by California Casualty | Auto Insurance Info |

We want our cars to be safe and reliable, yet sometimes, parts malfunction. When it’s a defect that creates a safety risk, the automaker is responsible for fixing it. That’s when you get an auto recall notice. These notices inform car owners that something needs to be adjusted or replaced to make their vehicles safe to drive.

How common are recalls?

Recalls happen all the time. In 2020, there were nearly 900 safety recalls affecting 55+ million cars and equipment, according to the National Highway Traffic Safety Administration (NHTSA), the government agency responsible for exploring safety complaints. NHTSA looks at safety issues, both large and small. If the car doesn’t meet the minimum safety standard, automakers are required to announce a recall. The recall is usually for a specific make and model. The vehicle manufacturer is legally obligated to inform buyers and cover the costs of repairs. Even so, only about 75% of vehicles recalled in a given year are ever fixed, according to NHTSA.

Note: There is a time limit on recalls, usually 8 years. A repair after that timeframe usually means you have to cover the cost.

Why might my car be recalled?

Recalls affect parts of the car that could cause an immediate safety hazard. They could be small or large, and include airbags, tires, brakes, engines, and electrical components. They would not, however, include air conditioners, radios, or ordinary wear and tear. One recall that occurred this past year was for the seat belt in a Ford Motor F-150 Super Cab. The belt was installed incorrectly and as a result, didn’t provide enough restraint in the event of a crash. Takata airbags again surfaced this year as NHTSA looked at 20+ automakers who used the potentially explosive bags. Other 2021 recalls were for brake issues, hood problems, battery fire hazards, and diesel engine stalling, according to Car and Driver.

Why do people sometimes ignore recalls?

It may be because they are not aware of the recall. Perhaps the notice was mailed to an old address and not forwarded. Maybe they think it will take too much time or effort, or they could be without a car. Finally, they simply may not care.

Why should I pay attention?

It’s easy to ignore recall notices. Don’t. Even a small defect can put you in a life-threatening situation. Plus, ignoring a recall can affect your insurance. If you’re involved in an accident and the faulty part is the cause, you might not get reimbursed for repairs or for medical costs.

How do I know if my vehicle has been recalled?

If you’re the original owner of the car, you should get a recall notice in the mail. If you take your car in for regular maintenance at the dealership, you also should be notified. If, however, you purchased the vehicle as a used car, and you get your car serviced at a local mechanic, you may not be aware of a recall. It’s easy to check, however. Visit the NHTSA recalls website and input your vehicle identification number (VIN). You’ll find this 17-character number on the lower left of your car’s windshield, on the inside of your driver’s side door, or on your registration or insurance documents. Not only can you check car recalls, but you can find recalls on child car seats and tires. You can also download the app to your phone and get alerts.

What do I do if I get a recall notice?

If your car is recalled, contact the dealership and schedule a repair as soon as possible. Ideally, the dealership will provide a loaner car but if not, you may qualify for a rental car with your auto policy or be reimbursed. If the dealer gives you a rental car while yours is being repaired, you’ll want to verify that you have the right insurance coverage for a loaner. Finally, if you already fixed the defect before you learned about the recall, you can get reimbursed from the dealership.

Recalls keep us safe. Other ways that you can stay safe are to wear seat belts, practice defensive driving techniques, and maintain and insure your vehicle. After all, your car is one of your greatest investments. Safe travels.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Homeowners Insurance Info, Safety |

When the temperatures dip low, wind speeds hit high, and precipitation is in the forecast, you could be in the path of a winter storm. These powerful acts of nature have the potential to cut off power and trap you and your family in your home for days, and that’s not all… Winter storms have also been associated with hypothermia, frostbite, carbon monoxide poisoning, and even heart attacks.

Being well prepared is your best defense. Follow this guide so you can weather winter storms safely.

Know what to expect when

The National Weather Service issues severe weather alerts for winter storms. While the exact amounts of snow vary based on where you live, here are some general definitions.

