by California Casualty | Auto Insurance Info |

It may be hot, but chances are it’s not hot enough to fry an egg on the hood of your car. That’s just one of the many myths you might hear about hot cars. While such legends ] are fun to think about, some myths can be dangerous if believed.

The more you know about the truth about hot cars, the better you are able to stay safe this summer

Below are eight common hot car myths. We’ve also added steps you can take to protect your car, your kids, and your pets as the temperatures soar this summer. Here are the myths- debunked.

Myth #1

It’s only 10 minutes. It’s fine to leave the kids or the pets in the car.

You would be surprised at how quickly the inside of a parked car heats up. In just 10 minutes, the temperature can rise 20 degrees. Cars can reach dangerous levels quickly. It could be 60 degrees outside, but the inside of the car could be up to 100 degrees due to the windows functioning like a greenhouse and trapping the heat inside.

Don’t leave anyone in the car, especially children and pets who may be vulnerable to the heat. Children’s bodies cannot cool themselves as well as adults. Dogs can only cool themselves by panting. Even if you think it’s not that hot out, it’s best to err on the side of caution. What about if the air conditioning is running? That’s not a good idea either. There have been instances where the compressor has failed or dogs or children have bumped the controls, switching from cool to heat. There is never a safe way to do this so make alternate arrangements for child and pet care. If you see a child or pet in a hot car, call 911. It may just be a lifesaving call.

Myth #2

Leave the window cracked open to keep the car cool when you park.

You might think that opening the window a crack will help keep the temperature at a reasonable level. Surprisingly, there is just about a 2-degree difference between a closed window and one that’s cracked open. Plus a slightly open window can be an invitation to car thieves. It’s not worth risking a theft of your car or endangering anyone or anything inside.

If you’re parking your car, and you’d like to keep it cool, try these tips.

-

- Park in the shade or, if possible, in a garage.

- Use a sun shield for your windshield.

- Cover the interior with light-colored fabric.

- Consider a solar-powered ventilation fan.

- Finally, tinted windows can make a difference (but check first to see the rules in your state. Not all locations allow them)

Myth #3

You can save a lot of money by rolling down the windows and not using you’re a/C.

Want to save money in the summer and be more fuel-efficient, just sweat it out, right? Wrong. While blasting your air conditioner in the summertime does slightly increase gas usage, it is not enough that you would even notice. And while most people think all they have to do is roll their windows down so they do save that small percent of gas, rolling your windows down at high speeds can also reduce your fuel economy. This is because of the aerodynamic drag (wind resistance) it creates, making your vehicle use more energy to push through the air

Remember a hot driver is a distracted driver. So, don’t be afraid to use your AC. If you want to get the most out of your fuel this summer, roll your windows down when you are driving at lower speeds or when you first get into your vehicle to let the heat out and use your A/C (at a consistent temperature) when you are driving faster.

Myth #4

Only neglectful parents forget their child in a car.

You hear stories of babies or young children being left in cars with tragic endings. You might assume that those parents who would forget their children are bad parents. That’s not the case. It could easily happen to anyone.

Follow these tips so that you don’t put yourself or your child in this dangerous situation.

-

- Keep an important item in the back seat with your children such as a work ID, purse or wallet, or cell phone.

- Put your child’s stuffed animal, diaper bag, or other items in the front passenger seat as a reminder.

- Ask your child’s caregiver to contact you if your child does not arrive at a certain time.

These steps will help keep everyone aware—and safe.

Myth #5

You can’t do anything if your car overheats.

A vehicle can overheat for a number of reasons, but usually, it is because something is wrong with the cooling system. If you don’t take the proper action your engine could become permanently damaged. If your car overheats, don’t just pull to the side of the road- there are other steps that you need to take.

First, turn off the A/C and crank up your heat. We know this sounds bizarre in the summer, but it will pull heat away from your engine and give you time to pull over to a safe location. Next, shut off your car for about 15 minutes. Keep an eye on your temperature gauge and make sure it starts to drop. If you haven’t already, this is where you will need to check and add your coolant, if needed. Finally, after giving it a few minutes rest, restart your engine and take it to your local mechanic.

