by California Casualty | Homeowners Insurance Info, Safety |

Hurricanes are natural disasters that bring demolishing winds and massive amounts of rainfall to land from the ocean. Coastal towns and cities across the world have been torn apart by hurricanes, but they aren’t the only ones who are usually affected. Hurricanes can cause significant damage to towns over 100 miles inland! September, is the most active month of the year, so now is the time to protect yourself and your family from these deadly natural disasters.

The relative lack of storms so far this hurricane season is bringing both good and bad news. While we are all taking a sigh of relief that there has yet to be a major storm, it could also be bringing a false sense of security. Many people in states where hurricanes usually hit may be “dropping their guard.” A new survey finds only a quarter of those living in hurricane-prone states think they are prepared if a monster storm hits, and nearly half of the respondents say they have yet to make any preparations this year.

Remember all hurricanes, no matter what size, have the potential to cause significant damage and life-threatening situations. Looking back at the destruction previous hurricanes like Harvey, Sandy, and Katrina have caused, it is essential that you make sure your family, home, and belongings are completely protected.

Important Hurricane Coverages:

- Flood Insurance. A regular home insurance policy will not pay for damages caused by flooding, but when you add flood insurance to your policy it will cover all damages that happen to your property, even if you rent! Be aware that when you add flood insurance there is a 30-day waiting period until it goes into effect, so that means it is often too late to purchase it when a hurricane or tropical storm is approaching.

- Scheduled Personal Property Insurance (Floater). Many people find that after a natural disaster their insurance coverage is limited on expensive personal items (ex. jewelry, furniture, technology, firearms, collectibles, furs, instruments, etc.). Floaters protect your personal items for their full value.

Steps to Protect Your Home & Family

- Heed evacuation notices and keep your car’s gas tank full in case of evacuations

- Stock up on essentials like bottled water, non-perishable food items, toilet paper, and pet food

- Make sure pets are kept inside, safe, and have a spot to do their “business”

- Have a family evacuation and communication plan

- Prepare an emergency kit (ex. flashlight, medicines, cash, and important documents)

- Get a NOAA Weather Radio

- Sign up for National Weather Service storm texts at https://www.weather.gov/subscribe-hurricaneinfo

- Charge cell phones and other devices and have charged spare batteries

- Install storm shutters or purchase 5/8 exterior grade or marine plywood to cover windows or doors

- Add straps or additional clips to roofs to reduce damage

- Bring in or secure anything that can be propelled by wind (ex. grills, bicycles, lawn furniture, play equipment, etc.)

- Know how to turn off propane tanks and gas lines

After a Hurricane Strikes

- Make sure you, your family, and pets are safe and secure

- Register yourself as “safe” on the Safe and Well website

- Follow all city boil and curfew orders

- Secure the property from further damage or theft

- Contact your insurance company as soon as possible

- Keep or document receipts and other expenses if you are evacuated or forced to find another place to live because of damage to your home or apartment

- Be wary of unscrupulous contractors following a natural disaster

It’s important to know that flooding and storm surge are the biggest threats to life when hurricanes hit. Leave low-lying areas, never drive or cross through running water, and avoid rivers, streams, and creeks; which could flash-flood.

For more information visit:

https://www.ready.gov/hurricanes

https://mycalcas.com/?s=hurricane

https://www.iii.org/article/preparing-hurricane

https://www.cdc.gov/features/hurricanepreparedness/index.html

https://www.redcross.org/get-help/how-to-prepare-for-emergencies/types-of-emergencies/hurricane.html

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info |

You’ve bought a house. Congratulations! Now the fun begins. As a new homeowner, you’re going to be responsible for a lot more than when you were renting.

Follow these 7 money-saving tips to set up your new home like a pro.

Tip #1: Wait to spend on nonessentials. Fix things first.

Don’t worry about buying furniture, changing your cabinets, decorating or personalizing your home right away. Right now, your focus should be on repairing and replacing.

-

- Take care of any maintenance and repairs that you can do yourself, such as painting walls and replacing doorknobs and locks.

- Hire a qualified contractor for electrical work, plumbing, roof repair, gas appliances, and to handle any toxic materials like mold or asbestos.