-

- Winter storm watch – Conditions are right for hazardous winter weather within 48 hours. It doesn’t mean it will occur, but a winter storm is possible.

- Winter storm advisory – Usually issued within 36 hours of an expected storm, an advisory lets you know to anticipate snow, sleet and/or freezing rain.

- Winter storm warning – Expect snow, sleet, ice, freezing rain and/or hazardous winter conditions within the next 12-24 hours.

Get ready

Your primary concerns during a severe winter storm are the loss of heat, power, and communications, having enough food and supplies, and protecting your home from possible storm damage. Stock up on supplies, take protective measures for your home and create a disaster plan to share with everyone in the family. That may include planning for evacuation if needed.

Stock up and charge up- Building your emergency kit.

-

- Stock up on food that requires no cooking or refrigeration. Make sure you have a manual can opener if you’re planning to open cans.

- Include baby food and diapers if needed.

- Buy cases of bottled water to use in case the pipes freeze. You can use this for brushing teeth, flushing toilets, and bathing. Make sure you have at least 3 gallons of water per person. You can also fill the bathtub with water as an extra source.

- Make sure you have enough prescription medications, and any toiletries needed.

- If you have pets, stock up on food for them.

- Gather your flashlights and extra batteries. Collect candles and matches.

- Pull out the battery-powered radio for weather updates. You can also use it to play music to pass the time.

- Make sure you have lots of blankets and warm clothes for each member of the household.

- Charge all of your devices ahead of the storm. Charge any portable battery backups. Determine how you will charge your phone during a power outage.

Protect your home

-

- Make sure your home’s furnace is in good working order.

- Check for drafts and use these winter window hacks to keep your home warm and toasty.

- Know how to turn off your utilities, such as gas lines or water, in an emergency.

- Consider buying emergency heating equipment such as a wood or coal-burning stove or electric or kerosene heater. Review all safety precautions, and be careful of fire hazards when storing fuel.

- Consider installing a portable generator. Review generator safety and never run a generator in an enclosed space.

- Make sure your smoke detector and carbon monoxide detectors are working. If you’ll be using your fireplace or wood stove for heat, they should be near that area. Have a fire extinguisher nearby just in case, or try this way to put out fires without an extinguisher.

- Test your snow blower and have it serviced if necessary.

- Take a walk around your house and identify any trees that could fall. If there’s time, trim them back.

Be prepared to leave if needed

-

- Service your vehicle and make sure you’re prepared for winter. Have a mechanic check your antifreeze, windshield-washer fluid, defroster, wipers, battery, brakes, and tires.

- Keep your car’s gas tank full for emergency use.

- Stock your car with these must-carry items.

- Research local shelters and warming stations in your area in case you need to evacuate your home.

- Prepack a bag for each member of the family, including pets.

Once the Storm Arrives

During the storm…

-

- Limit your time outside. Hypothermia and frostbite are real dangers.

- Do not attempt to travel during treacherous conditions. You could find yourself in an accident or stranded on the road.

- Stay tuned to emergency weather alerts.

- Check on neighbors if they’re older or have young children who are more at risk in extreme cold.

After the storm…

-

- Avoid driving until conditions have improved. Follow winter driving safety guidelines.

- Keep a supply of kitty litter and/or ice melt to clear sidewalks.

- Be careful to not overexert yourself. It’s common for heart attacks to be brought on by overexertion from shoveling or clearing snow.

- Assess any damage to your home or property and alert your insurance company. You have home insurance for a reason. Put it to work if you need it.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

Car batteries don’t last forever. Luckily, if your car won’t start due to a dead battery, there’s an easy fix. You can jump start it.

Jump starting a car transfers the battery power from a live battery in one vehicle to the dead battery in another. It does this by creating a circuit, most commonly using jumper cables. Jump starting isn’t a permanent fix, but it will help you get to where you’re going. And then, you can schedule a follow-up with your mechanic to check your battery and replace it as needed.

It’s not difficult to jump start a car, but you do need to know how to do it properly. If you do not connect the cables in the right way and in the exact order, you could be in for trouble. Follow this process to successfully jump start your car — or someone else’s — this season.

