by California Casualty | Auto Insurance Info |

You’ve been in an accident. Thankfully, you’re not hurt, but unfortunately, you can’t say the same for your vehicle. If the repairs on your car cost more than your vehicle is worth and it needs to be totaled, in the insurance world it is considered a ‘total loss.’

Sounds expensive, right? Don’t worry, your auto insurance policy is designed to protect you in case of an accident. Here are some FAQs to know what to do if this happens to you or a member of your family.

How do you know if your car is totaled?

A vehicle is usually considered a total loss if the damage meets or exceeds around 80% of its value. The insurance company will send an adjuster to look at your car in most cases. The repair shop also may weigh in. The mechanic will examine the structure of your vehicle. He or she will list the repairs needed. Your insurer will check state laws – because some states have rules about how much damage qualifies for a total loss. In all, this assessment will determine the cost to repair your car. If that amount is too much, your vehicle is considered “totaled.”

It is worth noting that you don’t have to be in a car accident to total your vehicle. Your car also could be damaged beyond repair by fire or extreme weather. If a tree falls on your car, that could total it too. The claim process works the same way for those situations.

How much will you get for your car if it is totaled?

If your car is totaled, your insurer will pay you for the actual cash value (ACV) of your car. That amount is determined by your vehicle’s age, condition, mileage, options, and resale value. Since newer vehicles depreciate once you drive them off the lot, the cash value of your car may not be the same as the price you paid—even if the accident occurs soon after you purchased the vehicle.

What if the accident was the other driver’s fault?

If the accident was not your fault, you can file a claim with the other driver’s insurance company. Their policy will pay you using their property damage liability coverage. But what happens If the other driver doesn’t have insurance, or doesn’t have enough insurance to cover damages? Then you will be covered under uninsured/underinsured motorist property damage. These are optional coverages in the majority of states. In some states, you are not allowed to carry collision and UMPD at the same time. Also, sometimes UMPD has a policy maximum or cap on the amount it will pay. If you have UMPD/UIMPD, and it isn’t enough to cover the total cost of your car, your own collision coverage will help.

What if the accident was your fault—or the fault of Mother Nature?

If you caused the accident, and your car is totaled, your insurance company will pay the cash value of your car minus your deductible and any state taxes or fees. When you are at fault, your collision coverage kicks in. Collision pays for totaled cars after colliding with another vehicle, tree, rail or other structure. You have this coverage if you are financing or leasing a vehicle; it’s required.

If Mother Nature caused the damage, comprehensive coverage pays for it. Again, this is coverage that is required if you are financing or leasing a vehicle. Comprehensive covers natural disasters, fires, vandalism, theft, and animals that damage your vehicle. However, if your car was paid off, and you don’t have comprehensive or collision insurance, you would be responsible for the full costs to repair your totaled vehicle.

Your car doesn’t look that bad. How could it be totaled?

You can’t always tell the extent of the damage by looking at a vehicle. For example, a car that sat in flood waters higher than the seat would have extensive flood damage to the engine. Looking at it after it has dried out might not tell you that parts need replacement. In addition,

repairs from collisions can cost more than you think. Finally, your state may have regulations that require vehicles with a certain amount of severe damage to be declared a total loss.

What if you want to keep your car anyway?

We understand that you may have a sentimental attachment to your car. Talk to your claims adjuster to see if you are able to keep it. Your settlement will be less if you decide to do so. In addition, you will have to talk to your insurance agent about the possibility of keeping a totaled vehicle on your policy or if you have to find other insurance. Proceed with caution. A car that has been totaled is usually better off replaced than rebuilt.

What if you haven’t paid off your car yet?

Accidents happen. That’s true whether your car is paid off or you’re still making loan payments. If you total your car and you’re still paying for it, you will continue to be responsible for the amount owed. That’s true even if you’re no longer able to drive the car. The good news is that you can use the money from the cash value of your totaled vehicle to repay the lender.

After you get the insurance check, there may still be an amount owed, and you will be responsible for it. Consider gap insurance also known as loan/lease insurance. This type of insurance covers the difference between the loan or lease payoff and the cash value of your car. It can provide peace of mind should you find yourself in this situation.

What if you totaled a leased car?

Your insurer will send the check for cash value to your lender. You will be responsible for any additional charges. If you still owe but the accident was not your fault, contact the other driver’s insurance company to cover that additional payment. It’s always a good idea to continue to make your lease payments until the insurance company issues the check so that your credit rating doesn’t suffer.

