by California Casualty | Auto Insurance Info, Helpful Tips, Safety, Travel |

When it comes to keeping your tires inflated, you have a choice. You can fill up with air, like people have done for decades, or you can use nitrogen. What are the pros and cons of each? Let’s take a closer look.

Nitrogen

Remember when you studied molecules in science class? Molecules are the smallest amount of a substance that still carries its properties. Nitrogen molecules are larger and slower than the molecules in air. As a gas, nitrogen also is drier. These properties give nitrogen some advantages.

PROS

-

- Nitrogen won’t seep out of your tires as quickly as air because of its larger, slower molecules. That will help you to maintain your tire pressure longer.

- The moisture naturally found in air can cause changes in temperature. With nitrogen, there is no moisture and therefore it is less susceptible to temperature changes that affect tire pressure.

- Nitrogen is especially good for locations with very high or low temperatures. It is often used in race cars, heavy vehicles, and aircraft because it is nonflammable and able to more easily maintain its temperature.

- Nitrogen will not react to rubber, steel, or any of the tire’s components. There is no oxidation which can damage tires. That should help preserve your tire over time.

CONS

-

- You most likely will pay to inflate your tires with nitrogen. The initial charge to remove the air and fill them with nitrogen can cost about $30 per tire. Then, it will be about $7-10 per tire for topping it off as you need more nitrogen.

- Nitrogen may not be significantly better than air at maintaining tire pressure. Consumer Reports found only a 1.3 psi difference between air and nitrogen over the timeframe of a year.

- There is no scientific evidence that nitrogen helps with fuel economy.

- It is harder to find places to fill up with nitrogen. You will have to search for locations that offer nitrogen, even for a fee.

Note: If your tire is low and there is no place to get nitrogen, you can top your tire off with air. It won’t harm your tires, but it will reduce the effectiveness of the nitrogen alone.

Air

You may be surprised to learn that air is composed of mostly nitrogen. In fact, the mix is 78% nitrogen, 21% oxygen, and about 1% of other gases. Air, which has been used to inflate tires for over a century, also has its advantages.

PROS

-

- Air is often free. If it costs, it is minimal such as a dollar or two.

- Air is readily available. You can find it at gas stations, convenience stores, wholesale clubs, tire shops, and more.

- While air loses pressure over time, its rate is close to that of nitrogen. Plus, with air, drivers are more likely to check in often versus relying on nitrogen to stay pressurized.

CONS

-

- You will experience more pressure changes with air. Air is affected by temperature changes due to water vapor in its mix. However, it is worth noting that most tire shops have moisture separators that limit the amount of water vapor.

- The oxygen in air can cause oxidation, which can make rubber brittle over time.

- You will have to fill your tires more often when you have air versus nitrogen.

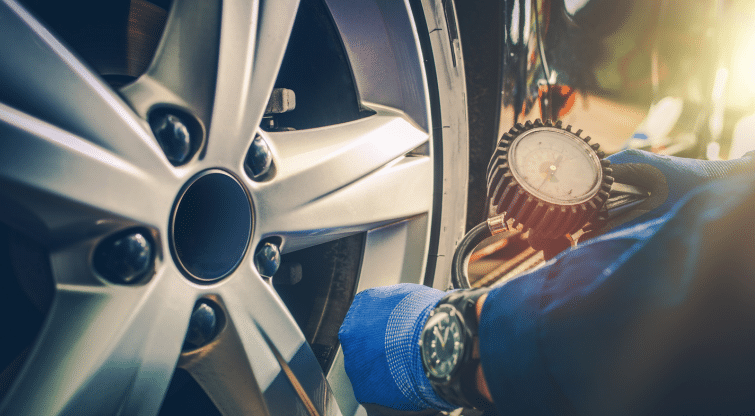

Tire Pressure is Key

When you fill up with nitrogen, you get a green cap on your tire valve. When you fill up with air, your cap will be black. However, whether you use nitrogen or air, you still will fill your tires to the same recommended pressure. Check the inside of your door or your driver’s manual to find the right psi.

