by California Casualty | Calcas Connection |

7.3 million families are living in poverty in the United States. For these families and individuals, the winter months are more expensive meaning they may not have the budget to buy winter coats for their children.

‘Coats for Kids’ was established in 2013 by the Professional Fire Fighters of Utah (PFFU) to combat one of the most fundamental hardships of childhood poverty- the absence of a warm winter coat.

In Utah, and many other communities across the country, the lack of a winter coat often results in frequent school absenteeism which translates to forgone learning, missed opportunities for socialization and play, and the loss of balanced nutrition provided through the school’s meal program. Helping students stay warm as they walk to and from school helps prevent illness and leads to increased attendance, allowing children of families in need to experience the critical childhood benefits their school has to offer.

For more than a decade, PFFU has watched the problem of childhood poverty creep mercilessly into the homes of the communities it serves. Poverty ravages families without discrimination – and by necessity those struggling to survive naturally prioritize food, heat, and rent above winter clothing.

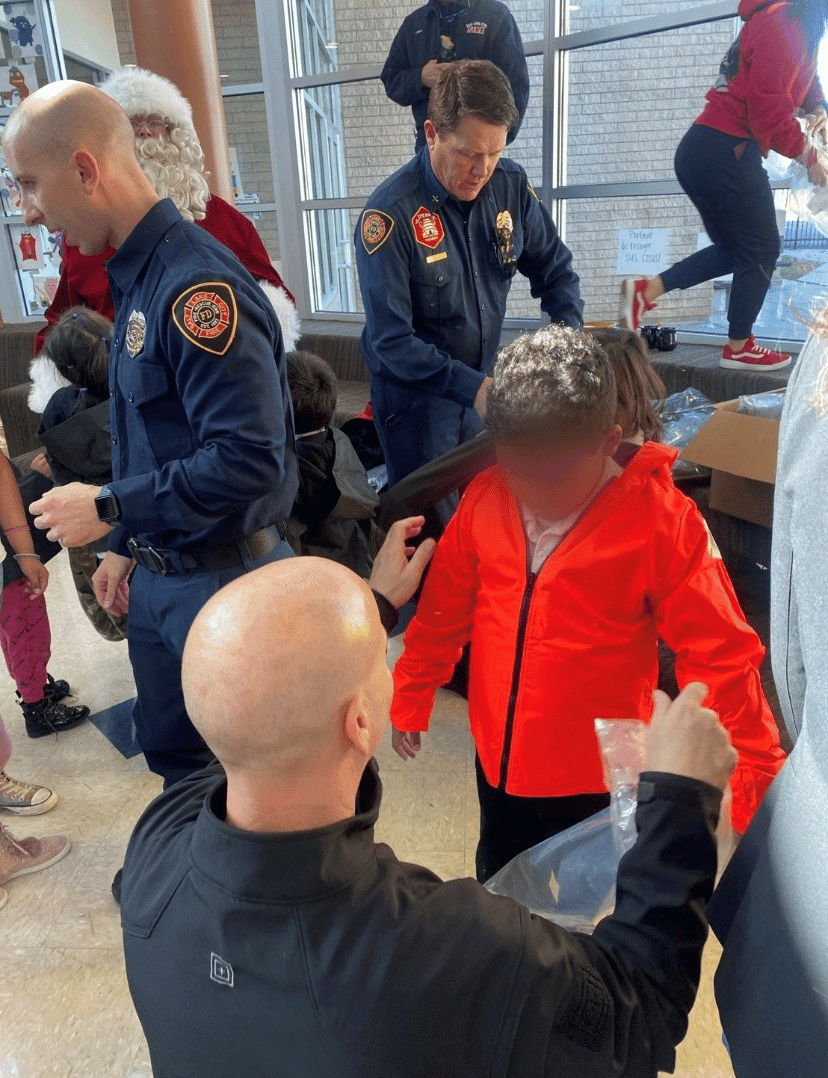

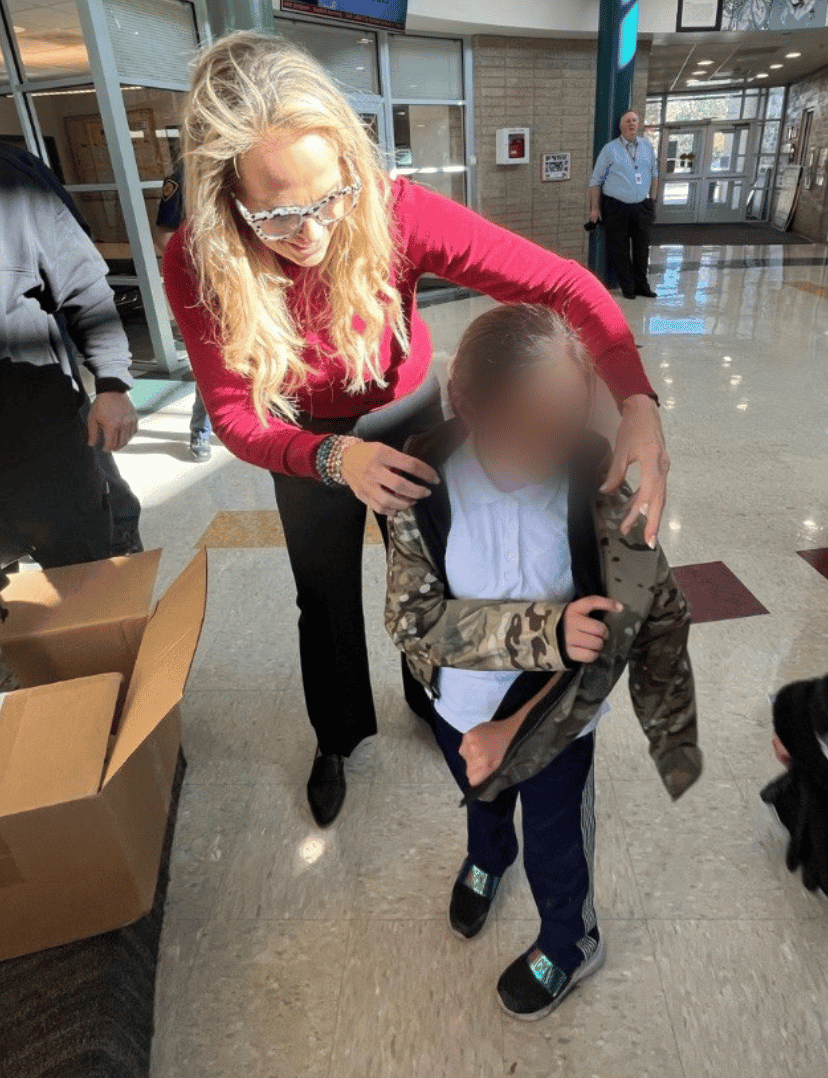

Each year California Casualty partners with the PFFU to deliver winter coats to children in need in their area through PFFU’s ‘Costs for Kids’ program. There is no denying the joy of a child being zipped into their brand-new coat by their hometown heroes. And to date, we’ve donated over 2,500 coats in fourteen different elementary schools to children in need.

California Casualty Field Marketing Manager, Michelle Hawkins attended this year’s event at Mountain View Elementary School in Salt Lake City.

*Children’s faces have been blurred for privacy

“This was my first time attending Coats for Kids alongside members of PFFU.,” Said Michelle. “The care and cheer PFFU and Salt Lake City Fire Members brought to the students and staff of Mountain View was magical. This was a special group of people serving their community in a way that will impact those students’ lives forever.

