Follow Us on Social Media!

See what we are doing in your community and stay up-to-date on contests, giveaways, and more by following us on all of our social media channels.

See what we are doing in your community and stay up-to-date on contests, giveaways, and more by following us on all of our social media channels.

Get ready for a scary good time! Halloween is nearly here and kids everywhere will be out trick-or-treating. Remember a safe Halloween is a Happy Halloween; make sure your children are out and about in a way that they can be easily seen.

The ghosts and goblins (or more likely known as little trick-or-treaters) come out after the sun has gone down. Which is fun when you’re behind the mask, but not so fun if you are behind the wheel. When it’s dark, it’s harder for drivers to see pedestrians in the street. Add to that, excited children who may run out suddenly, and the results could be tragic. In fact, children are twice as likely to be hit by a car on Halloween than on any other day of the year.

That’s why it’s important to decide carefully on the costume your child will wear to ensure he/she is the most visible. And before they leave the house, you’ll also want to go over important pedestrian safety rules. You may even decide that accompanying your child is the best thing to do (recommended for children under 12).

Here are some more Halloween safety tips to consider for every vampire, witch, and werewolf!

Tip #1: Use reflective tape on your child’s costume.

Increase your child’s chances of being seen by adding pieces of reflective tape to his/her costume and/or jacket. Do so creatively and you may have a skeleton with glowing bones or a superhero with a gleaming emblem. Reflective tape works by reflecting light back, so wearers will be easily seen in a car’s headlights even in the pitch dark.

Tip #2: Add a glow stick or a clip-on light.

Decorate your child’s costume or candy bag with clip-on lights. These can be Halloween-themed lights or any small clip-on. Consider giving your child glow stick bracelets or necklaces; these are a festive, fun, and bright addition to any costume.

Tip #3: Select costumes with light colors.

Darker color costumes may be spooky but they are hard to see when it gets dark. When possible, choose lighter-colored outfits. If your child insists on a dark color, use tip #1 to lighten it up.

Tip #4: Choose face paint over masks.

Masks can block your child’s vision and depth perception. They also cover up your trick-or-treater’s face so it may not be easily seen. Face paint is a great alternative. You can even find glow-in-the-dark varieties for more visibility. Choose a face paint that is labeled safe for use with children. Test it on your child’s arm before Halloween. If you want a natural version, you can make homemade face paint.

Tip #5: Travel in groups and carry a flashlight.

Whether you walk around with your kids, or they travel with their friends, insist that they go in groups. Large groups – especially with both adults and children – are easier to see. If one or more group members carry a flashlight, that’s added protection. Having an adult also will help keep trick-or-treaters safe. The excitement of Halloween can overtake a child’s focus on safety.

Tip #6: Don’t walk and text.

You may often text while you’re walking but it’s not a good idea –and while supervising children on Halloween, it’s an especially bad idea. A study from Stonybrook University showed that we are 61 percent more likely to veer off course when we are walking and texting. Not only could you walk into traffic – or other people – or step off the curb, but your attention is distracted from the trick-or-treaters in your care.

Tip #7: Choose safe, lighted routes.

If you are able, choose a residential neighborhood with street lights and sidewalks for trick-or-treating. Walk on the sidewalk and cross at the corner, looking first for cars. If there are no sidewalks, and you need to walk in the street, you should keep to the left and walk facing cars. This will ensure you see cars coming toward you. Halloween is not the time to jaywalk; it can be especially dangerous. Do not walk out between cars, and definitely do not run into the street for any reason.

Tip #8. Watch for cars.

Watch for cars that are turning corners or pulling out of driveways. They could surprise you if you’re not expecting them—and you could surprise them by being in their path. If you’re the one driving at night on Halloween, look out for pedestrians.

For more safety tips, see our blogs on Halloween fire safety and Halloween safety tips for pets.

Have a Happy Halloween!

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

Our team at California Casualty remains focused on the appreciation, motivation, and recognition of our amazing employees.

As an organization over a century old, family-owned, and steeped in tradition, we know that honoring the drive and accomplishments of our workforce makes a difference to you, to us, and especially to them.

