by California Casualty | Auto Insurance Info, Homeowners Insurance Info, Safety |

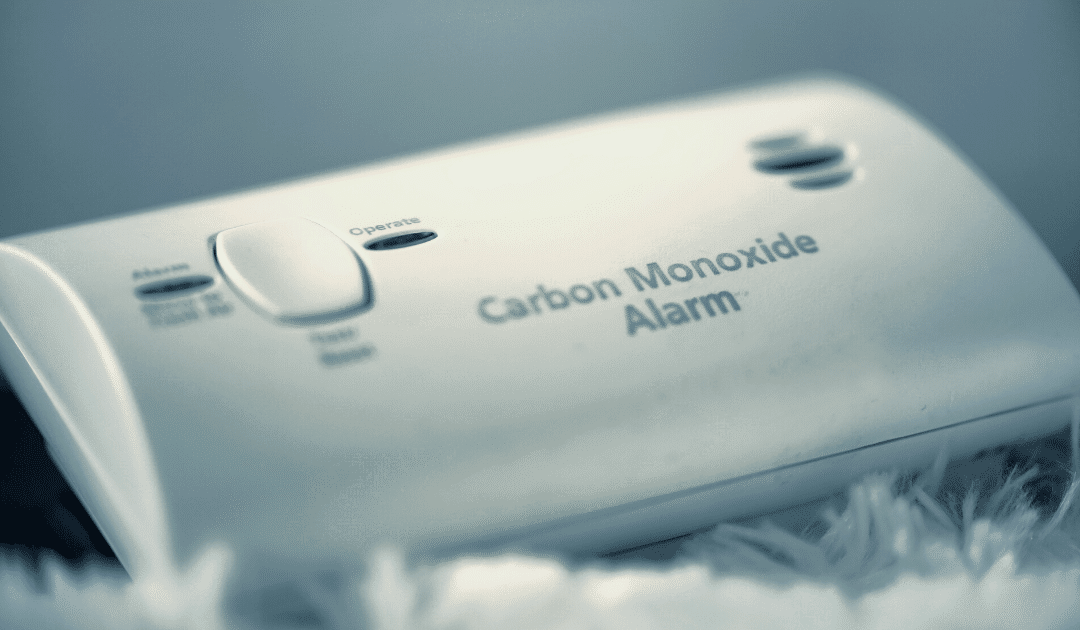

Often called the “silent killer,” carbon monoxide (CO) is an odorless, colorless gas that claims more than 400 American lives each year, sends 20,000 to the emergency room, and hospitalizes more than 4,000.

It is an indiscriminate killer, striking its victims when they’re unaware or asleep. This poisonous gas is produced by burning fuel in vehicles, stoves, lanterns, fireplaces, gas ranges, furnaces small engines, and portable generators. Here are tips for keeping you, your family, and pets safe from it.

Prevention Tips For Your Home

Here are top strategies to prevent an inadvertent CO leak or exposure in your home.

-

- Install at least one battery-operated or battery back-up CO detector on each floor of your home, including the basement and garage (if it’s attached). Detectors on your main floors should be inside or directly outside the bedroom or sleeping areas.

- Test your alarm(s) monthly, replace batteries every six months and replace the units themselves every five years.

- Maintain yearly inspection schedules for your heating system, furnace, water heater, fireplace, chimney, and any other gas or coal-burning appliances.

- When buying gas appliances, only buy those carrying the seal of a national testing agency.

- Make sure all gas appliances are vented properly.

- Never burn charcoal or use a generator or portable gas camp stove indoors.

- If you smell an odor coming from your gas refrigerator, have an expert check it – the odor could indicate it’s leaking CO.

Prevention Tips for Your Car

Your vehicle actively produces CO every time you start the engine, so do the following to stay safe.

-

- Take your vehicle to a trusted mechanic yearly for an exhaust system check. Small leaks can cause CO buildup inside your car.

- Do not run your vehicle inside an attached garage, even with the garage door open.

- If your car has a tailgate, make sure you open vents or windows anytime you open the tailgate while the engine is running – if you open only the tailgate, CO fumes will be pulled into the passenger area.

