by California Casualty | Homeowners Insurance Info |

You want to take good care of your house. Not only does it provide shelter and a cozy environment for you and your family, it’s also your largest investment and you want to make sure it to holds up over time.

That’s why it’s important to avoid these unfortunately common and costly mistakes made by homeowners. Doing these things to your house could cost you big time now – or in the future, if you decide to sell.

Home Improvements

You should never…

Remove architectural features.

You may be tempted to remodel but make sure in doing so, you don’t destroy the charm of your home. That quaint tin ceiling, the chair rail molding along the wall and that detailed millwork are selling features to future buyers. Architectural details offer curb appeal and help distinguish your home.

Get rid of a bedroom or a bathtub.

Bedrooms sell homes, and similarly, so do bathtubs. Families are looking for both when buying a new house. That’s why you should never remove a bathtub in favor of a new shower. You’ll discourage families with kids and pets who need the tub. Similarly, taking down a wall to merge two bedrooms into one large one may be good for you, but it will detract from your home’s future sale price.

Cover wallpaper with water-based paint.

Water-based paint reacts with wallpaper glue, causing it to peel. So, if you paint over wallpaper with water-based paint, you’ll have a peeling mess on your hands. Instead, use oil-based primer to provide a protective barrier. Let it dry fully and then apply latex paint.

Leave cabinet doors on when you’re painting.

Painting your cabinets is an easy way to give your kitchen a facelift without spending tons of money. Just make sure that when you do, you remove the cabinet doors. That way, you won’t paint over hinges and hardware. It will turn out to be a much more professional job. Remember to keep track of which doors go in which spots. Label them with numbers under the hinge locations or back where it won’t be visible.

Do your own plumbing or electrical.

You may know a bit about plumbing or electrical. That doesn’t mean that you should add a bathroom or rewire your house. DIY projects are great when they match your experience. Hire a professional for jobs that are beyond your skill level to avoid costly mistakes.

Daily Living

You should never…

Flush flushable wipes.

They may say flushable, but they really aren’t if you want to keep water flowing through your pipes. Flushable wipes are made from synthetic materials that don’t break down. As a result, they can get stuck in your pipes or make their way to the sewer system and clog it up. The best choice always for toilets is toilet paper.

Let ceiling fans run.

You may think ceiling fans cool down your home. In reality, they move air around which helps your sweat evaporate more quickly. That’s what makes you feel cooler. It makes sense to run a ceiling fan in the room where you are; however, running it in every room when people are not present just doesn’t make sense. It just increases your energy bill.

Leave a brick in the toilet.

It used to be common for people to put a brick in their toilets to displace the amount of water used. That would ultimately save them money. But water causes bricks to crumble over time and those pieces can really damage or clog your pipes. Instead, try filling a half-gallon milk carton with sand and put it in the tank. That will save you a half-gallon of water for each flush. Or you could replace your toilet with a new model that uses less water.

Put starchy food down the disposal.

Starchy foods clump up when they come in contact with water. That’s great for cooking but terrible for garbage disposals, which can get easily clogged. Instead, put the potatoes, rice and oatmeal in the trash or compost pile.

Pour bleach or drain cleaner down the drain.

Diluted bleach is great for cleaning surfaces but not so great for pipes. That’s because this harsh chemical can damage them. Bleach also kills the good bacteria that break down waste. In that way, bleach can actually cause clogs. Drain cleaner also is hard on pipes. If you’re trying to clear a drain, use a pipe snake instead.

Outdoors

You should never…

Plant trees too close to your house.

Trees enhance our property and provide beauty and shade. But having trees too close to our homes can be dangerous. Branches can break off during storms, and in heavy winds, and limbs or trees can fall on your house. In addition, their large root systems can grow into your foundation, weakening it. Always take care to plant trees far enough away from your house: at least 30 to 50 feet away for medium and large trees and 10 feet away for smaller trees (less than 30 feet tall when full grown).

Plant invasive species.

You may love the Rose of Sharon, but if you plant it in your garden, you could find more than you bargained for. This pretty plant is an invasive species, meaning that it will easily take over your garden and your lawn. It’s tough to get rid of invasive species, so do yourself a favor. Don’t plant them in the first place and remove them as soon as possible.

Skip the last mow of the season.

Long grass provides a place for critters to hide. It also means that they will have a safe path to get into your home during the winter months. Keep your lawn short and you’ll be less likely to have these unwanted guests, plus your grass will be healthier.

Leave your hoses connected in winter.

