by California Casualty | Firefighters, Homeowners Insurance Info, Peace Officers |

Your home and the personal property inside are your most valuable assets. If the unexpected were to happen, give yourself peace of mind by knowing your personal possessions have an extra layer of protection by placing them in a home safe.

Keeping a durable safe inside your home is one of the best ways to ensure your valuables, personal belongings, and other important documents inside remain secure in the event of a burglary, fire, or natural disaster. But buying a safe that is water, fire, and/or theft-resistant can be quite a monetary investment.

If you are questioning whether it’s “worth it” to purchase a home safe, here are some important factors to remember.

You’ll have quick access to important information

If you need cash or important documents like your Home Warranty, you won’t have to jump through any hoops or wait to get the information you need. All of your important information will be in one place that is quickly accessible to you and your family.

Your important items will remain safe

In the event of a disaster, there may not be time to grab all of the items you would like to bring with you. With a home safe, no matter the occurrence, your important possessions will remain secure.

You can also use it for firearm & weapon storage

If you keep weapons in your home, you can rest assured knowing that they will be locked away in your safe, out of sight and reach from your children and any guests (wanted or unwanted).

What Kind of Safe Should I Purchase?

Not all safes have the same functionality. Before you purchase a safe of your own, do your research on what will work best for you and your family. If you live in a flood or wildfire-prone area, be sure to invest in a safe that protects against water or fire. If you chose to use your safe for weapon storage, remember to find a safe that protects against humidity.

Home safes also come in many different sizes, with the average home save being 1.2 – 1.3 cubic feet. If you have an area of your home that you know you would like to place keep your safe (out of the eyes of an intruder) be sure to purchase a safe with the correct dimensions, so it will fit properly in your space.

The size of your safe should also take into account what you will keep inside of it. For example, if you are storing multiple family heirlooms, along with all of your emergency documents and a full emergency kit, you may want to invest in a larger safe.

Here are some examples of what you can keep in your home safe.

Items to Keep Inside Your Safe

Personal Documents – Birth certificate, passport, social security card, marriage license, vaccination & medical history, tax returns

Important Information – Passwords, health insurance information, legal documents, wills, death decrees, immigration paperwork, & external hard drives

Money & Bank Information –Cash, bank account numbers, checks, credit cards, bonds, stock certificates, & precious metals like gold or silver

Home& Auto Information – Insurance information, contracts, warranties, permits, deeds, & titles

Weapons – Firearms, knives, bows, & ammunition

Jewelry – Expensive necklaces, bracelets, earrings, watches, diamonds, gemstones, & engagement or wedding rings

Spare Keys – House keys, deposit box keys, car keys, garage door openers, & neighborhood facility keys

Heirlooms – Trinkets, photos, & items from childhood or passed down from generations

Emergency Information- List of family cell phone numbers & addresses, family disaster plan, emergency kit,& home inventory

Owning a safe is one of the easiest ways to make sure your personal property stays protected. Save yourself worry and stress by investing in a safe for your home today – your future self will thank you.

First responders- you help keep us safe all year long; let us help you keep your valuable possessions safe too. Click here to enter to win one of THREE Liberty Safes filled with 5.11 Gear courtesy of California Casualty!

DISCLAIMER: Contest terms and conditions apply, see page for details.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info |

Personal Property, also referred to as “contents coverage,” is the term insurance companies use to collectively define the things you own inside your home. Imagine picking up your house, turning it over, and giving it a good shake. What would fall out? Furniture, electronics, clothing? The possessions that “make your house a home” are considered your personal property.

Should something insurance-related (like damage or theft from a covered peril) happen to your home, you’d likely have many personal property items to replace. Both homeowners and renters insurance policies typically include Personal Property Coverage, but in order to for your insurance coverage to help replace your items, you need to know how much personal property coverage you really need. That’s when a home inventory comes in handy.

Most people know a good ballpark for the dollar amount/coverage limit they need to cover the exterior of their home, known as Dwelling Coverage, but they rarely know the value of their personal items inside their home. Having the right amount of coverage to replace these personal items will make your life so much easier if/when you have a covered claim.

Plus, most insurers offer optional scheduled personal property coverage, or rider, for more special and/or expensive items such as jewelry, watches, and furs that have values above your personal property coverage limits.

Here are some things to consider when it comes to protecting your belongings.

-

- For homeowners policies, personal property coverage is usually a percentage (ranging from 20-50%) of your homeowners’ Coverage A (Dwelling Coverage) on your policy. However, you can purchase more coverage if needed.

- Renters are able to choose their personal property amount for their policies.

- There are two types of personal property coverage: replacement cost and actual cash value.