Students at Mountain View in a variety of grades received a total of 300 coats to help them stay warm and safe during the winter months ahead.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Finances |

It’s gift-giving season, but there’s no need to stress.

You’ve got first-rate ideas that are sure to impress.

Just take a pause before filling your cart,

and consult this short blog for an awesome head start.

Give one and give all, with forethought and reason.

Use these clever ways to save money this season.

1. Make a list and check it twice.

The more people you have on your holiday list, the more money you’ll spend. That’s why narrowing down your list of gift recipients is a good first step.

-

- Write down the names of all the people on your gift list.

- Take a second look at the list. Is there anyone you can delete, or move to a card-only list? Adjust the list as necessary.

- Then, for each name, write down the person’s hobbies/interests.

- Write down 1-3 possible gift ideas and their approximate costs.

- Total up the list, and compare it to your holiday gift-giving budget in #3. You may need to adjust gift-giving expectations.

2. Limit the number of people you buy for.

You may want to buy for everyone on your list but there are creative ways to limit the number of people, and still cover everyone.

-

- Whether in a group of friends, coworkers, or family, draw names and set a price limit. That way, you only have to buy for one person.

- Do a white elephant gift exchange. Everyone brings one wrapped gift. People take turns choosing a present and opening it. They may keep their gift or “steal” someone else’s gift. The last person to go has the choice of any gift in the room.

- Give a group gift. Connect with your siblings to contribute to your parents’ gift. Or give one gift to a family that everyone will enjoy.

- Skip all the adults and just give to the children. This only works if everyone agrees; otherwise, you will have some folks showing up with gifts, which could be awkward.

