by California Casualty | Homeowners Insurance Info |

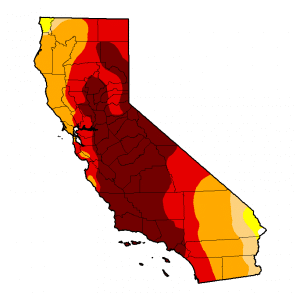

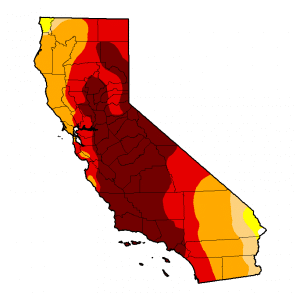

California is parched, and bracing for another scary fire year. Once again, much needed rain and snow has eluded the state. The snow pack is a paltry six percent of normal and this January through March was the driest ever in recorded history. The U.S. Drought Monitor has much of the Golden State in extreme or exceptional drought.

In many areas the unprecedented drought has reduced the greenery to dried sticks and CAL FIRE is warning that moisture content in fuels like trees and grasses are at extremely low levels – leaving them tinder dry and susceptible to wildfire.

2015 Exceptional Drought-U.S. Drought Monitor

The National Interagency Fire Center is predicting above normal wildland fire potential for much of California, starting in May and June and continuing through fall.

It is imperative that you take steps NOW to protect your home and property.

That’s why California Casualty has prepared this important fire prevention information, because we have a stake in keeping you, your family and your most important asset as safe as possible.

Home Wildfire Prevention Tips:

- Create a 30-foot defensible space around your home by removing as much flammable material as you can. Replace flammable vegetation with fire resistive plants.*

- Reduce the number of trees in heavily wooded areas by spacing native trees and shrubs at least 10 feet apart. On trees taller than 18 feet, prune lower branches six to ten feet off the ground.

- Remove branches overhanging the roof or coming within 10 feet of the chimney. Clean all dead leaves and needles from the roof, gutters, and yard.

- Install a roof that meets a fire classification of “Class B” or better. Cover the chimney outlet and stovepipe with nonflammable screening no larger than half-inch mesh.

- Install dual- or triple-paned windows, and limit the size and number of windows that face large areas of vegetation.

- Put woodpiles and liquid propane gas tanks at least 30 feet from all structures and clear away flammable vegetation within 10 feet of those woodpiles and propane tanks.

*California Casualty has a free “Reducing Wildfire Risk” pamphlet available here. You can also find additional helpful information linked from our home insurance page.

Help Firefighters Save Your Home!

- Make access easy. Roads need to be wide enough to accommodate fire trucks with room for them to turn around. Driveways and bridges must be strong enough to carry heavy emergency vehicles and equipment. Identify at least two ways to and from your house and make sure they are clearly marked. All access routes should be free of low hanging tree branches and cleared of flammable vegetation at least 10 feet from roads and five feet from driveways.

- Maintain an emergency water supply that meets fire department standards, such as a community water hydrant system, or a cooperative emergency storage tank with neighbors. If your water comes from a well, consider an emergency generator to operate the pump during a power failure. Clearly mark all water sources and create easy access to your closest emergency water source.

If You’re Forced to Evacuate:

- Know the best routes to safe areas and practice them with your family.

- Prepare an evacuation kit ahead of time.

- Know where and how you and your family will reconnect if you become separated.

In case of possible evacuation, your kit should contain the following items:

- Social Security cards

- Driver’s licenses

- Credit cards

- House deed

- Copies of vehicle titles

- Marriage license

- Birth certificates

- Copies of insurance policies

- Home inventory list / photos

- Health insurance cards

- Prescription medications

- Baby food or formula (if you have little ones)

- Important personal computer information downloaded to disk

- Valuable jewelry

- Photographs

- Home videos

- Items with sentimental value, such as wedding dress or baby keepsakes

- One week’s worth of clothing

- Pets with ID tags, carriers, and pet food

FEMA has more information about evacuation kit and plans at https://www.ready.gov/build-a-kit

Insurance Tips if You’re Impacted:

- Residents evacuated from their homes should contact their insurance agents or companies immediately and let them know where they can be reached. As adjusters are allowed into the burned-out areas they will want to go in with their policyholders to assess the damage. Many companies will set up 24-hour emergency hotlines.