1. Park so that your car’s engine is next to the other car’s engine without touching. In most cases, your cars will have to be facing each other in order for the jumper cables to reach.

2. Place both vehicles in park or neutral. Shut off the ignition. Put on the parking brake.

3. Pop the hoods. Locate the batteries.

4. Get out the jumper cables. Note that they have red and black clamps.

5. Attach one of the red clamps to the positive terminal on the dead battery. Look for the big plus sign or the letters POS to make sure it is positive. Sometimes the positive terminal is also the larger one. (Always connect the dead battery first. Otherwise, you could be feeding energy in the cables and cause a safety hazard.)

6. Attach the other red clamp to the positive terminal on the battery of the working battery.

7. Clamp the black negative to the negative terminal of the working battery.

8. Attach the last black clip to an unpainted metal surface on the car with the dead battery. You can find such a surface on one of the metal struts that holds the hood open.

9. Start the working vehicle and let the engine run for a few minutes.

10. Try to start your vehicle. If it doesn’t start right away, give it another minute and then try again.

11. Remove the cables in the reverse order that you connected them.

12. If the jump start works, don’t shut off your vehicle. Drive around for at least 15 minutes to recharge your battery. And always remember to thank the person who helped you!

If you want to jumpstart your car on your own, you can buy a battery jumper pack. Most people consider this one of the must-carry safety items for your car in the winter. A battery jumper pack is a portable battery with cables that can jump-start your car without the need of another vehicle. If you choose to go this route, be sure to carefully follow the directions. The procedure varies from device to device.

If you feel unsure or unsafe at any point, call for 24/7 roadside assistance. You can also call if the jump start does not work and you need a tow.

Do’s and Don’ts of Jump Starting

Now that you have the basics down, it’s good to review some safety do’s and don’ts.

Do…

-

- Read your owner’s manual on jump starting. In some cases, jump starting may void the warranty. In other cases, there may be jump start lugs where cables need to be attached. The manual will detail any special instructions.

-

- Make sure the battery on the good Samaritan’s vehicle has at least as much voltage as your own. Otherwise, serious damage could occur.

-

- Check that the clamps on the jumper cables are rust-free.

-

- Check that the battery does not have corrosion or rust. You can clean corrosion and dirt with a wire brush. (Corrosion will sometimes prevent the battery from charging.)

-

- Unplug accessories like cell phone chargers. The power surge from the jump start could cause them to short out.

-

- Turn off headlights, hazard lights, turn signals, and the radio in both vehicles.

-

- Use rubber gloves and safety goggles if you have them for extra safety.

Don’t…

-

- Lean over the battery of either car.

-

- Smoke while jump starting a car.

-

- Jump start a battery if it is cracked, leaking or the fluids are frozen. This can lead to an explosion.

-

- Ignore the warning signs:

-

-

- Slow starting engine

- Dim lights and electric issues

- Check engine light is on

- Corroded connectors

- Rotten egg smell

And don’t forget! AutoZone offers free battery testing so you can feel confident that your battery is fully charged.

Finally, remember to turn your lights off. We all know how that typically ends.