Maintaining the correct pressure helps your tires last longer, your car handle better, and could even help with fuel economy. Under or over inflated tires increase your risk of a blowout and increase wear and tear. No matter whether you use nitrogen or air, regularly checking the pressure of your tires is part of responsible vehicle maintenance.

Your car is one of your greatest investments. Protect it with the right insurance for added peace of mind.

Safe travels from all of us at California Casualty.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Helpful Tips |

You’re ready for a new set of wheels. Time to head to the dealership, test drive some models, and negotiate like a pro. Or you could boot up your laptop and start clicking from the comfort of your couch.

Online car shopping is a game-changer. You can shop anytime, anywhere, with access to a multitude of vehicles without the sales pressure. But is it right for you?

What it Means to Buy a Car Online

Many of us shop online for everything from clothes to groceries. A car, of course, is a larger purchase. It costs much more and so there is more at stake. You might be comfortable researching a car online, and even calculating loan payments. But there’s a comfort level to continuing the car buying process in the dealer showroom. However, more and more people are taking the plunge into online car shopping. They’re buying online from start to finish.

Pros & Cons

It’s ultra-convenient to shop for a car online.

- You don’t have to go to a dealership during business hours. You can shop on your schedule from any place.

- There is likely more inventory available online than at your local dealership.

- You can get pre-approved for a loan before you even start shopping.

- There is less sales pressure and no haggling. Prices are clearly posted, and what you pay ultimately depends on the base price, any trade-in, and your credit rating.

- You can fill out paperwork online at your leisure.

- Many online marketplaces have a short return window, so if the car wasn’t what you expected, you can return it.

- You can get the car delivered to your driveway.

Of course, there are some downsides.

- You can’t physically see the car or test drive it before you buy it. (Some services are offering test drives, however, and you can always test drive at a dealership before buying online.)

- You can’t negotiate the price.

- Online purchases often come with extra fees. It can cost $1,000 or more to deliver a car.

- Your financing choices may be limited. The seller may restrict you to a single lender.

- You cannot get your car the same day, as you would at a dealer.

- You can potentially get more incentives onsite at a dealer, such as lease specials or cash rebates.

Online Sellers

There are a variety of online vehicle sellers. Some new car dealers offer the full online experience, including car delivery. There are also services that sell used vehicles in online marketplaces. Still others connect buyers with private sellers. Each site has different terms and warranties, so make sure you understand them before you buy. Here are some of the most popular:

- Carvana offers used cars, auto loan prequalification, and a 7-day return window. Car delivery is not available everywhere and may include a shipping fee.

- CarMax also sells used cars. They can deliver a car for test driving (fees may apply). CarMax offers financing and has a 7-day return window.

- Vroom sells used cars with a 7-day or 250-mile return window. Vroom also offers access to online financing.

You may buy from private sellers on sites such as these:

- eBay Motors connects you with private sellers. The site offers free vehicle purchase protection that can cover you if there are problems with the sale.

- CarGurus also connects you with private sellers and offers support for paperwork including title transfers. They offer financing through their partner, Auto Pay.

Red flags

- Be careful with sellers that are not vetted by a third party. While you can find cars on Craigslist and Facebook Marketplace, it is more difficult to know if it’s a scam.

- Avoid bait-and-switch scenarios, where the car you want is suddenly not available, but another similar more expensive model is. If a seller does that, chances are there will be problems later with other items such as warranties.

- Beware of fraudulent websites. Make sure the site and the seller are legitimate. If the price is too good to be true, it probably is.

- Do not make a deal without a written agreement. Remember to read the fine print.

Ready to buy?

- Know what you can afford for a monthly payment, and then work backwards to determine how much you can finance.

- Know your credit score. Your credit rating is used to determine your interest rate.

- Pre-qualify for a loan. You can get a loan from a bank or credit union, or from the dealership or online marketplace where you will get your vehicle.

- Determine the type of car that fits your needs. Do you need a large SUV for off-roading and camping with the family? Perhaps you need the right car for your teen driver? Browse the online inventory to find the car that meets your budget and needs.