3. Set and follow a budget.

Americans will spend an average of $832.84 on gifts and holiday items this season. You may spend less—or more. Keep to what you can afford by putting together a gift-giving budget.

-

- Make sure the budget is realistic.

- Decide how to split the budget among your gift recipients.

- Keep the budget with you, on your phone or in your purse or wallet, so you can reference it throughout the holiday season.

- Not sure what to budget? Look at your credit card statement from last year and see what you spent on gifts.

4. Shop around.

You could buy items at full price or you could buy them on sale. Find the best deals by shopping around, finding discounts, and using cards and sites that give rewards.

- Compare prices of an item at various retailers before you buy it. Use apps like Honey, PriceGrabber, ShopSavvy, and CamelCamelCamel.

- Look for online promo codes at sites like CouponCabin, RetailMeNot, and SlickDeals.

- Use online shopping portals, like BeFrugal, Rakuten, and MrRebates, to get money back when you shop. Or use credit cards with cash-back rewards.

- If shopping online, look for free shipping. There’s a free shipping day in mid-December, and many retailers participate.

- Many stores offer discount codes during the holiday season and additional discounts for teachers, students, veterans, military families, seniors, nurses, and first responders. Look for or ask about discounts that apply to you.

5. Buy second-hand items or make your own gift.

Not only are gently-used gifts sustainable, but they are also much less expensive than buying new. So is making your own gift. However, you’ll want to give it to the right person. (Not everyone appreciates a thrift store or homemade present.)

-

- Second-hand gifts can be very thoughtful. You can gift family heirlooms or your own special item.

- For the fashionista, hipster, or collector, thrift stores are a treasure trove of potential gifts.

- Facebook Buy-Sell-Trade or Marketplace groups offer free and low-cost gift ideas.

- Baked goods, candy, and cocoa make wonderful holiday gifts. Put it in a decorative tin or basket to make it festive.

- Exercise your creativity with some home crafting.

6. Save on gift wrap.

Skip the expense of gift wrap with your own homemade version. You can be creative with items you probably have around the house.

-

- Substitute any of the following for wrapping paper: butcher block paper, newspaper comics, and black paper with drawings done with a white paint marker.

- Use shredded colored paper to cushion gifts in boxes and gift bags.

- For extra-large presents, a plastic tablecloth works well as gift wrap.

- Use old cards cut with pinking shears for your gift tags.

- Remember to save this year’s bows, ribbons, and wrap for next year’s presents. Wind the ribbon around old wrapping paper tubes.

Pro Tip: To freshen wrinkled bows, put them in the dryer with a damp washcloth. Run the machine on the delicate cycle for 2 minutes.

7. Choose a less gift-focused holiday.

Talk to your family and friends sooner rather than later if you’d prefer to focus less on the gifts and more on the spirit of the holiday season.

-

- Consider making a joint donation to a favorite charity instead of gift-giving.

- Volunteer together over the holidays.

- Give the gift of your time. Babysitting, a home-cooked meal, and even cleaning out the basement are all wonderful ways to show you care.

- Plan a family trip or experience instead of giving actual gifts

Looking for extra cash for holiday gifts?

Some insurance companies allow you to skip payments around the holidays. At California Casualty, you have the option to skip your auto insurance payment for three whole months. (You also have this option to skip in the summer.) Ask your agent for details.

Happy holidays from all of us at California Casualty!

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

You slow down for the yellow light but the car behind you does not. Bam! It wasn’t your fault but now you have to get your car fixed. Or maybe a storm knocks out a window in your house. Now you need to get it repaired.

Accidents happen. Washing machines overflow; things are stolen or vandalized. That’s why you have insurance. Your policy protects your vehicle, your home, and your belongings, taking some of the financial stress away to help you repair and replace those necessary items. Here’s an overview of the insurance claims process so that you can do it easily.

When to File a Claim

Every policy has a deductible, an amount that you are required to pay out-of-pocket before insurance kicks in. The general rule is to file a claim when the payout is greater than the deductible and you cannot cover it on your own. You also should file a claim whenever someone is injured and when it’s not clear who is at fault. That way, the insurance companies can get together and determine the outcome.

How to File a Claim

Let’s say you were in a car accident. Here are the steps to take to file a claim. (You also can refer to the back of your California Casualty insurance card. It lists the steps to follow in the event of a loss.)

Step 1: Call the police if needed.

-

- Call 9-1-1 if anyone is injured or you suspect drugs or alcohol are involved.