Myth #6

If it’s hot enough, your car window can shatter.

Unless your windshield has previous damage, you don’t have to worry about the glass shattering. But if the conditions are right, it could crack. Glass will expand when it’s hot and contract when it’s cold. Big swings in temperature can cause stress cracks, cracks that suddenly appear for no apparent reason.

You can prevent stress cracks in the future by

-

- Avoiding large changes in temperature such as blasting the air conditioning in a hot car.

- Parking in a garage to reduce heat exposure.

- If you’re washing your car on a hot day, try lukewarm water instead of cold for less of a temperature difference.

If you do get a stress crack, get it fixed as soon as possible. Check with your insurance provider to see if your policy will cover stress crack damage.

Myth #7

You need to fill up your gas tank in the morning

Many people think that you should fill up your gas tank in the morning when it’s cooler outside because gasoline will expand when heated. Meaning your get more energy per gallon in the early morning hours than you would later in the day when the temperature rises. This is false.

Not only does the energy content of gasoline stay the same in varying temperatures, filling stations store their gas in underground tanks. So the temperature of the gasoline coming out of the pump varies very little throughout the day. No matter what time you get gas, even in extreme heat, you will be getting the same energy content.

Myth #8

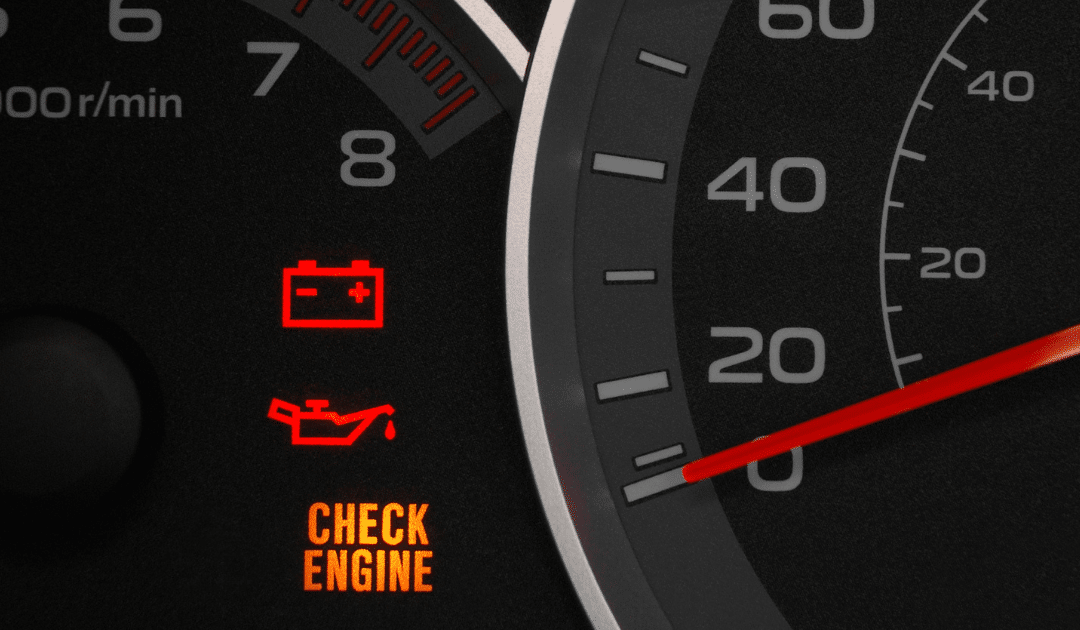

The heat won’t have a lasting effect on how your car runs.

Excessive heat can affect your car in the long term. Hot air in your tires causes them to expand, and they could over-inflate. The heat thins your engine oil so it doesn’t lubricate as well. High temperatures cause battery fluid to evaporate, which can weaken batteries or speed up the corrosion process.

Follow these tips to protect your car this summer.

-

- Monitor your tire pressure and watch for overinflation.