- Comparison shop across at least three websites to determine the best options. Consult Consumer Reports, Edmunds, and Kelley Blue Book to ensure that your car is priced at current market value.

- If you’re able to arrange a test drive, do so. You want to make sure that you can fit comfortably in the car, and you like how it handles. If all checks out, then go ahead with the purchase.

A car is one of your greatest investments. For added peace of mind, protect it with the right insurance.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Helpful Tips |

Your car is more than just a mode of transportation; it’s a companion on life’s journey. But like any good friend, it needs a little care to keep it going strong. Whether you’re a road trip enthusiast or someone who relies on their wheels for daily commutes, extending the life of your vehicle makes sense. So, buckle up as we explore some simple yet effective ways to make your car last longer.

Ditch the heavy keychain.

When you put the key into the ignition, a heavy keychain can drag it down. That puts pressure on the tumblers inside the ignition. Over time, that can cause the ignition switch to fail. If your car keys share space with lots of other keys, consider a car-only keychain.

Watch for this warning sign: your key sticking in the ignition when you turn on the car. Get the ignition replaced before it leaves you stranded.

Use your parking brake.

The parking brake has an important job: to keep your car from rolling when parked. However, you don’t just need a parking brake on an incline; you need it whenever and wherever you park. Parking brakes help take the stress off the transmission. In addition, if not used, your parking brake can corrode over time. This can lead to expensive repairs. So, engage that parking brake whenever you park.

Don’t idle in the driveway.

It’s not a good idea to idle your car for long periods of time. Not only does it waste gas, but it can also do some damage. During idling, the oil pressure may not send oil to every part of the engine. The engine also won’t operate at its peak temperature. That means there could be incomplete fuel combustion, soot deposits on cylinder walls, contaminated oil, and damaged components.

Be mindful of moisture.

Moisture can do a lot of damage to your vehicle. Water that seeps into your car’s body panels can cause rust. Extreme heat and humidity can reduce your car’s battery life. Moisture inside your car can also lead to mold and mildew. Finally, salt water can damage your car’s paint. Don’t drive through water, which can expose your undercarriage to unnecessary moisture. Clean corroded battery terminals if you live in humid areas. Make sure to keep your car dry and as cool as possible during the hot, humid months to avoid expensive future repairs.

Change the oil and the air filter.

If your oil is dirty, it can affect the components in your engine. Without proper oil changes, your engine could seize up, which will cost you more than nearly any other car repair. Most manufacturers suggest changing the oil every 5,000-7,500 miles. Newer vehicles will alert you when you need an oil change. You also need to change the air filter, although not as often as the oil. The air filter removes dirt and debris, which also can harm your engine. Change your air filter every 15,000 to 20,000 miles.

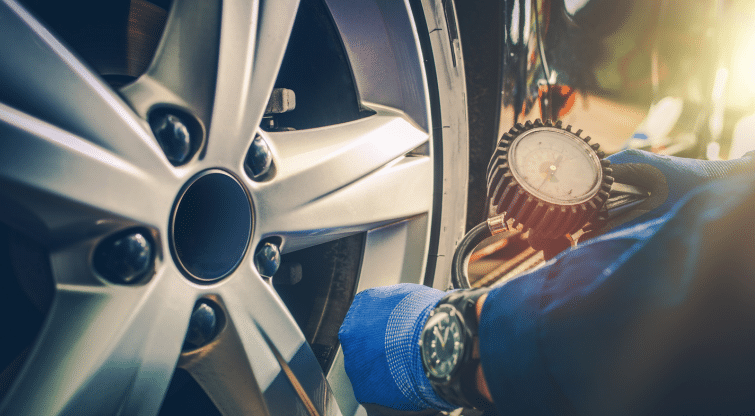

Help your tires wear evenly.

Tires naturally wear down over time. Keep them working well by inflating them at the recommended pressure. That will help prevent blowouts. Tires also wear unevenly; that’s why it’s important to rotate them every 6 months or 6,000-8,000 miles. Otherwise, your tires will wear out faster and have to be replaced.