Every employee is essential to the success of our organization. And in this Behind the Scenes, we take a look at our Customer Service Department and their efforts to continually build a strong team of insurance professionals.

Through our Emerging Leaders program, we have identified the technical and behavioral competencies necessary to be successful in a Customer Service leadership role. We aligned these competencies with a curriculum and a tracking guide that our Team Managers use when leading development planning sessions.

This curriculum utilizes both internal resources and professional designations such as the Associate in Insurance Services designation offered by The Institutes Risk & Insurance Knowledge Group.

In 2021, we rolled out a self-paced individual study program consisting of articles, book summaries, reflection pages, and collaboration groups. The program has been well-received and continues to grow.

In the last year, we’ve been honored to watch a few of our brightest stars earn promotions within the company. Tonya Turentine and Meredith Savage were promoted to Service Team Managers, Darrah Zinn to Rating and Underwriting Systems Analyst, and Amber Ferrell and Alyson Proctor to Learning and Development Instructors.

We also have several others working through a development plan to become the next generation of Senior Customer Care Specialists.

To see more California Casualty employees celebrated for their role in our organization, please visit: https://bit.ly/3v5TCvd

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

We don’t think much about our heat, electrical, or plumbing until they stop working…

Like a regular health checkup, a home system checkup includes routine maintenance that can help prevent costly repairs and future emergencies.

Homeowners, follow our checklist to keep your home systems running smoothly all season long.

The HVAC system is responsible for heating and cooling your home. Regular maintenance can help lower your utility bills, increase your system’s lifespan, and ensure you are breathing healthy air.

A plumbing system delivers fresh water to your sinks, bathtubs, toilets, and other fixtures. It also takes away water and waste to a sewer or septic tank. Regular maintenance will help prevent issues such as leaks, clogs, and frozen pipes, which can be disruptive and costly.

An electrical system powers your lights, appliances, and more. Working around electricity requires knowledge and skill to take the proper safety precautions. If you’re unsure of how to do something, consult a trained professional.

Your home security system protects you from threats. No matter what system you have, a semi-annual check can keep it in top working order.

Home fires spike in the fall and winter. Being prepared is key and could save your life if you are the victim of an unexpected house fire.

Take the proper precautions to avoid winter home hazards and keep your home in good working order this season.

For more fall maintenance tips click here.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

To celebrate our 25-year partnership with the Fire Fighters Association of Missouri, California Casualty provided a memorial wall sponsorship to the Fire Fighters Memorial Foundation of Missouri.

Field Marketing Manager Katelyn Hoffman and Strategic Account Manager Rebecca Stumpf just recently had a chance to see our etching. They had attended the FFAM Board Meeting the day before, and made a special stop on their way home.

Originally the duo had planned to celebrate our 25 year anniversary at the FFAM Annual Convention, but both the 2020 and 2021 conventions were canceled due to the pandemic