- An actual cash value policy factors in depreciation (use and age) to provide reimbursement based on the current value of an item, not what it would cost to replace it.

- A replacement cost value policy typically pays the dollar amount it takes to replace your item following a covered claim. Replacement cost value usually has a slightly higher premium cost than actual cash value, and some insurance companies will give you the option to choose replacement cost value if you’re willing to pay a little more premium.

- It’s also important to know that personal property coverage usually has certain limits on what it will pay to replace an item or category of items. Be sure that the coverage (or amount of anticipated compensation in the event of a covered claim) you actually need is within these limits or you may want to add coverage to better protect your cherished possessions.

- There are exclusions to personal property coverage! Items in your home like pets, property of roommates, boarders, or tenants (for homeowner’s policies), and vehicles are not covered.

- Sometimes if the event that caused the damage (peril) is not “named” on the policy, there is no coverage for that cause of loss.

It’s a good idea to take inventory of your personal property, complete with pictures and the purchase price of each item. As an easy reminder, and to stay on top of all of your new possessions, mark your calendar to do your home inventory every six months- once in the middle of the year and again at the end of the year. In the event of a loss, your up-to-date home inventory will help simplify the process of filing a claim.

A conversation with an insurance advisor will be helpful as you consider your coverage limits. Knowing what you own and understanding how your personal property coverage works can give you more confidence as you navigate through the quoting process and comfort in the event of a loss.

DISCLAIMER: These general industry descriptions are not representative of your individual insurance policy. Please be sure to review your policy at least once yearly with your insurance representative and mention any home improvements to ensure your coverage is complete.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | News |

We have amazing employees at California Casualty. The New Employee Spotlight is a series aiming to highlight the talented individuals that are brand new to our team. Please help us give them a warm welcome!

Today we’re spotlighting New Inbound Sales Representative, Beau Hughes.

Let’s get to know Beau!

What California Casualty office do you work in?

Colorado Springs!

What is one interesting fact you want us to know about you?

I can ride a unicycle

If you could eat one food for the rest of your life, what would it be?

Tacos

What do you like to do on the weekends?

Snowboard

Hike

Play Video Games

What made you want to start your new career with California Casualty?

Having been in the call center industry for the greater part of the last 10 years, California Casualty has always had a good reputation. When I was looking for my new career, I was looking to work somewhere that had a great culture, that cared about its employees, and I wanted to find something that would enable me to learn a new skill.

I read a bunch of reviews online and everything seemed to match with everything I was looking for. I’ve been here for almost 3 weeks, and I am impressed with the culture and incredibly happy to work here!

If you want to learn more about Beau or are interested in a career at California Casualty, connect with him on LinkedIn! Or visit our careers page at https://www.calcas.com/careers

by California Casualty | Behind the Scenes, Calcas Connection |

Each year the California Casualty Partner Relations Department recognizes employees for their commitment and dedication to serving our group partners by developing and nurturing relationships and creating leader advocates. In a year of so much uncertainty, the efforts of these individuals shined as they adapted to a virtual environment. Nominated by their fellow managers or their peers, the 2020 Partner Relations Advocate Award recipients were Angela Morgan (WA), Bonnie Harber (NJ), Brandon Watson (TX), Inez Morales (CA), Justine Sallee (IL), Michelle Hawkins (WA), Norma Alfaro (CA) and Stephanie Whitmore (CA). Read on to learn more about each award recipient and why they were nominated.

With nearly six years of experience, Bonnie Harber has become a permanent fixture at events throughout her territory in New Jersey and is well respected by association staff, leadership, fellow business partners, and her colleagues. Her dynamic personality, teamwork, and dedication have generated exceptional production results and strong relationships internally and externally.

Michelle Hawkins’s manager noted that she is simply the best. She completely understands advocacy and how leveraging her relationships publicly affects her field access, retention, business growth, and overall marketing plan. It’s all intertwined and she knows exactly what she is doing.

Stephanie Whitmore moved at the start of the pandemic from Iowa to California. She used her tenacity and creativity to introduce herself to group leaders in her new territory while she continued to be present virtually in her previous territory of Iowa and Nebraska. It was written of her, “The great thing is about her tenacity and creativity, is that she does not keep it to herself. She constantly shares what she is doing with her teammates and department”.

Countless hours were dedicated by Norma Alfaro to ensure her fellow California field team members staff and our partner, the California Teachers Association, had all they needed to make it through 2020 successfully. Norma was nominated from two different Partner Relations employees, with one noting, “With every challenge comes an opportunity to adapt, persevere and demonstrate one’s inner strengths. In 2020, Norma proved that she could not only weather the storm but thrive.”

