by California Casualty | Educators, In Your Community, News |

Congratulations to all of the recipients of the 2025 California Casualty Music & Arts Grants! Our field team had the privilege to connect both in-person and virtually with many of the grant recipients to present them with a check for $300 to put towards supporting their schools’ music or arts program.

Check out the awardee spotlights and see the full list of recipients below.

Jessica Bennett – 2025 Music & Arts Grant Awardee Spotlight

Diablo Vista Elementary, Antioch, California

Jessica Bennett, California Teachers Association (CTA)

Grade Level Art Program

Jessica wrote on her application: “From my 18 years of experience, all extracurricular programs are always in jeopardy and often the first ones impacted by budget cuts in the education system. We currently do not have any art classes or curriculum at my school, and I am unaware of any within the district. Therefore, this grant would at minimum provide my 4th grade team with the ability to introduce more art into our classroom by purchasing the expensive and needed materials that our very small budgets can’t such as paints, pastels, paper, clay, etc. With these materials we would be able to provide more hands on art experiences for our 4th grade students.

Jessica says…” I am excited to purchase all of the new art supplies for my kids. First up on my list is the necessary clay and paint for our art projects.”

Pictured: Principal Bonny Bausola, Awardee Jessica Bennett, and Angie Rajczyk, Sr. Account Development Manager for California Casualty

Danielle Jensen – 2025 Music & Arts Grant Awardee Spotlight

Stoneman Elementary School, Pittsburg, California

Danielle Jensen, California Teachers Association (CTA)

Elementary Visual Arts Program

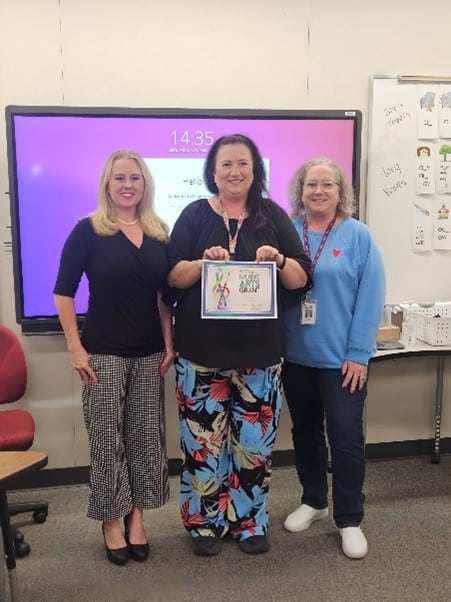

Danielle wrote in her application: “I teach in a Title One school with over 81% of our scholars receiving free or reduced lunch. The 2023-24 school year was the first year of our elementary visual arts program, and the district allotted each EVAP teacher with a (one-time) $1,500 budget per site to purchase art supplies from the district-approved company (Southwest). There were many items I was unable to purchase for my art students that I want to get this year to give them more varied art experiences. Specifically, they have been asking for opportunities to sculpt with clay and weave with yarn. Budgets have not yet been formalized for the 24-25 school year, so I am unsure how much EVAP funding there will be. Receiving this grant will help ensure that my 200+ art students at Stoneman get to experience sculpture and the fiber arts, most for the very first time, regardless of anticipated budget constraints”

Danielle says on winning the award.…” I am looking forward to purchasing the necessary materials to teach my kids how to use yarn and weave, a beautiful artistic skill to have.”

Pictured: Art Teacher Makaela Huntsinger, Awardee Danielle Jensen, and Angie Rajczyk, Sr. Account Development Manager for California Casualty

Jessica Fitzsimmons – 2025 Music & Arts Grant Awardee Spotlight

Wilson Elementary, Medford, Oregon

Jessica Fitzsimmons, Oregon Education Association (OEA)

Feeling in Art

Jessica wrote in her application: “With all of the uncertainty in education right now, I am unsure if this program will be affected by budget cuts. I will use this money to buy Play-Doh and clay and tools to go with those for students to have a creative outlet anytime they are having big feelings. Students are much more apt to express their feelings non-verbally while they are regulating. It would be used with students K-5.”

Pictured: Principal Nicole Lavelle, Awardee Jessica Fitzsimmons. Dee Dee Templeton, Sr. Account Development Manager for California Casualty

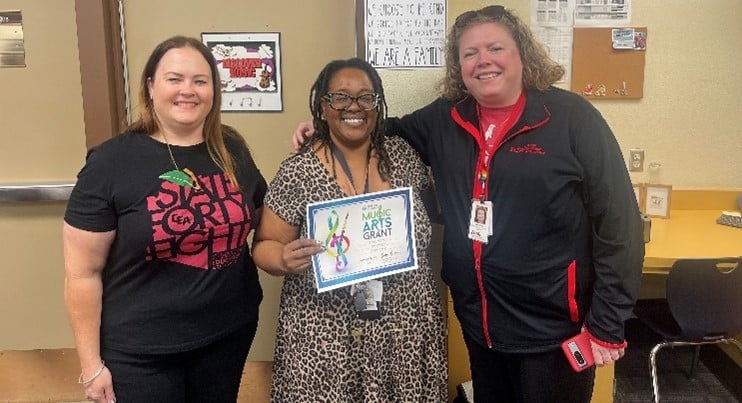

Michelle Orgon – 2025 Music & Arts Grant Awardee Spotlight

Clyde W. Needham, Lodi, California

Michelle Orgon, California Teachers Association (CTA)

Classroom Art

Michelle wrote on her application: “An art enrichment program, choice by students. The students are socio-economically disadvantaged. They will choose a multi-week course. This will teach specific skills for students to develop skills and learn techniques for developing art through a project by age. They will learn about different artists and apply similar concepts to art they create on their own. This will give them a creative opportunities and develop artist understanding and appreciation”

Michelle Orgon says: “I am so grateful to California Casualty to help support students and classroom teachers with this grant. This grant will afford my students with additional art opportunities.”

Pictured: Angie Rajczyk, Sr. Account Development Manager for California Casualty, Awardee and former LEA President Michelle Orgon, and Principal Charalee Cunninghan.

Jocelyn Babb – 2025 Music & Arts Grant Awardee Spotlight

Berkshire Elementary School, Bakersfield , California

Jocelyn Babb, California Teachers Association (CTA)

Transitional Kindergarten Art Program

Upon receiving the award, Jocelyn stated: “This grant from California Casualty will make such a meaningful difference in my Transitional Kindergarten classroom by allowing us to add more hands-on art and creative experiences to our daily learning. These funds will support process art, fine motor activities, and open-ended projects that help students build confidence, communication skills, and a true love of learning. For many of my students, school is their main place to explore art materials, so this gift truly expands what’s possible for them. I am incredibly thankful for the opportunity to give my students more ways to create, explore, and express themselves.”

Pictured: Awardee Jocelyn Babb

Micah Brandt – 2025 Music & Arts Grant Awardee Spotlight

Wheatland Middle School, Wheatland , Wyoming

Micah Brandt, Wyoming Education Association (WEA)

Middle School Art: Ceramics Program

Micah Brandt wrote in her application: ”I have $700 budget per year and 120 students. $5.80 isn’t much to educate a student for five months. $1.40 per student per month. One of my pottery wheels just broke and this would be enough to order a new pottery wheel motor for $125 and purchase new clay tools…”

Pictured: Greg Herold, UniServ Director, Jolie Spence, Sr. Account Development Manager California Casualty, Awardee Micah Brandt, Leslie Harlan, Platte County EA President.

Erica Seago – 2025 Music & Arts Grant Awardee Spotlight

Arrowhead Middle School, Kansas City, Kansas

Erica Seago, NEA

Instrumental Music

Erica Seago wrote in her application: Our school district has a fine arts department that is being impacted by overall school budget cuts. Each year a smaller percentage of the budget is allocated for the fine arts department despite growing numbers enrolled. Our school district is an urban Title 1 district and this money would be able to help provide things like tuners for band and orchestra, binders for music, and some instrument supplies for basic maintenance.

Pictured: Awardee Erica Seago

Alexis Mauser – 2025 Music & Arts Grant Awardee Spotlight

Henderson Elementary, Henderson, Colorado

Alexis Mauser, Colorado Education Association (CEA)

Henderson Elementary Art Program

Alexis Mauser applied for the grant on behalf of Art Teacher Amanda Jensen. On the application she wrote: “We are the only school in the district that only has 2 specials – they cut music last year and replaced it with art. Since replacing it, we have relied on donations for supplies in the art room. I think our school really gets overlooked and it’s not fair for the teachers to be the ones to have to make up for it.”

Pictured: Jolie Spence, Sr. Account Development Manager California Casualty, Kathey Ruybal, BEA President, Alexis Mauser, Applicant and Art Teacher Amanda Jensen

Danielle Luby – 2025 Music & Arts Grant Awardee Spotlight

Lee Elementary School, Salem, Oregon

Danielle Luby, Oregon Education Association (OEA)

Classroom Art Supplies

Dee Dee Templeton, Sr. Account Development Manager, shared the news with Danielle about her application being selected for a Music & Arts Grant. Dee Dee mentioned that Danielle was overjoyed to receive the award and that the moment was made even more special by including her entire 2nd-grade class in the presentation. The kids were bursting with excitement and questions. They were so engaged and curious, which made the whole experience truly unforgettable. Seeing the students’ enthusiasm and joy was incredibly heartwarming.

Ms. Luby has fantastic plans for the grant funds, including several creative projects like parade floats and a fun tie-dye activity.

Pictured: Kristin Ross-Patchin, AVP Strategic Account Manager at California Casualty, Awardee Danielle Luby, Dee Dee Templeton, Sr. Account Development Manager for California Casualty

Abby Blakeney – 2025 Music & Arts Grant Awardee Spotlight

Abraham Lincoln High School, Denver, Colorado

Abby Blakeney, Colorado Education Association (CEA)

Instrumental Music Program: Band, Guitar, and Peer-to-Peer Music

Abby wrote in her application: “These grant funds would be used to purchase music and curriculum that better fits our student population (including our Special Needs music makers) and provide extra playing materials such as reeds and guitar picks that our students are always in need of.”

Pictured: Jolie Spence, Sr. Account Development Manager California Casualty, Awardee Abby Blakeney – dressed as Sally Brown from Peanuts for a staff costume contest.

Jenny Hall – 2025 Music & Arts Grant Awardee Spotlight

Antelope Trails Elementary School, Colorado Springs, Colorado

Jenny Hall, Colorado Education Association (CEA)

Antelope Trails Elementary School Music Classrom

Jenny wrote in her application: “These funds will be used to buy instruments and musical equipment for the music room. The $250 grant would almost double my classroom budget for the entire year. Since I teach the entire school, over 300 students will benefit from this grant.”

Pictured: Awardee Jenny Hall, Jolie Spence, Sr. Account Development Manager California Casualty

Shantelle Gillis – 2025 Music & Arts Grant Awardee Spotlight

Northside Elementary, Sandpoint, Idaho

Shantelle Gillis, Idaho Education Association (IEA)

Arts Integration

In her application, Shantelle wrote: “Because we are a small and rural school, we are not provided with an art teacher like other schools in our district are. But we know how important art is to our students so the grant money provides us with an art parapro and budget for supplies needed to offer this to all our students each school year.”

Pictured: Awardee Shantelle Gillis, Art Paraprofessional Janice Riley.

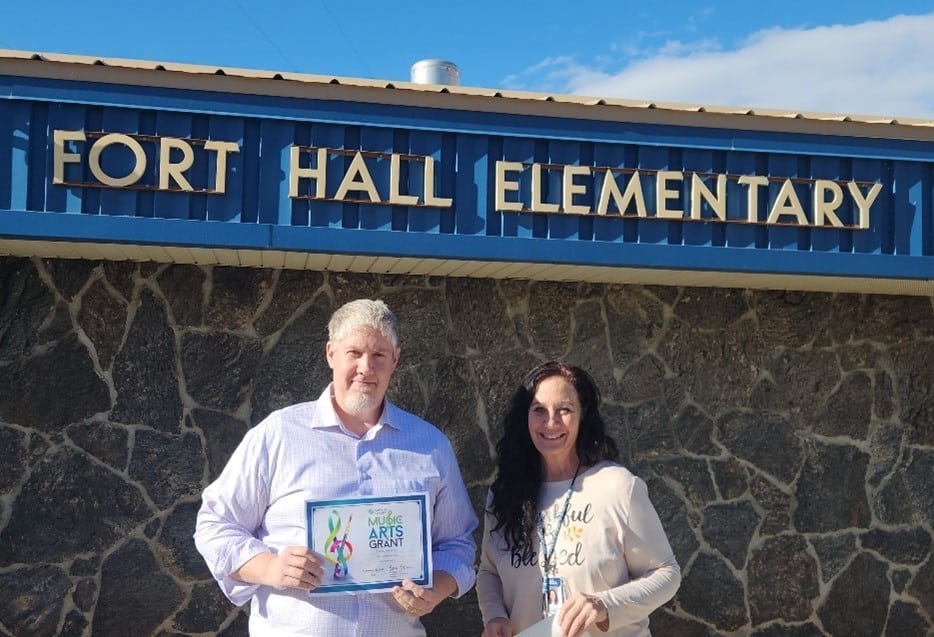

Adam Smith – 2025 Music & Arts Grant Awardee Spotlight

Fort Hall Elementary, Pocatello, Idaho

Adam Smith, Idaho Education Association (IEA)

5th Grade Native American Art Project

Dee Dee Templeton, Sr. Account Development Manager with California Casualty shared that Mr. Smith applied for the grant for his class to purchase additional art supplies to create projects that are culturally relevant to their Native American students.

Pictured: Awardee Adam Smith, Principal Debbie Steele.

