranges from clear to yellow brown in color. You’ll find the leak near the wheels. It’s not safe to drive if you have a brake fluid leak. It may cause the brakes to fail.

Car pulls to one side while braking

If the car is pulling to one side or the other when you brake, you’re probably only getting brake power to that side. That’s an indication that you need new brakes or pads or that you have a jammed caliper. Either way, you’ll want to get it checked out.

Pulsating during braking

If your car vibrates, shakes, or pulses as you brake, it could be due to warped or unevenly worn rotors. It also could be caused by adhesive that gets hot and smeared across the rotor. Mechanics call this “glazing” and it can compromise brakes.

Rattling or clicking when you brake

Some vehicles hold brake pads with clips, bolts, or pins. If they become loose, they’ll begin to rattle. You may hear a clicking sound when you brake.

Poor brake performance

If your car takes longer to stop than usual, or if you are pressing the brake pedal down to the floor to get your car to stop, there is a problem. Causes include worn rotors, low brake fluid, and brake pads that are too thin. It could also be an issue with your car’s hydraulic system.

Grinding sound while braking

This is a sign that your brake pads are completely worn. The grinding sound you hear is “metal on metal” as the caliper and rotor scrape against each other. Because this can easily damage them and other parts, you’ll need to get this addressed right away.

Stay on top of maintenance

When one part of the braking system is damaged, it can affect other parts. Driving with worn brakes also can damage your tires. It can wear them down and cause them to be unbalanced. Your car is one of your greatest investments. Keep it well maintained and protect it with the right insurance.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Safety |

The nights are getting longer. That means your headlights are more important than ever. Keeping them clean and in good working order will help you stay safe. Follow this guide to keep your headlights shining bright and sparkling like new.

Why are clean headlights important?

You might think that foggy headlights don’t make that much of a difference. In reality, their light can be dangerously dim. Foggy headlights emit only about 20% of the light that new headlights do, according to AAA. Not only is that a problem at night, but cloudy headlights can limit your visibility in rain and fog, too. It is just as important to replace your headlights as it is to replace your windshield wipers.

What causes headlights to wear out?

Most headlights today are made of thick plastic. While these lenses are more scratch-resistant than glass and can last a long time, their surfaces do wear out. The sun’s UV rays cause the lenses to oxidize, which creates microscopic cracks and yellowing. That impacts the quality of light they can emit. A car wash won’t be able to clean this type of damage.

Pro Tip: You can help limit your headlights’ exposure to UV rays and slow the yellowing process. Park in a cool, dry place that is away from direct sunlight. Consider a protective cover for your vehicle. Park your car inside whenever possible.

Every vehicle is different, and some methods work better than others.

There are a variety of ways to clean your car’s headlights. You can do many of them with supplies you already have around the house. Depending on your vehicle, you will find that some methods work better than others so feel free to experiment.

How to Clean Your Headlights

Start with a clean surface. Headlights pick up dirt, grime, and dust. Before you dive into the deep cleaning, you want to remove that debris. Here are several ways to do so. (You just need to choose one method for the initial clean; you won’t want to do them all.) Remember to wear latex gloves to protect your skin.

- Soap and water: Use car wash soap that is made for plastic headlight lenses. Mix one part of the soap with two parts of water. Put the mixture in a spray bottle. Spray it directly onto your headlights and then wipe it off with a microfiber cloth.

- Use a specialized cleaner such as bug-and-tar remover. Spray it on your headlights. Let it sit for a few minutes, and then wipe it off with a sponge or microfiber cloth.

- Try rubbing alcohol. Dip a soft cloth into the alcohol and then gently scrub the headlights. Rinse with water.

Protect your vehicle’s paint. It’s a good idea to cover the painted finish around each headlight so that you don’t damage your car’s paint. Use a tape without a strong adhesive. Painter’s tape works well.

Method #1: Using a Restoration Kit

You can buy headlight restoration kits at your local auto shop. These kits come with sandpaper that help you to gently remove the microscopic cracks.

- Start with the roughest piece of sandpaper in the kit.

- In between sanding, keep headlights wet using water in a spray bottle.

- Repeat with the next coarsest sandpaper and continue to the finest one.

- Clean your headlights with soap and water. Use car soap made for headlights.