Safe travels.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

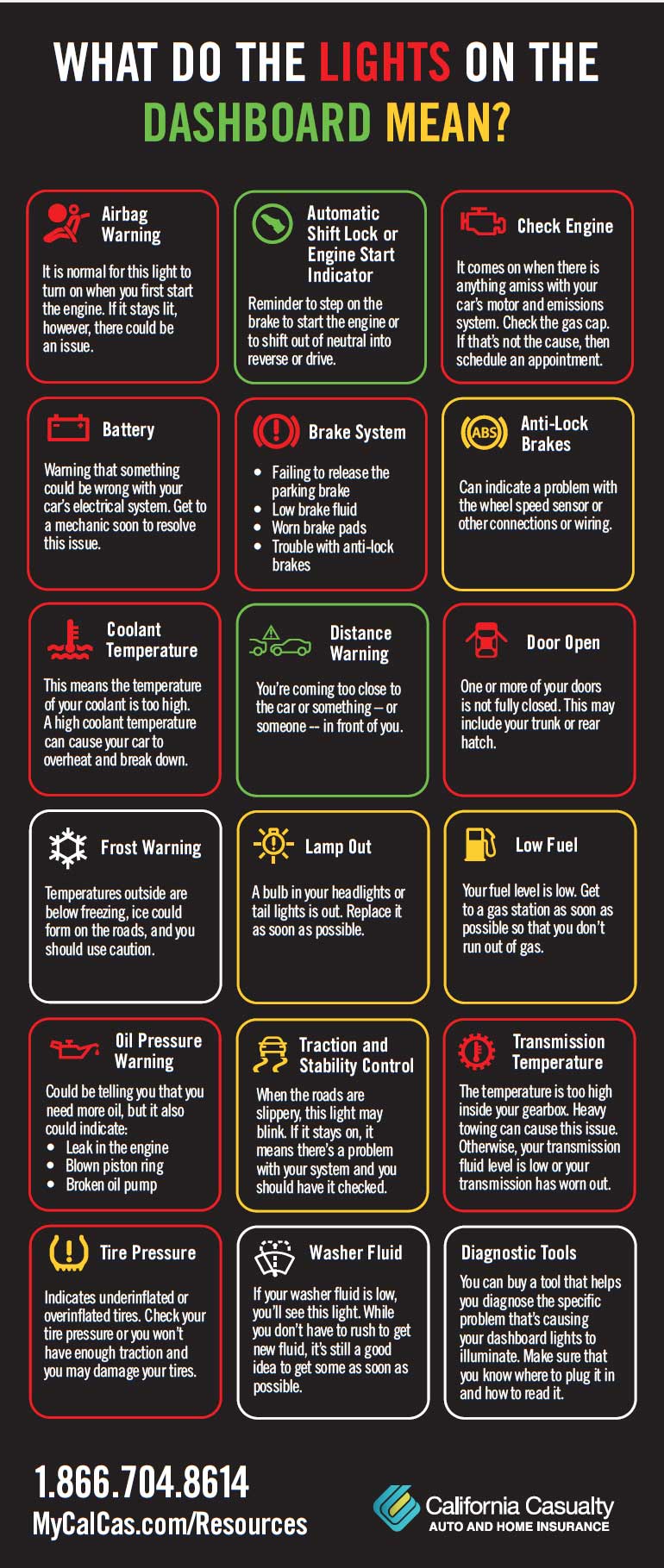

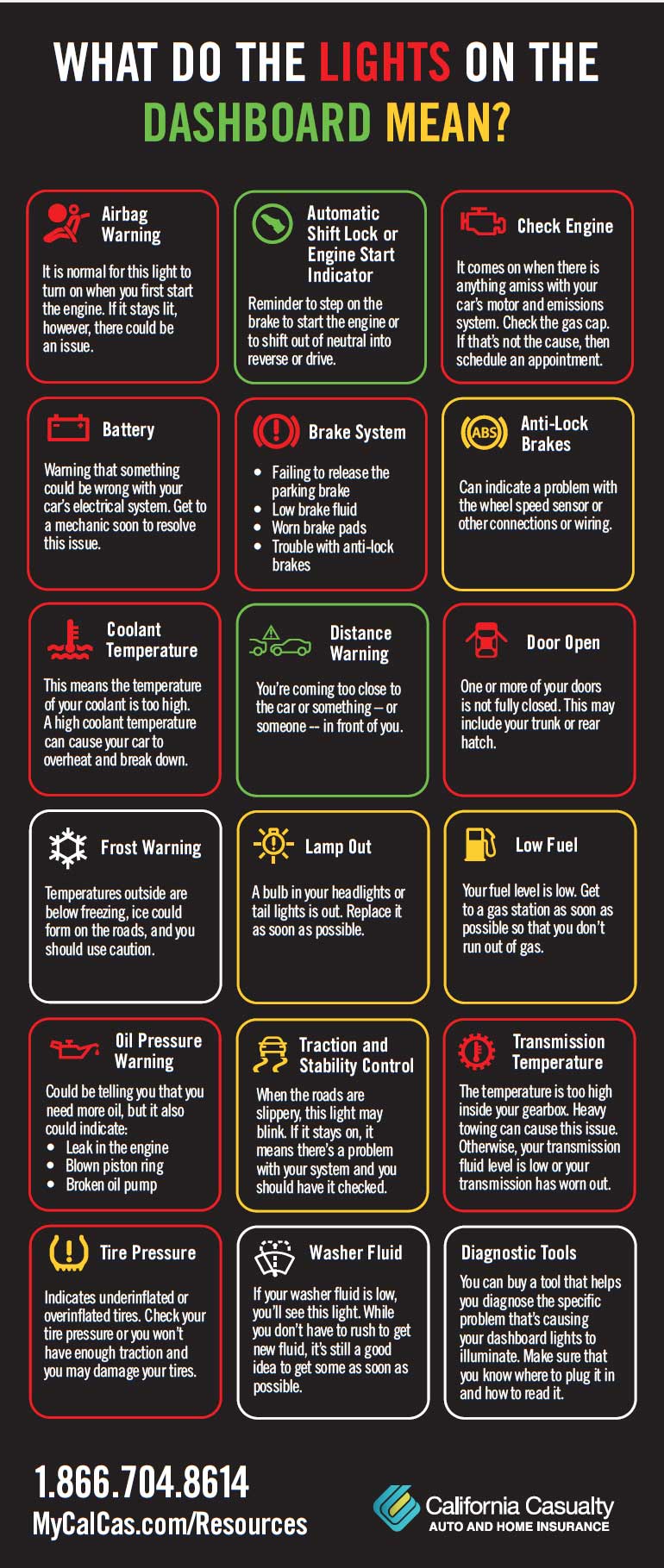

Whether it’s a minor problem or a major issue, you can count on that light on the dashboard illuminating. Our cars warn us when something isn’t right, and that’s good because there are some warning signs you shouldn’t ignore.

Knowing the meaning of your dashboard lights will help you know if it’s a situation that requires immediate attention—or if it can wait. Here are some important lights and what they mean.

Airbag Warning

The airbag warning light looks like a passenger with a large ball on his/her lap. It is normal for this light to turn on when you first start the engine. If it stays lit, however, there could be an issue. Your car is safe to drive, but you will want the airbag checked so that it will deploy during an accident.

Automatic Shift Lock or Engine Start Indicator

Today’s newer cars require that you step on the brake to start the engine. You also need to step on the brake to shift out of neutral into reverse or drive. This foot-shaped light is a reminder.

Check Engine

This light looks like a miniature engine. It comes on when there is anything amiss with your car’s motor and emissions system. Some cars have two stages of a check engine light: illuminated (less serious) and flashing (serious warning). It could mean:

-

- Loose gas cap

- Faulty oxygen sensor

- Catalytic converter issues

- Mass airflow sensor

- Worn-out spark plugs

- Loose wire

If you’re driving and everything seems fine, don’t panic. Pull the car over and check the gas cap. If that’s not the cause, then schedule an appointment as soon as possible. If the check engine light is on, and the car starts making strange noises or driving erratically, pull over and get it towed to your mechanic. That could indicate a more serious issue.

Battery

This light that resembles a battery is a warning that something could be wrong with your car’s electrical system. It doesn’t necessarily mean that there’s an issue with your battery. It could be:

-

- Corroded cable or wire

- Alternator

- Battery

- Electrical components

Get to a mechanic soon to resolve this issue. A battery light is a warning that your car could break down.

Brake System

This light is usually an exclamation point in a circle. It illuminates for several reasons.