- Fill your engine oil to the highest level.

- Check your battery’s charge

- Schedule routine maintenance.

- Make sure to maintain your car to keep it running well.

These myths are proof that you shouldn’t believe everything that you see or hear. ( And as for debunking the” frying an egg on a hot car hood” myth, it has to be about 158 degrees Fahrenheit before eggs even start to cook. That egg can also damage the paint surface and turn into an expensive repair).

Knowledge is power, especially when it comes to your vehicle. Use yours wisely and have a safe summer.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Safety |

It’s never a bad time for a road trip!

If you are like the millions of American’s who are hitting the road this season to travel in a Recreational Vehicle (RV), follow these 3 key steps to keep you safe.

1. Before You Hit the Road in Your RV:

- Check the exterior for cracks and missing or damaged seals

- Inspect and test the battery

- Examine and pressurize the tires

- Replace filters and replenish brake, coolant, transmission, hydraulic and washer fluids

- Clean, inspect and refill LP gas lines and appliances

- Test carbon monoxide and smoke detectors

- Flush and fill the water system looking for leaks, clarity, and drinkability

- Check batteries and that all appliances are working

- Inspect sewer hoses and waste tank valves for cracks or sticking

When you are far from home it is also vital that you have the right equipment on hand that can get you out of any situation.

2. What To Pack in Your RV:

- Proper extension cord with the correct amps

- Surge protector for variable campground electrical systems

- Drinking water approved hose

- Matches or a lighter

- Portable chargers

- Food, water, and essential groceries

- Pressure regulator and water filter for variable campsite water pressures and contaminates

- A set of tools

- Extra clothing and blankets

- Laser temperature tester to detect overheated brakes, tires, and axles

- Emergency first aid kit

The last step in making sure you are all prepared before you travel is making sure you have RV Insurance.

3. The Proper Coverage for Your RV

California Casualty has been providing RV Insurance for over 40 years. Our RV Insurance program is designed to accommodate almost all recreational vehicles from pop-ups to coaches. We cover motor homes up to $120,000 in value and our partner market covers up to $500,000 in value.

Coverages Include:

- Total Loss Replacement

- Emergency Vacation Expense

- Disappearing Deductibles

- Full Timer’s Package

- Replacement Cost Personal Effects

- 24-Hour Roadside Assistance

- Windshield Coverage

- Free Pet Injury

If you would like to add RV coverage to your policy call our Sales Department at 1-844-854-7265. For more information on RV Insurance Coverage, please contact our Customer Service Department at 1-800-704-8614 or visit www.calcas.com.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

As more cyclists (of all ages) take to the road to enjoy the nice weather, now is a great time to brush up on the rules for safely sharing the streets.

Think of bikes as cars, but with fewer safety features. Road hazards such as potholes and debris may cause a cyclist to suddenly swerve, much like if they were driving a vehicle. And although riding on the right side of the lane is preferred for bike traffic, there may be the occasion when cyclists take to the center if road conditions require it.

Understanding cyclists and anticipating their next move will help you safely share the road. Here are some quick safety reminders on driving with cyclists this summer.

1. They have the right to “drive” in your lane, but they also need their space. Always give cyclists the right of way. Be sure to watch your speed compared to theirs. Pass only when there’s ample room (at least 3 feet between you and their bike) and while other vehicles are not approaching.

2. Look for bicyclists everywhere. Cyclists may not be riding where they should be or may be hard to see—especially in poorly lit conditions, including dusk/dawn/night and even in inclement weather.

3. Avoid turning in front of a bicyclist who is traveling on the road or sidewalk, often at an intersection or driveway. An oncoming cyclist may be traveling faster than you think. Drivers turning right on red should look to the right and behind to avoid hitting a bicyclist approaching from the right rear. Stop completely and look left-right-left and behind before turning right on red.

4. Completely stop at red lights or stop signs to let bikers pass or check for unseen bikers. Make eye contact with cyclists at intersections or crosswalks to acknowledge their presence and signal to let them know they are free to pass.

