by California Casualty | Homeowners Insurance Info |

Hurricane season began June 1. Are you ready? The nation’s top emergency managers warn that millions of Americans from the Gulf Coast to the Eastern Seaboard as far north as Maine are in danger. Southern California has even experienced tropical storms, giving the West Coast a reason to be concerned.

Hurricane season began June 1. Are you ready? The nation’s top emergency managers warn that millions of Americans from the Gulf Coast to the Eastern Seaboard as far north as Maine are in danger. Southern California has even experienced tropical storms, giving the West Coast a reason to be concerned.

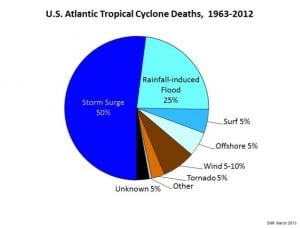

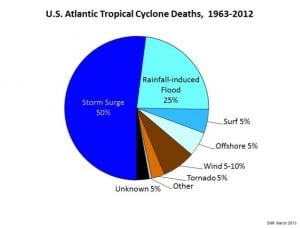

While hurricanes are associated with extreme winds, the National Hurricane Center warns that storm surge actually causes the most damage and loss of life.  The Federal Emergency Management Agency (FEMA) has developed new maps to show the danger. They also have a list of hurricane preparedness tips that include:

The Federal Emergency Management Agency (FEMA) has developed new maps to show the danger. They also have a list of hurricane preparedness tips that include:

- Prepare an emergency kit

- Have a family evacuation and communications plan

- Install hurricane shutters or stock up on boards 5/8 exterior grade or marine plywood to cover windows and doors

- Install straps or additional clips to roofs to reduce damage

- Have a NOAA Weather Radio

- Be prepared to bring in anything that can be picked up by wind (bicycles, lawn furniture, play equipment, grills, etc.)

- Know how to turn off propane tanks and gas lines

- Keep your car’s gas tank full in case of evacuation

Are you covered if a hurricane strikes? The insurance industry recommends everyone take these steps:

- Learn how you can mitigate damage from wind and flooding associated with hurricanes

- Begin or update your home inventory (knowyourstuff.org)

- Understand your insurance – know whether you have actual cash value or replacement cost coverage, know how much living expenses coverage you have and make sure you have flood insurance (not covered with most home or renters insurance)

- Store copies of your inventory and insurance information in a safe location away from home

- Get an annual insurance review to make sure you have enough coverage for the dwelling and possessions

And here is what to do if there is damage to your property:

- Contact your insurance company as soon as possible

- Secure the property from further damage or theft

- Keep or document receipts and other expenses if you are evacuated or forced to find another place to live because of damage to your home or apartment

- Be wary of unscrupulous contractors following a natural disaster

California Casualty is ready to help before or after the storm. Contact an advisor today for a policy review, to arrange for flood insurance or upgrade coverages at 1.800.800.9410 or visit www.calcas.com. It’s also our policy to call customers in a disaster area to make sure you are okay and help start a claim, and our Claims department is available 24 hours a day, even on holidays if you have an emergency.

Resources for this article:

https://www.ready.gov/hurricanes

https://www.redcross.org/prepare/disaster/hurricane

https://www.fema.gov/national-flood-insurance-program-flood-hazard-mapping

https://www.nhc.noaa.gov/prepare/

https://viewer.zmags.com/publication/698e58a3#/698e58a3/1

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters and nurses. Get a quote at 1.800.800.9410 or www.calcas.com.

by California Casualty | Finances, Helpful Tips |

Back-to-school shopping can be stressful and expensive. But it doesn’t have to be. Discover how to turn this annual ritual into a stress-free, budget-friendly adventure, ensuring your kids are well prepared without breaking the bank.

#1: Do an inventory at home.

Before you buy anything, “shop” at home. See if there are leftovers from last year. You might already have a supply of #2 pencils or unused notebooks. Check closets and last year’s backpacks. Make it a fun treasure hunt where the kids get involved.

#2: Spread out the shopping.

Give yourself plenty of time to find the best prices on the items on your list. Start early so you won’t feel pressured to buy everything in one trip. Also, remember that you don’t have to get it all by the start of school. Email the teacher to ask which items are most important, and which can wait. For clothing, start with the necessities: one pair of everyday shoes, one pair of sneakers, and a couple of new outfits. Wait until the fall holidays to shop the clothing sales.

#3. Check giveaway groups.

There are communities of recyclers who give away things for free. You can find many of them online. Check with your our local Buy Nothing Project group on Facebook or the Buy Nothing app. Look for your area’s Freecycle Network. Join these groups and ask your neighbors for what you need. You might be surprised at what you find, and it could inspire you to do your own decluttering.