Leaving your hoses attached can trap water which can freeze your pipes and damage them. Don’t make that mistake. Disconnect your hoses when you put away your lawnmower for the winter.

Park your car on your lawn.

It seems like common sense to park in the driveway or on the street and not on your lawn. After all, you could ruin your grass that way. But there’s another important reason. You could create a fire hazard from a hot engine on dry grass. You also may leak harmful chemicals onto your lawn. For these reasons, many local ordinances make it illegal to park on the lawn.

Luckily, home insurance covers repairs from most mistakes like these. An annual review of your homeowner’s policy will ensure you are fully covered. Talk to your insurance agent to see what’s covered under your current policy.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

Have you ever passed up a spot because it required you to parallel park? Don’t worry, you’re not alone. The anxiety/stress that comes with parallel parking is well known. But it doesn’t have to be.

Whether you’re teaching your teen how to parallel park or you simply want to brush up on your technique, here’s a 5-step process to parallel park like a pro.

1. Find a parking spot.

Look for a spot that seems big enough. You will need a space about one and a half times the length of your car. It takes practice to estimate the right size so don’t get discouraged. If you’re not sure if the spot is big enough, pull away and find another.

2. Signal and get in position.

You will be pulling up alongside the car in front of the empty spot. Check your mirrors and your surroundings for other cars and pedestrians. Turn on your right turn signal. Position your car so that its center is even with the other car’s rear bumper. You should be parallel, about 2-3 feet away from the other car.

3. Turn the wheel to the right and reverse.

Sit up tall and turn your body 90 degrees. Again, check your surroundings. When all is clear, put the car in reverse and turn the steering wheel sharply toward the curb so you are approaching at 45-degree angle. Use your car’s backup camera to help guide you. Stop when you see the full front of the car in the back of you in your driver’s side mirror. If your right rear wheel taps the curb, move forward a bit.

4. Turn the wheel in the opposite direction to straighten out.

You can’t continue on that 45-angle without hitting the curb. That means that sometime during your reverse, you will need to stop turning toward the curb and start turning in the other direction. For most cars, you do this when your passenger’s side mirror is in line with the rear bumper of the car in front. As you turn the wheel in the other direction, continue backing up slowly until your car is parallel to the curb.

5. Straighten and align.

You want to make sure you’re between 12 and 18 inches from the curb. Your backup camera will give you an idea of how close you are. You also want to be centered in the spot so that you, and the cars in front and behind you, can get out easily. Creep forward until you are centered. Congratulations! You just parallel parked successfully.

Hi-tech help from your vehicle

When they first came out, backup cameras were revolutionary in helping with parallel parking. The latest technologies are even more so. Parallel parking assist is available on some newer models in a variety of price points. These systems use a camera and sensor-based guidance system that steers the car into the space with little help from the driver.

Simply drive past a parking spot and the car will notify you if it is large enough. Then, select the spot, put it in reverse, engage the parallel parking assist option, and remove your hands from the wheel. Self-parking cars can even do it themselves, and the driver is optional. You can even stand outside the car and use a remote control!

Quick Parallel Parking Safety Tip: Remember to never park in front of a hydrant or fire lane.

Drive safe!

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

You’ve been in an accident. Thankfully, you’re not hurt, but unfortunately, you can’t say the same for your vehicle. If the repairs on your car cost more than your vehicle is worth and it needs to be totaled, in the insurance world it is considered a ‘total loss.’

Sounds expensive, right? Don’t worry, your auto insurance policy is designed to protect you in case of an accident. Here are some FAQs to know what to do if this happens to you or a member of your family.

How do you know if your car is totaled?

A vehicle is usually considered a total loss if the damage meets or exceeds around 80% of its value. The insurance company will send an adjuster to look at your car in most cases. The repair shop also may weigh in. The mechanic will examine the structure of your vehicle. He or she will list the repairs needed. Your insurer will check state laws – because some states have rules about how much damage qualifies for a total loss. In all, this assessment will determine the cost to repair your car. If that amount is too much, your vehicle is considered “totaled.”

It is worth noting that you don’t have to be in a car accident to total your vehicle. Your car also could be damaged beyond repair by fire or extreme weather. If a tree falls on your car, that could total it too. The claim process works the same way for those situations.

How much will you get for your car if it is totaled?

If your car is totaled, your insurer will pay you for the actual cash value (ACV) of your car. That amount is determined by your vehicle’s age, condition, mileage, options, and resale value. Since newer vehicles depreciate once you drive them off the lot, the cash value of your car may not be the same as the price you paid—even if the accident occurs soon after you purchased the vehicle.

What if the accident was the other driver’s fault?

