by California Casualty | Auto Insurance Info |

The end of the school year is in sight!

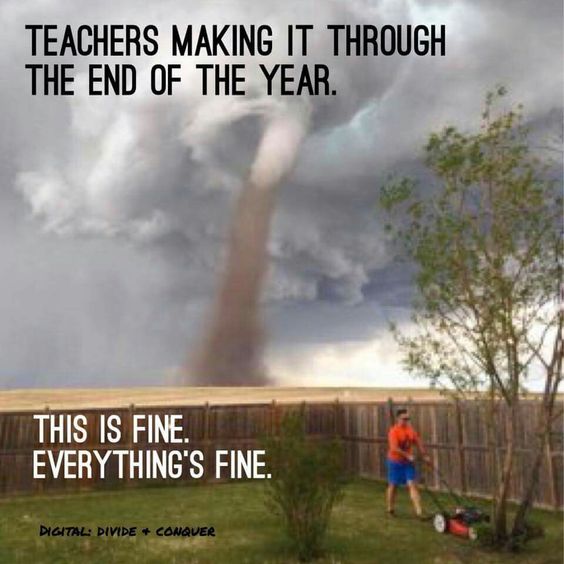

Here’s how educators are feeling right around this time of year.

During those last few weeks in May…

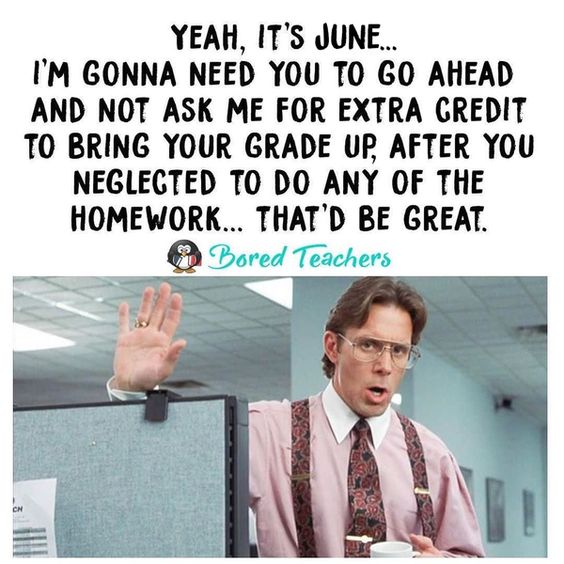

And when June finally rolls around…

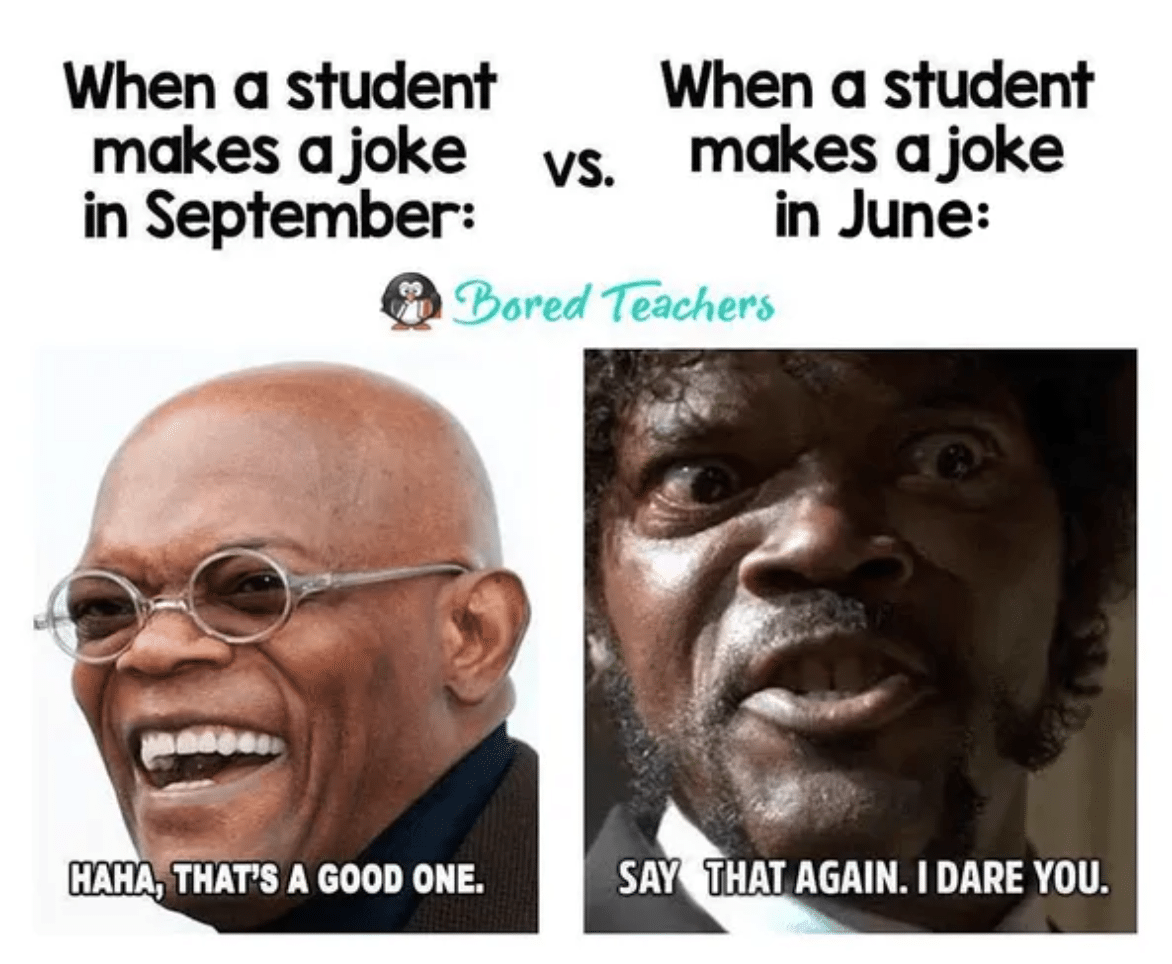

Don’t get us wrong, there are still some bright points.

But at the end of the last day…

And then it’s sweet, sweet SUMMERTIME!

For more memes visit our “Teachers: End of the Year Memes” board on Pinterest!

Don’t forget to give us a follow at California Casualty to stay up to date on every new meme we discover! Scan our Pincode with your Pinterest camera to follow:

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. California Casualty does not own any of the photos in this post, all are sources by to their original owners. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

A tire blowout is a rapid loss of air that causes your vehicle to lose control. It’s a dangerous surprise that can happen anytime your car is in motion. If you are driving down the road and suddenly hear a loud POP or THUD and feel your car begin to jerk or pull to the side, odds are you have just experienced a blowout.

Tire blowouts can be frightening, especially for young or inexperienced drivers, and can cause you to feel like you’re losing control of your vehicle. Blowouts cause 78,000 crashes a year, so keeping your cool and knowing how to proceed after a blowout is vital.

Here’s what to do if a blowout happens to you.

Step 1: Don’t panic. The most important thing you can do during a blowout is to stay calm. Don’t try to immediately overcorrect or press on your brakes- this could cause you to lose even more control.