-

- Failing to release the parking brake

- Low brake fluid

- Worn brake pads

- Trouble with anti-lock brakes

An illuminated ABS (anti-lock brake) light can indicate a problem with the wheel speed sensor or other connections or wiring. If your brake light is lit, and the parking brake is not the issue, bring your car in for a professional checkup as soon as possible.

Coolant Temperature

This light resembles a thermometer and if it comes on, it means the temperature of your coolant is too high. There are several possible causes.

-

- Broken water pump

- Low coolant levels in the radiator

- Leaking or burst coolant hose

- Damage to the radiator

A high coolant temperature can cause your car to overheat and break down. It also can permanently damage your engine. Pull over and let the car cool down. Adding coolant can temporarily fix the problem but get your vehicle checked by a mechanic before you drive it further.

Distance Warning

If you’re driving a newer vehicle, you may see this light when you’re coming too close to the car or something – or someone — in front of you. The light resembles two cars about to hit each other and is a warning to slow down.

Door Open

An image of a car with doors open indicates that one or more of your doors is not fully closed. This may include your trunk or rear hatch. Closing the door should make the light go out, and have you on your way.

Frost Warning

This light, which resembles a snowflake, comes on when temperatures outside are below freezing. It will stay on as long as it’s cold, to remind you that ice could form and you should use caution.

Lamp Out

Resembling a sun with an exclamation mark, this light comes on when a bulb in your headlights or tail lights burns out. Replace it as soon as possible so your car is visible to other drivers.

Low Fuel

A gas tank appears when your fuel level is low. Get to a gas station as soon as possible so that you don’t run out of gas.

Oil Pressure Warning

This light that resembles an oil can could simply be telling you that you need more oil. But it also could indicate something more serious:

-

- Leak in the engine

- Blown piston ring

- Broken oil pump

If the light doesn’t go off after you’ve added oil, then get your car checked out professionally. Do not ignore this light and drive for an extended period of time—or you could damage your engine.

Traction and Stability Control

When the roads are slippery, your car’s traction control light may blink. That simply means that it’s doing its job and there’s no cause for concern. This light, which looks like a car with skid marks, can stay on. If that happens, it means there’s a problem with your system and you should have it checked. Also, if this light turns on during dry, sunny conditions, there may be a repair or adjustment needed.

Transmission Temperature

This gear wheel image with a thermometer lights up when the temperature is too high inside your gearbox. Heavy towing can cause this issue. Otherwise, it’s likely that your transmission fluid level is low or your transmission has worn out. Get your car to a mechanic as soon as possible.

Tire Pressure Monitoring System

When any one of your tires is low, your TPMS system kicks in. The light looks like a tire that’s a bit deflated with an exclamation mark. Don’t drive on severely underinflated or overinflated tires; you won’t have enough traction and you can damage your tires. Adding air to deflated tires should get the light to go off, but if you have persistent problems, have your tires checked by a professional.

Washer Fluid

If your washer fluid is low, you’ll see this light, which resembles a windshield being squirted. While you don’t have to rush to get new fluid, it’s still a good idea to get some as soon as possible. Dirt, snow, and ice can quickly build up on your windshield, making it hard for you to see.

Car Diagnostic Tools

You can buy a tool that helps you diagnose the specific problem that’s causing your dashboard lights to illuminate. Auto Zone offers this Fix FinderSM Service for free. If you are doing it yourself, make sure that you know where to plug it in and how to read it. Some car diagnostic tools require you to enter your car’s make and model, VIN, and other information. You can then decide if it’s something you can fix or an issue that your mechanic needs to address.

Importantly, you will want to address any issues in a timely manner. Ignoring them can create more expensive repairs and dangerous conditions down the road.

Check our other blog for maintenance mistakes that can cost you. Your car is one of your greatest investments. Keep it well maintained and protect it with the right car insurance.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

Nearly 60% of Americans are underinsured or don’t understand what is covered by their policies.

Make sure you are properly covered going into the new year with these 6 New Year’s insurance resolutions

1. Make sure you have the correct amount of auto coverage

Have your driving habits changed in the past year? Maybe you accepted a new job and your commute is longer or smaller, or you added a new driver to your policy. These life changes will all affect your insurance coverage and premium costs.

