by California Casualty | Helpful Tips, Safety |

Batteries power so much of our daily lives — phones, flashlights, toys, tools — and yet when they die, most of us don’t give them a second thought. Trash can? Recycling bin? Junk drawer, forever? The truth is that improper battery disposal can be dangerous for the environment and even a fire risk. Let’s break down the right way to dispose of batteries to keep everyone safe.

Why Battery Disposal Matters

Not all batteries are created equal. They are made from different metals and chemicals. Some contain hazardous materials like mercury, lead, nickel, and cadmium — substances that can leak into soil and water if sent to a landfill. Other batteries contain valuable materials, such as lithium and cobalt, that are costly and difficult to replace. Proper recycling keeps these materials in circulation.

Types of Batteries

Non-Mercury Alkaline and Zinc Carbon Batteries

These are the most common household batteries — A, AA, AAA, C, D, and 9-volt — used in items like toys, flashlights, and remote controls. Earlier versions of these batteries – made before 1996 – contained mercury and therefore required hazardous disposal precautions. But now these general-purpose batteries may be placed in the regular trash if your local municipality allows it.

Disposal:

- General trash if your town/state allow it*

- Recycling options at stores like Home Depot, Lowe’s and Staples

- Do not toss multiple batteries together, as any remaining charge can cause them to spark and potentially start a fire.

*Note: In states like California, it is illegal to throw any type of battery in the trash.

Mercury Batteries

Mercury and silver-oxide batteries often are found in small electronics, such as single-use button cells in watches, cameras, and hearing aids. Older general use batteries manufactured before 1996 also fall into this category. These batteries contain heavy metals and must be handled by professionals.

Disposal:

- Tape terminals before recycling to limit danger of an errant charge. Use clear packing tape, electrical tape or duct tape so it won’t easily peel off. If tape isn’t clear, make sure the type of battery and brand is visible.

- Household hazardous waste disposal per your local municipality

- Recycling options at retailers like Home Depot, Lowe’s and Staples

- Mail-in kits are available at companies like the Battery Network (formerly Call2Recycle).

Rechargeable Batteries

Rechargeable batteries come in many shapes and sizes. While they sometimes look like regular alkaline batteries, they require special hazardous disposal. These batteries contain heavy metals and must always be recycled, never thrown in the trash.

Types:

- Lithium-ion (Li-ion): Found in phones, laptops, and many electronics; can spark or catch fire if damaged

- Nickel-cadmium (NiCd): Often used in cordless power tools, phones, digital cameras, and medical equipment; cadmium is highly toxic

- Nickel-metal hydride (Ni-MH): Commonly found in power tools, digital cameras, and gaming controllers

- Small-sealed lead acid (SSLA/Pb): Used in mobility scooters, children’s ride-on toys, emergency lighting, and hospital equipment

Disposal:

- Individually bag batteries before bringing them to a hazardous recycling site.

- Alternatively, tape terminals before recycling to limit danger of an errant charge. Use clear packing tape, electrical tape or duct tape so it won’t easily peel off. If tape isn’t clear, make sure the type of battery and brand is visible.

- Household hazardous waste disposal per your local municipality

- Recycling options at retailers like Home Depot, Lowe’s and Staples

- Mail-in kits are available at companies like the Battery Network (formerly Call2Recycle).

Lead Acid Batteries

Lead acid batteries are commonly found in cars, boats, motorcycles, golf carts, and lawn mowers. These batteries contain sulfuric acid and lead and should be handled with care. They should always be professionally recycled. The good news is that almost all the materials (lead, plastic, and acid) can be reclaimed and recycled to make new batteries.

Disposal:

- Many auto repair shops and retailers, like AutoZone, accept used car batteries for recycling.

- You can also check with your town for information on safe household hazardous waste disposal.

- You may be able to find other resources at the Battery Network (formerly Call2Recycle).

EV Batteries

EV batteries are high-capacity lithium-ion batteries. As a consumer, you will likely not have to worry about handling them. They will be recycled by your auto repair shop, dealership or battery manufacturer when it is time to change them out.

Of note is that EV batteries can cause fires in electric and hybrid vehicles. This can happen if the battery is overcharged, damaged, or has a faulty design.