Symptoms of CO Poisoning

It’s important to know that symptoms can vary in terms of severity, and often mild symptoms are mistaken for the flu (although without fever).

-

- Low to moderate poisoning results in:

- Fatigue

- Headache

- Nausea

- Dizziness

- High-level poisoning results in:

- Confusion

- Vomiting

- Loss of muscular coordination

- Loss of consciousness

- Ultimately death

If you or a family member are experiencing any of these symptoms get outside to fresh air immediately then call 911.

When Your Carbon Monoxide Alarm Sounds

First off, you should know – from regular testing – what the different beep sequences and alarm sounds mean. For instance, there may be different beep patterns indicating low batteries, a detector that needs to be replaced, and a true CO emergency. When you hear the CO emergency signal:

- Do not try to find the source of the leak – instead, immediately move outside to fresh air.

- Call 911, emergency services, or the fire department.

- Do a headcount for all family members and pets (do you have a family emergency plan in place?)

- Do not re-enter your home until emergency responders have given word that it’s safe to do so.

When it comes to carbon monoxide poisoning, it’s best to err on the side of abundant caution. A person can be poisoned by a small amount of the gas over a long period of time, or by a large amount during a short time. The measures above should keep both your indoor air quality and your family safe and healthy.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Safety |

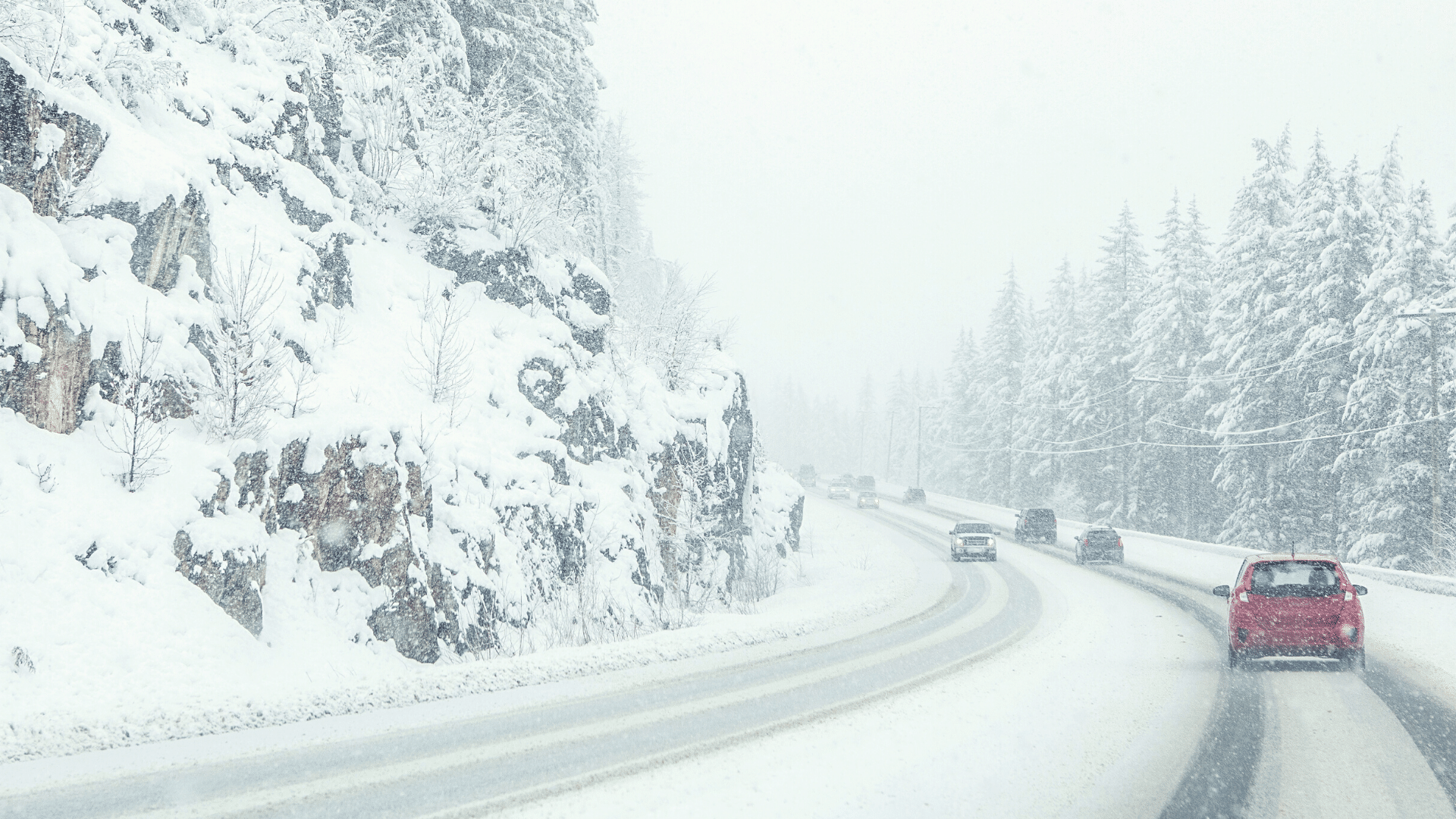

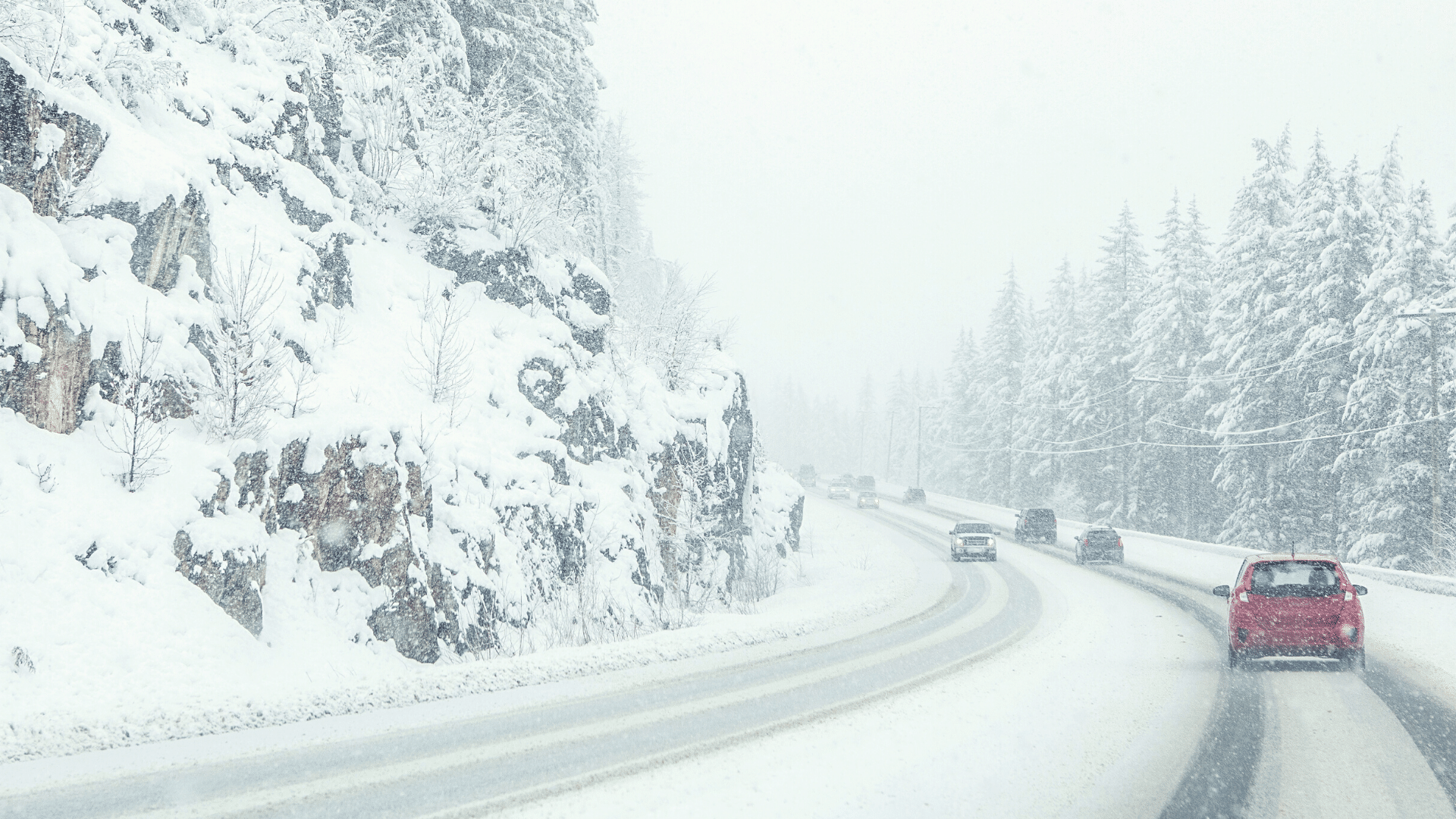

There’s never a good time for severe weather to hit, but among the worst is when you’re on the road. A sudden snowstorm can quickly impair your visibility, make road conditions extremely dangerous, and affect how your car handles.

Stay safe on wintertime roads with these tips for driving in snow, whiteouts, and on ice.

