by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

While you’re finalizing your summertime plans for vacation, road trips, and or weekend getaways, thieves and burglars are just getting started on their busy season.

Read on to learn how to protect your home and car from break-ins this summer.

Home

Contrary to TV dramas, most burglaries take place during the day, between 10 am and 3 pm. They’re more frequent in the summer months than any other season, and the average dollar loss is around $2,000. The most commonly stolen items during a break-in include cash, jewelry, medications/drugs, guns, and electronics. Here are some ways to protect your home against intruders while you’re away.

- Make It Look Like Someone’s Home – Set interior lights on timers. Keep up your lawn/landscaping care schedule. Put a hold on newspaper and mail delivery. Close blinds in rooms where expensive items, such as TVs and other large electronics, might be visible.

- Don’t Share On Social Media – Resist putting your upcoming travel plans on social media. The same goes for voicemail, answering machines, and email autoreply. If you can’t help posting on social, keep the dates vague and make sure that your posts are only shared with (close) friends.

- Be Lock Savvy – Remove any spare keys on your property (burglars know where to look). Do a thorough check to make sure the locks work on all windows and doors — and make sure you lock everything before leaving. Finally, lock the garage as well as your car inside it!

- Tap Your Neighbors – Depending on how long you’ll be gone, consider asking a trusted neighbor or friend to check in on your home periodically. They can check for signs of attempted entry, landscaping issues, or other damage. Inside your home, they can adjust blinds and shift furniture a bit to convey human presence.

- Install an Alarm System – It may be worth getting an alarm system. Be sure to put alarm signs in the front and back yard (the latter is where most intruders enter premises). Make sure to let your alarm company know when you’ll be out of town, and that they have an updated list of contacts and numbers.

Auto

It’s time to hit the road — for road trips, weekend trips and day hikes. Here are 5 simple ways to reduce the risk of a break-in while you’re away from your car.

- Lock It – This goes without saying, but do make sure to lock all doors, including the trunk, and make sure all windows are rolled up. Sometimes key fobs misfire, so it’s best to do a manual check of your doors. If you’re traveling with kids, double-check their windows in case they rolled them down.

- Hide Valuables – If possible, leave nothing of value in the car anywhere. Any visible items — even loose change or phone charging cords — increases the risk of a break-in. If that’s not possible, bring what you can with you in a purse or day pack, and/or stow them away in your car (in the glove box, under a seat, stashed in the trunk, etc.). Make your car look as tidy and sparse as possible before locking and leaving it.

- Park Smart – Be aware of your chosen parking spot’s surroundings. Parking garages tend to be safest. On the street, avoid areas that have broken glass near the curb. Choose a spot near other parked cars, in a well-lit and busy area.

- Consider an Anti-Theft Device – If your car didn’t come with one, you may want to install an audible alarm system, which emits a loud noise when someone attempts to enter. Other devices include steering wheel locks (an old standby that’s very affordable), wheel locks, brake locks and tire locks. There are also higher-tech solutions such as GPS-enabled tracking systems.

- Take the Spare – Thieves know where to look for spare keys, so be sure to always take all keys with you.

Nothing ruins a summer adventure like a break-in. Taking some smart steps beforehand to protect your home and car will pay off with peace of mind and fond summer memories.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Safety |

Less traffic has been hitting the roads, but cities and states across the country are actually seeing an increase in accidents- in adults and in teens. Fatal accidents involving teenagers has already hit an all-time high. Preliminary data from The National Safety Council indicates a 14% increase nationwide in fatal miles driven in the spring of 2020, compared to 2019.

While many people across the country stay inside and continue their “new normal” – working from home and only leaving the house when necessary, drivers on the less crowded roadways may be prone to take advantage of open lanes of traffic by driving recklessly, resulting in fatal accidents.

States all across the country have experienced increases in roadway deaths including California, Arkansas, Connecticut, Illinois, Louisiana, Nevada, New York, North Carolina, Oklahoma, Tennessee, and Texas.