#4. Shop without the kids.

It will be less stressful to shop without the kids and easier to stick to your budget. Plus, if you’re not doing a dedicated shopping trip for school supplies, it’s easier to pick up things as you’re out. However, if you are going to bring your kids, get them involved. Set expectations about what they will be getting so they are not disappointed. Start with a short list of items and a budget. Pro Tip: If they can spend under that amount, give them the extra to spend on something they’d like.

#5. Go with a plan.

Estimate how much items will cost and set your budget. Keep that list with you so you can check it periodically as you’re out. Importantly, stick to the list. Remember you don’t have to get everything in one trip or at one location. Watch weekly ads from local stores. Download apps to get notices of sales. Be strategic about how and where you shop.

#6. Compare prices before you buy.

How do you know you’re getting the best price? Try online tools like Google Shopping, which will compare prices. Coupon browsers like Honey, Capital One Shopping and CouponCabin also can help. Some stores match competitors’ advertised deals but there are limitations. (For example, Walmart will match a price on one item per day and only if it’s on Walmart.com for a lower price.) Shop with a credit card that gives cash back for extra savings.

#7. Check dollar stores and thrift stores.

Dollar stores offer great deals on essential supplies, such as glue, highlighters, pencil pouches, notebooks, and more. However, as our teacher friends often mention, it’s worth purchasing the name brands, Crayola and Ticonderoga, for crayons and pencils which may not be found at the dollar store. Thrift stores are also a great source to gear up for back to school. Look for gently used items from clothing to backpacks. Just make sure to check back regularly for new finds.

#8. Use discounted gift cards.

This clever hack allows you to buy a gift card for less than its face value. Then you can spend it at full value. That’s an automatic discount if you use it for school supplies. Check out sites like GiftCardGranny, Raise, MyGiftCardsPlus, and CardCash. Just make sure to carefully read the requirements. Do you have an unused gift card that you won’t use? You can sell it for extra cash too.

#9. Buy in bulk.

If you have membership to a warehouse store, check out school supplies that you can buy in bulk. You can split them among your children or share them – and the cost – with friends and family.

#10. Watch for sales after you’re done.

Keep your receipts. If the price drops on your item within two weeks, you may be able to get some of your money back. Policies vary per store so check with yours when you make the purchase.

Finally, prepare for the school year by brushing up on back-to-school safety and carpooling tips. Teach your kids how to be safe around cars. For added peace of mind, make sure you and your precious cargo are fully protected with the right vehicle policy. Wishing you a happy and healthy back-to-school season!

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Helpful Tips |

The moment you drive a new car off the lot, it begins to lose its value. This can come as quite a shock to new car owners. After all, you just spent your hard-earned money on a vehicle. Yet car depreciation is a reality. Understanding it will help anyone looking to buy, sell, or trade in a vehicle.

What exactly is car depreciation?

It’s the difference between the price you paid for your car and how much it is worth if you were to sell it.

How much do cars depreciate?

It depends a bit on the make and model of car. In general, cars lose 20% of their value in the first year, and 60% over the first five years, according to Kelley Blue Book. You can check out their 5-Year Cost to Own for details on different makes and models. You can also find a car calculator online to get an idea of depreciation for your specific vehicle.

What causes depreciation?

Most things that we buy lose value over time due to wear and tear. That’s the same with cars and trucks. Depreciation is caused by the age of the vehicle and the mileage for starters. In addition, as new models come out with redesigns and new technology, there is less demand for older vehicles. Finally, the condition of the car matters. If your car has been in an accident, or has lots of dents or rusting paint, that impacts the resell value.

Can you slow down depreciation?

While depreciation is inevitable, the good news is that you can take steps to help your car keep its value a little longer.

- Maintain your car. Since wear and tear can increase depreciation, taking care of your car helps it stay working its best. Follow the owner’s guide for recommended maintenance.

- Take care of your car’s appearance. Dents and scratches can reduce your vehicle’s value. Wash your car, repair scratches and dents, and keep it clean.

- Drive carefully. Accidents and damage – even when repaired – will impact a car’s value.

- Avoid custom modifications. While these can be fun, they may make it harder to sell your car down the line.

Here’s how to make depreciation work in your favor.

- Do you use your car for business? You can deduct your car’s depreciation on your taxes.

- Are you buying a car? You can purchase a one-year-old car that is as good as new, but you pay only about 80% of the price. Or you could choose a three-year-old vehicle where the bulk of the depreciation has occurred. Make sure to look for one with low mileage for the greatest value.

- Choose a make and model that will resell well. Some vehicles hold their value better than others. It depends on the brand’s reputation plus overall customer demand for certain models. Among the top resellers for 2024 are the Ford Bronco, the Toyota Tacoma, and the Mercedes Benz G-Class.

