by California Casualty | Auto Insurance Info |

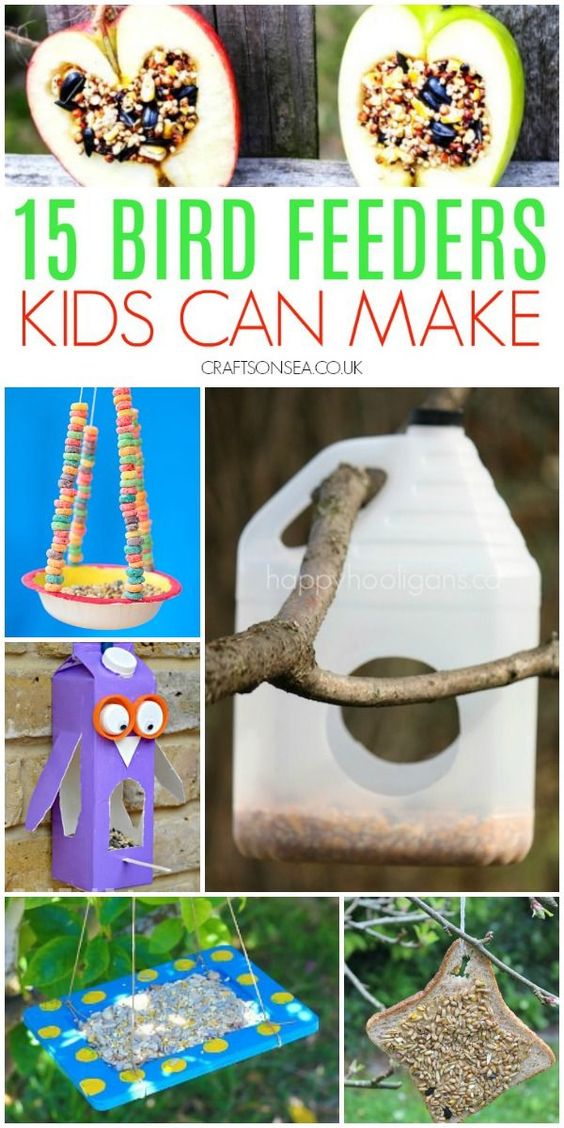

Originally designed to house drivers’ gloves, today’s glovebox is the place for important items that you need in arm’s reach and readily accessible. All too often though, this handy compartment turns into a receptacle for outdated registration cards, empty wrappers, condiment packets, and other forgotten items.

Get in the Spring Cleaning spirit and take a little time to organize your glovebox—you’ll be so glad you did! A neat, tidy, and functional glovebox will serve you well when you need it (which is usually unexpectedly or in an emergency).

Here are some of the must-have and nice-to-have items for your glovebox.

Glovebox Must-Haves

-

- Owner’s Manual. Who hasn’t wondered what that weird symbol that just lit up on your dash means? From maintenance guidelines and emergency information to understanding every specific detail about your vehicle, your manual is the go-to guide.

- Proof of Insurance. This is required in almost every state, and if you get in an accident or pulled over you’ll be glad you have it handy. Vehicle registration is best kept in your wallet.

- Emergency Contact Numbers. These are probably already programmed into your phone, but it’s smart to have a printout just in case.

- Medical Information. If you’re injured in an accident or have trouble communicating, having a written list of medical conditions, medications, or allergies could be a lifesaver. Better yet, add info for all your family members.

- Pen and Paper. If you’re in an accident, you’ll need to exchange information (while under stress and possibly shaken up). Good ole fashioned pen and paper to the rescue.

Glove Box Nice-to-Haves

-

- First Aid Essentials. Think of it as a pared-down emergency kit: just the basics. With band-aids, tweezers, antibiotic ointment, and alcohol swabs at the ready, you can take care of minor cuts or scrapes. Carry a complete first aid kit in your trunk.

- Spare Phone Charger. Thank goodness for USB plugs in our cars. Still, if something goes wrong, or if you arrive at a destination with a dead phone, you’ll thank yourself for carrying an extra.