Disposal:

- These batteries must be recycled at a hazardous waste facility.

- Recycling fees can be part of the overall battery cost.

Battery Safety Tips

No matter the battery type, keep these safety tips in mind:

- Keep batteries away from moisture. Store them in cool, dry places.

- Use only the charger designed for your rechargeable battery. Switching to other chargers can create a fire risk.

- Never burn batteries. They can explode when exposed to fire.

- Watch for damage. Swollen or leaking batteries should be handled with caution. Place the damaged battery in a nonflammable material such as sand or kitty litter. Contact your local hazardous waste facility for disposal instructions.

Taking a few extra minutes to recycle or dispose of batteries correctly helps prevent fires, protects natural resources, and keeps hazardous materials out of landfills.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Helpful Tips, Safety |

Whether you’re driving down a dark back road, navigating a rain-soaked highway, or flashing your brights to warn another driver, your headlights are doing far more than simply lighting the way. They’re keeping you safe, visible and aware of everything ahead. From classic halogen bulbs to cutting-edge LED, today’s vehicle headlights come in a variety of types — each designed to improve your driving experience in different conditions.

Before we get into the specifics, let’s break down the components that create that important illumination. Headlights are generally defined by three core factors:

- Halogen, HID, LED, or laser: the source of the light

- Reflector or projector housings: the architecture that shapes and directs the beam

- Adaptive systems: the intelligence that moves the light as you drive

Each layer plays a different role, and together they determine how confidently you can read the road ahead — and how clearly other drivers can see you coming.

The Light Source

Halogen Headlights (about 700 lumens)

How they work: When electricity flows through a tiny metal wire inside the bulb, the wire gets extremely hot. Because the bulb is filled with halogen gas, the heat makes the wire glow brightly, creating the light you see from a halogen headlight.

Halogen headlights are the most traditional type and are still common in older vehicles and budget-friendly cars. In setups that use separate bulbs for low and high beams, halogens are often the choice for high beams. Their main advantage is cost — they’re inexpensive to produce and replace. However, they use more energy and don’t last as long as newer lighting technologies.

High-Intensity Discharge (HID) Headlights (about 3,000 lumens)

How they work: HID headlights don’t use a wire to make light. Instead, they create a tiny electrical spark between two metal points inside a bulb filled with special gas. That spark glows extremely bright, producing a strong, efficient beam of light.

HID headlights — often referred to as Xenon headlights if they use Xenon gas — deliver a bright, intense light that makes nighttime driving noticeably clearer. Their distinctive bluish-white glow has made them a popular aftermarket upgrade.

LED Headlights (about 2,000-4,000 lumens)

How they work: LED headlights use tiny electronic components called diodes. When electricity flows through them, the movement of electrons creates light instead of heat. By grouping many of these small LEDs together, manufacturers can produce a bright, efficient, and tightly focused beam for the road.

LED headlights have become the go‑to choice for many modern vehicles—and for good reason. They’re extremely energy‑efficient, long‑lasting, and adaptable. Although they can be more expensive to replace, LEDs typically outlast halogen and HID bulbs by several years, which helps offset the cost.

One of their biggest strengths is flexibility. LEDs can be arranged in complex matrix patterns, allowing both low and high beams to be built into the same housing. Individual sections can brighten or dim independently, working seamlessly with automatic high‑beam assist systems that rely on forward‑facing cameras.

Laser Headlights (Advanced/Limited-Use Technology)

How they work: Laser headlights don’t shine lasers onto the road. Instead, tiny laser diodes fire into a phosphor material, which then produces a very bright white light.

Laser headlights represent the cutting edge of automotive lighting, but their high cost and limited availability mean they’re mostly found in luxury and performance vehicles. Because they generate such an intense beam, they’re usually paired with LED systems and often activate only at higher speeds to extend high‑beam range.

The Shape and Direction

While the bulb creates the light, the housing determines how that light is shaped and aimed.

- Reflector Headlights: Reflector headlights are the old-school standard. Early designs featured a bulb placed inside a reflective steel bowl, covered by a glass or plastic lens. The bowl spread the light, while the lens helped direct it forward. Over time, mirrored surfaces improved beam control and made it possible to replace just the bulb instead of the entire unit.

