Complete a Home Inventory

If you are one of the almost 50% of U.S. households that has never completed a home inventory there is no time like the present.

Why is a Home Inventory Important?

A Home Inventory Checklist is a list of your valuable objects in case there is a fire, destructive storm or if someone breaks in and steals your belongings. Doing a home inventory is very important because without one many people have a difficult time pinpointing or recalling everything that might have been destroyed or taken, and unfortunately that can delay claims or keep you from getting full compensation. So, before the hectic holiday season rolls around, and take the time to take inventory of your home.

Just go room by room and document:

- Electronics

- Personal care items

- Jewelry

- Art

- Kitchen items and appliances

- Furniture

- Carpeting

- Beds and linens

- Clothing

- Sports equipment

- Yard and garden tools

You can choose to write everything down or use photo/video documentation of your belongings. Don’t forget to take pictures of the exterior of your home as well (photos are best from all angels- including the landscaping and any decks or porches). Also take note of everything in the garage, attic, or basement- like holiday ornaments, lawn and yard equipment, tools, etc.

Trying to tally what needs to be replaced is not something you want to do in the event of a claim, so completing your inventory will give you some peace of mind if the worst should happen; and you can use the time to get rid of the old and make room for the new, before the craziness of the holidays.

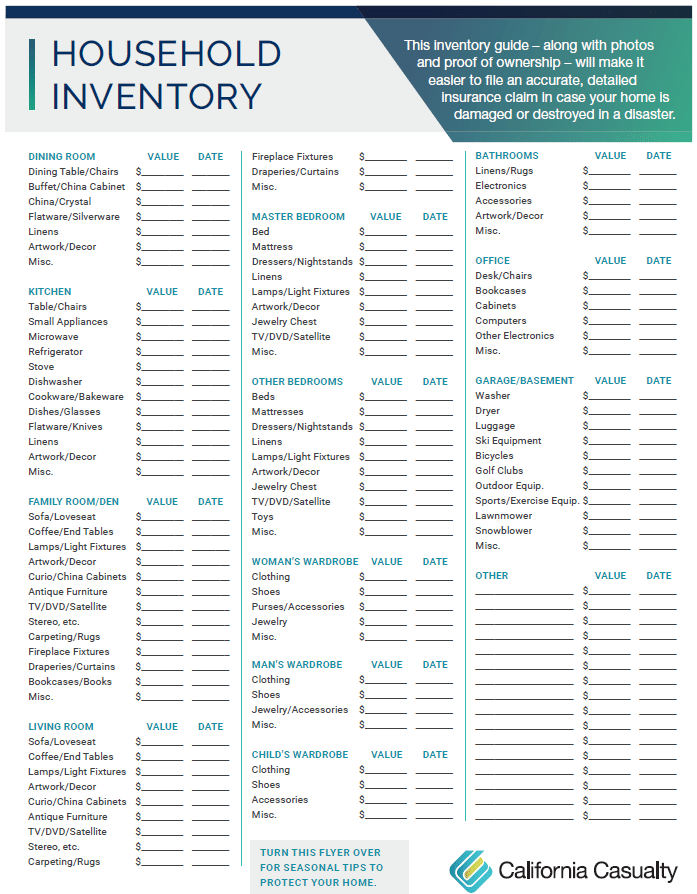

To help you out, we’ve got a handy home inventory guide already made just for you! You can download it by clicking on the “Household Inventory” image below.

New Year’s Resolution: Complete a Home Inventory

Here’s an unsettling statistic – about half of US households still haven’t completed a home inventory. Of those who have done one, 40 percent haven’t updated it in many years. It’s a resolution that we urge you to make.

Why? You’ve worked hard to make your house a home. Now it’s time to create a record of everything that you own. Trying to tally what needs to be replaced is not something you want to do in the event of a claim.

Home inventory is so important. It provides a list of your things in case there is a fire, destructive storm or someone breaks in and steals your valuable belongings. Without an inventory, many people have a difficult time pinpointing or recalling everything that might have been destroyed or taken. That could delay your claim or keep you from getting full compensation.

Whether you choose to write everything down or use a video camera (like your phone), now is a great time to get started. Just go room by room and document:

- Electronics

- Personal care items

- Jewelry

- Art

- Kitchen items and appliances

- Furniture

- Carpeting

- Beds and linens

- Clothing

- Sports equipment

- Yard and garden tools

Don’t forget to take pictures of the exterior of your home from all sides (including the landscaping and any decks or porches), and all the stuff in the garage, attic or basement (holiday ornaments, lawn and yard equipment, tools).