Inez Morales’s sense of responsibility towards her customers and her groups is amazing. Although she works with all our group partners in California, Inez was specifically nominated for her work as a PORAC Back-Up Account Manager. Inez has a gift with relationships that have helped her to keep doors open to new opportunities and the ability to quickly address policyholder and group concerns.

Brandon was nominated for his attitude of service and advocacy as a representative in Texas, New Mexico, and Arizona. Since he started with California Casualty in 2011 he has exhibited great advocate qualities. He cares for the members of the associations we serve and it is welcomed, respected, and appreciated by the leaders and members of these associations.

As one of our field representatives in Illinois since 2012, Justine Sallee’s, ability to develop and maintain relationships has served her well. She recognizes the value of service and care for the leadership and members of our partner associations. This has enabled her to leverage these relationships to gain access, maintain visibility and generate policyholder growth in her territory. She is a well-rounded field marketing manager and is liked and respected by her association leadership and members.

To round out the 2020 Partner Relations Advocate Award recipient is Angela Morgan. Angela has embraced and led the way in building sustainable business practices to market throughout her territory. She is consistent and relentlessly couples short-term and long-term wins throughout her day. She understands the need for the immediate while teeing up future relationships and opportunities to leverage.

Congratulations to all the recipients!

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Pets |

April 11th is National Pet Day!

Is there a better way to celebrate than snuggling your own pet and scrolling through some cute videos and photos together? No, we didn’t think so. That’s why we are sharing a list of our favorite famous pets on the internet for your viewing pleasure.

These pets CATapulted into fame online and we (and millions of others) are soaking up every minute of it. Here are our 9 favorite four-legged internet stars you need to check out.

1. Jiffpom – A Pomeranian melting hearts all over the world.

2. Nala – With those blue eyes, how could this cat not be destined for stardom?

3. Mr. Pokee – For all of us who have forgotten how ridiculously cute hedgehogs are.

4. Esther the Wonder Pig – Her name says it all, really…

5. Juniper & Friends – Adventures of a fox and her friends (fellow rescued exotics).

6. Loki – A wolfdog and silly adventurer.

7. Maru – The feline famous for fitting himself into any – ANY – sized/shaped box or container. Guinness record holder for most YouTube video views of an individual animal.

