by California Casualty | Auto Insurance Info, Finances, Homeowners Insurance Info |

From groceries to gas, it seems like we’re paying more for everything these days. Now insurance rates are increasing as well. Why is this happening, and more importantly, what can we do about it? Here’s what you need to know.

What we’re seeing…

Car insurance rates rose 9% over the course of 2022, a trend that is expected to continue with another 7% rate growth in 2023 according to Insurify. Home insurance rates increased by an average of 12.1% in 2021, and another 3% in 2022 said Bankrate.com. Experts predict rate increases each year for the next few years due to the perfect storm of inflation, supply chain issues, weather changes, and other factors.

We’re experiencing historic inflation.

Inflation is at its highest level in decades. Inflation has had a significant impact on the cost of auto parts and labor, as well as medical expenses for bodily injuries.

From March 2021 to March 2022, here’s how prices have increased:

-

-

- Medical services – increased 2.9%

- Auto repair costs – increased 4.9%

- Car rental costs – increased 13.8%

- Used vehicles – increased 35.3%

Similarly, the costs associated with a home claim also have been affected by inflation. This includes additional temporary living expenses, replacement of personal property and home furnishings, cost of construction labor, and costs of construction supplies.

From March 2021 to March 2022, here’s how prices have increased:

-

-

- Rent – increased 5.1%

- Home furnishings – increased 10.1%

- Construction labor and trade services – increased 21.3%

- Construction materials and goods – increased 22.2%

Supply Chain Issues

There are supply chain issues created by the pandemic and by a labor shortage. When we can’t get parts or supplies to repair a vehicle or a home, the process becomes lengthier and results in repairs simply costing more.

Other Factors

The severity and frequency of vehicle accidents are on the rise. Traffic fatalities reached a 16-year high in 2021 according to the National Highway Traffic Safety Administration, due to an increased trend in post-pandemic risky driving behaviors – speeding, driving distracted, not wearing seatbelts, and driving under the influence. This rise in accidents directly affects claims, which contributes to rising auto insurance costs.

Similar conditions come into play for home insurance costs. The number of extreme climate events and weather disasters is also increasing. In 2022, there were 18 disasters with losses of more than $1 billion each, according to the National Centers for Environmental Information.

An inside look at how this affects your insurance rate

As material and labor costs rise, the cost to repair and replace damaged homes and vehicles increases. Factor in the ongoing supply chain issues and costs increase even more. The amount you pay for insurance is likely to go up when the cost to settle claims rises.

“But I’ve never been in an accident, so why would my rate go up?”

Even if you have a spotless driving record or never filed a claim, it’s likely that your insurance costs could be impacted due to economic factors that are out of your control – regardless of the company that provides your coverage. Insurers across the country have been raising rates, some multiple times in the past 12 months. However, it’s not all doom and gloom. There are ways you may be able to reduce your costs.

What You Can Do to Lower Your Premiums

Your insurance provider can recommend adjustments that still give you the quality coverage you need but with a lower premium. Start with a thorough policy review and make sure to look at these areas.

• Review deductible options. Generally, the higher your deductible, the lower the cost of your insurance premium. Since the deductible is the amount your insurance provider will subtract from an insurance payout, you’ll have to select a deductible that you’re comfortable paying out-of-pocket after a loss. Note that there can be diminishing returns if you set your deductible much higher than average, so as a consumer, you need to balance the premium savings against the amount you’d be required to pay after a loss.

• Take advantage of discounts. You may qualify for insurance discounts for being part of a professional association, such as groups for teachers, nurses, or first responders. There are also discounts for being retired, good student discounts, setting up automated payments, and for paying in full upfront. You may also receive a discount for quoting online.

• Buy home and auto insurance from the same company. When you bundle your home and auto insurance, you can often qualify for reduced rates, saving hundreds of dollars.

• Remove Gap coverage if no longer needed. When you buy or lease a new vehicle, it starts depreciating once you drive it off the lot. Gap insurance ensures that you will get the full replacement value of your car if it is totaled or stolen. As a car begins to age, this gap goes down and the need for coverage is less.