Completing your inventory will give you some peace of mind if the worst should happen. We’ve got a handy home inventory guide that you can download here.

Too Late is Too Late: Why you Need a Home Inventory

By Carrie Mitchell, Owner & Founder

TWS Home Inventory

Knowing the despair that follows a major loss, Carrie Mitchell founded TWS Home Inventory in 2012 after helping victims of the devastation caused by Colorado’s Waldo Canyon fire in. It was in the aftermath that Carrie realized how much heartache and stress could be avoided with a professionally detailed home inventory. TWS Home Inventory is now available in California and the East Coast.

Carrie and TWS Home Inventory have been featured in Colorado media, FOX News National, FOX News Business, the Insurance Journal and the Huffington Post. Carrie will be providing us with important content about the need for a home inventory and the many ways not having one could hurt you.

California Casualty proudly insures a sector of society that knows all too well the importance of being proactive instead of reactive in our everyday lives. As educators, health care providers, fire fighters, first responders, and peace officers you see the devastating aftermath of situations outside of our control.

TWS Home Inventory and Asset Management Group was founded in 2012 as a direct result of the plight of affected homeowners in the aftermath of Colorado’s Waldo Canyon Fire. As a homeowner personally affected by this natural disaster that devastated the Colorado Springs area in 2012, I saw first-hand the trail of destruction left behind: over 350 homes destroyed and countless numbers severely damaged, 18,247 acres of forest blackened, firefighting costs alone were over $15 million, home losses and insurance claims were estimated at over $356 million two years after the fire, and many claims remain in dispute even after three years.

Although most homes were insured, the financial recovery for contents was much less than the insured structure amount and for valuables such as jewelry, guns, paintings, family heirlooms and antiques. Many of these precious possessions were simply lost forever. The simple reason for this fact is that most homeowners had no physical record or documentation of their valued possessions, let alone were even able to remember a fraction of the items lost. Now, three years later, many homeowners are still struggling to itemize their possessions leaving them with a feeling of being victimized a second time.

As a volunteer assisting these homeowners, the idea for a professionally documented home inventory service was born and TWS Home Inventory and Asset Management Group was formed. In 2013, the Black Forest Wildfire brought even greater devastation to the Colorado Springs area with over 511 homes destroyed and it was followed by the Waldo Canyon Flood.

The Root of the Problem

Once insured, a homeowner assumes that everything is covered and is totally unaware of the serious need for a documented inventory, much less the value that it adds to their insurance coverage. In my experience, most homeowners never read their policy to see what actually is and is not covered until they are in the claims process. Any loss, partial or total, requires some form of proof of ownership of contents, especially when it comes to specific valuable articles. Working with victims of loss, one thing seems to always be evident; homeowners tend to want to blame the insurance company for insufficient compensation. Unfortunately, few realize until after the fact that it is the homeowner’s responsibility prior to that loss to inform the insurance carrier of what they own to ensure proper coverage.

In the coming months we look forward to sharing with you the invaluable information learned over the past three years from homeowners affected by some of the worst natural disasters in recent years. Our goal in this series is to help educate proactive policyholders on the specific personal items you may own which need to have appraisals, floaters, riders, and endorsements not covered in a typical homeowner’s policy, because

When it’s too late….It’s too late!

You can learn more about Carrie Mitchell and free home inspection resources at

Common Home Insurance Purchasing Mistakes

Your home is one of your greatest investments; you need to make sure that it’s fully protected. That’s where home insurance comes in, but it’s not one-size-fits-all. There are plenty of decisions to make when buying your own policy- from coverage limits and extra protection for your belongings to important add-ons like water back up and sump pump discharge or overflow coverage and flood insurance.

It’s easy to make a quick choice when looking for insurance without realizing there could be major consequences (that could cost you thousands of dollars out-of-pocket). That’s why we’ve compiled the most common home insurance purchasing mistakes, so that you won’t make them.

Don’t just look at the price.

Of course, you want a good price. However, sometimes a cheap policy is a red flag. The company may be shady. Talk to friends and neighbors about companies they use. See which ones are endorsed by your union, bank, etc. If you’re worried that the price is “too good to be true,” check the coverage to make sure it’s not missing important items. Also, consider that there are many ways to lower your home insurance costs if price is a concern.

