by California Casualty | Homeowners Insurance Info, Safety |

The recent large earthquakes in Southern California are a reminder to always be earthquake-ready.

Earthquakes come on suddenly, with very little warning. They can be a sharp jolt followed by the ground shaking and cracking, or waves rolling across the ground.

Earthquakes can hit anywhere at any time, and while the West Coast is considered “earthquake country,” the U.S. Geological Survey warns that earthquakes have been registered in every state in the union, with special seismic hazards for areas encompassing the western-third of the nation, and areas extending from Missouri and Illinois to most of the Eastern Seaboard.

After an earthquake strikes many are often left disoriented and full of adrenaline –psyche and security shaken as much as their house. Post-quake your home or apartment may look damage-free, but there can be many hidden dangers.

After checking your family and others for injuries, here are key steps you need to take to ensure your safety:

- Check for gas and water line leaks. Know where the shutoff valves are if you smell gas or detect water leaking to prevent fires and water damage.

- Be aware of downed power lines.They can still carry a dangerous current.

- Inspect chimneys and brick areas for cracks. If cracked, they could send dangerous debris down on you or others.

- Check water heater and furnace vents. If they have become separated, it could send dangerous carbon monoxide into the home.

- Watch for electrical sparking or the smell of burning wire insulation. This could lead to a fire. Unplug any broken lights or appliances and turn off power at the main fuse box if you detect an issue.

- Clean up spilled medicines, drugs or harmful chemicals. Bleach, turpentine, hazardous garden supplies, etc.

- Don’t drink from faucets or other unprotected water sources. Wait until given the okay from your municipality or utility, because they could be contaminated.

Always Plan Ahead

Before an earthquake, or other natural disaster hits, you should always have a plan. Here are some tips to help you and your family prepare:

- Develop a family communication plan and “meet-up” location if you become separated

- Have your first aid kit fully stocked

- Prepare an emergency kit with: water, medicines, food, money, other important documents, etc.

- Have basic emergency supplies gathered all in one place: flash lights, batteries, blankets, a radio, lighters or matches, cell phone chargers, extra clothes

- Be sure to have coverage insurance.

If you have comprehensive coverage with your auto insurance, your vehicle is covered for damage from falling debris and other impacts from earthquakes.

However, earthquake damage is not covered under your homeowners or renters insurance policy, and less than 20% of Americans have purchased a policy. That means most people whose property suffers losses from a temblor will be paying out of pocket or relying on federal assistance and loans for recovery.

You can be prepared; California Casualty provides earthquake insurance as an endorsement to home owners policies in California, Illinois, Kentucky, Missouri, Oregon and Rhode Island. We also offer earthquake coverage through our partner, GeoVera Insurance Company, in California, Oregon and Washington. Learn more and get a quote at 877.652.2638 or visit www.calcas.com/earthquake-insurance.

For more information visit:

https://bit.ly/2Xz4Db6

https://bit.ly/2XVRckI

https://bit.ly/2S53H8k

by California Casualty | Homeowners Insurance Info |

Ask anyone who has experienced a large earthquake; the experience is not fun. Walls shake, the earth rolls, and you have no control over what might happen for the next few seconds – or up to a minute – as the roller coaster continues. Californians are more aware after the recent temblor in Napa.

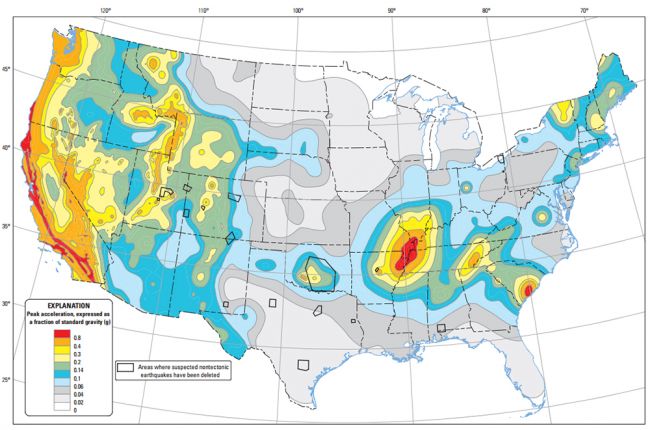

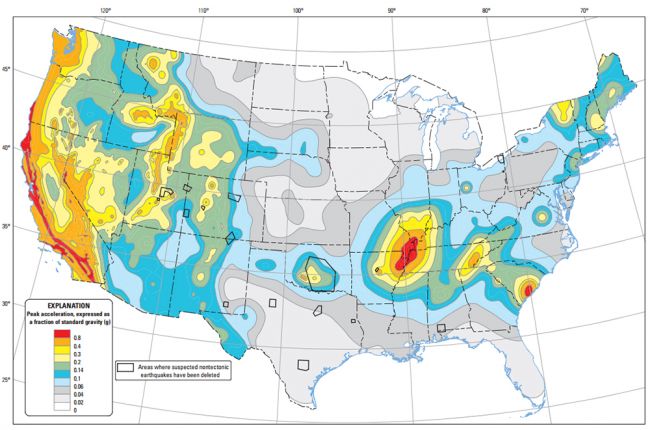

Now, there is more concern as the U.S. Geological Survey has expanded their maps of earthquake prone areas. The new mapping shows 42 states now facing a reasonable chance of a damaging quake within 50 years, with 16 sates facing a high risk of damaging ground movement. Those high risk states are Alaska, Arkansas, California, Hawaii, Idaho, Illinois, Kentucky, Missouri, Montana, Nevada, Oregon, South Carolina, Tennessee Utah, Washington and Wyoming.