- Seal with a clear coat if the kit includes one.

Method #2: Vinegar and Baking Soda (or Toothpaste)

Common household supplies like vinegar and baking soda are effective cleaners. Alternatively, you can use toothpaste with baking soda. Just make sure the toothpaste does not have flavor crystals which can scratch the surface. Here’s how to use them to clean your headlights.

- Mix up a paste of baking soda and vinegar. Use two-parts distilled white vinegar to one-part baking soda. (You also can use toothpaste without the vinegar instead.)

- Apply the mixture using a microfiber cloth. Rub it on each headlight. Then let it dry.

- Wipe it off with a clean microfiber cloth.

- Rinse with water.

Method #3: Window Cleaner or WD-40

Chemical agents like glass cleaner and WD-40 also can do the job.

- For window cleaner, spray a generous amount onto your headlights. Let it soak in. Then, use a microfiber cloth to wipe it down.

- For WD-40, apply it with a clean, soft cloth. Rub it firmly in a circular manner. Rinse with car soap and water when you are done.

- Apply a car polish using a clean cloth to help protect the surface.

Method #4: A Quick and Temporary Fix

You can help fill in the microscopic cracks and scratches with petroleum jelly or olive oil.

- Put a coin-sized amount petroleum jelly or olive oil on a microfiber cloth.

- Rub it into your headlights.

- Do not rinse. The thin layer will coat your headlights but will disappear the next time it rains.

If you cleaned your headlights and it didn’t help:

- Check their alignment. Consult your owner’s manual on how to adjust your headlights or bring them to a professional.

- Check the inside if the headlight. Dissemble your headlight and use car soap and water or glass cleaner to clean the inside. Make sure to completely rinse and wipe away any liquid. Any residue can be heated by the powerful bulbs.

How to Change Your Headlights

Most new cars have LED headlights which can last the lifetime of the vehicle. However, if you have an older car, you will need to change your headlight bulbs. There are different headlight setups, with the most common being the twist and lock and the spring clip. Check your owner’s manual to see which one you have. Remember to replace bulbs in pairs. If one bulb went out, chances are the other is likely to go out soon.

Directions

- Make sure your car is turned off. Open the hood.

- Disconnect the negative ground cable from the battery.

- Look for the headlight connection. Disconnect the wires from the headlight bulb.

- For at Twist and Lock:

- To pull the bulb out, you will need to push the tab and twist the headlight counterclockwise.

- To install the new bulb, you will need to put it in and twist it clockwise until it locks.

- For a Spring Clip:

- Press the spring to release the bulb. Then pull it out.

- Put the new bulb in and lock it in place.

- Reconnect the wires to the headlight.

- Reconnect the negative ground cable to the battery.

- Close the hood.

Halogen Bulbs

Note that classic cars may use a sealed-beam halogen bulb. You can’t replace these bulbs. You must replace the entire headlight housing.

- Make sure your car is turned off. Open the hood.

- Disconnect the negative ground cable from the battery.

- Find the headlight housing and unplug the wires for the blinker and headlight.

- Disconnect any electrical connections from the back of the housing.

- You will need a screwdriver to loosen the bracket on the housing and remove it.

- Replace it with the new housing.

- Reconnect the housing to the headlights and blinker.

- Reconnect the negative ground cable to the battery and close the hood.

Your car is one of your greatest investments. Keep your car well maintained and protect it with the right insurance. Safe travels.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Safety |

Are you more likely to encounter a vehicle fire in an electric vehicle or a gas-powered one? The answer may surprise you. We’re breaking down the risks of each, and sharing important tips to help keep you safe from a car fire no matter which type of vehicle you drive.

Fires happen in all types of vehicles.

Despite articles circulating on the Internet, there is no government agency tracking fires by the type of vehicle. So, we don’t have a clear idea of which type of vehicle is more prone to fires: gas, electric or hybrid. You’re more likely to see a fire in a gasoline-powered engine than an EV or hybrid, simply because there are more of those vehicles on the road.

We do know that less than half of one percent (or 0.04) vehicles catch fire in any given year. Even though that seems like a low percentage, consider that there were more than 200,000 vehicle fires in the U.S. in 2018, as reported by the National Fire Protection Association (NFPA).