- Projector Headlights: Projector headlights take things a step further. In addition to the bowl, mirrors, and bulb, they include a magnifying lens that increases brightness and precision. A built-in shield directs the light downward, reducing glare for oncoming drivers. Projector housings can accommodate halogen, HID and LED bulbs, making them a common choice in modern vehicles.

The Intelligence

Adaptive Headlights

Adaptive headlights represent the most advanced lighting systems on the road today. These headlights can adjust brightness, direction, and beam pattern based on steering angle, speed, road conditions, and surrounding traffic. As you turn the steering wheel, the headlights swivel to illuminate curves and corners more effectively — improving visibility while helping to reduce glare for oncoming drivers.

A Word About Headlight Alignment

Even the best headlights won’t perform well if they’re not aimed correctly. Over time, bumps, vibrations, and normal wear can knock them out of alignment, reducing how far and how evenly they illuminate the road.

How to check alignment:

- Park within 5 feet of a wall or garage door.

- Mark the center of each beam with painter’s tape in a cross shape.

- Back up 20–25 feet.

- If the beam no longer lines up with the tape marks, the headlights need adjustment.

For the most accurate results, have a professional handle the alignment.

When to Replace Your Headlights

Halogen bulbs typically last around five years, though this varies with use. Consider replacing or testing your headlights if you notice:

- Dimming or reduced visibility

- Flickering or inconsistent brightness (may point to electrical issues, not just worn bulbs)

- One bulb burning out (the other is usually close behind)

Note that cloudy or yellowed headlight lenses can sometimes be restored with cleaning or polishing kits.

And while proper maintenance goes a long way, having the right insurance adds an extra layer of confidence every time you drive. Safe travels from all of us at California Casualty.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Helpful Tips, Homeowners Insurance Info, Safety |

