by California Casualty | Auto Insurance Info |

No matter the situation, it’s stressful to be in a car crash. It’s even more nerve-wracking if the other driver refuses to stop. In a hit-and-run, you’re left all alone with all of the damage—and if you can’t find the other driver—the cost.

A hit-and-run is defined as a collision where at least one driver leaves the scene without sharing information or offering help. In most states, this is against the law, but it happens more often than you think- every 43 seconds someone is the victim of a hit-and-run. If there’s damage to your car, a hit-and-run could be a misdemeanor but if there’s also injury, it could be a felony.

So what do you do if a hit-and-run happens to you?

Step #1: Safety comes first. Check for injuries and that you’re in a safe location.

If you’re hurt and need immediate medical attention, call 9-1-1. If your car is in a dangerous location, and could be hit again, move it out of harm’s way.

Step #2: Look for a witness.

Look for a witness. If witnesses are nearby, ask if they’d make a statement. Take their contact information to share with police. (This is good advice for any type of accident.)

Step #3: Write down as much information as you can. Take photos.

Take a moment and write down what you remember about the accident, including the most important thing—the license plate number if you saw it. That will help the police to locate the vehicle. Also include information about the other car, such as the vehicle’s make and model, color, and direction of travel. If you saw who was driving, include a description of that person. Then, take photos of the damage to your car and the place where the accident occurred.

Step #4: Stay where you are and call the police.

In some states, it’s legally required to call the police. You’ll want to do so even if it’s not and even if the damage wasn’t serious. The police need to get out there immediately to make a report from the scene of the accident so that they can help to track down the other driver. In addition, your insurance provider will likely ask for a copy of the police report. Police reports document any physical evidence such as tire marks as well as any witness statements.

Step #5: Call your auto insurer.

Let your insurer know about the accident and file a claim. Calling your insurance company will allow you to find out coverages available, limits, and deductibles. If you don’t have a body shop, they can often refer you to one in your area. At California Casualty, we call these “GRN’s” – Guaranteed Repair Network. These approved independent facilities meet the company’s strict customer service and quality standards. Your insurer will let you know about the repair process and will share information on whether your policy covers a rental car while your vehicle is being repaired.

Step #6: If you need a tow, call roadside assistance.

If your car is damaged to the point where it cannot be driven, have it towed to your body shop.

Know your towing limits. Some coverage will take your car to the nearest place of repair. You may have to pay out-of-pocket if you to tow your car further. Finally, before any work can be done to repair your car, you will want to verify the process with your insurance company.

Who pays for repairs from a hit-and-run?

If you’re able to locate the other driver and he/she is insured, you will be able to file a claim with the driver’s insurance company. If that’s not the case, you have a couple of options. These vary by state and are also determined by how your insurance company handles hit-and-run accidents.

Collision Coverage

Your collision insurance kicks in if you don’t have underinsured or uninsured motorist coverage. If your car is totaled, collision coverage offers either “actual cash value” for your vehicle or the amount necessary to repair or replace the vehicle with another of similar kind and quality—subject to the deductible. There are certain cases where the deductible could be waived; check with your insurer. Collision applies both to accidents with other drivers and collisions with objects such as a fence or mailbox. It also covers vehicle rollovers. Unlike liability insurance, collision coverage is not usually required—unless you’re leasing a car or paying off a loan on a vehicle. However, it may be good to have, especially in the event of a hit-and-run.

Uninsured/Underinsured Motorist Property Damage

One reason that a driver might run from the scene of an accident is if he or she does not have car insurance. If that’s the case, even if the police identify the driver, you cannot file a claim with his/her insurance company. If you have uninsured/underinsured motorist property damage, you can use that to pay for repairs. These are optional coverages in the majority of states. In some states, you are not allowed to carry collision and UMPD at the same time. Also, sometimes UMPD has a policy maximum, or cap on the amount it will pay. If you have UMPD/UIMPD, and it isn’t enough to cover the total cost of your car, your own collision coverage will help.