Other factors that will influence car depreciation include supply and demand. If there are supply chain disruptions that reduce inventory, used versions of those models could be valued at a higher rate. In addition, rising gas prices can put more fuel-efficient cars in demand. Keeping tabs on the market can help you to make informed decisions.

Insurance can also help with depreciation.

Since car loans can last five years, your new car could lose 50% of its value before you pay it off. The loan doesn’t go away even if your car is totaled or stolen. In the event of a total loss, insurance pays the current market value of your vehicle. That’s where a new car replacement policy or gap insurance could help.

New car replacement insurance gives you the money for a new vehicle of the same make and model, minus your deductible. This is typically an add-on coverage that is paired with either collision or comprehensive coverage.

Gap insurance stands for Guaranteed Asset Protection. It is also called loan/lease coverage. Gap is an optional coverage that is paired with either collision or comprehensive coverage. In a covered claim, collision or comprehensive help pay for the totaled or stolen vehicle up to its actual cash value. Gap covers the rest of the loan or lease.

Your car is one of your greatest investments. Keep it protected for added peace of mind.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Helpful Tips |

You’re ready for a new set of wheels. Time to head to the dealership, test drive some models, and negotiate like a pro. Or you could boot up your laptop and start clicking from the comfort of your couch.

Online car shopping is a game-changer. You can shop anytime, anywhere, with access to a multitude of vehicles without the sales pressure. But is it right for you?

What it Means to Buy a Car Online

Many of us shop online for everything from clothes to groceries. A car, of course, is a larger purchase. It costs much more and so there is more at stake. You might be comfortable researching a car online, and even calculating loan payments. But there’s a comfort level to continuing the car buying process in the dealer showroom. However, more and more people are taking the plunge into online car shopping. They’re buying online from start to finish.

Pros & Cons

It’s ultra-convenient to shop for a car online.

- You don’t have to go to a dealership during business hours. You can shop on your schedule from any place.

- There is likely more inventory available online than at your local dealership.

- You can get pre-approved for a loan before you even start shopping.

- There is less sales pressure and no haggling. Prices are clearly posted, and what you pay ultimately depends on the base price, any trade-in, and your credit rating.

- You can fill out paperwork online at your leisure.

- Many online marketplaces have a short return window, so if the car wasn’t what you expected, you can return it.

- You can get the car delivered to your driveway.

Of course, there are some downsides.

- You can’t physically see the car or test drive it before you buy it. (Some services are offering test drives, however, and you can always test drive at a dealership before buying online.)

- You can’t negotiate the price.

- Online purchases often come with extra fees. It can cost $1,000 or more to deliver a car.

- Your financing choices may be limited. The seller may restrict you to a single lender.

- You cannot get your car the same day, as you would at a dealer.

- You can potentially get more incentives onsite at a dealer, such as lease specials or cash rebates.

Online Sellers

There are a variety of online vehicle sellers. Some new car dealers offer the full online experience, including car delivery. There are also services that sell used vehicles in online marketplaces. Still others connect buyers with private sellers. Each site has different terms and warranties, so make sure you understand them before you buy. Here are some of the most popular:

- Carvana offers used cars, auto loan prequalification, and a 7-day return window. Car delivery is not available everywhere and may include a shipping fee.

- CarMax also sells used cars. They can deliver a car for test driving (fees may apply). CarMax offers financing and has a 7-day return window.

- Vroom sells used cars with a 7-day or 250-mile return window. Vroom also offers access to online financing.

You may buy from private sellers on sites such as these:

- eBay Motors connects you with private sellers. The site offers free vehicle purchase protection that can cover you if there are problems with the sale.

- CarGurus also connects you with private sellers and offers support for paperwork including title transfers. They offer financing through their partner, Auto Pay.

Red flags

- Be careful with sellers that are not vetted by a third party. While you can find cars on Craigslist and Facebook Marketplace, it is more difficult to know if it’s a scam.

- Avoid bait-and-switch scenarios, where the car you want is suddenly not available, but another similar more expensive model is. If a seller does that, chances are there will be problems later with other items such as warranties.

- Beware of fraudulent websites. Make sure the site and the seller are legitimate. If the price is too good to be true, it probably is.

- Do not make a deal without a written agreement. Remember to read the fine print.

Ready to buy?

- Know what you can afford for a monthly payment, and then work backwards to determine how much you can finance.

- Know your credit score. Your credit rating is used to determine your interest rate.

- Pre-qualify for a loan. You can get a loan from a bank or credit union, or from the dealership or online marketplace where you will get your vehicle.

- Determine the type of car that fits your needs. Do you need a large SUV for off-roading and camping with the family? Perhaps you need the right car for your teen driver? Browse the online inventory to find the car that meets your budget and needs.