5. Don’t honk at someone on a bike. The noise could startle them, making them lose control of the bike they are riding. If it’s absolutely necessary, do so from a distance and make it a light tap.

6. Take extra precautions if you are sharing the road with children riding their bikes. They are smaller and harder to spot on the road, especially for drivers of bigger cars. Plus, these young bicyclists won’t have the same control over their bikes or know the rules of the road as mature riders.

7. Knowledge of common biking hand signals is a must. These include sticking the left arm straight out to indicate a left turn, holding the left arm up at a 90-degree angle to indicate a right turn, and pointing the left arm down at a 90-degree angle to indicate a stop or slowing down.

Taking extra precautions when you are behind the wheel and understanding a cyclist’s next move can help you avoid an accident. Use these tips this summer to help you both navigate the road ahead safely and seamlessly.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

Breaking down on a busy street or highway can be dangerous. Roadside assistance is an add-on coverage that’s at your service 24/7 to help you get back on the road safely if you are left stranded due to an accident or car problems.

Whether you run out of gas, a tire blows out, or you are experiencing any other kind of car or engine trouble, roadside assistance has your back. Instead of spending money on an expensive tow, you can rest assured knowing that you are covered when you choose to add it on to your auto insurance policy.

Plus, when you add roadside assistance to your coverage you will pay as little as around $1 a month. This is a coverage you can’t afford to NOT have!

What Will Roadside Assistance Cover?

When you add- on Express Road Service to your California Casualty auto policy, you will be covered if you need assistance with

- Jump starts

- Lockouts

- Tire repair or change

- Gas, oil, and water delivery

- Towing to the nearest repair facility

And you won’t even have to remember to make additional payments to keep roadside assistance. Your cost of coverage will be rolled into your monthly premium to help make payments more convenient for you.

Talk to your insurance agent to understand what is covered. Ask about additional services and the exclusions and limitations when adding roadside assistance to your policy.

Why Do I Need It?

Roadside assistance offers you fast, reliable service available to you when you need it most. Here’s why everyone should add this coverage on to their auto insurance policy.

- Affordability. With annual prices as low as $1 dollar a month, you won’t even feel like you’re paying for additional coverage. Rates at these prices can’t be beaten even by other big-name clubs or associations like AAA.

- 24/7 hour service. No matter if your car breaks down at 12 a.m. or 12 p.m. you will never be stranded, roadside assistance will come to you at any time of day or night to help service or tow your vehicle.

- Peace of mind. If your car is older, or starts having mechanical issues you can have peace of mind driving to your destination (no matter how far) knowing that roadside assistance is a phone call away.

- Towing. Car tows are very common and can be costly if you do not pay for roadside assistance. The average cost for a car tow without roadside coverage is $109.

- Teen Driver Safety. If your family has a teen driver on the road, as parents you can breathe easier when handing over the keys knowing your young driver can call roadside assistance for help if the unexpected were to happen.

If you have an auto policy without roadside assistance, what are you waiting for? Call and add-on this cheap and essential coverage today at: 1.800.800.9410

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

You let them get their license, and you’ve handed over the keys. But are they truly ready?

Sure, you set rules for when they drive, where they go, and who rides with them. You also taught them the dangers of distracted driving. But, have you taught them about the 3,000lb piece of machinery that they are now handling?

Driving responsibility doesn’t stop with passing the driver’s test, turning down the radio, adjusting the mirrors, and using the turn signals. Before they get behind the wheel, young drivers should know basic vehicle care, maintenance, and warning signs.

Wiper blades and washer fluids – if they can’t see where they are going, how will they get there safely? Get your young driver in the habit of checking their wiper blades and washer fluid levels. There are super easy fixes to help correct wiper blade problems. And be sure they also know how to refill washer fluid (where it goes and what product to use).

Lights – it’s important to always have clean headlights and working rear lights, brake lights, turn signals and reverse lights. These are the ways other drivers know what actions to expect from your teen’s vehicle. Show your teen how to check them regularly. Remind them of the importance of properly functioning lights. Teach them how to change them or how they can contact the dealership to have them changed by a technician.