What causes vehicle fires?

Engines produce heat, and when heat connects with a spark or a flammable liquid, a fire can start. Here’s a quick overview of how fires typically happen in gas versus electric vehicles.

Gas-powered combustion vehicles

- Fuel system leaks are the most common causes of fires in gas-powered vehicles. Gasoline is highly flammable and can catch fire from a single spark. Gasoline at a high enough temperature can ignite by itself.

- Electrical system failures are the second most common cause of gas-powered car fires. The electric current produced by a standard lead-acid battery, along with faulty or loose wiring, can produce sparks. Those sparks can ignite a fluid leak or hydrogen gas buildup.

- Flammable fluids can cause fires if their lines, hoses, or containers are damaged. These fluids circulate through your gas-powered engine, and include oil, transmission fluid, power steering fluid, brake fluid, engine coolant and gasoline or diesel. An overheated engine can sometimes cause these fluids to seep out of their designated areas. The anti-lock brake system also can leak brake fluid that can cause an electric short, which can lead to a fire.

- Exhaust-related fires can come from catalytic converters. These parts can be so hot that they can ignite grass under your vehicle. Catalytic converter fires usually occur if your car’s engine doesn’t burn fuel properly, and extra stuff winds up in the exhaust. That causes your catalytic converter to work too hard to burn off those extra pollutants.

- Crashes can cause fires, even though most vehicles are designed with crumple zones that protect the engine, battery, and gas tank. Even so, a crash can cause fluid to leak, and create heat and smoke, which are the ideal conditions for a fire.

Electric vehicles

- Batteries can cause fires in electric and hybrid vehicles. This can happen if the battery is overcharged, damaged, or has a faulty design. The battery is short-circuited, causing a chemical reaction that results in flammable, poisonous gases. This can even happen when a car is not being driven.

- Crashes can damage the battery. If the coolant surrounding the battery leaks out, it can quickly heat up and cause a fire. A crash can also compromise the battery so that it short circuits and heats up. Manufacturers have included safety features such as automatic shutoffs for batteries during a crash, and coatings that help fire from spreading.

EV Car Fires: Much Tougher to Control

Lithium-ion batteries provide their own fuel source, and as a result, can burn for hours on end. They are sometimes hotter than gasoline-powered fires, and therefore harder to cool down. If you call 9-1-1 for a car fire involving an electric or hybrid vehicle, make sure you mention that fact. There are specialized fire extinguishers and firefighting techniques for electrical fires.

Signs Your Car May be in Danger of Catching Fire

Older vehicles may have wiring or other issues that can lead to a fire. However, any car could be at risk. If your vehicle exhibits any of the following signs, take it to your mechanic immediately.

- Quick drops in fuel levels or oil levels

- Wide ranges and changes in your engine’s temperature

- Fuses that repeatedly that pop

- A smoky or burning smell

- Smoke or sparks

- Fluid leaking under your car

What to Do if Your Car Catches Fire

Here’s what to do if your car catches fire.

- Pull over safely as soon as you can.

- Turn the engine off.

- Get everyone out of the car and at least 100 feet away.

- Call 9-1-1.

- Don’t go back into the vehicle for any reason.

- Don’t open the hood. A burning car can explode at any moment.

Your car is one of your greatest investments. Keep your car well maintained and protect it with the right insurance. Safe travels.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Safety |

When your son or daughter starts driving, it’s a milestone moment. It can also be a little nerve wracking. You can’t be everywhere to keep them safe, but you can help them by choosing the right vehicle. In honor of Teen Driver Safety Week, we researched the best and safest cars for teens in 2023, according to the Insurance Institute for Highway Safety (IIHS) and Consumer Reports.

What makes a good vehicle for teens?

You want a car with strong reliability ratings and excellent crash test scores. Today’s cars also have hi-tech safety features that can help keep young drivers safe. These include:

- Blind spot monitoring to let you know if there is a vehicle in your blind spot.

- Automatic emergency braking when the car senses a potential collision.

- A lane departure warning that makes a sound or other signal if you veer toward the next lane.

- A lane-keeping assist that steers your vehicle back into your lane.

- Pedestrian detection that identifies people walking in front of the car.