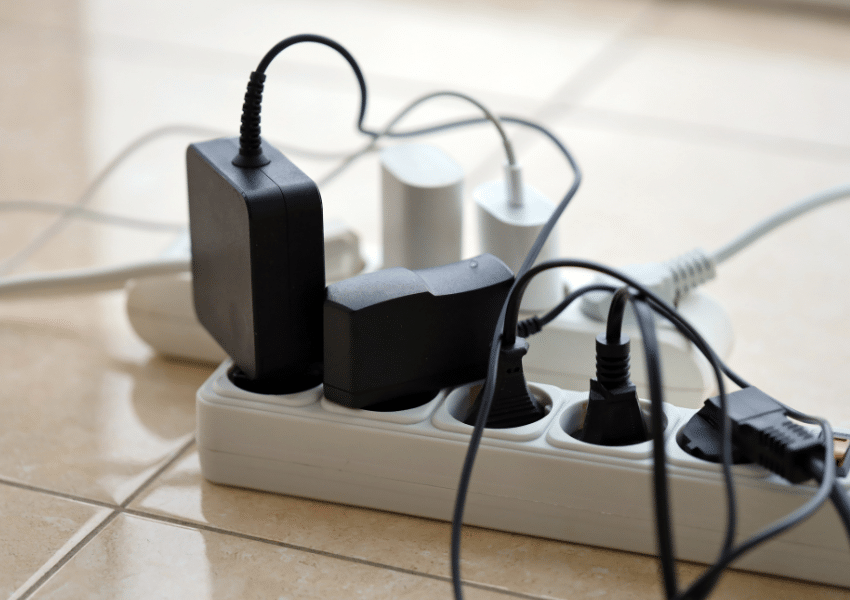

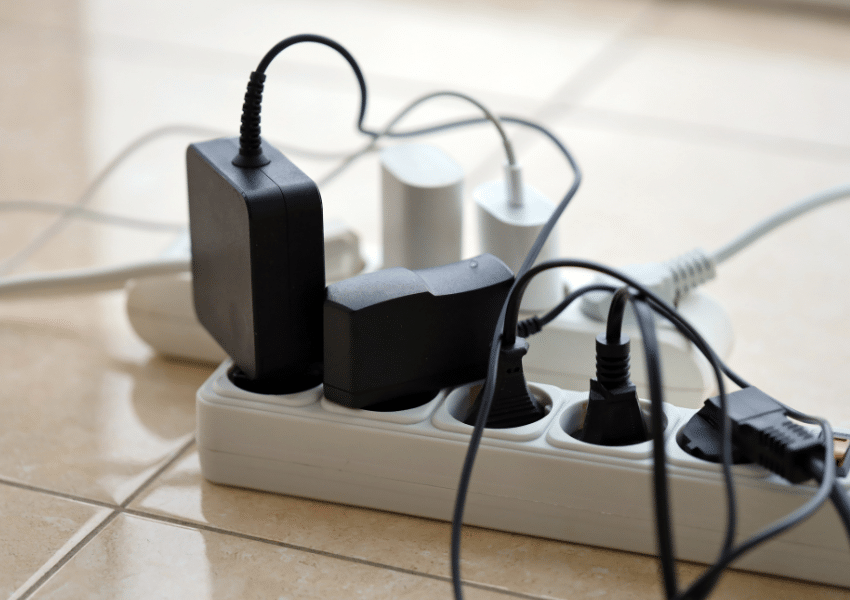

From curling irons to coffee makers, it’s tempting to plug just about everything into your power strip. But not all devices are meant to share that space. In fact, plugging the wrong items into a power strip can quietly overload your system and increase the risk of damage or even fire. Before you add one more cord, here’s what you need to know.

Power Strips vs. Surge Protectors: What’s the Difference?

Power strips are simply electrical outlets attached to a cord. They plug into a wall outlet to give you more places to plug things in.

Surge protectors, on the other hand, are power strips with a built-in safety feature. If there’s a sudden spike in electricity — such as during a lightning storm or a brief power fluctuation — they redirect excess voltage away from your devices to help prevent damage.

While surge protectors add a layer of protection, neither power strips nor surge protectors are designed to handle high-wattage appliances.

What Happens When You Overload a Power Strip?

Every device pulls a certain amount of electricity. When the combined demand of everything plugged into a power strip exceeds what it’s rated for, a power strip can overload. That overload can cause:

- Overheating

- Melted wiring or outlets

- Sparks

- Electrical fires

- Permanent damage to appliances

Most household power strips are rated for 15 amps at 120 volts, which equals 1,800 watts total. You can usually find this information printed on the strip’s label. Before plugging in any device, make sure its wattage keeps the total below this limit. As you add more devices, keep a running total to avoid exceeding the strip’s capacity.

Avoid Plugging in These Items

Just because a plug fits in a power strip doesn’t mean it belongs there. The items below use a lot of electricity — often in sudden bursts — which can overload a power strip and create serious safety risks.

1. Air Conditioners: Air conditioners cycle on and off, creating power spikes. Their continuous high electrical draw can overheat a power strip and melt internal wiring.

2. Air Fryers: Air fryers use short bursts of extremely high wattage. These surges can overwhelm a power strip and damage both the strip and your appliance.

3. Blenders: Blenders have powerful motors that draw a high amount of wattage, especially at startup—far more than a power strip can safely handle.

4. Curling Irons & Flat Irons: Hair styling tools heat quickly and often draw over 1,500 watts, pushing most power strips to their limit.

5. Coffee Makers: Coffee makers rely on heating elements that require intense bursts of power, increasing the risk of overheating or electrical damage.

6. Dehumidifiers: Like air conditioners, dehumidifiers use compressors that cycle on and off, causing power surges and sustained electrical loads.

7. Electric Blankets: These blankets contain heating elements that draw significant wattage for long periods, making them unsafe for power strips.

8. Extension Cords: Never plug an extension cord into a power strip. This practice, known as daisy chaining, is a well-known fire hazard.

9. Hair Dryers: Hair dryers frequently pull 1,500 watts or more, making them one of the most common causes of overloaded strips.

10. Microwaves: Microwaves draw between 1,000 and 1,500 watts and use powerful motors, which far exceeds what a standard power strip can handle.

11. Power Tools: Table saws, circular saws, chop saws, and air compressors all have high startup amperage surges that can overload a strip instantly.

12. Refrigerators: Refrigerators use compressors that cycle repeatedly, pulling a high current each time they start — something power strips aren’t built for.