- When choosing a contractor, get cost estimate quotes from three different providers. This will help you find the one that is most cost-effective.

- Make sure any contractors you use are licensed to work in your state. Ask for references and talk to some of their past clients.

Tip #2: Seal your home. Check your insulation and look for small air leaks.

Insulation is the material that keeps the heat in your home during the winter and the cool in during the summer. When you have the right amount of insulation, and no air leaks around openings like doors, it will help to lower your heating and cooling bills

-

- Check to see that you have at least six inches of insulation in your attic. You will need more in colder climates.

- Don’t forget to insulate around the attic opening. That’s a common place to lose heat.

- Wrap any exposed water pipes in insulation. This will help prevent frozen pipes.

- Caulk and weatherstrip to seal small air leaks around doors, windows, and electric outlets. These are all places where air can get in and out.

Tip #3: Regulate the temperature in your home.

Your home’s heating and cooling systems work to keep things comfortable—at a cost. You can help reduce those bills with a few simple adjustments.

-

- Install a programmable thermostat. This allows you to raise the heat while you’re at work and cool down when you are home during the summer months and vice versa for the winter.

- Lower the temperature on your hot water heater to 120 degrees F. Not only will it help with your energy bill, but it will also help prevent scalding burns.

- Install ceiling fans. This is a great way to move air around, and help reduce the amount of air conditioning you need.

- Close the blinds to block the sun which can heat up your house.

Tip #4: Watch for standing water or water leaks.

A sudden increase in your water bill is a sign that you probably have a leak. Keeping on top of these repairs is an easy way to prevent this unnecessary cost.

-

- If you have a dripping faucet, repair or replace it as soon as possible.

- Check under the sinks for wet spots that may indicate leaky pipes.

- If your toilet is constantly running, that could raise your water bill as well. You may need to replace a part such as a flapper, fill valve or chain.

- Check for a leaky toilet. Remove the tank lid and put a few drops of food coloring in the back of the tank. Wait 30 minutes without flushing your toilet. If you see the color in the toilet bowl within that time, you probably have a leak.

Tip #5: Take advantage of tax benefits and incentives.

As a homeowner, you may qualify for tax benefits and incentives if you itemize deductions on your tax return. Consider hiring an accountant to help you maximize your refund.

-

- Mortgage interest is deductible.

- Home equity loan interest is deductible if you spent the money on home improvements.

- You may get a tax break for paying property taxes.

- If you work at home, you can deduct home office expenses.

Tip #6: Pay off your mortgage early.

You can reduce the amount of interest that you pay if you budget correctly and pay off your mortgage early.

-

- Switch your mortgage to a biweekly payment. If your monthly payment is $1,000, pay half, $500, every two weeks. You will pay the same amount that you would, but will end up making 13 full payments instead of just 12 in a year. You also will rack up less interest, which is calculated daily. Overall, this will end up saving you thousands of dollars.

- Make extra principal payments when you send your monthly payments.

- Consider using any windfalls, such as your tax refund, as payments toward your principal.

Tip #7: Update your insurance.

Your home is likely your largest investment. Make sure it is protected with the right insurance.

-

- Your mortgage lender requires homeowner insurance. Many homeowners pay the mortgage lender who in turn pays the insurance company through an escrow account.

- Consider bundling your car insurance and homeowner insurance to save money.

- Make sure that you have disability income insurance so that you can continue to pay for your home in the event you are unable to work.

- If you live in an area that floods, consider adding flood insurance. Similarly, there is earthquake insurance.

- Consider an umbrella policy for extra coverage beyond your homeowner policy.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

Although it is recommended to review your home and auto insurance policies yearly, 60% of all Americans are underinsured and/or don’t understand their policies. Do you know what’s really covered with your insurance policy?

If you don’t or you have any doubts, now is a great time to get an annual review of your auto and home/renters insurance policies. You’ll sleep better at night knowing you are protected against expected surprises if you have a claim. You may also find you are eligible for additional savings and discounts!