- Call the non-emergency police number to report the accident. An officer may show up and take a police report. While you don’t necessarily need one, it will make the claims process easier. If the police are not needed, or available, you may file an accident report online, by mail, or at the police station.

Step 2: Get the other driver’s information.

-

- You feel bad so it may be tempting to say the accident was your fault. Whether or not it was, don’t take the blame. Don’t apologize.

- Exchange information. Get the other driver’s name. Take a photo of the other driver’s license, insurance card, and registration. Alternatively, you can write down the information. Make sure you have the year, make, model, license plate number, and color of the other car.

Step 3: Write down facts and take photos. Look for witnesses.

-

- Take photos of the scene, license plates, traffic signs, and anything else that may help you to remember the details of the accident.

- Include the direction the cars were traveling, your speed, weather, road conditions, and what happened.

- Use your phone to make detailed notes.

- There may be witnesses. Look around and ask for the contact information of those individuals. They may later be contacted by your insurance company or police, if needed, to support your rendition of the accident.

Step 4: Call your insurance company.

-

- Report the accident. The adjuster will ask questions. Answer them honestly and thoroughly. If you don’t know the answer, say so.

- Your adjuster will share the process of getting your car repaired. They will send you paperwork to fill out.

- Let them know if there is a police report.

- Don’t sign anything from the other person’s insurance company. Let your insurer take the lead.

Step 5: File your claim.

-

- Most insurance companies allow you to file your claim online. That means you’ll fill out the necessary paperwork online or by email.

- To complete the filing of your claim, you’ll need to fill out the forms that you are sent.

- You may have to get a repair estimate and include that information.

- Then, you’ll wait for approval. Once the repair is authorized, you’ll be able to proceed with the repairs. Either you or the repair shop will receive payment from the insurance company, so check with your adjuster.

The Difference with a Homeowner’s Claim

A homeowner’s, renter’s or personal property claim follows a similar process. The main difference is that you need to provide a Proof of Loss statement. That’s a list of items that were damaged or stolen and how much it costs to replace them.

Can you wait to file a claim?

You should not wait. Your insurance contract specifies your specific Duties After Loss. You must give prompt notice to the insurer; notify the police in case of loss by theft; protect the property from further damage, prepare an inventory of damaged personal property; and cooperate with the investigation.

So, the next time that life throws a wrench into your plans, remember that you have insurance. The claims process is an easy way to get the help you need.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | News |

We have amazing employees at California Casualty. The New Employee Spotlight is a series aiming to highlight the talented individuals that are brand new to our team. Please help us give them a warm welcome!

Today we’re spotlighting Sales Support Specialist, Dailen Terry

Let’s get to know, Dailen!

Where are you from?

Colorado Springs, CO

What is one interesting fact you want us to know about you?

I was my high school’s class valedictorian.

If you could eat one food for the rest of your life, what would it be?

Pizza

What do you like to do on the weekends?

Working out

Watching movies

Playing video games with my friends

What made you want to start your new career at California Casualty?

I wanted to be somewhere that was flexible with my school schedule and join a loving work family.

If you want to learn more about Dailen or are interested in a career at California Casualty, connect with him on LinkedIn! Or visit our careers page at https://www.calcas.com/careers

by California Casualty | Auto Insurance Info |

If you’ve ever had your windshield hit by a rock, you know the sinking feeling of watching a crack appear—and grow.

Cracks happen and sometimes they’re unavoidable. But did you know that your windshield is at higher risk for cracks in the winter? It’s true. Knowing the causes of cracks will help you protect your windshield this season. If you do get a crack, we’ve included a guide on how to handle it, which can hopefully save you an expensive repair.

All About Your Windshield

Your windshield is a protective barrier between you and the road ahead. It also provides a clear line of sight. When your windshield cracks, it compromises your safety and can limit your visibility.

Windshields are made of laminated glass, which includes two layers of glass with a piece of plastic in the middle. The layers are fused together, making them stronger than ordinary glass. Even though windshield glass is strong, however, cracks still happen.

Tiny cracks can occur from everyday driving. Cracks happen when your windshield is hit by a rock or debris. The metal frame of your windshield expands and contracts in extreme temperatures. This causes stress on your glass which can crack it over time. Finally, our own human error can cause glass to crack, such as when we pour hot water over an icy windshield. A crack between the two layers of glass can trap moisture between the layers. This can weaken the structural integrity of your windshield and cause cracks down the road.

Types of Cracks

In most cases, cracks or chips smaller than the size of a quarter are able to be fixed. But you cannot let even a tiny crack alone. Don’t ignore these small cracks or chips; they can start out small and eventually get larger, past the point of repair, and cause you to need a total windshield replacement.

