by California Casualty | Auto Insurance Info |

Your son or daughter has graduated college and is ready to start his or her adult life. Is now a good time to take them off your car insurance?

It’s a decision that many parents tend to put off. Unlike health insurance, there is no maximum age for children on a vehicle policy. As long as they live with you, and drive a car you own, they could remain on your policy indefinitely. However, you may also choose to remove them, and that’s the case even if they do live with you. Here are some reasons why you might consider it.

-

- It will likely save you money. It is more costly to insure younger, less experienced drivers and so removing them from your policy will likely lower your premium.

- It will teach your child responsibility. Car insurance premiums are usually among the first bills that a young person is responsible for paying.

- It can improve their credit score. Paying the premiums on time will help build your child’s credit score.

- You both may qualify for a multi-vehicle household bundles or discounts.

- In some cases, children move to a new address and don’t update their auto insurance right away. Getting your child his or her own policy will ensure that there is no gap in coverage when they move out.

When you need to remove your child

If you’re thinking about removing your child from your auto policy, read on. We’ve compiled a list of situations when it is recommended that young adults have their own policy.

Your son or daughter no longer lives with you.

-

- Your policy is tied to your home address. If your child has moved away, they can’t be on your policy.

- If, however, your son or daughter is simply living at college, their home address is likely still yours. That allows them to remain on your policy, with some modifications.

- If the college is enough of a distance away, and they are not driving, the insurance premium may be temporarily discounted or reduced.

- If they take their car to college, the new location will be incorporated in the premium quote.

Your son or daughter is covered under another auto policy.

-

- The car that your child drives can only go on one policy. If your son or daughter is covered under another policy, such as in cases of separation or divorce, you do not need to pay for a second policy.

- If your son or daughter lives mostly at one location, your teen may be listed on the policy at that home.

- If your son or daughter regularly parks his or her car at both parents’ homes, your child will still be covered at both locations under one policy.

Your child has bought his/her own car.

-

- Insurance companies generally require that any vehicles on your policy be in the primary policyholder’s name.

- If your child buys his/her own car, the insurer may require a separate policy.

- If you do not get a separate policy, then you remain the primary policyholder. If your child gets into an accident with his/her car, and the claim is covered, the check will be written to you.

How to remove your child from your policy

1. Contact your insurer. Ask to have your child removed from the policy.

Insurance companies usually require you to list all household members of driving age when you apply for, or renew, your policy. If your child gets his or her own policy, and still lives at home, you will need to exclude them from your coverage. That means they won’t be covered in an accident even if they had an occasional use with permission. Note that you may be charged a fee or excluding a driver that lives in your household.

2. Provide proof of other insurance.

When you remove your child from your policy, your insurer will require proof that your child has his/her own policy. You can choose to get a new policy with your current insurer and maybe take advantage of household discounts. You also could change insurance companies. Make sure to set up the timing so that one policy kicks in when the other one lapses.

3. Provide proof of new address.

If your child has moved to a new address, your insurer may ask for proof of residence. This may include a utility bill or other authorized mail.

Talk to your insurer about options so that you can find the best fit for your family, and also meet state and insurance requirements.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

You’ve probably heard of someone stealing a catalytic converter, but never thought it could happen to you in your neighborhood. Well, think again…

The number of catalytic converter thefts reported in insurance company claims has greatly increased over the past three years, and the National Insurance Crime Bureau estimates that these thefts increased by 1,215% between 2019 and 2022. Stolen catalytic converters can garner anywhere from $20 to $350 on the black market, with the replacement cost to vehicle owners averaging over $2,500 according to the National Automobile Dealers Association.