Having the right coverage is important for protecting your vehicle and keeping you from having to pay thousands in the event of an accident that is not your fault. Schedule an annual review with your insurer to make sure you are fully protected. Then, stay on top of your coverage by managing your account online.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Safety |

Keep yourself, your passengers, and other drivers on the road safe in these four common high-pressure situations when you need to pull over on the side of the road.

Pulling over on a highway

Tip #1: If you need to pull over, do not panic or make sudden moves. This could cause you to make rash decisions. Check your surroundings and know the positions of the other vehicles on the road. This will help ensure that you don’t cut them off.

Tip #2: Don’t go left. The left side of a highway usually has less space. If there’s no barrier, it also might put you close to oncoming traffic. Put on your right turn signal. Start moving to the right as soon as you can do so safely.

Tip #3: Look for a wide shoulder. Avoid construction zones and places that are overgrown with trees. The ideal spot has a wide shoulder next to flat grass to allow your vehicle as much distance from the highway as possible.

Tip #4: Be aware of road conditions. Weather can make the roads slippery, such as black ice which can cause dangerous conditions. As you’re traveling right, adjust your speed accordingly. Be aware of any debris.

Tip #5: Activate your hazard lights so other vehicles are aware you are there. This is especially important in the dusk or dark. Do not exit your vehicle. You are much safer inside your car. However, if you must get out, stay on the side opposite to the highway, and never turn your back on traffic. Follow steps, if needed, in the next section on roadside assistance.

Tip #6: Give yourself ample time and space getting back onto the highway. Getting up to highway speed takes time. Turn off your hazards and put on your turn signal. Start to accelerate in the shoulder lane. When you are up to speed, safely merge back into traffic.

Roadside emergencies

Tip #1: Recognize there is a problem. You might notice that your car is in trouble due to noises, smells, or lights on the dashboard. Put on your hazard lights to alert other drivers that you are having an issue. Be aware of other cars around you as you look for a safe place to pull over.

Tip #2: Find a safe place to stop. Avoid stopping at a corner or the bottom of a hill where your car might surprise other drivers without enough room for them to slow or stop. If you can make it to a freeway exit, a rest stop, or a parking lot, do so. If not, a wide shoulder on the side of the road will work. Try to stop under a street light if possible.

Tip #3: Mark your spot. Don’t exit your car until it’s safe to do so. If you’re on a busy road, get out the passenger side and stay away from traffic. Set up emergency flares or fluorescent cones that warn other drivers you are there. Then return to your vehicle.

Tip #4: Call for roadside assistance if you need it. You may have roadside assistance through your insurer, but if you don’t, you can call a local towing service. There also are some apps that will connect you with service providers, such as HONK and Urgent.ly. Check with your local municipality as well. The state of California offers a free Freeway Service Patrol program to help clear the roads from broken down vehicles.

Tip #5: If you can, take care of simple repairs. You may be able to fix your flat tire or jumpstart your car.

Tip #6: Be careful of anyone who stops to help. Use your best judgment. Some people who offer to help may wish to cause harm. Err on the safe side and lower your window only enough to talk. Let the good Samaritan know that professional assistance is on its way.

Police stops

Tip #1: As soon as you hear the siren or see the flashing lights, put on your hazards. This lets the police officers know that you saw them and that you’re slowing down.

Tip #2: Search for a place to pull over that’s large enough for two cars. Most officers will permit you to go a short distance to a driveway, business parking lot, or gas station. If the car is unmarked, make sure you are in a safe place, such as in a well-lit area with people around or near an open business.

Tip #3: Turn off the ignition and wait. It may take several minutes for the officer to exit the car. He or she may be getting information about your car. Be patient and wait. Do not get out of your car.

Tip #4: If it’s a marked vehicle, roll down your window. If it’s an unmarked car, wait until the police officer approaches and asks for credentials before you roll down your window.

Tip #5: Be calm when you talk with the officer. The officer will most likely ask you for your license, registration, and insurance card. Let them know if you do not have one of the required documents.

