by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

Odds are you know someone who is getting married this summer. Now through September is when the majority of weddings take place each year in the U.S. While it’s a time of joy and dreams of the future, there are many important decisions: how many people to invite, is there a need for a wedding planner, who will cater the meal and what about entertainment. Once the rings are exchanged and the honeymoon is over, there’s another important step – getting your auto and home insurance in order. Here’s a checklist for newlyweds.

- Combine Your Insurance

If you both have separate cars with different insurance companies, now that you are married you can find discounts by putting both vehicles on the same policy. It will also ensure that both drivers are covered no matter which car they use. Get extra savings by bundling your autos with your home or renters insurance.

- Marriage Discount

Make sure to inform your insurance company that you got married – most auto and home insurance companies offer important discounts for newlyweds. Men under the age of 25 are usually considered high risk drivers. However, once they marry they often see a big drop in insurance premiums. The lower rates can also apply to those in domestic partnerships.

- Increase Homeowner or Renters Coverage

Wedding presents are wonderful. You now have a new set of china, expensive new appliances and other things for your home. These assets need to be covered. Talk to an insurance advisor to make sure you have enough coverage to protect all the things you own and to increase your liability protection. It’s also a great time to create an inventory of all the things you own to help you purchase the right insurance protection and make filing a claim much easier.

- Get Extra Protection for High Value Items

That beautiful new wedding ring and special gifts like fine art or silverware may need scheduled personal property protection, often called a “floater,” to make sure they are covered for their full value. Most homeowners and renters policies will provide limited coverage for those items. Scheduled personal property coverage will also pay to replace a ring, without a deductible, even if it was misplaced or damaged in the disposal.

Just like marriage, California Casualty is a committed partner in helping with your auto and home insurance needs. Don’t go it alone, contact a California Casualty advisor today for a free quote or no hassle policy review at 1.800.800.9410 or visit www.calcas.com.

Resources for this article:

https://www.knowyourstuff.org

by California Casualty | Homeowners Insurance Info |

Springtime is tornado season in the United States. Many people have been lulled into false sense of security by the relatively slow start this year. But once again Mother Nature flexed her muscles sending destructive storms roaring through much of the Midwest. As the cleanup of twisted metal and splintered wood continues, it’s a reminder that people in tornado prone areas need to be ever vigilant of the often deadly storms.

Are you ready? A recent survey commissioned by the Property Casualty Insurers Association of America (PCI) found 56 percent of Midwesterners consider themselves not well prepared for the aftermath of a natural disaster or severe weather.

Tornados are violent, abrupt and are often obscured by rain or darkness. Being prepared ahead of time is essential.

Here is important, potentially lifesaving information about tornados from Weather Underground:

- Develop an emergency plan for your family

- Know where safety shelters are located

- Monitor NOAA Weather Radio when severe weather is forecast

- Know the difference between a tornado watch and warning – a watch means conditions are right for tornado activity and people should be on alert, a warning means a tornado has been sighted and you should take shelter immediately

Here are tornado danger signs:

- Dark, greenish sky

- Large hail

- A large, dark, low-lying cloud that may be rotating

- A loud roar, often compared to a freight train

These are dos and don’ts from the American Red Cross if you are caught in a tornado:

- Do go immediately to an underground shelter, basement or safe room

- Do find a small windowless room in the interior of a home or hallway on the lowest level of a sturdy building

- Don’t stay in a mobile home unless absolutely necessary

- Do stay in your vehicle with the seat belt fastened and your head below the windows, covering your head with a blanket, coat or your hands

- Do go to a low lying area like a culvert or ditch if caught outdoors and cover your head with a coat or your hands

After a tornado:

- Continue listening to local news or a NOAA Weather Radio for updated information and instructions.

- If you are away from home, return only when authorities say it is safe to do so.

- Wear long pants, a long-sleeved shirt and sturdy shoes when examining your walls, doors, staircases and windows for damage.

- Watch out for fallen power lines or broken gas lines and report them to the utility company immediately.

- Stay out of damaged buildings.

- Use battery-powered flashlights when examining buildings – do NOT use candles.