If you have to get back on the road, follow these safety tips to avoid a deadly collision.

Brush Up on Traffic Rules & Regulations

It’s never a bad idea to re-familiarize yourself with traffic laws, especially if it’s been a while since you’ve been behind the wheel. Before you get back on the road, take some time to go over basic traffic rules and regulations for your state, and minimize the risk of getting in an accident.

Don’t Speed

Speeding is a bad habit that most of us are guilty of, and when traffic is light the urge to speed increases (especially on the interstate). Not only is speeding against the law, but it also makes the road extremely dangerous for everyone on it. Speeding alone causes over 100,000 deaths every year. With clear roadways during the pandemic, more drivers are speeding to get to their destination causing fatal accidents. Avoid injuring yourself and/or others, and don’t speed.

Drive Defensively

It’s more important than ever to stay alert and aware when you are on the road. Defensive driving is a set of driving skills that allow you to defend yourself against possible collisions caused by other drivers. These skills include: preparing to react to other drivers, avoiding distractions, and planning for the unexpected. You should always drive defensively, even if you are obeying all of the traffic laws, because other drivers may not be.

Watch Out For Pedestrians

In the early months of the pandemic, we saw more and more people turn to walking and biking for socially distant exercise, and many people have kept up with these healthy habits. When you are behind the wheel stay alert and keep an eye out for pedestrians that may be biking in streets or using crosswalks.

Educate Your Young Driver

Every May – September is considered the “100 Deadliest Days” for young drivers, as many hit the road for the first time (even during the pandemic). Teens are inexperienced behind the wheel, which makes them more susceptible to reckless and distracted driving – the number one killer of teens in America. Pair inexperience and reckless driving with an increase in fatal accidents and you have a recipe for disaster. Before your young driver gets behind the wheel this summer, educate them on following the rules of the road, even when there is no traffic. For more tips on teaching your teen driver click here.

Lastly, Make Sure You Have the Proper Coverage. Although this will not help you avoid a collision, it will save you time and money in the event you do get into an accident. While collision rates are on the rise, it’s important, now more than ever, to have the right auto insurance protection for when you get back on the road. This will not only help with out-of-pocket expenses due to an accident, but it will also give you peace of mind knowing that your insurance is one thing you don’t have to worry about during these trying and uncertain times.

Drive smart and stay safe. For more auto insurance tips click here.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Safety |

Whether summer road trips beckon or you’re resuming more pre-quarantine activities, increased highway time with your tiny-passenger crew means revisiting best practices for safety.

Check out the following tips for keeping kids safe while in your ride. We’ve also gathered some strategies for keeping your car’s interior safe (and clean) from those same tiny passengers.

The Safety Basics

-

- Always use a car seat. Car seats are designed to protect children from injury or death during vehicle collisions, so choosing the right one and installing it properly tops the list. Check the car seat laws in your state here, and refer to the National Highway Traffic Safety Administration for an in-depth guide on car seats and booster seats.

- Activate child locks to prevent any dangerous mishaps with children accidentally opening doors.

- Use the window locks to keep children from playing with the controls and potentially getting their hand, arm or hair caught in a rolling window.

- Secure safety belts. If there are any unused, loose belts within arm’s reach of your child, secure them so there’s no chance of them becoming an entanglement hazard.

- Never leave a child alone in a car. Not even for a minute. From heat stroke and abduction risk to the possibility of a hit-and-run incident or your child getting loose in the car, the potential of harm is simply too great to chance it.

- Never leave your keys in the ignition or car. Ever-observant, your children have surely seen how you use your keys and, if afforded the chance, could try mimicking your actions.

- Use the back-up camera to avoid hitting children outside your vehicle who may be out of view.

More Child-Proofing

-

- Declutter the car. Any object can become a projectile in an accident, so make sure items are secure or stowed away. Keeping your car clean also decreases the risk of your child grabbing something that might be a choking hazard.