William Brewer – 2025 Music & Arts Grant Awardee Spotlight

F.L. Schlagle High School, Kansas City, Kansas

William Brewer, Kansas National Education Association (KNEA)

Vocal Music Program

William wrote in his application: “The grant funds will aid in the purchase of a djembe drum, a 5-piece full size drum set, and a conga drum set, culturally relevant instruments for school heritage assemblies and performances.”

Pictured: Awardee William Brewer

Janina Tabor – 2025 Music & Arts Grant Awardee Spotlight

Harvey Clarke Elementary, Forest Grove, Oregon

Janina Tabor, Oregon Education Association (OEA)

Classroom Art Supplies

Dee Dee Templeton, Sr. Account Development Manager with California Casualty shared that Janina plans to use the grant funds to purchase art supplies. She would like to add watercolors, tempura cakes, and watercolor paper for a classroom project. Janina mentioned she buys all her classroom supplies out of her own pocket.

Pictured: Dee Dee Templeton, Sr. Account Development Manager with California Casualty, Awardee Janina Tabor

Yvette Cortes – 2025 Music & Arts Grant Awardee Spotlight

Sierra Vista Elementary , Madera, California

Yvette Cortes, California Teachers Association (CTA)

2nd Grade Art Program

On her application, Yvette wrote: “Sierra Vista is a Title I school. The grant would be allocated in the 2nd grade level which consists of 4 classes. Art is not taught with a big emphasis as students get older and I believe our students would benefit greatly from art funds so that they can learn to express themselves through their creativity. This grant will us to have funds for supplies such as paint, construction paper, clay, etc.”

Pictured: Awardee Yvette Cortes

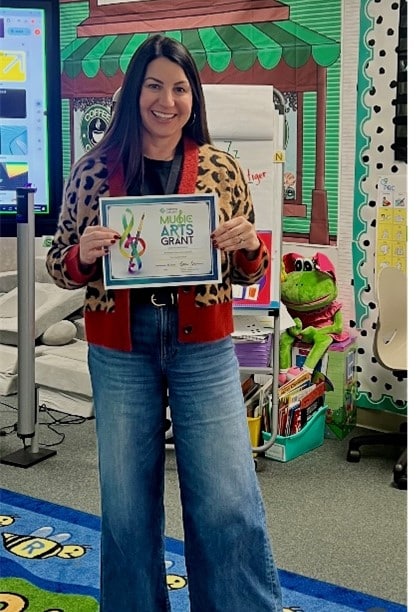

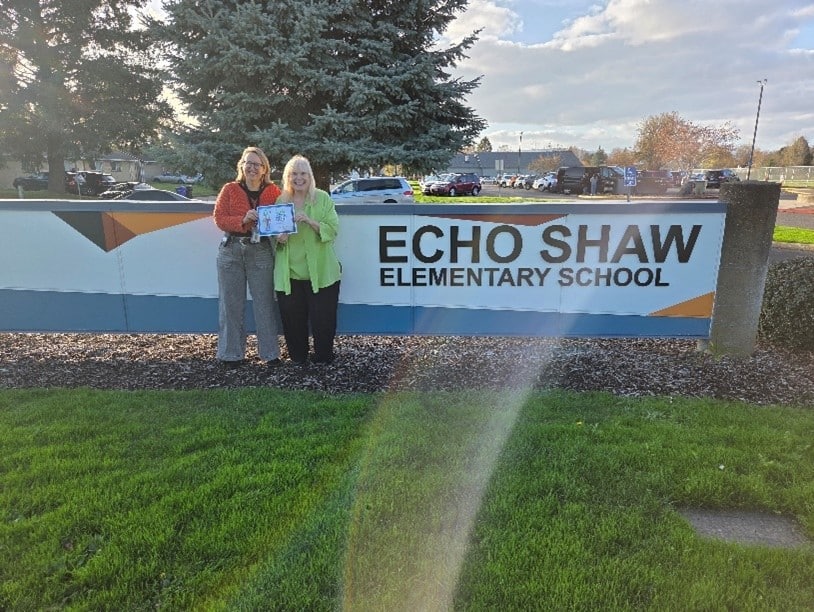

Kristin King – 2025 Music & Arts Grant Awardee Spotlight

Echo Shaw Elementary School , Cornelius , Oregon

Kristin King, Oregon Education Association (OEA)

Classroom Art Supplies

Dee Dee Templeton, Sr. Account Development Manager with California Casualty, had the pleasure of delivering the grant to Ms. King and her entire 3rd grade class. Both she and her students were thrilled to win the award.

Ms. King plans to use the grant funds to purchase art supplies and to take her students on a field trip to the Portland Youth Philharmonic. She also shared that she has several exciting art projects planned for January.

Pictured: Principal Laura Mannen, Awardee Kristen King.

Erica Rutledge – 2025 Music & Arts Grant Awardee Spotlight

Frye Elementary, Chandler, Arizona

Erica Rutledge, Arizona Education Association (AEA)

Frye Elementary School Disney Musical

Erica included on her application: “We never have received funding in support of our musical. We depend on parent donation and thrifting to get our costumes and props. This grant will go to helping us build our prop and costume closet and towards set pieces we share with other title I schools. This is our 3rd year in the musical program and it is completely up to us to pay for the license, scripts and score.”

Pictured: Chandler EA President Laurel Miller, Awardee Erica Rutledge, AEA Organizational Consultant Katie Nash

Alice Wilson – 2025 Music & Arts Grant Awardee Spotlight

Coronado Village Elementary School, Coronado, California

Alice Wilson, Association of Coronado Teachers

Third Grade Art Programs

Inez Morales, Sr. Account Development Manager at California Casualty had the pleasure of awarding Ms. Wilson with the grant award, which she was thrilled to receive. She stated that the funds will allow her to purchase crayons, markers, and erasers for every 3rd‑grade student, with a little extra left over for additional art supplies.

Pictured: Awardee Alice Wilson

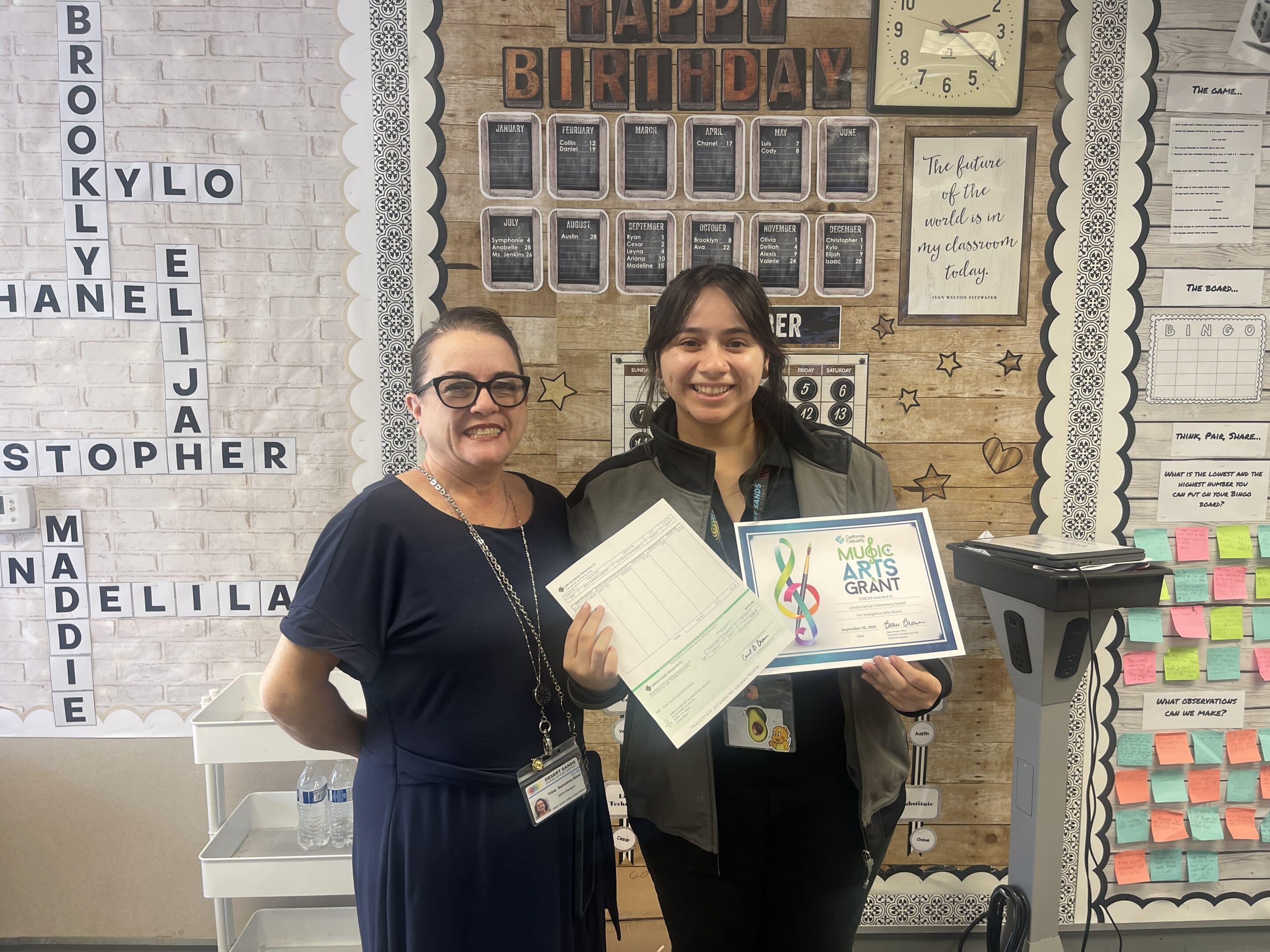

Evangelina Felix Osuna – 2025 Music & Arts Grant Awardee Spotlight

Amelia Earhart Elementary School, Indio, California

Evangelina Felix Osuna, California Teachers Association (CTA)

Inez Morales, Sr. Account Development Manager at California Casualty, presented Ms. Osuna with the award and adds that upon receiving it she was completely shocked. Ms. Osuna learned about the grant at the New Educator Conference. The funds will help her purchase specialty supplies for their new program.

Pictured: Trina Alesi, Desert Sands TA President, Awardee Evangelina Osuna

Erica Holloway – 2025 Music & Arts Grant Awardee Spotlight

Charles Bursch Elementary, Baldwin Park, California

Erica Holloway, Baldwin Park Teachers Association

Performing Arts & Dance

Ms. Holloway wrote in her application: “Although we have received some grant money for the visual arts, I personally teach an afterschool program for the performing arts where I teach dance to students in grades 1-5. Last year, my class enrollment doubled to 28 and I anticipate it doubling again. I work in a low income area where our families do not have the extra money to send their children to a studio. The funds would be to purchase costumes for the students to wear.”

Pictured: Principal Ofelia Romero, Jana Charles, Sr. Account Development Manager with California Casualty, Awardee Erica Holloway

Vanessa Van Dyck – 2025 Music & Arts Grant Awardee Spotlight

Jefferson Leadership Academy, Long Beach, California

Vanessa Van Dyck, Teachers Association of Long Beach

Introductory, Intermediate, Advanced Art

On her application, Ms. Van Dyck wrote: “Funds for our Visual Arts Program are shared with our Music Program. Allocated funds include teacher pay as well as a supply budget per CA Prop. 28.

Money from this grant will support funding of consumable art supplies which will be used across the three levels of art – introductory, intermediate, and advanced. The projects affected by this grant will be multicultural, inclusive, and support scaffolding for English Learners and students with special needs. Thank you for this opportunity!”

Pictured: Jana Charles, Sr. Account Development Manager with California Casualty, Awardee Vanessa Van Dyck

The complete list of 2025 Grant recipients are:

- SuJenna Griner, Vacaville High School, Vacaville, California, VAPA – Printmaking Supplies

- Marisa Finlayson, Pioneer High School, Woodland California, Music & Jazz Band

- Kristin Wells, Bowman Charter School, Auburn, California, Band Program

- Jessica Bennett , Diablo Vista Elementary , Antioch, California, Grade-level Art Program

- Danielle Jensen, Stoneman Elementary School, Pittsburg, California, Elementary Visual Arts Program

- Michelle Orgon, Clyde W. Needham, Lodi, California, Classroom Art

- Adam Smith, Fort Hall Elementary, Pocatello, Idaho, 5th Grade Native American Art Project

- Shantelle Gillis, Northside Elementary, Sandpoint, Idaho, Arts Integration

- Jessica Fitzsimmons, Wilson Elementary, Medford, Oregon, Feeling in Art

- Janina Tabor, Harvey Clarke Elementary, Forest Grove, Oregon, Classroom Art Supplies

- Danielle Luby, Lee Elementary School, Salem, Oregon, Classroom Art Supplies

- Kristin King, Echo Shaw Elementary School, Cornelius, Oregon, Classroom Art Supplies

- Lauren Pomrantz, Del Mar Elementary, Santa Cruz, California, Annual First Grade Musical

- Jocelyn Babb, Berkshire Elementary School, Bakersfield, California, Transitional Kindergarten Art Program

- Yvette Cortes, Sierra Vista Elementary, Madera, California, 2nd Grade Art

- Erica Rutledge, Frye Elementary, Chandler, Arizona, Our yearly Disney Musical, Finding Nemo

- Amanda Sabados, Silver Gate Elementary, San Diego, California, Special Education Music Enrichment Program

- Alice Wilson, Coronado Village Elementary School, Coronado, California, Third Grade Art Programs

- Marisa Primacio, Clear View Elementary School, Chula Vista, California, Dance Program

- Evangelina Felix Osuna, Amelia Earhart Elementary School, Indio, California, Elementary Visual Arts

- Erica Holloway, Charles Bursch Elementary, Baldwin Park, California, Performing Arts & Dance

- Vanessa Van Dyck, Jefferson Leadership Academy, Long Beach, California, Introductory, Intermediate, Advanced Art

- Bill Estrada Gallimore, Glendale High School, Glendale, California, Instrumental Music

- Amber Garcia, Centennial School District R-1, San Luis, Colorado, Art and Music Department

- Abby Blakeney, Abraham Lincoln High School, Denver, Colorado, Instrumental Music Program: Band, Guitar, and Peer-to-Peer Music

- Jenny Hall, Antelope Trails Elementary School, Colorado Springs, Colorado, Music classroom at ATE

- Alexis Mauser, Henderson Elementary, Henderson, Colorado, Art

- William Brewer, F.L. Schlagle High School, Kansas City, Kansas, Vocal Music Program

- Erica Seago, Arrowhead Middle School, Kansas City, Kansas, Instrumental Music

- Micah Brandt, Wheatland Middle School, Wheatland , Wyoming, Middle School Art: Ceramics Program

by California Casualty | Educators, In Your Community, News |

California Casualty has delivered $1,000 Thomas R. Brown Athletic Grants to educators at 10 public middle and high schools across five states to help support their school sports program(s). Since its inception in 2010, the Thomas R. Brown Athletics Grant Program has helped fund burdened athletic programs in 773 public schools across the nation.

