by California Casualty | Behind the Scenes |

California Casualty recognizes employees who have made a significant impact on how our organization does business as your insurance partner with two annual awards.

The Thomas R. Brown Pride in the Code Award is a tribute to Tom Brown, recognizing employees for outstanding contributions that reflect one or more of the company’s five core values drawn from the California Casualty Code: Acting with Integrity, Fulfilling our Promises, Providing Exceptional Service, Pursuing Excellence through Learning and Working as a Team.

Throughout the year, employees can be nominated by their peers to receive a PRIDE in the Code award. Quarterly award winners are selected from among all employees receiving a PRIDE in the Code award during a particular quarter. The highlight each year is when one of the quarterly winners is selected for the annual Thomas R. Brown PRIDE in the Code award.

The Carl G. Brown Jr. Award of Excellence, considered California Casualty’s highest honor, is given to those who exemplify the value of Carl G. Brown Jr. – author of the California Casualty Code – who, over his 40 years of service, tirelessly dedicated his time, talent and energy to the company and the community.

Each year, in keeping with Mr. Brown’s deep personal commitment to responsibility and achievement in both these areas, the award is presented to an employee in recognition of excellence in their contributions to California Casualty and their local community.

The 2020 recipient of the Thomas R. Brown Pride in the Code Award is Carleen N., Senior Communications Systems Analyst, for Providing Exceptional Service.

Carleen went above and beyond to help our employees work through phone and workspace issues at the outset of the COVID-19 pandemic. She was instrumental in assisting employees in many areas of the company to set up workspaces at home. Carleen solved numerous work-from-home phone issues, helped departments learn how to use our enterprise videoconferencing solution, and supported employees coming back into the office.

In addition to demonstrating the value of Providing Exceptional Service, Carleen is also someone who lives our core value of Working as a Team. One of her PRIDE in the Code nominators, Lisa P., said, “Carleen worked with so many employees with varying levels of system expertise. She was always patient and kind, with a positive attitude the entire time.” Another of her nominators, Greg F., added, “Carleen was willing to do whatever it took, working later in the evenings and on weekends as well!”

Managers and team leaders across the company recognize that Carleen’s expertise and dedication have helped their teams deliver for California Casualty’s policyholders in this difficult time, when nurses, law enforcement, firefighters, and educators are being stretched to do their jobs in ways that would have seemed unimaginable a year ago. Mike McCormick stated, “We have been able to continue to be available to our group members through it all because of Carleen’s responsiveness in working with our team!”

The Sales Leadership Team summed it up well: “We are so appreciative of Carleen and wanted to recognize her for the difference she makes. Thank you, Carleen!”

The 2020 recipient of the Carl G. Brown Jr. Award of Excellence is Todd B., Senior Vice President-Underwriting Operations/ Analysis & Corporate Legal.

Todd started his CCMC career in the Colorado Service Center in 1998, excelling as a Sales Representative and as a Sales Team Manager. From 2003 to 2012, a period that included his election to Vice President in 2009, Todd had responsibility for various combinations of the following departments: Underwriting Operations, Service, Sales, and Direct Mail/Marketing Services. After a brief hiatus of just over one year as a self-employed entrepreneur, Todd returned to California Casualty in 2013 as Manager of Home Office Underwriting. Over the next few years, Todd gained responsibility for Underwriting Quality Assurance and Underwriting Operations, and he was re-elected Vice President in 2017. In 2020, Todd’s responsibilities were further expanded to add Corporate Legal and Licensing, and in December 2020 he was elected Senior Vice President.

Todd is a true champion of continuing education, personally earning seven insurance designations including his CPCU. He has successfully encouraged his staff to do the same as a way to increase their knowledge and elevate their expertise, through learning and obtaining the designations to reflect their achievements and their professionalism. On the application submitted for this award, Todd’s nominators stated, “With the value, he has set on education, it is no surprise that Underwriting has experienced a large number of employees receiving designations over the past few years with more in the works.” We are proud of the many employees in Underwriting and throughout the company who have risen to the challenge of boosting their knowledge and expertise, as California Casualty moves forward in a rapidly changing personal lines marketplace.

