by California Casualty | Auto Insurance Info, Finances |

Did you know there is actually a way to save money on your insurance policy?

These 10 Auto Insurance Tips could help you save and keep more money in your pocket each month:

Combine your insurance.

Insurance companies like California Casualty offer discounts when your home or renters insurance is combined with your auto insurance.

Increase your deductibles.

Sure, the amount you will pay will be a little more if something happens to your vehicle, but the amount you’ll save each month could add up to much more, especially if you are incident-free for a number of years. Just make sure you have an emergency fund to cover that higher deductible.

Check for good driver/good student discounts.

Speaking of incident-free, when’s the last time you had an accident or a moving violation. Most insurance companies will give you a good driver discount, but make sure you tell them. The same goes for students who get good grades.

Take a defensive driving course.

When’s the last time you refreshed your skills? You may qualify for a discount after showing proof that you have completed a safe driving program.

Check insurance costs when buying a new vehicle.

Many vehicles will cost you less; others will increase your premiums. It depends on numerous criteria from the power of the engine, its safety rating and the loss history of the vehicle.

Clean up your credit.

Many companies look at your credit score and how well you do in paying your bills. The better your credit score, the better rate you are likely to receive. Clean credit also helps when you want to buy a new car, rent or buy a home, etc.

Cut your driving.

Ride a bike, join a carpool or move closer to work. How many miles you drive each year can affect your rates; the less you drive, the greater the possible discount.

Pay your premium in full each year.

Not only can you get a discount but you will avoid monthly service charges.

Get a policy review.

Has your commute changed? Did you install a security device? Did you get married? All of these can lower your rates. Talking with your insurance advisor at least once a year is the best way to make sure you get the discounts you’re entitled to. Follow this insurance coverage checklist.

Compare your current insurance to California Casualty.

We are pretty certain that when you stop and compare benefits and prices, California Casualty will be right there with the best of them. Why? We are a 100-year-old, policyholder owned company that provides auto and home insurance to educators, firefighters, LEOs and nurses with exclusive benefits not available to the general public.

Related Articles:

Insurance Tips for Newlyweds

It’s Time for a Policy Review

4 Ways to Save with a Teen Driver

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

In a world where you can be anything, always be kind. There a million different ways to make someone smile, but the easiest way is to just simply be kind. When you show someone an act of kindness like, tipping your server generously or even just striking up a friendly conversation, it can change a person’s entire mood.

It is important for us, as people, to recognize that we don’t know what someone else is going through in life or how they are feeling; but we can make their day a little better by simply showing them kindness. That is why we should always be kind to everyone we meet.

Showing kindness is easy and can even put you in a better mood! Here are 10 Random Acts of Kindness that you can do today and every day:

- Give a Stranger a Compliment

- Volunteer or Donate to a Fundraiser/Charity

- Hold the Door or Elevator

- Pay for Someone Else’s Meal

- Write a “Thank You” or Encouraging Note

- Do a Favor Without Asking for Anything in Return

- Send a Care Package to a Soldier

- Donate Blood

- Visit a Nursing Home

- Bake Cookies for Your Office

Want some more ideas? Click here.

Related Articles:

10 Kindness Week Ideas for Schools

Random Acts of Kindness Resources for Educators

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

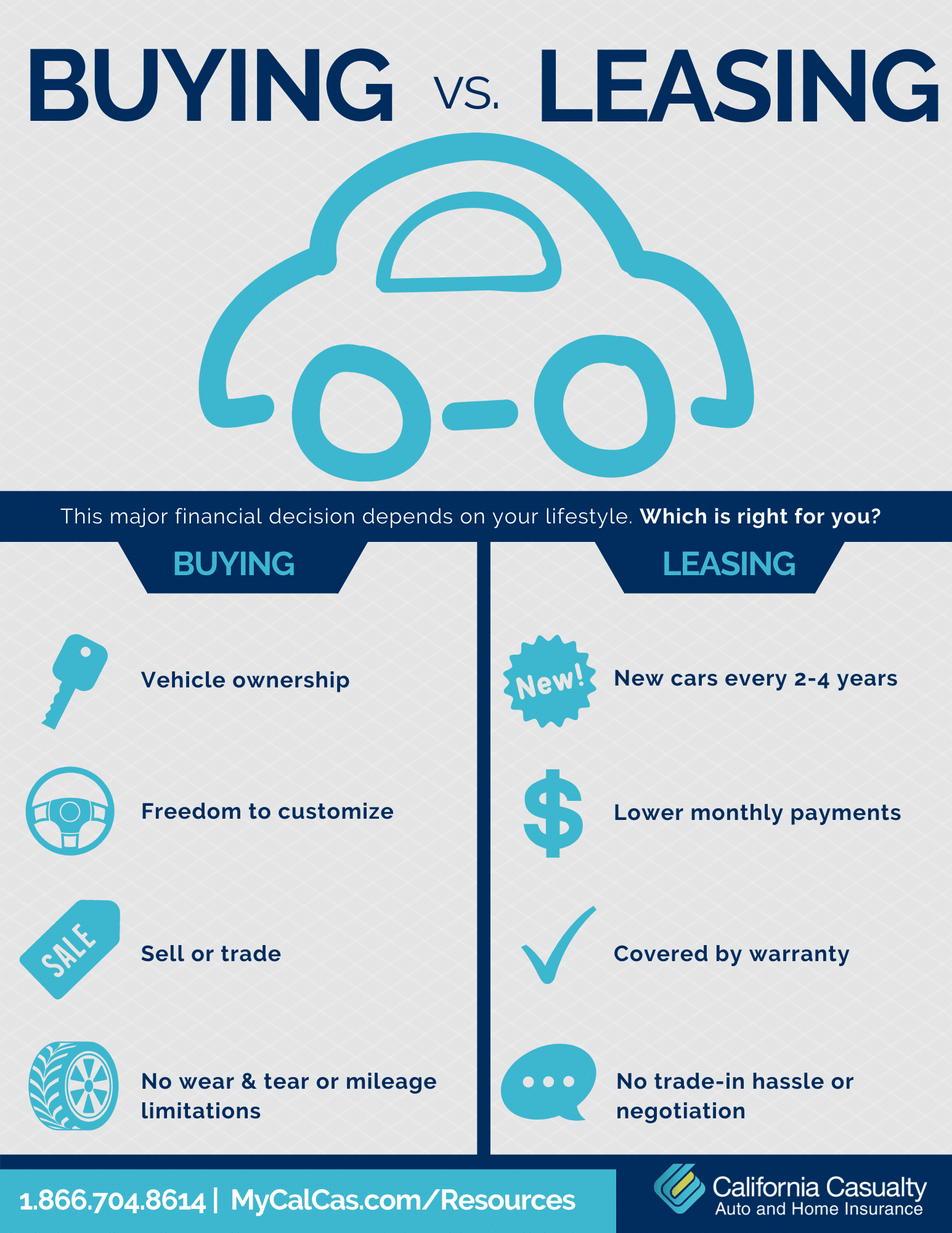

What is the smarter choice, buying or leasing a car? It’s a tough question with no wrong or right answer. The truth is this major financial decision ultimately depends on your lifestyle and budget.

Buying

Traditionally, financing the purchase of a vehicle often means your monthly payment may be more than what you could expect to pay by leasing. However, once the car is paid off, it’s yours to keep for as long as you’d like. You’ll no longer have the expense of a monthly car payment, but you should factor in costs related to upkeep, maintenance and repairs.

Leasing

With a lease, you’re essentially paying for the portion of the cost of the vehicle for the duration of the lease term. Often, this can result in a lower monthly payment. At the end of the lease, the vehicle is returned. You then have the option to lease a new vehicle and begin making payments on the new lease. Here are some major differences to consider when you are looking into buying or leasing a car.