Named in honor of Tom Brown, an ardent sports enthusiast and California Casualty Chairman Emeritus, the Thomas R. Brown Athletic Grant reflects his conviction that the values cultivated on the field—such as teamwork, trust, communication, and confidence—extend far beyond sports, enriching academic and personal development. Athletic programs play a pivotal role in shaping students’ character, fostering well-rounded individuals who excel both in the classroom and in life.

California Casualty recognizes the vital role of youth sports in promoting children’s physical and mental well-being. We are delighted to announce that the 2024/2025 Athletic Grants will support the following initiatives:

-

- Diablo High School – Concord, California – Girls Volleyball

- Natomas High School – Sacramento, California – Swim Team

- Paramount High School – Paramount, California – Girls Flag Football

- San Benancio Middle School – Salinas, California – Wrestling and Soccer

- Tahquitz High School – Hemet, California – Cross Country

- Aurora Frontier P-8 – Aurora, Colorado – Boys & Girls Basketball

- Carmody Middle School – Lakewood, Colorado – Carmody Bike Club

- Post Falls High School – Post Falls, Idaho – Track and Field

- Lebanon High School – Lebanon, Oregon – Unified Basketball

- Laramie Middle School – Laramie, Wyoming – Middle School Athletic Programs

Congratulations to all of our 2024/2025 grant recipients!

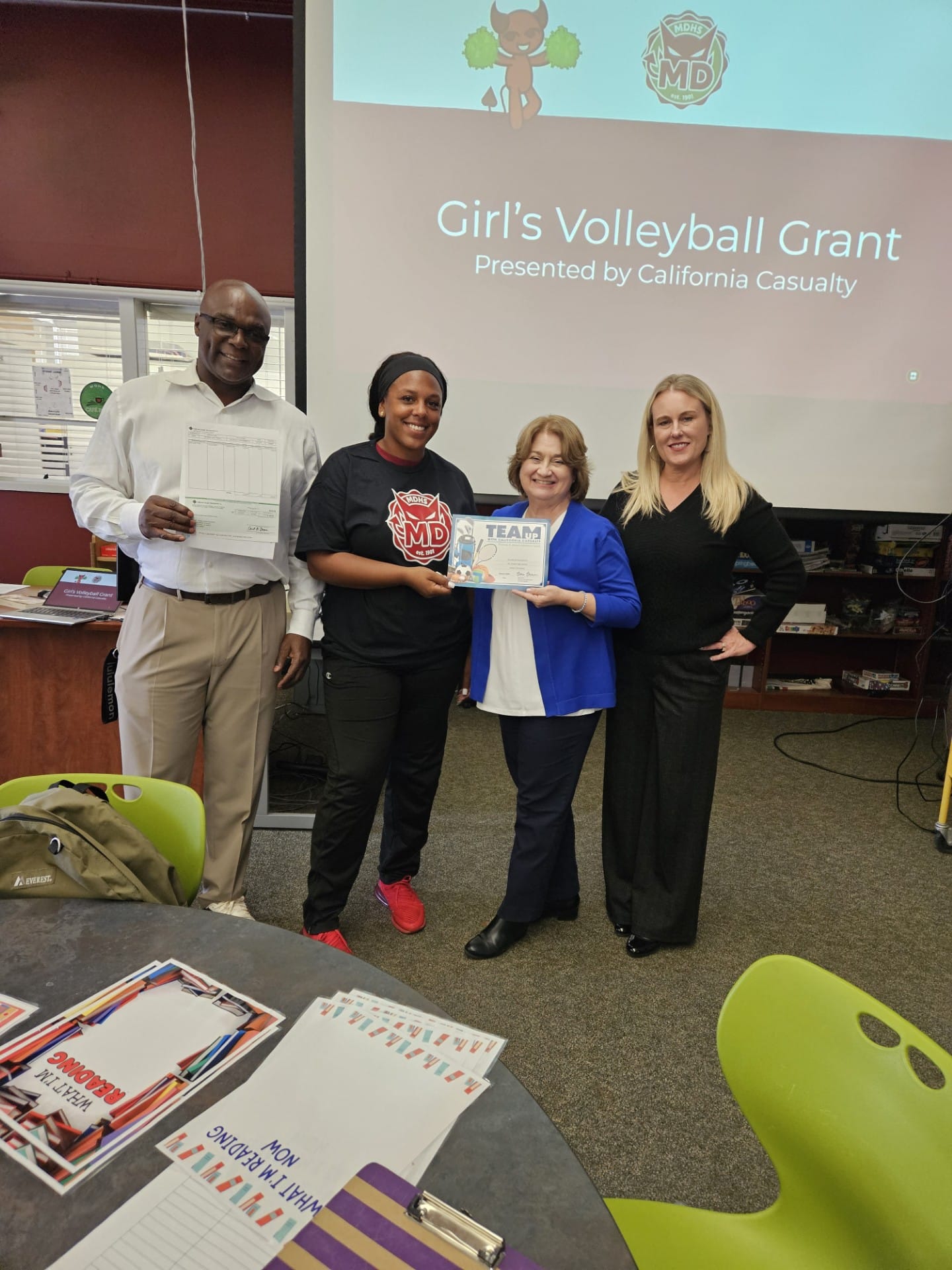

Mt. Diablo High School, Concord, CA

Applicant: Taylor Thompson

Athletic Program: Girls Volleyball

Photo L-R: Principal, Dr. Markell McCain, Recipient, Taylor Thompson, Mt Diablo EA President, Linda Ortega, and Angie Rajczyk

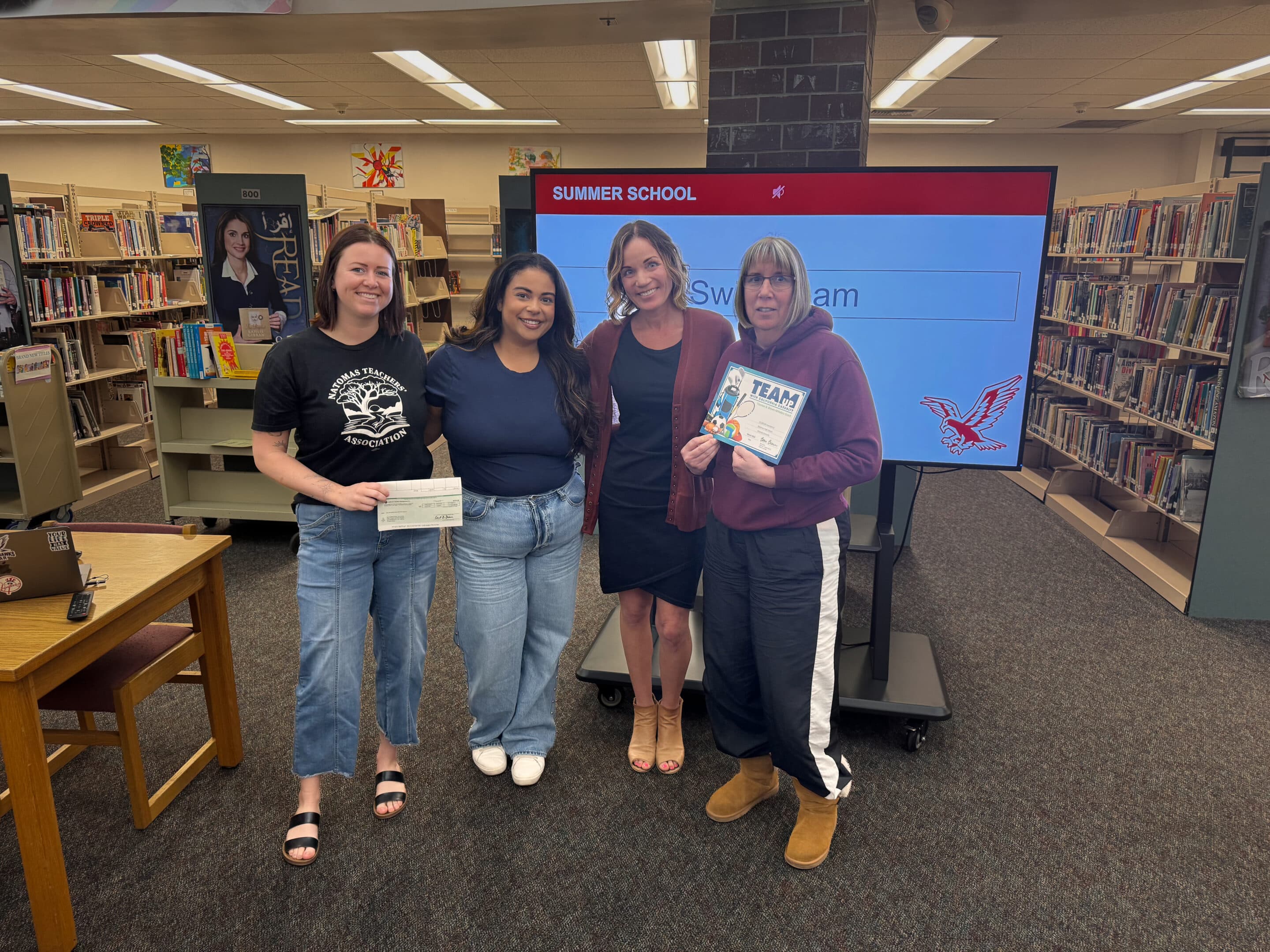

Natomas High School, Sacramento, CA

Applicant: Amanda Connelly

Athletic Program: Swim Team

Photo L-R: Swim Coaches, Eliana & Danielle, Amanda Keidel, Recipient, Amanda Connelly

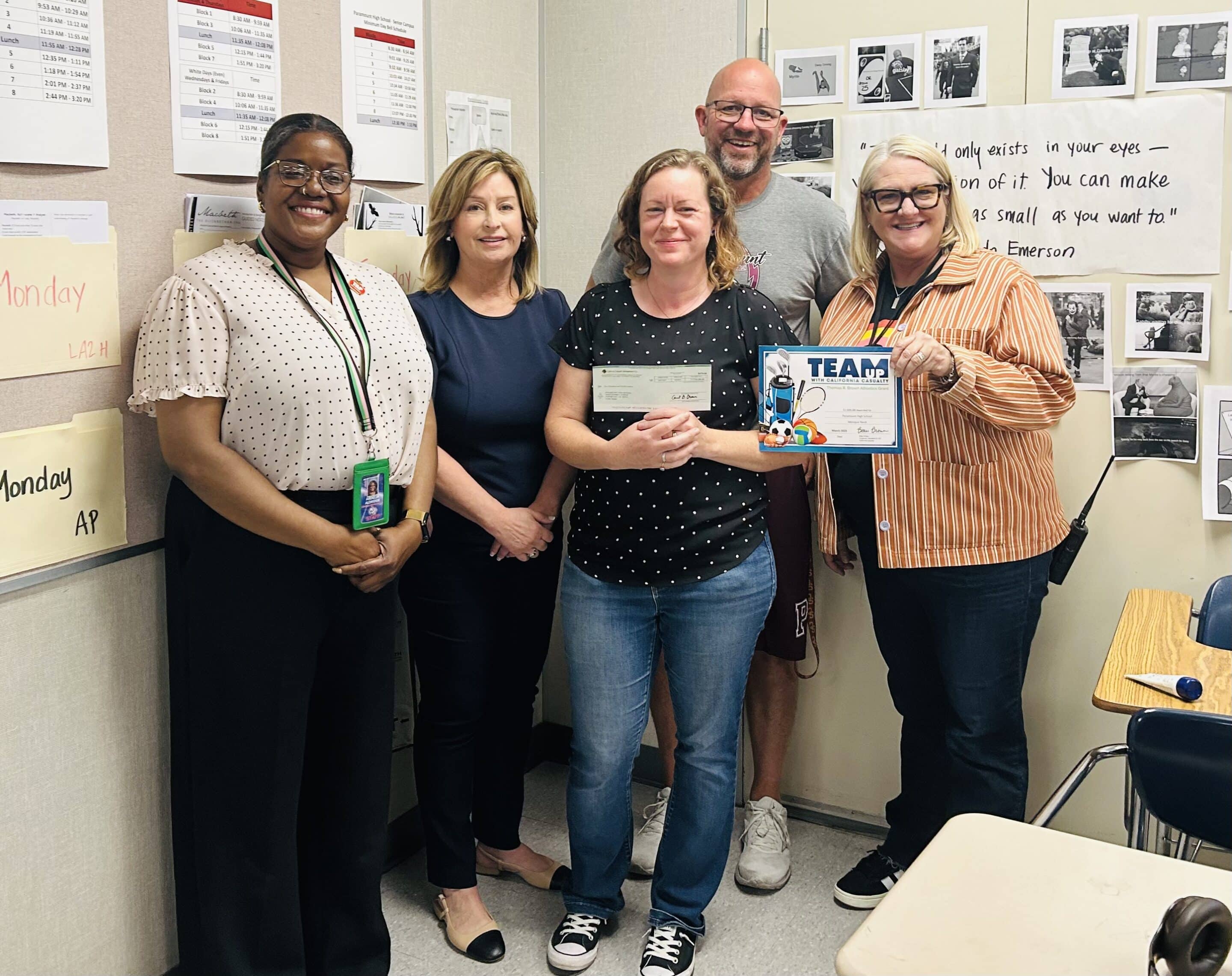

Paramount High School, Paramount, CA

Applicant: Monique Reed

Athletic Program: Girls Flag Football

Photo L-R: TAP president, (DeeDee) Ardelia Aldridge, PE Coach, Frank Bignami, Flag Football Coach, Monique Reed and school principal, Jill Hammond.