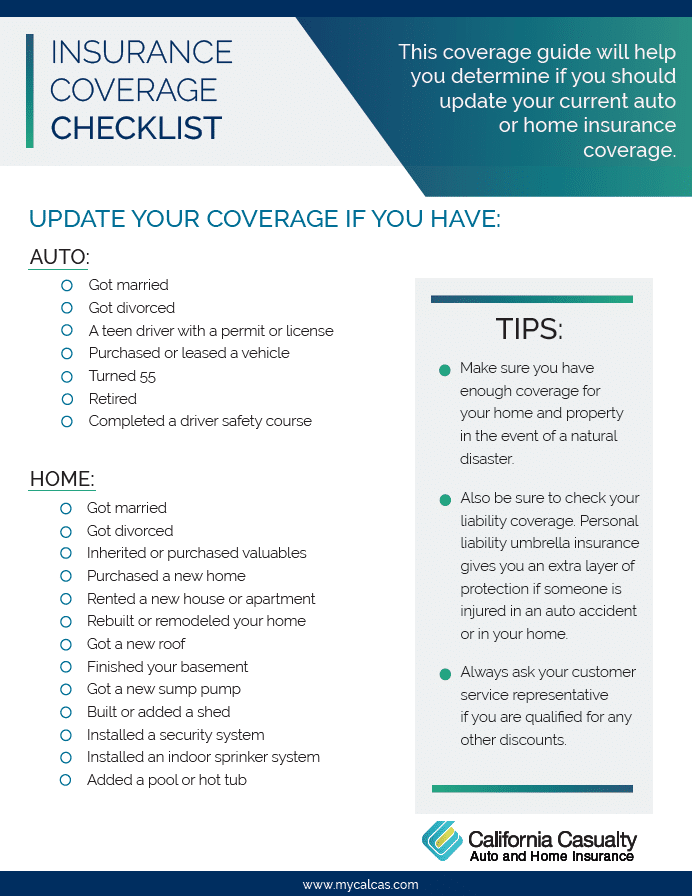

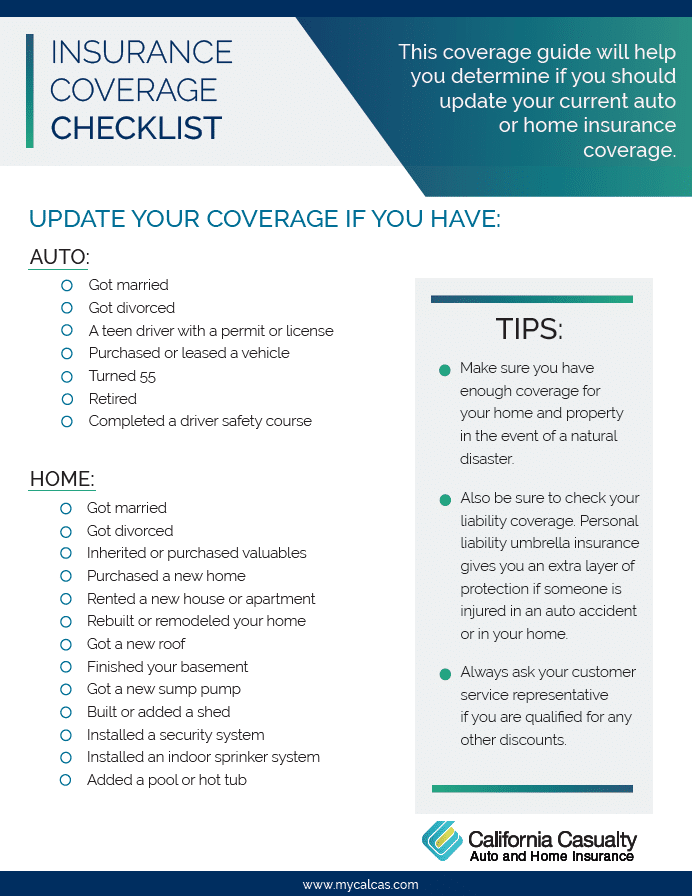

Here are seven examples of why you should contact your insurance advisor to review your policy:

- You got married. Newlyweds often pay less for insurance than when they were single. You can also find discounts by combining your autos with one insurance company. It also means all those expensive wedding gifts you received might need extra protection.

- You got divorced. You probably are no longer sharing a vehicle and moved into a different residence. You’ll need to inform your insurance company to set up separate auto and home or renters insurance policies.