Buying:

- Ownership

- Personal Customization

- Builds Long-Term Equity

- Wear & Tear t Isn’t Penalized

- Unlimited Mileage

- Loan Payments

- Can Sell/Trade Whenever You Want

- Same Car for X-Number of Years

- Must Pay For Repairs Out-of-Pocket Once Warranty Expires

Leasing:

- Must Return

- Returned in the Same Condition

- Can Finance to Purchase

- Pay for Excessive Wear & Tear

- Mileage Limitations

- Lease Payments

- Must Completely Finish Lease

- New Car with Newer Technology Every Few Years

- Repairs Usually Covered by Warranty

There is no one-size-fits-all option when it comes to leasing or buying a car. So when it is time to make the important decision there are a few factors that you need to look at.

Cost and Lifestyle

Your lifestyle and what you would like to have in the future are both major factors that play into the decision on leasing or buying. Do lower or higher payments work best with your budget? Would you like to own your car in the end and be able to sell in the future? Or would you rather continue making small payments on different vehicles? Remember both vehicles will also require a down payment along with other fees.

You should also consider the cost of regular auto insurance, that you would need if you purchased a vehicle, compared to gap and collision coverage, you would need when you lease a vehicle. To discuss auto coverage speak to a California Casualty advisor.

Flexibility

Figuring out how flexible you are when it comes to contracts is helpful in determining if you should lease or buy. If you tend to regularly want a new car with the newest technology, leasing may be your best option. However, if owning a vehicle outright is more appealing and you plan on keeping it long after that new car smell has worn off, you might consider buying. Just like cost, all is dependent upon you and your lifestyle.

Related Articles:

10 Safest Used Cars for Teens

Buying a Car? Avoid a Flood of Tears

Car Insurance Does More Than Fix Your Car

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Safety |

Collisions involving deer and elk spike across the United States from October through December, as the animals are continuously moving to seek new habitats to breed and forage for food. More than 1.5 million accidents involving deer take place every year in the U.S., causing over $1 billion in vehicle damage. hitting a deer

Accidents happen, even to the most vigilant driver, so if a deer jumps out in front of you, here’s what you can do.

Steps to Take After Hitting a Deer

- Attempt to move your vehicle to the side of the road

- Use your hazard lights

- Call local law enforcement or the state patrol

- Don’t approach or attempt to move an injured animal

- Take photos of the crash, the damage to your vehicle, and the roadway where it occurred

- Fill out an accident report

- Contact your California Casualty agent as soon as possible at 1.800.800.9410

Deer can be found in many different landscapes and are on the move from dusk until dawn. So much so, there is no real way to avoid them. However, you can reduce your chances of hitting a deer by following these steps:

- Don’t drive distracted

- Don’t speed, especially in rural/wooded areas

- Use high beams at night when there is no oncoming traffic

- Continuously scan the road for movement on the sides

- Pay attention to wildlife warning signs

- Honk your horn if you see a deer, to scare them away from the road (they often travel together)

- If a deer runs out in front of you, hit your breaks immediately, do not swerve

In the event of an accident, make sure you have the correct coverage, call a representative today to review your policy.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Educators |

Most of us would never drive after drinking or pull our phone out and scroll through social media while behind the wheel, but if you’ve ever been jolted awake as your car hit the rumble strip on the side of the road or you fell asleep at a stoplight, you were engaged in as dangerous a situation as driving while impaired or distracted. It’s important that all of us understand the implications of drowsy driving as we observe Drowsy Driving Prevention Week in November.

Drowsy driving is now listed as one of the National Highway Traffic Safety Administration’s top public safety dangers behind the wheel along with drugged, drunken and distracted driving. The National Sleep Foundation has concluded that anyone who has slept less than two hours in a 24 hour period is too sleep-deprived to operate a vehicle.

Here’s why; drowsy driving is estimated to cause the following each year:

• 328,000 crashes in the U.S.