Todd is a “skilled and enthusiastic communicator” who is “able to gain buy-in by others for procedure changes and project implementations.” The key to his success is that his “openness to creative solutions is contagious and is a great gift Todd provides to those he interacts with.” Todd has always been open to new processes and innovations, leading or collaborating with others on many projects that have positively impacted California Casualty and how we do business. Todd is a bowhunter who has held leadership positions in organizations dedicated to conservation and record keeping. He has served as a director on the board of the Colorado Bowhunters Association, from which he received the 2018 CBA Bowhunter of the Year award, a lifetime achievement award, for his many hours of service and efforts. Todd has also served as a director of the Rocky Mountain Bighorn Society and of Pope & Young, the largest bowhunting organization in North America.

Please join us in congratulating Todd!

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | In Your Community |

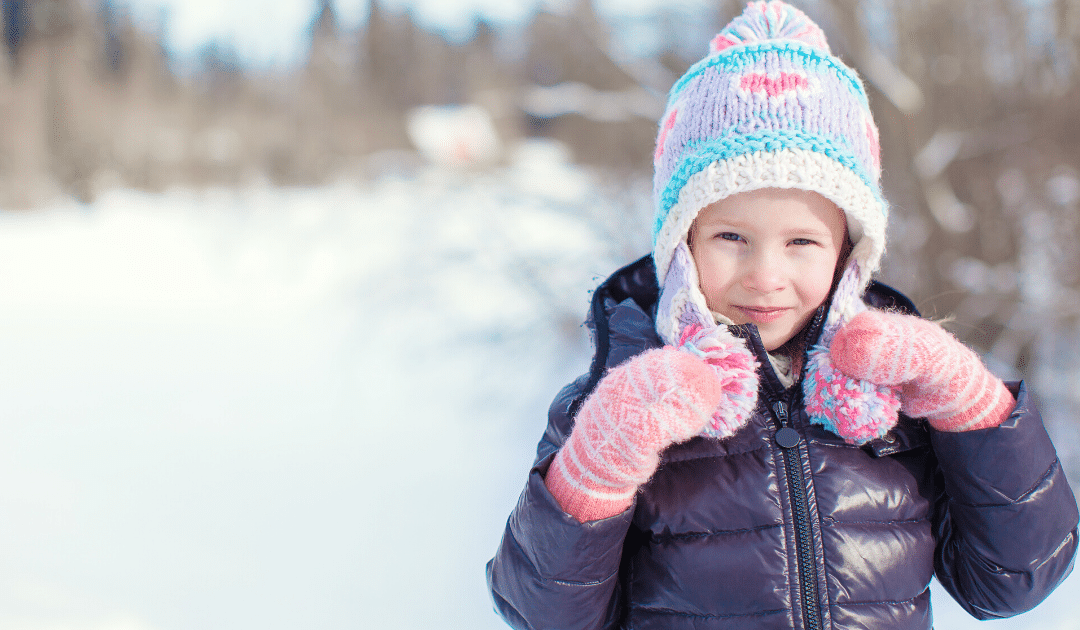

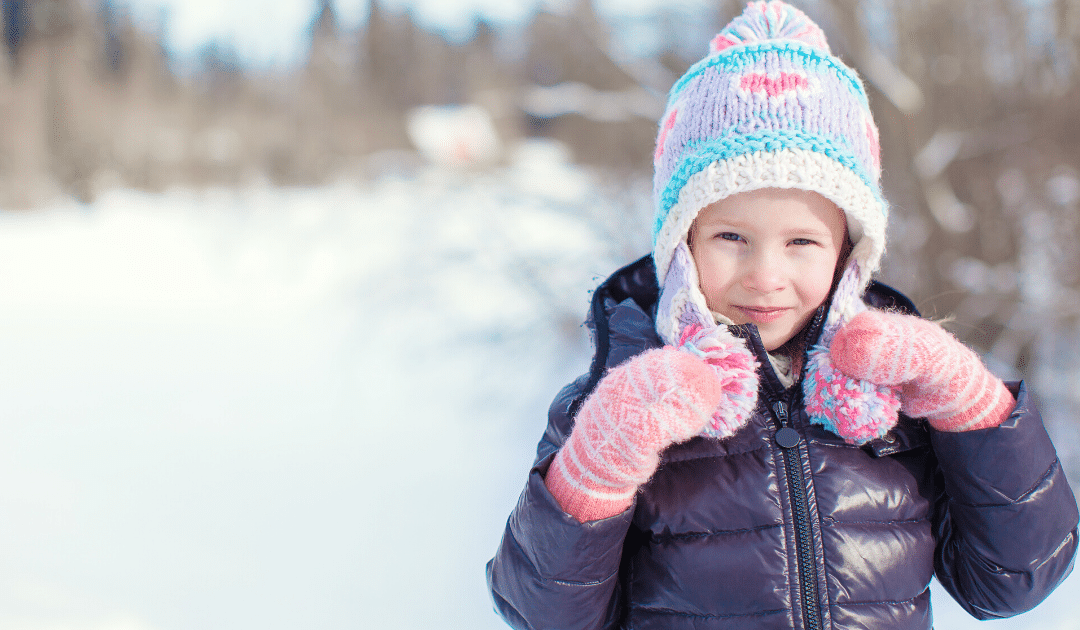

California Casualty along with its long-time partners, the Professional Firefighters Association of Utah (PFFU) and the National Education Association (NEA), recently came together to deliver 85 warm coats to children at risk through the PFFU Coats for Kids program.

Students at Redwood Elementary School in Salt Lake Valley’s Granite School District will be a lot warmer this winter thanks to California Casualty, PFFU Local 2970, Star Orullian of Granite Education Association, Redwood Elementary School Principal Jolynn Koehler, and NEA Member Benefits Affiliate Relations Specialist, Sean Mabey.

Students at Redwood Elementary School in Salt Lake Valley’s Granite School District will be a lot warmer this winter thanks to California Casualty, PFFU Local 2970, Star Orullian of Granite Education Association, Redwood Elementary School Principal Jolynn Koehler, and NEA Member Benefits Affiliate Relations Specialist, Sean Mabey.

Coats for Kids was established in 2013 by the Professional Fire Fighters of Utah to combat one of the most fundamental hardships of childhood poverty- the absence of a warm winter coat.

For more than a decade, PFFU has watched the problem of childhood poverty creep mercilessly into the homes of the communities it serves. Poverty ravages families without discrimination – and by necessity those struggling to survive naturally prioritize food, heat, and rent above winter clothing.