If the accident was not your fault, you can file a claim with the other driver’s insurance company. Their policy will pay you using their property damage liability coverage. But what happens If the other driver doesn’t have insurance, or doesn’t have enough insurance to cover damages? Then you will be covered under uninsured/underinsured motorist property damage. These are optional coverages in the majority of states. In some states, you are not allowed to carry collision and UMPD at the same time. Also, sometimes UMPD has a policy maximum or cap on the amount it will pay. If you have UMPD/UIMPD, and it isn’t enough to cover the total cost of your car, your own collision coverage will help.

What if the accident was your fault—or the fault of Mother Nature?

If you caused the accident, and your car is totaled, your insurance company will pay the cash value of your car minus your deductible and any state taxes or fees. When you are at fault, your collision coverage kicks in. Collision pays for totaled cars after colliding with another vehicle, tree, rail or other structure. You have this coverage if you are financing or leasing a vehicle; it’s required.

If Mother Nature caused the damage, comprehensive coverage pays for it. Again, this is coverage that is required if you are financing or leasing a vehicle. Comprehensive covers natural disasters, fires, vandalism, theft, and animals that damage your vehicle. However, if your car was paid off, and you don’t have comprehensive or collision insurance, you would be responsible for the full costs to repair your totaled vehicle.

Your car doesn’t look that bad. How could it be totaled?

You can’t always tell the extent of the damage by looking at a vehicle. For example, a car that sat in flood waters higher than the seat would have extensive flood damage to the engine. Looking at it after it has dried out might not tell you that parts need replacement. In addition,

repairs from collisions can cost more than you think. Finally, your state may have regulations that require vehicles with a certain amount of severe damage to be declared a total loss.

What if you want to keep your car anyway?

We understand that you may have a sentimental attachment to your car. Talk to your claims adjuster to see if you are able to keep it. Your settlement will be less if you decide to do so. In addition, you will have to talk to your insurance agent about the possibility of keeping a totaled vehicle on your policy or if you have to find other insurance. Proceed with caution. A car that has been totaled is usually better off replaced than rebuilt.

What if you haven’t paid off your car yet?

Accidents happen. That’s true whether your car is paid off or you’re still making loan payments. If you total your car and you’re still paying for it, you will continue to be responsible for the amount owed. That’s true even if you’re no longer able to drive the car. The good news is that you can use the money from the cash value of your totaled vehicle to repay the lender.

After you get the insurance check, there may still be an amount owed, and you will be responsible for it. Consider gap insurance also known as loan/lease insurance. This type of insurance covers the difference between the loan or lease payoff and the cash value of your car. It can provide peace of mind should you find yourself in this situation.

What if you totaled a leased car?

Your insurer will send the check for cash value to your lender. You will be responsible for any additional charges. If you still owe but the accident was not your fault, contact the other driver’s insurance company to cover that additional payment. It’s always a good idea to continue to make your lease payments until the insurance company issues the check so that your credit rating doesn’t suffer.

What if your teen totals your car?

In most cases, teen drivers are covered under their parents’ policies. The coverage selected by the policy owner will apply. If you have comprehensive and collision insurance, your teen will have the same deductible that you selected. Your or your son/daughter will pay the deductible and the insurance will cover the remaining cost. If, however, you don’t have comprehensive and collision, you will be responsible for the full amount.

Make sure you add your teen driver to your policy. Some insurers will deny coverage if your son or daughter is in an accident and not on your policy. Others will charge you for back premiums from the time the teen was licensed. National Teen Driver Safety Week is Oct. 17-23, 2021. It’s a good time to talk to your teen about car maintenance tips and distracted driving to help keep them safe on the roads.

What are the steps to take if your car is totaled?

After an accident, totaled vehicles are often sent to the impound lot, or tow yard, which is a holding place until the next step. If declared a total loss, they could be sent on to a salvage auction. Because the car may not be in your possession, you will want to remove all important information right after the accident.

-

- Make sure to clear out your personal belongings. Check all storage areas within your vehicle, including the glove compartment, trunk, and cubbies.

- Get all copies of the key.

- Get the title. If your car is leased, request that the title be sent to your insurance company. If you are not leasing, and you own the car, you can request a copy of the title from the DMV.

- Schedule vehicle pickup or drop-off with your insurer.

- Your adjuster will advise on handing over the title, and the keys if not already with the car.

- Sign the paperwork and receive payment.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

Your son or daughter may have your eyes and your talent for sports. They also likely have your driving habits. Studies have shown that teen drivers often model their driving off of their parents.