- Use sunshades to protect their delicate skin from harsh UV rays. You can find easy-to-use shades in a variety of shapes, sizes, and styles.

- In-car entertainment. The upside to living in the Age of Screens is that they’re a parent’s best friend in keeping kids distracted and entertained in the car.

- Never drive distracted. Not only does distracted driving endanger you and your children, it sets a bad example for their future driving habits. Eating, texting, inattention, and daydreaming all pull your focus away from the road. So does engaging with your kids in the back seat, which is all the more reason to get everyone set up and settled in before you pull out from the driveway.

- Maintain your vehicle to decrease the chances of overheating, breaking down or getting stranded.

Minimizing the “Mess Orbit” in Your Car

-

- Get a rug or a beach towel to protect underneath the car seat and along the entire seat’s length. It’s easy to remove, shake out, and throw in the washer.

- If you allow food in the car, only allow that which can be vacuumed up (i.e. nothing squishy, mushy or sticky). For liquids, water (in spill-proof cups) tops the list for easiest clean-up.

- Cover the backs of the driver and front passenger seats to protect them from dirty footprints.

- Put cupcake liners in the cupholders to catch those unreachable crumbs.

- Invest in a quality seat protector for leather seats that may become stressed by the car seat’s weight over time.

As with anything else that involves kids, creating habits and routines are often the key to success. When it comes to vehicle safety, adopting best-practice habits will keep your entire crew safer and happier on the road.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