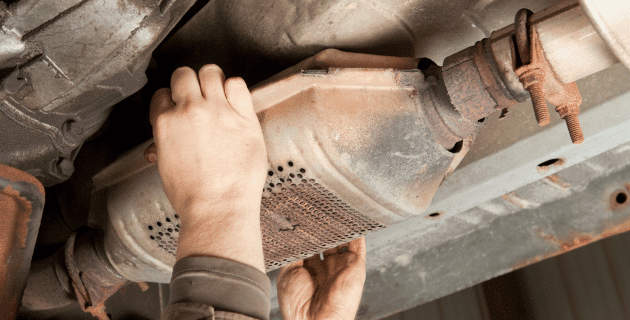

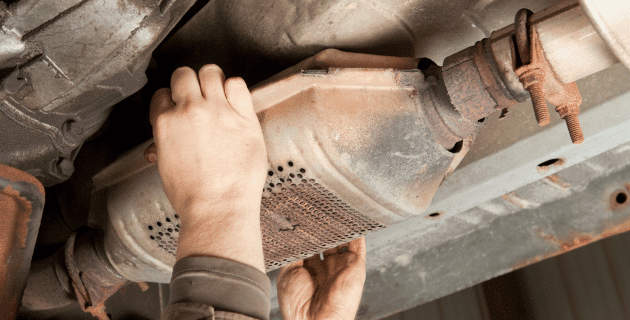

What are catalytic converters?

Catalytic converters are part of your car’s exhaust system. They turn harmful emissions into harmless gases. These essential car parts contain precious metals like platinum, palladium or rhodium, which can be worth hundreds to thousands of dollars when sold to scrap yards. Catalytic converters are especially attractive to thieves because they are not easily tracked. Plus, they can be removed from your vehicle in a matter of minutes.

What vehicles are thieves targeting?

Any car manufactured after 1974 has a catalytic converter, and is a potential target. However, thieves often look for taller vehicles like pickup trucks or SUVs because they can slide underneath them more easily. They also look for hybrids, which have a greater supply of those precious metals in their catalytic converters. The only vehicle without a catalytic converter is an electric vehicle (EV).

What steps can you take to prevent a theft?

You want to make it more difficult for thieves to steal your catalytic converter, and harder for them to profit if they do. Here are some of the most popular ways to help prevent a theft.

Keep things well-lit and secure.

For thefts that occur at night, keeping your property lit up could be a deterrent. Install motion sensor lights in your driveway which could surprise a thief and potentially scare him away. A home security system with visible cameras also can help prevent thefts.

Park in the right place.

Park in your locked garage if you have one, or in your driveway. Avoid street parking that is beyond the scope of your security cameras. If you’re in a public space, choose the first row of parking spaces near the building. These are generally the ones that are well lit and covered by the building’s security camera. They have the added advantage of being the places where people are most likely to pass by.

Pro Tip: For cars with lower clearances, you might find that parking on hills, gravel or uneven surfaces can help make it harder for thieves to get underneath. They may pass by your car for a converter on another vehicle that’s easier to reach.

Mark your converter.

Etch your car’s VIN or license plate number onto your catalytic converter. This will help alert scrap dealers that it’s a stolen part. While thieves could file off the etching, the filing marks will still be noticeable. Alternatively, paint your catalytic converter a bright color. It’s unsellable in that condition; thieves will have to clean off the paint, which is a time-consuming process. They may decide not to bother with your catalytic converter and look elsewhere.

Install an anti-theft device.

Aftermarket devices can be installed that make it difficult or impossible to remove a catalytic converter. These include cages, panels and shields. You can weld the bolts of your converter so they cannot be turned. You also can weld your converter in place. Add a warning sticker on your vehicle’s window saying that your car has an anti-theft device. Thieves will see it and take notice.

Add an alarm.

You can install a motion sensor alarm that will go off if someone is using a vibrating power tool on your car. It’s easy to install. The downside is that it’s also easy to remove, and so it may not be the deterrent you want.

Start a neighborhood watch group.

Catalytic converter theft is often a crime where a whole neighborhood is targeted on a single night. Forming a neighborhood watch group will help prevent a series of thefts. Set up a text chain and share information from your doorbell and security cameras. Report suspicious behavior, such as unknown cars circling the block. If you see someone tampering with vehicles on your street, report it immediately to the police—and alert your neighbors.

How do you know if your converter is stolen?

You don’t have to know cars to know when your catalytic converter is stolen. You’ll hear it as soon as you start your car. It will make a loud roar which will become even louder when you accelerate. Your car also may sputter. It will not drive smoothly. You may notice an increase in exhaust and/or exhaust smells. The check engine light may go on. The theft may have been silent and secretive, but the aftermath is not.

