by California Casualty | Homeowners Insurance Info |

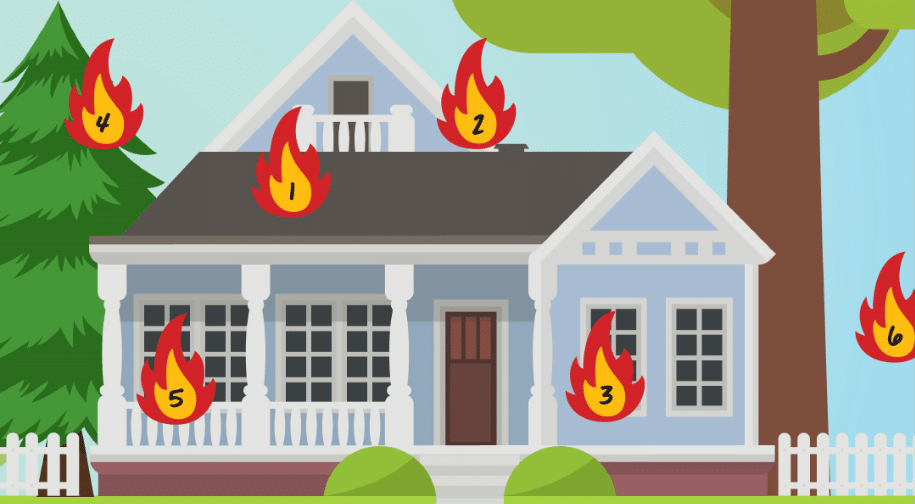

Your home is one of your greatest investments; you need to make sure that it’s fully protected. That’s where home insurance comes in, but it’s not one-size-fits-all. There are plenty of decisions to make when buying your own policy- from coverage limits and extra protection for your belongings to important add-ons like water back up and sump pump discharge or overflow coverage and flood insurance.

It’s easy to make a quick choice when looking for insurance without realizing there could be major consequences (that could cost you thousands of dollars out-of-pocket). That’s why we’ve compiled the most common home insurance purchasing mistakes, so that you won’t make them.

Don’t just look at the price.

Of course, you want a good price. However, sometimes a cheap policy is a red flag. The company may be shady. Talk to friends and neighbors about companies they use. See which ones are endorsed by your union, bank, etc. If you’re worried that the price is “too good to be true,” check the coverage to make sure it’s not missing important items. Also, consider that there are many ways to lower your home insurance costs if price is a concern.

Don’t buy the wrong type of policy.

There’s a different policy for insuring your home when you’re living in it, versus insuring your home when you’re renting it out. Make sure your policy addresses your living situation. If you have the wrong type of policy, there is a chance your claim may not be covered.

Don’t underinsure your home.

It may be tempting to insure your home for the amount that you owe on it, and nothing more. Don’t do it. If your home is worth $350,000 and you owe $50,000 on the mortgage, you should insure your home for the full amount. If you insure it just for $50,000, that’s what you’ll get if your home is declared a total loss. All of that money will go to the bank and you’ll be left with nothing to rebuild. That’s why at California Casualty, we don’t write a policy unless it covers 100% of the replacement cost. Ask us about our 360Value tool which makes sure you’re insured for full value.

Don’t reduce your coverage to lower your premium.

If you’re using a company other than California Casualty, and you decide to reduce your coverage below your home’s value to lower your premium, you’re putting yourself at risk. You won’t have enough money to rebuild. The better way to go is to raise your deductible. This is the amount that you pay out-of-pocket before insurance kicks in. You can do this to save money with your California Casualty policy, too. According to NerdWallet, you could save 20 percent by raising a $500 deductible to $1,000. If you do increase your deductible, make sure that you can cover that deductible should something happen.

Don’t think flood or earthquake insurance is automatically included.

Many people don’t realize that homeowner’s insurance does not include floods or earthquakes. For that, you will need a separate policy. If you’re in a flood zone, you will want that extra insurance. There’s a 30-day waiting period to buy flood insurance so don’t wait until the last minute. Live in an earthquake-prone zone? The same principles apply and you will not be covered by just a regular home insurance policy.

Don’t skip the additional coverage.