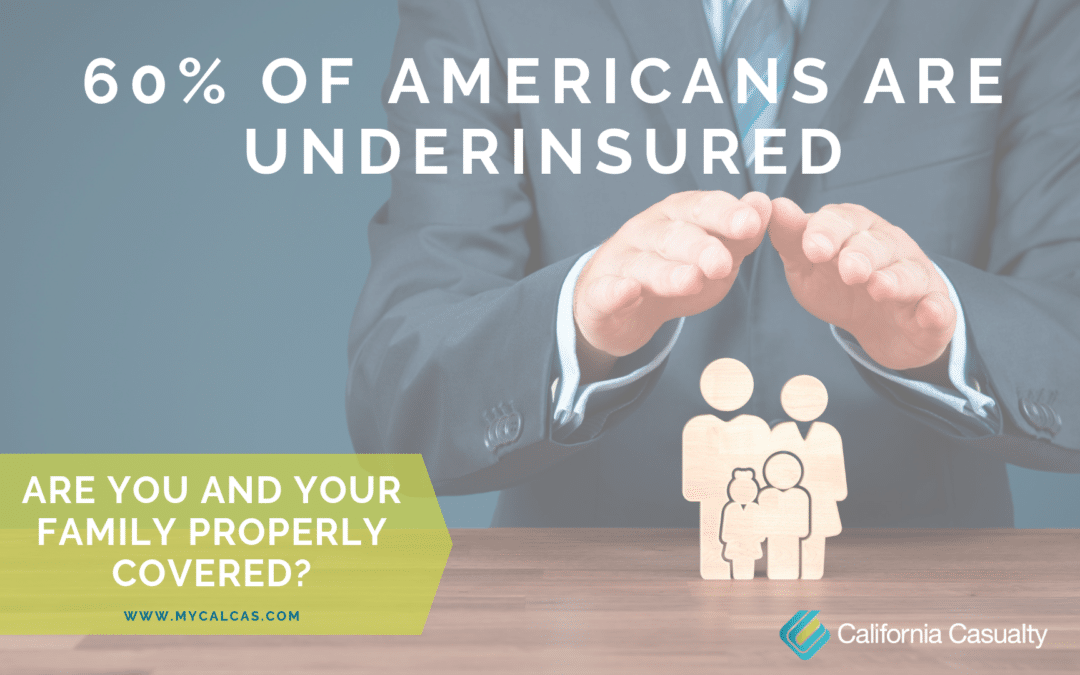

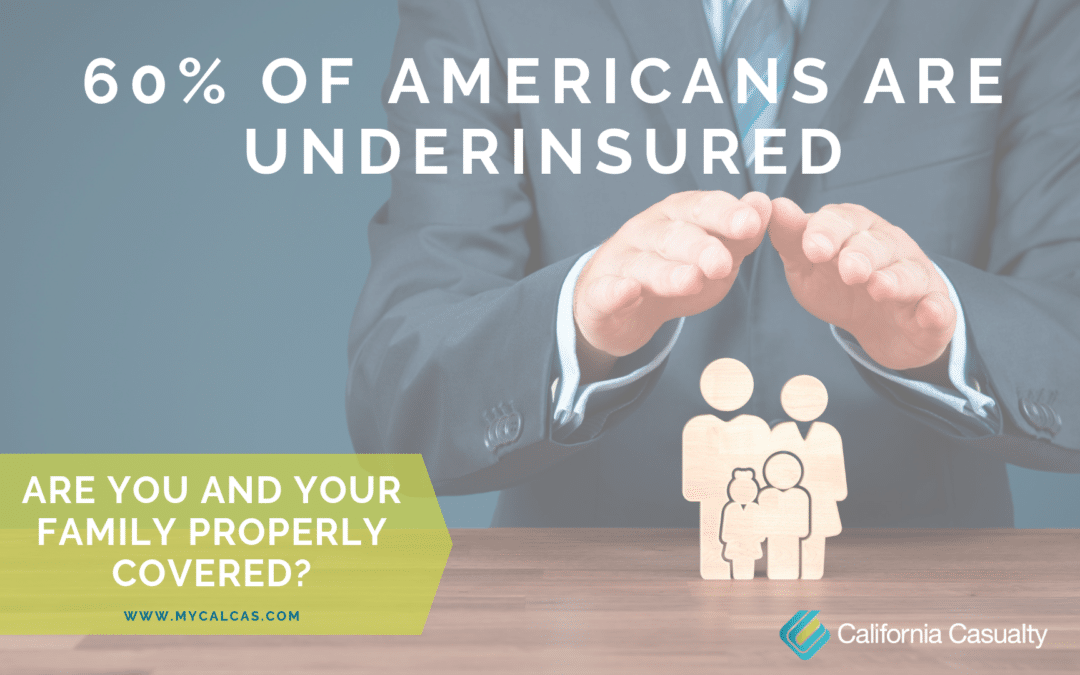

Although it is recommended to review your home and auto insurance policies yearly, 60% of all Americans are underinsured and/or don’t understand their policies. Do you know what’s really covered with your insurance policy?

If you don’t or you have any doubts, now is a great time to get an annual review of your auto and home/renters insurance policies. You’ll sleep better at night knowing you are protected against expected surprises if you have a claim. You may also find you are eligible for additional savings and discounts!

Here are seven examples of why you should contact your insurance advisor to review your policy:

- You got married. Newlyweds often pay less for insurance than when they were single. You can also find discounts by combining your autos with one insurance company. It also means all those expensive wedding gifts you received might need extra protection.

- You got divorced. You probably are no longer sharing a vehicle and moved into a different residence. You’ll need to inform your insurance company to set up separate auto and home or renters insurance policies.

- Your teen got a driver’s permit or license. You need to let your insurance company know if they are driving your vehicles, or if you bought them one. Make sure that you take advantage of good student discounts and additional multi-vehicle savings!

- You bought or inherited valuables such as antiques, fine art, jewelry or other collectibles. Your standard homeowners or renters insurance policy provides limited coverage of high dollar items. This is a good time to purchase scheduled personal property endorsements to cover your new valuable possessions for a higher amount.

- You’ve added on to your home or have remodeled. Improvements to your house mean there is more to protect. Contacting your insurance company is a good way to make sure that you have enough coverage. This also applies for a new gazebo, shed or pool, or hot tub.