- If you smell gas or hear a blowing or hissing noise, open a window and get everyone out of the building quickly and call the gas company or fire department.

- Take pictures of damage, both of the building and its contents, for insurance claims.

- Use the telephone only for emergency calls.

- Keep all of your animals under your direct control.

- Clean up spilled medications, bleaches, gasoline or other flammable liquids that could become a fire hazard.

- Check for injuries. If you are trained, provide first aid to persons in need until emergency responders arrive.

Some common myths associated with tornados are:

- Leave windows open to equalize pressure

- Tornados don’t hit large cities

- Tornados don’t occur in mountains

- Seeking shelter under an overpass is a safe

There is new information from recent storms that sturdy garage doors may be the best protector of a home. The study of tornado damage found wood frame homes with sturdy garage doors suffered less damage than homes with flimsy garage doors.

The research from the University of Alabama also concluded that tornado shelters – underground or above ground safe rooms – saved lives.

The researchers compared damage from major tornadoes that struck Moore, Oklahoma in 2013 to studies of similar storms that hit Tuscaloosa, Alabama and Joplin, Missouri in 2011.

Some of the conclusions:

- Flimsy garage doors proved to be a weak link, allowing pressurization that destroyed supporting walls and the roof when the garage was breached by devastating winds

- Storm shelters save lives even in the worst tornadoes

- In the areas damaged by lesser winds, the garage was often the root cause for failure of residential structures, allowing roofs and supporting walls to collapse

The study found that increased building safety standards and incorporation of more storm shelters are working to prevent some damage and save lives.

If your property suffers damage from a tornado:

- Secure the property from further damage or theft

- Contact your insurance company as soon as possible

- Inventory losses and take photos

- Save receipts of meals, purchases and hotels related to not being able to live in your home

- Be careful of unscrupulous contractors

This is also a reminder how important it is to take an inventory of your home and possessions before a disaster strikes.

Another way to protect your home is with an insurance policy review. Call a California Casualty advisor today, 1.800.800.9410 or visit www.calcas.com.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters and nurses. Get a quote at 1.800.800.9410 or www.calcas.com.

Resources for this article:

https://www.nws.noaa.gov/om/severeweather/resources/ttl6-10.pdf

https://www.redcross.org/prepare/disaster/tornado

https://www.wunderground.com/resources/severe/tornado_safety.asp?MR=1

https://www.pciaa.net

https://esridev.caps.ua.edu/MooreTornado/Images/MooreTornadoFinalReport.pdf

by California Casualty | Firefighters |

Springtime is a beautiful time of year – but it also begins the lead up to several dangerous weather related seasons. One such dangerous season is fire season, which runs from summer to fall, and is especially threatening to our western states.

Springtime is a beautiful time of year – but it also begins the lead up to several dangerous weather related seasons. One such dangerous season is fire season, which runs from summer to fall, and is especially threatening to our western states.

The best time to prepare for fire season is before it starts – so here are some tips to help you stay safe during fire season.

If you live in an area that could be threatened by wildfires, you should make sure you have at safety zone of at least 30 feet around your home, and as much as 100 feet if you live in a pine forest. Are your plants fire-resistant? If not, you might consider replacing them with hardwoods. Regularly clean up fallen leaves, pine needles and other plant debris, especially from underneath structures, and trim away tree branches that could touch your roof or are at least 15 feet from a stovepipe. If any tree branches on your property touch power lines, contact your power company to come have them trimmed.

You can make your own disaster preparedness kit, and store items in an easily transportable container, such as a camper’s backpack or a duffel bag. Your kit should have a first-aid kit, some canned food and an opener, a battery powered radio and flashlight with plenty of extra batteries. You should also have a supply of drinking water; experts recommend about three gallons per person. You might also consider stashing away a small amount of cash in your disaster kit. Some weather resistant clothing – such as ponchos and rain boots – may also come in handy. Include copies of all your most important documentation in the disaster kit, such as insurance policies, wills, birth and marriage certificates, credit card and banking information, titles and deeds to your property. Place these items in waterproof bags in the kit, or in a fireproof safe, if you have one. As a double precaution, send copies of your important documentation to a relative or friend who lives in another state or region.

