by California Casualty | Health, Helpful Tips |

It’s easy to exercise in the spring and fall when the weather beckons you to come outside. It may take a bit more inspiration in the winter, but it’s worth it.

Getting outside in cold weather connects you with nature, lifts your mood, and gives you a beneficial dose of sunlight/vitamin D. It also boosts your immunity during cold and flu season. With no heat and humidity, you might even be inspired to work out longer.

However, there is a way to do it safely. Follow these winter fitness tips for the basics of exercising in cold weather.

Choose the right fabrics.

When you’re wet, you lose body heat and that makes you feel cold. The colder you are, the less likely you’ll want to work out. In addition, cold can put you at risk for frostbite or hypothermia. Avoid active wear made from cotton, which holds in moisture from sweat and rain/snow. Instead choose synthetic fibers like polyester, nylon, and polypropylene. They dry quickly and wick away moisture.

Layer your clothes.

Use layers to trap warm air next to your body. Start with a thin base layer of synthetic fabric, which will keep sweat away from your skin. Then add a middle layer such as a fleece. Your outer layer should be either a lightweight nylon windbreaker or if it’s cold, a heavyweight waterproof jacket. As you exercise and get warmer, remove a layer, and tie it around your waist. That will help you from getting hot and sweaty which can lead to feeling damp and cold.

Pro Tip: Wear bright colors. Visibility is more limited in winter from rain, snow, fog, or dark skies. Be seen by the people and vehicles in your immediate area.

Protect your hands and feet.

In cold weather, blood is circulated to the core of your body, leaving less heat funneled to your extremities – your fingers, ears, nose, and toes. That means these areas are less warm. To counter that effect, wear a hat or headband, gloves or mittens, and thick socks. Choose materials like wool or synthetic as cotton could get wet. If your toes get cold, consider your shoes. Running shoes are designed to let heat escape. You can buy shoe covers at skiing and hiking stores. There also are specialty running sneakers designed for winter.

Protect your skin.

Winter isn’t just cold; it’s dry, and that can affect your skin. Apply moisturizer or lotion regularly. When you’re going to be outdoors, also apply sunscreen. SPF rays can damage your skin even when it’s cloudy. Snow reflects up to 80 percent of UV rays, so you get doubly exposed. UV rays also increase with elevation. Every 1,000 meters (3,281 ft.) in altitude, UV radiation increases by 10 percent.

Make sure you have traction.

When you’re exercising on icy surfaces, it’s easy to slip. That can lead to injury. Make sure that you have footwear with good traction and stay on plowed surfaces or salted ones. Take care to remove ice from your own property. If you will be primarily on the ice and snow, consider adding snow or ice spikes to your footwear. Just note that while those spikes help on icy surfaces, they can affect your balance on dry ones.

Take the time to warm up.

It’s especially important to warm up for an exercise routine in cold weather. You want to

Increase your blood flow and temperature so you’re not at risk for sprains and strains. A good analogy is what happens when you stretch a cold rubber band. It can snap more easily than a warm one. That’s what could happen to your muscles. For your warm-up, choose low intensity moves that are like those in your workout. Lunges, squats, and arm swings, for example, are good for runners.

Pro Tip: Head into the wind at the beginning of your workout. When you’re on your way back and feeling sweaty, you won’t have to fight the wind chill as much. That will help keep you warmer.

Pay attention to your breathing.

Cold weather causes your airway passages to narrow. That’s why it can hurt to breathe when you’re exercising in cold weather. Breathing through your nose can help but isn’t always possible when you’re moving intensely. Try wrapping a scarf or some thin fabric around your mouth. It will help keep in the humidity.

Hydrate.

You may not feel as thirsty during cold weather workouts. However, you’re still losing fluids. Dehydration carries risks, including headaches and a drop in energy. Sip water while you’re exercising. If you’re going to be exercising for more than 90 minutes, choose a sports drink like Gatorade.

Cool down. Change clothes.

You can get chilled fast after a workout. Take the time to cool down, which helps reduce later muscle soreness. It also helps your heart transition from an exercise pace to a normal rhythm. Then get out of your damp clothes. Take a warm shower and change into clean, dry clothes.

Avoid severe weather.