Tip #6: If you get a ticket or citation, do not argue. Be respectful. Thank the officer if you get a verbal warning. After the officer has returned to his or her patrol car, pull out safely into traffic

Tip #1: Listen for a siren. A police, ambulance, or fire truck siren can be heard for a good distance. If you think you hear a siren, shut off your radio or music. Try to determine the direction where it is coming from. Look for flashing lights.

Tip #2: Put on your right turn signal and slow down. Continue listening for the siren and looking for lights. Identify a place where you can safely pull over to the right of the road.

Tip #3: Check your mirrors and make sure the way is clear. Pullover and park your car. You can leave the engine running as you shouldn’t be there for long.

Tip #4: Watch for the emergency vehicle and wait until it has passed. When you do pull out, you will want to stay at least 500 feet behind it.

Tip #5: Check your mirrors, put on your turn signal and carefully pull back into traffic. You may need to wait your turn, as other drivers will be doing the same thing.

Drive safe.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com

by California Casualty | Auto Insurance Info |

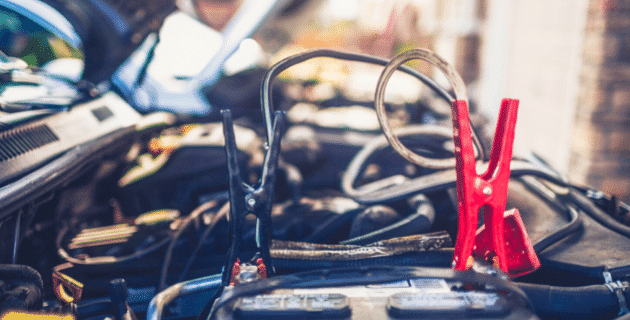

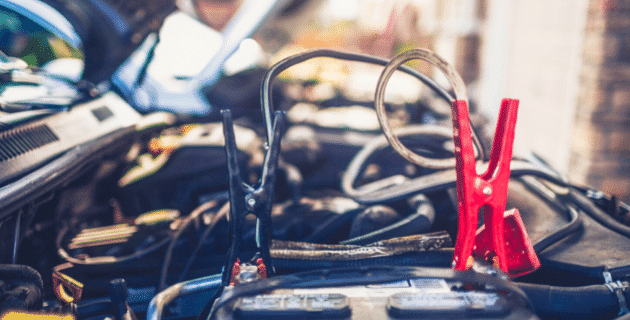

Car batteries don’t last forever. Luckily, if your car won’t start due to a dead battery, there’s an easy fix. You can jump start it.

Jump starting a car transfers the battery power from a live battery in one vehicle to the dead battery in another. It does this by creating a circuit, most commonly using jumper cables. Jump starting isn’t a permanent fix, but it will help you get to where you’re going. And then, you can schedule a follow-up with your mechanic to check your battery and replace it as needed.

It’s not difficult to jump start a car, but you do need to know how to do it properly. If you do not connect the cables in the right way and in the exact order, you could be in for trouble. Follow this process to successfully jump start your car — or someone else’s — this season.

1. Park so that your car’s engine is next to the other car’s engine without touching. In most cases, your cars will have to be facing each other in order for the jumper cables to reach.

2. Place both vehicles in park or neutral. Shut off the ignition. Put on the parking brake.

3. Pop the hoods. Locate the batteries.

4. Get out the jumper cables. Note that they have red and black clamps.

5. Attach one of the red clamps to the positive terminal on the dead battery. Look for the big plus sign or the letters POS to make sure it is positive. Sometimes the positive terminal is also the larger one. (Always connect the dead battery first. Otherwise, you could be feeding energy in the cables and cause a safety hazard.)

6. Attach the other red clamp to the positive terminal on the battery of the working battery.

7. Clamp the black negative to the negative terminal of the working battery.

8. Attach the last black clip to an unpainted metal surface on the car with the dead battery. You can find such a surface on one of the metal struts that holds the hood open.

9. Start the working vehicle and let the engine run for a few minutes.

10. Try to start your vehicle. If it doesn’t start right away, give it another minute and then try again.

11. Remove the cables in the reverse order that you connected them.

12. If the jump start works, don’t shut off your vehicle. Drive around for at least 15 minutes to recharge your battery. And always remember to thank the person who helped you!

