by California Casualty | Auto Insurance Info |

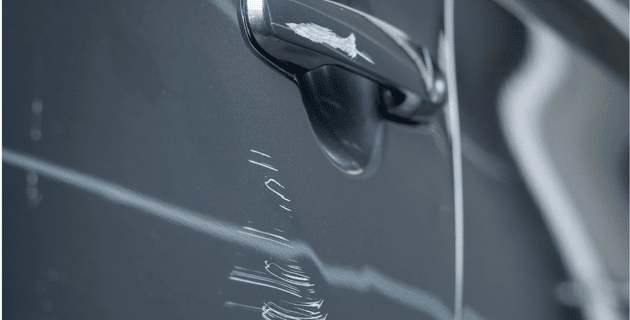

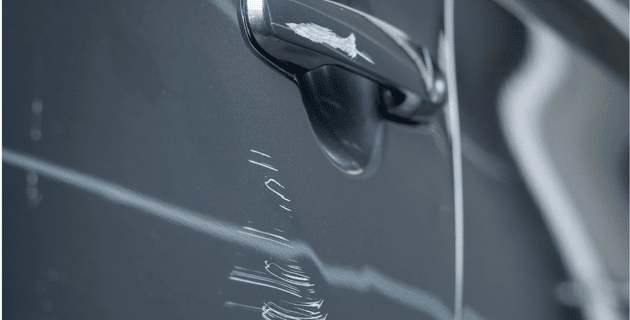

What’s more frustrating than returning to your car after shopping, and noticing a new door ding or scratch? Whether it was the car next to you, a runaway shopping cart, or a careless passerby… unfortunately dings happen.

While dings are inevitable, you can take steps to avoid them. Here are some proven tips and tactics to help protect your vehicle.

Park in an end spot.

In general, parking as far away from other cars as possible will help to minimize the chance of dings. If you’re in the end spot, you have the added protection of only having one side of the car next to another vehicle. Park as close to the outer edge as you can, which will give you an extra foot of space between you and the other car. Hopefully, that’s plenty of room to avoid swinging car doors.

Open your door slowly.

While some dings happen to us, we also can cause others. Being aware of your surroundings and opening your car door slowly will help you exit without hitting anything.

Look for the lines.

Parking lot lines are supposed to keep everyone lined up neatly in their own spaces. That’s not always the case. Avoid those spots where people are over the lines or positioned at a strange angle. That’s a sign they may not be as careful around your car. Also, avoid parking in tight spaces. Even if you can navigate those, the cars around you may not do as well.

Stay away from shopping cart return areas.

Runaway shopping carts are a key cause of dents and dings. Park far away to put as much distance between your car and the carts as possible.

Park beside a car in great condition.

You can tell by the condition of a perfectly clean and waxed car that it is well-maintained. Look for those cars in the lot and park next to them. Chances are the owner will take great care in not dinging his car or yours. Similarly, you’ll want to park away from those cars that have lots of dents and dings. Those owners probably don’t even notice and may take less care.

Avoid parking on the same side as a child safety seat.

Sometimes people can scratch or dent your car without meaning to do so, such as exuberant children and parents balancing too much. You may be able to avoid such situations by looking at the placement of the child safety seat in the neighboring car. Try not to park on the same side as the seat. Chances are that’s the side where parents and children will be congregating.

Pro Tip: Parents, teach your kids safety in and around vehicles.

Stay away from busy walkways.

Skateboarders and bicycle riders can whiz by your car and accidentally knock into it. Pedestrians also can scratch your car as they squeeze by. Park away from busy walkways so these encounters are less of a possibility.

Use covered parking.

Dings and dents are sometimes weather-related. Avoid damage from hail and other weather events by parking in a garage or other covered option. Alternatively, you can use a car cover to protect your vehicle. See our related blog on protecting your car from spring storms, too.

Pay attention to your surroundings.

It’s easy enough to brush by something and scratch your car. That’s why paying attention to your surroundings in a parking lot is your best defense. Look out for tall curbs, signs, light posts, walls, and cement pillars. Take steps to avoid them and a potential parking lot accident.