Wash your car.

Cars get dirty, and that dirt buildup is more than cosmetic. It can slowly destroy your paint, which can lead to rust. That’s why washing your car is important. How often depends on the weather, whether you park outside, and if your car is exposed to pollen, bugs, sap from trees, salt on winter roads and more. Wash biweekly or as needed and wax every month or so.

Prevent pests.

If you leave food and wrappers in your car, you could attract mice and bugs. They in turn can do damage that requires repairs. Clean up all food items, wrappers, and containers. Block broken seals or holes where they can get in. If you suspect pests, have your upholstery professionally cleaned.

Protect the interior.

Leather can become dry and brittle after years of exposure to the sun. Apply a conditioning solution routinely to help prevent cracks and keep seats in good condition. Use a windshield shade to help slow upholstery fading.

Don’t fill your tank if you see the tanker.

Gasoline tankers can stir up sediment as they refuel the tanks at gas stations. That could cause you to get dirty gasoline, which can clog your fuel filter or fuel injector. Avoid filling up at a station when it is being filled by a tanker. You’ll avoid a potential expensive repair.

Avoid bad driving habits.

Certain driving habits can reduce the lifespan of your car. Don’t brake hard all the time, it can lead to deterioration of your brake pads. Don’t turn at high speeds; that’s hard on your tires. Don’t strongly accelerate when the engine is cold. Don’t rev your engine when your car isn’t properly warmed up. Avoid potholes and running over curbs which can harm your tires. Good driving habits can help reduce the need for expensive repairs.

Pay attention to maintenance lights.

Don’t skip routine maintenance. It may cost you now but save you money in the long run.

If you have a newer car, it will let you know when it needs service. When the maintenance light is on, schedule your appointment. However, you can look out for things, too. If you hear an unusual noise, take your car in. Watch for puddles under your car. It’s better to get ahead of potential problems than to pay for them as they become big issues.

Keep your car protected.

You may do everything right but accidents still happen, including some that could total your car. Your car is one of your greatest investments. Protect it with the right auto insurance for added peace of mind.

Check out our blog on Pro Tips to Keeping Your New Car Ageless for more tips.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Helpful Tips, Safety |

We all know the basics: stop at red lights, obey the speed limit. What about laws about passing cars on the right, or restraining pets in your vehicle? We put together a list of the lesser-known traffic laws that potentially could land you in trouble if you break them. Not knowing about them – unfortunately – isn’t a defense if you get stopped.

Use your turn signal.

Most states require that you signal when you turn right or left and when you change lanes. In fact, you are supposed to signal 100 feet before you turn or move to a new lane. You could get flagged for a non-criminal moving violation if you fail to do this.

Don’t change lanes in the middle of an intersection.

In some states, it is illegal to change lanes in the middle of the intersection. You’re expected to stay in your lane as you cross through it. Even when it is legal, it might be unsafe, and you can be pulled over for that, too.

Come to a complete stop at a stop sign.

You may be tempted to pause rather than stop at a stop sign. The law clearly states that you must come to a complete stop. That means no forward momentum with the speedometer at 0. If you don’t come to a complete stop, you can be cited for running a stop sign. We suggest stopping for three seconds, which will be long enough for an observing police officer to see you have stopped. It’s also long enough for you to check for oncoming traffic, pedestrians, or road hazards.

Follow the rules at a four-way stop.

With a four-way intersection, every driver has a stop sign. That means each vehicle should come to a complete stop. The first vehicle to arrive has the right of way. If two cars arrive at the same time, the car to the right goes first. Bicycles must follow the same rules as cars at a four-way stop and yield to the vehicle who arrived first, or the one on the right. Pedestrians, however, have the right of way, and can cross before any vehicles proceed.

Know about improper passing.

In New Jersey, you cannot pass a car on the right except in special circumstances. The car must be turning left or there must be at least two lanes of traffic traveling in the same direction. In Massachusetts, Pennsylvania, New Jersey, and Illinois, it’s illegal not to move to the right if a car is trying to pass you. In some states, the far left lane is only for passing.