- Keep receipts. Out of pocket expenses during a mandatory evacuation are reimbursable under most standard homeowner policies.

- Be prepared to give your agent or insurance representative a description of your damage.

- Take photos of the damaged areas. These will help with your claims process and will assist the adjuster in the investigation.

- Prepare a detailed inventory of all damaged or destroyed personal property. Be sure to make two copies-one for yourself and one for the adjuster. Your list should be as complete as possible, including a description of the items, dates of purchase or approximate age, cost at time of purchase and estimated replacement cost.

- Make whatever temporary repairs you can. Cover broken windows, damaged roofs and walls to prevent further destruction. Save receipts for supplies and materials you purchase. Your company will reimburse you for reasonable expenses in making temporary repairs.

- Secure a detailed estimate for permanent repairs to your home from a reliable contractor and give it to the adjuster. The estimate should contain the proposed repairs, repair costs and replacement prices.

- Serious losses will be given priority. If your home has been destroyed or seriously damaged, your agent will do everything possible to assure that you are given priority.

Don’t forget to make a complete inventory of all the items in your home before disaster strikes – doing so will help if you have to make a claim.

Here’s a List of Fire Prevention Resources:

www.calfire.ca.gov/fire-prevention

www.nfpa.org

www.disastersafety.org

https://www.redcross.org/images/MEDIA_CustomProductCatalog/m4340149_Wildfire.pdf

https://www.ready.gov/build-a-kit

https://www.knowyourstuff.org/iii/login.html

A defensible space pamphlet from California Casualty can be found on our resource page, www.calcas.com/resources.

by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

Nearly 60% of Americans are underinsured or don’t understand what is covered by their policies.

Make sure you are properly covered going into the new year with these 6 New Year’s insurance resolutions

1. Make sure you have the correct amount of auto coverage

Have your driving habits changed in the past year? Maybe you accepted a new job and your commute is longer or smaller, or you added a new driver to your policy. These life changes will all affect your insurance coverage and premium costs.

Making sure you have the right amount of auto coverage is crucial in case of an accident, so you don’t have to end up paying the majority of your costs out of pocket. For example, make sure you have enough liability coverage on your current policy. If you cause an accident, you are responsible for damages (and if it is a serious accident loss of wages of the victim/their family). Liability coverage is used to pay for those damages that you caused.

Your insurance will only pay for the amount that you’ve designated for liability. The rest comes from your pocket, so don’t skimp on this important coverage.

2. See if you qualify for any additional discounts

Did you know that if you have a teen driver they can take a driver’s safety or education course to qualify for discounts on your auto insurance? You can also turn in their report card for a ‘good student discount’.

You may qualify for insurance discounts for being part of a professional association, such as groups for teachers, nurses, or first responders. There are also discounts for being retired, for drivers turning 25, for paying via automatic bank payments, and for paying in full upfront. You may qualify for a new home discount, or a discount if you have updated your utilities (electrical, plumbing, heating, cooling) in an older home, or added a security system. There are also discounts for a new roof and an automatic sprinkler system. You can even be rewarded for being a loyal customer!

3. Create a home inventory checklist

A home inventory is a list of all of your possessions and their values. While creating one may sound like a waste of time, it’s important to have an updated list of all of your possessions so that you can get fully compensated if there was a disaster like a fire or a tornado, or a burglary. Without a home inventory, you may have difficulty pinpointing all of your belongings and lose out on their value and it can even delay the claims process. Start fresh with all of your new belongings after the holidays and put the checklist in a safe space, in the event of an unexpected loss, you’ll be glad you did.

4. Do you need additional coverage?

Did you know your home and/or renter’s insurance doesn’t include flood coverage? If you live in a flood-prone area you need to have Flood Insurance. The same goes for Earthquakes and Earthquake Insurance.

Do you have a pet that you love like a child of your own? While they will be covered if you are both in an accident in a covered vehicle thanks to Pet Injury Protection from California Casualty, make sure you will get reimbursed for any emergency surgeries, x-rays, labs, prescriptions, and more by adding Pet Insurance.

Need some extra coverage in case of an accident or disaster to ensure your family and belongings are safe? Ask your insurance agent if Umbrella Insurance or Scheduled Personal Property Coverage is right for you.