- Small Flashlight or Headlamp. LED technology has allowed small bulbs to cast big light. If you find yourself stranded in the dark, you’ll be happy to have it. Be sure to also have a couple of extra batteries, as well as another flashlight in your trunk (also with spares).

- Tire Gauge. Tire gauges at gas stations are often damaged or inaccurate. Get a good quality gauge and make sure you know your vehicle’s PSI rating for tires (hint: it’s in the manual and on the tire wall).

- Money. How many of us have run to the store for just one thing and realized at checkout that you left your wallet at home. Twenty to forty dollars should be enough.

- Snacks. You never know when you’ll be stuck in traffic at mealtime—stash a few high-protein bars as a back-up.

- Sunscreen. A small tube goes a long way in a pinch.

While you are organizing your glovebox, don’t forget to give the rest of your vehicle a spring cleaning and disinfect all of your services to prevent harmful viruses and bacteria, like coronavirus.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Good to Know |

As the nation begins to open its doors and more people get back on the road, it’s important — now more than ever — to make safety your number one priority. Not only following all of the traffic laws, but also making sure your vehicle is clean and free of any harmful bacteria or viruses, like coronavirus.

Routine vehicle cleaning and disinfecting will ensure the safety of you and your passengers. So, whether it’s a few trips to the grocery store, getting a much-needed haircut, or returning to the office, as we head into our “new normal,” remember to consistently clean and disinfect your vehicle to help you stay healthy and safe.

Items You’ll Need

-

- Disposable gloves

- A bucket of warm water

- Soap (preferably anti-bacterial)

- Microfiber cloths

- Disinfectant wipes (if available)

- A portable vacuum

Cleaning Your Vehicle

Before you start, make sure to suit up in gloves and a facemask, as well as clothes that can be washed as soon as you’re done.

Next, thoroughly clean the most high-touched areas. These include:

-

- Steering wheel

- Gear shift

- Turn signal/wiper lever

- Navigation screen

- Door handles (inside and outside)

- Dashboard

- Heating/cooling controls and vents

- Radio dials

- Seats and armrests

- Seatbelts and latches

- Mirrors

- Locking/window controls

And don’t forget other places that you or someone else has touched, such as the seat adjustment controls, grab handles and cup holders.

Just as with washing your hands, you’ll need to (gently) scrub for at least 20 seconds to break down the virus. Disinfectant wipes and other automotive cleaning solutions are your best option for surfaces. If those are not available, use warm, soapy water and dry with a microfiber cloth.

For your seats, leather or upholstery, you can use disinfectant wipes, upholstery cleaner, or a small amount of warm, soapy water. To avoid damage, make sure you aren’t using too much water or scrubbing too aggressively. After washing leather seats, apply a leather conditioner/restorer to keep them from cracking, and let dry. When using any alcohol-based disinfectants, make sure they contain at least 70 percent alcohol.

Finally, make sure to regularly shake out and vacuum your floorboards and mats. These are frequently touched, yet overlooked areas of vehicles that have the potential to carry harmful germs from the bottoms of shoes.

DO NOT USE bleach, hydrogen peroxide, or any ammonia-based cleaning products in your vehicle.

Safely Riding with Passengers

It is always a good idea to keep safety and disinfectant items in your car, especially if you are transporting others. These include:

-

- Sanitizer (at least 70% alcohol)

- Disinfectant Wipes

- PPE – gloves and face coverings like masks, bandanas, or scarves.

When you are riding with others or using a rideshare service, it may be impossible to maintain the CDC recommended social distance guidelines. So, when in a car with others, consider wearing your mask and roll down or crack a window. It’s important to let fresh air in because ventilation in cars is usually poor.

If you are riding with someone who is infected but asymptomatic, coronavirus particles can build up inside the cabin, increasing your chances of contracting the virus. Cracking a window will help disperse the particles and decrease your chances of infection.

How California Casualty is Keeping Vehicles Clean

Customer safety and satisfaction is our main priority. That is why California Casualty partners with Enterprise to handle the vehicle rental needs of our customers during the claims process.