In Utah, and many other communities across the country, the lack of a winter coat often results in frequent school absenteeism which translates to forgone learning, missed opportunities for socialization and play, and the loss of balanced nutrition provided through the school’s meal program. Helping students stay warm as they walk to and from school leads to increased attendance, allowing children of families in need to experience the critical childhood benefits their school has to offer.

There is no denying the joy of a child being zipped into their brand new coat by their hometown heroes. Since 2013 the Professional Firefighters of Utah Coats for Kids drive has resulted in 2,198 coats purchased and provided to needy children in fourteen different elementary schools in Utah.

“What happened today at Redwood Elementary mattered to many little First Graders”, said Sean Mabey “Seeing those little kids wearing coats, smiling and waving, will be a highlight for me personally this season.”

Representing California Casualty, Assistant Vice President, Valerie Cregan commented, “It is truly an honor for all of us at California Casualty to join in support of our valued business partners in their efforts to help the children of the Salt Lake Valley community.”

Representing California Casualty, Assistant Vice President, Valerie Cregan commented, “It is truly an honor for all of us at California Casualty to join in support of our valued business partners in their efforts to help the children of the Salt Lake Valley community.”

“The Professional Fire Fighters of Utah, and all of our IAFF Affiliate Locals are very proud of our ongoing Coats for Kids project. Our ability to supply coats is only possible through our members’ fundraising efforts and our great partners such as California Casualty. As 2020 was a most difficult fundraising year – California Casualty stepped up BIG to help us get more kids in coats just in time for the holidays.” Jack Tidrow, President.

In attendance: Redwood Elementary Principal Jolynn Koehler; Granite Education Association Representative Star Orullian; PFFU President Jack Tidrow; PFFU Secretary/Treasurer Susan Davis; IAFF Local 2970 Firefighters Kyle Stewart, Bronson VonTussenbrook, and Drew Griffin. Attending remotely from California Casualty: Lisa Almeida, AVP, Valerie Cregan, AVP, and Erica Reich, Senior Field Marketing Manager; attending remotely from NEA Member Benefits: Sean Mabey.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Consider This |

It’s officially pothole season.

Potholes can pop up on roadways during any season, but why do they seem so prevalent during the first few months of the year?

