by California Casualty | Auto Insurance Info, Safety |

While we’ve all had some extra time at home to tidy up our houses and yards, we can’t forget about our vehicles! It feels like forever since we’ve been out on the road, and we’ve really missed our cars. Although we aren’t driving nearly as often right now, we will be soon, and that is why it is important to make sure our cars are clean and running properly.

Make sure your car is in prime condition for the next time you are behind the wheel by following our interior and exterior Spring Cleaning Car Care Checklist:

Cleaning the Interior

- Remove Trash: Cars fill up quickly when you have kids and are always on the go; receipts, water bottles, wrappers, etc. Make sure the first thing you do is pick up all of the trash on the inside and place a bag that can serve as a trashcan for the next time you have to throw something away.

- Shake out Mats: Remove all large pieces of trash or debris from the floor mats of your car. After, take all of the mats out of your car and shake them out in an open area, and then lay them in a clean spot. To make cleaning easier in the future, look into purchasing heavy-duty rubber mats.

- Clean Vents and Ducts: The best way to do this is with pressurized air, but if you don’t have it you can use a dusting cloth or a wet wipes

- Vacuum: Try and get every part of your vehicle that you can, this includes floorboards, seats, under the seats, trunk, cup holders, and any other space that is large enough. Don’t forget to vacuum the floor mats before putting them back in your car as well.

- Organize: If you have certain items that you keep in your car at all times, like blankets, umbrellas, chairs, sports equipment, reusable shopping bags, coolers, etc. Take these out, make sure each item is clean and has a special place that will not cause clutter or take up too much space when you put it back in your car after it’s been vacuumed. Placing organization bins in your trunk can help out with this.

- Wipe Down: Use a wet wipe or dusting cloth to clean and wipe down your dash, front console, and anywhere else that dirt can hide. And then if you would like to go an extra step you can detail your dash by using a microfiber cloth and some polish or dashboard wipes to make your steering wheel and dash shine.

- Change Air Freshener: After your car is clean from top to bottom change out your air freshener to a nice spring scent and you are good to go!

Now that your car is clean on the inside, it’s time to make sure everything is up and running properly on the outside.

Cleaning & Checking the Exterior:

- Get an Oil Change: You should change your oil about every 5,000 miles depending on the year, make, and model of your vehicle and your own personal driving habits. This will help keep your engine clean and running properly.

- Check the Air Filter: Air filters should be changed at least every 15,000 miles. Air filters are inexpensive and will help you increase your gas mileage, reduce emissions, and allow more air to flow to your engine to help it run smoothly and prolong it’s life.

- Check Your Tires: If a car has been sitting for long periods of time, especially in colder weather, pressure can slowly leak out of your tires, so it is important to check your air pressure and make sure you have the right amount. While you are checking the pressure look at the tread on your tires, if it is low consider getting new tires altogether.

- Buy New Wipers: Spring is rainy season for most of the US, and when you are driving in the middle of a spring storm, it is important that your windshield wipers do their job. You should replace them once a year, so spring is the perfect reminder.

- Go Through the Car Wash: Dust, mud, pollen, bugs, and rain residue are all commonly found on cars in the spring. Make your car look shiny and new by taking it through the car wash and getting a polish or by giving it your own wipe down at home! Pro tip: don’t forget the tires!

Drive safe!

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | News |

We have amazing employees at California Casualty. The Employee Spotlight is a new series aiming to highlight those talented individuals that make up our successful company culture and community. From human resource recruiters and learning and development trainers to claims adjusters, marketers, customer support specialists, partner relations, sales representatives, and beyond; each week, we’ll highlight a new team member, so you can get to know us better and see how our employees make us who we are as a company.

This edition of the Employee Spotlight will feature our Customer Care Specialist, Sarena Means

Sarena has been with us for almost 4 years now and is based in our Colorado office.

Let’s get to learn Sarena!

What made you want to work in Customer Service at California Casualty?

I heard it was a wonderful company that’s proven its place in the industry by being family-owned for 4 generations and in business for more than 100 years, and it definitely is!

People love working here and stay a really long time. I was so impressed with the tenure here. I’ve never seen another company with higher employee retention. It makes for a great family-like environment and culture.

What is your favorite part about your job?

I love my co-workers, I’ve never worked with better people, and we also have great customers. They love us and we love helping them!

Also, in my position here at CalCas, I feel like I have a lot of opportunities to be heard. I may not always get what I want, but I don’t ever feel belittled by my managers, or that I don’t have anything of value to contribute. The management is always willing to listen to me and my concerns. I feel like I’m important at California Casualty, and they give me the opportunity to do what I do best.