First, some general winter-weather rules of thumb

The below apply to all bad weather driving scenarios.

-

- Make sure your tires have plenty of tread before winter weather hits – or better yet, install winter tires.

- Check the weather before you leave the house; if it’s too bad, wait it out.

- Clear all snow, ice, and dirt from windows, windshield, brakes, and all other lights before leaving your driveway.

- Drive slowly the entire time while on the road (the more dangerous conditions, the slower).

- Drive smoothly, avoiding sudden movements on the steering wheel, brakes, and control panels.

Driving in Snow

The quality of snow in a snowstorm can vary widely, depending on wind speed and direction, moisture levels and more. The snow might be slushy or dry, sparse or voluminous, and it might be falling straight down or at a sharp angle. All of these variables affect how you should proceed on the road, but the following will keep you safer across many conditions.

-

- Go slow – Increase your following distance to at least 8-10 seconds.

- Be hyper-aware of your surroundings – Vigilance on the road will help you avoid snow dangers and also spot (and get out of the way of) out-of-control drivers who are sliding your way.

- Don’t use cruise control – It’s important that you’re paying close attention and that you’re able to react to road conditions quickly.

- Use your headlights – Make sure your headlights are on (no matter the time of day), and that they’re on dim and not high. This will help your visibility and also help other drivers see you.

- Adjust how you brake – If you’re coming up on a stop sign or signal, come to a stop slowly (that extra following distance comes in handy here). Don’t slam on your brakes, as this can put you into a skid. If you have anti-lock or ABS brakes make sure you’re comfortable with how they work in all weather conditions, including snow.

