by California Casualty | Homeowners Insurance Info |

Personal Property, also referred to as “contents coverage,” is the term insurance companies use to collectively define the things you own inside your home. Imagine picking up your house, turning it over, and giving it a good shake. What would fall out? Furniture, electronics, clothing? The possessions that “make your house a home” are considered your personal property.

Should something insurance-related (like damage or theft from a covered peril) happen to your home, you’d likely have many personal property items to replace. Both homeowners and renters insurance policies typically include Personal Property Coverage, but in order to for your insurance coverage to help replace your items, you need to know how much personal property coverage you really need. That’s when a home inventory comes in handy.

Most people know a good ballpark for the dollar amount/coverage limit they need to cover the exterior of their home, known as Dwelling Coverage, but they rarely know the value of their personal items inside their home. Having the right amount of coverage to replace these personal items will make your life so much easier if/when you have a covered claim.

Plus, most insurers offer optional scheduled personal property coverage, or rider, for more special and/or expensive items such as jewelry, watches, and furs that have values above your personal property coverage limits.

Here are some things to consider when it comes to protecting your belongings.

-

- For homeowners policies, personal property coverage is usually a percentage (ranging from 20-50%) of your homeowners’ Coverage A (Dwelling Coverage) on your policy. However, you can purchase more coverage if needed.

- Renters are able to choose their personal property amount for their policies.

- There are two types of personal property coverage: replacement cost and actual cash value.

- An actual cash value policy factors in depreciation (use and age) to provide reimbursement based on the current value of an item, not what it would cost to replace it.

- A replacement cost value policy typically pays the dollar amount it takes to replace your item following a covered claim. Replacement cost value usually has a slightly higher premium cost than actual cash value, and some insurance companies will give you the option to choose replacement cost value if you’re willing to pay a little more premium.

- It’s also important to know that personal property coverage usually has certain limits on what it will pay to replace an item or category of items. Be sure that the coverage (or amount of anticipated compensation in the event of a covered claim) you actually need is within these limits or you may want to add coverage to better protect your cherished possessions.

- There are exclusions to personal property coverage! Items in your home like pets, property of roommates, boarders, or tenants (for homeowner’s policies), and vehicles are not covered.

- Sometimes if the event that caused the damage (peril) is not “named” on the policy, there is no coverage for that cause of loss.

It’s a good idea to take inventory of your personal property, complete with pictures and the purchase price of each item. As an easy reminder, and to stay on top of all of your new possessions, mark your calendar to do your home inventory every six months- once in the middle of the year and again at the end of the year. In the event of a loss, your up-to-date home inventory will help simplify the process of filing a claim.

A conversation with an insurance advisor will be helpful as you consider your coverage limits. Knowing what you own and understanding how your personal property coverage works can give you more confidence as you navigate through the quoting process and comfort in the event of a loss.

DISCLAIMER: These general industry descriptions are not representative of your individual insurance policy. Please be sure to review your policy at least once yearly with your insurance representative and mention any home improvements to ensure your coverage is complete.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

While there may be some debate about the cause, more and more people are accepting the fact that a changing climate is leading to extremely erratic weather with more intense storms, prolonged drought, and rising temperatures.

This has led to some of the most dramatic disasters in the U.S. Throughout these impressive weather swings, roofs have been damaged, homes flooded, trees toppled and vast acreage blackened. Many property owners are wondering what’s next and what they can do to safeguard their property?

Here are some important steps that you can take to help protect your property and your family from the major effects of climate change.

Storms

Snow and ice storms, hurricanes and spring/summer thunderstorms have become more intense. From record hail, tornado outbreaks, and torrential downpours; our homes and property are taking a beating.

When these storms hit, check and repair:

- Roofs and shingles

- Gutters and downspouts

- Decks and porches for loose, cracked or exposed wood

- Exterior for chipped or peeling paint, cracks, holes or exposed wood or siding

- Attics for evidence of leaks

- Basements or crawl spaces for damp areas and cracks

- Concrete slabs for cracks or shifting soil

- Chimneys for damage or dirty flues

- Trees and bushes for broken or weak trunks and branches, and removing any branches that overhang your home

Fire

Wildfires in much of the country have burned hotter and consumed more structures and acreage in recent years. Climate change has extended the fire season by an extra two months across the U.S.! In much of the South and West it begins in early spring, ending late fall.