As with floods and earthquakes, not everything is covered in your basic policy. Know what is covered and what is not covered so that you aren’t surprised in the event of a loss. Take an inventory of your possessions. Make sure your policy covers the valuables in your home. There’s a theft limit to jewelry coverage, and so you might need an insurance rider, an optional add-on to your policy.

You might want additional coverage for water backup and sump pump discharge or overflow.

If you’re a member of a homeowner’s association, you might consider increasing your loss assessments coverage which goes toward special assessments for expenses associated with your community. However, you may be surprised at what your policy does cover, such as your garden shed or detached garage and its contents. It also covers your kid’s stuff when he/she is away at school, your parent’s stuff if you’re storing it for them while they’re in a nursing home. Those are covered at just 10% of coverage limits, so you might consider additional coverage.

Don’t forget to ask about discounts.

You may qualify for insurance discounts for being part of a professional association, such as groups for teachers, nurses, or first responders. There are also discounts for being 55+ and retired, and for paying in full upfront. You may qualify for a new home discount, or a discount if you have updated your utilities (electrical, plumbing, heating, cooling) in an older home. There are discounts for a new roof and an automatic sprinkler system, for fire and burglar alarms, and for monitored security systems. You can even be rewarded for being a loyal customer. When you bundle your home and auto insurance, you can often qualify for reduced rates, saving hundreds of dollars.

Don’t go it alone.

Insurance is complicated. Your house is one of your most expensive assets. Take the extra step and talk in-depth to a professional insurance agent. At California Casualty we tailor our coverage to you and your home. Your agent can help determine the unique risks for your home and what you need to fully protect it—and that you don’t pay more than you have to.

Don’t buy it and forget it.

Remember to update your policy if you renovate your house. Some companies’ contracts require you to notify them if a renovation exceeds a certain amount. In addition, you’ll want to update your policy immediately if you buy or receive additional valuables, such as jewelry.

Make sure to sit down each year to review your policy. Ask what additional endorsements are available. Review your renewals; policies change and these changes will often be explained in the renewal packet. Consider increasing personal liability to cover, at a minimum, the market value of your home.

Finally, don’t forget to…

-

- Shop around. Getting competitive quotes will help you determine the right price.

- Ask friends and family members for referrals to their insurance company.

- Research the company. Make sure the company is licensed to work in your state. Check its reviews on the Better Business Bureau and online.

- Look for a company that will be responsive to your needs. Good customer service and claims service are key.

It’s your home. Make sure it’s protected.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com

by California Casualty | Firefighters, Homeowners Insurance Info, Peace Officers |

Your home and the personal property inside are your most valuable assets. If the unexpected were to happen, give yourself peace of mind by knowing your personal possessions have an extra layer of protection by placing them in a home safe.

Keeping a durable safe inside your home is one of the best ways to ensure your valuables, personal belongings, and other important documents inside remain secure in the event of a burglary, fire, or natural disaster. But buying a safe that is water, fire, and/or theft-resistant can be quite a monetary investment.

If you are questioning whether it’s “worth it” to purchase a home safe, here are some important factors to remember.

You’ll have quick access to important information

If you need cash or important documents like your Home Warranty, you won’t have to jump through any hoops or wait to get the information you need. All of your important information will be in one place that is quickly accessible to you and your family.

Your important items will remain safe

In the event of a disaster, there may not be time to grab all of the items you would like to bring with you. With a home safe, no matter the occurrence, your important possessions will remain secure.

You can also use it for firearm & weapon storage

If you keep weapons in your home, you can rest assured knowing that they will be locked away in your safe, out of sight and reach from your children and any guests (wanted or unwanted).

What Kind of Safe Should I Purchase?

Not all safes have the same functionality. Before you purchase a safe of your own, do your research on what will work best for you and your family. If you live in a flood or wildfire-prone area, be sure to invest in a safe that protects against water or fire. If you chose to use your safe for weapon storage, remember to find a safe that protects against humidity.

Home safes also come in many different sizes, with the average home save being 1.2 – 1.3 cubic feet. If you have an area of your home that you know you would like to place keep your safe (out of the eyes of an intruder) be sure to purchase a safe with the correct dimensions, so it will fit properly in your space.

The size of your safe should also take into account what you will keep inside of it. For example, if you are storing multiple family heirlooms, along with all of your emergency documents and a full emergency kit, you may want to invest in a larger safe.

Here are some examples of what you can keep in your home safe.