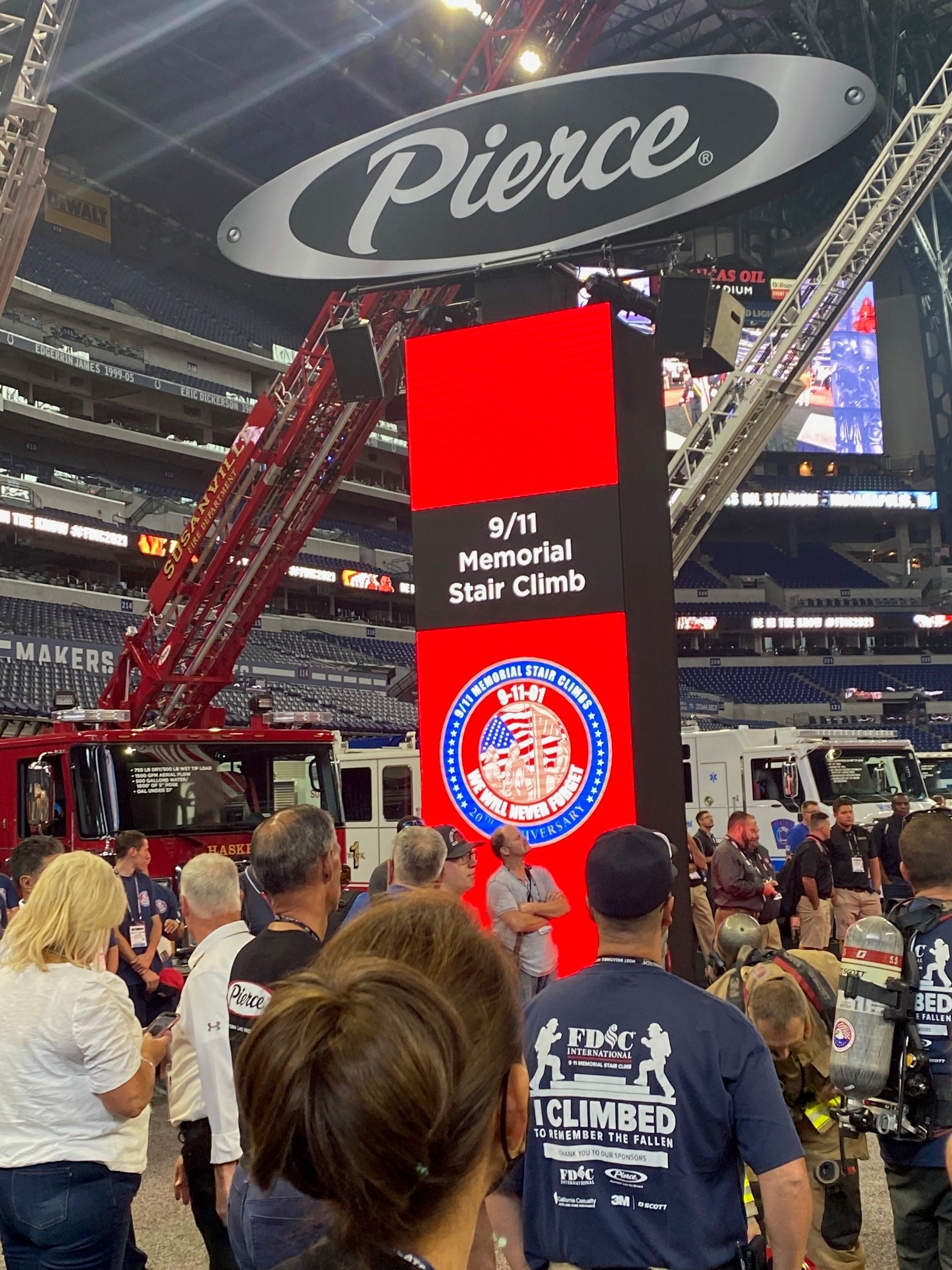

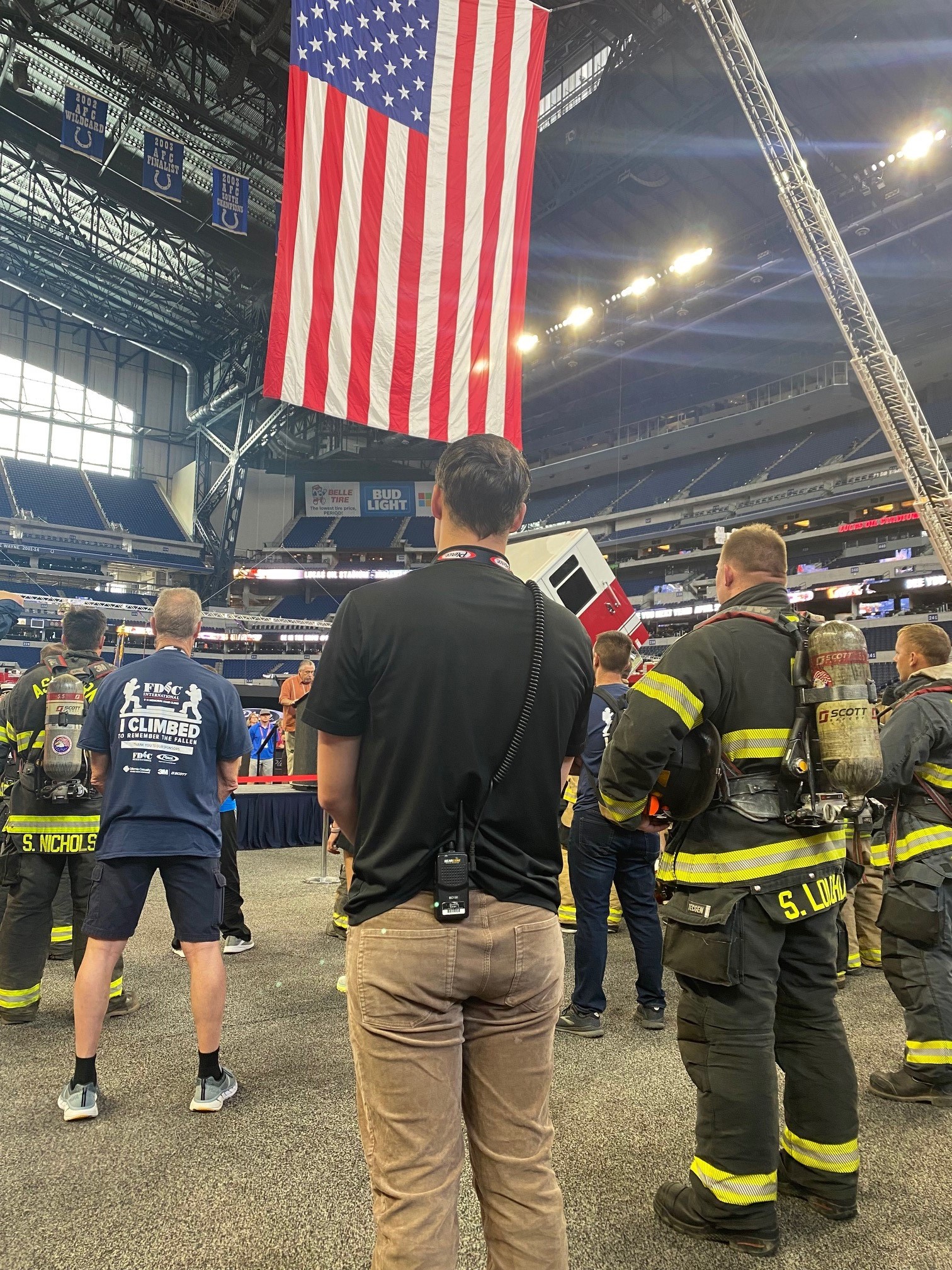

Our team attended and sponsored the National Fallen Firefighters Foundation FDIC 9/11 Memorial Stair Climb in Indianapolis, IN. This year marks 20 years since the September 11th attacks. These stair climbs are put in place to remember and honor those that we have lost, and to help raise funds for the families of other fallen or injured heroes.

In July, the Los Angeles Firefighters Association and California Casualty honored retired Capt. Rick Godinez as the “2019 Firefighter of the Year” in L.A. after the initial ceremony was postponed in 2020 due to the pandemic. Senior Field Marketing Manager, Charlene Rowens, had the privilege of handing Godinez his award on stage. He retired from the LAFD in April of 2020.

Shannon, an Early Childhood Special Education Teacher and California Teachers Association member from Palmdale School District, heard about the $2,500 Giveaway on the California Casualty Facebook page. She plans to use a good portion of the funds for her classroom and students, and the remainder to financially help her daughter who will be attending college in the fall.

Shannon has been a teacher for 30 years, attributing the kids as her reason for joining the profession. When asked what advice she would give to anyone interested in joining the field of education, Shannon, stated, “Be patient and flexible. This work requires you to be adaptable and always willing to learn.” She also shared that her CTA membership provides many resources and the support that she needs to do her job.

NJEA Member, Angela M., received the news that she was a winner virtually. Angela is a retired educator who taught Fourth and Fifth Grade for over 25 years in Bergen County, New Jersey. At age 93, and retired from the profession since 1990, Angela says she will most likely donate a part of her $2,500 winnings, but otherwise does not have plans for the money.