If you want to jumpstart your car on your own, you can buy a battery jumper pack. Most people consider this one of the must-carry safety items for your car in the winter. A battery jumper pack is a portable battery with cables that can jump-start your car without the need of another vehicle. If you choose to go this route, be sure to carefully follow the directions. The procedure varies from device to device.

If you feel unsure or unsafe at any point, call for 24/7 roadside assistance. You can also call if the jump start does not work and you need a tow.

Do’s and Don’ts of Jump Starting

Now that you have the basics down, it’s good to review some safety do’s and don’ts.

Do…

-

- Read your owner’s manual on jump starting. In some cases, jump starting may void the warranty. In other cases, there may be jump start lugs where cables need to be attached. The manual will detail any special instructions.

-

- Make sure the battery on the good Samaritan’s vehicle has at least as much voltage as your own. Otherwise, serious damage could occur.

-

- Check that the clamps on the jumper cables are rust-free.

-

- Check that the battery does not have corrosion or rust. You can clean corrosion and dirt with a wire brush. (Corrosion will sometimes prevent the battery from charging.)

-

- Unplug accessories like cell phone chargers. The power surge from the jump start could cause them to short out.

-

- Turn off headlights, hazard lights, turn signals, and the radio in both vehicles.

-

- Use rubber gloves and safety goggles if you have them for extra safety.

Don’t…

-

- Lean over the battery of either car.

-

- Smoke while jump starting a car.

-

- Jump start a battery if it is cracked, leaking or the fluids are frozen. This can lead to an explosion.

-

- Ignore the warning signs:

-

-

- Slow starting engine

- Dim lights and electric issues

- Check engine light is on

- Corroded connectors

- Rotten egg smell

And don’t forget! AutoZone offers free battery testing so you can feel confident that your battery is fully charged.

Finally, remember to turn your lights off. We all know how that typically ends.

Safe travels.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

Nearly 60% of Americans are underinsured or don’t understand what is covered by their policies.

Make sure you are properly covered going into the new year with these 6 New Year’s insurance resolutions

1. Make sure you have the correct amount of auto coverage

Have your driving habits changed in the past year? Maybe you accepted a new job and your commute is longer or smaller, or you added a new driver to your policy. These life changes will all affect your insurance coverage and premium costs.

Making sure you have the right amount of auto coverage is crucial in case of an accident, so you don’t have to end up paying the majority of your costs out of pocket. For example, make sure you have enough liability coverage on your current policy. If you cause an accident, you are responsible for damages (and if it is a serious accident loss of wages of the victim/their family). Liability coverage is used to pay for those damages that you caused.

Your insurance will only pay for the amount that you’ve designated for liability. The rest comes from your pocket, so don’t skimp on this important coverage.

2. See if you qualify for any additional discounts

Did you know that if you have a teen driver they can take a driver’s safety or education course to qualify for discounts on your auto insurance? You can also turn in their report card for a ‘good student discount’.

You may qualify for insurance discounts for being part of a professional association, such as groups for teachers, nurses, or first responders. There are also discounts for being retired, for drivers turning 25, for paying via automatic bank payments, and for paying in full upfront. You may qualify for a new home discount, or a discount if you have updated your utilities (electrical, plumbing, heating, cooling) in an older home, or added a security system. There are also discounts for a new roof and an automatic sprinkler system. You can even be rewarded for being a loyal customer!

3. Create a home inventory checklist

A home inventory is a list of all of your possessions and their values. While creating one may sound like a waste of time, it’s important to have an updated list of all of your possessions so that you can get fully compensated if there was a disaster like a fire or a tornado, or a burglary. Without a home inventory, you may have difficulty pinpointing all of your belongings and lose out on their value and it can even delay the claims process. Start fresh with all of your new belongings after the holidays and put the checklist in a safe space, in the event of an unexpected loss, you’ll be glad you did.