What have you learned in your position at California Casualty?

Looking back, I actually didn’t really know much about our affinity groups. We offer a lot of service to our community heroes and I’ve learned more than I ever thought I would about Teachers, and Police Officers, Firefighters, and Nurses.

You get to really know these people and what matters most to them, and it gives you a deeper level of respect for them and what they do every day to help us.

What are your favorite activities to do outside of the office?

I love my family and really enjoy all things with them. Movies, games, Sunday dinners, outside in the sunshine, any and all of it.

Life is changing for us right now. Our oldest moved out in November after buying her first house, and our youngest is going through the Air Force Basic Military Training. That means my husband and I are very new empty nesters and haven’t figured out what that means for us. We’re adjusting to a new normal, but it’s an exciting time!

Anything else you would like the audience to know about you?

My name is Sarena and I’m often teased by customers on the phone about having the same name as the famous tennis player; coincidentally, I actually played tennis in high school. Obviously didn’t go pro, but it was definitely a love of mine for a few years.

I was in an American Furniture Warehouse commercial circa 1999.

I love the Marvel movies, Harry Potter, and Lord of the Rings. I could watch any of the movies from any of the collections at any time and be completely entertained.

If you want to learn more about Sarena or are interested in a career at California Casualty, connect with her on LinkedIn! Or visit our careers page at https://www.calcas.com/careers

by California Casualty | Educators, Health |

Our Education Blogger is a public school teacher with over a decade of experience. She’s an active NEA member and enjoys writing about her experiences in the classroom.

The “discussion.” It’s inevitable. Kids are going to want to talk about Coronavirus-COVID19 (if they haven’t asked you already). This is a difficult, yet important, discussion. So, where do we start the conversation?

The good news- There’s no right or wrong way to approach this topic. However, if you are unsure of how to navigate this conversation, you may find these tips to be helpful.

Be Calm

Your kids naturally react to your emotions. When you are calm, kids are more likely to listen to you and better understand.

Be Available

Allow time in your schedule simply for talking. Tell your kids you are available if they have questions. Try not to force conversations. When kids are having strong feelings, validate those feelings and talk about them.

Be Prepared

Don’t be surprised if you have to repeat information to your kids; any type of crisis can be confusing. Kids need to find ways to feel reassured, and repetition of information can satisfy this need.

Be Honest

Adults want to make scary situations less frightening for kids. It’s natural. But during times of crisis and uncertainty, it is important to be honest with kids. Provide information using age-appropriate language and concepts. Also, remind kids that not everything they read or see is an accurate representation of the truth; we must be mindful consumers of media.

Be Sensitive

We may struggle to find the answer to the big question: Why? Please find reliable information to help you answer this question (fact sheets from CDC). Don’t use language that blames a group of people or assumes specific races or ethnicities contract or spread the virus.

Be Attentive

Know what your kids are watching and hearing on TV and online. It’s always a good idea to limit screen time, especially during a crisis. Too much information can be overwhelming and may cause confusion or anxiety. Also, be aware that kids may be listening to adult conversations.

Be Proactive

Revisit proper hygiene routines with them, like:

-

-

-

- Practicing sneezing and coughing into your elbow or tissue

- Washing hands for 30 seconds using soap and hot water (wash before eating or touching food and after blowing nose, coughing, sneezing, or using restroom)

- Hand sanitizing

- Avoiding sick people

Be Comforting

Reassure kids that they are safe in their homes. Try to avoid making promises to kids that no one in their families or close circles will contract the virus. Remind them that most people who become sick from COVID19 will recover.

Be Inspiring

This is a great time to show kids how helpful people can be during times of crisis. Even though many people have been affected by this virus, there are also many people who are reaching out to help. Ask your kids if they’d want to help during this time. Focusing our attention on positive actions can have a tremendous effect on our well-being.

A few ways kids can help:

-

-

-

- Give blood (must be 17 years old)

- Support your local food bank

- Donate money to reputable non-profits

- Write letters or make pictures to send to doctors and nurses at local hospitals

- Send letters or pictures to people living in residential centers (local retirement centers and nursing homes)

One last thing to remember: kids are resilient. The way adults respond and offer support to kids can help mitigate the potential negative emotional consequences related to this traumatic event. Our kids will bounce back, and perhaps even grow, from this experience.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

For more information visit:

www.cdc.gov

www.aacap.org

by California Casualty | News |

We have amazing employees at California Casualty. The Employee Spotlight is a new series aiming to highlight those talented individuals that make up our successful company culture and community. From human resource recruiters and learning and development trainers to claims adjusters, marketers, customer support specialists, partner relations, sales representatives, and beyond; each week, we’ll highlight a new team member, so you can get to know us better and see how our employees make us who we are as a company.