- Your teen got a driver’s permit or license. You need to let your insurance company know if they are driving your vehicles, or if you bought them one. Make sure that you take advantage of good student discounts and additional multi-vehicle savings!

- You bought or inherited valuables such as antiques, fine art, jewelry or other collectibles. Your standard homeowners or renters insurance policy provides limited coverage of high dollar items. This is a good time to purchase scheduled personal property endorsements to cover your new valuable possessions for a higher amount.

- You’ve added on to your home or have remodeled. Improvements to your house mean there is more to protect. Contacting your insurance company is a good way to make sure that you have enough coverage. This also applies for a new gazebo, shed or pool, or hot tub.

- You’ve moved to a flood or earthquake prone area. Neither earthquake nor flood insurance is included with most homeowners or renters policies. You need to purchase separate flood or earthquake insurance. Keep in mind that flood insurance has a 30-day waiting period before it becomes effective.

- You’ve retired. This often means you are driving less, which could significantly reduce your insurance costs. Drivers over 55 also often get discounts from their insurance companies and you can further reduce your premiums by completing a driver safety course.

Knowing more about your insurance could save you money on your premiums and heartache in the event of a break-in or natural disaster.

If it is time for your auto or home insurance coverage review contact one of our customer care advisors today at 1.800.800.9410. A few minutes of your time will provide the appropriate protection, and we may even find you some extra savings!

If you don’t know where to start to determine if it’s time for your policy review, download our free Insurance Coverage Checklist. Just click the image below for your free download!

by California Casualty | Calcas Connection, Consider This |

When you signed up with California Casualty, you joined a well-respected, 105-year-old, family-owned insurance company. It’s easy, after the excitement of making a change, to forget some of the reasons you chose California Casualty. Not only did you qualify for special group pricing, you also received valuable benefits that came with your auto and home insurance. They include:

- Rates good for a full year, not six months like many insurers offer

- Auto insurance that covers $500 for non-electronic items taken from your vehicle

- $0 deductible for accidents in a rental car

- Broad policy protection for anyone you allow to drive your vehicle

- Free ID defense

- Free pet injury coverage up to $1,000

- Holiday or summer skip payment options

- Exceptional towing and roadside assistance availability

However, we can help you in many other ways. Our advisors can also line you up with flood insurance and, in certain states, earthquake insurance. If you have a boat, classic car, RV, motorcycle or snowmobile, California Casualty can get you the insurance you need. We even offer pet health insurance that can save you thousands of dollars if something happens to your furry friend.

TAKEAWAY:

If you need flood and earthquake insurance, or coverage for your pet, boat, collectable car, motorcycle or summer and winter recreation vehicles, contact our Agency Services team at 1.877.652.2638 or email [email protected]. Also, please share your California Casualty experience with your colleagues and family members; we’d love to offer them the same quality insurance with the benefits that you are enjoying, visit www.calcas.com.

by California Casualty | Calcas Connection, Consider This |

It’s something we all hope never happens to us: a sewer backup or sump pump failure, but a flooded home caused by this event can happen to anyone at any time. In fact, any home with a toilet and a sink is susceptible.

It’s important to note that damage caused by a sewer backup or sump pump failure is not covered under your standard homeowner’s insurance policy. When you purchase your policy or call in for a policy review you will need to add-on Sump Pump/Water Backup Coverage. Without this endorsement, you’ll be paying for the damage yourself.

Here are five reasons to have water backup/sump pump overflow coverage:

- It can happen to any system

- Just a couple inches of water backup can cause thousands of dollars in damage – ruining carpets, destroying appliances, and crumbling drywall

- It helps speed up the necessary clean-up, preventing mold and further damage

- It’s not covered under flood insurance

- It’s relatively inexpensive!

If you live in an older home, one that has a basement and/or a sump pump, and there have been problems with backed-up sewers in your neighborhood, you should definitely consider adding water backup and sump discharge or overflow coverage to your homeowner’s insurance policy.

With a California Casualty water backup endorsement, you’ll have as much as $10,000 to clean up and repair damage (amount varies by state). Review your policy and if you don’t have a water backup endorsement, or don’t know if you do, contact a California Casualty advisor today at 1.800.800.9410 option 3, or email [email protected].

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.