The cost to replace a catalytic converter can be pricey, but if you have comprehensive insurance for your vehicle, that will help to cover the replacement part, after the deductible has been met. Make sure that your auto insurance policy is up to date and that you are fully covered should anything happen.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

You don’t have to wait for your auto policy to expire to change insurance companies. However, you do need to make sure you’re fully covered without any gaps in insurance. We’ve compiled some guidelines to help you decide if a change is right for you.

When should you think about changing policies?

While you don’t need a reason to change your auto insurance, there are some times when it makes sense for you to revisit your policy—even if you don’t change insurance companies. You may end up modifying your current policy to meet your evolving needs. For example:

-

- If you’ve had a major life change, such as getting married or divorced, you may need more or less insurance.

- If you’ve moved to a new zip code or state, the new location could affect your premium.

- If you’ve become a homeowner, you can bundle your auto and home and save money.

- If you’ve gone from working out of the home to remote work, your annual mileage may be less.

- If you’ve bought a new car, you will want to check insurance policy options.

- If your teenager is about to get his or her license, that will add to your policy.

- If your credit score has improved, you may qualify for a lower rate.

- If you’re unhappy with your current insurer, you can consider a change.

- If you’re approaching your renewal date, you can terminate a contract without cancellation fees.

Follow these steps to make the change.

Step 1: Consider your coverage options.

Figure out how much coverage you need. If you depend upon your care, you want to make sure that you have enough to replace it if necessary. Also, check your state laws. Some states will require you to have certain car insurance. If you lease or finance a car, your lender or lessor will require you to purchase collision and comprehensive insurance.

Step 2: Compare quotes from multiple insurers.

Get quotes from several insurers, and make sure you are comparing the same coverage, limits and deductibles. Sometimes policies are cheaper because they don’t have the same coverage. This is also a good time to contact your current insurer to find out about discounts, or other ways to lower your cost. California Casualty offers discounts to nurses, educators, and first responders.

Step 3: Check for penalties and perks.

If you’re in the middle of your policy contract, there may be a penalty for canceling. Make sure you figure that into the decision to switch. You also will want to look for the perks, or little extras, that are offered. Some insurers offer inexpensive roadside assistance or accident forgiveness for qualified customers. Some have smartphone apps or are available 24/7 online.

Step 4: Do your research.

You want to know how your new insurer handles claims, and whether they have a good customer service rating. It may not be worth a lower price if it’s going to be a hassle dealing with the new company. Check out your insurer with the Better Business Bureau, JD Power, or the National Association of Insurance Commissioners.

Step 5: Make sure there’s no gap in coverage.

Car insurance lapses can be expensive, especially if you have an accident on the day in between. If you cancel one policy, make sure the other one is already in place. Your new insurance company can provide proof of insurance to your old company. However, they cannot cancel your policy. You need to do so. You’ll receive a refund for any unused portion. There may be a cancellation fee.

Pro Tip: Also remember to cancel automatic payments to your old insurer with your bank or credit card.

Step 6: Notify your insurer and lender.

Make sure to officially cancel your policy with your old insurer. Otherwise, your insurer will think you simply stopped paying your bill, and you could be liable for charges. Some insurers require 24 hours before canceling, so make sure you are aware of the terms. Also let your lender or lessor know about your new insurance if you are leasing or financing your car.

Step 7: Replace your insurance ID.

Once you make the change, ask for a digital copy of your insurance card. You can also order a printed card. Remember to place your new insurance card in your car’s glovebox.

Finally, if you have an open claim, wait to make a change.

You may not be able to change insurers if you have an open claim with your current insurance company. The claim has to be paid and closed. Also, the rate quoted from your new insurance company may not take into account that most recent claim. If that’s the case, you could have a big increase when you renew with the new company, or even be responsible for a retroactive fee.

Get started with a free quote today at mycalcas.com/quote.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info |

You probably don’t think much about the air you breathe in your home, but maybe you should. That air can be filled with tiny debris- including dead skin cells, pollen, dirt, and bacteria, and breathing too of it much over time could be unhealthy. Fortunately, your home’s air filters trap these particles, helping keep your whole family healthy.

What exactly is floating in the air?

-

- Dust – We see it on our tables and abandoned trinkets on our mantle, but where does dust come from? The bulk of dust varies home to home, but basically dust is ‘anything that can flake off’ including dead skin cells, pet fur, food, dirt, pollen, pieces of books, carpet upholstery, debris from outside, etc. If not properly cleaned, mold, bacteria, and dust mites are all likely to inhabit dust and pollute your air.