All vehicles rented from Enterprise carry the Complete Clean Pledge – to follow best practices recommended by leading health authorities to ensure your safety. In addition to vacuuming and wipe-down cleaning, between every rental, Enterprise uses a disinfectant to sanitize key areas throughout the entire vehicle. View them here.

For more information on the Complete Clean Pledge and all that Enterprise is doing to help keep our customers safe, please visit their website at https://www.enterprise.com/en/car-rental/on-call-for-all.html

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Safety |

If you have a teen who will be driving soon, consider taking advantage of this extra time at home and teaching them the rules of the road. Preparation and knowledge always make a safer driver, and this extra time means your teen can learn in a no-rush environment and absorb the material at their own speed.

Remember that you have more influence on your teen than you may think. Share your driving experiences with them—lessons learned, close calls, even your mistakes. Stress safety as the top priority, always.

Here’s how you can prep your young driver for the road.

The Rules of the Road

The first step is for them to become familiarized with the basic laws and rules of driving. Look into driver education courses online. Classes are interactive and teach traffic laws, safe driving techniques, and the dangers and risks of the road.

Your state’s DMV website should also have plenty of resources, such as driver handbooks, driving tutorials, and sample written tests.

Tour the Vehicle

To help your teen get a feel for the vehicle, take them through all the features and controls—both inside and outside the car. First, inside:

-

- Location of owner’s manual, registration and insurance card

- Dashboard controls

- Windshield wipers

- Seat belts, airbags, and other safety features

- Steering wheel & seat adjustment

- Headlights, low beams, fog lights, and high beams

- Turn signals

- Emergency/parking brake

- Gas and brake pedals (and ABS)

- Cruise control

- Mirrors — location & adjustments

- Emergency lights & warning indicator lights

- Ignition

Next, take a tour around the outside of the vehicle:

-

- Overview of the engine, including the battery and 5 important fluids (engine oil, coolant, power steering fluid, brake fluid, and windshield washer fluid)

- Tires — reading PSI and correct inflation

- Location of safety items such as spare tire, jack, jumper cables, chains and emergency roadside kit (bonus: teach them how to change a tire)

- Taillights & brake lights

Remember to also explain things such as vehicle maintenance schedules (check the owner’s manual), safety ratings, and what to do in roadside emergencies.

Go for a Spin

If your teen has done well on the above, has a learner’s permit, and is covered by your insurance, it might be time for them to start practicing (depending on your city’s current stay at home orders).

Although streets should be relatively quiet, start first in a large, empty parking lot. Be sure to give directions in a clear, calm voice, and well in advance. Answer questions calmly and informatively. Give your teen time to learn at a comfortable pace. Take your time and gradually increase driving practice time.

Your state’s DMV should have lesson plans online for practice sessions. But in general, lessons start with the basics of starting the vehicle, making adjustments to controls, moving forward, stopping, backing up and turning, before moving on to lane changes, intersections, and practicing in traffic. Advanced lessons include parallel parking, freeway driving, and parking on hills.

Take the Pledge

Teen drivers are involved in more collisions than any other age group. Risk factors include distracted driving, risky behaviors behind the wheel, driving inexperience, and lack of maturity.

You can reinforce the responsibility and privilege of safe driving by signing a safe driving contract with your teen (samples here and here). You can also lead by example by joining your teen in taking a pledge against distracted driving: sign up for the National Safety Council’s Just Drive campaign or California Casualty’s Keep on Course campaign.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Safety |

While we’ve all had some extra time at home to tidy up our houses and yards, we can’t forget about our vehicles! It feels like forever since we’ve been out on the road, and we’ve really missed our cars. Although we aren’t driving nearly as often right now, we will be soon, and that is why it is important to make sure our cars are clean and running properly.

Make sure your car is in prime condition for the next time you are behind the wheel by following our interior and exterior Spring Cleaning Car Care Checklist:

Cleaning the Interior

- Remove Trash: Cars fill up quickly when you have kids and are always on the go; receipts, water bottles, wrappers, etc. Make sure the first thing you do is pick up all of the trash on the inside and place a bag that can serve as a trashcan for the next time you have to throw something away.