While cold weather workouts are beneficial, there’s a limit to when you should exercise outside. Avoid the extreme cold. Don’t exercise outdoors during winter storms. Prolonged exposure to the cold can cause frostbite and hypothermia. The cold also can put a strain on your heart. If you have a chronic health condition such as asthma or a heart problem, talk to your doctor about whether cold weather exercise is right for you.

Know the signs of hypothermia.

Finally, be aware of the signs of hypothermia. That’s when your body temperature drops too low and affects other systems in your body. If you experience any of these signs, get medical help right away.

- Shivering

- Lack of coordination

- Slow reactions

- Slurred speech

- Mental confusion

- Exhaustion or sleepiness

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Helpful Tips |

It may be tempting to hide under the covers on the next cold winter day and binge movies. But it’s also a great time to get things done at home. In fact, it’s easier to be productive when you don’t want to be outside. Plus, checking off your “to do” list feels great. Follow this guide for some ideas of productive things that you can do at home on cold winter days.

- Declutter

It’s time to pick your favorite waffle iron and set the rest free. Go through your home and collect items to donate. Include gently used bedding, warm clothing, shoes, books, and even canned goods for the food bank. Clean up and give back at the same time. Check out our guide on Easy Ways to Declutter Your Home for more tips.

- Throw things out.

It goes without saying but you probably have single socks that you’re hoping will eventually find a mate. Now is the time to part with them, too. Go ahead and throw out your extra socks, your worn-out underwear, half-used candles, orphaned Tupperware (bottoms without lids or vice versa), expired food, and half-empty, fully expired beauty products.

- Organize

When is the last time you took a good look at your closet? Or your kitchen cabinets? Now is a great time to go through them. Start with one space. Pull out everything and assess whether you use these items or not. For your closet, put together outfits for various occasions to determine what you will wear and what you probably won’t. For closets, cabinets, and other storage areas, it’s always helpful to put similar things together so that they’re easy to find for future use.

- Listen to a book.

You can curl up on the couch and read the latest bestseller—or you can listen to the audio version while you’re cleaning, organizing, and decluttering. Not only will it provide the perfect soundtrack, but it will also engage your brain and you will feel extra productive.

- Workout

Getting up and moving is just what you need on a cold winter’s day. Luckily you can do that right inside. Find an inspirational YouTube workout video or turn on your favorite tunes and have a private dance party. If you have a jump rope or hula hoop, channel your inner child and have some fun!

- Try a new recipe.

Cold winter days are perfect times to bake cookies, make soup, make pet treats, and enjoy the time you might not otherwise have to try out new recipes. You can also take some time to cook and freeze meals so you’re ready for the week ahead. Tools like Recipe Radar help you find recipes based on ingredients that you already have on hand.

- Do a craft project.

Indulge your creative side with an arts and crafts project. It’s a great way to relax. Choose something practical, like making birthday cards or holiday cards to have in stock for the future. Or try something whimsical such as a sock bunny. The Internet has lots of ideas; do a search based on your interests and the supplies at hand.

- Explore a hobby; learn a skill.

Maybe you’ve always wanted to learn a second language or brush up on your knife skills in the kitchen. There’s so much free content online that it’s easy to find videos about your areas of interest. Take a makeup tutorial. Try meditation. Not sure where to start? Sites like Skillshare offer a free month of classes on a variety of topics.

- Enjoy a spa day.

You don’t get a chance to pamper yourself nearly enough. Make time for a long, hot bath. Do a beauty treatment. Give yourself a manicure and pedicure. Don’t forget to hydrate. Make yourself a glass of cucumber water for that extra spa touch.

- Organize your photos.

If you’re like most people, you have albums of photos – on your phone, in print, or both. You just don’t always have the time to cull through them. Organizing your photos is the perfect indoor activity for a cold winter’s day. Sort your digital photos into albums so you can more easily find them. Save them to the cloud to free up space on your phone. Delete any photos that you don’t want anymore. For printed photos, follow a similar process. Decide which ones you will keep and in what format (e.g. scan to digital, place in a photo album). Consider giving away or throwing out photos to keep your collection manageable.

- Catch up with friends or family.