- VOCS – Your furniture, your belongings, and the building materials in your walls also give off gases. These are known as VOCs, volatile organic compounds. They are floating in the air and affect your air quality. You probably also are breathing in gases released from cooking and cleaning. In addition, pollutants can travel in from outside. You might even have mold if there is humidity in your home.

You won’t necessarily smell or see any of these, and exposure to these particles is pretty much unavoidable. Over time, these compounds can build up in your system and lead to illness. That’s why air filters are so important. They can trap alot of the unhealthy particles. (They won’t however trap mold. You will need a separate treatment to get rid of the source of the moisture and remove the mold.)

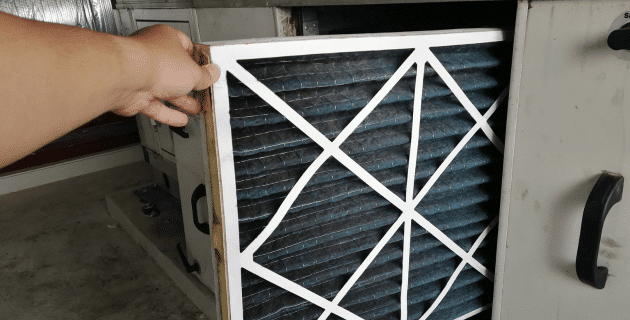

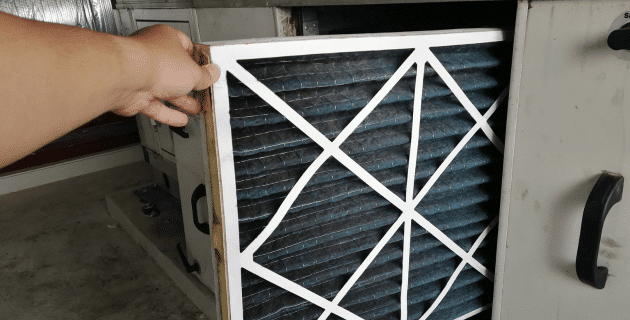

What are air filters?

Air filters resemble rectangular cardboard frames filled with a material that looks and feels like pleated or woven coffee filters. When air is forced through the filter, the particles become trapped in the material. You’ll find air filters in your heating and cooling system, and as part of your furnace. Typically, a house will have one or two intake vents that require an air filter but you may have more depending upon the number of floors.

One size does not fit all.

Air filters come in different standard sizes and thicknesses. The measurements are printed right on their frames. Check the size of your vent openings so you’ll know which ones to buy. Air filters work best when they fit snugly. That way air goes through it and doesn’t leak around it. However, you should not have to bend or crush the filter to make it fit. While filters range from about one to five inches in thickness, most HVAC systems are built for one-inch thicknesses.

What are air filters made of?

Air filters are made from various materials, which allows them to collect different-sized particles. Most filters are disposable but there are some that are considered permanent and can be cleaned and used again. Here’s what you might find at your local hardware store:

-

- Disposable fiberglass: The most common type, this collects bigger particles.

- Disposable pleated: This is made of cotton or polyester, and is able to pick up large and small particles. It is the most affordable.

- Disposable electrostatic: This type has electrically charged fibers to collect smaller particles. It is slightly more expensive than the disposable pleated.

- Permanent electrostatic: This type is washable and can be reused. While you need to clean it regularly, you also will need to replace it every 6-8 years. It’s more expensive than disposable filters.

- High efficiency pleated: This type is thicker than many others, as much as 4-5 inches, which doesn’t work for a lot of systems. It can trap the smallest particles, and is more expensive.

How good are they at trapping particles?

Air filters come with a rating scale that tells how well they trap particles. This rating is called MERV, short for Minimum Efficiency Reporting Value. MERV ratings were established by the American Society of Heating, Refrigeration, and Air Conditioner Engineers.

-

- MERV 1-4 provides the basic level for the lowest cost.

- MERV 6-8 offers good filtration and is most commonly used in homes.

- MERV 9-12 is above average and can trap smaller particles.

- MERV 13-16 offers the highest quality and removes particles as small as 0.3 microns.