Before a major shake “rocks your world,” Ready.gov has a comprehensive list of earthquake preparedness tips:

- Prepare an emergency kit, have an evacuation plan and determine how your family will communicate

- Fasten shelves securely to walls

- Make sure large or heavy items are on lower shelves and breakable items like bottles, glass and china are stored in low, closed cabinets with latches

- Repair defective electrical wiring or leaky gas connections and install flexible pipe fittings to avoid gas or water leaks

- Locate safe spots in each room under a sturdy table or against an inside wall

- Hold earthquake drills with your entire family

Safety is paramount after the shaking has subsided. The American Red Cross has a checklist of does and don’ts following an earthquake that include:

- Turn off water and gas main-lines to your dwelling

- Stay away from downed power lines and damaged structures

- Extinguish small fires

- Clean up spilled medications, bleach or other dangerous liquids

- Monitor updates with battery powered or hand-crank radios

- Offer help to those who might be trapped or need special assistance.

Once you are in a safe place, contact your insurance company. Keep in mind that earthquake damage is not a part of most people’s home insurance policy; separate earthquake coverage needs to be purchased. Earthquake insurance is available as an endorsement to California Casualty homeowners in California, Oregon, Missouri, Illinois, Kentucky and Rhode Island and California Casualty has partnered with GeoVera to underwrite earthquake insurance for homeowners in California, Oregon and Washington. If you need earthquake protection, call a California Casualty advisor today at 1.800.800.9410.

Sources for this article:

https://www.ready.gov/earthquakes

https://pubs.usgs.gov/of/2014/1091/

https://earthquake.usgs.gov/hazards/

https://www.redcross.org/prepare/disaster/earthquake

by California Casualty | Safety |

Today, an 8.9-magnitude quake struck Japan, causing widespread devastation and setting off a chain of tsunamis that are affecting coastlines as far away as California. Our thoughts and prayers go out to those whose lives have been turned upside-down by this historic disaster.

When things like this occur – it’s important that we remind ourselves of steps to take in the face of disaster.

Earthquake safety is all about preparedness. We found a list of 7 Steps to Earthquake Safety, and wanted to share them with you here:

– Identify hazards such as heavy items that aren’t secured, and repair them

– Create a disaster plan

– Prepare disaster kits that contain first aid items and fresh water

– Identify building weaknesses and repair them

– Drop, Cover, and Hold on

– After an earthquake, check for injuries and damage

– Follow your disaster plan

We encourage you to read the full description of the steps here.

We also recently posted a guide to flood safety, which can be important in the aftermath of a tsunami. Follow the link to read.

by California Casualty | Educators, Safety |

In many areas, a major safety concern is the ongoing threat of earthquakes. While they can’t be avoided, it is possible to take steps to mitigate the damage from these occurrences.

As part of our commitment to educators, I want to share an interesting webinar offered by the Applied Technology Council. This webinar will provide more information on steps that can be taken to improve the earthquake safety of schools. It may be a little too scientific for some, but I thought it would be of interest to some folks out there!

Here’s more info:

Numerous school buildings located in multiple States and U.S. territories are vulnerable to earthquake losses and damage. This includes potential:

• Death and injury of students, teachers, and staff

• Damage to or collapse of buildings

• Damage and loss of furnishings, equipment, and building contents

• Disruption of educational programs and school operations

• Inability of the community to use schools as temporary shelters

At this webinar, you will learn the following:

• How to assess and analyze your earthquake risks

• How to develop an actionable plan to reduce and manage earthquake risks

• How to initiate an earthquake risk reduction plan for existing school buildings that were not designed and constructed to meet modern building codes

• How to secure “non-structural” elements of the school facility

• How to apply “incremental seismic rehabilitation” to protect buildings and ensure occupant safety

• Why “incremental seismic rehabilitation” is an affordable alternative for school safety

by California Casualty | Helpful Tips, Homeowners Insurance Info |

Understanding the difference between your home warranty and home insurance can save you from financial headaches when things go wrong at home. Let’s break down these two types of coverage to help you make informed decisions about protecting your property.

The Difference At-A-Glance

- Home warranties cover repairs and replacements for certain systems and appliances in your home.

- Home insurance covers property damage to your home, other structures, or belongings in the case of unexpected events like fires, hail, wind, vandalism, or theft.

Both come with limits on what they cover. Read on to find out more.

What You Need to Know About Home Warranties

The name, home warranty, can lead you to believe that this protection covers your home. That’s not exactly the case. Home warranties cover the major appliances and systems in your house.