- Know when and how to stop – Don’t stop if you don’t have to (starting again can be dangerous and difficult), and never stop on a hill. If you must stop, remember it takes vehicles longer to come to a stop in snowy conditions.

- Drive in the tracks of the car in front of you – This will make it easier to control your vehicle.

Driving in Whiteout Conditions

Whiteouts may be one of the most dangerous of snowy conditions. Here’s how to handle it if you find yourself in one.

-

- Remain calm – This is harder said than done but trying to remain calm will help you avoid over-reacting or making poor decisions.

- Slow WAY down – The most dangerous thing about a whiteout is the sudden loss of visibility. Slowing down will give you time to see what other drivers are doing and have time to react if an accident or other emergency happens right in front of you.

- Make yourself visible to other drivers – Just as you can’t see other drivers, they can’t see you. Make yourself as visible as possible by turning on your headlights (fog lights are best if you have them), and perhaps even your hazards. You can even use hand signals out the window if you need to.

- Wait out the whiteout – If visibility drops to zero and you feel unsafe, look to the nearest exit and pull off. From there, find a shoulder to pull over on. If there are no exits on your stretch of highway, pull to the side of the road, turn on your hazards, and wait out the storm.

Driving in Ice

Besides the snow you can see, there may be ice that you can’t. Notoriously hard to see, black ice acts as a glaze that coats surfaces and makes them extremely slippery and dangerous. When driving, you’ll want to be on the lookout – and ready – for it on all roads, but especially bridges, overpasses, tunnels, roads beneath overpasses, and at the bottom of hills. Check out our tips for spotting and safely negotiating black ice here.