Umbrella Insurance is an extra layer of coverage that protects you and your family by covering additional damage costs that extend beyond the limits of your homeowner’s, auto, or watercraft policies. This additional coverage ensures your personal assets are safe. The primary purpose of this coverage is to protect you if you’re found liable for causing bodily injury to others or damage to their property. It also protects against incidents involving slander, libel, false arrest, and invasion of privacy, as well as any legal defense costs – even if you’re not found liable.

Personal Property Coverage, also referred to as “contents coverage,” is the term insurance companies use to collectively define the things you own inside your home. Scheduled Personal Property Coverage, or rider, is additional coverage for more special and/or expensive items such as jewelry, watches, heirlooms, furs, collectibles, etc. that have values above your personal property coverage limits. Both coverages are invaluable to make sure your personal belongings are covered in the event of a disaster or burglary.

5. Know what benefits are available to you

At California Casualty we offer our insured exclusive benefits like:

-

-

-

- Affiliate Group Rates & Generous Discounts

- FREE ID Defense Resolution

- Summer or Holiday Skip Payment Options

- Waived / Reduced Deductible for Collision or Vandalism While Parked on School Property – for Educators

- Personal Firearm Coverage & Fallen Hero Benefits – for First Responders

- No Charge Personal Property Coverage Up to $500

- 24 x 7 Towing & Roadside Assistance

- $1,000 Free Pet Injury Protection Coverage

And more! Speak to your insurance agent and ask which benefits are available immediately to you.

6. Schedule your annual free policy review

When’s the last time you took a look at your Insurance policy? Chances are if you haven’t had an accident or a loss, it’s probably been a while. And knowing more about your insurance could even save you money on your premiums. That’s why it is recommended to speak to your insurance agent at least once a year for your annual policy review. They will answer all of your questions and make sure you have the correct amount of coverage.

We know understanding your insurance coverage can be confusing, but we’ve got you covered! There is no better time to start getting the most out of your insurance protection than the new year. Call your California Casualty agent today to make sure you are taking advantage of your coverage and benefits all year long.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info |

Personal Property, also referred to as “contents coverage,” is the term insurance companies use to collectively define the things you own inside your home. Imagine picking up your house, turning it over, and giving it a good shake. What would fall out? Furniture, electronics, clothing? The possessions that “make your house a home” are considered your personal property.

Should something insurance-related (like damage or theft from a covered peril) happen to your home, you’d likely have many personal property items to replace. Both homeowners and renters insurance policies typically include Personal Property Coverage, but in order to for your insurance coverage to help replace your items, you need to know how much personal property coverage you really need. That’s when a home inventory comes in handy.

Most people know a good ballpark for the dollar amount/coverage limit they need to cover the exterior of their home, known as Dwelling Coverage, but they rarely know the value of their personal items inside their home. Having the right amount of coverage to replace these personal items will make your life so much easier if/when you have a covered claim.

Plus, most insurers offer optional scheduled personal property coverage, or rider, for more special and/or expensive items such as jewelry, watches, and furs that have values above your personal property coverage limits.

Here are some things to consider when it comes to protecting your belongings.

-

- For homeowners policies, personal property coverage is usually a percentage (ranging from 20-50%) of your homeowners’ Coverage A (Dwelling Coverage) on your policy. However, you can purchase more coverage if needed.

- Renters are able to choose their personal property amount for their policies.

- There are two types of personal property coverage: replacement cost and actual cash value.

- An actual cash value policy factors in depreciation (use and age) to provide reimbursement based on the current value of an item, not what it would cost to replace it.

- A replacement cost value policy typically pays the dollar amount it takes to replace your item following a covered claim. Replacement cost value usually has a slightly higher premium cost than actual cash value, and some insurance companies will give you the option to choose replacement cost value if you’re willing to pay a little more premium.

- It’s also important to know that personal property coverage usually has certain limits on what it will pay to replace an item or category of items. Be sure that the coverage (or amount of anticipated compensation in the event of a covered claim) you actually need is within these limits or you may want to add coverage to better protect your cherished possessions.

- There are exclusions to personal property coverage! Items in your home like pets, property of roommates, boarders, or tenants (for homeowner’s policies), and vehicles are not covered.

- Sometimes if the event that caused the damage (peril) is not “named” on the policy, there is no coverage for that cause of loss.