• Make your home disaster resistant. Talk to your insurance agent about how you can disaster-proof your home. You may be able to save on your premiums by adding storm shutters, reinforcing your roof or buying stronger roof materials, or even clearing brush from around your home. Older homes can be retrofitted to make them better able to withstand earthquakes or other natural disasters. In addition, consider modernizing your heating, plumbing, and electrical systems to reduce the risk of fire and water damage.

• Choose electronic documents rather than mail. This is an easy change that often comes with a discount and can add up in the long run.

• Skip a payment. Some insurance companies allow you to skip payments around the holidays. At California Casualty, you have the option to skip payments during the summer or holiday months when budgets tend to be extra tight. Ask your agent for details.

California Casualty has been slower with rate increases than the bigger carriers. We will always strive to keep our prices as affordable as possible for our members. When we do make rate changes, it is to be able to maintain the financial fortitude to keep our promises to every policyholder during their time of need.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses.

by California Casualty | Auto Insurance Info |

Brrrr…it’s cold out there. But those freezing temperatures don’t just affect us. They can also impact our cars, some even to the point where they may not start or function.

Here’s a quick checklist to help you know what to look for, and what to do, to ease the effects of frigid temps on your vehicle.

Check your tires.

A lot is riding on your tires. You want them to grip the road in all conditions, whether dry or wet, snowy or icy. However, as temperatures dip, so does the pressure in your car’s tires. That underinflation can result in serious safety issues. Underinflated tires can cause your car to lose traction, and slip and slide in wet conditions. The tires’ treads can wear unevenly. You could even be at risk for a tire blowout. Having the right tire pressure helps with a safe ride and also improves gas mileage.

What to do: Check your tire’s air pressure at least once a week and fill your tire as needed to manufacturer’s specifications. Consider getting winter tires that perform better on snowy surfaces if you live in a place with frigid temperatures.

Check the battery.

Batteries help start our cars and power electrical features. Most batteries use a chemical reaction with lead acid to generate the electric current. In freezing temperatures, this reaction is slower and your battery’s power is reduced. That means it may not have enough “juice” to start at all. This is especially true for older or weaker batteries.

What to do: If your car doesn’t start immediately, turn off the lights, heater, radio, phone chargers, and anything that is powered by your battery. Try starting your car again to see if that helps. If not, use jumper cables to get your vehicle going. In general, keep battery connections clean and free of corrosion, which will help it work to its best potential. Also, consider a battery warmer. Finally, replace your battery if it is more than 3 years old. If you’re unsure of your battery’s life, have it tested. Many auto shops offer that service for free.

Are you driving an Electric Vehicle (EV)? Cold can affect your battery too. There’s less energy for acceleration and your range may decrease. Preheat your EV before going out. Be prepared for longer charging times in winter months.

Check your fluids.

Freezing temperatures can affect your car’s oil, coolant, and transmission fluids. When it’s very cold, these fluids become so thick that the engine cannot circulate them, or has to work harder to do so. Without these essential fluids, your vehicle cannot operate properly or sometimes at all. With a lack of oil, your engine isn’t lubricated. With a lack of transmission fluid, your car struggles to switch gears. With a lack of coolant, your engine can overheat. The frozen coolant can also crack and damage your radiator hoses.

What to do: Let your car warm up fully before driving. Switch to low-viscosity oils, or synthetic oils, which flow more easily when it’s cold. Make sure there is a proper ratio of antifreeze (coolant) to distilled water. An improper mix can have a higher freezing point. You can check your coolant’s freeze point with a refractometer. Also, winter is a good time to have your transmission fluid checked and replaced if needed.

Fill your gas tank.

Gas will not freeze unless it’s 100 degrees below zero. But water in your gas tank or lines can become ice that clogs the system. The ice can make it hard to start your car or give you a sputtery ride. It also can leave you stranded with your car unable to go anywhere.

What to do: Keep your gas tank at least half full to avoid this problem. If you do get stranded with a frozen fuel line, you can get your car towed to a warm location. You also can try adding gas and/or fuel line antifreeze to the tank.

Let screens warm up.

You may notice your liquid crystal display (LCD) screens being slow in the cold. That’s because the molecules in LCDs slow down when the temperature drops.

What to do: Wait for the car to warm up, and the screens should resume their normal speed. You can install an engine block heater to help things along or park in a warmer place like a garage to minimize the cold’s effects.

Clear your windshields.