- Shake out Mats: Remove all large pieces of trash or debris from the floor mats of your car. After, take all of the mats out of your car and shake them out in an open area, and then lay them in a clean spot. To make cleaning easier in the future, look into purchasing heavy-duty rubber mats.

- Clean Vents and Ducts: The best way to do this is with pressurized air, but if you don’t have it you can use a dusting cloth or a wet wipes

- Vacuum: Try and get every part of your vehicle that you can, this includes floorboards, seats, under the seats, trunk, cup holders, and any other space that is large enough. Don’t forget to vacuum the floor mats before putting them back in your car as well.

- Organize: If you have certain items that you keep in your car at all times, like blankets, umbrellas, chairs, sports equipment, reusable shopping bags, coolers, etc. Take these out, make sure each item is clean and has a special place that will not cause clutter or take up too much space when you put it back in your car after it’s been vacuumed. Placing organization bins in your trunk can help out with this.

- Wipe Down: Use a wet wipe or dusting cloth to clean and wipe down your dash, front console, and anywhere else that dirt can hide. And then if you would like to go an extra step you can detail your dash by using a microfiber cloth and some polish or dashboard wipes to make your steering wheel and dash shine.

- Change Air Freshener: After your car is clean from top to bottom change out your air freshener to a nice spring scent and you are good to go!

Now that your car is clean on the inside, it’s time to make sure everything is up and running properly on the outside.

Cleaning & Checking the Exterior:

- Get an Oil Change: You should change your oil about every 5,000 miles depending on the year, make, and model of your vehicle and your own personal driving habits. This will help keep your engine clean and running properly.

- Check the Air Filter: Air filters should be changed at least every 15,000 miles. Air filters are inexpensive and will help you increase your gas mileage, reduce emissions, and allow more air to flow to your engine to help it run smoothly and prolong it’s life.

- Check Your Tires: If a car has been sitting for long periods of time, especially in colder weather, pressure can slowly leak out of your tires, so it is important to check your air pressure and make sure you have the right amount. While you are checking the pressure look at the tread on your tires, if it is low consider getting new tires altogether.

- Buy New Wipers: Spring is rainy season for most of the US, and when you are driving in the middle of a spring storm, it is important that your windshield wipers do their job. You should replace them once a year, so spring is the perfect reminder.

- Go Through the Car Wash: Dust, mud, pollen, bugs, and rain residue are all commonly found on cars in the spring. Make your car look shiny and new by taking it through the car wash and getting a polish or by giving it your own wipe down at home! Pro tip: don’t forget the tires!

Drive safe!