- You’ve moved to a flood or earthquake prone area. Neither earthquake nor flood insurance is included with most homeowners or renters policies. You need to purchase separate flood or earthquake insurance. Keep in mind that flood insurance has a 30-day waiting period before it becomes effective.

- You’ve retired. This often means you are driving less, which could significantly reduce your insurance costs. Drivers over 55 also often get discounts from their insurance companies and you can further reduce your premiums by completing a driver safety course.

Knowing more about your insurance could save you money on your premiums and heartache in the event of a break-in or natural disaster.

If it is time for your auto or home insurance coverage review contact one of our customer care advisors today at 1.800.800.9410. A few minutes of your time will provide the appropriate protection, and we may even find you some extra savings!

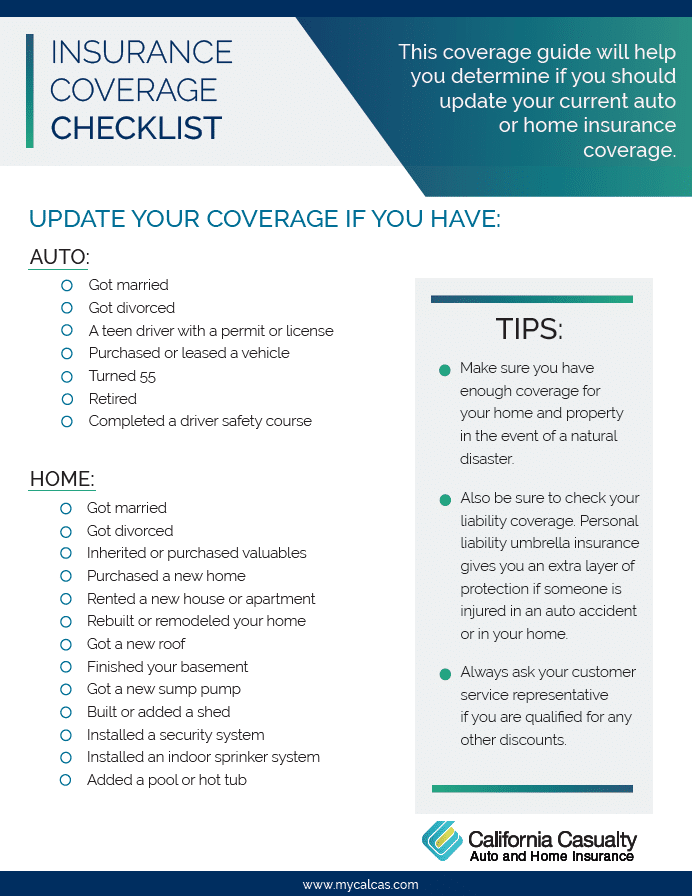

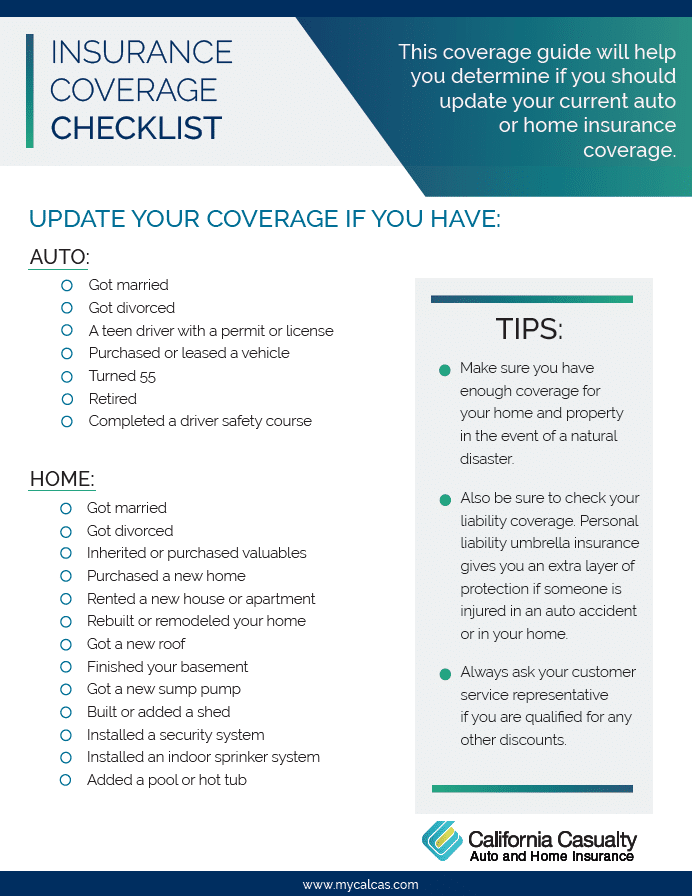

If you don’t know where to start to determine if it’s time for your policy review, download our free Insurance Coverage Checklist. Just click the image below for your free download!

by California Casualty | Auto Insurance Info, News |

We have amazing employees at California Casualty. The Employee Spotlight is a new series aiming to highlight those talented individuals that make up our successful company culture and community. From human resource recruiters and learning and development trainers to claims adjusters, marketers, customer support specialists, partner relations, sales representatives, and beyond; each week, we’ll highlight a new team member, so you can get to know us better and see how our employees make us who we are as a company.

This edition of the Employee Spotlight will feature our Inbound Sales Representative, Kevin DeSousa

Kevin is a newer employee at CalCas, he’s almost been with us for a year and is based in our Colorado office.

Let’s get to learn Kevin!

What made you want to work as a Sales Representative at California Casualty?

I really just enjoy talking to people. It feels great when you’re also assisting a customer with a necessity such as insurance.

What is your favorite part about your job?