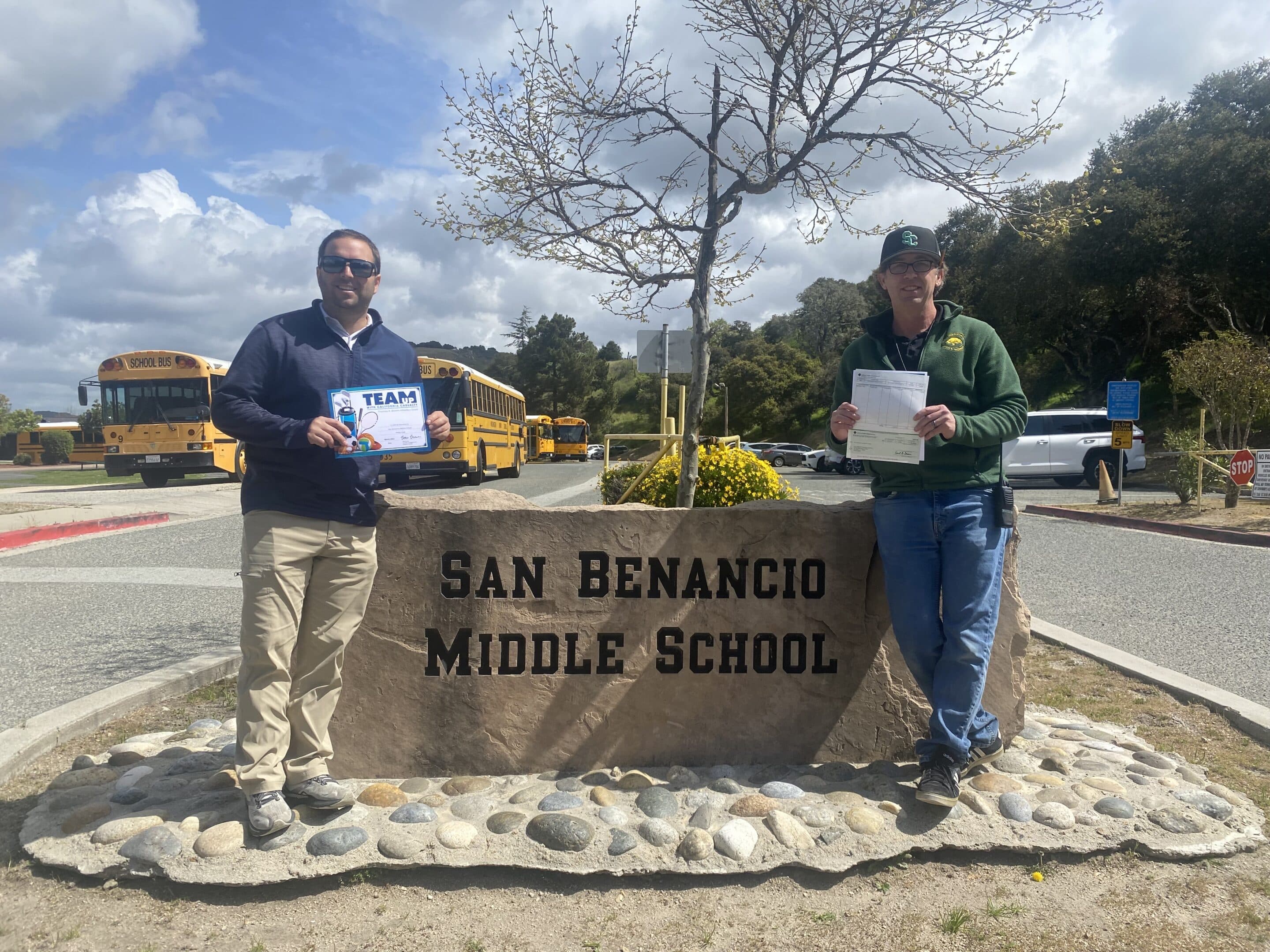

San Benancio Middle School, Salinas, CA

Applicant: Phillip Snell

Athletic Program: Wrestling and Soccer

Photo L-R: Principal, Joe Carnazzo, Recipient, Phillip Snell

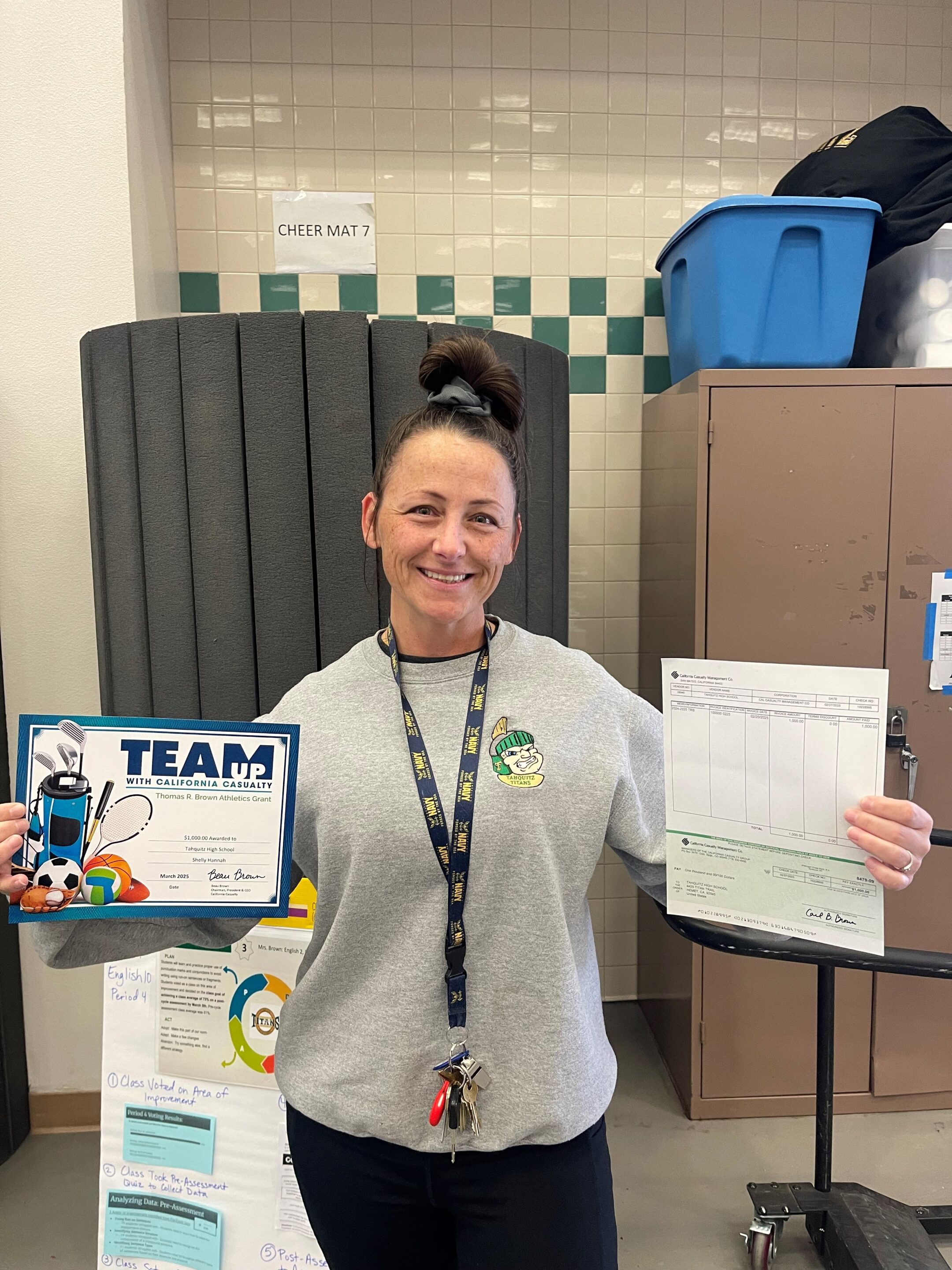

School: Tahquitz High School, Hemet, CA

Applicant: Shelly Hannah

Athletic Program: Cross Country

Photo: Recipient, Shelly Hannah

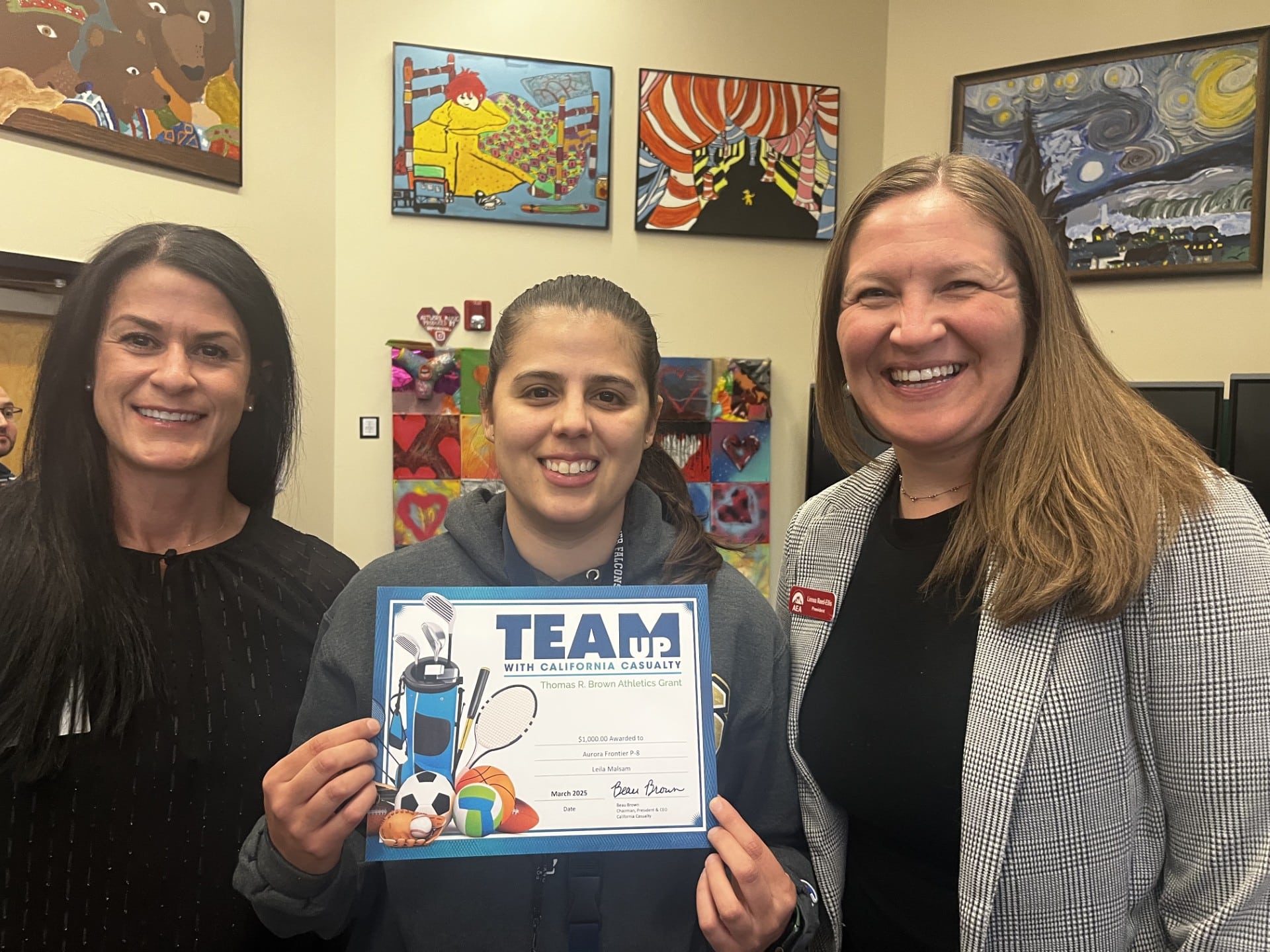

Aurora Frontier P-8, Aurora, CO

Applicant: Leila Malsam

Athletic Program: Boys & Girls Basketball

Photo L-R: Jolie Spence, Recipient, Leila Malsam and AEA President, Linnea Reed-Ellis