8. Doug the Pug – Self-proclaimed “King of Pop Culture.”

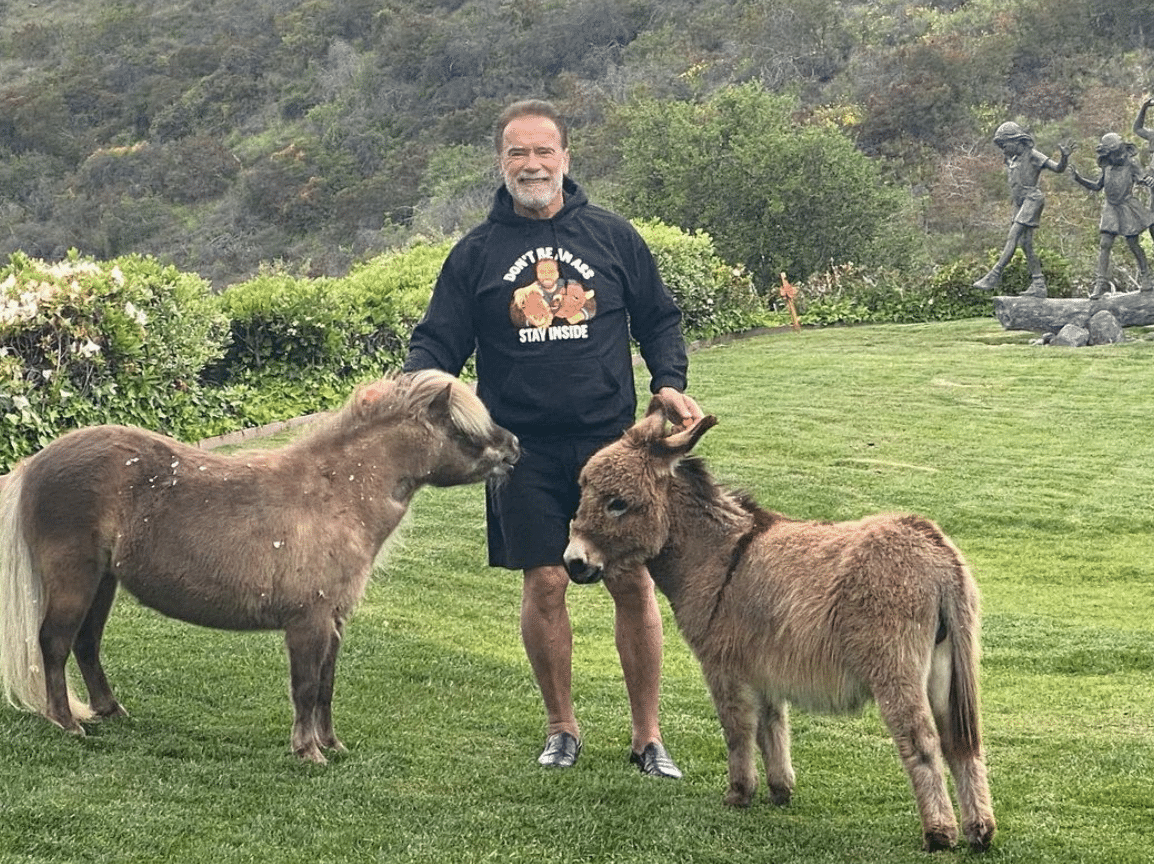

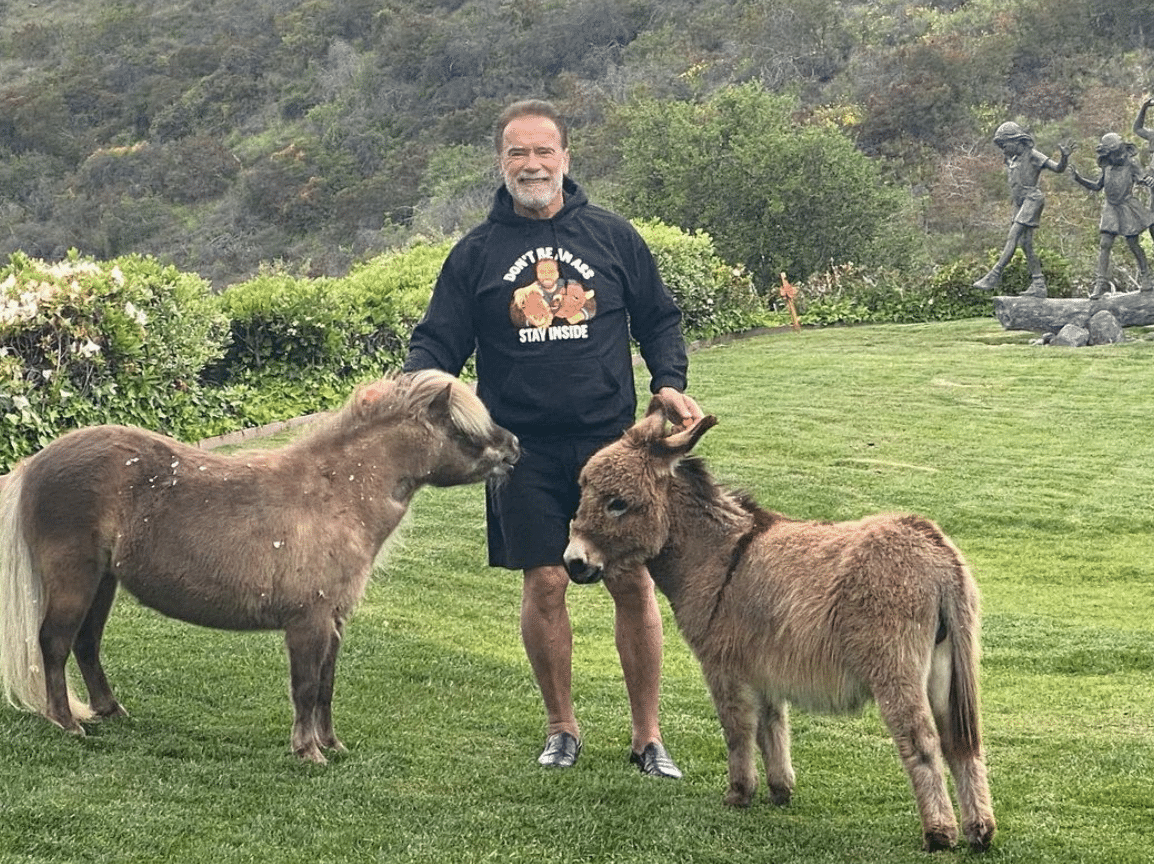

9. Whiskey and Lulu – Arnold Schwarzenegger’s mini horse and mini donkey were central in his coronavirus PSA at the start of the pandemic. While they may not have their own account you can find them on Arnold’s Instagram here.

Happy viewing and happy National Pet Day!

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.