• 6,400 highway deaths

• $109 billion in costs, not counting property damage

Here are some other startling statistics:

• More than half of drowsy driving crashes involve drivers age 25 and younger

• Driving 18 hours without sleep is equal to .05 blood alcohol impairment

• As many as one-third of drivers admitted that they have fallen asleep while driving

If you’ve battled to keep awake behind the wheel, you know how dangerous it can be; much like drunk drivers, overtired drivers have proven to have:

• Slower reaction times

• Impaired judgment

• Increased risk of risk-taking

• More frequent blinking/eye closure

• Deficits in cognitive performance

• Memory impairment

• Attention failure

Safety groups and the National Sleep Foundation urge you to pull over, stop and rest if you notice any of these warning signs:

• Difficulty focusing

• Frequent eye blinking

• Daydreaming

• Trouble recalling the last few miles or moments

• Repeated yawning or rubbing your eyes

• Trouble keeping your head up

• Driving across lanes or hitting a shoulder rumble strip

And, if you are a teacher, you are not immune. In addition to the risks associated with drowsy driving, being sleep deprived could also be affecting your performance in the classroom. A Ball State University study found nearly a fourth of teachers said their classroom skills were significantly diminished and half admitted to missing work or making errors do to a serious lack of sleep. About 43 percent slept an average of six hours a night and 64 percent said they felt drowsy during the school day. Exacerbating the problem is that so many school personnel spend late nights grading papers and preparing lesson plans. The study also found that almost half of the respondents worked a second job to make ends meet.

Lack of sleep can lead to serious health issues. Those who get only six hours or less per night were more likely to have a depletion of performance with an increased risk of heart attack, stroke, diabetes, depression, and obesity.

So what can you do to get more sleep? Experts say good sleep hygiene is essential:

• Try to get eight hours of sleep each night

• Avoid napping during the day

• Stop using stimulants such as caffeine, nicotine, and alcohol close to bedtime

• Stay away from heavy meals close to bedtime

• Get vigorous exercise during the day and try relaxing rituals such as yoga before bedtime

• Keep the bedroom for sleep; remove the TV

• Create a good sleep environment: eliminate excess noise and light and the temperature neither too hot or cold

Remember, getting a good night’s sleep and finding more time to relax can lead to a better classroom experience for you and your students, as well as reduce your risk of driving drowsy.

For more information visit:

https://bit.ly/2CyFr7K

https://bit.ly/2O1KRx9

https://bit.ly/32xAxCd

https://bit.ly/2NCKDxy

https://bit.ly/2q3OL0t

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

October can be a “scary” time of year, but it doesn’t have to be frightening for those who take the proper precautions in protecting their property. With that in mind, here are…

Five ways to ward off scary insurance mistakes that can stop you dead in your tracks this Halloween season:

1.Protect against uninsured and underinsured drivers.

It’s estimated that one-out-of-seven drivers don’t have insurance. But, there are many more drivers that purchase bare minimums. Make sure you have protection with uninsured/underinsured motorist coverage. For about 20 cents a day, you can be protected against unexpected medical bills if you or your vehicle is hit by an uninsured or underinsured driver whose mask slipped over their eyes.

2. Purchase renters insurance.

Many renters think their landlord’s policy will cover them in the event of a fire, storm or other malady. Your landlord’s property insurance only covers the building, not the things you own. Renters insurance covers your prized possessions, loss of use of the home or apartment you rent and liability protection in case someone gets hurt on the premises. Plus, the cost is as little as $10 to $20 a month.

Most homeowner or renters insurance policies do not include damage from flood and earthquakes. Without separate flood and earthquake insurance, you could be stuck paying for all the damage and a place to live if your home is uninhabitable.

4. Have appropriate insurance for your home or vehicle.

What happens if jack-o-lantern candle accidentally starts a fire? Or someone trips and falls on your steps? Without enough coverage for the damage or liability, you could be paying out of pocket for a claim.

5. Update your coverage.

Did you recently add a new room to the house or have you purchased new electronics, appliances or jewelry? Maybe you got married in the past year or have a new driver in the household. Get a policy review to make sure the new items you purchased are covered. Additionally, you should update your insurance after a life event such as marriage, divorce or there is a new driver in the house.

Don’t make any scary insurance mistakes that will haunt you. Connect with a California Casualty advisor today!

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.