When it comes to the downsides of winter, hazardous driving situations are among the top. But between staying off the road when possible, and taking precautions when you do have to drive, you can keep yourself, your family, and other drivers safer.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

We have amazing employees at California Casualty. The Employee Spotlight is a new series aiming to highlight those talented individuals that make up our successful company culture and community. From human resource recruiters and learning and development trainers to claims adjusters, marketers, customer support specialists, partner relations, sales representatives, and beyond; each week, we’ll highlight a new team member, so you can get to know us better and see how our employees make us who we are as a company.

This edition of the Employee Spotlight will feature Field Marketing Manager, Nina Ericksen

Nina has been with us for 9 years and works remotely for our Partner Relations team.

Let’s get to know Nina!

What made you want to work as a Field Marketing Manager for California Casualty?

I had worked as an Account Manager in the financial services field for 20 years. I loved the work but did not like the volatility of the industry.

California Casualty gave me the work I love in a stable environment.

What is your favorite part about your job?

Without a doubt, the relationships with my leadership team is my favorite part of the job. It never feels like work when you are spending time with people who are friends.

I love my job at CalCas because I work with some of the best people I know both inside and outside of the company. I feel proud of the way we help and support members of the community that are in the business of giving to others every day.

What have you learned in your position at California Casualty?

The most useful information I have learned about myself in my position is to never lose hope or allow yourself to be defeated. Just wake up every morning and show up, put one foot in front of the other, and before you know it you have achieved what may not have seemed possible!

What are your favorite activities to do outside of the office?

I love spending time in my off-hours with my two granddaughters, aged 6 and 1. They are the lights of my life.

I also spend as much time as possible at the beach and taking my dog, Luke, for walks.

Anything else you would like the audience to know about you?

Here are some fun facts about myself:

-

- I grew up in Central New York State.

- I met my husband while he was cutting my hair.

- I was in musical theater in High School.

- I am deathly allergic to Kiwi.

- Old movies, especially film noir, are my jam.

If you want to learn more about Nina or are interested in a career at California Casualty, connect with her on LinkedIn! Or visit our careers page at https://www.calcas.com/careers

by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

The same winter wonderland scene that gives us soft snowdrifts outside cozy living rooms can also serve up treacherous blizzards, freezes, and black ice.

Contrary to its name, black ice is actually clear and forms a frozen “glaze” that coats all kinds of surfaces and can cause slips, falls, and car accidents. It’s incredibly dangerous not only because of how slippery it is but also because it’s so hard to spot. Transparent and thin, it can hide in plain sight.

It frequently occurs on roads, sidewalks, porches, pathways, and driveways – in other words, surfaces we frequent to get where we’re going every day. Here are some ways to stay safe at home and on the road when conditions are ripe for black ice.

At Home

Besides your driveway, you probably have paved walkways or other hard-surfaced paths around your home. These tips will help reduce injury risk when ice is underfoot, and before it forms.

-

- Unblock drains and gutters. This will help melting snow and ice go where you want it to, so it doesn’t freeze on walkways.

- Keep up with snow shoveling. Make sure to keep up with falling snow so that it doesn’t melt and refreeze into a slipping hazard.

- Put out a tarp. If freezing temps are on their way, lay out a tarp or cloth where you want to prevent black ice. This can include your car, porch, pathways, and the driveway.

- Add some grit. You can sprinkle fine gravel, sand, kitty litter, wood ash or coffee grinds on surfaces to reduce slickness. A note of caution that some work better than others and some can leave a mess.

- Consider a snow-melting mat. If you deal with freezing temps very often, you might want to look into heated driveway mats, which can be effective at preventing black ice formation.

- During icy conditions

- Clear out the snow. If snow has fallen, clear it out so the sun can dry the surface rather than melt the snow into ice.

- Consider a de-icer. Use these with caution though (and probably as a last resort), as some can be harmful to pets, your yard, driveway, and the environment. Try not to over-salt, either, for the same reasons.

In the Car

When temps are at or below freezing, avoid driving if you can. But if you have to get on the road, keep these precautions in mind.