Don’t buy the wrong type of policy.

There’s a different policy for insuring your home when you’re living in it, versus insuring your home when you’re renting it out. Make sure your policy addresses your living situation. If you have the wrong type of policy, there is a chance your claim may not be covered.

Don’t underinsure your home.

It may be tempting to insure your home for the amount that you owe on it, and nothing more. Don’t do it. If your home is worth $350,000 and you owe $50,000 on the mortgage, you should insure your home for the full amount. If you insure it just for $50,000, that’s what you’ll get if your home is declared a total loss. All of that money will go to the bank and you’ll be left with nothing to rebuild. That’s why at California Casualty, we don’t write a policy unless it covers 100% of the replacement cost. Ask us about our 360Value tool which makes sure you’re insured for full value.

Don’t reduce your coverage to lower your premium.

If you’re using a company other than California Casualty, and you decide to reduce your coverage below your home’s value to lower your premium, you’re putting yourself at risk. You won’t have enough money to rebuild. The better way to go is to raise your deductible. This is the amount that you pay out-of-pocket before insurance kicks in. You can do this to save money with your California Casualty policy, too. According to NerdWallet, you could save 20 percent by raising a $500 deductible to $1,000. If you do increase your deductible, make sure that you can cover that deductible should something happen.

Don’t think flood or earthquake insurance is automatically included.

Many people don’t realize that homeowner’s insurance does not include floods or earthquakes. For that, you will need a separate policy. If you’re in a flood zone, you will want that extra insurance. There’s a 30-day waiting period to buy flood insurance so don’t wait until the last minute. Live in an earthquake-prone zone? The same principles apply and you will not be covered by just a regular home insurance policy.

Don’t skip the additional coverage.

As with floods and earthquakes, not everything is covered in your basic policy. Know what is covered and what is not covered so that you aren’t surprised in the event of a loss. Take an inventory of your possessions. Make sure your policy covers the valuables in your home. There’s a theft limit to jewelry coverage, and so you might need an insurance rider, an optional add-on to your policy.

You might want additional coverage for water backup and sump pump discharge or overflow.

If you’re a member of a homeowner’s association, you might consider increasing your loss assessments coverage which goes toward special assessments for expenses associated with your community. However, you may be surprised at what your policy does cover, such as your garden shed or detached garage and its contents. It also covers your kid’s stuff when he/she is away at school, your parent’s stuff if you’re storing it for them while they’re in a nursing home. Those are covered at just 10% of coverage limits, so you might consider additional coverage.

Don’t forget to ask about discounts.

You may qualify for insurance discounts for being part of a professional association, such as groups for teachers, nurses, or first responders. There are also discounts for being 55+ and retired, and for paying in full upfront. You may qualify for a new home discount, or a discount if you have updated your utilities (electrical, plumbing, heating, cooling) in an older home. There are discounts for a new roof and an automatic sprinkler system, for fire and burglar alarms, and for monitored security systems. You can even be rewarded for being a loyal customer. When you bundle your home and auto insurance, you can often qualify for reduced rates, saving hundreds of dollars.

Don’t go it alone.

Insurance is complicated. Your house is one of your most expensive assets. Take the extra step and talk in-depth to a professional insurance agent. At California Casualty we tailor our coverage to you and your home. Your agent can help determine the unique risks for your home and what you need to fully protect it—and that you don’t pay more than you have to.

Don’t buy it and forget it.

Remember to update your policy if you renovate your house. Some companies’ contracts require you to notify them if a renovation exceeds a certain amount. In addition, you’ll want to update your policy immediately if you buy or receive additional valuables, such as jewelry.

Make sure to sit down each year to review your policy. Ask what additional endorsements are available. Review your renewals; policies change and these changes will often be explained in the renewal packet. Consider increasing personal liability to cover, at a minimum, the market value of your home.

Finally, don’t forget to…

-

- Shop around. Getting competitive quotes will help you determine the right price.

- Ask friends and family members for referrals to their insurance company.

- Research the company. Make sure the company is licensed to work in your state. Check its reviews on the Better Business Bureau and online.

- Look for a company that will be responsive to your needs. Good customer service and claims service are key.

It’s your home. Make sure it’s protected.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com