- When you might purchase a home warranty

Home warranties are generally offered when you purchase a new appliance or system. Examples include washers, dryers, refrigerators, ovens, dishwashers, and garage door openers. You also may have a home warranty for electrical, plumbing, heating, and cooling systems. In case one of these “big ticket” purchases malfunctions, you can avoid a major out-of-pocket expense. The home warranty kicks in after the manufacturer’s warranty expires.

You can also buy a home warranty at any time directly from a home warranty company. Sometimes home warranties are offered as part of real estate transactions as an incentive to close the deal. Such warranties offer peace of mind for the future homeowner.

- What your home warranty covers

Home warranties usually cover service, repair, and replacement of a product for a covered problem and everyday wear and tear.

- What your home warranty doesn’t cover

Your policy might deny coverage if you have not been keeping up with maintenance. They also could deny coverage for improper installation or modifications, pest damage, or pre-existing conditions. Check your warranty policy for the details of what may be excluded from coverage.

You file a claim. The warranty company connects you with an approved contractor to perform the repair. A technician visits your home to diagnose the appliance or the system, and to recommend a repair or replacement. There may be a service fee associated with this visit. If the repair is simple, the technician can do it the same day. If a replacement is needed or a part must be ordered, then a follow-up appointment is scheduled.

- When seeking a home warranty, be an informed consumer:

- Take an inventory of your large home appliances and systems. Write down their age and condition. Record the last time they were serviced.

- Estimate how much it will cost you to replace those systems. If you can afford to replace them without help, you do not need a home warranty.

- Consider a home inspection. This will document any pre-existing conditions that will not be covered by a warranty.

- Research coverages and payment amounts. Read the fine print. Many companies limit the amount that they will pay, and it may only be a portion of the appliance or system.

- Check that the company you choose is in good standing with the Better Business Bureau.

What You Need to Know About Home Insurance

A homeowner’s policy is a “package” of coverages. It protects your home and personal property from specific events that can damage them and provides additional living expenses if you are unable to live there due to an insured loss. In addition, your homeowner’s policy covers you for lawsuits or liability claims that might otherwise be your responsibility if you accidentally injure other people or damage their property.

- When you might purchase home insurance:

You will purchase home insurance when you buy your home. If you have a home mortgage, then maintaining homeowner’s insurance is generally a requirement of your loan agreement. Even if you own your home outright, it’s recommended that you protect your equity in the home by maintaining homeowner’s insurance.

- What your home insurance covers and doesn’t cover:

Following are highlights of what your home insurance policy covers and doesn’t cover. For details on these and other coverages, see our blog on Home Insurance 101.

-

- Dwelling coverage refers to the structure of your home: the roof, walls, floorboards, cabinets, and bath fixtures. A loss is covered unless it’s excluded by your policy.

- Other structures insurance covers pools, fences, gazebos, sheds, etc. A loss is covered unless it’s excluded by your policy.

- Personal property coverage protects your possessions, such as furniture, clothes, sports equipment, and other personal items. If your possessions are stolen, or damaged by fire/smoke or any of 16 covered “perils,” your policy will pay for them subject to your deductible.

- If your home is damaged in a covered loss, it may not be livable. If that’s the case, you would need to stay somewhere else. Loss of Use, also called Additional Living Expense, covers you for any necessary increase in living expenses, such as lodging, food, and gas.

- Personal Liability protects you if a claim is made or a suit brought against you for bodily injury or property damage caused by an occurrence to which coverage applies. Liability covers you at your place or anywhere in the world.

- If you are not liable, but your guest was injured through his/her own fault, then Coverage F – Medical Payment to Others may cover your guest’s medical bills.

- How coverage works:

You file a claim. You’ll fill out the necessary paperwork online or by email. For a homeowner’s or personal property claim, you will need to provide a Proof of Loss statement. That’s a list of items that were damaged or stolen and how much it costs to replace them. You may have to get a repair estimate and include that information. Then, you’ll wait for approval. Once the repair is authorized, you’ll be able proceed. Either you or the contractor will receive payment from the insurance company, so check with your adjuster. You will be responsible for the deductible amount, the amount that you will pay out-of-pocket before insurance kicks in.

- When seeking home insurance, be an informed consumer:

Estimate how much it would cost to rebuild your home from scratch in your current location. Also ballpark the cost to replace all your personal property. This will give you a starting point as to how much insurance you will need.

Determine if you will need specialized coverage beyond a standard homeowner’s policy. For example, you may want flood or earthquake coverage for your location.

-

-

- Shop around for insurance, and keep in mind, that it usually pays to buy home and auto coverage from the same company. When you bundle your home and auto insurance, you can often qualify for reduced rates, saving hundreds of dollars.

- Ask about discounts. You may qualify for insurance discounts for being part of a professional association, such as groups for teachers, nurses or first responders. There are also discounts for being retired, for paying via automatic bank payments, and for paying in full upfront.

- Check that the insurance company you choose is in good standing with the Better Business Bureau.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.