13. Space Heaters: Drawing around 1,500 watts, space heaters push power strips to their absolute limit. Their constant cycling makes them especially dangerous.

14. Toaster Ovens: With powerful heating elements and rapid bursts of high wattage, toaster ovens should always be plugged directly into a wall outlet.

15. Washing Machines & Dryers: These appliances require high-current loads and, in many cases, 240-volt outlets. Power strips are never appropriate for them.

Warning Signs Your Power Strip Is Overloaded

Power strips don’t always fail dramatically. Often, they give subtle warning signs first. Knowing what to look for can help you catch a problem early and prevent damage or fire risk.

- The strip feels warm or hot to the touch

- The circuit breaker trips frequently

- Devices shut off unexpectedly

If you notice any of these signs, unplug devices immediately and move high-powered items to a wall outlet.

The Safer Rule of Thumb

If an appliance:

- Produces heat

- Has a motor

- Uses a compressor

- Or draws a lot of power

…it belongs directly in a wall outlet, not a power strip.

Finally, make sure to fully protect your home with the right insurance. If despite your best efforts to follow all the safety rules, a fire was to happen, your policy can provide added peace of mind.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Helpful Tips, Safety, Travel |

Your tires do a lot more than roll you from point A to point B. They keep you safe, improve fuel efficiency, and make every drive smoother and quieter. Yet terms like rotation, alignment, and balancing often sound like auto shop jargon best left to the pros. In this Tires 101 guide, we break down what these services really mean, why they matter, and how a little tire care can go a long way toward protecting your vehicle — and your wallet.

Tire Rotation

What is tire rotation?

Tire rotation is the practice of moving your tires to different positions on your vehicle — front to back, side to side, or diagonally — so they wear more evenly over time. Because each tire position experiences different forces, rotation helps distribute that wear instead of allowing one tire to do all the hard work.

Why tire rotation matters

Even tread wear means longer-lasting tires, better traction, and a smoother ride. Rotating your tires also helps maintain predictable handling and braking, especially in wet or slippery conditions. As a bonus, evenly worn tires roll more efficiently, which can help improve fuel economy.

What happens when you skip rotation

When tires are not rotated, they wear unevenly and wear out faster — sometimes thousands of miles sooner than expected. Front tires, in particular, tend to wear more quickly on most vehicles because they handle the bulk of steering, braking, and acceleration. Over time, uneven wear can lead to noise, vibration, and reduced grip on the road.

How often rotation is needed

Most vehicles benefit from tire rotation every 5,000 to 8,000 miles, or as recommended by your vehicle’s manufacturer. Many drivers pair tire rotation with routine oil changes, making it easy to remember and stay consistent.

How rotation is done

The rotation pattern depends on several factors: your vehicle’s drive system (front-, rear-, or all-wheel drive), whether your tires are directional, and whether the front and rear tires are the same size.

- Front-Wheel Drive (FWD): Front tires move straight back; rear tires move to the front and switch sides.

- Rear-Wheel or All-Wheel Drive (RWD/AWD): Rear tires move straight forward; front tires move to the back and switch sides.

- Directional Tires: Designed to roll in one direction only, these tires can move front to back but must stay on the same side.

- Staggered or high-performance setups: If front and rear tires are different sizes, they are typically rotated side to side only.

Pro Tip: If you have a full-size spare that matches your other tires, ask whether it can be included in the rotation to keep it in good condition and ready for use.

Tire Alignment

What is tire alignment?

Tire alignment — also called wheel alignment — ensures your wheels are perpendicular to the ground and parallel to each other. Alignment involves adjusting the angles of the wheels, so they point straight ahead and make optimal contact with the road.

Why tire alignment matters

Proper alignment helps your vehicle drive straight, handle predictably, and wear tires evenly. When your wheels are aligned correctly, your steering feels more responsive, your ride is smoother, and your tires last longer.

What happens when alignment is off

Misaligned wheels can cause tires to wear unevenly or prematurely. You may notice your vehicle pulling to one side, your steering wheel sitting off-center, or increased rolling resistance that forces your engine to work harder. Over time, poor alignment can reduce fuel efficiency, increase stopping distances in emergencies, and even cause steering wheel vibration.