When winter is ending and spring is on the horizon, the weather is constantly fluctuating between mild and freezing temperatures. Rain, snow, and ice get into smaller holes and cracks in the pavement, and as the temperature jumps back and forth from high to low, the precipitation continually freezes and thaws expanding those pavement cracks causing others to form. As cars and heavy trucks drive over them, the asphalt chips away, thus creating potholes.

Potholes, no matter how small, can wreak havoc on your entire vehicle. Here are 5 ways hitting a pothole can cause damage.

1. Steering & Suspension

Your vehicle’s suspension absorbs bumps so you can’t feel them when you drive. If you cause enough wear and tear on your suspension system, it could result in a number of problems with your steering, including: vibrations, noises when you turn, vehicle pulling to one side, etc.

2. Undercarriage

Vehicles that ride lower to the ground have a better chance of being damaged by a pothole. They can cause scratches and scrapes, that aren’t dangerous until they start to rust or leak. They can also rip off low-hanging bumpers.

3. Tires & Wheels

It’s no secret that debris from potholes can cause holes, leaks, and tears in your tire, but when you hit a pothole fast enough, it can also cause a complete tire blowout. Potholes can also damage your wheels by bending or cracking your rim. And if there is visible damage, you’ll likely have to replace the entire wheel.

4. Body & Exhaust System

Pavement debris and rocks can scratch the paint on your vehicle and cause rips and leaks in your exhaust pipes, muffler, and catalytic converter. If your exhaust pipes have been damaged, it can be a serious issue. Ripped pipes can leak exhaust fumes into the cabin of your vehicle and cause serious health issues (including death). If you hear a strange noise or lose power after hitting a pothole, there is a good chance your exhaust pipes have been damaged and you need to pull over.

5. Loss of Control

Lastly, one of the most dangerous consequences of hitting a pothole is that it could cause you to lose control of your vehicle. Losing control for even a few seconds, could not only cause damage to your vehicle, but could also be deadly for you and your passengers. That is why it is important to watch the road for potholes when you drive and try and avoid them.

Potholes are extremely dangerous for you and your vehicle, but sometimes accidents do happen.

So, what if you accidentally hit a pothole, is damage done to your vehicle covered by insurance? Typically pothole damage is covered if you have collision insurance. If you aren’t sure, call your agent and review your coverage today.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Finances, Good to Know |

Was one of your New Year’s resolutions to start saving money, or to start spending a little more wisely? The best way to save money for you and your family’s future is to create a budget.

Most people cringe at the thought of sitting down and going over their finances, but budgeting doesn’t have to be scary. Even if you think you are in good financial standing you may be shocked when you sit down and go through the numbers. A budget will help you monitor your flow of money and get rid of unnecessary spending, saving you money each month, so what’s there to lose?

Here are 7 easy steps to begin setting your budget.

Step 1. Sit Down Together

Get together with your significant other to calculate the total amount of money you each have coming in each month. From there you will be able to more accurately know where you can cut spending and start saving.

Step 2. Find Out Your Essential Spending Costs

When you begin to sit through and work out your family’s budget, it’s important to start by writing out all of the essential spending your family does each month. This will include payments for your mortgage, rent, bills, insurance, auto loans, student loans, schooling, daycare, food, prescriptions, and essential groceries and clothing.

Step 3. Find Out Your Non-Essential Spending Costs

Next, you will write all costs that may not be essential, but you would like to keep putting money towards them each month. If you have any non-essential spending that you don’t use anymore this would be a good time to start cutting that spending out to help you save. Non-essential monthly spending could include just about anything, like streaming services- Netflix, Hulu, Spotify, or Disney +, etc., subscription and other services like Amazon Prime, Adobe Creative Suite, Dollar Shave Club, Stitch Fix, etc. It could also include any club or gym memberships, extracurriculars, etc.

Step 4. Set Aside Extra Cash to Pay off Debts

By paying off your debts more quickly you can get yourself in better financial standing for the future. To do this start, use the money that is left that you have calculated from your essential and non-essential spending, and start by paying a little above the average monthly payment on your credit cards. Do this every month until you get the balance low enough to completely pay them off. It doesn’t have to be much, a few extra dollars here and there will still get you closer to paying debt off than the minimum payment. You can also do this with your other loans, like your car or home, as well. You can either do this with multiple debts or choose one debt to pay off at a time; it depends on you and your preference and financial situation.