Items to Keep Inside Your Safe

Personal Documents – Birth certificate, passport, social security card, marriage license, vaccination & medical history, tax returns

Important Information – Passwords, health insurance information, legal documents, wills, death decrees, immigration paperwork, & external hard drives

Money & Bank Information –Cash, bank account numbers, checks, credit cards, bonds, stock certificates, & precious metals like gold or silver

Home& Auto Information – Insurance information, contracts, warranties, permits, deeds, & titles

Weapons – Firearms, knives, bows, & ammunition

Jewelry – Expensive necklaces, bracelets, earrings, watches, diamonds, gemstones, & engagement or wedding rings

Spare Keys – House keys, deposit box keys, car keys, garage door openers, & neighborhood facility keys

Heirlooms – Trinkets, photos, & items from childhood or passed down from generations

Emergency Information- List of family cell phone numbers & addresses, family disaster plan, emergency kit,& home inventory

Owning a safe is one of the easiest ways to make sure your personal property stays protected. Save yourself worry and stress by investing in a safe for your home today – your future self will thank you.

First responders- you help keep us safe all year long; let us help you keep your valuable possessions safe too. Click here to enter to win one of THREE Liberty Safes filled with 5.11 Gear courtesy of California Casualty!

DISCLAIMER: Contest terms and conditions apply, see page for details.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info, Safety |

In the US, home break-ins occur about every 18 seconds. That’s pretty alarming. Not only can a thief steal your belongings, they can rob your peace of mind leaving you and your family feeling violated, scared and even angry.

In the US, home break-ins occur about every 18 seconds. That’s pretty alarming. Not only can a thief steal your belongings, they can rob your peace of mind leaving you and your family feeling violated, scared and even angry.

By taking the time to educate yourself and following some simple precautions, you’ll be better prepared to protect your family and home from a break-in ever occurring.

Know it: A security system may prevent a burglar from even attempting to break in.

Do it: Have a security system installed and monitored – and display the yard signs and window stickers you are provided.

Know it: Thieves sometimes rely on the cover of night, but most burglaries happen between 10am and 3pm while many people are at work or school.

Do it: Keep bushes and shrubs trimmed back. Consider getting motion activated security. Leave on a TV or radio. A barking dog can serve as a great deterrent to thieves – while you get to enjoy a wagging tail and a wet nose when you arrive home.

Know it: Burglars are often familiar with your neighborhood or daily schedule.

Do it: Varying your routine will make it harder for the bad guys to tell when you’re not home.

Know it: Signs that you’re on vacation or out of town for an extended period can make your home an easy target for burglary.

Do it: Put your mail, newspaper and deliveries on hold. Have a trusted friend or neighbor watch your home. Put indoor lights on timers. Some police departments offer an out of town home watch. If your local authorities provide this service, be sure to sign up several days prior to going out of town. Be vigilant about what you and your family post on social media.

Know it: 34% of burglars enter through the front door. Another 30% take advantage of unlocked windows or other unlocked doors.

Do it: LOCK YOUR DOORS AND WINDOWS! Keep your garage doors closed, even when home.

Know it: The top three things a burglar is looking for are cash, prescription drugs and jewelry but don’t doubt that these criminal opportunists will take anything they can get their hands on. Unfortunately, this often includes your identity.

Do it: Don’t leave valuables, cash or items that can be used for ID theft in plain sight or hidden in obvious places. Keep an up-to-date home inventory with a record of serial numbers from electronics to aid in filing police reports and insurance claims. Be sure to have an identity theft protection and recovery service if burglars get access to your personal or banking information.

We can’t stop all criminals, but California Casualty is here to protect you with quality auto and home / renters insurance with exclusive benefits not available to the general public. Every policy also comes with free ID theft protection.

Sources for this article:

https://www.iii.org/press-release/vacation-bound-use-these-five-prevention-tips-to-protect-your-home-against-burglars-while-youre-away-070312

https://www.safewise.com/blog/8-surprising-home-burglary-statistics/

In the US, home break-ins occur about every 18 seconds. That’s pretty alarming. Not only can a thief steal your belongings, they can rob your peace of mind leaving you and your family feeling violated, scared and even angry.

In the US, home break-ins occur about every 18 seconds. That’s pretty alarming. Not only can a thief steal your belongings, they can rob your peace of mind leaving you and your family feeling violated, scared and even angry.