What if your teen totals your car?

In most cases, teen drivers are covered under their parents’ policies. The coverage selected by the policy owner will apply. If you have comprehensive and collision insurance, your teen will have the same deductible that you selected. Your or your son/daughter will pay the deductible and the insurance will cover the remaining cost. If, however, you don’t have comprehensive and collision, you will be responsible for the full amount.

Make sure you add your teen driver to your policy. Some insurers will deny coverage if your son or daughter is in an accident and not on your policy. Others will charge you for back premiums from the time the teen was licensed. National Teen Driver Safety Week is Oct. 17-23, 2021. It’s a good time to talk to your teen about car maintenance tips and distracted driving to help keep them safe on the roads.

What are the steps to take if your car is totaled?

After an accident, totaled vehicles are often sent to the impound lot, or tow yard, which is a holding place until the next step. If declared a total loss, they could be sent on to a salvage auction. Because the car may not be in your possession, you will want to remove all important information right after the accident.

-

- Make sure to clear out your personal belongings. Check all storage areas within your vehicle, including the glove compartment, trunk, and cubbies.

- Get all copies of the key.

- Get the title. If your car is leased, request that the title be sent to your insurance company. If you are not leasing, and you own the car, you can request a copy of the title from the DMV.

- Schedule vehicle pickup or drop-off with your insurer.

- Your adjuster will advise on handing over the title, and the keys if not already with the car.

- Sign the paperwork and receive payment.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info |

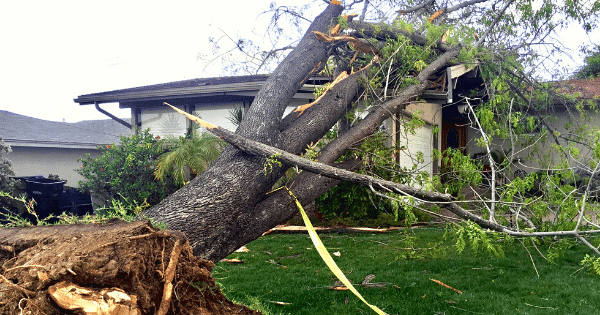

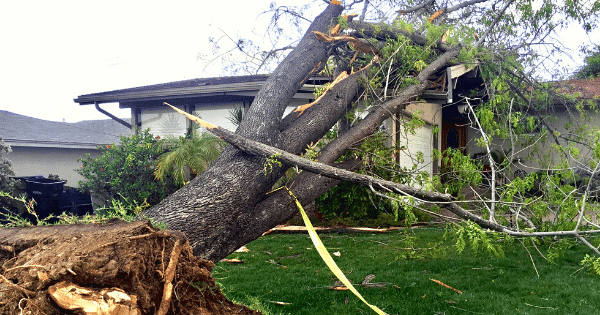

When storms and high winds take down trees, it can be frightening. If you’re not covered for the damage- the bill can be pretty scary, too.

If a tree fell on your home tomorrow, would you be covered by your insurance policy? Whether or not a fallen tree is covered depends on what caused the tree to fall and where it fell. Here’s everything that you need to know.

If a healthy tree falls on your home…

Strong winds can cause even healthy trees to fall. When a tree hits your house, your garage, your deck, your shed, or your fence, your homeowner’s policy usually covers the costs of repair. That also includes the cost of tree removal. Of course, you have to first pay your deductible. Check your property contract to see what is covered. There may be a cap – a maximum paid per tree. Finally, an annual policy review is a good time to review your coverages, before anything happens.

If an unhealthy tree falls on your home…

It’s a little different with diseased or dying trees. They’re more likely to fall—with or without a storm. As a homeowner, your responsibility is to check the trees on your property, trim the branches, and make sure the trees are healthy. If a diseased or dying tree falls on your home as a result of a severe storm or high winds, your policy most likely will not cover it.

If a tree falls but does not hit your home…

If a tree falls and doesn’t damage anything, that’s great (and lucky) news! However, a downed tree is considered a hazard and you are still responsible for removing it from your property. Unfortunately, in this case, your homeowner’s insurance does not cover that tree removal. The only exception is if the fallen tree is blocking a driveway or a ramp for someone who is handicapped. But proceed with caution – before you remove the tree, check with your local regulations. There are laws that govern tree removal in some states, and you may need a permit.