Besides knowing that we’re helping our teachers, law enforcement officers, firefighters, and nurses! I enjoy really getting to know our customers, I talk to each person on the phone like I’m talking to one of my family members. I don’t want to under-insure my family and I also don’t want to over-insure my family; I want to make sure that everyone is paying for what they need to help take the best care of themselves as possible.

What have you learned in your position at California Casualty?

I have learned so much. Since getting hired on, I have a completely newfound respect for the insurance industry. Before it was just thinking that my car/house is covered from damage if something were to happen. But now, it’s much more than that, knowing what all the numbers mean and why certain people need certain coverages -not everyone needs the same coverage. Literally, within my first month here, I went home and redid my own insurance and made sure that I was covered correctly.

What are your favorite activities to do outside of the office?

I enjoy my family and my church family. Anytime we can all get together that is a good day!

I love going camping and enjoying the wilderness, I would say I go fishing, but I have yet to catch anything this season, so we’ll just skip that….

I have also enjoy working on updating my house and working in my yard with my small farm.

Anything else you would like the audience to know about you?

Been married 10yrs in August; we have an 8-year-old boy and a 4-year-old girl.

I am originally from New Hampshire and a HUGE Patriots Fan

I own a lot of animals on my small farm I have: 2 Dogs (1 Grand Pyrenees and 1 Husky), 7 Chickens, 3 Ducks, 1 Bearded Dragon, 2 Hermit Crabs, and 2 Guinea Pigs.

I am 100% Portuguese; for my childhood summer vacation most kids would go to Disney; I would go to the Azores and I LOVED it.

If you want to learn more about Kevin or are interested in a career at California Casualty, connect with him on LinkedIn! Or visit our careers page at https://www.calcas.com/careers

by California Casualty | Auto Insurance Info |

Our streets and freeways are coming back to life after having been empty for months. Now that we’re all getting back on the road, we’re getting re-acquainted with driving etiquette, traffic laws and sharing space with other drivers . . . which makes this a great time for a safe-driving refresh.

Here are 10 top driving errors and how you can easily correct them.