-

- Check the tires. Tires are the only part of your car that touches the road. The less tread, the less traction. If they’re getting worn, replace them asap. Better yet, get winter tires.

- Know your brakes. Standard brakes perform differently from anti-lock, or ABS, brakes, so make sure you know what kind you have and how they behave in snowy, icy, and other hazardous road conditions.

- Do a winter safety check. Make sure your vehicle is prepped for winter safety (and stranding as a worst-case scenario!) – follow our tips here.

- Double-check your car kit. All it takes is one small patch of black ice to cause a slide that lands you immobile on the roadside. Check that your emergency winter car kit contains everything you need.

- Warm-up your car. Let your car warm up before getting on the road. When you feel the heat coming through the vents, it’s sufficiently warmed and ready to go.

- Improve your visibility. Make sure you set out with 100% visibility. If your windshield is foggy inside or iced over on the outside, use our tips here to get it cleaned off and clear.

- Take your time. Give yourself extra time to get where you’re going and be sure to drive much slower than you normally would – this will give you and other drivers more time to react if you need to.

- Slow down and increase following distance. Give yourself and other drivers more room than normal – and never tailgate.

- Know what to do in a skid. If your car goes into a skid, do not hit the accelerator or the brakes. Instead, steer gently in the direction of the skid, making sure not to jerk the steering wheel. Get the full step-by-step info here.

Your best bet against injuries caused by black ice is to use an abundance of caution, make prevention a habit and develop a “sixth sense” for spotting this wintertime danger. Stay safe out there!

This article is furnished by California Casualty. We specialize in providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Safety, Travel |

The holidays are HERE, and unfortunately so is the holiday traffic. As millions hit the road to travel near and far this holiday season roadways will quickly become overly congested, traffic delays more frequent, and holiday road rage will start to set in for many drivers.

If you are like the thousands of Americans hitting the road this season, follow our holiday traffic safety tips below.

1.Plan Head

Before you hit the road make sure your vehicle is properly maintained and ready for the trip. Plan out your route ahead of time, and if it’s possible, avoid driving through areas you know will be jammed with holiday traffic. Before you head out it’s also a good idea to check the forecast and plan ahead for inclement weather. Don’t forget to pack your emergency car kit!

The more traffic, the higher the chance for an accident. It’s important not only to drive safely, but also to keep an eye on other drivers. In holiday traffic jams always expect the unexpected, watch for drivers cutting you off, slamming on their breaks, speeding up and slowing down, etc. Be prepared for anything, and always stay attentive behind the wheel.

3. Avoid Distractions

Distracted driving causes thousands of fatal traffic accidents every single year. Add in holiday traffic and distracted driving becomes even more dangerous and deadly. We know it can be hard to avoid common distractions like your phone, especially when you are driving long distances by yourself, but it’s important for your safety that you keep your eyes on the road and your hands on the wheel at all times.

4. Keep Your Cool

If someone makes a decision that makes you angry when you are driving, try not to let it affect you. This may be hard, but getting angry doesn’t solve anything. Road rage is a form of distracted driving because you cannot think clearly. If you start to feel yourself becoming angry or anxious try listening to music, taking deep breaths, and remember there is nothing you can do about other driver’s decisions or to make traffic move quicker- so stay calm.

5. Watch for Animals

Deer move with cold fronts. This means as the temperature continues to drop and as we get closer to the end of the year, the likelihood of seeing or hitting a deer increases. Hitting a deer, or any other animal, can total your vehicle, hinder your plans, and even cause serious injury (or death). Stay alert and watch for animals, especially if you choose to travel in rural areas at night.

If you plan on making multiple stops or staying at any hotels during your trip, be sure to follow our Traveling Safely During the Pandemic guide.