It’s a good idea to take inventory of your personal property, complete with pictures and the purchase price of each item. As an easy reminder, and to stay on top of all of your new possessions, mark your calendar to do your home inventory every six months- once in the middle of the year and again at the end of the year. In the event of a loss, your up-to-date home inventory will help simplify the process of filing a claim.

A conversation with an insurance advisor will be helpful as you consider your coverage limits. Knowing what you own and understanding how your personal property coverage works can give you more confidence as you navigate through the quoting process and comfort in the event of a loss.

DISCLAIMER: These general industry descriptions are not representative of your individual insurance policy. Please be sure to review your policy at least once yearly with your insurance representative and mention any home improvements to ensure your coverage is complete.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by Clarke Henning

Resources and Helpful Tips Here you will find a variety of resources and helpful tips in the form of checklists, infographics and more. Whether you are looking to understand the meaning of an auto insurance term, creating or updating your home inventory, or looking...

by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

While there may be some debate about the cause, more and more people are accepting the fact that a changing climate is leading to extremely erratic weather with more intense storms, prolonged drought, and rising temperatures.

This has led to some of the most dramatic disasters in the U.S. Throughout these impressive weather swings, roofs have been damaged, homes flooded, trees toppled and vast acreage blackened. Many property owners are wondering what’s next and what they can do to safeguard their property?

Here are some important steps that you can take to help protect your property and your family from the major effects of climate change.

Storms

Snow and ice storms, hurricanes and spring/summer thunderstorms have become more intense. From record hail, tornado outbreaks, and torrential downpours; our homes and property are taking a beating.

When these storms hit, check and repair:

- Roofs and shingles

- Gutters and downspouts

- Decks and porches for loose, cracked or exposed wood

- Exterior for chipped or peeling paint, cracks, holes or exposed wood or siding

- Attics for evidence of leaks

- Basements or crawl spaces for damp areas and cracks

- Concrete slabs for cracks or shifting soil

- Chimneys for damage or dirty flues

- Trees and bushes for broken or weak trunks and branches, and removing any branches that overhang your home

Fire

Wildfires in much of the country have burned hotter and consumed more structures and acreage in recent years. Climate change has extended the fire season by an extra two months across the U.S.! In much of the South and West it begins in early spring, ending late fall.

Fire prevention experts recommend that anyone in or near a fire-prone area, especially what is called the Wildland Urban Interface (WUI), needs to take these steps to minimize their fire risk and help responding crews:

- Create at least a 100 foot defensible space area around homes and structures (200 feet or more may be needed on hillside areas)

- Keep combustible wood piles, propane tanks and other flammable materials 30 feet from homes and structures

- Remove weeds and dry shrubs near structures

- Keep laws trimmed and mowed

- Trim tree branches 10 feet up from the ground and remove any that overhang your home or other structures, and keep trees spaced 30 feet apart

- Install a fire resistant roof and deck

- Make sure your street name and address are visibly posted for emergency vehicles

- Clear flammable vegetation 10 feet from roads and five feet from driveways, and cut back overhanging branches on roads and drive ways

Keeping your home well maintained is essential to withstand the vagaries of weather. You can find more wildfire preparation tips here.

Know Your Insurance

In the event of these extreme storms it is also critical that you understand your insurance and know:

- If your homeowners policy includes replacement cost or actual cash value,

- Whether you are covered for new additions, improvements or appliance and other upgrades,

- That a floater or scheduled personal property endorsement is needed to fully cover high value items such as fine art, furs, jewelry, silverware and musical instruments

Keep in mind: flood and earthquake insurance are not included with your home or renters policy. However when you have California Casualty, you can easily add each to your policy though our agency services program. Please contact: 1.877.652.2638 or agencyservices@calcas.com .

Another important coverage you should add to your policy is comprehensive coverage. Without it your vehicle won’t be protected if it is damaged or destroyed by a flood, fire or falling tree limb. To ask a customer service representative about adding comprehensive coverage please contact: 1.800.800.9410 or visit www.calcas.com

Lastly, make sure your belongings are also completely covered in the event of a storm or fire. If you haven’t completed a home inventory yet, now is the time to do it. Having a list and proof of the things you own will help you with reimbursement if your home or apartment is damaged by a natural disaster. For our free Home Inventory Guide click here.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.