How often alignment is needed

A good rule of thumb is to have your alignment checked once a year or every 10,000 to 15,000 miles. You may also need an alignment after hitting potholes, curbs, or other road hazards — or anytime your vehicle doesn’t feel quite right.

How alignment is done

Alignment adjustments are made to your vehicle’s suspension system, not the tires themselves. Technicians fine-tune three key angles:

- Toe: The degree to which tires point inward or outward when viewed from above.

- Camber: The inward or outward tilt of the tire when viewed from the front of the vehicle.

- Caster: The forward or backward tilt of the steering axis when viewed from the side.

Together, these adjustments ensure your wheels work in harmony rather than fighting against one another.

Tire Balancing

What is tire balancing?

Tire balancing ensures that the weight of each tire and wheel assembly is evenly distributed around the entire circumference. Proper balance allows your wheels to spin smoothly without vibration.

Why tire balancing matters

Balanced tires improve ride comfort, reduce vibration, and help your tires wear evenly. They also minimize stress on your suspension and steering components, contributing to better overall vehicle performance.

What happens when tires are unbalanced

When a tire has a heavy spot, it can wobble as it spins, causing noticeable vibrations, especially at highway speeds. Unbalanced tires may lose consistent contact with the road, leading to uneven tread wear and shortened tire life. Over time, this imbalance can also strain suspension and steering parts.

How often balancing is needed

Tires should be balanced every 6,000 to 8,000 miles, typically at the same time they are rotated. Balancing is also recommended whenever you install new tires or notice unusual vibrations.

How balancing is done

A technician mounts the tire and wheel assembly on a computerized balancing machine that detects weight imbalances. Based on the machine’s readings, small lead, zinc, or steel weights — either clip-on or adhesive — are placed on the wheel rim. The tire is then re-spun to confirm that the weight is evenly distributed.

General Tire Care

Keeping your tires in good shape goes beyond rotation, alignment, and balancing. Regular inspections and proper inflation play a critical role in tire safety and longevity.

Check tire pressure regularly using a gauge, ideally when tires are cold — meaning they haven’t been driven for at least three hours. The correct pressure can be found in your owner’s manual or on the sticker inside the driver’s side door.

- Underinflated tires generate excess heat and stress, leading to irregular wear and increased risk of failure.

- Overinflated tires are more susceptible to punctures and road damage.

It’s also wise to visually inspect your tires for cuts, cracks, bulges, or embedded objects so small issues can be addressed before they become major problems.

Finally, make sure your vehicle is fully insured for added peace of mind.

Safe travels from all of us at California Casualty.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Helpful Tips, Homeowners Insurance Info, Safety |

The holidays sparkle with lights, candles, and festive meals. All that cheer makes the season special but it also brings a few fire risks we don’t always think about.

In fact, home fires happen more often between Thanksgiving and New Year’s than at any other time of year. The good news? With just a handful of easy precautions, you can keep the season safe, cozy, and full of joy. Here’s how to protect your home and loved ones while still enjoying all the magic of the holidays.

Holiday Cooking: The Heart of the Home — and a Common Fire Risk

Holiday meals often mean more time in the kitchen, more dishes on the stovetop, and more distractions. Cooking fires are the leading cause of home fires during the holidays, especially when distractions shift your attention away from cooking.

Fire Risks

- Leaving food unattended on the stove or in the oven

- Steam, splashing oil, or hot liquids causing burns or igniting nearby flammable items

- Grease fires that can flare up quickly if frying food overheats

- Stoves left on, long after cooking is complete

Safety Tips

- Stay in the kitchen while cooking, especially when frying, boiling, or broiling.

- Keep flammable items away from the stovetop, including oven mitts, wooden utensils, food packaging, towels, and curtains.

- Use a timer as a reminder that something is cooking, even if you step away briefly.

- Create a kid-free and pet-free zone of at least three feet around the stove and oven to prevent accidental bumps or burns.

- Avoid cooking if you’re sleepy or have consumed alcohol, as both can slow reaction time and increase risk.

Electrical Power & Holiday Lighting: Sparkle Without the Spark

Holiday lights add warmth and cheer, but faulty cords or overloaded outlets can quickly turn decorative into dangerous.