It’s important to note that the higher the MERV rating, the lower the airflow. That means your system will have to work harder, which could be more expensive and also lead to a shorter system lifespan. Consult a professional HVAC technician to provide a recommendation for your system and needs.

How to change your filters

Changing an air filter is quick and easy. Follow these steps. Use a ladder if the vent you are trying to reach is high up.

-

- Turn off your furnace.

- Locate the filter compartment. Remove the door or service panel.

- Slide the old filter out and put the new one in.

- Use a rag to clean any dust on the vent.

- Repeat with intake vents throughout your home.

- Turn your furnace back on.

What if your filter looks clean when you go to change it?

-

- Check and make sure it’s fitting well with no gaps.

- Make sure it’s not upside down. Arrows should point toward the fan or your system.

- Try a filter with a higher MERV rating to catch more.

How often should you change your filters?

A clean air filter makes your heating and cooling system more efficient. This can save you money, as much as $9-$22 a month. Manufacturers usually recommend changing your air filter every 60-90 days. However, if you have pets or allergies, you may want to replace them more frequently. Create a calendar alert so you will know when to change yours.

Pro Tip: Hold your filter up to the light. If you can’t see light through it, it is time to change it.

In addition, you may want to add pet-friendly plants that also help with indoor air quality. Finally, make sure to protect your home with the right insurance for added peace of mind. After all, your home is your greatest investment.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info |

You’ve bought your dream home and it’s time to get it insured. You want to choose the right coverage to fully protect your investment. While you have a basic idea of what home insurance probably covers, you may not know the particulars.

A homeowner’s policy is actually a “package” of coverages. It protects your home from specific events that can damage your property, and provides additional living expenses if you are unable to live there due to an insured loss. It also protects your personal belongings. In addition, your homeowner’s policy covers you for lawsuits or liability claims that might otherwise be your responsibility if you accidentally injure other people or damage their property. Here’s the breakdown from A to Z (or in this case, F).

Coverage A: Dwelling

Dwelling coverage refers to the structure of your home. This includes the roof, walls, floorboards, cabinets, and bath fixtures. The easiest way to think about it is that if you could tip your house upside down, the dwelling is everything that remains attached.

What is covered: This insurance covers open perils. That means a loss is covered unless it’s excluded by your policy. Coverage A generally covers direct physical loss due to fire/smoke, lightning, windstorms and hail, explosions, vandalism and theft. If one of these perils destroys your home, your insurance provider will pay to rebuild it up to your policy limits.

What is not covered: If it is listed as an exclusion, it is not covered. Typically, natural disasters such as flooding and earthquakes are not covered by dwelling coverage. You can add these coverages with a separate policy or an endorsement added to your property policy.

Coverage B: Other Structures

If your pool is in the ground or installed permanently above the ground on your property, it is covered under Coverage B – Other Structures. This is an insurance term describing a detached structure on your property. Other structures include pools, fences, gazebos, sheds, etc. However, if your pool is above-ground but portable, it is considered part of your personal property and covered by Coverage C – Personal Property insurance.

What is covered: This insurance covers open perils. That means a loss is covered unless it’s excluded.

What is not covered: Typical exclusions include flood, earthquake, or wear and tear. For other structures, the coverage limit is generally set at 10% of your home’s coverage limit. That means if your home is insured for $200,000, the coverage limit for your detached garage would be $20,000. For an additional premium, you can add an endorsement to increase your coverage.

Coverage C: Personal Property

Personal property coverage protects your possessions, such as furniture, clothes, sports equipment, and other personal items. Again, if you could tip your home upside down, everything that would fall out is considered personal property. This coverage protects these items whether they are in your house or off-premises.

What is covered: If your possessions are stolen, or damaged by fire/smoke or any of 16 covered “perils,” your policy will pay for them subject to your deductible. For personal property coverage on a homeowner’s policy, you typically get 50 or 75% of Coverage A, the total amount of coverage for your home. You may choose replacement cost or the actual cash value (ACV) for reimbursement. ACV is the amount the item is worth, minus depreciation for its age. It will cost a little more for a policy that provides replacement cost.

What is not covered: There are dollar limits for certain items, such as jewelry, firearms, animals, cars, planes. See your policy for a full list. You may choose to purchase additional coverage to ensure your valuables are fully insured.