Step 2: Grip the steering wheel firmly. Keep both hands on the steering wheel and keep the car moving forward in a straight line. You may feel the need to try and steer off to the side of the road or overcorrect if it starts to fishtail- don’t. To avoid an accident keep the car as straight as you can.

Step 3: Tap your gas pedal. If you are trying to regain control of your vehicle, accelerating lightly will help you because you are keeping your forward momentum. Braking immediately will only cause the car to become harder to control and could lead to an accident. Gently press the gas pedal and adjust to how the car moves. Once you’ve regained full control, slowly remove your foot from the accelerator and let the car slow.

Step 4: Brake Slowly. When your speedometer reads 30mph, it’s safe to slowly begin braking. After you have slowed enough to begin hitting your breaks it is safe to steer the vehicle into the rightmost lane or shoulder of the road (if possible). Continue braking steadily until your car stops completely.

Step 5: Put on your hazards. Put it in park and turn on hazard lights or put out reflective triangles and collect yourself. If you are still in the middle of the road, you should exit your vehicle and get to safety- out of the way of a collision.

Step 6: Change your tire or call roadside assistance. If you can safely change your tire and there is no damage done to your rim, now is the time to do so. If you cannot safely change your tire or don’t have a spare call for roadside assistance.

How to Avoid a Future Blowout.

A tire blowout may happen due to a number of circumstances: underinflation, too much weight in the vehicle, hitting a pothole or other debris, and even over-wear.

To avoid a future blowout, try to miss potholes & debris- when you can safely do so- and make sure to maintain your tires. You can do this by routinely checking your tire pressure, monitoring your tires for wear and tear (even small cuts and other minor defects can lead to a blowout), and most importantly keeping up with getting new tires.