- Built-in systems with teen driver controls, such as speed warnings and muting of audio while driving.

You will want to avoid:

- Sports cars, which have too much horsepower and could tempt a teen to drive beyond their skill level.

- Small cars that weigh under 2,750 pounds; their crumple zones are not good.

- Large vehicles with long braking distances.

- Vehicles with seats for lots of passengers. Each additional passenger increases the odds of an accident due to distractions.

Following is the list of vehicles with above average reliability scores and good crash tests. Prices provided are from Kelley Blue Book and are estimates for the lowest trim models as of May 2023.

New Cars

Small Cars

| Mazda 3 sedan or hatchback |

$23,000 |

Midsize Cars

| Subaru Legacy |

$25,100 |

| Subaru Outback |

$29,300 |

Small SUVs

| Honda HR-V |

$24,400 |

| Subaru Forester |

$27,700 |

| Mazda CX-5 |

$27,800 |

| Mazda CX-50 |

$28,900 |

| Toyota RAV4 |

$29,300 |

| Honda CR-V |

$29,700 |

| Lexus UX |

$36,000 |

Midsize SUVs

| Subaru Ascent |

$34,600 |

| Hyundai Palisade |

$36,600 |

| Toyota Highlander |

$37,100 |

| Mazda CX-9 |

$38,300 |

| Lexus NX |

$39,800 |

Minivan

Best Choices for Used Cars

Small Cars

| Mazda 3 sedan or hatchback |

2014-20; built after October 2013 |

$9,100 |

| Ford C-Max Hybrid |

2014-16 |

$10,000 |

| Toyota Prius |

2014; built after November 2013 |

$12,900 |

| Subaru Impreza sedan or wagon |

2018, 2022 |

$14,500 |

Midsize Cars

| Subaru Legacy |

2013-21; built after August 2012 |

$7,800 |

| Mazda 6 |

2014-18 |

$10,200 |

| Subaru Outback |

2015-18, 2022 |

$12,200 |

| Toyota Prius v |

2015-17 |

$14,500 |

| Volkswagen Passat |

2017 |

$14,500 |

| BMW 3 series |

2017 or newer; built after November 2016 |

$16,500 |

Large Cars

| Toyota Avalon |

2015 or newer |

$14,600 |

| Hyundai Genesis |

2016 |

$18,000 |

Small SUVs

| Volvo XC60 |

2013, 2017 |

$9,600 |

| Mazda CX-5 |

2014 or newer; built after October 2013 |

$11,800 |

| Mazda CX-3 |

2016, 2019 |

$13,900 |

| Honda CR-V |

2015 or newer |

$15,200 |

| Honda HR-V |

2017 or newer; built after March 2017 |

$16,000 |

| Toyota RAV 4 |

2015 or newer; built after November 2014 |

$16,100 |

| Kia Niro Plug-in Hybrid |

2018 |

$18,900 |

| Subaru Forester |

2018 or newer |

$20,000 |

Midsize SUVs

| Nissan Murano |

2015 or newer |

$12,400 |

| Hyundai Santa Fe Sport |

2018 |

$15,700 |

| Toyota Highlander |

2014 or newer |

$17.100 |

| Acura RDX |

2016 or newer |

$19,300 |

Minivan

| Toyota Sienna |

2015-20 |

$15,700 |

Pickup

| Toyota Tacoma extended car or crew cab |

2016 or newer |

$17,900 |

Remember, when looking at vehicles, talk to your insurance agent to see what will save you the most with your teen on your policy. And don’t forget to look out for recalls or damage from previous owners.

Finally, here are some other ways that you can help your teen stay safe.

- Sign them up for driver’s ed or safety classes.

- Make sure they get experience driving in all kinds of conditions.

- Teach them what to do in emergencies.

- Talk to them about how dangerous it is to drive while distracted.

- Make sure they are fully insured for peace of mind.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

Buying your first car is a right of passage. Getting your first auto insurance policy is one, too. Whether you’ve graduated from your parents’ policy, just moved out, or purchased your first car, here’s what you need to know about getting that important first policy.

Learn about the types of coverages.

An auto policy is made up of different coverages. You choose the types you need from a range of options. Some coverages are required by law. Others are optional but will help to fully protect your investment.