Tire pressure, tread, and rotation – show your teen driver where the PSI rate is listed on the sticker of the driver’s door jam. Teach them how to check their tire pressure. Show them how to fill their tires with air or reach out to the dealership if they need more nitrogen. Be sure to explain that tire pressure can change with cooler and warmer weather, so it’s smarter to check more often. Show them, the quarter test, not the penny test to check tire tread. Explain the importance of tire rotations to help tires wear evenly. Share with them the notion that rotating and balancing tires should be done on a routine schedule that makes the most of their tire investment.

Check fluids and change the oil – have your young driver get in the habit of checking their oil levels, brake fluid, antifreeze, and transmission fluid. Explain what products go where and how to maintain the right levels as needed. Teach them how to change their oil, or how often to schedule an oil change on a regular basis.

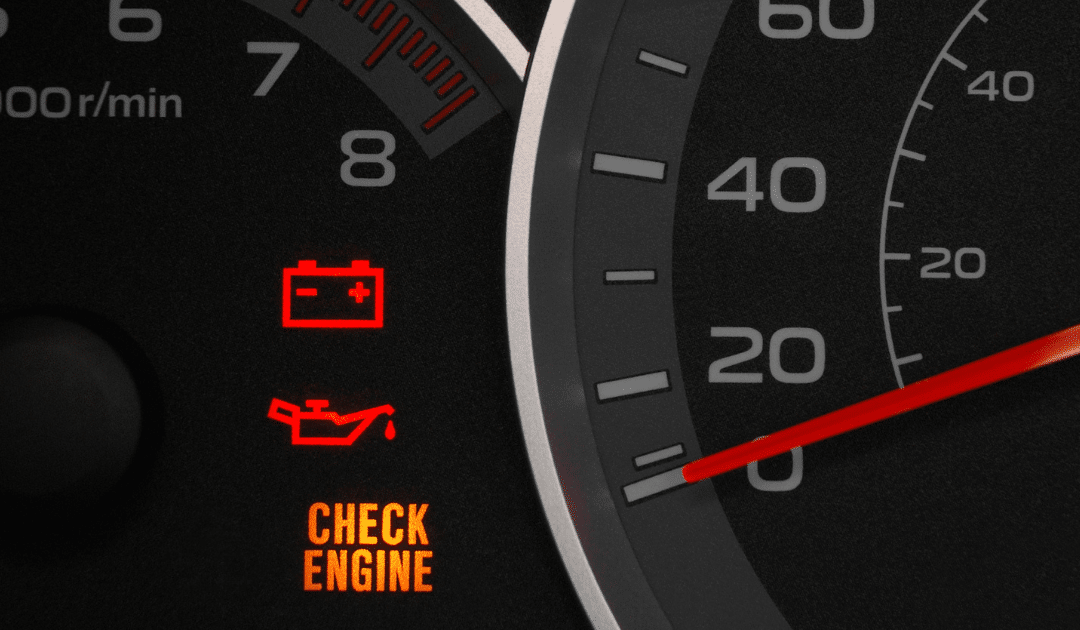

A car battery can fail at any time, but there are usually warning signs. If new drivers know how they function and what the signs are for replacement, then they can be more proactive when a new battery is needed. A completely dead battery is a safety issue if they are stranded.

Knowing the dashboard warning lights can make a world of a difference for the safety of your young driver and their passengers. There are 15 common warning lights on your dashboard that hold significant meaning. Have your new driver review them with you!

And in case of a roadside emergency, give your teen a list of contacts to call, do a run-through of how to change a tire, gift them an emergency roadside kit.

It’s a lot to digest, but the responsibility of becoming a driver is worth the time invested in sharing the knowledge above. It’s another layer of protection to keeping your driver safe.