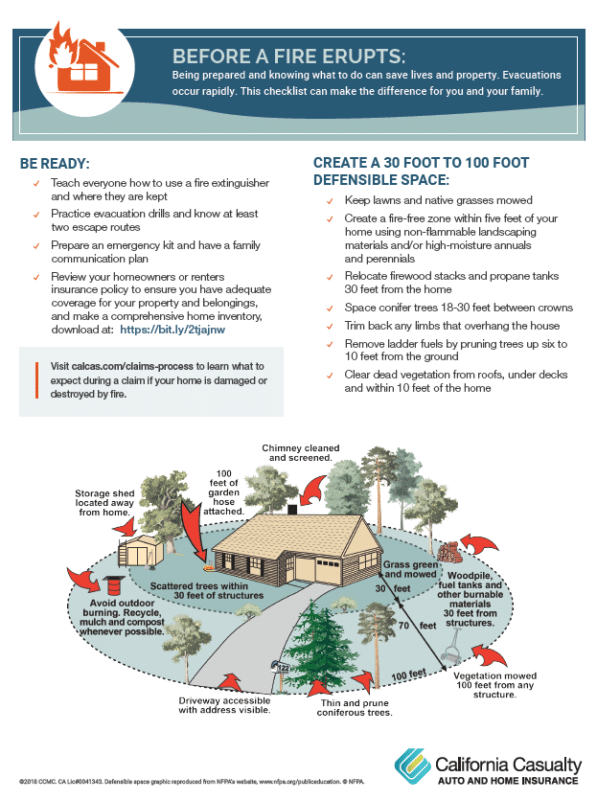

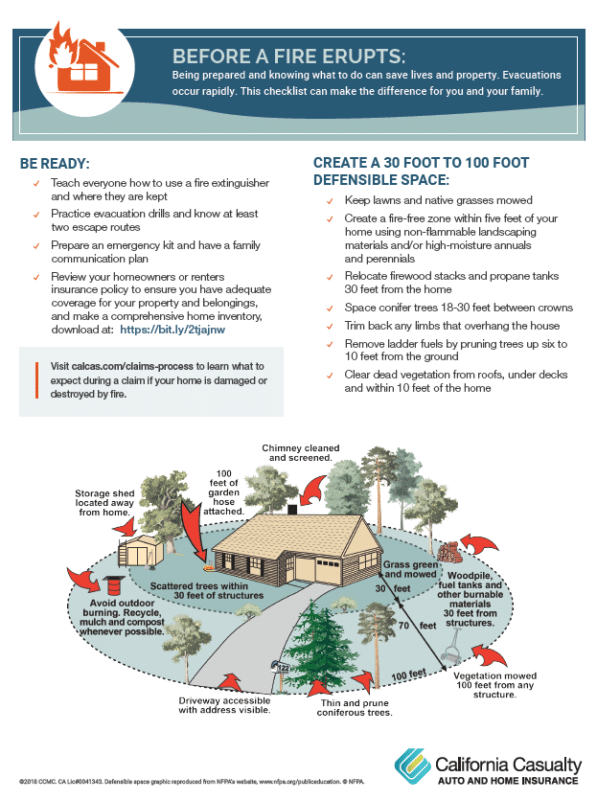

Fire prevention experts recommend that anyone in or near a fire-prone area, especially what is called the Wildland Urban Interface (WUI), needs to take these steps to minimize their fire risk and help responding crews:

- Create at least a 100 foot defensible space area around homes and structures (200 feet or more may be needed on hillside areas)

- Keep combustible wood piles, propane tanks and other flammable materials 30 feet from homes and structures

- Remove weeds and dry shrubs near structures

- Keep laws trimmed and mowed

- Trim tree branches 10 feet up from the ground and remove any that overhang your home or other structures, and keep trees spaced 30 feet apart

- Install a fire resistant roof and deck

- Make sure your street name and address are visibly posted for emergency vehicles

- Clear flammable vegetation 10 feet from roads and five feet from driveways, and cut back overhanging branches on roads and drive ways

Keeping your home well maintained is essential to withstand the vagaries of weather. You can find more wildfire preparation tips here.

Know Your Insurance

In the event of these extreme storms it is also critical that you understand your insurance and know:

- If your homeowners policy includes replacement cost or actual cash value,

- Whether you are covered for new additions, improvements or appliance and other upgrades,

- That a floater or scheduled personal property endorsement is needed to fully cover high value items such as fine art, furs, jewelry, silverware and musical instruments

Keep in mind: flood and earthquake insurance are not included with your home or renters policy. However when you have California Casualty, you can easily add each to your policy though our agency services program. Please contact: 1.877.652.2638 or [email protected] .