Angela recalls that when she was actively teaching, she and her students were a team – they worked together and learned from each other. She said that June and September were her least favorite months during the school year. She hated September because she had to pretend to be a big bad ogre so that the students thought she was tough, but she hated June because he meant she had to say goodbye to all of her friends.

One of our Q2 winners, Autumn Erickson, is a 5th-grade teacher at Mt Vernon School in Springfield, Oregon. Autumn was very surprised to find out she won a $2,500 Educator Jackpot from California Casualty. When asked how she wanted to spend the $2500, she said that she has some home improvement projects waiting, including painting. She also wants to buy raised garden beds for the yard.

Our second Q2 winner has not received the surprise news that they are a winner. Our Field Team is working diligently to schedule that presentation.

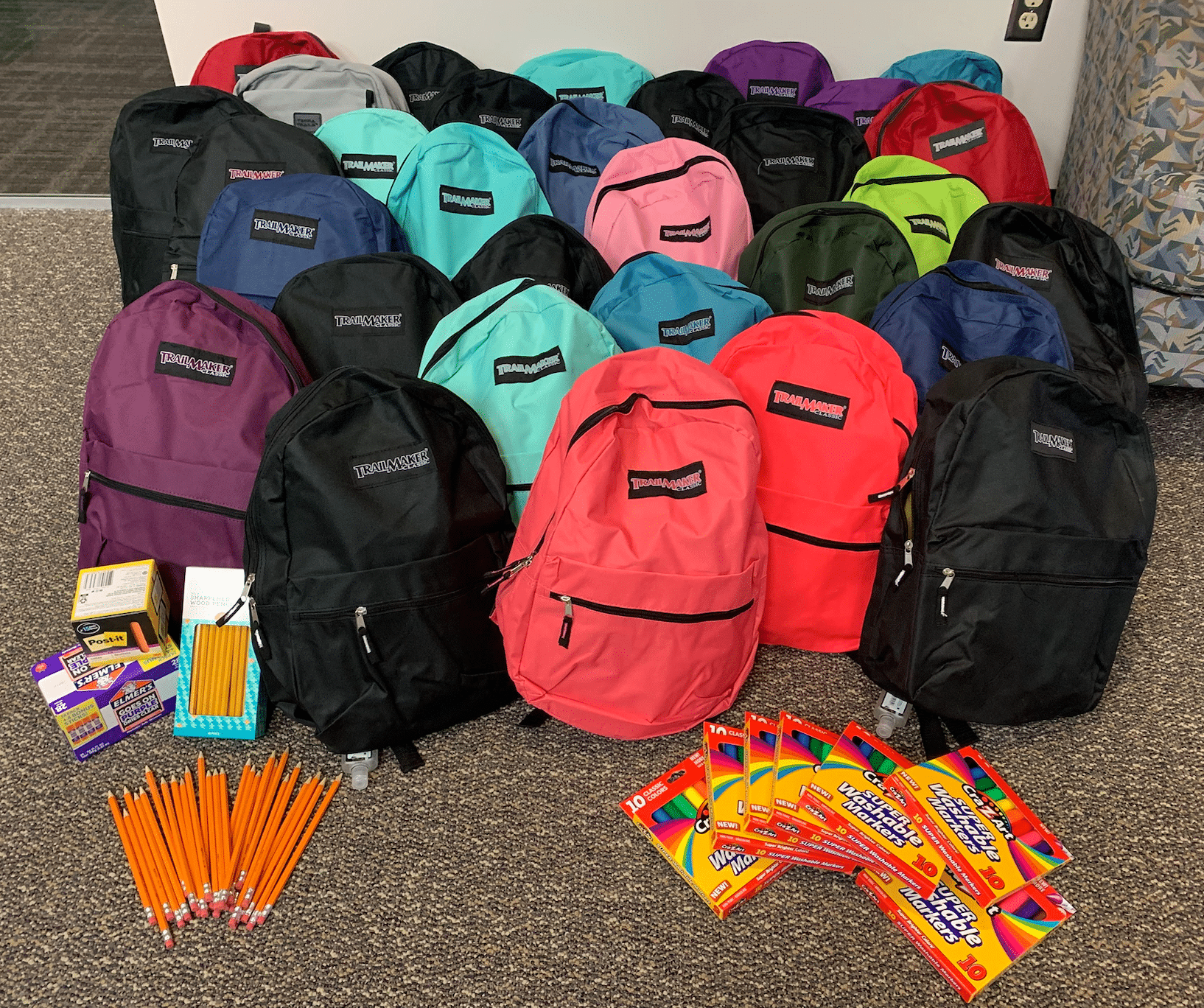