Step 5. Set a Limit for Extra Spending

Setting Limits may be hard at first, but when you sit down and calculate your average cost at the grocery store or your weekly retail therapy, you may find out that you are overspending. Set a reasonable limit for yourself when you go shopping, one that fits into your budget, and stick to it. Bye overspending.

Step 6. Leave Yourself Some Room

A common mistake in budgeting is not leaving room for events that take place throughout the year like, Holidays, Birthdays, Weddings, Back to School, Baby Showers, etc. If you have an event coming up, know to keep a little bit of extra money out to put it towards. Even if the event is your family going out to eat once a month, remember to leave yourself some room. One of the best ways to do this without overspending is to take out a cash deposit and put it in an envelope to use on that date. That way it is out of your account, you have a spending limit, and the rest can go towards your savings.

Step 7. Determine How Much You Can Save

Once you have all of your spending calculated, you can then determine how much you can save each month. Assuming that some of your payment already goes into your 401k, it’s important to also contribute a personal savings account every month or every paycheck. Think of your personal savings account as a nest-egg for you and your family in case of emergencies. It is wise to contribute enough money into this account until you have reached an amount that could support your family’s essential needs for at least 6 months. Do not pull out of this account.

If you would like to start a savings account that you want to attribute money towards each month for additional life events like college, home-ownership, your own wedding, engagement rings, renovations, family trips, vacations, etc. open a new account, a new one that doesn’t include the nest-egg savings you have built, and start contributing what you can until you have reached your goal.

BONUS TIP: Track Your Spending

To stay on track is to monitor your spending. You should track every dollar moving in and out of your account. There are hundreds of budgeting apps that can help you, or you could just make it a point to look at your online banking at the end of each day. Tracking all of the cash flow in real-time will help you cut out costs that aren’t necessary or that you may not use as often as you think you do. This will also help you monitor your account for any suspicious purchases or accidental charges.

Budgeting doesn’t have to be scary, and if you get the math wrong on your first month that’s okay. Fix some spending/saving and try again, and don’t be afraid to make adjustments where they are needed. It’s your money, find whatever works for you and your family.

Happy budgeting!

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Behind the Scenes |

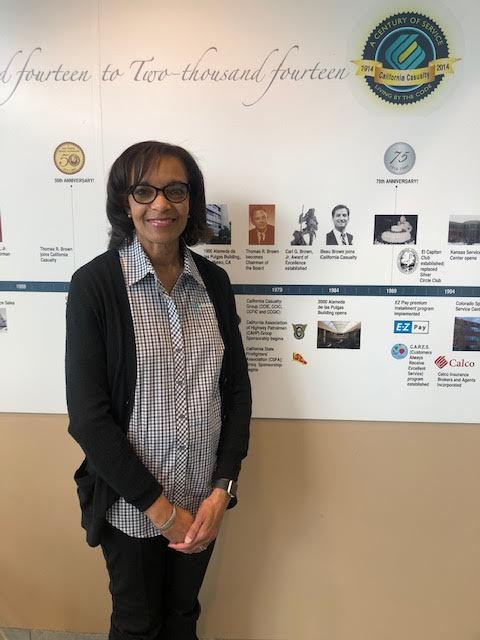

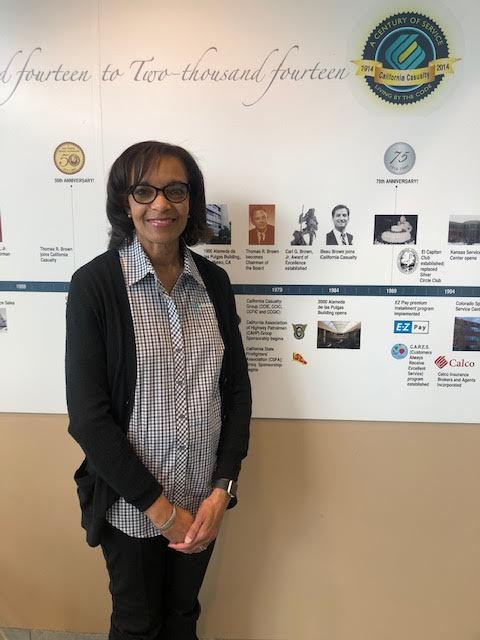

As 2020 comes to a close, so does a great career for Debbie Hunter-Ellis AVP- Customer Service Manager. Debbie celebrated her 40th anniversary with California Casualty in July and at the end of this year will celebrate her much-deserved retirement.