Do not park sideways.

You may have seen cars parked sideways or diagonally, taking up multiple parking spots. While in theory, it prevents anyone from parking near them, in practice, it’s considered a “jerk” move. There have been cases where people have targeted a car just because someone parked it that way.

Finally, while you can use insurance to fix door dings, most repairs are not much more than your deductible. You’ll probably be paying out-of-pocket. The good news is that modern technology has made it possible for paintless dent removal. It’s eco-friendly and usually less expensive than a body shop repair.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Homeowners Insurance Info, Safety |

Thanksgiving is a special time to gather with loved ones. But when your turkey catches fire, your aunt drinks a little too much and falls and breaks her leg, or your fur baby takes a little nip of a guest, it’s time to be thankful for insurance. Fortunately, there’s coverage for most Thanksgiving dinner disasters. Whether you’re home entertaining guests, or traveling to friends or family, we’ve compiled a quick guide.

Cooking Fires

It’s easy to lose sight of something on the stove or in the oven when you’re also attending to guests. That’s why you’re more likely to have a holiday cooking fire on Thanksgiving than on any other day of the year, according to the National Fire Protection Association (NFPA). The risk increases if you’re deep-frying a turkey. Deep fryers heat up to such a degree that they have caused severe burns and injuries, and even deaths. (If you must have a deep-fried turkey, consider ordering one from your local grocery store.) When cooking fire accidents happen, your homeowner’s or renter’s insurance policy will cover the damage to your home, your belongings, and any related injuries to your guests. (For the guest injury part, skip to the next section.)

-

- Your homeowner’s policy includes dwelling coverage. This covers the repair or rebuilding of the structure of your home up to your policy limit. So, if the fire damages your kitchen or other areas, you can report the claim to your insurance adjuster. They will advise you on how to proceed. Your insurer will likely send someone out to inspect the damage and write up an estimate. You will get reimbursed by your policy, minus your deductible (which is the amount that you chose to pay out-of-pocket before insurance kicks in).

-

- Personal property coverage is that part of your homeowner’s or renter’s policy that protects your possessions such as kitchen appliances, furnishings, and if the fire spreads beyond the kitchen, your television, clothing, etc. Fire is one of 16 different named “perils” that your policy covers. There are dollar limits for certain items such as money, jewelry, and firearms, so check with your insurer. For personal property coverage on a homeowner’s policy, you typically get 50 or 75% of Coverage A, the total amount of coverage for your home. If you’re renting, you get to choose the amount of personal property coverage when you select your policy.

-

- You can select replacement cost or actual cash value (ACV) for personal property. ACV is the amount the item is worth, minus depreciation for its age. It will cost a little more for a policy that provides replacement cost (and we strongly recommend it).

-

- Depending upon the extent of the fire, your house may not be livable. If that’s the case, you would be covered for any necessary increase in living expenses, such as lodging, food, and gas. Under Coverage D – Loss of Use, called “Additional Living Expense,” your policy will provide a flat percentage toward living costs, usually 30% of the Coverage A amount. Some states have time limits (e.g. 12 months) on when you can use that coverage. Plan to cover those additional expenses out-of-pocket.

Pro Tip: Having a fire extinguisher could earn you a discount on your home insurance policy.

Guest Injuries

Injuries can happen anytime, especially during gatherings where people may drink. Guests could become tipsy and trip, slip, and fall. That could happen even if they’re not drunk, of course. Burns could occur if there is a kitchen fire. Your guests could get food poisoning. Your normally well-behaved fur baby could bite one of your guests. While you can’t anticipate every situation, you can make sure there are no obvious dangers in your home, such as tripping hazards or unsecure handrails. Keep everyone’s safety and comfort in mind, including where your pet may be during the festivities. Then, if a guest does get injured, your insurance can kick in.