Whether that’s good news… or not so good…. here’s a closer look at this phenomenon, and how you can keep your teen safe on the road.

What We Say Vs. What We Do

What parents do behind the wheel has a greater impact than what they say, according to a study by Toyota and the University of Michigan Transportation Research Institute. Researchers surveyed new drivers aged 16-18 and parents of this age group. They found that teens who engage in unsafe driving behaviors, such as cell phone use, often have parents who do the same.

That makes sense because long before your teen started driving, he/she was a passenger in your car. For years, you have been modeling driving habits without realizing it. Therefore, telling your teen not to text when driving – when you do it – can actually suggest that it’s really okay.

Tips for Parents of Teen Drivers

Now that your teen is driving, this is a good time to revisit and possibly revamp your driving habits. Here are seven easy ways that you can set a good example for your young driver.

1. Refresh yourself on the rules of the road.

It’s been a while since you’ve studied for your state driving test. Now might be a good time for a refresh. Pick up your state’s DMV handbook and review the rules. If your teen sees you taking this seriously, he/she will too. Pay special attention to your state’s graduated driver licensing program. States have these laws to ease new drivers into driving with limited hours, limited passengers and other precautions.

2. Put away the phone.

If you’ve ever texted or made a call while driving, you’re not alone. This distracted driving behavior is as common among adults as teens. But cell phone use is as dangerous as driving under the influence. You are just as likely to get into a crash when using a cell phone as when drinking and driving. Teens are frequent texters, and the temptation to do so behind the wheel is great. A study in the Journal of Adolescent Health revealed that nearly 40 percent of teens had texted or emailed while driving in the past 30 days. That’s why it’s important to model behavior where you put your cell phone away. Don’t use it at stop signs or red lights. Consider using your phone’s “do not disturb” setting while driving. That will automatically put it out of commission.

3. Put away the food.

It might be common for you to eat or drink behind the wheel. After all, isn’t that what drive-throughs are for? Yet anything that takes your attention away from the road is a distraction that could cause an accident. Instead of eating while driving, pull over into a parking spot. Then you can really enjoy that hot lunch, coffee or treat with your teen.

4. Watch your speed.

It’s tempting to drive faster when you’re running late. You also may speed when you’re tired after a long day and you just want to get home. However, speeding is never safe and often costly—in terms of tickets and wear-and-tear on your tires. Speeding also uses more gas. Make every effort to drive the speed limit with your teen. Set your car to cruise control. Remember why you are modeling this behavior.

5. Talk to your teen about drinking and driving.

The teenage years are filled with experimentation. Your teen may on occasion try alcohol, even if it’s illegal and you have forbidden it. As we know, drinking and driving are a dangerous combination. About one in four teen car crashes involve driving under the influence, according to the Substance Abuse and Mental Health Services Administration. Talk with your teen about their options should they find themselves in a situation where they – or a friend – have been drinking and is about to get in the driver’s seat. Emphasize that it is never okay to drink and drive and that the consequences could be deadly.

6. Make time to drive with your teen.

Your teen has watched you drive for years. Now it is your turn. Make the time to drive with your teen, in all road conditions. Show them that you trust them behind the wheel. Compliment him/her on safe driving behaviors. The more time you spend in the car with them, the more comfortable you (and they) will be when they are driving on their own.

7. Create a written safety agreement.

Sure, you’ve told your teen a hundred times not to text while driving and to be home by 10 pm. But putting those rules in writing makes them official. A written safety agreement shows in black and white exactly what you expect from your teen. Violations of that agreement could result in loss of driving privileges.

Use the elements of your state’s graduated license program as a basis for the safety agreement. This will likely include limiting the number of passengers in the car with your teen and the times that he/she can be on the road. Make sure you include any other family rules such as the curfew for the car being home, and how you wish your teen to check in with you. In doing so, you are setting up your teen for a lifetime of safe driving.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Educators |

It’s spooky season!

Get your little monsters ready for a spooktacular good time and enhance their love of reading with these 13 fun and not-so-scary Halloween books.

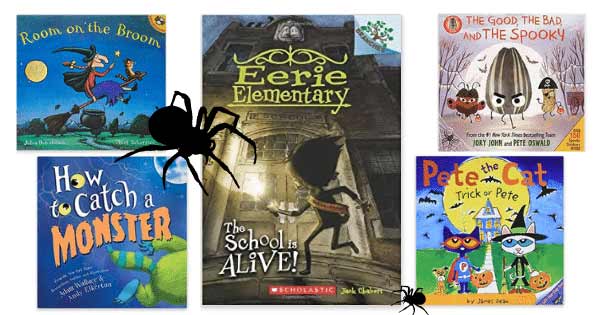

1. Pete the Cat: Trick or Pete

Pumpkins, candy, and costumes! With flaps that reveal fun Halloween surprises, this Pete the Cat holiday story is sure to be a sweet treat for your little trick-or-treaters. Follow Pete as he goes trick-or-treating from house to house and discover what is waiting behind each door.