As 2020 comes to a close, so does a great career for Debbie Hunter-Ellis AVP- Customer Service Manager. Debbie celebrated her 40th anniversary with California Casualty in July and at the end of this year will celebrate her much-deserved retirement.

We recently had the pleasure to (virtually) sit down with Debbie and discuss her life and her career at California Casualty. Here’s what she told us:

“I was born in Natchitoches, Louisiana home to the 1989 hit movie “Steel Magnolias”. I was raised in a military family and lived most of my life in Northern California. San Jose State University, home of the Spartans, is my alma mater. I graduated with a BA degree in Business Management. During college, I worked in the Career Center where I was responsible for organizing the on-campus interviews for graduates seeking employment with corporations in the Silicon Valley and Bay area region. This is where I came across California Casualty, who was recruiting college graduates. The family-owned business and their willingness to hire and train graduates fresh out of school was an attractive attribute.”

Debbie applied and soon started off as a Customer Service Representative in San Jose, where she learned about automobile and home insurance, and how to service customers on their policies.

After eight years in her Customer Service role, she was promoted to Customer Service Supervisor which quickly transitioned to a Customer Service Team Manager. At that time, she moved with California Casualty and had the honor to take part in the opening of our Colorado Springs Service Center.

Debbie said, “The opening of the Service Center was a rewarding experience. As a Customer Service Team Manager, I contributed to the development of processes and procedures, recruiting, guiding, and developing employees while meeting the customer and the company expectations.” Debbie managed a team of 10 – 15 Customer Care Specialist for over 20 years. And each year her team excelled at providing quality customer experience to California Casualty’s affinity group members. “The Customer Service Team Manager position is where I established a solid foundation for continuous learning and leadership development.” she said, “Furthermore; this provided the opportunity for the Customer Service Department Manager where I have been in this leadership role for the past 7 years.”

It’s a very great and rare occurrence when an employee reaches a milestone as great as their 40-year mark. When asked about her past four decades with California Casualty, she said, “I have seen and experienced a lot of positive change during the past 40 years. We have really achieved great heights! It is rare to say you have only worked for one company in your career. I’m humbled and grateful for the amazing opportunity and experience with California Casualty.”

Debbie said she will miss the unique culture that has developed over the years, but the strong relationships and the day-to-day interactions with the Customer Service Management Team and employees will never be forgotten.

And the Customer Service Department will never forget the impact Debbie has had on them. Debbie’s friends and peers, Vice President of Customer Service, Daphne Pavone, and Senior Customer Service and Agency Services Team Manager, Bianca Odom, had a few parting words they wanted to say to, and on behalf of, Debbie as she gets closer to her well-deserved retirement day.

“Debbie Hunter-Ellis is a wonderful person and an amazing co-worker. She cares about her colleagues and has spent her career focused on delivering quality customer service and developing her people. Debbie’s calm and professional demeanor makes her a natural ‘go-to’ for an additional and balanced perspective. I consider Debbie a colleague and a friend. Thank you, Debbie, it has been a true joy working with you! I wish you all of the best in this new chapter of life. -Daphne”

“Ever since I joined the Customer Service Team, Debbie has been a great mentor and friend. She has always been a leader that has demonstrated good judgment and sets an example for others to follow as she is hard-working, fair, honest, dependable, and understanding. I appreciate Debbie more than I could ever express and I’m sad to see her go; although I’m also very excited for this next step in her life. Congratulations Debbie! We will miss you! –Bianca”

In retirement, Debbie plans to spend her days traveling, enjoying outdoor activities, and exploring creative endeavors.

Enjoy every second of it, Debbie, you’ve earned it! We will all miss you and wish you the best. You’ll always be a part of the CalCas family; thank you for 40 years.

by California Casualty | In Your Community |

Every year, Impact Teen Drivers and California Casualty offer enrolled students, ages 14 to 22, the opportunity to win prizes for their original works (creative writing, video, graphic design, or music) showcasing creative solutions for preventing the #1 killer of their peers –reckless and distracted driving.

Distracted driving is anything that takes a driver’s eyes off the road, hands off the wheel, mind off driving, or keeps ears from being alert to surroundings. Commonly referred to as accidents, these crashes are actually 100% preventable.