Throughout the entire month of July, our Kansas City gathered school supplies and donations for Phoenix Family’s Operation Backpack. This initiative gives school supplies to low-income families in the Kansas City community. Our Kansas employees donated a total of 31 backpacks completely stuffed with school supplies, like kleenex, paper, pens, sharpens, glue, etc. to help local students succeed and make them feel confident as they walk through the door on that first day of school.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

Many of our policyholders know that until recently, our company has been led by four generations of the Brown family. But the family ties do not end there. California Casualty has had a number of family members working together at our company over the years. However, not many have had the honor of sharing a 25+ Year Anniversary in marriage and at work.

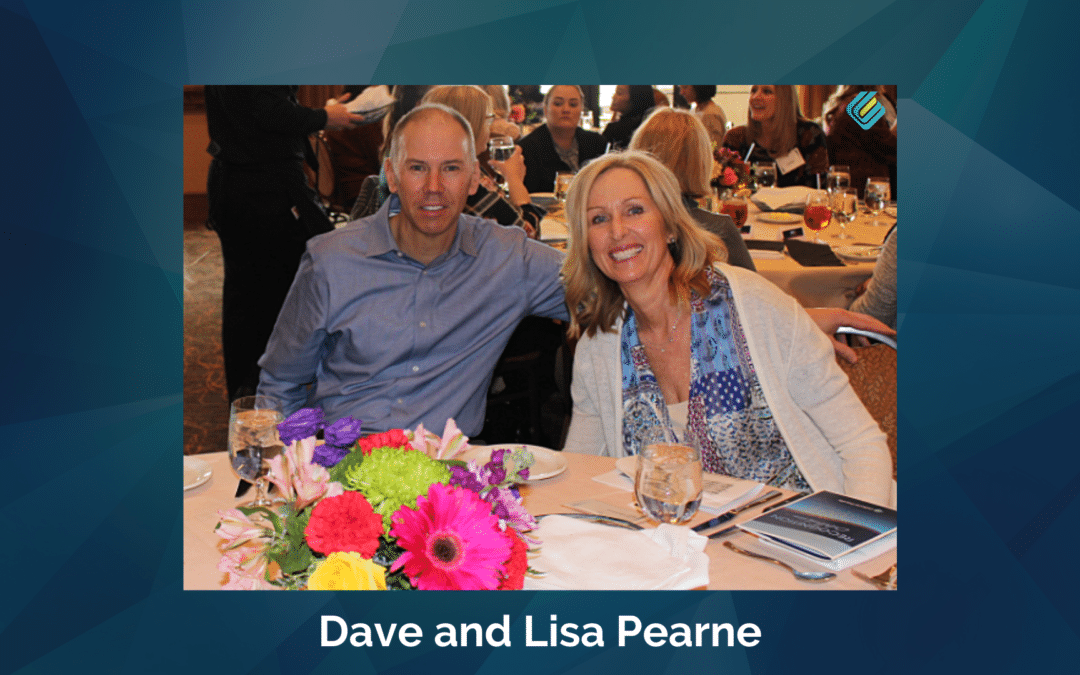

Meet Lisa and Dave Pearne, a husband and wife duo that have reached this impressive milestone.

Q: How long have you been with the company? Who started first? How did you BOTH join the CalCas family?