2. Room on the Broom

The witch and her cat are happily flying through the sky on a broomstick when the wind picks up and blows away the witch’s hat, then her bow, and then her wand! Luckily, three helpful animals find the missing items, and all they want in return is a ride on the broom. But is there room on the broom for so many friends? And when disaster strikes, will they be able to save the witch from a hungry dragon?

3. Creepy Pair of Underwear

Jasper Rabbit is NOT a little bunny anymore. He’s not afraid of the dark, and he’s definitely not afraid of something as silly as underwear. But when the lights go out, suddenly his new big rabbit underwear glows in the dark. A ghoulish, greenish glow. If Jasper didn’t know any better he’d say his undies were a little, well, creepy. Jasper’s not scared obviously, he’s just done with creepy underwear. But after trying everything to get rid of them, they keep coming back!

4. Creepy Carrots

Another fun tale of Jasper Rabbit! Jasper loves carrots—especially Crackenhopper Field carrots. He eats them on the way to school. He eats them going to Little League. He eats them walking home. Until the day the carrots start following him…or are they?

5. Little Blue Truck’s Halloween

Beep! Beep! It’s Halloween! Little Blue Truck is picking up his animal friends for a costume party. Lift the flaps in this large, sturdy board book to find out who’s dressed up in each costume! Will Blue wear a costume too?

6. The Little Old Lady Who Was Not Afraid of Anything

Once upon a time, there was a little old lady who was not afraid of anything! But one autumn night, while walking in the woods, the little old lady heard . . . clomp, clomp, shake, shake, clap, clap. And the little old lady who was not afraid of anything had the scare of her life!

7. The School is Alive!

In this first book in the series, Sam Graves discovers that his elementary school is ALIVE! Sam finds this out on his first day as the school hall monitor. Sam must defend himself and his fellow students against the evil school! Is Sam up to the challenge? He’ll find out soon enough: the class play is just around the corner. Sam teams up with friends Lucy and Antonio to stop this scary school before it’s too late!

8. How to Catch a Monster

Get ready to laugh along in this fun children’s monster book as a brave young ninja heads into the closet to meet the monster that’s been so scary night after night! But what if our monster isn’t scary at all? Maybe our hero is about to make a friend of the strangest sort…

9. It’s Halloween and I’m Turning Green

It’s Halloween, and you know what that means! Candy! Costumes! More candy! What would happen if a kid ate a million hundred pounds of chocolate in one night? One thing’s for sure—when the kids from Ella Mentry School go trick-or-treating, it will be a Halloween to remember.

10. The Witches

Grandmamma loves to tell about witches. Real witches are the most dangerous of all living creatures on earth. There’s nothing they hate so much as children, and they work all kinds of terrifying spells to get rid of them. Her grandson listens closely to Grandmamma’s stories—but nothing can prepare him for the day he comes face-to-face with The Grand High Witch herself!

11. Pumpkin Jack

The first pumpkin Tim ever carved was fierce and funny, and he named it Jack. When Halloween was over and the pumpkin was beginning to rot, Tim set it out in the garden and throughout the weeks he watched it change. By spring, a plant began to grow! Will Hubbell’s gentle story and beautifully detailed illustrations give an intimate look at the cycle of life.

12. The Vampire Bunny

Harold, the dog thinks the Monroes’ new pet rabbit is just a cute little bunny. But when the vegetables in the Monroes’ kitchen start turning white, Chester the cat is worried. Could Bunnicula be a vampire bunny? Chester will stop at nothing to protect the Monroes and their vegetables from the threat.

13. The Good, The Bad, and the Spooky

Halloween is the Bad Seed’s favorite holiday of the year. But what’s a seed to do when he can’t find a show-stopping costume for the big night? Postpone trick-or-treating for everyone, of course! Can he get a costume together in time? Or will this seed return to his baaaaaaaaad ways?

Want some crepy tunes for the background while you read? Don’t forget to listen to our Halloween Playlist on Spotify all month long. And if you need costume or classroom party or treat inspiration, we’ve got you covered.

Have a safe and happy Halloween!

This article is furnished by California Casualty. We specialize in providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.