Restrain your pets.

We want to keep our pets safe, and there are several states that have laws on the books to make sure we do. New Jersey has a law requiring you to secure your pet in a carrier or with a seatbelt. In Hawaii, you can be fined for having your pet on your lap or rolling down the windows without restraining your pet. Maine, Connecticut, and Arizona classify pets under distracted driving.

Know when to yield.

It may be obvious that you need to yield at a yield sign. But did you also know that in many states, you must yield to pedestrians in a crosswalk? You also must yield to those who are blind and using a white cane or seeing eye dog. In a “T” intersection, where a road dead ends into another road, the car at the dead end must yield to the continuing road. Finally, if you’re making a turn onto a road, you must yield to traffic on that road.

Move over and slow down for emergency vehicles.

When you see flashing lights, it’s time to slow down and move to the side of the road. This allows for the safe passage of emergency vehicles. Every state has a Move Over law except for Washington, DC. If you don’t move over or slow down, you could be subject to a fine, license suspension, or even jail time.

Put headlights on when it’s raining.

Visibility is down when it’s raining. That’s why several states require headlights to be on anytime your wipers are in use, even in daylight. Some states only require headlights in dense fog, low visibility, and at night. In these situations, your headlights can help other drivers see you better.

Don’t tailgate.

Tailgating is considered a traffic violation. While states aren’t consistent with how they define tailgating, often such tickets are issued after a rear-end collision. If you’re alert and focused on the road, it takes you about 2 seconds to react to a roadway hazard. That means a safe following distance is at least 3 seconds or more. Use the 3-second rule as a starting point. You can measure the distance in seconds this way: Find a landmark such as a mile marker or telephone pole. Start counting once the car in front of you passes that landmark. Count slowly until your car reaches the same landmark. That is the number of seconds that you are traveling behind the vehicle in front of you.

Wear your seat belt.

Most of the country has laws for seat belts. Some states require you to wear both front and back seat belts. Others just focus on front seat belts. If you’re caught without your seatbelt, you could be subject to fines.

Know your state’s cell phone laws.

Most states require cell phone use to be hands-free, and consider texting while driving as distracted driving. However, some states go further and penalize drivers for accessing, viewing, or reading non-navigation content on phones.

Keep the minimum insurance.

Most states require drivers to carry auto insurance. The state sets the minimum amount and type. Generally, this includes bodily injury liability and property damage liability. If you have a leased car, your lender will require you to have more extensive coverage.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Helpful Tips |

Your best friend wants to borrow your car. He wouldn’t ask unless he really needed it. So even though you know about his past fender benders, you give in. What happens if your friend gets into an accident in your car? Read on to find out.

Car insurance follows the car, not the driver.

You may assume that your friend’s insurance will cover him, since he got into the accident. That’s not the case. Car insurance covers the car rather than the driver. You don’t even have to be in the car. If your car is in an accident, and the driver is at fault, your insurance will be used to cover damages to the vehicles involved. If you carry collision coverage, it will take care of damage to your car, less your deductible. If your coverage isn’t enough to pay all the damages, your friend’s auto insurance may act as secondary coverage.

Interesting sidenote: While car insurance follows the driver, that’s not the case with tickets. If your friend gets a ticket while in your car, that only affects his record.

Permissive use vs. non-permissive use

The fact that you gave permission to your friend is important. Most auto policies allow you to lend your car to a person for occasional, short-term use. If they are driving your car on a more regular basis, you need to add them to your policy. It’s worth noting that coverage limits may vary under permissive use.

Sometimes a family member or friend borrows your car without permission. If they cause an accident, you are not responsible for the damage. However, it can be difficult to prove that you did not grant them permission. Plus, you will still need to get your car repaired and file a claim with your insurance company. A good tip is to keep your keys secured away from others if you have concerns with them taking your vehicle.