Safe travels and Happy Holidays! 🙂

This article is furnished by California Casualty. We specialize in providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

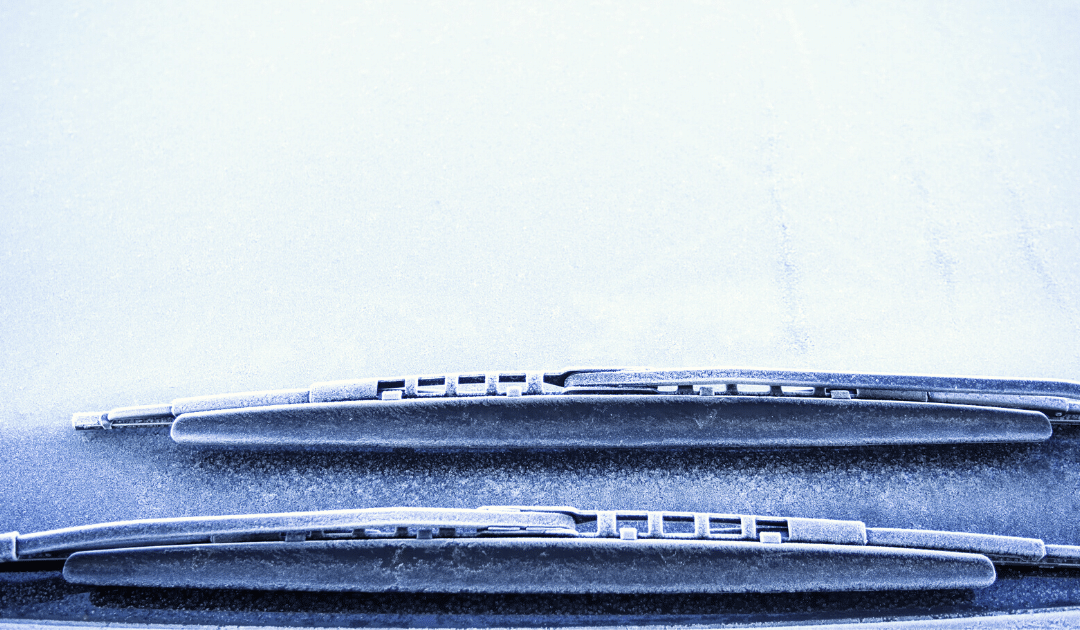

What’s makes a hectic, rushed morning even worse? Coming outside to find your windshield frosted over.

Get on the road quickly and safely by using one or more of these defrosting hacks. We’ve also included “don’ts” for each one to help you get precious morning minutes back and prevent damage to your windshield.

Remove the Bulk of Ice

DO use a soft brush or ice scraper to remove caked ice on your windshield. Choose a scraper made of plastic.

DON’T use a metal scraper, key or spatula. Metal items or those not specifically made for windshields may scratch, cut or damage the glass.

Do a Slow Warm

DO start your car and turn on the defroster. Depending on how cold it is, defrosting may take anywhere from 5 to 15 minutes. This will melt any remaining ice and also defog the inside of the glass. You can also turn the heater onto its highest setting to absorb excess moisture from the cab.

DON’T use other heat sources such as a hairdryer or portable heater. Rushing the heating process can easily crack glass as it goes from cold to hot quickly. Your defroster is calibrated for safe heating.

Turn on the A/C

DO turn on your air conditioning. Even though this seems counterintuitive, the A/C function will help dry the air, which is especially helpful when it’s rainy outside. And yes, you can use your heater and A/C at the same time.

DON’T turn on the air recirculation button. Winter air is typically dry, so you’ll want to pull in fresh outside air when defrosting to replace the more humid air inside the vehicle.

Use Water

DO pour cold to lukewarm water on the windshield to help the defrost process along. You can also do this to any frozen-over door handles.

DON’T pour hot water onto a frosty or icy windshield. Just as with other heat sources, this can crack the glass.

Use a De-Icing Solution

DO use a DIY or store-bought spray to de-ice your windshield if you’d rather not scrape. If making your own, mix two parts rubbing (or isopropyl) alcohol with one part water in a spray bottle and spray over the ice. You can keep this solution in your car, as alcohol won’t freeze until about -128 deg F.

DON’T use hot water in the solution.

Frosted windshields are one of winter’s annoying inconveniences, but unfortunately aren’t going anywhere anytime soon. To make sure they don’t ruin your day, use the tips above and remember to not rush them or take shortcuts – taking a couple of extra minutes will keep you and your windshield safe.

This article is furnished by California Casualty. We specialize in providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.