New tires can generally last you anywhere from 25,000 to 50,000 miles. You will want to refer to your owner’s manual for recommendations on what tires you can put on your vehicle and their lifespan. A great way to keep your tires in check is to monitor their tread. You can do this by using the quarter test. If you are unfamiliar with the quarter test, here’s how it works- place a quarter in the center of the tread (thickest part of the tire), with the head facing you, in a new tire the quarter will easily fit and you should be unable to see the hair on the top of the head. If the hair is partially visible, you should think about replacing the tires. If you can see the very top of the head, the tires need to be replaced right away.

What About Insurance?

So, are you covered if you experience a tire blowout? Your auto insurance policy may cover sudden or accidental damage to your tires, like a blowout, depending on your policy.

Before an unexpected blowout happens to you make sure you’re covered. Check with your auto insurance provider or call in to review your policy.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

Do you have a car loan? If so, welcome to the (big) club! – Americans owe a collective $1.3 trillion in auto loan debt. Yikes!

If you’re like most others, you’re probably wondering how you can pay your loan off faster. Below are some strategies, tips, and tricks to help you get to the finish line sooner rather than later. The best thing is, you can start on all the below right away!

- See if there’s a prepayment penalty – Some lenders disincentivize early payoff (because they want the interest) by including this penalty in your loan terms. If yours includes this, you’ll need to do some calculations comparing which method will be wiser: pay off early with the penalty or pay off over time as normal (with the interest).

- Consider refinancing – If your loan has a high-interest rate, shop around for other loan options. These could include your bank, a different bank, a credit union or even a credit card with a good transfer option. If your credit score has improved since your original loan, you’ll probably be able to get a better deal. Go for a shorter loan term rather than a long one – the goal is to pay it off quickly.

- Round up – This is an easy and relatively painless way to start knocking down the debt when your budget doesn’t have a ton of wiggle room. The idea is to round up your regular payments as much as you can afford. If your payments are $350, round up to $400. Over time, those extra dollars add up.

- Cancel the extras – When you first took out your loan (especially if you did so through a dealership), you may have added on some extras such as service contracts, GAP (or Guaranteed Asset Protection) waivers, extended warranties, service contracts or warranties for tires and wheels. Unless these are truly useful, consider canceling them.

- Make bi-weekly payments – If you usually pay monthly, you can play a mental trick on yourself to make a good dent on your loan. Split your normal monthly payment in half and make that payment every two weeks.

- Use a windfall – Windfalls are an excellent strategy to pay off debt, invest, make IRA contributions or enable purchases that seem out of reach. If your car loan is priority, use any unexpected influx – from a tax return, work bonus, cash gift, etc. – and put a chunk down on your loan. Check to make sure any extra payment you send will go to reducing the principal, instead of toward interest or other fees.

- Start a side hustle – This could be short-term or temporary, but earning extra income is a great way to pay off part or all of your loan balance in a fairly short amount of time. Even just a few weeks or months could do the trick.

- Consider selling your car – If you owe a lot on your vehicle or circumstances (such as financial, family or commute) have changed significantly, you may want to consider selling your vehicle and getting a more affordable one instead.

- Pare down expenses – A great rule for ongoing financial health is to do regular budget checks. If you haven’t done so in a while, check out our guide and see where you can free up cash to put towards paying off your loan.

- Snowball your payments – “Snowballing” is a debt paydown strategy that goes like this. First, rank your loans/debts from lowest to highest. Then, focus on the smallest loan, paying it off as quickly as possible while making the minimum payments on the rest. Once it’s paid off (and after you’ve done a happy dance), start the process again, using the “extra” money you would have been paying to that first loan and applying it to the next.

If you’ve read this far, congrats on taking the first step to pay your loan off faster! Your two most important tools in reaching your goal are having a plan and having the discipline to execute on it. These actions will not only get you your pink slip faster but also decrease the amount of interest you’ll pay over the life of the loan. Get started today – you can do it!

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

Umbrella Insurance, sometimes called “personal umbrella insurance”, is a type of personal liability insurance that provides an extra layer of affordable liability protection in the event of an accident.

Adding Umbrella Insurance protects you and your family by covering additional damage costs that extend beyond the limits of your homeowner’s, auto, or watercraft policies. This additional coverage ensures your personal assets are safe.

Considering adding an Umbrella Insurance policy? Here are some answers to frequently asked questions.

What does it cover?