When insurance won’t pay

There are very few instances where insurance will deny coverage of an accident. These include:

- If the person is specifically excluded from your policy

- If the person was intentionally breaking the law

- If the person borrowed your car to offer a commercial service, like a rideshare

How coverage works

For those times when insurance does pay, here is a breakdown of the coverages that typically apply in a car accident:

- Collision: Your collision coverage will pay for repairs to your car minus the deductible. Collision coverage is not required unless you’re leasing a car or paying off a loan on a vehicle. However, it may be good to have, especially in the event of an accident.

- Liability: Liability covers damages to the other vehicle. This coverage is required by law in most states. The two main types of liability coverage are bodily injury and property damage.

Bodily injury: This coverage helps pay for medical expenses, lost wages, and pain and suffering for the driver and passengers in the other In no-fault states, your own injuries are typically covered by your auto policy through a Personal Injury Protection (PIP) claim. (It differs from state to state.)

Property damage: This coverage helps pay for repairs for the other vehicle or for repair/replacement of property, such as a fence, that is damaged or destroyed by the collision.

- Uninsured/Underinsured Motorist Property Damage: If the other driver is at fault and is not insured or is underinsured, UMPD coverage will help pay for repairs. These are optional coverages in most states. In some states, you are not allowed to carry collision and UMPD at the same time. Also, sometimes UMPD has a policy maximum, or cap on the amount it will pay.

Lending your car can be an expensive favor.

Think carefully before you lend your car to anyone. Even though you didn’t cause the accident, your insurance rates can go up at the next policy renewal.

Before you lend your car, it’s a good idea to review your auto policy and the policy of your friend or family member. Your insurance provider can help to answer any questions you may have.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Firefighters, Nurses, Peace Officers |

The winter season is a season of joy, celebration, and togetherness for many of us. For first responders — police, firefighters, nurses, paramedics – this time of year looks very different.

Winter is the time when emergencies increase. Icy conditions cause accidents. There are more heart attacks in cold temperatures. House fires are more common. Thefts are too. All of this keeps first responders working hard, and often extra hours. That means they sacrifice time with their own families to keep us safe.

Here are some thoughtful ways to show appreciation to our local heroes this holiday season and throughout the year. Remember, the key is to express genuine gratitude and to make these gestures personal and heartfelt.

Deliver some holiday cheer.

Make or buy some food or treats. Drop off coffee for the morning shift. Include donuts or pastries. A soft pretzel or cookie tray is always fun, and a homemade hot meal goes a long way. You also can drop off gift cards to local restaurants. Include cash to cover delivery fees and tips.

Bring a basket.

It’s cold out there. Put together an appreciation basket that includes the things that will make life easier for first responders doing their jobs this winter. Consider hand warmers, ChapStick, hand lotion, cough drops or hard candy, tissue packs, hot cocoa packets, and tea bags. Discover some more ideas in our blog on a winter survival kit.

Send notes and pictures.

Encourage your family and friends, especially children, to create handmade thank-you cards expressing appreciation for the hard work of first responders. Collect these cards and deliver them to the local police station, fire department, or hospital. Don’t forget that a personal handwritten note by anyone of any age is always appreciated.

Share your gratitude.

Write a letter to your local newspaper, sharing a positive story about the service provided by first responders in your community. Use social media platforms to thank your local first responders. Your positive stories can inspire others to express their gratitude as well.

Host a community appreciation event.

Coordinate a community gathering or event to express gratitude. This could be a small ceremony, a casual get-together, or a potluck dinner where community members can interact with first responders in a relaxed setting.

Offer your skills or services.

If you have a skill or service that could benefit first responders, consider offering it as a token of appreciation. This could range from providing free maintenance services to organizing a free workshop on stress management or well-being.

Support first responder charities.

Contribute to charities or organizations that support the well-being of first responders. This could involve monetary donations, volunteering your time, or organizing a fundraising event to benefit these essential workers.

Collaborate with local businesses.

Partner with local businesses to offer discounts or special promotions for first responders, police, firefighters, and nurses. Not only does this show appreciation but it also supports local businesses.

Volunteer at the station.

Offer your time by volunteering at the local police station, firehouse, or hospital. This could involve helping with administrative tasks, organizing events, or simply being a supportive presence.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.