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Educators, News |

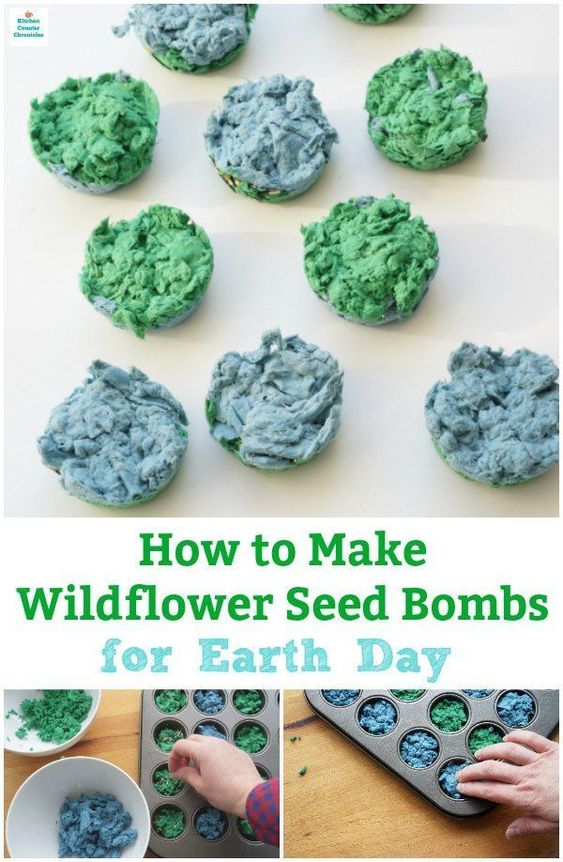

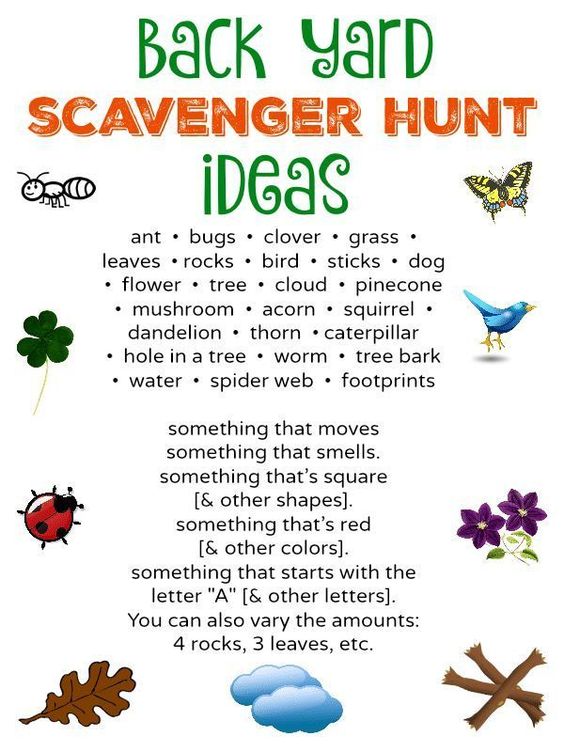

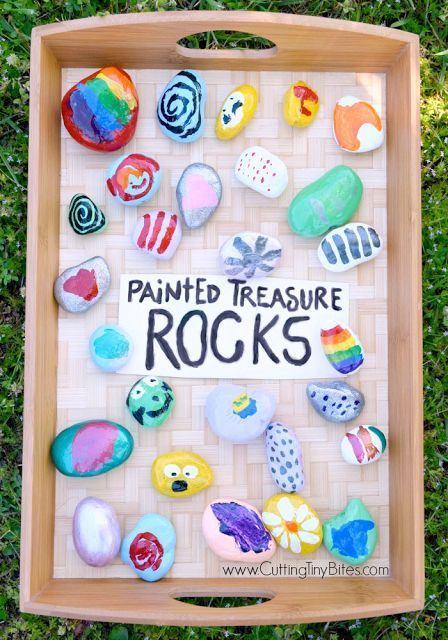

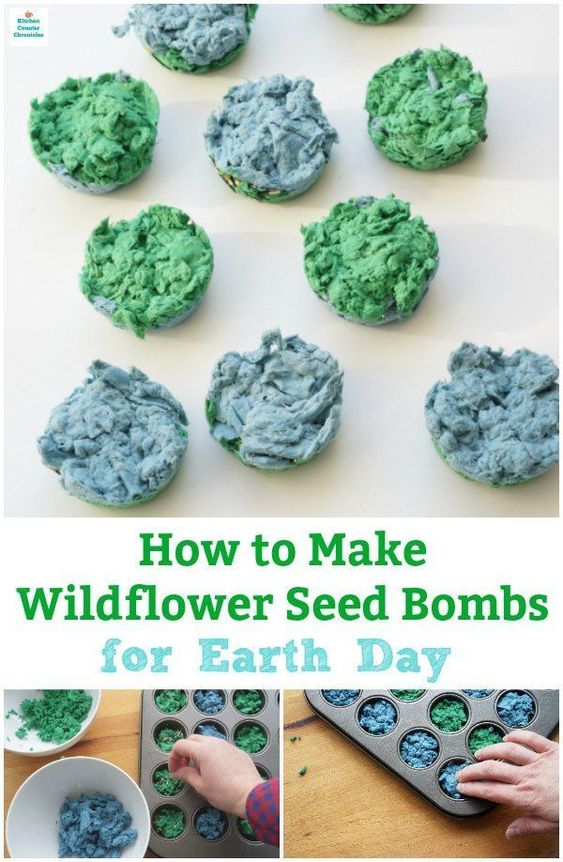

Earth Day is a holiday celebrated around the globe to raise awareness about environmental impacts and issues.