The primary purpose of this coverage is to protect you if you’re found liable for causing bodily injury to others or damage to their property. It also protects against incidents involving slander, libel, false arrest, and invasion of privacy, as well as any legal defense costs – even if you’re not found liable. It protects not just you as a policyholder, but also other family members within your household.

What does it not cover?

Umbrella insurance does not cover damage to your own property, nor does it cover any deliberate damage to others’ property caused by anyone on the policy.

How does it work?

Think of it as a “supplement” to your core coverage. Let’s say you have liability limits of $250,000 through your auto and homeowners insurance and you’re sued for $1,000,000. The umbrella insurance would kick in after legal fees and costs exceed $250,000 – which can happen staggeringly quickly – protecting you against having to pay the remaining amount out of pocket.

How do you know if you need it?

You might need an umbrella policy if you: own a car, own a home, want to protect your assets against a lawsuit or judgment, or want to protect your retirement savings or future earnings. Accidents happen every day – umbrella insurance is an affordable way to protect the assets that you’ve worked hard to acquire.

How much does it cost?

For the amount of protection it offers, liability insurance is surprisingly affordable. The decision on whether or not to get it calls for weighing the risk of what you stand to lose – current assets as well as the potential loss of future income or earnings. It’s especially affordable if you already have a policy with the same insurance company. Are you already a California Casualty member? Call us for an Umbrella Insurance quote today!

Does it cover car rentals?

Your automobile policy is the primary coverage for any damage or injuries you might cause while driving a rental car. However, if the cost of damage or any lawsuit fees is greater than your auto insurance liability limits, that’s when umbrella insurance protection would provide you further protection.

Does it cover rental property?

If you’re a renter and have renters insurance, an umbrella policy can extend your liability protection beyond the limits of your primary policy. If you’re a landlord, this coverage can help protect you from lawsuits by tenants, their guests, or other third parties.

If you are still on the fence about Umbrella Insurance, here’s what you can do. Add the value of your home, significant assets, and any investment portfolios or retirement savings accounts, and determine how much liability coverage you have from your home and auto policies. Do your current policies cover your assets?

If the answer is no, it may be time to consider an Umbrella Insurance Policy.

Find out more about what we have to offer by calling us at 877.652.2638, or email us at [email protected].

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

There’s nothing quite like that new car feeling. If you’re going into the new year with a new ride, you can take steps to make sure it runs and looks great for years to come. By maintaining the interior, exterior, and engine, you’ll not only keep it looking new, but also ensure that it’s safer on the road, costs you less in repairs, performs optimally, and holds its resale value.

Here are 30 quick tips to keep your car ageless.

Protect the Interior

1. Use windshield screens to protect your interior from UV rays and to keep internal temperatures down (direct light and high temps dry out and fade interiors fast!).

2. Regularly run your A/C to keep it in top working condition – 10 mins every week should do the trick. Same for the defroster.

3. Have a trash receptacle in the car, which can help prevent stains, spills, and loose trash.

4. Clean the interior – seats, dash, carpets, door panels – at least once a month.

5. Vacuum weekly, using a handheld vac with an attachment.

6. Although sometimes difficult at the beginning, but makes a huge difference over time: try implementing a rule of banning greasy, oily, creamy, or crumbly foods from the car.

7. Replace any floormats that are wearing through – as soon as holes form, your carpet underneath is at risk of damage.

8. Remove stains immediately – don’t wait! The sooner you get to them, the easier they come out.

9. Get your A/C serviced after several years – when not checked, it can cause a moldy smell that settles into your car’s upholstery for good.

10. Apply protective conditioners to leather and vinyl seats and the dash to keep them protected from sun exposure. Think of them as sunscreen for your car.

Don’t Forget the Exterior

11. Wash your car weekly to rid it of dust, mud, and dirt. Go to your local car wash or, if washing at home, only use cleaners formulated for cars.

12. Wax at least twice a year – not only does this keep your ride shiny but it helps protect your paint from UV rays.

13. Repair windshield chips immediately. Waiting can give them time to spread, causing unsafe conditions and requiring a more expensive windshield repair.

14. Only use microfiber towels on your car’s interior and exterior. Other fibers, as well as paper towels, may scratch or damage surfaces.

15. Garage (or cover) your car if possible. This keeps it safe from UV rays, the errant baseball, bird droppings (which can etch paint), car thieves, and a host of other risks.

16. If you can, get professional detailing done annually. The pros do an amazing job and, over time, regular detailing boosts your vehicle’s resale value.