This edition of the Employee Spotlight will feature our Customer Care Specialist, Amber Ferrell

Amber has been with us for almost 4 years now and is based in our Colorado office.

Let’s get to learn Amber!

What made you want to work in Customer Service at California Casualty?

I love helping people!

With California Casualty insuring those that make the biggest difference in our communities (teachers, first responders, and nurses), there is an immense amount of satisfaction you receive knowing that you have made a positive impact on one of those customers. 🙂

What is your favorite part about your job?

My favorite part about working at California Casualty is that you are given the resources and support to accomplish your goals and to be successful in any role.

California Casualty is definitely a company that you want to work for until you retire. You have so many opportunities for internal growth, that anything is possible!

I love working here. Being a part of this organization makes me feel as though I am not only part of a team, but a family. Not just with my fellow colleagues, but with our customers as well.

What have you learned in your position at California Casualty?

Working in customer service I have discovered that every day is a learning experience, giving you the opportunity with each customer interaction to expand your knowledge and confidence.

I can honestly say, I learn something new every single day.

What are your favorite activities to do outside of the office?

I enjoy cooking and baking, gardening, DIY projects, camping and just getting away to the mountains whenever possible

Anything else you would like the audience to know about you?

I was born and raised in Colorado. I lived in South Florida for 11 years before returning home to Colorado. While in Florida I worked at a florist for 10 years, which is where I developed my love for plants and flowers. I will always appreciate how much a bouquet of flowers can brighten someone’s day

My husband and I have a serious passion for cooking. We enjoy taking cooking classes together and putting our skills to the test at home with our kiddos.

We also have a love for classic cars and we hope to one day buy a project car that we can restore.

If you want to learn more about Amber or are interested in a career at California Casualty, connect with her on LinkedIn! Or visit our careers page at https://www.calcas.com/careers

by California Casualty | Educators |

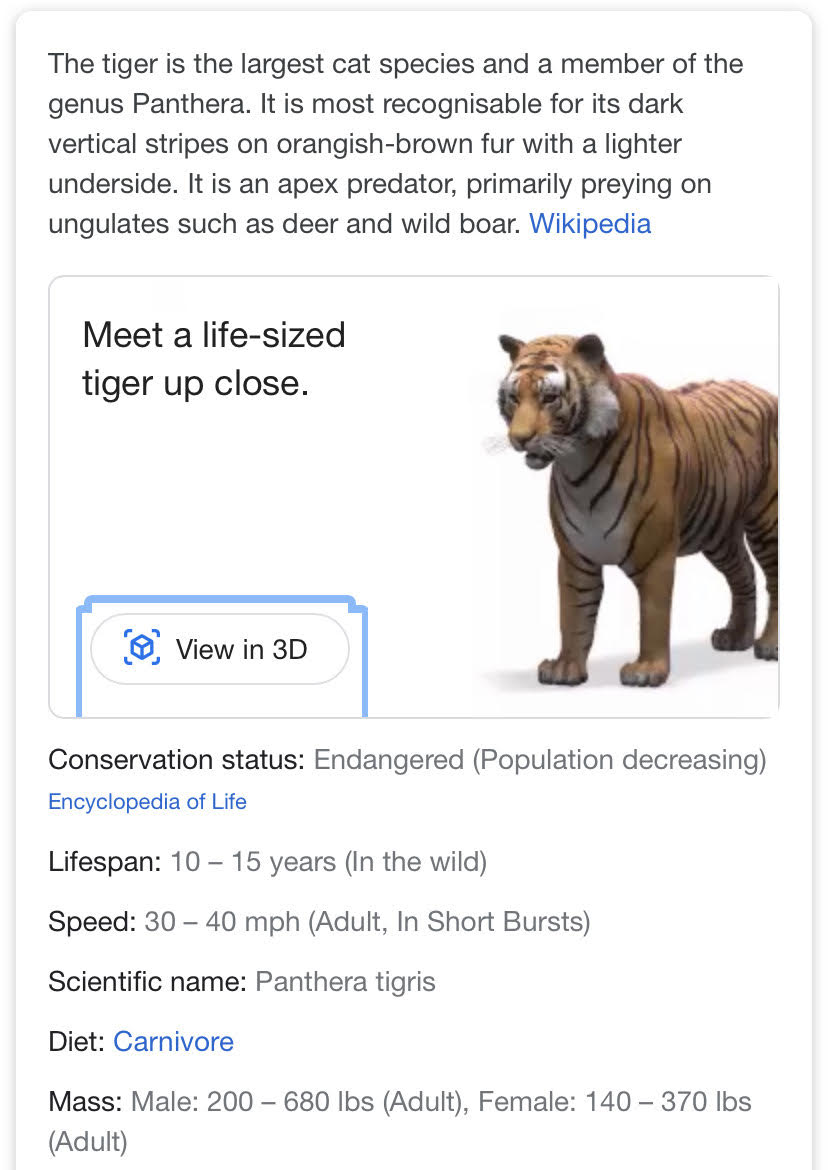

You may not be able to get out and visit a regular zoo, but with Google’s 3D animal feature you can bring the zoo to you!