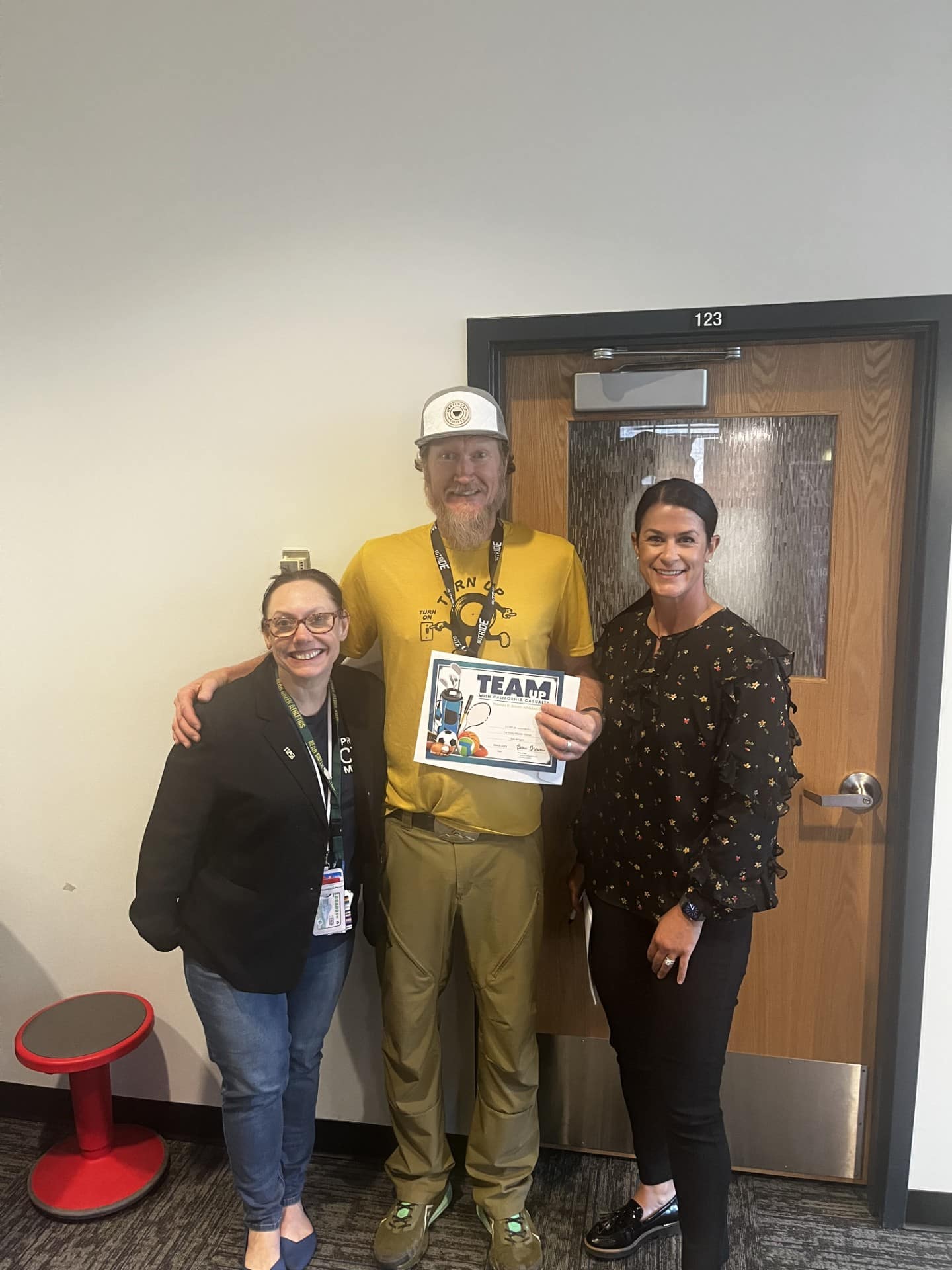

Carmody Middle School, Lakewood, CO

Applicant: Rob Wright

Athletic Program: Carmody Bike Club

Photo L-R: CEA Executive Committee and JCEA Secretary, Ang Anderson, Recipient, Rob Wright, and Jolie Spence

Post Falls High School, Post Falls, ID

Applicant: Brian Etchison

Athletic Program: Track and Field

Photo L-R: Assistant Principal, Mike Mclean and Recipient, Brian Etchison

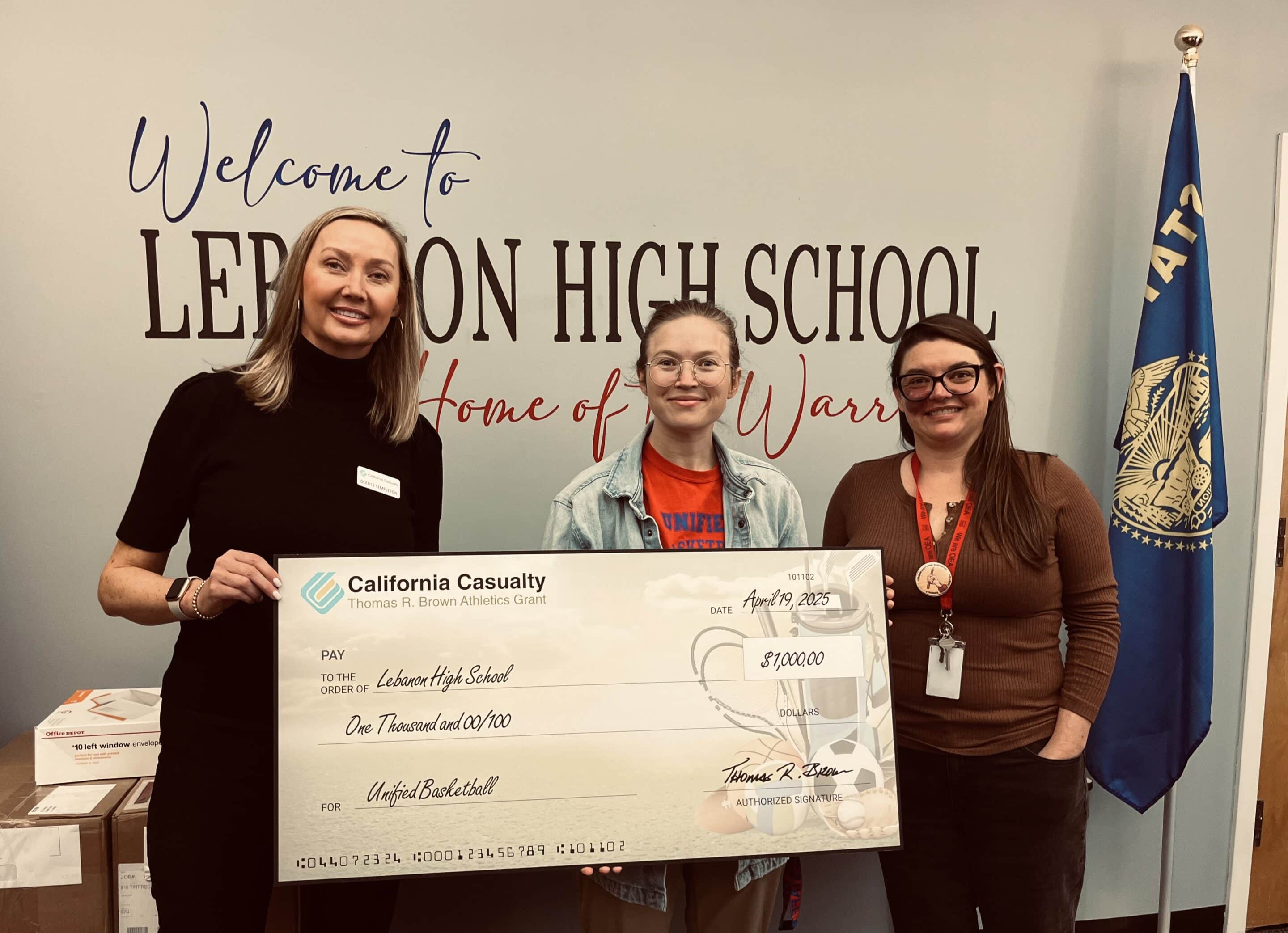

Lebanon High School, Lebanon, OR

Applicant: Sheridan Echternach

Athletic Program: Unified Basketball

Photo L-R: Dee Dee Templeton, Recipient, Sheridan Echternach and Lebanon EA President, Bonita Randklev

Laramie Middle School, Laramie, WY

Applicant: Jamie Simmons

Athletic Program: Middle School Athletic Programs

Photo L-R: Jolie Spence, Jamie Simmons and Greg Herold (Uniserv Director)

by California Casualty | Educators, In Your Community, News |

Congratulations to all of the recipients of the 2024 California Casualty Music & Arts Grants! Our field team had the privilege to connect both in-person and virtually with many of the grant recipients to present them with a check for $250 to put towards supporting their schools’ music or arts program.

Check out the awardee spotlights and see the full list of recipients below.

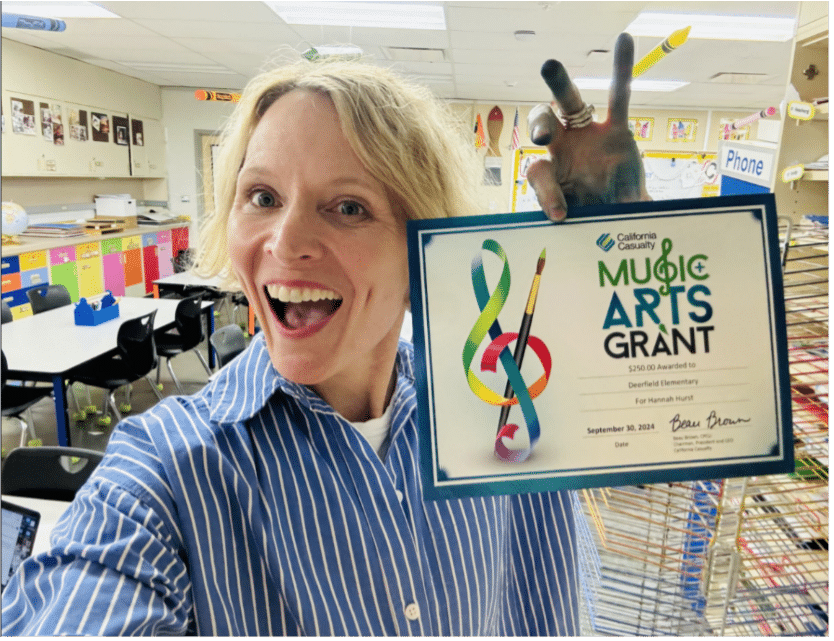

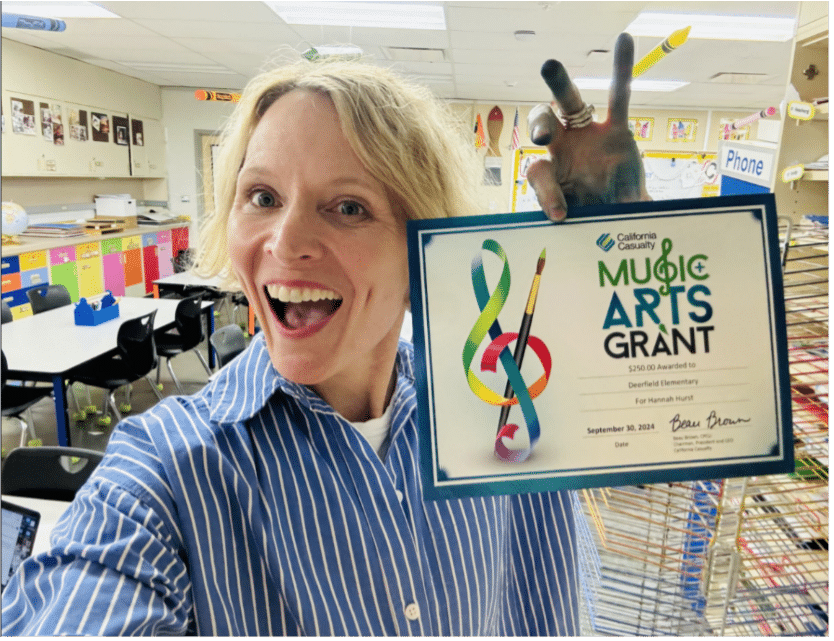

Hannah Hurst – 2024 Music & Arts Grant Awardee Spotlight

Deerfield Elementary School, Lawrence, Kansas

Hannah Hurst, Kansas National Education Association Member

Deerfield Elementary Art Program

Hannah Hurst, art teacher and Kansas National Education Association Member, applied for a Music & Arts Grant to request funding for the Deerfield Elementary Art Program. Deerfield Elementary School is within the Lawrence Public Schools in Lawrence, Kansas and is considered a Title 1 school, with 28% of the student population considered economically disadvantaged.

Hannah wrote in her application, “My elementary art program lost 20% of its funding last school year due to a district wide budget crisis. Our budget now only allocates $3.00 per student for art supplies. This grant would help purchase consumable supplies for over 500 students.”

Jolie Spence, Sr. Account Development Manager with California Casualty, located in the greater Denver area, presented Hannah with the grant during a staff meeting via Zoom. Hannah remarked after receiving the grant “I am just thrilled to be able to provide my students with the supplies they need to have the very best art education!”