- Incorrect Speed

DON’T: drive too fast or too slow. Drivers often go faster than the posted speed limit (which is incredibly dangerous near schools and in residential areas) or drive too fast in extreme weather conditions or congested traffic. On the flip side, driving well below the speed limit can cause unsafe conditions for you or other drivers.

How to Correct: Make sure to abide by speed limits and also adjust speed according to your specific environmental conditions.

- Improper Lane Changes

DON’T: make unsafe lane changes. Changing lanes without double-checking for other vehicles can often lead to disastrous results. Blind spots, speed, and distraction all increase the risk of a collision.

How to Correct: Make it a habit to check mirrors, use turn signals, and do a full head check before changing lanes.

- Following Too Closely

DON’T: tailgate other cars. In the event of a stop or crash, there is not enough reaction time to avoid a crash.

How to Correct: Always stay several car lengths behind the traffic in front of you. A good rule of thumb is the 3-second rule. Using a fixed object as your guide, count the number of seconds (one-one thousand, two-one thousand…) between when the car in front of you passes it and you pass it. Add extra time in unsafe weather conditions or when roads are slick.

- Improper Turns

DON’T: avoid turning too wide. When you turn wide from the middle of the road, you risk colliding with pedestrians, bicyclists and other cars on the right.

How to Correct: To make a proper turn, use your turn signal about 100 feet before the turn and hug your car to the right as you slow your speed and complete the turn. This two-step process alerts other drivers around you and prevents others from moving in between your car and the curb.

- Passing Errors

DON’T: pass another vehicle within 100 ft of a railroad crossing or intersection, on a hill or curve, if you are in a “no passing” zone, or if there is oncoming traffic.

How to Correct: Passing another vehicle requires extreme caution, as you are briefly in the lane of oncoming traffic. To pass correctly, first make sure you have a long clear sightline of the other lane and that it’s free of oncoming traffic for a safe distance. Once you pass, don’t turn back into the right-hand lane until you can see the entire vehicle you just passed in your rearview mirror.

- Right-of-Way Violations

DON’T: assume you always have the right-of-way. Forty percent of all crashes involve intersections, so it’s prudent to use caution every time you approach and cross an intersection.

How to Correct: Make sure you fully stop at stop signs, obey the signals, and yield properly. Whenever there are other cars, be sure to scan the intersection — look left, straight ahead, right, and back to the left again. This gives you the time and visibility to pass safely through the intersection.

- Sudden Stops

DON’T: slam on your brakes, unless there is a valid reason.

How to Correct: Practice defensive driving and stay aware of your surroundings. Remember that any sudden movements will create a chain reaction behind you, and no one is anticipating your moves. To avoid any surprises, make sure to watch the road for pedestrians, animals crossing, or debris. In the event of an emergency, pull off to the shoulder and turn on your hazards.

- Riding the Brakes

DON’T: keep your foot on the brake while you are driving.

How to Correct: Keeping an overanxious foot on the brakes can create a “little boy who cried wolf effect” — making the driver behind you stop paying attention to your taillights and increasing the chance of a collision. Riding the brakes also wears them out much quicker. Save your breaks and ride smart.

- Not Using Your Turn Signals

DON’T: ignore your turn signals. Turn signals are an important safety feature that alerts other drivers of our intention to turn or change lanes. This gives them time to react safely, gives you the space you need to move and just generally be alert to a situational change.

How to Correct: Use your turn signals every time you are behind the wheel.

- Leaving the High Beams On

DON’T: drive with your high beams inappropriately. Incorrect use of high beams can be extremely dangerous. They can temporarily blind the drivers in front of you and those in oncoming traffic.

How to Correct: Limit the use of high beams to situations where you need them — on dark roads that have infrequent traffic, turn them off as soon as you see oncoming headlights, and remember never to use them in foggy or snowy conditions.

Soon enough, it’ll feel like we were never away from our cars and roadways. But while we’re here — getting back to our driving “normal” — it’s a perfect time to re-incorporate those safety basics back into our driving practice.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.