Another important coverage you should add to your policy is comprehensive coverage. Without it your vehicle won’t be protected if it is damaged or destroyed by a flood, fire or falling tree limb. To ask a customer service representative about adding comprehensive coverage please contact: 1.800.800.9410 or visit www.calcas.com

Lastly, make sure your belongings are also completely covered in the event of a storm or fire. If you haven’t completed a home inventory yet, now is the time to do it. Having a list and proof of the things you own will help you with reimbursement if your home or apartment is damaged by a natural disaster. For our free Home Inventory Guide click here.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info, Safety |

Summertime is in full swing! However, along with summer heat is the threat of summer burglary. Nobody wants to return home to find someone has burglarized their hard-earned possessions.

Unfortunately, the U.S. Department of Justice warns that break-ins heat up during the summer months. Most of those are crimes of opportunity from criminals looking for an easy target like open windows or garage doors.

Here are some tips to prevent a summer burglary:

Make Your Home Less Vulnerable

- Trim back bushes or hedges that block visibility and give a thief areas to hide

- Install outdoor lighting

- Put indoor lights on timers

- Have a security system installed

- Get a dog

- Keep garage doors closed

- Always lock doors and windows

- Keep watch of your neighbors’ homes and ask they do the same for you

- Have a trusted friend, neighbor or relative make trips to your home or park a car in the driveway to make it look lived in while you are away

Don’t Advertise to Criminals

- Stop mail and newspaper deliveries if you are going away

- Arrange for any home deliveries to your neighbors when you are not home

- Don’t leave garbage cans out while you are away

- Never leave notes on doors telling someone you are out and when you will return

- Leave a radio or TV on while you are away

- Conceal valuables and don’t them visible from the outside

- Break down and conceal boxes for expensive items and electronics when putting out the trash (boxes for the new 60” HD TV or the latest computer are like shopping flyers for thieves)

- Don’t advertise on social media that you are going away to grandma’s house or a wonderful vacation (this goes for your children)

Protect Yourself

- Make a complete home inventory of your possessions to assist if you need to file a police report, speed up an insurance claim and help with a tax-loss write off

- Be sure to have an identity theft protection and recovery service if burglars get access to your personal or banking information

- Protect your possessions with homeowners or renters insurance

Not only do you feel violated after someone breaks into your home, but it can be expensive to fix the damage and replace items. That’s why you need homeowners and renters insurance. We can’t stop all criminals, but California Casualty is here to protect you with quality auto and home insurance with exclusive benefits not available to the general public. Every policy also comes with free ID theft protection. Call an adviser today for a policy comparison or review at 1.800.800.9410, or visit www.calcas.com.

For more information visit:

https://bit.ly/2JXf93n

https://bit.ly/2YlWhDe

This article is furnished by California Casualty, providing auto and home insurance to teachers, law enforcement officers, firefighters and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info, Safety |

Wildfires seem to be burning faster and more intense than ever. The past few years have seen the largest and most destructive conflagrations in US history. Wildfire preparation tips are more important than ever.

Too many people have come back to find melted remnants of prized personal possessions; homes in ashes.

Here are five key wildfire preparation tips for your community or neighborhood:

- Create a home inventory. 60% of homeowners and renters have still not documented the things they own, which can cause post-fire/disaster headaches.

- Know where fire extinguishers are kept and teach everyone how to use them. Make them easily accessible in the event an of emergency.

- Have a family escape plan. Practice how you would exit your home from different rooms in the event of a fire and set a safe meeting point, away from the property, if you were to get separated.

- Prepare an emergency kit with important documents. Include copies of banking information, insurance policies, home mortgage and deeds, etc.

- Review and understand your insurance policy. Whether you are renting or owning, know what it pays and does not pay for. Get extra protection for collectibles and high-dollar possessions with a scheduled personal property endorsement.

While these are great wildfire preparation tips, there are several other things to keep in mind in you are effected :

- Contact your insurance company as soon as possible

- Secure the property from further damage

- Contact creditors, banks and appropriate agencies about credit cards, tax returns, Social Security cards or other papers that may have been scattered in the disaster

- Check your credit report to make sure nobody is using your personal information

- Be very wary of fly-by-night work crews and contractor fraud

Download and print your copy of these Wildfire Preparation Tips here.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters and nurses. Get a quote at 1.800.800.9410 or www.calcas.com.