If you haven’t had a chance to chat with friends or family in a while, give them a call. Chances are that they’re stuck inside too and would love to hear from you. Not only can you catch up, but you can also plan your next get together. Don’t feel like talking? Write a letter. Everyone loves a handwritten note.

- Plan your summer vacation.

What better time than a cold winter’s day to dream about summer? Do some research and plan your next vacation. You can often find a better selection of vacation rentals by planning so far in advance. You may find money-saving deals on flights, accommodations, rental cars, and activities. Plus, you’ll be able to set a budget with ample time to save up for your trip.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Helpful Tips |

Picture this: you’re on the brink of capturing the perfect moment. Then it hits you like a digital disappointment – “not enough storage.” The fear of missing out is real. Here’s how to free up space on your phone for perfect picture taking anytime.

Don’t “double save” your photos.

If you use HDR mode or if you take photos on Instagram, you could be saving your photos twice, and that takes up twice the space.

HDR, or high dynamic range, makes your photos look better. If the setting is on for your smartphone, it creates a regular image and an HDR one every time you take a photo. Here’s how to turn it off.

For an iPhone:

- Go to Settings.

- Select Camera.

- Scroll down until you see Smart HDR.

- Toggle the button to turn off Smart HDR.

- Then the next time you take a photo, look for a switch in the upper right corner. Tap the HDR icon to turn it on or off.

For an Android:

- Go to Settings.

- Click on your Camera. The location varies from phone to phone and might be under photos.

- Look for the gear in the upper left corner. It opens camera settings.

- Look for the toggle to turn Auto HDR off.

Eliminate duplicates on Instagram.

Instagram automatically saves a copy of your edited photo in your camera roll. That could easily eat up extra storage space. Here’s how to turn that feature off.

For an iPhone:

- Login to the Instagram app on your phone.

- Tap the three lines in the top right corner.

- Choose Settings.

- Click on Account.

- Select Original Photos.

- Use the toggle in the box to turn this feature off.

- This will stop Instagram from saving photos and videos to your camera roll.

For an Android:

- Login to the Instagram app on your phone.

- Tap the profile button in the lower right corner.

- Tap the three lines in the top right corner.

- Choose Settings.

- Click on Account.

- Select Original Posts.

- Use the toggle in the box to turn off 3 different features: Original Posts, Posted Photos, and Posted Videos.

- This will stop Instagram from saving photos and videos to your camera roll.

Delete photos and videos.

Your photos and videos can take up a lot of room. Periodically deleting them from your phone can help free up space.

With iPhones, if you delete an image from your photo album, you’ll also delete it from the Cloud. There are a few workarounds such as turning off iCloud photo sharing and Sync this iPhone. However, you probably want to keep that connectivity.

To delete photos/videos on an iPhone:

- Open Photos.

- From the Library tab, select All Photos.

- Choose the photo or video that you want to delete.

- Tap the trash button, then delete photo.

- Then find the Recently Deleted album and select delete all to permanently remove them.

To delete photos/videos on an Android:

- Open the Google Photos app.

- Sign into Google.

- Tap or hold a photo that you want to remove. You may select multiple ones.

- At the top, choose Delete.

Can’t bear to permanently lose your photos? You can always transfer your photos to CDs or an external hard drive or store them online in a service like Dropbox or Flickr.

Clean up your data.

Your phone stores lots of data, from text message conversations to temporary files. Removing these items can help clear up some space.

For an iPhone, clear your message history:

- Go to Settings.

- Choose Messages.

- Select Message History.

- The default option is forever. Change it to one year or less.

For an iPhone, clear your cache:

- Go to Settings.

- Choose Safari.

- Select Clear History and Website Data.

For an Android, clear your cache.

- Open your Chrome app.

- Tap more at the top right.

- Choose History.

- Clear browsing data.

- Choose a time range at the top. “All time” will delete everything.

- Check the boxes next to “Cookies and site data” and “Cached images and files.”

- Select Clear Data.

Manage your storage.

You can get a good idea of what is taking up space on your phone by looking at your storage.

For an iPhone:

- Go to Settings.

- Choose General.

- Select Storage & iCloud Usage.

- Then tap Manage Storage. This is the list of how much space is taken up by apps.

- Click Optimize iPhone Storage.

For an Android:

- Go to Settings.