-

- You may be covered for guest injuries under your homeowner’s or renter’s liability coverage. If you are found liable, the policy may cover damages to the injured party. This can include medical expenses, lost wages, pain and suffering, and permanent scarring. The policy also provides a defense in court, if needed, for the policyholder. This is at the insurance company’s own expense.

-

- If you are not liable, but your guest was injured through his/her own fault, then Coverage F – Medical Payment to Others may cover your guest’s medical bills.

-

- Liability coverage does not apply to you and your family. Your own injuries or illnesses are not covered under homeowner’s or renter’s policies. You would use your own health insurance policy to cover any injuries that you might have in your home.

-

- If your dog has bitten a guest, make sure that your dog’s breed is not restricted by your insurance policy. Some policies will not cover breeds such as Pit Bulls, Doberman Pinschers, or Rottweilers. California Casualty does not currently have such restrictions.

Thanksgiving on the Road

If you’re among the millions who drive to Thanksgiving celebrations, you’ll want to make sure your car is well-maintained, and that your car insurance is up to date. Be ready for the holiday traffic, and drive safely. An accident can put a damper on the holiday. The good news is that you’re covered if you do have one.

-

- If you cause an accident, you are responsible for damages. You would pay with your vehicle’s liability policy. Importantly, auto liability does not cover any damage to your own vehicle; that’s covered by collision. It also does not cover injury to you and your family; it only covers the people in the other car. Liability coverage is required by law in most states.

-

- There are two types of liability coverage:

- If you are found liable for the accident, bodily injury coverage helps pay for medical expenses, lost wages, and pain and suffering for the driver and passengers in the other vehicle. We say “helps pay” because it depends on how much coverage you choose. The costs of an accident can be more than your insurance policy limit.

- Property damage coverage helps pay for repairs for the other vehicle or for repair/replacement of property, such as a fence, damaged or destroyed in the collision.

-

- If you are not at fault for the accident, the other driver is responsible for damages. Your insurance kicks in if the other driver does not have enough insurance. Collision covers your car for any type of damage, regardless of fault or if the person does not carry any/enough insurance. Underinsured motorist (UIM) and uninsured motorist (UM) coverage are for injuries. They cover you and your passengers if you are hit by an at-fault UM or UIM. Uninsured motorist property damage (UMPD) can cover your car if hit by an at-fault uninsured motorist.

-

- Unlike liability insurance, collision coverage is not usually required—unless you’re leasing a car or paying off a loan on a vehicle. However, it may be good to have.

No matter where you enjoy the holiday, we wish you a safe celebration. From our family to yours, Happy Thanksgiving!

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

You’re home visiting family when your cousin asks to borrow your car. You hesitate because you’re not sure if your insurance covers him. The good news is that it probably does, but the bigger picture is that a lot depends upon your specific policy. Read on to find out what to expect before you encounter this situation in real life.

Vehicle insurance typically follows the car, not the driver.

Your automobile insurance policy covers your car, and that’s the case whether you’re driving it or someone else is driving it. It is your policy that is considered the primary policy if an accident happens. The policy of the driver borrowing your car would be considered excess insurance if it ends up being used at all.

What happens if your friend or relative gets in an accident?

If your friend or relative was at fault, your insurance would cover the accident. Here’s how it would play out.

Liability would help pay for damage to the other car and help pay for the other driver’s and passengers’ medical bills. It will not pay for your friend’s injuries, if any, or for damage to your car.

Collision can pay for your vehicle repairs, once your deductible is met. Collision, however, is an optional coverage (unless you’re leasing or financing the car). Not every policyholder will have collision. If you do not have collision insurance, you will be responsible for the repair and/or replacement of your car out of your own pocket.

Medical payments coverage can help pay the medical bills for your friend or relative if they are injured.

There are some exceptions and extenuating circumstances…

If the accident was so extensive in terms of damage or injuries, it could max out the policy limits. In that case, your friend’s insurance may be asked to cover the remaining amount. If your friend doesn’t have insurance, then you will need to cover the costs out-of-pocket.