Making sure you have the right amount of auto coverage is crucial in case of an accident, so you don’t have to end up paying the majority of your costs out of pocket. For example, make sure you have enough liability coverage on your current policy. If you cause an accident, you are responsible for damages (and if it is a serious accident loss of wages of the victim/their family). Liability coverage is used to pay for those damages that you caused.

Your insurance will only pay for the amount that you’ve designated for liability. The rest comes from your pocket, so don’t skimp on this important coverage.

2. See if you qualify for any additional discounts

Did you know that if you have a teen driver they can take a driver’s safety or education course to qualify for discounts on your auto insurance? You can also turn in their report card for a ‘good student discount’.

You may qualify for insurance discounts for being part of a professional association, such as groups for teachers, nurses, or first responders. There are also discounts for being retired, for drivers turning 25, for paying via automatic bank payments, and for paying in full upfront. You may qualify for a new home discount, or a discount if you have updated your utilities (electrical, plumbing, heating, cooling) in an older home, or added a security system. There are also discounts for a new roof and an automatic sprinkler system. You can even be rewarded for being a loyal customer!

3. Create a home inventory checklist

A home inventory is a list of all of your possessions and their values. While creating one may sound like a waste of time, it’s important to have an updated list of all of your possessions so that you can get fully compensated if there was a disaster like a fire or a tornado, or a burglary. Without a home inventory, you may have difficulty pinpointing all of your belongings and lose out on their value and it can even delay the claims process. Start fresh with all of your new belongings after the holidays and put the checklist in a safe space, in the event of an unexpected loss, you’ll be glad you did.

4. Do you need additional coverage?

Did you know your home and/or renter’s insurance doesn’t include flood coverage? If you live in a flood-prone area you need to have Flood Insurance. The same goes for Earthquakes and Earthquake Insurance.

Do you have a pet that you love like a child of your own? While they will be covered if you are both in an accident in a covered vehicle thanks to Pet Injury Protection from California Casualty, make sure you will get reimbursed for any emergency surgeries, x-rays, labs, prescriptions, and more by adding Pet Insurance.

Need some extra coverage in case of an accident or disaster to ensure your family and belongings are safe? Ask your insurance agent if Umbrella Insurance or Scheduled Personal Property Coverage is right for you.

Umbrella Insurance is an extra layer of coverage that protects you and your family by covering additional damage costs that extend beyond the limits of your homeowner’s, auto, or watercraft policies. This additional coverage ensures your personal assets are safe. The primary purpose of this coverage is to protect you if you’re found liable for causing bodily injury to others or damage to their property. It also protects against incidents involving slander, libel, false arrest, and invasion of privacy, as well as any legal defense costs – even if you’re not found liable.

Personal Property Coverage, also referred to as “contents coverage,” is the term insurance companies use to collectively define the things you own inside your home. Scheduled Personal Property Coverage, or rider, is additional coverage for more special and/or expensive items such as jewelry, watches, heirlooms, furs, collectibles, etc. that have values above your personal property coverage limits. Both coverages are invaluable to make sure your personal belongings are covered in the event of a disaster or burglary.

5. Know what benefits are available to you

At California Casualty we offer our insured exclusive benefits like:

-

-

-

- Affiliate Group Rates & Generous Discounts

- FREE ID Defense Resolution

- Summer or Holiday Skip Payment Options

- Waived / Reduced Deductible for Collision or Vandalism While Parked on School Property – for Educators

- Personal Firearm Coverage & Fallen Hero Benefits – for First Responders

- No Charge Personal Property Coverage Up to $500

- 24 x 7 Towing & Roadside Assistance

- $1,000 Free Pet Injury Protection Coverage

And more! Speak to your insurance agent and ask which benefits are available immediately to you.