- Select Storage.

- Choose “Free up space” button.

- This will take you the Google Files app.

- You may follow the Cleaning Suggestions from the Files app.

- You also may click the three parallel lines in the top left corner. Select Settings and look for the Smart Storage setting. Toggle it to turn it on.

Organize your apps.

There are apps that you use every day and others that you rarely use. Take this opportunity to delete the latter.

For an iPhone:

- Touch and hold the app on the home screen.

- Choose Remove App to take it off the home screen.

- Or choose Delete to remove it from your phone.

For an Android:

- Open the Google Play Store app.

- Tap your profile at the top right.

- Choose Manage Apps and Devices.

- Click Manage, then select the name of the app you would like to delete.

- Select Uninstall.

Note that the Google Play Store has an Uninstall Manager that tells you which apps are ones that you don’t use.

Pro Tip: You can also delete the data for the apps you use. Just uninstall and reinstall them.

Try an app.

There are apps that you can download for Android phones that help you clean it. Some popular names include 1-Tap Cleaner, CCleaner, AVG Cleaner, and others. Apple has its own version called iPhone Cleaner: Clean Storage +. These apps sometimes cost money, and so you can determine if they are necessary.

Expand your phone’s memory.

Finally, if you have an Android phone, you may be able to expand its memory with a micro-SD card. iPhones unfortunately have the amount of storage that is set at the factory.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Safety |

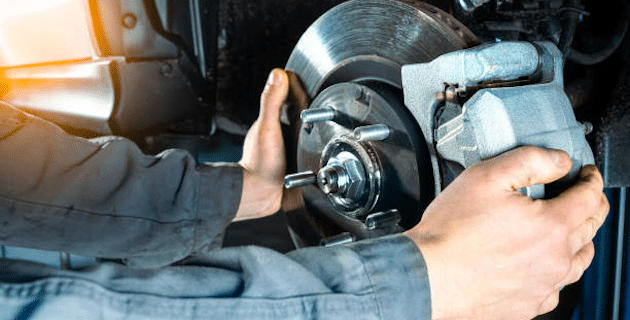

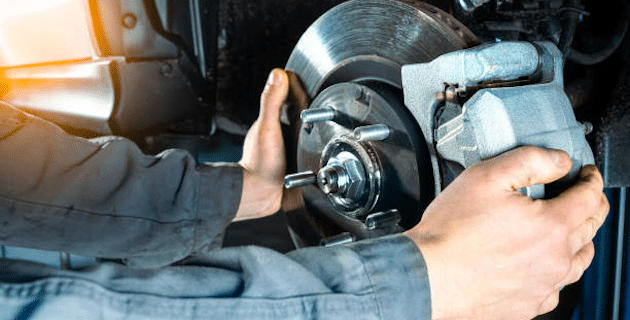

When to get your brakes checked

Your car could be trying to tell you something. Every screech, squeal, or grind could be its way of asking for new brakes.

First, a word about how brakes work…

Most vehicles today have disc brakes. When you press the brake pedal, the car pushes pressurized fluid through its brake lines. The fluid goes into a pair of calipers (clamps) lined with brake pads. They start to squeeze the rotors (metallic discs) from either side. The rotors are located behind each wheel and so the resulting friction slows the spinning, and eventually stops the car.

This constant squeezing and release causes wear and tear. Cars will need new brake pads every 25,000 to 65,000 miles, and new rotors between 30,000 and 70,000 miles. The actual mileage depends on your driving habits. Frequent braking, braking at high speeds, and driving a heavier car will take their toll on your brakes.

How to tell when you need new brakes

The good news is that your car gives you warning signs when brakes begin to wear out. If you notice any of the following, it’s time to get your brakes checked.

Squealing or screeching sound

Brake pads are built with a small piece of metal that becomes exposed as the pads wear down. The metal vibrates against the rotors, causing a high-pitched squeal or screech. That usually happens when the thickness of the pad is at the lowest possible level while still being considered safe to drive. So, if you hear the squeal, you will want to act soon. If you let it go too long, it will become a heavy grinding sound and it can start damaging other parts.

Pro Tip: Know that brake squeaks and squeals can happen if a car has been sitting for a while. That’s because the pads are covered with moisture, rust, and grime. Those noises go away after a few uses of the brakes.