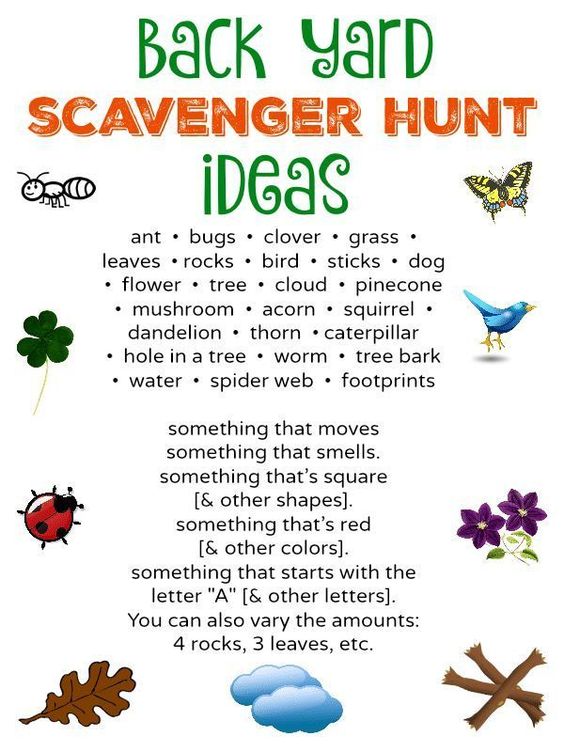

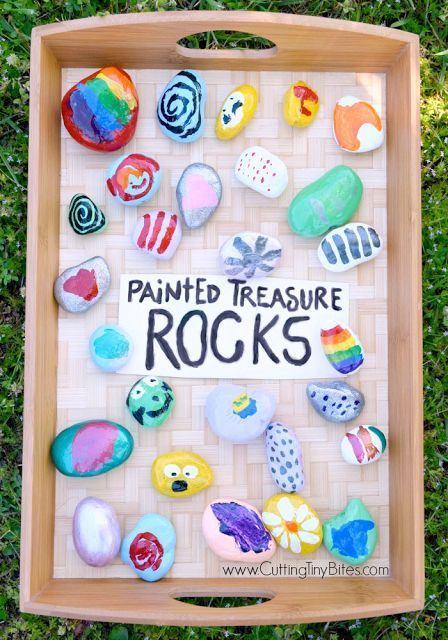

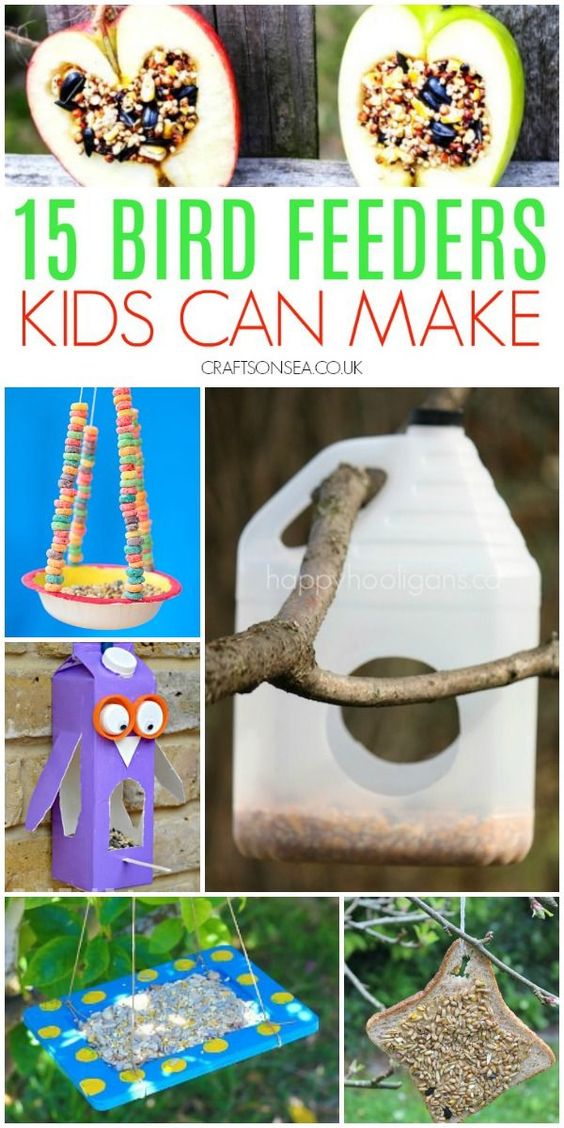

Celebrate the holiday by getting outdoors with your kids and trying some of these fun crafts!

Head over to our Pinterest board, “Earth Day Crafts for Kids” for more fun Earth Day activities you can do with your kids at home. Don’t forget to give us a follow at California Casualty to stay up to date on every new recipe idea we discover! Scan our Pincode with your Pinterest camera to follow:

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters and nurses. California Casualty does not own any of the photos in this post, all are sourced to their original owners. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Safety |

Snowy and icy roads are the cause over a hundred thousand accidents every year, according to the US Department of Transportation. One of the most common, and arguably the most dangerous, parts about driving in the winter is hitting a hidden patch of ice called black ice.

Black ice is a thin coat of highly transparent ice. It is called black ice because it is so thin it blends in with road pavements making it practically transparent and very hard to see- therefore it is highly dangerous. Black ice can be anywhere, but it is commonly found on bridges, overpasses, and on shared areas of roadways, like intersections.

If you are driving in a winter storm, hitting black ice may be unavoidable, but you can minimize your risk of an accident by taking these precautions.

Prepare for Icy Road Conditions

If you have to get out on the roadways during a snow or ice storm, use these tips:

Drive Slow – Reduce your speed to a slow and steady pace. You should brake for stop signs and intersections earlier than normal and leave at least an 8-10 second following distance between vehicles.

Know Your Brakes- Look at your car’s manual to see if your brake system is standard or anti-lock (ABS). If you hit black ice with standard brakes: steer into the skid and slowly pump your breaks until you are back in control. If you have ABS, steer into the skid and apply steady pressure to your breaks until you are back in control (do not pump them).