Photo: Hannah Hurst, Awardee

Molly Curro – 2024 Music & Arts Grant Awardee Spotlight

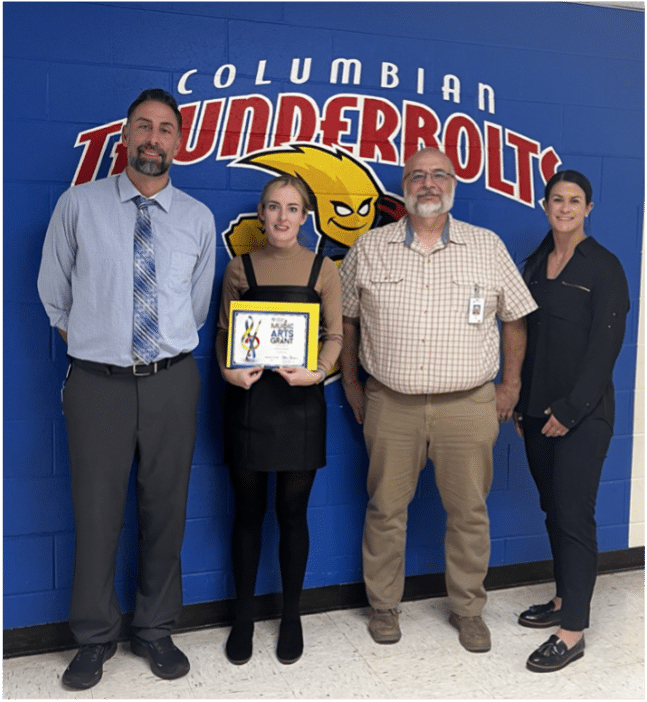

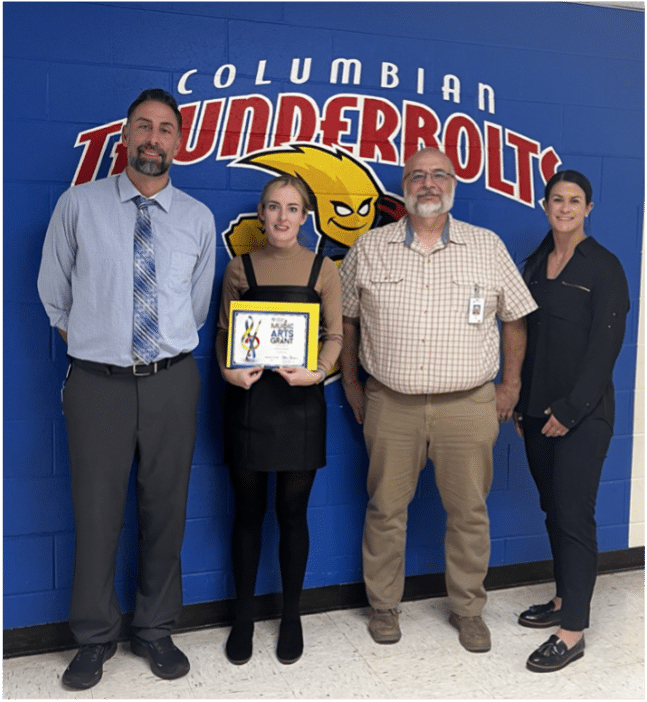

Columbian Elementary School

Molly Curro, Colorado Education Association Member

Columbian Elementary Art Program

Molly Curro, music teacher and Colorado Education Association member, heard about the Music & Arts Grant from her local union, Pueblo Education Association (PEA). She knew that her school Columbian Elementary, located in a high poverty community, would greatly benefit from the grant.

Molly wrote in her application that the grant would go towards a Piano Lab that would enhance music education through hands-on learning, promote creativity and collaboration among students and in turn enrich the school’s overall arts program.

Jolie Spence, Sr. Account Development Manager with California Casualty located in the greater Denver area, was excited to award this grant to Molly and Columbian Elementary. She along with Mike Maes (PEA President), Justina Carter (PEA Vice President), Jimmie Pool, Columbian Elementary Principal and colleagues presented the grant to Molly.

Photo L-R: Jimmie Pool, Columbian Elementary Principal, Molly Curro, Awardee, Mike Maes, Pueblo Education Association President, Jolie Spence, Sr. Account Development Manager

Kendall Wightman – 2024 Music & Arts Grant Awardee Spotlight

Elmhurst Elementary School, Ventura, California

Kendall Wightman, Teacher and California Teachers Association Member

Elmhurst Elementary Art Program

Kendall Wightman, Art Teacher and California Teachers Association Member, heard about the California Casualty Music and Arts Grant from her local union representative. Kendall shared in her application, “with budget cuts over the years, the school no longer receives the simplest of materials such as Sharpie markers for our students.”

Jana Charles, Sr. Account Development Manager, working located in the Southern California Los Angeles area, along with the Music & Arts Grant committee selected Kendall’s application to receive. Jana was due to surprise Kendall with the grant, however plans changed, “this was my most unforgettable presentation. On November 6th while in route to Elmhurst ES, I received a call from the school secretary advising me to turn back immediately, as schools across the district were dismissing staff and shutting down operations due to the wildfires in Ventura County. Despite the chaos, one week later I had the privilege of attending their November 13th staff meeting to surprise CTA member, Kendal Wightman, with the grant. This group was the most humble and enthusiastic group of individuals.” Although the Mountain Fire was destructive, burning over 20,000 acres, damaging and destroying hundreds of building, luckily few individuals were injured.

Photo L-R: Bret Klopfenstein, Principal (and happy CalCas customer), Sarah McLaughlin, President of Ventura Unified Education Association (another happy CalCas customer), Jana Charles, Kendall Wightman, Awardee, and Ryan Oast, Ventura Unified Education Association site representative

Katrina Snow – 2024 Music & Arts Grant Awardee Spotlight

Paradise Valley Elementary, Casper, Wyoming

Katrina Snow, Art Teacher and Wyoming Education Association Member

Paradise Valley Elementary Lunar New Year Program

Paradise Elementary School in Casper, Wyoming services a dual language student population of both Mandarin Chinese and English. Each year the art, music and physical education teachers fund and host an all-school student art show that centers around the Zodiac animal of the Lunar New Year.

Katrina Snow, Art Teacher and Wyoming Education Association member, was excited to learn about the grant, writing that if awarded a grant, funds would go to props, costumes and other supplies so each student could make at least 2 projects to celebrate the Lunar New Year’s Year of the Snake.

Jolie Spence, Sr. Account Development Manager located in the greater Denver area, notified Katrina of the grant awardee. Jolie received a note from Katrina stating, “we are very excited to use these funds to enhance our all-school Lunar New Year Celebration taking place on January 31, 2025. The funds will be used well for the art show and performance by all of our talented students. Thank you for this opportunity!”

Photo: Katrina Snow, Awardee

Blake Kuroiwa – 2024 Music & Arts Grant Awardee Spotlight

Mountainside High School, Beaverton, Oregon

Blake Kuroiwa, Oregon Education Association Member

Mountainside Band Program

Blake Kuroiwa, Band Instructor, Teacher and Oregon Education Association member, applied with a note stating that the band budget had been reduced by half this year due to cuts. This has reduced the program’s ability to serve students of lower socio-economic status. The funds from the grant will aid those students who wish to participate in marching band, winter guard, or winter percussion.

Dee Dee Templeton, Sr. Account Development Manager working locally in Oregon, presented to Blake along with the Band Booster President, Stephanie Marr. Dee Dee remarked that Blake was excited and thankful to receive the grant. He told Dee Dee that he spends his summer break looking for opportunities to raise funds and to find grants.

Photo L-R: Dee Dee Templeton, California Casualty Sr. Account Development Manager, Stephanie Marr, Band Booster President, Band member, Dani Castaneda, band member and Blake Kuroiwa, Awardee

Jim Phillips – 2024 Music & Arts Grant Awardee Spotlight

Coeur d’Alene High School, Coeur d’Alene, Idaho

Jim Phillips, Instrumental Music Director and Idaho Education Association Member

Coeur d’Alene High School Orchestra Program

Coeur d’Alene High School receives a Music & Arts Grant to help keep the music going. Located seven hours north of Boise is Coeur d’Alene High School in Coeur d’Alene, Idaho. The area is known for being the playground of the Pacific Northwest because of the many recreational activities. But for the orchestra department at the high school, budget cuts were impacting students’ ability to continuously play.

Jim Phillips, Instrumental Music Director and teacher at Coeur d’Alene High School wrote in his application that the orchestra has not had a budget for about five years. If a string breaks in rehearsal, the instrument and the player are out of commission until a new string can be acquired.

Dee Dee Templeton, Sr. Account Development Manager working locally in Oregon, shared the goods news with Jim about his application being selected for a Music & Arts Grant. Dee Dee shared that Jim was so thankful for the grant award, that being able to have new strings readily available is such a basic need.

Photo L-R: Jim Phillips, Awardee, and Mike Randles, Coeur D’Alene High School Principal

Melanie Tanesco – 2024 Music & Arts Grant Awardee Spotlight

J.C. Crumpton Elementary School, Marina, California

Melanie Tanesco, 1st Grade/Special Education Teacher and California Teachers Association Member

J.C. Crumpton Elementary Saturday Academy – Inclusive Program

Melanie Tanesco, 1st Grade/Special Education Teacher and California Teachers Association member, heard about the California Casualty Music & Arts Grant from her local union newsletter. She knew the J.C. Crumpton Elementary Saturday Academy program would benefit from the grant.

Melanie wrote in her application that the program includes painting, STEAM art challenges and other inclusive programs attended by both general and special education students. “The grant will ensure that all students continue to benefit from these enriching experiences, helping our kids to be creative and embrace their unique talents. Despite potential budget constraints, the focus will be on maintaining the quality and accessibility of our inclusive Saturday Academy to support the diverse needs of our student community and foster a love for creativity and learning.”

Chris Nieto, Account Development Manager located in central California, delivered the good news to Melanie. Chris said that “Melanie was very excited and thankful to be chosen as one of this year’s recipients of the California Casualty Music & Arts Grant. She plans to use the funds for a variety of art projects.”

Photo: Melanie Tanesco, Awardee, and Chris Nieto, Account Development Manager

Brian Mabry – 2024 Music & Arts Grant Awardee Spotlight

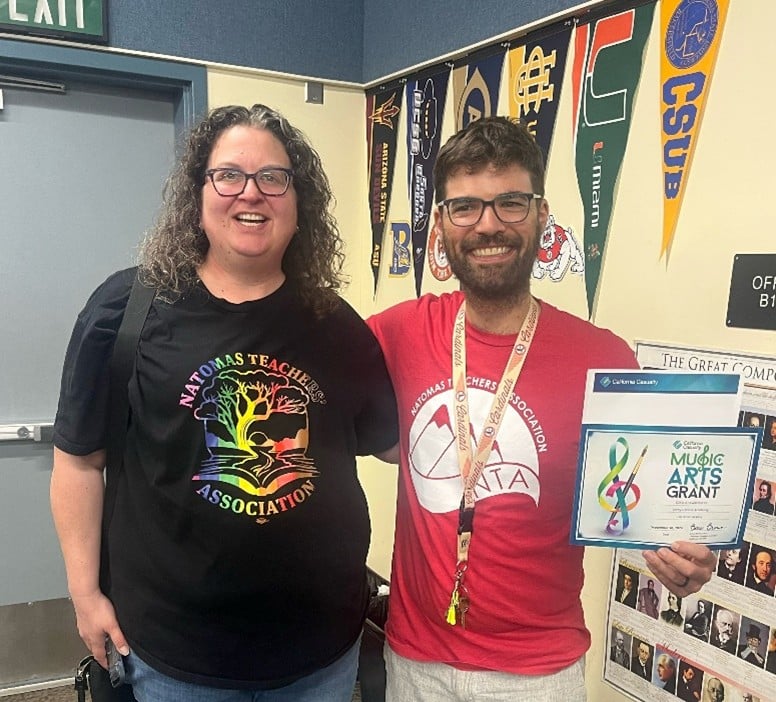

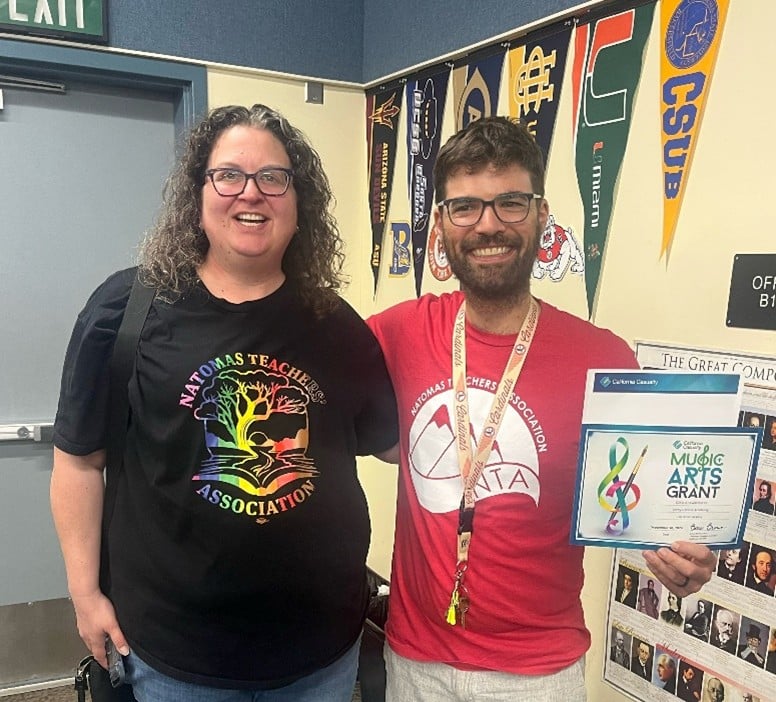

Leroy Greene Academy, Sacramento, California

Brian Mabry, Music Teacher and California Teachers Association Member

Leroy Greene Academy Band

Brian Mabry, Music Teacher at Leroy Greene Academy was in the middle of updating his California Casualty Insurance policy when he was surprised by Amanda Keidel, Account Development Manager covering accounts in northern California, and Mara Harvey, Natomas Teachers’ Association President. They were there to deliver a $250 Music & Arts Grant award to Brian.

In the application, Brian wrote, “the LGA music program has suffered for the past several years due to lack of staffing. Previously it offered classes for junior high and high school students with two different teachers. Last year they could not find a teacher; the music class was transformed into a computer course. In my first year, I started a band program and have almost 200 students.”

Amanda said that Brian was very surprised and thrilled; he plans to purchase sheet music and reeds for his classes.