Fire Risks

- Flickering lights especially when other appliances are turned on (signals a loose connection)

- Discolored or warm outlets

- Burning plastic or rubbery smells near outlets or cords

- Buzzing, sizzling or cracking sounds from outlets or cords

- Frequently blown fuses or tripped breakers

Safety Tips

- Use lights that are tested and approved by a qualified testing lab.

- Make sure outdoor lights are rated for outdoor use and protected from moisture.

- Replace worn, frayed, or broken cords

- Avoid overloading outlets and skip multi-plug adapters whenever possible.

- Always turn off holiday lights before going to bed or leaving the house.

Christmas Trees: Festive Focal Points That Need Care

A Christmas tree — real or artificial — can be a stunning centerpiece, but it also deserves careful placement and maintenance.

Fire Risks

- Trees placed too close to heat sources such as fireplaces, radiators, or space heaters

- Frayed wires or overloaded extension cords igniting branches

- Live trees drying out and becoming increasingly flammable

Safety Tips

- Place your tree at least three feet away from any heat source, including fireplaces, heat vents, candles, or lights.

- Use lights labeled for indoor use and follow manufacturer guidelines on how many strands can be safely connected.

- Water live trees daily. A well-hydrated tree is far less likely to ignite.

- Turn off tree lights before going to bed or leaving the house.

- Dispose of live trees promptly after the holiday, before they dry out.

- For artificial trees, look for a fire-resistant label for added peace of mind.

Candle Fires: Warm Glow, Real Risk

Candles play a meaningful role in many holiday traditions, including the menorah of Chanukah and the kinara of Kwanzaa. Decorative candles are also popular throughout the season. While candles beautifully set the festive mood, open flames always require care.

Fire Risks

- Candles placed too close to decorations, curtains, or furniture

- Unstable candle holders that can tip over

- Curious children or pets knocking candles over

Safety Tips

- Place menorahs or kinaras on a nonflammable surface, such as a tray lined with aluminum foil to catch dripping wax.

- Never leave candles unattended. Blow them out when leaving a room or going to bed.

- Keep candles out of reach of children and pets. Curious hands and wagging tails can cause accidents in seconds.

- Keep lit candles well away from decorations and other flammable materials.

Decorations: Festive, Fun—and Sometimes Flammable

Holiday décor adds personality and warmth to your home, but many decorations are made from materials that can ignite if exposed to heat or sparks.

Fire Risks

- Decorations placed near heat vents, lights, or fireplaces

- Flammable materials igniting from a spark or hot surface

Safety Tips

- Choose decorations that are flame-retardant or flame-resistant whenever possible.

- Keep decorations away from heat sources, including vents, candles, and fireplaces.

Fireplaces: Cozy Comfort with Important Rules

A crackling fire is a holiday favorite, but fireplaces require extra attention during busy gatherings.

Fire Risks

- Stockings, garlands, or decorations hung on the mantel can ignite if exposed to heat or sparks.

- Embers or sparks can escape the fireplace and ignite nearby furniture, rugs, or wrapping paper.

- Creosote buildup in the chimney increases the risk of a chimney fire.

- Fires left unattended or not fully extinguished before bedtime can reignite overnight.

Safety Tips

- Never light the fireplace if stockings or decorations are hanging from the mantel.

- Keep wrapping paper, gift boxes, and decorations at least three feet away from the fire.

- Use a fire screen to prevent embers from escaping.

- Make sure all embers are completely out before heading to bed or leaving the room for the night.

- Install and maintain working smoke detectors on every level of your home.

- Keep a fire extinguisher accessible and make sure adults in the household know how to use it.

- Review your home insurance coverage to ensure you’re properly protected, an important step for peace of mind year-round.

A safe home is the foundation of a joyful holiday season. By staying mindful and taking a few proactive steps, you can focus on what truly matters — time together, cherished traditions, and making memories that last long after the decorations come down.

Happy holidays from all of us at California Casualty!

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Helpful Tips, Pets, Safety |

Ghosts, goblins, and giggles — Halloween is one of the most magical nights of the year! Between the costumes, candy, and community fun, it’s a night made for memories. But even the most festive fright night needs a few safety tricks to keep the fun from turning into a scare. Whether you’re sending your little pumpkins out to trick-or-treat, wrangling a costumed pup, or decking out your porch for visitors, a little preparation goes a long way toward keeping the night safe and spooktacular.