On a cold day, your breath could condense and freeze on the inside of your windshield. Keep your windshields as clear as possible with the defrost function. Windshield washer fluid also may not work as well in the cold. It may be unable to spray because it’s frozen.

What to do: You can buy windshield washer fluid that is made for cold temperatures. Even so, it could freeze, so make sure your car is warmed up before using it. Also check that your car’s defrost system is in good working order.

Check the rubber on wipers and doors.

Freezing temps can cause the rubber on your windshield wiper blades to become brittle. They could easily tear or crack, which creates blurry windshields—a recipe for car accidents. In addition, doors can freeze shut in cold temperatures, which is an added annoyance.

What to do: Consider buying winter wiper blades which are made to hold up to cold temperatures. Make sure you replace your wiper blades when they are worn. For frozen car doors, try using silicone spray on the rubber door gaskets to keep them from freezing shut.

Check your belts and hoses.

Older serpentine belts may be brittle and can break when they get cold. They also may be so cold that they don’t bend as they should. Cold weather can also take its toll on your coolant hoses. A bad belt can continue to function but there often are signs that it is failing and needs to be replaced. Listen to noises your car may make to indicate that and other problems.

What to do: Have your mechanic check the drive belt system and coolant hoses at every oil change. Replace parts when they show signs of wear and tear.

Your car is one of your greatest investments. Keep it well-maintained and protect it with the right insurance.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

You slow down for the yellow light but the car behind you does not. Bam! It wasn’t your fault but now you have to get your car fixed. Or maybe a storm knocks out a window in your house. Now you need to get it repaired.

Accidents happen. Washing machines overflow; things are stolen or vandalized. That’s why you have insurance. Your policy protects your vehicle, your home, and your belongings, taking some of the financial stress away to help you repair and replace those necessary items. Here’s an overview of the insurance claims process so that you can do it easily.

When to File a Claim

Every policy has a deductible, an amount that you are required to pay out-of-pocket before insurance kicks in. The general rule is to file a claim when the payout is greater than the deductible and you cannot cover it on your own. You also should file a claim whenever someone is injured and when it’s not clear who is at fault. That way, the insurance companies can get together and determine the outcome.

How to File a Claim

Let’s say you were in a car accident. Here are the steps to take to file a claim. (You also can refer to the back of your California Casualty insurance card. It lists the steps to follow in the event of a loss.)

Step 1: Call the police if needed.

-

- Call 9-1-1 if anyone is injured or you suspect drugs or alcohol are involved.

- Call the non-emergency police number to report the accident. An officer may show up and take a police report. While you don’t necessarily need one, it will make the claims process easier. If the police are not needed, or available, you may file an accident report online, by mail, or at the police station.

Step 2: Get the other driver’s information.

-

- You feel bad so it may be tempting to say the accident was your fault. Whether or not it was, don’t take the blame. Don’t apologize.

- Exchange information. Get the other driver’s name. Take a photo of the other driver’s license, insurance card, and registration. Alternatively, you can write down the information. Make sure you have the year, make, model, license plate number, and color of the other car.

Step 3: Write down facts and take photos. Look for witnesses.

-

- Take photos of the scene, license plates, traffic signs, and anything else that may help you to remember the details of the accident.

- Include the direction the cars were traveling, your speed, weather, road conditions, and what happened.

- Use your phone to make detailed notes.

- There may be witnesses. Look around and ask for the contact information of those individuals. They may later be contacted by your insurance company or police, if needed, to support your rendition of the accident.

Step 4: Call your insurance company.

-

- Report the accident. The adjuster will ask questions. Answer them honestly and thoroughly. If you don’t know the answer, say so.

- Your adjuster will share the process of getting your car repaired. They will send you paperwork to fill out.

- Let them know if there is a police report.

- Don’t sign anything from the other person’s insurance company. Let your insurer take the lead.

Step 5: File your claim.

-

- Most insurance companies allow you to file your claim online. That means you’ll fill out the necessary paperwork online or by email.

- To complete the filing of your claim, you’ll need to fill out the forms that you are sent.

- You may have to get a repair estimate and include that information.

- Then, you’ll wait for approval. Once the repair is authorized, you’ll be able to proceed with the repairs. Either you or the repair shop will receive payment from the insurance company, so check with your adjuster.