If your neighbor’s tree falls on your home…

It’s not uncommon for a tree in your next-door neighbor’s yard to fall on your home. If it’s a healthy tree that got knocked over in a storm, your policy will likely pay for damages just as if the tree fell from your own property. However, in this case, your insurer may go through your neighbor’s insurance provider for payment, and if that’s what happens, you will be reimbursed for your deductible. One word of warning: If a tree falls because your neighbor cut it down incorrectly, that’s on him to pay for damage and tree removal. Insurance does not cover that.

If a tree falls on your car…

It makes sense if you think about it. Homeowners’ policies do not cover trees that fall on cars. Car insurance policies do—but only those policies with comprehensive coverage. Check to make sure that you have comprehensive coverage so that you will be covered in the event of a fallen tree.

What To Do If A Tree Falls

-

- Assess the damage. Be careful and watch for fallen power lines as you do so.

- Determine who may be liable for the damage.

- Contact your insurance company if you believe you have a claim or if you are unsure.

- If you have a claim, make sure not to move anything until you have spoken with your agent. Take and submit photos or videos of the damage from all angles. Your insurer will guide you through the process.

- If you do not have a claim, you may still be responsible for removing a tree. Before contracting with a tree removal service, ask for proof of insurance. The company will then be responsible for any further damage they may cause.

Avoid a Disaster By Keeping Your Trees Healthy

-

- Water your trees regularly but don’t overwater. Consult a garden reference to determine how much water your species needs.

- Add mulch around the base of your trees. This will help protect the roots from weather conditions. It also will keep your mowers from bumping into the roots or the trunk.

- Visually inspect your trees for signs of disease. Look for discoloration and stunted growth or signs of pests. Mushrooms growing at your tree’s roots also can indicate decay.

- Remove any dead branches or large limbs that look like a liability. Prune your trees during the winter months.

- If you are removing a tree- be careful where you dig, as root systems of large trees can extend two to three times farther than the branches.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Safety |

Fall brings cool, crisp weather, and beautiful colors, but it also brings its share of driving hazards. Autumn is damp and foggy in many places and temperatures tend to drop at night. These seasonal changes can impact road conditions.

Here’s what you need to know to stay safe when driving this fall.

Tip #1: Be aware of changing light patterns during shorter fall days.

Fall days naturally are shorter. The sun moves closer to the horizon, creating increased glare during sunrise and sunset hours. Once we end Daylight Savings Time on November 7, it will get darker earlier in the evening. “While we do only one-quarter of our driving at night, 50% of traffic deaths happen at night,” according to the National Safety Council. That’s because depth perception, peripheral vision, and color recognition are reduced in the dark.

-

- Keep a pair of sunglasses in your car for times when the sun’s blinding glare can obstruct your vision. In the fall, this often happens during morning and evening rush hour.

- Keep your windshield clean so that dirt streaks don’t contribute to the glare.

- Be especially careful driving in neighborhoods during dusk or dawn hours. The low light can make it harder to see children playing or people walking their dogs.

- At night, the glare of approaching headlights can be blinding. Do not wear sunglasses as they can obstruct your vision at night. The best strategy is to avoid looking directly into the lights of oncoming traffic. Glance toward the right and look for the white painted road line.

Tip #2: Slow down for leaves, which can make roads hazardous.

Autumn leaves are beautiful to behold but they’re also dangerous. Driving on wet leaves is as slippery as driving on ice. Leaves may be slippery when wet but If temperatures fall, those wet leaves actually become icy. Even dry leaves are dangerous. They can reduce traction and cause skidding. They can cover up road markings and potholes.

-

- Clean leaves off your windshield so they don’t get stuck in your wiper blades and block your vision.

- When driving on roads with leaves, slow down. Imagine hidden potholes under the leaves, which you would not want to hit at higher speeds.

- Give yourself plenty of distance between yourself and the car in front to avoid braking suddenly on a slippery surface.

- This is prime time for leaf gazing. Be aware that some drivers will have their eyes on the colorful fall foliage, rather than focusing on the road.

- Never drive through a leaf pile. Children love to jump and hide there.

- Do not park over a pile of leaves. It could create a fire hazard from the heat in your exhaust system.

Tip #3: Take care to see, and be seen, in fog.

Chilly fall mornings can create foggy conditions which reduce your visibility and the perception of distance when driving. You can take measures to see and be seen in fog.

-

- Keep your headlights on, even during the daytime in fog. Use fog lights if you have them. They are designed to shine low along the road.

- Avoid using your high beams. They do not work well in dense fog and will create a glare, making it harder for you to see.

- Keep moving at a safe speed, but put lots of distance between yourself and other drivers.