A: Lisa – 27 years; Dave – 25 years

It was my (Lisa) first job out of college. I never thought I would be in insurance, but loved what I saw in the company and the group members they served. They were willing to take a chance on me being so new to the workforce – just out of school. I started as a sales rep in Orange, CA in our smaller branch offices. I loved the people I worked with and the company as a whole.

When they (California Casualty) decided to open a service center in Colorado, Dave and I decided to give it a try. It was hard to leave our family but absolutely loved the outdoor life that CO had to offer. Our coworkers and friends quickly became our family here. We were newly married and thought if we didn’t like it, we could just move back to CA. That was in 1996, and we’ve been here ever since.

We love it here and it’s been an amazing place to raise a family.

Dave left his job with Conde Nast Traveler in CA to join me in CO. He was looking for a job here in CO when a Finance position opened up at CalCas, he interviewed and has been with the company ever since.

He is currently in a manager role and has an amazing team here in CO. They are small, but mighty and he feels fortunate to work with such a great team.

We both feel incredibly lucky to be here, and in the roles we are in.

Q: What are your favorite moments/important contributions to the company since you’ve been here?

A: (Lisa) Helping to start the Colorado Service Center for Sales from the ground up is my favorite contribution. My favorite part of my job is helping others aspire to be the best they can be-incredible people. I love our team, who continually look for ways to take care of our group members.

(Both) We are proud to work with a leadership team that has created high integrity, trust, and a true desire to help our group members and protect their greatest assets, being there for them in their greatest time of need.

(Lisa) A favorite moment was when I was a Sales rep 20+ years ago, I was helping a group member close on a new house and get the proper insurance. It’s exciting, but very stressful to purchase a new home. This member had many obstacles come her way, yet we stayed close and worked together to walk her through the process. After she closed on her home, she was so incredibly thoughtful and sent me flowers as a thank you. It was such a special touch I needed and. I have her note at my desk to this day and to remind me of the impact we can have helping our group members.

(Dave) My most memorable contribution is now – while working with an amazing team to transition to Guidewire. There is so much involved, but getting to be part of something that will help propel our company forward is incredibly satisfying. A favorite moment was receiving the Pride in the Code award and getting to be part of solutions to help our group members while helping the company.

Q: How do you manage to separate work life and family life – how do you keep the boundaries separated so you don’t think about work 24/7?

A: Funny, many times we do bring work home, but we can balance each other.

It takes incredible teamwork, as a married couple, to work together when both parents are working and kick in to help with whatever needs to be done. We have different seasons where one of us may be more busy and working longer hours at work, so the other one will pick up more with home life and vice versa.

We’ve always been supportive of each other’s careers while prioritizing family. We also have a lot of family support that has encouraged us in our careers and been instrumental with our kids.

We believe in work hard, play hard. We are passionate about what we do and give 100%, while valuing time away with family. We work for vacations. We have so many wonderful family memories, as the kids get older and schedules are busy, it sometimes takes work to coordinate, but family is so important and time away together is critical – it makes us better at what we do at work.

We all need time away to re-energize to be our best. California Casualty has always done an amazing job with encouraging work/life balance and we are very grateful!

Q: What makes “working together” (we know you have very different roles, but you still see each other in the hallways) easy, and what makes it challenging?

A: It’s great when we are working similar hours and can carpool.

Once here at work, we don’t see each other much as on different floors and busy with our own areas. We love if we can sneak in a lunch together, but doesn’t happen very often. It’s usually a quick conversation about what child has what and where they are.

It is great when there is an issue that has overlap in our areas, we can ask each other for further clarification to really understand the other side of things, to be able to make a more efficient decision.

Q: And finally…what do you love about the organization and having your family proudly represent it?

We love California Casualty and are grateful for all the opportunities they have provided us and our family. Our kids have grown up with CalCas and we have lifelong friends because of CalCas.

We love what Cal Cas stands for- a company with high integrity and a passion for our group members and so proud of who we serve.

We believe in our why statement and are proud to work for a company like CalCas: “People who commit to making a difference for our communities deserve financial protection with the highest levels of care, service, compassion, and understanding… which is why we exist.”

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.