6. Schedule your annual free policy review

When’s the last time you took a look at your Insurance policy? Chances are if you haven’t had an accident or a loss, it’s probably been a while. And knowing more about your insurance could even save you money on your premiums. That’s why it is recommended to speak to your insurance agent at least once a year for your annual policy review. They will answer all of your questions and make sure you have the correct amount of coverage.

We know understanding your insurance coverage can be confusing, but we’ve got you covered! There is no better time to start getting the most out of your insurance protection than the new year. Call your California Casualty agent today to make sure you are taking advantage of your coverage and benefits all year long.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

You’ve done it a hundred times – sitting in a cold car, watching your breath while you’re waiting for the engine to warm up. It’s a necessary part of winter driving, right? Experts would disagree.

It used to be that cars needed to be warmed up before you could drive them in cold temperatures. But that’s no longer the case with today’s vehicles. Whether you’re an experienced or a new driver, here’s what you need to know.

Why today’s cars don’t need a lot of warm-up time

A car’s engine works by igniting a mixture of gasoline and air. That used to be the job of the carburetor. But carburetors didn’t work well in cold temperatures because they couldn’t get the right mix with denser cold air. If you didn’t warm them up, you ran the risk of stalling your car. Starting in the 1980s, manufacturers stopped using carburetors in favor of new technology.

Today’s vehicles use electronic fuel injectors that can detect cold weather and release extra gasoline for the right fuel-air mix.

Warming up your car is a waste of time, gas, and money.

It’s a given that you could be using your time more productively than waiting for your car to warm up. As you idle, you’re burning gas, which is essentially wasting money, too. You’re also increasing wear and tear on your car’s engine. Plus, you’re adding pollution to the air. According to a 2009 study, idling your car contributes to 1.6% of all U.S. greenhouse gas emissions. That’s nearly double the entire iron and steel manufacturing industry. States have begun to take notice and issued anti-idling fines beyond 3 minutes.

A one-minute warm-up

With your car’s onboard computer and fuel injection system, it takes just about one minute for your car to warm up. That’s regardless of the outside temperature. That doesn’t mean that the inside of your car will be warm, or that the windows will be defrosted, but it does mean that the oil has traveled from the bottom of your engine to the top.

7 Steps to quickly heat up your car

Follow these steps to quickly heat up your car this winter.

1. Turn on your ignition without starting the engine. After about 5 seconds, you should hear the fuel pump priming the engine. Then start the car.

2. Don’t turn on the heat right away. The air being pumped out from the heater core will still be cold. That air will keep the engine from getting hot quickly.

3. Also make sure you are not running the radio, your seat warmers or defroster initially as these put a strain on the electric system.

4. Idle your vehicle for about 30 seconds (or a minute if your car is older). You can go a little longer if your car is covered in snow or ice. This will allow your vehicle to produce warm air.

5. You do want to give yourself time to warm up that has nothing to do with the engine. It’s all about your visibility and your comfort. You want to be able to see while you are driving and you want to be comfortable enough so you can concentrate on the road. Turn on the defroster to help clear the windows. Wait until you can drive safely; don’t try to drive with a small portion of cleared window.

6. Cars will warm up faster if you are driving than if you are idling. Normal driving for 5-10 minutes should do the trick.

7. Once you’re driving, point the warm air at your chest. That will warm you as quickly as possible. Then point the heat at your feet. As heat rises, the whole car will stay warm.

Tips for the extreme cold

In some places in the U.S., such as the upper Midwest, temperatures can dip well below zero and stay there. Consider these additional steps to help your car weather the cold.

-

- Once regular oil gets below 20 degrees Fahrenheit, it becomes thick. Use synthetic oil which holds its consistency.

- Battery heating pads and thermal wraps can keep your battery warm. A cold battery trying to hold a charge in frigid temperatures can harm your alternator.

- Oil heaters for the dipstick or magnetic heaters for the oil pan can help. There also are coolant heaters for antifreeze.

- Engine block heaters attach to your car and plug into an electric outlet. You can install a permanent heater, too.

Protect your car with auto insurance for peace of mind this winter and all year round.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.