- Reduce distractions so you can focus completely on the road.

- Use your windshield wipers and defroster to keep your glass clear. Set your defroster to warm to help dry out any moisture.

- If you need to, pull over to a safe spot. However, you will want to turn off your lights. In a fog, other drivers may see lights and think you are in a traffic lane. That could cause a collision.

Tip #4: Slow down on bridges and overpasses, which can freeze before roads.

As overnight temperatures drop below freezing, you can expect morning frost. That frost can impact your commute.

-

- Warm-up your car and clear away any morning frost on your windshield and windows before driving.

- Slow down on bridges, overpasses, and shaded areas. Like the signs say, they really do freeze before roads.

- Be aware of black ice. It doesn’t have to be snowing to create those slippery surfaces.

Tip #5: Be alert for deer at dawn and dusk.

Fall is breeding season for deer. That means you may see them more as they travel to find mates. You are more likely to hit a deer in November than at any other time of year, according to the Insurance Institute for Highway Safety. An adult deer can range from 150 to 300 pounds, so hitting a deer can cause significant damage to your car as well as kill the animal.

-

- Deer are most active during dusk and dawn. Be watchful of the side of the road movement during those times, especially in areas where there are deer crossing signs.

- Deer travel in groups. If you see one cross the road, chances are there are others following.

- If you see a deer, avoid swerving. Try to come to a controlled stop and wait for the animal to pass by. Put on your hazard lights to alert other drivers that you are stopped.

Tip #6: Make sure your vehicle is in good working order.

Keeping your vehicle in top condition will help you navigate the challenges of fall driving more easily.

-

- Check your vehicle’s headlights, turn signals, and tail lights to make sure they are working. Make sure your headlights are aligned.

- Check your car’s wipers and replace the blades if they are showing signs of wear.

- Check your car’s heating system to make sure it’s working.

- Make sure your tires have enough tread and are inflated. As temperatures rise and fall, your car tires may expand and contract. This causes loss of air pressure. You will want your tires to be inflated to manufacturer specifications. Check your owner’s manual.

- Finally, make sure you have the proper car insurance. Coverage will give you peace of mind should anything happen.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Good to Know, Safety |

Get ready for a scary good time! Halloween is nearly here and kids everywhere will be out trick-or-treating. Remember a safe Halloween is a Happy Halloween; make sure your children are out and about in a way that they can be easily seen.

The ghosts and goblins (or more likely known as little trick-or-treaters) come out after the sun has gone down. Which is fun when you’re behind the mask, but not so fun if you are behind the wheel. When it’s dark, it’s harder for drivers to see pedestrians in the street. Add to that, excited children who may run out suddenly, and the results could be tragic. In fact, children are twice as likely to be hit by a car on Halloween than on any other day of the year.

That’s why it’s important to decide carefully on the costume your child will wear to ensure he/she is the most visible. And before they leave the house, you’ll also want to go over important pedestrian safety rules. You may even decide that accompanying your child is the best thing to do (recommended for children under 12).

Here are some more Halloween safety tips to consider for every vampire, witch, and werewolf!

Tip #1: Use reflective tape on your child’s costume.

Increase your child’s chances of being seen by adding pieces of reflective tape to his/her costume and/or jacket. Do so creatively and you may have a skeleton with glowing bones or a superhero with a gleaming emblem. Reflective tape works by reflecting light back, so wearers will be easily seen in a car’s headlights even in the pitch dark.

Tip #2: Add a glow stick or a clip-on light.

Decorate your child’s costume or candy bag with clip-on lights. These can be Halloween-themed lights or any small clip-on. Consider giving your child glow stick bracelets or necklaces; these are a festive, fun, and bright addition to any costume.

Tip #3: Select costumes with light colors.

Darker color costumes may be spooky but they are hard to see when it gets dark. When possible, choose lighter-colored outfits. If your child insists on a dark color, use tip #1 to lighten it up.

Tip #4: Choose face paint over masks.

Masks can block your child’s vision and depth perception. They also cover up your trick-or-treater’s face so it may not be easily seen. Face paint is a great alternative. You can even find glow-in-the-dark varieties for more visibility. Choose a face paint that is labeled safe for use with children. Test it on your child’s arm before Halloween. If you want a natural version, you can make homemade face paint.

Tip #5: Travel in groups and carry a flashlight.