- Liability: If you are at fault in an accident, and others are involved, it’s good to have liability coverage. Liability coverage is required by law in most states. It covers you for bodily injury and property damage you cause to others. However, it does not cover any damage to your own vehicle; that’s covered by collision. It also does not cover injury to you and your family; it only covers the people in the other car.

- Collision: This coverage is if your car is damaged in a collision with another car or an object, such as a fence. Your collision coverage will pay for repairs minus the deductible. Collision coverage is not required unless you’re leasing a car or paying off a loan on a vehicle. However, it may be good to have, especially in the event of an accident.

- Comprehensive: Comprehensive coverage is for natural disasters, fires, vandalism, theft and animals that damage your vehicle. Think of it as “bad luck coverage.” Comprehensive coverage is not usually required unless you’re leasing a vehicle or paying a car loan. However, it’s valuable to protect your car.

- Medical expenses: If you or others are hurt in an accident, you will want medical expenses covered. You will either be able to get medical payments coverage or personal injury protection (PIP). These coverages apply to everyone in your car whether or not you are at fault in the accident. This type of coverage is good to have, as your health insurance may not cover auto accidents and does not normally protect your passengers. PIP is only available in some states and may be mandatory if your state offers it.

- Uninsured or underinsured motorist: You may encounter drivers who are not insured or who are underinsured. If so, you will need insurance to cover your car and the people in your car if hit by an at-fault driver in that situation. Uninsured/Underinsured Motorist Property Damage (UMPD) helps pay for repairs to your vehicle. Uninsured/Underinsured Bodily Injury coverage pays for medical treatment, lost wages, pain and suffering for you and your passengers. These are optional coverages in most states. In some states, you are not allowed to carry collision and UMPD at the same time. Also, sometimes UMPD has a policy maximum, or cap on the amount it will pay.

See our infographic for a quick overview of car insurance, or consult our blog on liability, collision and comprehensive coverage for more detail on these coverages.

Know what affects your car insurance premiums.

Your car insurance premium will be determined by the coverages you select and other factors that contribute to the risk you present as a driver. These include, but are not limited to:

- Where you live: If you live in the city, there’s greater risk for vandalism and theft. If you live in a location prone to floods, wildfires or other disasters, you could pay more as well. You don’t necessarily have to move to get better rates, but sometimes moving into a neighboring zip code can save you some money.

- How often you drive: The more you drive, the greater chances you have to get into an accident—even if you’re a safe driver. So, people who only drive their car for leisure will pay less than others with a long commute.

- Your car’s make and model: Generally, cars that are more expensive will cost more to replace; therefore, it will cost more to insure them. Cars that are highly rated for safety, or that include certain safety features, may qualify for a reduction in your premium.

- Your driving record: Insurance companies use your past behavior to predict your future behavior. That’s why drivers with few or no accidents, and few or no moving violations like speeding tickets, pay less than those with lots of claims. In many cases, companies keep the violations on record for 3 years. If you have a clean driving record otherwise, you may qualify for a lower rate.

Tips to Save Money on Your Policy

- Shop around. You’ll pay more as a first-time driver and so it’s always good to compare pricing. Compare quotes for insurance but be sure that you are looking at similar coverages or it won’t be a fair comparison.

- Raise your deductible. Since the deductible is the amount your insurance provider will subtract from an insurance payout, you’ll want to select a deductible that you’re comfortable paying out-of-pocket after a loss. However, if you can afford to raise the deductible, you could lower your premium.

- Reduce your annual mileage. Consider carpooling or taking public transportation to reduce your mileage, which in turn can reduce your premium. In most states, your insurer pulls reports to determine annual mileage. But your daily commute mileage to work each day can impact rates so it’s a good idea to live close to where you work.

- Ask about discounts. You may get a discount for installing an anti-theft device. You may qualify for affinity or association member group discounts. At California Casualty, we offer special group rates for educators, nurses, and public safety employees.

- Maintain a good insurance score. This score, known as the Financial Responsibility (FR) Score, is allowed in most states, and has a big impact on your premiums.

Insurance companies use the same basic information to determine your rate. At California Casualty, we have our own unique formula to help our clients save money. Learn more by getting a free quote at https://mycalcas.com/quote.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.