Coverage D: Loss of Use

If your home is damaged in a covered loss, it may not be livable. If that’s the case, you would need to stay somewhere else. Loss of Use, also called Additional Living Expense, covers you for any necessary increase in living expenses, such as lodging, food, and gas.

What is covered: Your policy will provide a flat percentage toward living costs, usually 30% of the Coverage A amount.

What is not covered: Some states have time limits on when you can use this coverage. Payment will be for the shortest time required to repair or replace the damage, or if you permanently relocated, the shortest time required for your household to settle elsewhere.

Coverage E: Personal Liability

Personal Liability protects you if a claim is made or a suit brought against you for bodily injury or property damage caused by an occurrence to which coverage applies. Liability covers you at your place or anywhere in the world.

What is covered: If you are found liable, the policy will pay up to its limit of liability for damages for which an insured is legally liable. This can include medical expenses, lost wages, pain and suffering, and permanent scarring. The policy also provides a defense in court, if needed, for the policyholder. This is at the insurance company’s own expense.

What is not covered: You are only covered up to your policy’s limit. Coverage starts at $100,000 but should be increased to a minimum of $300,000. You want to consider how much the home and all of your assets are worth and select an amount up to $1,000,000. If you have a pool, hot tub, trampoline or other attractive nuisance which is likely to attract children, consider adding an umbrella policy for additional coverage.

Coverage F: Medical Payments & Other

If you are not liable, but your guest was injured through his/her own fault, then Coverage F – Medical Payment to Others may cover your guest’s medical bills.

What is covered: Under Coverage F, the insurance company will pay the necessary medical expenses to a person injured on the insured location with the permission of an insured, or off the insured location if the injury is caused by the activities of an insured or caused by an animal owned by an insured.

What is not covered: You and your family are not covered. This is only for guests, and they are only covered up to the limit of your policy.

A Word About Deductibles

Generally, the higher your deductible, the lower the cost of your insurance premium. Since the deductible is the amount your insurance provider will subtract from an insurance payout, you’ll want to select a deductible that you’re comfortable paying out-of-pocket after a loss.

Common Home Endorsements

You may add specific endorsements to your homeowner’s package of policies for additional coverage. Here are some of the most popular ones.

Scheduled personal property (SPP) Coverage is for items that have higher values above your personal property coverage limits. This includes heirlooms, watches, jewelry, instruments, and furs. SPP offers much broader coverage for your precious items – if you misplace a set of earrings, they are covered; if a diamond falls out of a ring, or a guitar breaks, they’re covered. There is no deductible if the covered items are stolen, lost, or damaged. Insurance pays the lowest of the four options: repair, replace, actual cash value or the amount of insurance.

A Water Back Up and Sump Discharge or Overflow Endorsement covers two potential losses: (1) if the sewer backs up into your home via the sewers or drains or (2) if your sump pump overflows or discharges. The amount of coverage and the deductible vary by states. The endorsement comes with a maximum amount of coverage ($5,000 or $10,000) and its own deductible ($250, $500 or $1,000).

Home Day Care Coverage: This extends your liability coverage to those in your care. Most states require you to have it for licensing, and parents also may request to see proof of this coverage.

Refrigerated Property Coverage: When there is a power outage, the food in your refrigerator could spoil. A standard homeowner’s policy may cover the costs of replacing some of the food. A refrigerated property policy provides additional coverage. A refrigerated property policy adds up to $500 of coverage for property, such as meat that spoils because of a power outage or equipment failure.

Special Computer Coverage: With everyone working remotely, computers have become our lifeline. Consider a special computer coverage option to ensure you are covered for your devices: desktop computers, laptops, tablets and smart phones. With this coverage, you will receive more money for your devices if they are damaged than with traditional homeowner’s.

Permitted Incidental Occupancies: If you have a home-based business, this endorsement increases the coverage for your business property. This includes furniture, equipment, and supplies.

Ordinance or law coverage helps you bring your home up to current building codes for repairs and/or rebuilding.

Identity fraud coverage covers the expenses associated with identity theft.

Remember that you can ask for ways to lower your home insurance costs when you purchase a policy. You may be eligible for group discounts. There are discounts if you have a burglar/fire alarm. There also is a cost savings and convenience of paying in full with most policies.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.