The Create Real Impact contest is a proactive movement to reduce poor decision making and inattentive driving by 16 to 19-year-olds that has become an epidemic. Empowering messages from young people urging their peers to adopt safer driving attitudes and avoid the tragic result of bad choices behind-the-wheel can save lives.

The Fall 2020 Create Real Impact contest winners were recently selected.

Prizes are awarded by a panel of qualified judges based on the following weighted criteria: 25% concept/creativity; 25% execution of the idea; 50% effectiveness of the message emphasizing solution(s).

The following students will receive $1,500 Grand Prize educational grants for their entries:

-

- Jessie M., Sunbury, PA, in the music category for the work titled, “Some Things Change”

- Andre M., Halethorpe, MD, in the video category for “Don’t Drop the Ball”

- Erika A., Honolulu, HI, in the creative writing category for “A reverse poem of the preventable killer of teens – distracted driving”

- Mayumi D., Las Vegas, NV, in the graphic design category for the piece “No Distraction is Worth Risking Your Life”

Guohang (Henry) Z., Rowland Heights, CA, received $500 as the first runner-up for his video, “JUST DRIVE! (it’s free!)”

These students won for their works in Spanish:

-

- Fiorella M., Doral, FL, in the Spanish language category for the video “Create Real Impact- Como Prevenir Manejar con Distracciones” – a Judges Pick, receiving $1,000

- Alejandra B. Cheyenne, WY, for “Vale la pena?” – Honorable Mention Spanish Graphic Design, receiving $250

- Belen T., Salinas, CA, for “Informacion Para Padres De Conductores Adolecente” – Honorable Mention Spanish Video, receiving $500

These students had the most online votes for their submitted works. Each will receive $500 in grant funds:

-

- Maxwell R., Boston, MA, in the music category for “I Don’t”

- Gaby G., Bergenfield, NJ, in the video category for “Choose Today to Have a Tomorrow”

- Annaka T., Lemoore, CA, in the creative writing category for the piece “Anything can happen in a matter of a second”

- Alec B., Aptos, CA, for a graphic design submission titled, “It’s the mindset”

The 2021 Create Real Impact contest will kick off in January. Entries will be taken at www.createrealimpact.com. For more information on how to get schools and students involved, please contact [email protected].

About Impact Teen Drivers

Impact Teen Drivers was founded in mid-2007 by the California Association of Highway Patrolmen, California Casualty, and the California Teachers Association. The organization has emerged as a leading non-profit organization dedicated to reversing the pervasive yet 100% preventable crisis of teens killed in car crashes. ITD’s mission is to develop, promote, and facilitate evidence-based education and strategies to save lives and reduce injuries and fatalities caused by reckless and distracted driving. To learn more visit www.ImpactTeenDrivers.org or send an email to [email protected]

This article is furnished by California Casualty. We specialize in providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

Students at Redwood Elementary School in Salt Lake Valley’s Granite School District will be a lot warmer this winter thanks to California Casualty, PFFU Local 2970, Star Orullian of Granite Education Association, Redwood Elementary School Principal Jolynn Koehler, and NEA Member Benefits Affiliate Relations Specialist, Sean Mabey.

Students at Redwood Elementary School in Salt Lake Valley’s Granite School District will be a lot warmer this winter thanks to California Casualty, PFFU Local 2970, Star Orullian of Granite Education Association, Redwood Elementary School Principal Jolynn Koehler, and NEA Member Benefits Affiliate Relations Specialist, Sean Mabey. Representing California Casualty, Assistant Vice President, Valerie Cregan commented, “It is truly an honor for all of us at California Casualty to join in support of our valued business partners in their efforts to help the children of the Salt Lake Valley community.”

Representing California Casualty, Assistant Vice President, Valerie Cregan commented, “It is truly an honor for all of us at California Casualty to join in support of our valued business partners in their efforts to help the children of the Salt Lake Valley community.”

As 2020 comes to a close, so does a great career for Debbie Hunter-Ellis AVP- Customer Service Manager. Debbie celebrated her 40th anniversary with California Casualty in July and at the end of this year will celebrate her much-deserved retirement.

As 2020 comes to a close, so does a great career for Debbie Hunter-Ellis AVP- Customer Service Manager. Debbie celebrated her 40th anniversary with California Casualty in July and at the end of this year will celebrate her much-deserved retirement.