Want more tips for teaching your young driver the rules on and off of the road? Click here for more teen driver safety tips and here for the driving experiences your teen needs.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

No one likes getting cut off in traffic or the feeling of a tailgater trailing closely behind. When those feelings cross the line from irritation to retaliatory action, that’s road rage. Road rage, as most of us know, is significant anger and/or aggression directed toward one driver by another. It can be in the form of insults, gestures, physical attacks, and even dangerous driving maneuvers that can run you off the road.

Road rage is a form of distracted driving that can lead to collisions, injuries, and even death. Knowing how to keep your cool behind the wheel, and what to do if you are targeted by road rage, will help prevent accidents and bring you safely back home.

Road rage is more common than you think.

The majority of American drivers – almost 80 percent – admitted to aggressive driving or feelings of road rage in 2019, according to the AAA Foundation. The Foundation’s analysis of 10,000+ road rage incidents over 7 years revealed 12,610 injuries and 218 deaths. Road rage is a factor in more than half of all fatal collisions.

Know the causes of road rage.

There are many triggers for road rage. Most often, aggressive behavior stems from angry emotions that get out of hand due to situational circumstances, such as traffic conditions, or the driver’s own mental state.

-

- Road rage can be a habitual or learned behavior. Drivers may be in the habit of yelling at cars that cut them off. They may perceive the behavior as normal.

-

- Cars provide a layer of anonymity that makes it easy to “rage.” In road rage incidents, drivers do not see another person; they see a vehicle. As a result, they don’t think of the individual/family they will be affecting when they lash out at another driver.

-

- Drivers who “rage” may have a disregard for the law. They may be speeders and tailgaters, and have the perception that they are above the law.

-

- Traffic congestion and delays can cause road rage. Drivers who are running late are more likely to get upset during heavy traffic conditions.

-

- Distracted driving may prompt road rage. Drivers on their cell phones could contribute to road rage reactions when they don’t move as planned through traffic.

Know how to prevent road rage.

You don’t have to be an aggressive driver to experience road rage. It can happen to anyone! Here are some ways to stay cool behind the wheel.

-

- Make sure that you’re well-rested and ready to drive. Get enough sleep. Limit alcohol intake. If you’ll be traveling long distances, take time for regular stops to recharge.

-

- Leave plenty of time for your trip. Drivers who leave early are less likely to be stressed about traffic congestion or angry at other drivers who may delay the journey.

-

- Play soothing music. Set the mood for a relaxing trip with a soothing soundtrack.

-

- Don’t honk or yell. Raising your voice and honking your horn only serves to escalate a situation.

-

- Don’t tailgate. Leaving enough space between you and other cars helps prevent incidents that can lead to road rage.

-

- Remember to show some empathy. Everyone has a bad day now and again. Give your fellow driver the benefit of the doubt. He/she may not have meant to cut you off.

Know what to do If you’re a victim of road rage.

It can be frightening if you are the target of road rage. The most important thing to remember is to keep your cool, and follow these suggestions.

-

- Don’t return gestures. Don’t make eye contact. Engaging with an angry driver only escalates the potential for road rage. Keep your eyes on the road and, if possible, distance yourself from aggressive drivers.

-

- If you’re being tailgated, switch lanes. Try to move out of range of the other driver. Do not slam on the brakes to get them to back off. That tactic is dangerous.

-

- Stay behind an aggressive driver. Being in front of an aggressive driver puts you in their field of vision. Moving behind, and lengthening your distance, can help.

-

- Don’t pull over and stop. Unless you are stopping at a stoplight or stop sign, do not stop. Stopping your car is the precursor to engaging with the other driver—something that you do not want to do.

-

- If the harassment continues, pull into a police station. There may be times when you cannot shake the aggressive driver. In those cases, the best tactic is to head to the nearest police station.

Look out for road rage during these high-travel months.

Any time there is traffic and congestion on the roads is a time that could trigger road rage. The summer months, and especially August, have been shown to be prone to incidents of road rage. Similarly, holiday travel in December with its associated congestion, traffic delays, and inclement weather, can produce the conditions ripe for road rage.

Plan your travel accordingly and follow these tips to help keep you and your family safe.

Safe travels.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.