17. Check tire pressure monthly and adjust as needed according to the PSI listed in your owner’s manual. Under- and over-inflated tires increase your chances of a roadside emergency. While you’re checking pressure, inspect tires for bulges, cracks, and other damage.

18. Get tires rotated and have the alignment checked on schedule.

19. Clear leaves and other debris from the windshield exterior grill so as to not clog up the A/C system.

20. Touch up paint chips to discourage rusting.

21. Use a clay bar to get rid of road debris that doesn’t come off with washings.

22. Only use window cleaners that are safe for car windows – only vinegar mixes or special car formulas, nothing ammonia-based. And use microfiber towels rather than paper ones.

Maintain the Engine

23. Stick to your service schedule – trusted mechanics know what to do at the right time.

24. Keep revs under 3,000 – this will keep your piston rings happy and healthy.

25. If your check engine light comes on, get it checked! Most of the time, it’s something insignificant, but other times could signal a major problem.

26. Check oil regularly, even if you get it serviced professionally. Oil is your car’s lifeblood – best to err on the side of checking too often.

27. Drive your vehicle regularly – it keeps the battery charged and the fluids circulating. Start it at least once or twice a week and leave the engine running for 20 to 30 minutes to power the battery.

Don’t Forget To:

28. Get to know your owner’s manual. Know what the indicator lights mean, look at the maintenance schedules, know what kind of oil is recommended, and memorize your tire PSI.

29. Get fixes done sooner rather than later. Procrastinating on car repairs or service can multiply problems later on.

30. Make a habit of doing a visual check of your car each time you approach to get in. Whether it’s a low tire, a ding, or a back-up hazard, knowing what’s going on with your car at all times gives you the info needed to plan and act.

The more TLC you give your car, the more rewards you’ll reap in terms of safety, cost savings over time, and a steady resale value. Plus, there’s that “proud parent” feeling of having a car that both runs and looks great for years on end!

Now that you know everything to do to keep your car in tip-top condition, check out what you definitely shouldn’t do. Here are the10 Worst Things You Can Do To Your Car.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Consider This |

It’s officially pothole season.

Potholes can pop up on roadways during any season, but why do they seem so prevalent during the first few months of the year?

When winter is ending and spring is on the horizon, the weather is constantly fluctuating between mild and freezing temperatures. Rain, snow, and ice get into smaller holes and cracks in the pavement, and as the temperature jumps back and forth from high to low, the precipitation continually freezes and thaws expanding those pavement cracks causing others to form. As cars and heavy trucks drive over them, the asphalt chips away, thus creating potholes.

Potholes, no matter how small, can wreak havoc on your entire vehicle. Here are 5 ways hitting a pothole can cause damage.

1. Steering & Suspension

Your vehicle’s suspension absorbs bumps so you can’t feel them when you drive. If you cause enough wear and tear on your suspension system, it could result in a number of problems with your steering, including: vibrations, noises when you turn, vehicle pulling to one side, etc.

2. Undercarriage

Vehicles that ride lower to the ground have a better chance of being damaged by a pothole. They can cause scratches and scrapes, that aren’t dangerous until they start to rust or leak. They can also rip off low-hanging bumpers.

3. Tires & Wheels

It’s no secret that debris from potholes can cause holes, leaks, and tears in your tire, but when you hit a pothole fast enough, it can also cause a complete tire blowout. Potholes can also damage your wheels by bending or cracking your rim. And if there is visible damage, you’ll likely have to replace the entire wheel.

4. Body & Exhaust System

Pavement debris and rocks can scratch the paint on your vehicle and cause rips and leaks in your exhaust pipes, muffler, and catalytic converter. If your exhaust pipes have been damaged, it can be a serious issue. Ripped pipes can leak exhaust fumes into the cabin of your vehicle and cause serious health issues (including death). If you hear a strange noise or lose power after hitting a pothole, there is a good chance your exhaust pipes have been damaged and you need to pull over.

5. Loss of Control

Lastly, one of the most dangerous consequences of hitting a pothole is that it could cause you to lose control of your vehicle. Losing control for even a few seconds, could not only cause damage to your vehicle, but could also be deadly for you and your passengers. That is why it is important to watch the road for potholes when you drive and try and avoid them.

Potholes are extremely dangerous for you and your vehicle, but sometimes accidents do happen.

So, what if you accidentally hit a pothole, is damage done to your vehicle covered by insurance? Typically pothole damage is covered if you have collision insurance. If you aren’t sure, call your agent and review your coverage today.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.