Not all cracks are the same, and it’s good to know what kind you have. The type of crack determines how you deal with it.

-

- Basic crack – The simplest crack is a line that is not near the edge of the windshield. If the line is less than 1 inch long and doesn’t have other lines extending from it, it can be repaired.

- Floater – A crack that occurs away from the windshield edge is known as a floater. These can spread quickly.

- Edge crack – If the crack is near the edge of your windshield, chances are that the entire windshield needs to be replaced.

- Chip – If a small piece of glass is missing, you have a chip. A chip less than 1 inch in diameter, without any cracks coming from it, can be filled or repaired.

- Star – If your crack looks like a small chip with tiny cracks extending from it, you have a star crack. This type of crack could possibly be fixed but the repair may be visible.

- Bulls-eye – If your crack resembles a circular bulls-eye target, you have more extensive damage than it appears. This type of crack usually requires a full windshield replacement.

How to Avoid Cracks

Remove ice responsibly. In most places in the U.S., you’ll be dealing with icy windshields this winter. You need to clear the ice in order to drive. Glass can be brittle in cold temperatures, so you will want to avoid any sudden temperature changes.

-

- Do not throw hot water on your windshield. Hot water will refreeze, and surprisingly, it does so faster than cold water. Don’t use room temperature water either. This will still be a temperature extreme from the icy conditions and can crack your windshield.

- Skip the vinegar and water mixture. Vinegar doesn’t work well when there is already ice there. It also is an acid that can eat into glass causing pits.

- Don’t use a propane torch, hair dryer, or cigarette lighter. These are extreme changes in temperature and can crack the glass.

- Do not use a knife or blade that will chip or scratch your glass.

- Don’t hit the ice. It doesn’t take a lot of impact to cause damage to the glass.

- Do not use keys, snow shovels, or spatulas. They can all leave scratches and grooves.

- Do warm your car up slowly. Use your car’s heater and defrost settings. Wait until your car is warm to turn your car’s defrosters on high.

- Do use a plastic ice scraper. Ice scrapers are among the must-carry items in your car in winter.

- Do use a liquid deicer if you would like.

Avoid flying debris. While rocks and debris can hit your windshield almost anywhere, you can take steps to keep your car away from this potential hazard.

-

- Don’t drive over gravel roads, but if you must, keep a safe following distance from the vehicle in front of you.

- Don’t follow construction vehicles too closely.

- Don’t drive in hailstorms if you can help it. The best strategy is to find covered parking while it’s hailing. If you must drive in a hailstorm, slow down to lessen the impact.

Park in protected places. Mother nature can be tough on our windshields. Keeping your vehicle in a place with a constant temperature and away from wind, winter storms, snowstorms, and extreme weather can help to protect the windshield.

-

- Avoid exposing your windshield to extreme temperatures. If it’s going to be very cold, park your car inside if you can.

- You also can cover your car, which will help to protect your windshield wipers from freezing and cracking. You don’t want damaged wipers to scratch your windshield.

- If you can, park your car inside a garage during the winter months.

Periodically inspect your windshield. You may not even be aware of tiny cracks in your windshield. The sooner you catch them, the sooner you can address them.

-

- It’s hard to notice cracks while you’re driving. Make it part of your winter routine to periodically inspect your windshield when you get in or out of your car.

- Keep the windshield glass clean. This will help you to notice small cracks and chips.

- A winter car wash can help, but don’t run your car through one if there are any windshield cracks.

- Replace your wiper blades before winter hits.

- Don’t drive around with a crack. The sooner you take care of it, the less expensive the repair will likely be.

What to Do if You Get a Crack

Drive carefully. Drive over bumps slowly. Don’t whip around corners or cause any vibrations that could make damage worse.

Guard against dirt and moisture. While you are waiting for the repair, keep the crack clean and dry. Dirt and moisture can make repairs more complicated. (Pro Tip: Even window washer fluid can stain the crack so use a drop or two of dishwashing soap on a damp cloth.)

You only have one chance to get it right. DIY options include inexpensive windshield repair kits.

Most kits aren’t high quality and won’t last long-term. Some folks have tried to seal the crack with household items like superglue or nail polish remover. Don’t even consider that. It will prevent you from getting a professional repair.

Contact an auto glass repair specialist. California Casualty works with Safelite on claims for cracked windshields. Many glass repair providers offer same-day service and can come to you. A technician can fix repairable cracks in a matter of minutes. Most comprehensive auto insurance policies cover the cost of fixing small chips and cracks in your windshield. Even without insurance, a windshield repair is much less than a replacement.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.