Some policies only cover the person named on the policy so there is no coverage if you loan your vehicle to a friend or family member. Other policies provide coverage for friends/relatives on a limited basis. Some policies also don’t cover relatives living in the same house as you who are not already named on the policy. (That’s a good reason to make sure your teen driver is added as soon as he or she is driving.)

Some insurers increase your deductible before they cover an accident if someone other than an authorized driver on the policy is driving your car. Some policies also lower your liability coverage to state minimums if the accident is caused by someone other than a named insured/insured.

If, however, your friend or relative was not at fault, the other driver’s insurance would cover the accident.

Your friend or relative would need to get information from the other driver, including Identifying information like driver’s license number and/or vehicle license plate number. You can also get their name, address, insurer, policy number. An easy way to do this is to take a picture of the other driver’s insurance card, front and back. While you can file a claim with their insurance company, you can always file the claim with your own insurance company and let them start the process. They will subrogate the other company for payment.

If the accident was a hit and run, your policy could cover the costs, subject to your deductible if you carry collision coverage or uninsured motorist property damage.

Before you hand over the keys…

Accidents can be costly, and not only due to repairs and medical expenses. An accident may cause your insurer to raise your rates on your policy for the future, even though you are not the one involved in the accident.

It’s a good idea to know what you’re in for before you say yes to anyone wanting to borrow your car.

- Make sure they have a driver’s license and a good driving record.

- Know whether they have insurance, including collision.

- Read the fine print on your policy or talk to your insurance agent to know what is covered in the event of an accident.

- Decide what portion of the deductible, or any costs, your guest driver will need to pay in case of an accident.

With that information, you’ll be well on your way to making an informed decision about who gets to drive your car this season. Happy holidays!

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info |

It’s the beginning of the holiday season. In the coming weeks, you’ll be hosting guests, gathering with family, and celebrating in your home.

As a host, there’s a lot to do, so we’re here to help you get organized. From fall home safety updates to getting ready to entertain, we’ve got your November Home Checklist.

Entertaining

Entertaining is a big part of the season, no matter which holiday you celebrate. Here’s how to get your home ready.

Clean and prepare guest rooms.

Are you going to be hosting guests? Get a jump start on preparing the guest room. That way, you can give it a quick touch-up just before your guests arrive.

• Make the bed with fresh linens.

• Dust, vacuum and clear out any clutter. Empty the waste basket.

• Clear out the closet. Make sure there are empty hangers and room for a suitcase. Put an empty laundry basket in the closet for your guest’s dirty clothes.

• Set up the nightstand with a box of tissues, and don’t forget to leave the WiFi password!

Deep clean your bathrooms.

Whether or not your guests stay over, they will be using the bathroom. Do a deep clean of all of your bathrooms, but especially the ones your guests may use.

• Wash all washable items such as towels and mats.

• Scrub the shower, tub, and toilet.

• Clean the floors, walls, mirrors, and vanity. Dust the blinds.

• For overnight guests: Add a basket of travel-size toiletries your guests may have forgotten to pack.

Get your linens and serving pieces ready.

Whether you’ll be using the fine linens and China, or saving yourself some time and choosing to go with disposable utensils, make sure they are ready to go when you are.

• Launder and press fancy linens and napkins.

• Sharpen your kitchen knives. You’ll be doing a lot of cooking.

• Stock up on disposable items to get you through multiple snacks and meals.

• Pull out your favorite holiday pieces, inspect them and clean them.

Pro tip: Roll up fancy linens on old wrapping paper tubes to store them in a way that prevents wrinkles.

Decorate inside and out.

If you love to decorate for the holidays, now is the time to start. Make a realistic plan for your décor so you can ensure it’s safe and so it’s not too overwhelming.

• Many holiday traditions revolve around light. Add lights or candles, but keep fire safety in mind. Don’t overload extension cords.

• Decorate with a shopping bag nearby so you can easily toss old items you no longer use. You can donate or trash them.

• Immediately get donations out of your house by boxing them up and putting them in your car.