Whether you walk around with your kids, or they travel with their friends, insist that they go in groups. Large groups – especially with both adults and children – are easier to see. If one or more group members carry a flashlight, that’s added protection. Having an adult also will help keep trick-or-treaters safe. The excitement of Halloween can overtake a child’s focus on safety.

Tip #6: Don’t walk and text.

You may often text while you’re walking but it’s not a good idea –and while supervising children on Halloween, it’s an especially bad idea. A study from Stonybrook University showed that we are 61 percent more likely to veer off course when we are walking and texting. Not only could you walk into traffic – or other people – or step off the curb, but your attention is distracted from the trick-or-treaters in your care.

Tip #7: Choose safe, lighted routes.

If you are able, choose a residential neighborhood with street lights and sidewalks for trick-or-treating. Walk on the sidewalk and cross at the corner, looking first for cars. If there are no sidewalks, and you need to walk in the street, you should keep to the left and walk facing cars. This will ensure you see cars coming toward you. Halloween is not the time to jaywalk; it can be especially dangerous. Do not walk out between cars, and definitely do not run into the street for any reason.

Tip #8. Watch for cars.

Watch for cars that are turning corners or pulling out of driveways. They could surprise you if you’re not expecting them—and you could surprise them by being in their path. If you’re the one driving at night on Halloween, look out for pedestrians.

For more safety tips, see our blogs on Halloween fire safety and Halloween safety tips for pets.

Have a Happy Halloween!

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Nurses |

If a natural disaster strikes your community, what will you do?

As a nurse, your first instinct is to help. Whether you work at a school, a hospital, or clinic setting, your skillset is uniquely valued during an emergency. Here’s how you can help your patients cope after a natural disaster.

What types of natural disasters can you expect in your area?

Different parts of the U.S. are more prone to certain disasters than others, according to Popular Science. You’re more likely to experience wildfires in the western states and snowstorms in the Midwest and northeastern U.S. Tornadoes are common in south-central states while hurricanes often strike along the eastern seaboard. There are earthquakes in the west, and flooding happens pretty much everywhere. Not only do these disasters result in property damage, but they can also cause severe injury and even loss of life. Your nursing skills are much needed to minimize pain and suffering.

Why do nurses play key roles in a disaster?

As a nurse, you are a trusted professional. People look to you for guidance. You not only bring expertise in the medical field, you know how to coordinate care while helping to comfort patients, relieving some of their stress and fear.

In addition, disaster preparedness was likely part of your nursing training. If it wasn’t, or if you need a refresher, consider a disaster certification from the American Nurses Credentialing Center.

What are ways that nurses can help in a disaster?

Nurses play pivotal roles in a disaster, delivering onsite care to the injured. Often working amid chaos and with limited resources, nurses triage patients and administer medical care. If more serious care is needed, nurses help coordinate transport to the nearest hospital. Victims of disaster may experience post-traumatic shock syndrome, and nurses also monitor patients’ mental health and guide them to resources. In addition, nurses help displaced people find temporary shelter and food and get access to prescriptions as needed.

Helping in a disaster is not for everyone. There are potential safety and security threats. There are primitive conditions. There can be a significant time commitment away from your home and family. If you are able to clear your schedule to volunteer, consider the other attributes that will help make you successful in a disaster setting: (1) Your clinical expertise covers a wide range of medical conditions. (2) You are comfortable working in high-stress situations and can work through emotions. (3) You are able to work in rough conditions, perhaps without access to electricity, water and basic supplies. If you have the skills, the time, and the desire, disaster nursing could be right for you.

What is a school nurse’s special role following a disaster?

In addition to helping onsite following a disaster, we can’t forget about school nurses and the roles they play. They deal with the mental and physical effects among students, parents, teachers and staff. For families made homeless by the disaster, or those who need mental health services, a school nurse provides important connections to community resources. Similarly, she connects staff with district resources for mental and physical health.

How can you help your community prepare for a disaster?

You don’t necessarily have to volunteer in a disaster to help your community. You can be there to help prepare for a disaster in advance by assisting hospitals, schools, and towns in the creation of a comprehensive disaster plan.

Nurses can help with community education, leading disaster preparedness clinics, and giving people the knowledge to create their own disaster plans to make it safely through a disaster.

You can utilize resources from trusted organizations in developing the right program for your school, hospital, organization, and community. Consider these resources:

How can you volunteer to help in future disasters?

If you are interested in volunteering your time, make sure you have up-to-date vaccinations for traveling, and be prepared to leave immediately. The following organizations welcome disaster-related nurse volunteers:

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.