Little Monsters on the Move (Kids’ Safety Tips)

Keep your little ghouls glowing and grinning from door to door with these safety tips.

- Shine bright! Choose bright, reflective costumes or add glow sticks, light-up accessories, or reflective tape so kids stay visible as they roam.

- Double check the fit. Make sure costumes aren’t too long (no tripping hazards) and choose flame-resistant materials for extra safety.

- Breathe easy. Skip the mask and go for nontoxic face paint — it makes it much easier to see and breathe.

- Add ID. For younger kids, tuck a note with your name and phone number in a pocket, or write it discreetly on their arm — just in case you get separated.

- Stick to sidewalks. Walk on sidewalks whenever possible, and cross only at corners — never between parked cars. Review safety around vehicles with your kids.

- Make a plan. For older trick-or-treaters, set a route, a curfew, and some ground rules: stay in groups, visit only well-lit homes, and never enter a stranger’s car or house.

- Inspect the loot. Once the candy haul is home, check for anything unsealed or suspicious, and watch for choking hazards for younger kids.

- Think outside the block. Not sure about your neighborhood for trick or treating? Check out local mall events or community “Trunk or Treats” for a fun and family-friendly alternative.

Halloween can be confusing for our furry friends — after all, strangers in costumes and ringing doorbells aren’t exactly normal! Help your pets enjoy the night, too.

- Desensitize early. Let them see your costume ahead of time, especially if it includes masks or props. Try feeding them treats while you are in costume to get them accustomed to it.

- Practice door knocks. Have family members or friends simulate trick-or-treaters so your pet gets used to the noise and the routine.

- Create a safe space. Some pets prefer peace and quiet. Set them up in a cozy room with a radio or TV for background comfort during trick or treating hours.

- Keep them secure. Whether it’s behind a baby gate, in a crate, or on a leash, make sure they can’t bolt out an open door, or get slammed by one.

- Reflective is best. If your pet joins you outside, use a reflective leash. Add reflective tape to your dog’s costume or collar for extra visibility.

- Ensure an adult is in control. Even if your child can manage your dog, they are not experienced in how to react should something go wrong.

- Keep an eye on your pet’s mood. Your pet may act differently in a crowd of people with costumes, lights, noise and other stimuli. They may bite or scratch if they feel threatened. If they seem stressed, bring them home.

- No candy, please! Chocolate and artificial sweeteners like xylitol are toxic to pets, so keep those treats out of paw’s reach.

Home Sweet Haunted Home (For Homeowners)

Your home is part of the Halloween magic—make it inviting and safe for trick-or-treaters!

- Light the way. Replace any burnt-out bulbs, sweep away leaves, and clear your walkway of toys, bikes, or tools.

- Flameless fun. Skip open flames in pumpkins and go for battery-operated candles or LEDs instead.

- Decorate safely. Skip flammable décor like cornstalks or hay bales. They can ignite quickly from a warm bulb or stray spark. Choose safer materials to keep your spooky setup fire-free.

- Mind the allergens. Avoid candies with peanuts or tree nuts and consider nonfood treats like stickers or small toys. Did you know that a teal pumpkin on your porch signals that you’re giving out nonfood items for those concerned about allergies?

- Check your systems. Test smoke detectors and carbon monoxide detectors and ensure outdoor cameras and your security system are working.

- Pool precautions. If you have a pool, make sure it’s well-secured and off-limits to curious ghouls. Not only could it pose a danger to them in their Halloween costumes, it could put you, as the homeowner, at risk.

- Stay alert on the road. Driving during trick-or-treat hours? Slow down and keep an eye out for excited kids who may dart into the street.

- Neighborly watch. If you won’t be home during prime candy hours, let a neighbor know so they can keep an eye out. Leave a bowl of treats in a well-lit area for passersby.

Finally, know the Halloween horrors covered by your insurance policy. With a few thoughtful steps, you can make Halloween magical, memorable, and mishap-free. From all of us at California Casualty, have a safe and Happy Halloween!

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.