Photo L-R: Brian Mabry, Awardee and Mara Harvey, Natomas Teachers’ Association President

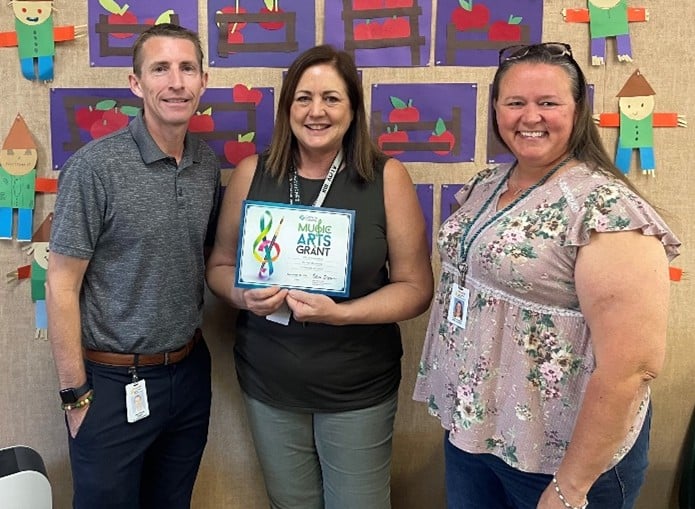

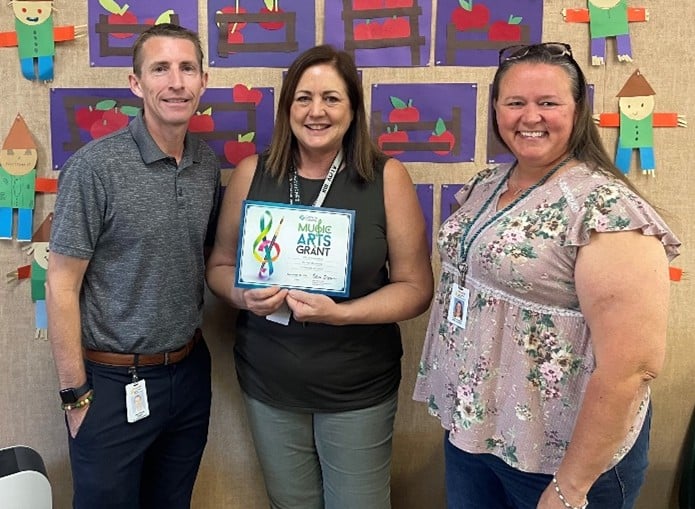

Rhonda McQuown – 2024 Music & Arts Grant Awardee Spotlight

Rio Vista Elementary, Cathedral City, California

Rhonda McQuown, Special Education Teacher and California Teachers Association Member

Special Education – Special Day Class

Rhonda McQuown, Special Education Teacher and California Teachers Association member, was surprised this fall with a $250 Music & Arts Grant from California Casualty.

Rhonda wrote in her application that she was requesting funding to purchase art supplies that are appropriate for her special education classroom of mild/moderate students that have learning disabilities, autism or intellectual disabilities, stating “appropriate art supplies will enhance student enrichment and art experiences.”

Inez Morales, Sr. Account Development Manager, located in southern California, had the pleasure of surprising Rhonda with the grant award. She along with the Principal, Vice Principal of Rio Vista Elementary, the Palm Springs Teachers Association President and fellow colleagues celebrated Rhoda and her students. Inez remarked, “Rhonda helps her students reach their full potential, offering not just academic instruction but also emotional support, advocacy, and life skills development. The way her students interacted with her spoke volumes about how special she is, there were smiles all around that day.”

Photo L-R: Aaron Tarzian, Rio Vista Elementary Principal, Rhonda McQuown, Awardee, Karen Johnson, Palm Springs Teachers Association President

Inez Rowles – 2024 Music & Arts Grant Awardee Spotlight

New Hope Elementary, Thornton, California

Inez Rowles, Teacher, New Hope Education Association President and California Teachers Association Member

Art in the Classroom

Inez Rowles, kindergarten teacher, New Hope Education Association President and California Teachers Association Member, at New Hope Elementary heard about the Music & Arts Grant from Angie Rajczyk, Account Development Manager covering accounts in the San Francisco Bay Area. New Hope Elementary is a one-building school district in a very rural area, with limited resources. Inez applied asking to support art education for the students in her classroom.

Angie along with New Hope Elementary Principal, Clint Johnson, presented the grant to Inez. Inez told Angie that ” I am so excited for the grant. I am going to use the funds to purchase portfolios and art supplies for all the students. This will allow them to keep all of their artwork in one place and be able to showcase it at the end of the year.”

Not only is Inez the local president of New Hope Education Association, the Principal, Clint, is an ACSA member!

Photo L-R: Inez Rowles, Awardee, Angie Rajczyk, Account Development Manager and Cliff Johnson, New Hope Elementary Principal

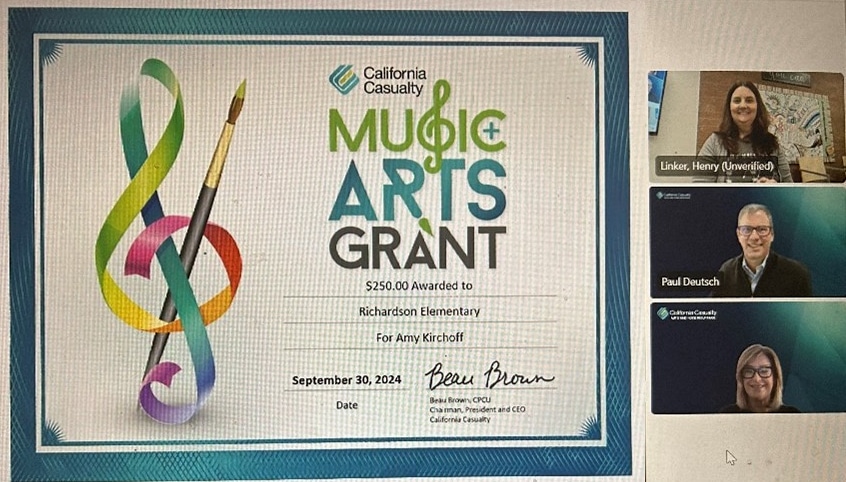

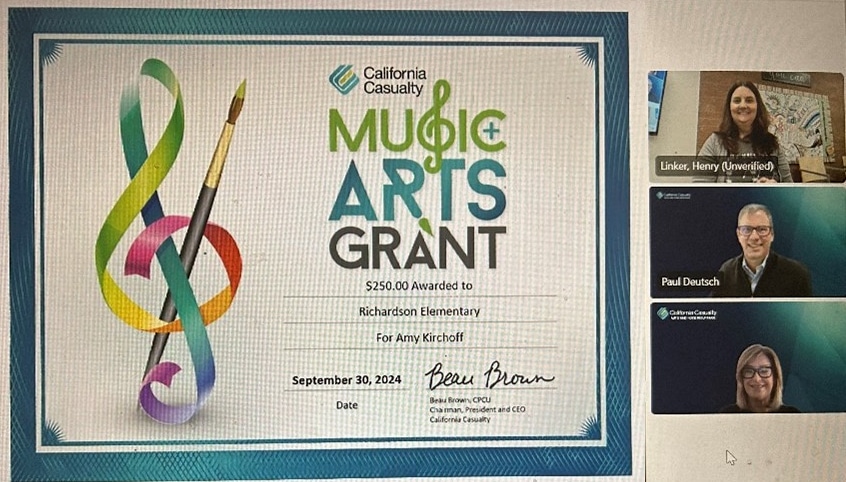

Amy Kirchoff – 2024 Music & Arts Grant Awardee Spotlight

Richardson Elementary School, Tucson, AZ

Amy Kirchoff, Music Teacher and Arizona Education Association Member

Richardson Elementary Music Program

Amy Kirchoff, music teacher and Arizona Education Association member, has felt the pressure of budget cuts. With an idea to broaden her students’ horizons through music she looked to the California Casualty Music & Arts Grant as a solution. Amy wrote if awarded, “the grant money will be used to purchase multicultural instruments, games, and activities for her students.”

On the afternoon of October 30th, Amy was expecting a routine discussion with her school principal, Mr. Linker, to celebrate her recent achievements. He informed Amy that there would be more participants attending the meeting virtually. It was an exciting moment when Jana Charles, Sr. Account Development Manager and Paul Deutsch, Strategic Account Manager presented Amy with the grant, recognizing her hard work and dedication. Jana remarked that Amy’s reaction was priceless, making the surprise even more special.

Photo Top-Bottom: Amy Kirchoff, Awardee, Paul Deutsch, Strategic Account Manager, Jana Charles, Sr. Account Development Manager

The complete list of 2024 Grant recipients are:

- Danielle Yeti,A.M. Winn Elementary School , Sacramento , CA , Electives programs for grades 6-8

- Ashley Martinez , Anna McKenney Intermediate , Marysville , CA , Drama

- Joleen Vincent , Creative Connections Arts Academy High School , Sacramento , CA , Introduction to Art classes

- Joleen Vincent , Creative Connections Arts Academy High School , North Highlands , CA , Visual Arts

- Beth Geise , Hooker Oak Elementary School , Chico , CA , Alzheimers Care

- Brian Mabry , Leroy Greene Academy , Sacramento , CA , LGA Band

- Erica Hung , Riverview STEM Academy , Rancho Cordova , CA , Education through Music

- David Hunter , Bridge Program – Diablo Unified School District , Concord, CA , Visual Arts

- Jessica Gutierrez , James Lick High School , San Jose , CA , James Lick Advanced Art Pathway / Visual Arts Program

- Leslie McNabb , Lone Tree Elementary , Antioch , CA , Classroom

- Angela Ordaz , Mountain View Elementary , Concord , CA , School Counseling

- Inez Rowles , New Hope Elementary , Thornton , CA , Art in my classroom

- Crystal Latonio , Zane Middle School , Eureka , CA , Art Therapy

- Alexa Quezada , El Monte Middle School , Orosi , CA , Art Elective Classroom

- Lindsay Doyle , Fairmont Elementary , Sanger , CA , Art Show

- Melanie Tanseco , JC Crumpton Elementary , Marina , CA , TK – 6th

- Amber Wilkerson , Los Ranchos Elementary School , San Luis Obispo , CA , Special Education Day Classes

- Rebecca Townsend , Rivergold Elementary School , Coarsegold , CA , Classroom

- Janet Washington , Stella Hills Elementary , Bakersfield , CA , Art

- Jim Phillips , Coeur d’Alene High School , Coeur D Alene , ID , Orchestra

- Jessica Johnson , Hawthorne Middle School , Pocatello , ID , Hawthorne Middle School Choirs

- Melissa Syverson , Lewiston High School , Lewiston , ID , Drama Department

- Ainsley Boan , Whitney Elementary School , Boise , ID , Art

- Andrew Thompson , Aloha High School , Aloha , OR , Music Studio Program

- Jennifer Stone , Cedar Park Middle School , Porland , OR , Band

- Blake Kuroiwa , Mountainside High School , Beaverton , OR , Mountainside Band Program

- Brianna Carder , Talmadge Middle School , Independence , OR , Mariachi Program

- Chelice M Gilman , Ella B. Allen Elementary , Bonita , CA , Visual Art

- Lisa Sandberg , Gus Franklin Jr. STEM School , Victorville , CA , Art program

- Carolyn Quirino , La Granada Elementary , Riverside , CA , Art lessons for students through Art Smarts

- Natalee Boggs , Murrieta Mesa High School , Murrieta , CA , Special Education

- Natalee Boggs , Murrieta Mesa High School , Murrieta , CA , Unified Leadership

- David von Behren , Oasis Elementary School , Twentynine Palms , CA , Autism Music and Sculpture

- Rhonda McQuown , Rio Vista Elementary , Cathedral City , CA , Special Day Class

- Jean Tillman , Brookhurst Elementary School , Garden Grove , CA , Kindergarten Students

- Kristen Hellewell , Castille Elementary , Mission Viejo , CA , Special Needs in Music

- Roberto Ontiveros , Century High School , Santa Ana , CA , Century Instrumental Music Program

- Kendall Wightman , Elmhurst Elementary , Ventura , CA , Elementary Art

- Araceli Garcia , Workman High School , City of Industry , CA , ELD Design-Based Learning Summer program

- Jessica Reed , York Elementary , Hawthorne , CA , Painting

- Kirstin Miller , Bear Creek High School , Lakewood , CO , Bear Creek High School Instrumental Music Program

- Kathy Van Wert , Bill Reed Middle School , Loveland , CO , Bill Reed Middle School Band Program

- Molly Curro , Columbian Elementary , Pueblo , CO ,

- Cheryl Malet , Escalante-Biggs Academy , Denver , CO , Art

- Michele Arthur , Jack Swigert Middle School , CO Springs , CO , Art

- Amelia Haug , Maplewood Elementary , Greeley , CO , Music Classes and Choir Program

- Amy Holle , Niwot High School , Niwot , CO , Unified Theater

- Patricia Koed , Platte Valley Middle School , Kersey , CO , PVMS Choir

- Kari Dusenbery , York International , Thornton , CO , Middle/High School art and Design

- Hannah Hurst , Deerfield Elementary , Lawrence , KS , Deerfield Elementary Art Program

- Crystal Plante , Hill City Grade School , Hill City , KS , Art

- Katrina Snow , Paradise Valley Elementary , Casper , WY , Primarily Art-art and music programs works together to create a school-wide art show and performance.