Make Sure You Have the Right Tires- When winter weather hits, it is recommended to switch from regular tires to snow tires or place snow chains on your tires. However, if you don’t want to replace your tires or purchase snow chains, make sure that your regular tires have the proper amount of tread and pressure to get you through the winter months.

Stay Alert- When you are driving over areas that black ice is commonly found, like bridges or overpasses, stay alert and be aware that your tires will probably start to lose traction. If you can feel your vehicle start to slide, don’t panic, reduce your speed even lower and proceed with caution.

3 Ways to Spot Black Ice

- Know When it Occurs: Black Ice occurs when the air is 32 degrees or below and rain/moisture is present on roadways. You can also expect black ice if it is sleeting or your car has ice frozen to its surface

- Glossy Looking Roadways: If a roadway looks glossy, wet, or patchy and it is below 32 degrees, you are probably looking at black ice. Before you get on the road, look at your sidewalk and see if it looks wet. If it does, very carefully move your foot over on top of it and see if you slide. If black ice has accumulated on the sidewalk, there is a good chance it will also be on the road.

- Pay Attention to the Cars In Front of You: If the cars in front of you are starting to slide or fishtail they are probably encountering black ice. If you are following at the recommended distance, you should have time to slowly change your speed before you drive over it. Another easy indicator is cars or tire tracks in the ditch or grass median.

The best way to avoid black ice is to completely stay off of the roadways when winter weather hits, but if you already know that won’t be an option, prepare yourself and with our winter driving safety tips.

Related Articles:

Winter Driving Safety

Emergency Winter Car Kit

8 Winter Driving Tips for New Drivers

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.