• Keep your holiday spending on budget whether for décor, entertaining, or gifts.

Pro Tip: To make decorating easier next year, take a picture of each room so you can easily duplicate it.

Home Maintenance

You’ll need to perform fall maintenance for your appliances and home systems. In addition, you’ll want to address common problem areas before they become problems during the holiday season.

Fix any plumbing issues.

That slow drain, finicky toilet, or nonworking garbage disposal can get worse over time. Take the time to look at these and see if you can DIY a fix or if they need professional help.

• Clean your garbage disposal to prevent it from growing bacteria.

• Use a “snake” tool to pull up debris from a slow drain.

• Fix your dripping faucets and address your running toilets, both of which can waste water on a daily basis.

• Make sure your sump pump is working before rainy season.

Cover gaps in your home.

Mice can squeeze through a gap that is about the width of a pencil. Bugs can enter even tinier cracks. To prevent rodents and bugs from taking refuge in your nice warm home, you will want to check your home for any gaps and cover them.

• You can use caulk to seal skinny gaps, squirt foam for medium-size gaps, and wire mesh and plaster for larger ones. Cover exterior vents with hardware cloth, a type of wire mesh.

• Common places for gaps are around doors and windows, where pipes and wires enter your home, or vents for exhaust fans. You also may find gaps where the wall and floor connect, and inside and around cabinets.

• Attach door sweeps to the bottoms of exterior doors.

Guard against carbon monoxide poisoning.

With the stove and fireplace in use, a buildup of carbon monoxide is common. Carbon monoxide is produced when we burn gasoline, wood, propane, charcoal, and other fuel. This gas is colorless and odorless, and can be deadly.

• Install battery-operated carbon monoxide detectors in your home (and replace the batteries each spring and fall).

• Have a professional check your heating system, water heater, and any gas or oil-burning appliances every year.

• Be careful about burning any fuels inside your home. Make sure there is proper ventilation.

• Be aware of the signs of carbon monoxide poisoning: headache, dizziness, nausea or vomiting, shortness of breath, and confusion. Get outside to fresh air, and seek medical attention.

Protect against slips and falls.

You and your guests will be walking in and around your house this season. Make sure the walkways are safe.

• Do a walk-through inside and outside your home. Make sure that there are no obstructions on common paths.

• Check that stairs and paths inside and out are well-lit. Falls can happen when you can’t easily see where you are going.

• Check railings to make sure they are secure and not wobbly.

• If you’re using a ladder for holiday decorations, make sure it is sturdy. Place it on firm, level ground. Maintain 3 points of contact whenever you climb it.

Other

Do your fall yard cleanup.

It will be winter soon. Make sure you have cleared your yard and prepared it for what’s to come so you will avoid any winter home hazards.

• Finish raking any leaves. Use a tarp to haul them to the curb or to a compost pile. Or you could run your lawn mower over them to shred them. They will decompose into a natural fertilizer.

• Remove any dead shrubs or trees. (Check for signs of life by scratching the bark at the base. If you see green, it’s alive.)

• Bring in, or cover, patio furniture.

• Only cut your grass if it is still growing. Once it’s below 50 degrees consistently, you can put your mower away.

Stock up for the winter

It’s been a while since you’ve had to use your winter gear. Make sure that it’s there and in good shape, and replace what is needed.

• Check your snow shovels, ice scrapers, and other snow tools.

• Service your snow blower and buy fuel.

• Order firewood if you use it.

• Pick up a bag of pet-safe ice melt.

• Restock emergency kits.

Check in on your home insurance policy.

For added peace of mind, check with your insurer and make sure your homeowner’s policy covers your current needs. Ask your provider about how to lower your home insurance costs.

What else is on your November Home Checklist? Tell us in the comments.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Finances, News |

If your bill at the grocery store is higher than you’d like, you’re not alone. The average cost of groceries is 13% higher than this time last year. A family of four can spend as much as $932 on their monthly food bill…

Fortunately, there’s something you can do about it. From how you pay for groceries to where and when you shop, here are our top tips for saving money on groceries and feeding your family on a budget.