- Lynnsey Patterson , Woods Learning Center , Casper , WY , Art

- Charla Jones , Carol G. Peck School , Glendale , AZ , K-8 art program

- Monika Beauvais Landi , Fulton Elementary School , Chandler , AZ , Fulton Elementary School General Music Program

- Gabriela Carrillo , Mitchell Elementary , Phoenix , AZ , Mitchell’s Art Program

- Christina Ozuna , Park Meadows Elementary , Glendale , AZ , Art

- Marguerite Samples , Pueblo Gardens PreK-8 School , Tucson , AZ , Art

- Graham Corp , Rhodes Jr. High School , Mesa , AZ , Special Education/Band

- Amy Kirchoff , Richardson Elementary , Tucson , AZ , Music

- Monica Tavcar , Sunrise Elementary School , Phoenix , AZ , Sunrise School Art Program

- Judith Arnold , Thomas Elementary School , Flagstaff , AZ , Native American education

by California Casualty | Auto Insurance Info, Calcas Connection, Finances, Helpful Tips, Homeowners Insurance Info |

We understand that changes to insurance premiums can be concerning, and we want to help you understand the factors that influence your rates. Insurance rates are determined by a combination of external conditions and personal policy coverage selections. Below, we’ll explain some of the most common reasons rates can increase and what changes in your policy could impact your premium.

External Factors That Can Cause Rate Increases

1. Rising Costs of Repairs and Replacements

For auto insurance, advanced technology in vehicles, like sensors and cameras, makes repairs more expensive. In the case of a total loss, rising prices for new and used vehicles drives up the cost of replacement. Similarly, home insurance is impacted by increasing prices for building materials and labor, making it more costly to repair or rebuild homes after a loss.

2. Weather and Natural Disasters

Severe weather events, such as wildfires, floods, and hailstorms, are happening more frequently and with greater intensity. These events lead to higher claim payouts and cause insurance rates to rise, even in areas that haven’t been directly affected.

3. Inflation

General inflation affects nearly every industry, including insurance. The rising cost of goods and services —from everything associated with a minor vehicle repair all the way to restoring extensive home damage, like parts, materials, labor, rental cars, temporary housing, legal and medical expenses —can result in an adjustment of premiums to align with the amount that is paid out on claims.

4. Increased Claim Frequency

More claims being filed—whether due to a rise in car accidents, litigation, or property damage—paired with increased claims costs can lead to paying out more on claims than what is collected in premium. When this happens, a rate increase can occur.

5. Reassessment of Risks

Insurance companies regularly re-evaluate risks in specific areas. If you live in a region that’s seen more accidents, theft, or natural disasters, your premiums may increase to reflect the heightened risk.

How Policy Changes or Adjustments Affect Your Premium

1. Adding or Removing Coverage

Expanding your coverage—such as adding comprehensive auto coverage or increasing your home insurance policy limits—will raise your premium. Conversely, reducing coverage may lower your rate but could leave you underinsured.

2. Adjusting Deductibles

Choosing a higher deductible typically lowers your premium since you agree to pay more out-of-pocket in the event of a claim. However, a lower deductible means your insurer covers more upfront, which increases your premium.

3. Policy Discounts and Loss of Discounts

We offer many discounts including affiliated group membership, bundling auto and home, multi-vehicle, safe driving, home security, non-smoking, good student, mature driver, etc. If you no longer qualify for a discount, your rate may increase.

4. Changes in Your Personal Profile

Life changes such as adding a new driver to your policy, changes to the number or type of covered vehicles, or moving to a different area can impact your premiums.

5. Claims History or Driving Record

Filing a claim can result in higher premiums at renewal. Additionally, if a ticket or accident is charged against your driving record, you may be subject to a surcharge that will likely raise your rates.

How You Can Help Manage Your Premiums

While some factors are out of your control, there are steps you can take to keep your premiums manageable:

- Bundle Policies: Combining your auto and home insurance or having multiple vehicles on one policy can help you save more.

- Review Your Coverage: Call us for a free policy review to make sure you’re not paying for coverage you don’t need.

- Increase Your Deductibles: Opting for a higher deductible can lower your premium but be prepared to cover more out-of-pocket costs in the event of a claim.

- Maintain a Safe Driving Record: Avoid accidents and traffic violations to keep your auto insurance costs down.

- Home Upgrades: A new roof, installing alarms, fire-resistive updates, or upgrading plumbing, electrical or HVAC systems can help you qualify for discounts.

- Ask About Discounts: Let us know if there have been changes, like completing a mature driving course, a child away at school without a vehicle, or reaching a milestone like retirement. We also offer discounts for multi-home, years claim free, good student, safe driving, and driver training for youthful drivers

We’re Here to Help

Whether it’s an auto accident or a home repair after a storm, having insurance helps ensure you’re not left to bear the full financial burden – so maintaining adequate coverage is crucial.

We understand that insurance can feel complex, but we’re here to make it simple and help make sure you have the coverage that’s right for you. Our trusted advisors are available to review your current policies, provide guidance on your coverage options, help explore ways to save, and answer any questions you have.

Thank you for trusting us to protect what matters most to you.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Calcas Connection, Finances, Homeowners Insurance Info, Safety |

Flooding is one of the costliest natural disasters in the United States, with the potential to impact millions of homes and communities. While FEMA and other agencies provide flood maps to help homeowners understand their risk levels, many of these maps are outdated, leading to a false sense of security for people who live in areas not designated as high-risk. Floods, however, aren’t limited to high-risk zones; even areas classified as low-risk are vulnerable under certain conditions. For these reasons, it’s vital to consider flood insurance no matter where you live.

Outdated Flood Maps and the Misleading Risk of Flooding

Flood maps are designed to inform residents and local authorities about the likelihood of flooding based on historical data, topography, and other factors. FEMA’s maps, for instance, divide areas into high, moderate, and low-risk zones, which guide flood insurance requirements and building regulations. However, some flood maps haven’t been updated for years and many don’t accurately reflect changes in land use, climate patterns, or new developments, which can significantly alter flood risks.

Changes to flood risks include:

- Urban Expansion: As cities and towns expand, natural land is replaced with pavement and buildings, which leads to increased runoff and reduced soil absorption. Areas previously considered low risk might become more prone to flooding as water has fewer places to go.

- Climate Change and Extreme Weather: Flood maps are based on historical data and often don’t account for the increasing frequency and intensity of extreme weather events that can result in both droughts and unprecedented rainstorms, often within the same year. In areas affected by wildfires where vegetation loss reduces soil stability, runoff increases. Outdated flood maps may fail to reflect these climate driven impacts, leading many property owners to underestimate their exposure.

- Erosion and Infrastructure Changes: Natural factors like erosion, as well as human-made infrastructure changes, can impact flood patterns over time. Rivers shift, drainage systems get updated, and dams or levees are added or removed—all of which can alter the flow of water and increase the risk in areas thought to be safe.

The Risks of Flooding in “Low-Risk” Areas

Approximately 40% of flood insurance claims in the U.S. come from properties located outside designated high-risk flood zones. Many low-risk or moderate-risk areas are prone to what is known as “flash flooding” from sudden, heavy rainfall or overflowing drainage systems that cannot keep up. Recent flooding incidents in areas far from coastlines or rivers illustrate how floodwaters can impact anyone, anywhere.

Causes of flooding in low-risk areas include:

- Heavy Rainfall: Even a few hours of intense rain can lead to flash flooding, especially in areas with inadequate drainage or impermeable surfaces like concrete. Low-risk flood zones can still see significant flooding from strong, localized storms.

- Snow Melt and Frozen Ground: In colder climates, rapid snowmelt or rain on frozen ground can lead to significant runoff, overwhelming waterways and drainage systems even in low-risk flood areas.

- Infrastructure Failures: Overflowing sewer systems, clogged drainage, or burst water mains can also lead to localized flooding, impacting areas that flood maps don’t highlight.

Because low-risk zones are not usually required to have flood insurance, many homeowners assume they’re safe. Unfortunately, without a flood-specific insurance policy, any flood damage may need to be covered out-of-pocket, which can lead to devastating financial loss.

Why Flood Insurance Is Essential, Even Outside High-Risk Areas

Given the limitations of flood maps and the growing risk of unexpected flooding, flood insurance is a wise investment for all homeowners. Standard homeowner insurance policies typically do not cover flood damage, so without flood insurance, homeowners face the full financial impact of repairs, replacement of belongings, and sometimes even temporary housing costs.

Here are several reasons to consider flood insurance regardless of risk classification:

- Affordable Coverage in Low-Risk Areas: In areas considered low- to moderate-risk, flood insurance premiums are often lower than in high-risk zones. This makes it possible to secure essential coverage without significant cost.

- Financial Protection: The cost of even minor flooding can add up quickly. Carpets, drywall, and flooring may need to be replaced, and waterlogged appliances or furniture might be beyond repair. Flood insurance helps cover these costs, sparing you from paying out of pocket.

- Home Value and Mortgage Requirements: While most mortgage lenders don’t require flood insurance in low-risk areas, opting for coverage can help protect your home’s value by making it easier to get it back to pre-flood condition.

- Adaptability to Climate Change: As weather patterns continue to change, so does the risk of flooding. Flood insurance ensures that you are protected no matter what nature brings, providing adaptable protection in an unpredictable environment.

Taking a Proactive Approach to Flood Protection

Beyond purchasing flood insurance, you can take steps to protect your property from potential flooding:

- Upgrade Drainage Systems: Make sure gutters and downspouts are clear and well-maintained to help direct rainwater away from your home.

- Install Sump Pumps or Flood Barriers: For homes with basements, sump pumps can be a lifesaver in the event of heavy rain. Flood barriers can also be installed around doors and windows for additional protection.

- Regular Property Checks: Monitoring your property for pooling water and ensuring nearby storm drains are clear can help reduce localized flooding.

Outdated flood maps and assumptions about risk can lead to costly surprises for homeowners. While flood insurance may seem unnecessary in low-risk areas, recent floods across unexpected locations show that no one is entirely safe from flood risks. By securing flood insurance and taking proactive protective measures, you can shield your finances and assets from unforeseen disasters – and be prepared no matter what the flood maps say.

If you’re interested in learning more or getting a flood insurance quote, the California Casualty Agency Services team can help. Call 1.877.652.2638 or visit https://www.calcas.com/flood-insurance.

by California Casualty | Auto Insurance Info, Calcas Connection, Good to Know, Helpful Tips |

You’re ready to head home after a night out, but there’s one thing missing: your car. You could have sworn you parked it right here, but it’s no longer there. Vehicle theft can happen anytime, anywhere. When it comes to keeping your car safe, where you park can make all the difference.

Theft by the Numbers

A vehicle is stolen every 32 seconds, according to the National Insurance Crime Bureau. More than a million vehicles are reported stolen each year. California and Colorado have some of the highest number of auto thefts in the country, and of course, urban centers are hotspots for theft. However, thefts happen in the suburbs too, and cars can even be taken from your driveway. In honor of July, National Vehicle Theft Protection Month, we’re taking a look at what you need to know to keep your vehicle safe.

The Worst Places to Park Your Car

Thieves are looking for a chance to steal a car. Don’t give them the opportunity to steal yours. Before you park your car for a short time, or overnight, look around and assess the area for theft potential. Is the area well lit? Are other vehicles parked nearby? Are people around? Is there a security camera or guard? Are there signs of break-ins or damage? All of these can offer clues to an area’s safety.

Avoid empty streets.

Quiet streets and alleyways offer thieves a place to work without interruption. With no one around to witness the theft, they can get in and out quickly with your vehicle.

Avoid poorly lit areas.

Thieves prefer locations where they can work without being seen. Well-lit areas increase their chances of being noticed, while poorly lit and dark locations offer cover.

Avoid high-crime areas.

Do your research before parking in a new place. If the crime rate is high, it’s worth paying for a more secure parking option. High-crime areas aren’t just seedy sections of town. They could be residential neighborhoods that are targeted by thieves.

Avoid empty lots.

You may see lots of cars at office parking lots or at schools. However, when these buildings are not in session, the empty lots provide an easy place for thieves to work. Don’t be tempted to park in an empty lot and put your vehicle at risk.

Avoid remote locations.

Places that are less frequently traveled can be attractive for thieves. Chances are these locations are less often patrolled.

Avoid parking near large vehicles.

Parking your smaller car next to a larger vehicle automatically gives thieves cover. The truck or large car blocks the view so they can work without being easily seen.

How to Protect Your Vehicle

A skilled thief can steal a car in about a minute. However, there are things you can do to make your car seem harder to steal because it will take longer, or they are more likely to get caught.

When parking away from home:

- Park in a garage with security cameras. Park in view of the cameras.

- Be aware of tow truck thieves who come in and tow away your vehicle. When you park, turn your wheel as far to one side as possible. If you have front-wheel drive, park forwards in the spot. For rear wheel drive, back into the spot. This will make it harder to tow your car.

- If you’re parking on the street, choose a busy road where there will be people and other cars the whole time your car will be there.

- Lock your vehicle. The first thing that thieves do is try the doors.

- Hide your valuables out of sight. Even loose change, phone chargers, and other items can tempt thieves to break in.

- Don’t crack your window open on a hot day. An experienced thief can use that to get inside.

- Protect your catalytic converter by etching your VIN onto it.

- Don’t run your car with the keys in it – while you’re somewhere else.

- Keep your registration and insurance in your wallet rather than your glove compartment. That will help prevent the risk of identity theft if your car is stolen.

- Use an anti-theft system. New cars come with one, and you can also add one after market.

When parking at home:

- If you can, park inside your home’s garage. Don’t leave the garage door open. Out of sight is out of mind, and thieves won’t try to steal a car they cannot see.

- Add motion sensor lights to your home and driveway area.

- Don’t leave your key fob in the car. Don’t put it near a door or window inside your home either. Thieves can use the signal to break into your vehicle. Consider keeping keys in a container that doesn’t allow digital signals to pass through.

If your car is stolen, be aware of resources for auto theft victims. Your vehicle is one of your greatest investments. Protect it with the right insurance.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.