The Difference with a Homeowner’s Claim

A homeowner’s, renter’s or personal property claim follows a similar process. The main difference is that you need to provide a Proof of Loss statement. That’s a list of items that were damaged or stolen and how much it costs to replace them.

Can you wait to file a claim?

You should not wait. Your insurance contract specifies your specific Duties After Loss. You must give prompt notice to the insurer; notify the police in case of loss by theft; protect the property from further damage, prepare an inventory of damaged personal property; and cooperate with the investigation.

So, the next time that life throws a wrench into your plans, remember that you have insurance. The claims process is an easy way to get the help you need.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

If you’ve ever had your windshield hit by a rock, you know the sinking feeling of watching a crack appear—and grow.

Cracks happen and sometimes they’re unavoidable. But did you know that your windshield is at higher risk for cracks in the winter? It’s true. Knowing the causes of cracks will help you protect your windshield this season. If you do get a crack, we’ve included a guide on how to handle it, which can hopefully save you an expensive repair.

All About Your Windshield

Your windshield is a protective barrier between you and the road ahead. It also provides a clear line of sight. When your windshield cracks, it compromises your safety and can limit your visibility.

Windshields are made of laminated glass, which includes two layers of glass with a piece of plastic in the middle. The layers are fused together, making them stronger than ordinary glass. Even though windshield glass is strong, however, cracks still happen.

Tiny cracks can occur from everyday driving. Cracks happen when your windshield is hit by a rock or debris. The metal frame of your windshield expands and contracts in extreme temperatures. This causes stress on your glass which can crack it over time. Finally, our own human error can cause glass to crack, such as when we pour hot water over an icy windshield. A crack between the two layers of glass can trap moisture between the layers. This can weaken the structural integrity of your windshield and cause cracks down the road.

Types of Cracks

In most cases, cracks or chips smaller than the size of a quarter are able to be fixed. But you cannot let even a tiny crack alone. Don’t ignore these small cracks or chips; they can start out small and eventually get larger, past the point of repair, and cause you to need a total windshield replacement.

Not all cracks are the same, and it’s good to know what kind you have. The type of crack determines how you deal with it.

-

- Basic crack – The simplest crack is a line that is not near the edge of the windshield. If the line is less than 1 inch long and doesn’t have other lines extending from it, it can be repaired.

- Floater – A crack that occurs away from the windshield edge is known as a floater. These can spread quickly.

- Edge crack – If the crack is near the edge of your windshield, chances are that the entire windshield needs to be replaced.

- Chip – If a small piece of glass is missing, you have a chip. A chip less than 1 inch in diameter, without any cracks coming from it, can be filled or repaired.

- Star – If your crack looks like a small chip with tiny cracks extending from it, you have a star crack. This type of crack could possibly be fixed but the repair may be visible.

- Bulls-eye – If your crack resembles a circular bulls-eye target, you have more extensive damage than it appears. This type of crack usually requires a full windshield replacement.

How to Avoid Cracks

Remove ice responsibly. In most places in the U.S., you’ll be dealing with icy windshields this winter. You need to clear the ice in order to drive. Glass can be brittle in cold temperatures, so you will want to avoid any sudden temperature changes.

-

- Do not throw hot water on your windshield. Hot water will refreeze, and surprisingly, it does so faster than cold water. Don’t use room temperature water either. This will still be a temperature extreme from the icy conditions and can crack your windshield.

- Skip the vinegar and water mixture. Vinegar doesn’t work well when there is already ice there. It also is an acid that can eat into glass causing pits.

- Don’t use a propane torch, hair dryer, or cigarette lighter. These are extreme changes in temperature and can crack the glass.

- Do not use a knife or blade that will chip or scratch your glass.

- Don’t hit the ice. It doesn’t take a lot of impact to cause damage to the glass.

- Do not use keys, snow shovels, or spatulas. They can all leave scratches and grooves.

- Do warm your car up slowly. Use your car’s heater and defrost settings. Wait until your car is warm to turn your car’s defrosters on high.

- Do use a plastic ice scraper. Ice scrapers are among the must-carry items in your car in winter.

- Do use a liquid deicer if you would like.

Avoid flying debris. While rocks and debris can hit your windshield almost anywhere, you can take steps to keep your car away from this potential hazard.