Low brake fluid warning light

Your brakes use hydraulic fluid and cannot function without it. If you see a low brake fluid light, that means something is going on. There could be a leak in the system. Or it could be you’re your brake pads have worn down, causing the fluid to fill the space that’s lower in the reservoir.

Pro Tip: Look for a driveway puddle after your car has been parked for a bit. This type of fluid ranges from clear to yellow brown in color. You’ll find the leak near the wheels. It’s not safe to drive if you have a brake fluid leak. It may cause the brakes to fail.

Car pulls to one side while braking

If the car is pulling to one side or the other when you brake, you’re probably only getting brake power to that side. That’s an indication that you need new brakes or pads or that you have a jammed caliper. Either way, you’ll want to get it checked out.

Pulsating during braking

If your car vibrates, shakes, or pulses as you brake, it could be due to warped or unevenly worn rotors. It also could be caused by adhesive that gets hot and smeared across the rotor. Mechanics call this “glazing” and it can compromise brakes.

Rattling or clicking when you brake

Some vehicles hold brake pads with clips, bolts, or pins. If they become loose, they’ll begin to rattle. You may hear a clicking sound when you brake.

Poor brake performance

If your car takes longer to stop than usual, or if you are pressing the brake pedal down to the floor to get your car to stop, there is a problem. Causes include worn rotors, low brake fluid, and brake pads that are too thin. It could also be an issue with your car’s hydraulic system.

Grinding sound while braking

This is a sign that your brake pads are completely worn. The grinding sound you hear is “metal on metal” as the caliper and rotor scrape against each other. Because this can easily damage them and other parts, you’ll need to get this addressed right away.

Stay on top of maintenance

When one part of the braking system is damaged, it can affect other parts. Driving with worn brakes also can damage your tires. It can wear them down and cause them to be unbalanced. Your car is one of your greatest investments. Keep it well maintained and protect it with the right insurance.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Educators, Firefighters, Nurses, Peace Officers |

It’s time to stop and reflect on the good that is around us. Starting each day with an inspiring message of gratitude not only sets the tone for positivity, it also benefits you in numerous ways. Being thankful increases feelings of happiness and optimism. Gratitude fosters positive self-esteem and improves relationships. It helps to reduce stress.

Embrace the power of gratitude with these inspiring quotes.

- “There are always flowers for those who want to see them.” – Henri Matisse

- “If you want to find happiness, find gratitude.” – Steve Maraboli

- “Enjoy the little things for one day you may look back and realize they were the big things.” – Robert Brault

- “Some people are always grumbling because roses have thorns; I am thankful that thorns have roses.” – Alphonse Karr

- “Gratitude can transform common days into thanksgivings, turn routine jobs into joy, and change ordinary opportunities into blessings.” – William Arthur Ward

- “Let us be grateful to people who make us happy; they are the charming gardeners who make our souls blossom.” – Marcel Proust

- “Gratitude turns what we have into enough.” – Aesop

- “The more grateful I am, the more beauty I see.” – Special Olympics CEO Mary Davis

- “An attitude of gratitude brings great things.” – Yogi Bhajan

- “The single greatest thing you can do to change your life today would be to start being grateful for what you have right now.” – Oprah Winfrey

- “Remember that what you now have was once among the things that you had hoped for.” – Epicurus

- “Sometimes we should express our gratitude for the small and simple things like the scent of the rain, the taste of your favorite food, or the sound of a loved one’s voice.” – Joseph B. Wirthlin

- “This is a wonderful day. I have never seen this one before.” – Maya Angelou

- “We must find time to stop and thank the people who make a difference in our lives.” – John F. Kennedy

- “We often take for granted the very things that most deserve our gratitude.” – Cynthia Ozick

- “Learn to be thankful for what you already have, while you pursue all that you want.” – Jim Rohn

- “Gratitude sweetens even the smallest moments.” – Anonymous

- “All that we behold is full of blessings.” – William Wordsworth

- “Among the things you can give and still keep are your word, a smile, and a grateful heart.” – Zig Ziglar

- “The more you are thankful, the more you attract things to be thankful for.” – Walt Whitman

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.