1. Redefine dinner.

Who says that dinner has to be a three-course affair with meat, veggies, a starch, and a dessert? Take the pressure off and serve breakfast for dinner a few times a week. Omelets are a relatively inexpensive meal and very filling. You also can have soup and sandwich night or a big salad. Be creative. Try going meatless to save money or adding beans to ground beef to increase the amount of food. Put shredded chicken over a soup, salad, or pasta and you’ll use a lot less than when serving pieces of chicken.

Pro Tip: Plan to cook so that you definitely will have leftovers. It’s easier and often cheaper to make a large portion than to plan a whole new meal with new ingredients.

2. Make a list and actually stick to it.

Make a meal plan for the week so you know exactly what to put on your shopping list. Pre-planning cuts down on impulse purchases, which can put you over budget. Then shop only for those items on your list. To help stick to your list, always make sure to eat before shopping,

3. Raid your pantry.

When meal planning, remember that you likely have plenty of food at home that you can incorporate. Look through your pantry and see if you can create a recipe around the food that is there. Check your freezer too. That way, you may just need a few items on your list to create some delicious meals.

Pro Tip: Check out websites that can help you build a recipe with ingredients that you already have like MyFridgeFood or SuperCook.

4. Sign up for the store’s loyalty program.

Most grocery stores offer loyalty programs that are free to join. You can get discounts automatically deducted at checkout. If you’re not on your store’s program, sign up the next time you’re there.

5. Clip coupons and look for sales.

Look at the weekly circular in print or digitally for sales, and clip/save coupons for the items you use. Digital coupons can even be loaded directly onto your loyalty card. Remember to do the math, however. Not all sales are the same good deal. Look at the unit price per ounce to compare the costs of different brands. Plus, if you’re not sure that you’ll use it, don’t buy it. Spoiled fruit in the garbage is the same as throwing away money.

6. Buy store brands.

The cost of store brands is usually 20-25% less. Try them out next time and see if you notice enough of a difference to justify buying the name brand. If you can’t buy all generic brands, at least try store brands for staples like salt and sugar.

7. Avoid pre-made items.

Convenience comes at a price. That means if something is prepared for you, you’re likely paying more for it. When you’re shopping, try to find food closest to its natural state. Buy block cheese instead of shredded cheese, and a box of pasta rather than a heat-and-eat variety. Snacks are some of the priciest items to buy. You can really save a lot here if you prepare them yourself.

8. Tally as you go.

Use the calculator on your phone to add up your order as you shop. You’ll be less likely to add items this way, and there will be no surprises when you get to the checkout. It might cause you to think, “do I really need this?”

9. When you shop matters.

Shop midweek when many grocery stores restock their shelves. That’s also when they change the discounts. If you’re lucky, you’ll get the price cut from last week’s sale. If you’re looking for clearance specials, shop first thing in the morning – or right after a holiday. If you’re looking for specials in the bakery, deli, or prepared foods section, shop right before closing. Many supermarkets mark down their rotisserie chickens, for example.

10. Pay with a rewards credit card or cash.

You might as well get some cash back when you shop. Pay with a grocery rewards card and you can automatically see some savings. Or if you can, pay with cash. Bring only the amount you want to spend, and when the cash runs out, you can’t buy anything else.

11. Compare prices at different stores.

Compare prices at different nearby grocery stores. Switch to a store that’s known for more affordable food prices like Walmart, Aldi, or Trader Joe’s. Even Dollar Tree has grocery items. Or you can join a wholesale club like Costco or Sam’s Club. These stores stock items in bulk at often lower prices. You’ll have to spend more upfront but you’ll save in the long run. That might not be for everyone but it’s a good value for large families.

12. Use a rebate app.

Sign up for apps like Ibotta and Rakuten. They give you cash back for buying groceries, among other items. Stores pay these apps a commission for sending them your way. Find out which apps link to your grocery store to make sure that they are an affiliate partner.

Happy shopping!

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.