If you haven’t prepared a household inventory, it is also advisable to do this, and you can do it either with a video camera, a Polaroid or digital camera or by taking notes. Include copies of the tapes or notes in your water- or fire-proof safe havens.

by California Casualty | Safety |

As weather forecasters are predicting an active few weeks for tornado activity, the Property Casualty Insurers Association of America (PCI) encourages homeowners and renters to take appropriate steps to be prepared, which includes a review of their insurance policies and discussion of coverage options with their insurance agent or company.

“With wind speeds that can reach nearly 300 miles per hour, tornadoes can be deadly and cause severe property damage,” said Donald Griffin, vice president personal lines for PCI. “Because tornadoes can occur rapidly and with little warning, advanced preparation is very important. We encourage consumers to know the warning signals used in their community and be prepared to take cover when alerted. Maintaining an emergency storm kit with a radio, flashlight, batteries and first-aid items is the first step in preparation. Other steps include conducting tornado drills with your family and ensuring that your property is adequately insured.”

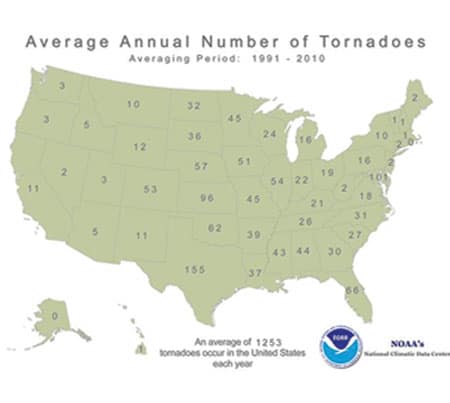

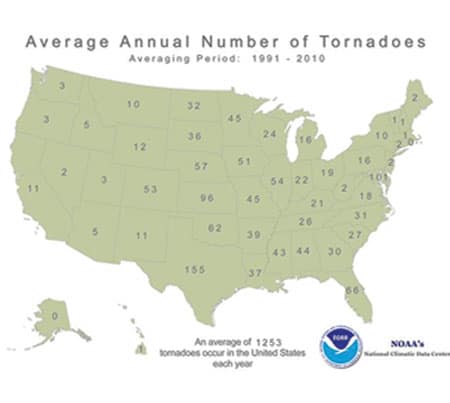

The peak of tornado season in the U.S. varies by geographic region beginning in southern states during the months of March and April. Peak tornado season for the southern plains occurs during May and June and typically takes place during June and July in the Midwest and northern plains. According to the National Oceanic and Atmospheric Administration’s National Climatic Data Center there were over 1,400 tornadoes in 2010. The highest concentrations of tornado reports were clustered in the Front Range of the Rockies, the Southeast, the Central and Northern Plains, and the Great Lakes. The largest outbreak of tornadoes for 2010 occurred on June 17th, there were at least 74 confirmed tornadoes reported across the Upper Midwest and Northern Plains.

Most tornado, windstorm, hail and similar severe weather-related losses are covered by either homeowners or renters insurance policies. Tornado losses to a home are covered by the “windstorm” peril under the homeowners insurance policy. Renters insurance also provides coverage to policyholder possessions under this peril. Protection from windstorm or hail damage for cars is covered under the “comprehensive” portion of the automobile insurance policy.

PCI pre-storm tips:

– Conduct a detailed inventory of your possessions including receipts, descriptions and photos of your home’s contents.

– Keep your insurance policy and CalCas Claims information along with other important information with you or in a secure place.

– Keep a cell phone charged and with you for emergencies.

– If you have one, keep a laptop computer close by. Most insurance companies allow claims reports to be submitted via the Internet.

If you experienced a loss from the storms:

– Immediately contact your insurance agent or company representative

– Inspect property and cars for damage

– Inventory losses and photograph damage, and save related receipts to assist with claims handling

– Secure property from further damage or theft

– Check the background and legitimacy of repair contractors. Ask your insurance company for assistance in locating a reputable contractor.

As always, we hope you never have to call to report a tornado related claim, but it pays to be prepared!