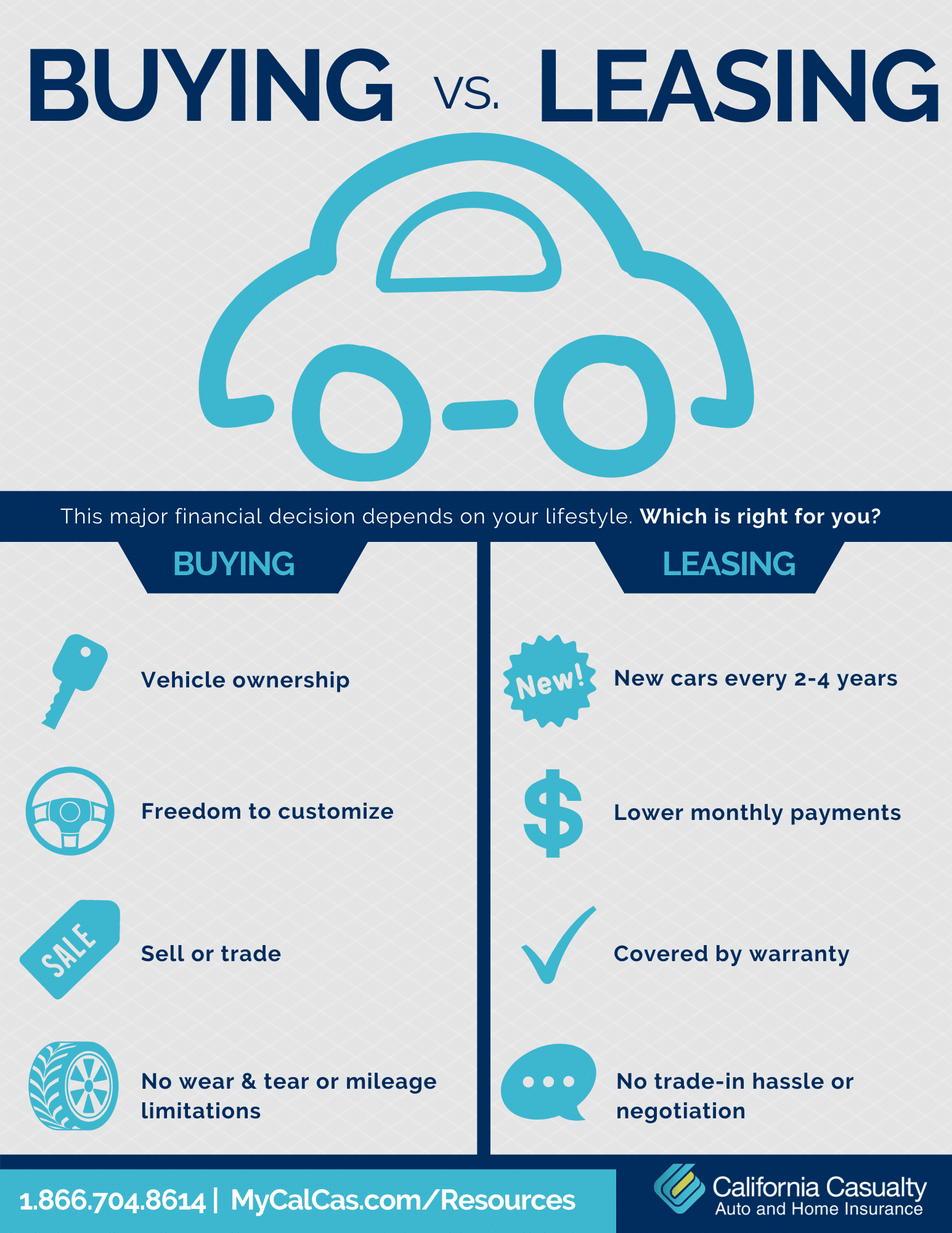

What is the smarter choice, buying or leasing a car? It’s a tough question with no wrong or right answer. The truth is this major financial decision ultimately depends on your lifestyle and budget.

Buying

Traditionally, financing the purchase of a vehicle often means your monthly payment may be more than what you could expect to pay by leasing. However, once the car is paid off, it’s yours to keep for as long as you’d like. You’ll no longer have the expense of a monthly car payment, but you should factor in costs related to upkeep, maintenance and repairs.

Leasing

With a lease, you’re essentially paying for the portion of the cost of the vehicle for the duration of the lease term. Often, this can result in a lower monthly payment. At the end of the lease, the vehicle is returned. You then have the option to lease a new vehicle and begin making payments on the new lease. Here are some major differences to consider when you are looking into buying or leasing a car.

Buying:

- Ownership

- Personal Customization

- Builds Long-Term Equity

- Wear & Tear t Isn’t Penalized

- Unlimited Mileage

- Loan Payments

- Can Sell/Trade Whenever You Want

- Same Car for X-Number of Years

- Must Pay For Repairs Out-of-Pocket Once Warranty Expires

Leasing:

- Must Return

- Returned in the Same Condition

- Can Finance to Purchase

- Pay for Excessive Wear & Tear

- Mileage Limitations

- Lease Payments

- Must Completely Finish Lease

- New Car with Newer Technology Every Few Years

- Repairs Usually Covered by Warranty

There is no one-size-fits-all option when it comes to leasing or buying a car. So when it is time to make the important decision there are a few factors that you need to look at.

Cost and Lifestyle

Your lifestyle and what you would like to have in the future are both major factors that play into the decision on leasing or buying. Do lower or higher payments work best with your budget? Would you like to own your car in the end and be able to sell in the future? Or would you rather continue making small payments on different vehicles? Remember both vehicles will also require a down payment along with other fees.

You should also consider the cost of regular auto insurance, that you would need if you purchased a vehicle, compared to gap and collision coverage, you would need when you lease a vehicle. To discuss auto coverage speak to a California Casualty advisor.

Flexibility

Figuring out how flexible you are when it comes to contracts is helpful in determining if you should lease or buy. If you tend to regularly want a new car with the newest technology, leasing may be your best option. However, if owning a vehicle outright is more appealing and you plan on keeping it long after that new car smell has worn off, you might consider buying. Just like cost, all is dependent upon you and your lifestyle.

Related Articles:

Buying a Car? Avoid a Flood of Tears

Car Insurance Does More Than Fix Your Car

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

- Graduation – When to Remove Your Child from Your Auto Policy - May 18, 2023

- How to Prevent Catalytic Converter Theft - May 17, 2023

- How Much Does Home Insurance Cost? - May 17, 2023