-

- Don’t drive over gravel roads, but if you must, keep a safe following distance from the vehicle in front of you.

- Don’t follow construction vehicles too closely.

- Don’t drive in hailstorms if you can help it. The best strategy is to find covered parking while it’s hailing. If you must drive in a hailstorm, slow down to lessen the impact.

Park in protected places. Mother nature can be tough on our windshields. Keeping your vehicle in a place with a constant temperature and away from wind, winter storms, snowstorms, and extreme weather can help to protect the windshield.

-

- Avoid exposing your windshield to extreme temperatures. If it’s going to be very cold, park your car inside if you can.

- You also can cover your car, which will help to protect your windshield wipers from freezing and cracking. You don’t want damaged wipers to scratch your windshield.

- If you can, park your car inside a garage during the winter months.

Periodically inspect your windshield. You may not even be aware of tiny cracks in your windshield. The sooner you catch them, the sooner you can address them.

-

- It’s hard to notice cracks while you’re driving. Make it part of your winter routine to periodically inspect your windshield when you get in or out of your car.

- Keep the windshield glass clean. This will help you to notice small cracks and chips.

- A winter car wash can help, but don’t run your car through one if there are any windshield cracks.

- Replace your wiper blades before winter hits.

- Don’t drive around with a crack. The sooner you take care of it, the less expensive the repair will likely be.

What to Do if You Get a Crack

Drive carefully. Drive over bumps slowly. Don’t whip around corners or cause any vibrations that could make damage worse.

Guard against dirt and moisture. While you are waiting for the repair, keep the crack clean and dry. Dirt and moisture can make repairs more complicated. (Pro Tip: Even window washer fluid can stain the crack so use a drop or two of dishwashing soap on a damp cloth.)

You only have one chance to get it right. DIY options include inexpensive windshield repair kits.

Most kits aren’t high quality and won’t last long-term. Some folks have tried to seal the crack with household items like superglue or nail polish remover. Don’t even consider that. It will prevent you from getting a professional repair.

Contact an auto glass repair specialist. California Casualty works with Safelite on claims for cracked windshields. Many glass repair providers offer same-day service and can come to you. A technician can fix repairable cracks in a matter of minutes. Most comprehensive auto insurance policies cover the cost of fixing small chips and cracks in your windshield. Even without insurance, a windshield repair is much less than a replacement.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

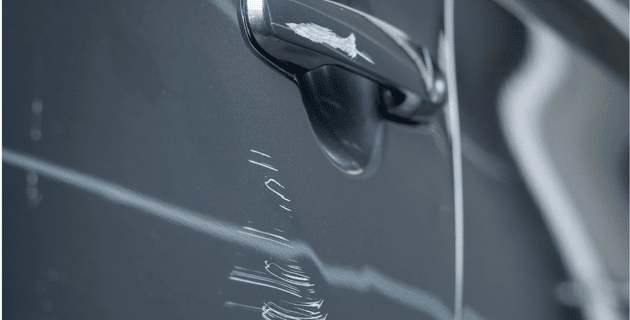

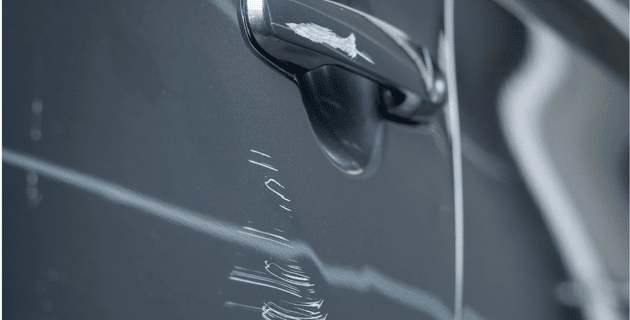

What’s more frustrating than returning to your car after shopping, and noticing a new door ding or scratch? Whether it was the car next to you, a runaway shopping cart, or a careless passerby… unfortunately dings happen.

While dings are inevitable, you can take steps to avoid them. Here are some proven tips and tactics to help protect your vehicle.

Park in an end spot.

In general, parking as far away from other cars as possible will help to minimize the chance of dings. If you’re in the end spot, you have the added protection of only having one side of the car next to another vehicle. Park as close to the outer edge as you can, which will give you an extra foot of space between you and the other car. Hopefully, that’s plenty of room to avoid swinging car doors.