4. Do you need additional coverage?

Did you know your home and/or renter’s insurance doesn’t include flood coverage? If you live in a flood-prone area you need to have Flood Insurance. The same goes for Earthquakes and Earthquake Insurance.

Do you have a pet that you love like a child of your own? While they will be covered if you are both in an accident in a covered vehicle thanks to Pet Injury Protection from California Casualty, make sure you will get reimbursed for any emergency surgeries, x-rays, labs, prescriptions, and more by adding Pet Insurance.

Need some extra coverage in case of an accident or disaster to ensure your family and belongings are safe? Ask your insurance agent if Umbrella Insurance or Scheduled Personal Property Coverage is right for you.

Umbrella Insurance is an extra layer of coverage that protects you and your family by covering additional damage costs that extend beyond the limits of your homeowner’s, auto, or watercraft policies. This additional coverage ensures your personal assets are safe. The primary purpose of this coverage is to protect you if you’re found liable for causing bodily injury to others or damage to their property. It also protects against incidents involving slander, libel, false arrest, and invasion of privacy, as well as any legal defense costs – even if you’re not found liable.

Personal Property Coverage, also referred to as “contents coverage,” is the term insurance companies use to collectively define the things you own inside your home. Scheduled Personal Property Coverage, or rider, is additional coverage for more special and/or expensive items such as jewelry, watches, heirlooms, furs, collectibles, etc. that have values above your personal property coverage limits. Both coverages are invaluable to make sure your personal belongings are covered in the event of a disaster or burglary.

5. Know what benefits are available to you

At California Casualty we offer our insured exclusive benefits like:

-

-

-

- Affiliate Group Rates & Generous Discounts

- FREE ID Defense Resolution

- Summer or Holiday Skip Payment Options

- Waived / Reduced Deductible for Collision or Vandalism While Parked on School Property – for Educators

- Personal Firearm Coverage & Fallen Hero Benefits – for First Responders

- No Charge Personal Property Coverage Up to $500

- 24 x 7 Towing & Roadside Assistance

- $1,000 Free Pet Injury Protection Coverage

And more! Speak to your insurance agent and ask which benefits are available immediately to you.

6. Schedule your annual free policy review

When’s the last time you took a look at your Insurance policy? Chances are if you haven’t had an accident or a loss, it’s probably been a while. And knowing more about your insurance could even save you money on your premiums. That’s why it is recommended to speak to your insurance agent at least once a year for your annual policy review. They will answer all of your questions and make sure you have the correct amount of coverage.

We know understanding your insurance coverage can be confusing, but we’ve got you covered! There is no better time to start getting the most out of your insurance protection than the new year. Call your California Casualty agent today to make sure you are taking advantage of your coverage and benefits all year long.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | In Your Community |

NEA Member Benefits recently added siblings to the list of family members eligible to access the NEA Auto and Home Insurance Program provided by California Casualty. Referred to as an NEA Member’s “Extended Family,” parents, in-laws, adult children, and now siblings can take advantage of the special rates, deep discounts, and personalized service available through the NEA Auto and Home Insurance Program.

California Casualty offers policyholders special benefits, such as:

-

- Rates good for a full year, not six months like many insurers offer

- Auto insurance that covers $500 for non-electronic items taken from your vehicle

- $0 deductible for accidents in a rental car

- Broad policy protection for anyone they allow to drive your vehicle

- Free ID defense

- Free pet injury coverage up to $1,000

- Holiday or summer skip payment options

- Exceptional towing and roadside assistance availability

Plus, as an NEA Member, you have more exclusive benefits, including:

-

- Waived/reduced deductible for collision or vandalism while parked on school property

- Educators excess liability coverage for protection in the classroom

- Fundraising coverage with $0 deductible for goods/funds valued up to $500 while under your care at school

- And more!

Tell your family (and colleagues) about the NEA Auto and Home Insurance Program. Members who switch see an average of $423 in savings.

This article is furnished by California Casualty, providing auto and home insurance to teachers, law enforcement officers, firefighters, and nurses. Get a quote at 1.800.800.9410 or www.calcas.com.