How To Use the Feature

It’s super simple! All you have to do is Google the name of the animal you would like to see in 3D. Google put’s it’s AR right at the top of the search, so when you scroll down you should see your animal with the button “View in 3D”.

You even get some facts about each animal that you are viewing, so you can make a whole lesson plan out of it!

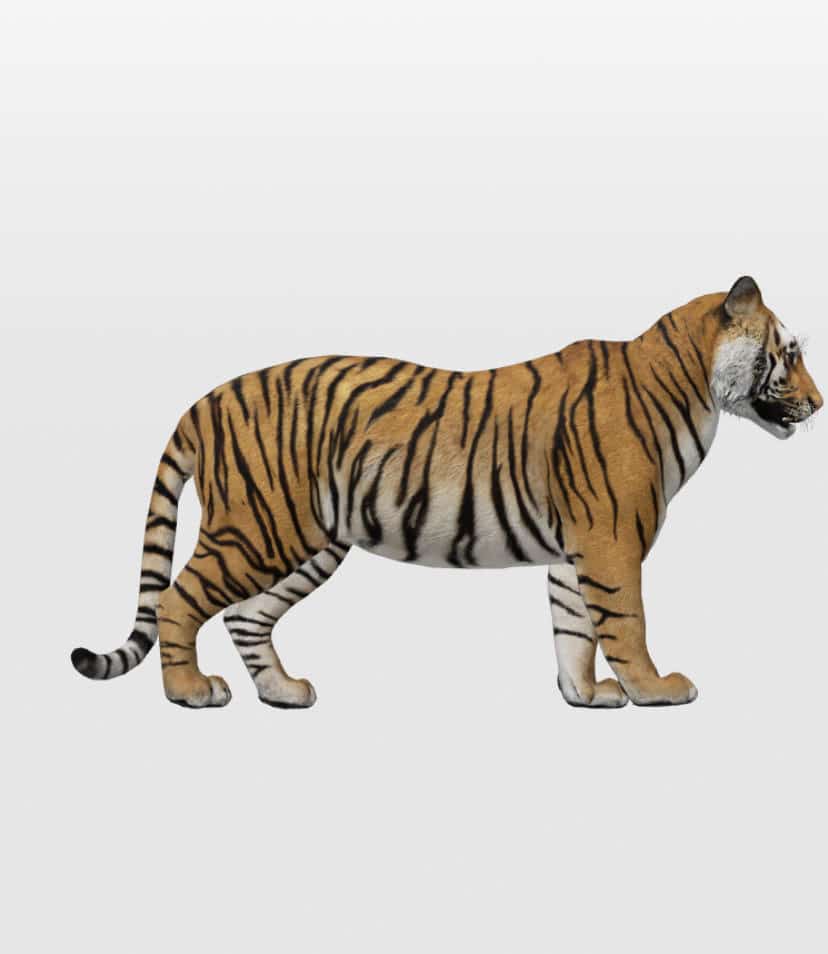

After you click the “View in 3D” button, you will be directed to a screen that has a 360-degree view of your animal that you are able to zoom in and out on. From here you can make the animal appear against a white background OR in the center of your room, but sliding the between “AR” and “Object”.

The best part about this feature is the animal is actually moving the whole time as if it’s real. You can see it blink, twist it’s head, open it’s mouth, roar, swim, etc.

What Animals Can I View in Google 3D?

You can view any of these animals using Google’s 3D feature:

- Alligator

- Angler Fish

- Ball Python

- Brown Bear

- Cat

- Cheetah

- Deer

- Dog

- Bulldog

- Pomeranian

- Lab

- Pug

- Rottweiler

- Duck

- Eagle

- Emperor Penguin

- Giant Panda

- Goat

- Hedgehog

- Horse

- Leopard

- Lion

- Macaw

- Octopus

- Racoon

- Shark

- Shetland Pony

- Snake

- Tiger

- Turtle

- Wolf

There is no official list from Google; however this list has grown since first launching the program, and 9 to 5 Google predicts more will be added over time.

The animal kingdom is just a click away, so what are you waiting for?

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.