Open your door slowly.

While some dings happen to us, we also can cause others. Being aware of your surroundings and opening your car door slowly will help you exit without hitting anything.

Look for the lines.

Parking lot lines are supposed to keep everyone lined up neatly in their own spaces. That’s not always the case. Avoid those spots where people are over the lines or positioned at a strange angle. That’s a sign they may not be as careful around your car. Also, avoid parking in tight spaces. Even if you can navigate those, the cars around you may not do as well.

Stay away from shopping cart return areas.

Runaway shopping carts are a key cause of dents and dings. Park far away to put as much distance between your car and the carts as possible.

Park beside a car in great condition.

You can tell by the condition of a perfectly clean and waxed car that it is well-maintained. Look for those cars in the lot and park next to them. Chances are the owner will take great care in not dinging his car or yours. Similarly, you’ll want to park away from those cars that have lots of dents and dings. Those owners probably don’t even notice and may take less care.

Avoid parking on the same side as a child safety seat.

Sometimes people can scratch or dent your car without meaning to do so, such as exuberant children and parents balancing too much. You may be able to avoid such situations by looking at the placement of the child safety seat in the neighboring car. Try not to park on the same side as the seat. Chances are that’s the side where parents and children will be congregating.

Pro Tip: Parents, teach your kids safety in and around vehicles.

Stay away from busy walkways.

Skateboarders and bicycle riders can whiz by your car and accidentally knock into it. Pedestrians also can scratch your car as they squeeze by. Park away from busy walkways so these encounters are less of a possibility.

Use covered parking.

Dings and dents are sometimes weather-related. Avoid damage from hail and other weather events by parking in a garage or other covered option. Alternatively, you can use a car cover to protect your vehicle. See our related blog on protecting your car from spring storms, too.

Pay attention to your surroundings.

It’s easy enough to brush by something and scratch your car. That’s why paying attention to your surroundings in a parking lot is your best defense. Look out for tall curbs, signs, light posts, walls, and cement pillars. Take steps to avoid them and a potential parking lot accident.

Do not park sideways.

You may have seen cars parked sideways or diagonally, taking up multiple parking spots. While in theory, it prevents anyone from parking near them, in practice, it’s considered a “jerk” move. There have been cases where people have targeted a car just because someone parked it that way.

Finally, while you can use insurance to fix door dings, most repairs are not much more than your deductible. You’ll probably be paying out-of-pocket. The good news is that modern technology has made it possible for paintless dent removal. It’s eco-friendly and usually less expensive than a body shop repair.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Homeowners Insurance Info, Safety |

Thanksgiving is a special time to gather with loved ones. But when your turkey catches fire, your aunt drinks a little too much and falls and breaks her leg, or your fur baby takes a little nip of a guest, it’s time to be thankful for insurance. Fortunately, there’s coverage for most Thanksgiving dinner disasters. Whether you’re home entertaining guests, or traveling to friends or family, we’ve compiled a quick guide.

Cooking Fires

It’s easy to lose sight of something on the stove or in the oven when you’re also attending to guests. That’s why you’re more likely to have a holiday cooking fire on Thanksgiving than on any other day of the year, according to the National Fire Protection Association (NFPA). The risk increases if you’re deep-frying a turkey. Deep fryers heat up to such a degree that they have caused severe burns and injuries, and even deaths. (If you must have a deep-fried turkey, consider ordering one from your local grocery store.) When cooking fire accidents happen, your homeowner’s or renter’s insurance policy will cover the damage to your home, your belongings, and any related injuries to your guests. (For the guest injury part, skip to the next section.)

-

- Your homeowner’s policy includes dwelling coverage. This covers the repair or rebuilding of the structure of your home up to your policy limit. So, if the fire damages your kitchen or other areas, you can report the claim to your insurance adjuster. They will advise you on how to proceed. Your insurer will likely send someone out to inspect the damage and write up an estimate. You will get reimbursed by your policy, minus your deductible (which is the amount that you chose to pay out-of-pocket before insurance kicks in).

-

- Personal property coverage is that part of your homeowner’s or renter’s policy that protects your possessions such as kitchen appliances, furnishings, and if the fire spreads beyond the kitchen, your television, clothing, etc. Fire is one of 16 different named “perils” that your policy covers. There are dollar limits for certain items such as money, jewelry, and firearms, so check with your insurer. For personal property coverage on a homeowner’s policy, you typically get 50 or 75% of Coverage A, the total amount of coverage for your home. If you’re renting, you get to choose the amount of personal property coverage when you select your policy.

-

- You can select replacement cost or actual cash value (ACV) for personal property. ACV is the amount the item is worth, minus depreciation for its age. It will cost a little more for a policy that provides replacement cost (and we strongly recommend it).

-

- Depending upon the extent of the fire, your house may not be livable. If that’s the case, you would be covered for any necessary increase in living expenses, such as lodging, food, and gas. Under Coverage D – Loss of Use, called “Additional Living Expense,” your policy will provide a flat percentage toward living costs, usually 30% of the Coverage A amount. Some states have time limits (e.g. 12 months) on when you can use that coverage. Plan to cover those additional expenses out-of-pocket.

Pro Tip: Having a fire extinguisher could earn you a discount on your home insurance policy.

Guest Injuries

Injuries can happen anytime, especially during gatherings where people may drink. Guests could become tipsy and trip, slip, and fall. That could happen even if they’re not drunk, of course. Burns could occur if there is a kitchen fire. Your guests could get food poisoning. Your normally well-behaved fur baby could bite one of your guests. While you can’t anticipate every situation, you can make sure there are no obvious dangers in your home, such as tripping hazards or unsecure handrails. Keep everyone’s safety and comfort in mind, including where your pet may be during the festivities. Then, if a guest does get injured, your insurance can kick in.

-

- You may be covered for guest injuries under your homeowner’s or renter’s liability coverage. If you are found liable, the policy may cover damages to the injured party. This can include medical expenses, lost wages, pain and suffering, and permanent scarring. The policy also provides a defense in court, if needed, for the policyholder. This is at the insurance company’s own expense.

-

- If you are not liable, but your guest was injured through his/her own fault, then Coverage F – Medical Payment to Others may cover your guest’s medical bills.

-

- Liability coverage does not apply to you and your family. Your own injuries or illnesses are not covered under homeowner’s or renter’s policies. You would use your own health insurance policy to cover any injuries that you might have in your home.

-

- If your dog has bitten a guest, make sure that your dog’s breed is not restricted by your insurance policy. Some policies will not cover breeds such as Pit Bulls, Doberman Pinschers, or Rottweilers. California Casualty does not currently have such restrictions.

Thanksgiving on the Road

If you’re among the millions who drive to Thanksgiving celebrations, you’ll want to make sure your car is well-maintained, and that your car insurance is up to date. Be ready for the holiday traffic, and drive safely. An accident can put a damper on the holiday. The good news is that you’re covered if you do have one.

-

- If you cause an accident, you are responsible for damages. You would pay with your vehicle’s liability policy. Importantly, auto liability does not cover any damage to your own vehicle; that’s covered by collision. It also does not cover injury to you and your family; it only covers the people in the other car. Liability coverage is required by law in most states.

-

- There are two types of liability coverage:

- If you are found liable for the accident, bodily injury coverage helps pay for medical expenses, lost wages, and pain and suffering for the driver and passengers in the other vehicle. We say “helps pay” because it depends on how much coverage you choose. The costs of an accident can be more than your insurance policy limit.

- Property damage coverage helps pay for repairs for the other vehicle or for repair/replacement of property, such as a fence, damaged or destroyed in the collision.

-

- If you are not at fault for the accident, the other driver is responsible for damages. Your insurance kicks in if the other driver does not have enough insurance. Collision covers your car for any type of damage, regardless of fault or if the person does not carry any/enough insurance. Underinsured motorist (UIM) and uninsured motorist (UM) coverage are for injuries. They cover you and your passengers if you are hit by an at-fault UM or UIM. Uninsured motorist property damage (UMPD) can cover your car if hit by an at-fault uninsured motorist.

-

- Unlike liability insurance, collision coverage is not usually required—unless you’re leasing a car or paying off a loan on a vehicle. However, it may be good to have.

No matter where you enjoy the holiday, we wish you a safe celebration. From our family to yours, Happy Thanksgiving!

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.