- Comparison shop across at least three websites to determine the best options. Consult Consumer Reports, Edmunds, and Kelley Blue Book to ensure that your car is priced at current market value.

- If you’re able to arrange a test drive, do so. You want to make sure that you can fit comfortably in the car, and you like how it handles. If all checks out, then go ahead with the purchase.

A car is one of your greatest investments. For added peace of mind, protect it with the right insurance.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

You slow down for the yellow light but the car behind you does not. Bam! It wasn’t your fault but now you have to get your car fixed. Or maybe a storm knocks out a window in your house. Now you need to get it repaired.

Accidents happen. Washing machines overflow; things are stolen or vandalized. That’s why you have insurance. Your policy protects your vehicle, your home, and your belongings, taking some of the financial stress away to help you repair and replace those necessary items. Here’s an overview of the insurance claims process so that you can do it easily.

When to File a Claim

Every policy has a deductible, an amount that you are required to pay out-of-pocket before insurance kicks in. The general rule is to file a claim when the payout is greater than the deductible and you cannot cover it on your own. You also should file a claim whenever someone is injured and when it’s not clear who is at fault. That way, the insurance companies can get together and determine the outcome.

How to File a Claim

Let’s say you were in a car accident. Here are the steps to take to file a claim. (You also can refer to the back of your California Casualty insurance card. It lists the steps to follow in the event of a loss.)

Step 1: Call the police if needed.

-

- Call 9-1-1 if anyone is injured or you suspect drugs or alcohol are involved.

- Call the non-emergency police number to report the accident. An officer may show up and take a police report. While you don’t necessarily need one, it will make the claims process easier. If the police are not needed, or available, you may file an accident report online, by mail, or at the police station.

Step 2: Get the other driver’s information.

-

- You feel bad so it may be tempting to say the accident was your fault. Whether or not it was, don’t take the blame. Don’t apologize.

- Exchange information. Get the other driver’s name. Take a photo of the other driver’s license, insurance card, and registration. Alternatively, you can write down the information. Make sure you have the year, make, model, license plate number, and color of the other car.

Step 3: Write down facts and take photos. Look for witnesses.

-

- Take photos of the scene, license plates, traffic signs, and anything else that may help you to remember the details of the accident.

- Include the direction the cars were traveling, your speed, weather, road conditions, and what happened.

- Use your phone to make detailed notes.

- There may be witnesses. Look around and ask for the contact information of those individuals. They may later be contacted by your insurance company or police, if needed, to support your rendition of the accident.

Step 4: Call your insurance company.

-

- Report the accident. The adjuster will ask questions. Answer them honestly and thoroughly. If you don’t know the answer, say so.

- Your adjuster will share the process of getting your car repaired. They will send you paperwork to fill out.

- Let them know if there is a police report.

- Don’t sign anything from the other person’s insurance company. Let your insurer take the lead.

Step 5: File your claim.

-

- Most insurance companies allow you to file your claim online. That means you’ll fill out the necessary paperwork online or by email.

- To complete the filing of your claim, you’ll need to fill out the forms that you are sent.

- You may have to get a repair estimate and include that information.

- Then, you’ll wait for approval. Once the repair is authorized, you’ll be able to proceed with the repairs. Either you or the repair shop will receive payment from the insurance company, so check with your adjuster.

The Difference with a Homeowner’s Claim

A homeowner’s, renter’s or personal property claim follows a similar process. The main difference is that you need to provide a Proof of Loss statement. That’s a list of items that were damaged or stolen and how much it costs to replace them.

Can you wait to file a claim?

You should not wait. Your insurance contract specifies your specific Duties After Loss. You must give prompt notice to the insurer; notify the police in case of loss by theft; protect the property from further damage, prepare an inventory of damaged personal property; and cooperate with the investigation.

So, the next time that life throws a wrench into your plans, remember that you have insurance. The claims process is an easy way to get the help you need.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

Hurricane season began June 1. Are you ready? The nation’s top emergency managers warn that millions of Americans from the Gulf Coast to the Eastern Seaboard as far north as Maine are in danger. Southern California has even experienced tropical storms, giving the West Coast a reason to be concerned.

Hurricane season began June 1. Are you ready? The nation’s top emergency managers warn that millions of Americans from the Gulf Coast to the Eastern Seaboard as far north as Maine are in danger. Southern California has even experienced tropical storms, giving the West Coast a reason to be concerned. The Federal Emergency Management Agency (FEMA) has developed new maps to show the danger. They also have a list of hurricane preparedness tips that include:

The Federal Emergency Management Agency (FEMA) has developed new maps to show the danger. They also have a list of hurricane preparedness tips that include: