by California Casualty | Safety |

In 2018, the U.S. Coast Guard counted 4,145 recreational boating accidents that caused 633 deaths. That’s a fatality rate of 5.3 deaths per 100,000 recreational vehicles. There were also just over 2,500 injuries and about $46 million dollars of property damage.

The weather’s beautiful. Your boat’s ready. The rivers, lakes, and shores are calling. We get it! But here’s a reminder to keep safety top of mind while enjoying excursions with friends and family.

Here are the top 6 causes of boating accidents, as reported by the U.S. Coast Guard.

- Alcohol

By far, the leading known contributor to accidents is alcohol use, which contributed to 19 percent of deaths. Remember that blood alcohol content laws are the same for drivers of cars and boats. Underage drinking laws and penalties also still apply. Alcohol use while boating can lead to reckless boating, excessive speed, and other avoidable risks.

- Operator Inattention

The boating vibe is definitely one of relaxation and fun. But it’s imperative that drivers remain attentive to their surroundings. Rocks, swimmers, submerged trees, floating debris, other watercraft and changing weather can quickly turn conditions hazardous.

- Improper Lookout

Besides the driver, every vessel must have an appointed lookout — someone who monitors for boat traffic; nearby vessels; and risks of collision, stranding and grounding. If anyone in the group is doing water sports, the lookout must alert nearby boats that someone’s in the water. Accidents in this category were due to there being no designated lookout or the lookout was not doing their job. For every boat trip, make sure you appoint someone and that they understand and fulfill their duties.

- Operator Inexperience

Safely operating a boat is not only about knowing how to drive and handle that specific vessel, but also knowing the relevant boating laws and regulations (including locale-specific rules). Boater education classes are a great first step to gain experience and know-how. Anyone driving a boat must also know how to handle emergency situations.

- Equipment Failure

Just as with cars, boats need regular maintenance, repairs, and upkeep. Make sure your boat is “water-ready” before taking it out for the season. This includes the engine and mechanical parts, as well as life preservers, flares, navigation lights, and other safety items. Do a test run of the safety equipment so you don’t have an unexpected failure out on the water.

- Excessive Speed

High speeds make debris, hazards, swimmers and other boats harder to see, and decreases reaction time. Be mindful of posted speed limits and speed laws, which should be followed at all times. Also, inexperienced drivers sometimes forget that boats don’t have brakes like cars, which can get them into trouble quickly in an emergency or unexpected situation.

Some Final Reminders…

Although related to the above top causes, we’d be remiss if we didn’t mention the following 4 boating risks to keep in mind.

-

- Busy Summer Days — Beautiful weather translates to crowded waters. More traffic means the driver and lookout must remain vigilant and attentive to hazards.

- Reckless Boating — This encompasses any risky or unsafe driving behavior, and exponentially increases with alcohol consumption and/or operator inattention and inexperience.

- Weather Conditions — Inclement weather such as strong winds, heavy rain, or sudden lightning is a hazard in itself but can also cause swells and large waves that threaten to capsize boats.

- Hydration —It’s easy to become dehydrated when out in the sun and the elements — and paradoxically, when surrounded by water. Remember to always have enough water on board and hydrate, hydrate, hydrate!

Many crashes can be avoided by knowing the risks and following safety guidelines. With precautions in place, you’ll have peace of mind to enjoy those beautiful summer days and sunsets on the water.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Pets, Safety |

It’s that time of year again — time to light up the grill, gather family and friends and celebrate American Independence. If yours, your neighborhood’s or your city’s plans include fireworks, then there’s one group that won’t necessarily be in a celebratory mood: household pets.

Every year, July 5th is the busiest day at animal shelters across the country. They receive an influx of dogs and cats who fled their homes the night before, trying to escape the sound and explosions of fireworks. When scared and pumping adrenaline, pets can scale high fences and break loose from leashes and chains.

If your pet is scared of loud noises, take these precautions to ensure that they stay safe and sound this July 4th.

Before the Holiday

-

- If your pet is especially nervous, consult your veterinarian about tranquilizers or drugs that can help with anxiety. Talk with them about giving a “practice” dose of medication before the event to see how your pet responds.

- Work with an animal behaviorist or trainer. For some pets, positive reinforcement and behavior modification training around their fears can make all the difference.

- Make sure your pets’ ID tags are updated with your current contact information and that tags are securely affixed to their collar.

- Update their microchip registration and pet license information. If they aren’t yet chipped, this is a good opportunity to do so.

On July 4th

-

- Move them to a room and put on soothing music. Cover windows to minimize the sound and flashes of light.

- An anxiety vest — or even a snugly fitting t-shirt — could help calm them.

- If they are especially anxious, make sure someone checks in on them frequently. That person should act calm and reassuring — animals look to their humans to gauge danger.

- Noise anxiety is not as common with cats as it is with dogs, but it can happen. Cats tend to hide (very well) when scared, so make sure you check in on them too. Keeping them indoors (and in a room of their own) is a good idea.

- If for any reason your pet is outside during fireworks, keep them away from any lit fireworks, which can result in burns to the face, nose, lips, eyes, or inside of the mouth.

After the Festivities

Whether or not you ignited fireworks on your property, search your front and back yards for unignited fireworks or spent remnants. Remember that some may have landed in your yard from neighbors. Immediately remove any you find — fireworks contain many chemicals and heavy metals that are toxic to animals. Do a second cleaning sweep in the morning before letting animals access your yards.

If you’re not sure if your pet may have been exposed to or ingested fireworks — lit or unlit — watch for the following signs, which vary depending on the type and amount ingested. Contact your vet immediately.

-

- Abdominal Pain

- Vomiting

- Bloody diarrhea

- Seizures

- Tremors

- Shallow breathing

- Jaundice

- Acute kidney failure

Having a game plan to keep your pets safe during the holiday ensures that you won’t spend July 5th searching the streets and shelters. If your dog or cat could talk, they’d thank you for it.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

Although it is recommended to review your home and auto insurance policies yearly, 60% of all Americans are underinsured and/or don’t understand their policies. Do you know what’s really covered with your insurance policy?

If you don’t or you have any doubts, now is a great time to get an annual review of your auto and home/renters insurance policies. You’ll sleep better at night knowing you are protected against expected surprises if you have a claim. You may also find you are eligible for additional savings and discounts!

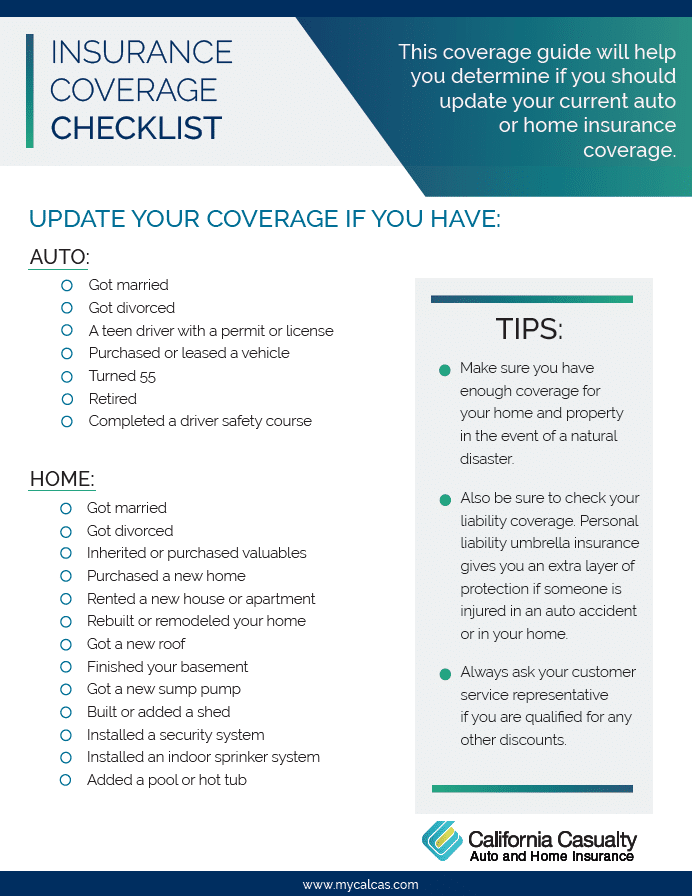

Here are seven examples of why you should contact your insurance advisor to review your policy:

- You got married. Newlyweds often pay less for insurance than when they were single. You can also find discounts by combining your autos with one insurance company. It also means all those expensive wedding gifts you received might need extra protection.

- You got divorced. You probably are no longer sharing a vehicle and moved into a different residence. You’ll need to inform your insurance company to set up separate auto and home or renters insurance policies.

- Your teen got a driver’s permit or license. You need to let your insurance company know if they are driving your vehicles, or if you bought them one. Make sure that you take advantage of good student discounts and additional multi-vehicle savings!

- You bought or inherited valuables such as antiques, fine art, jewelry or other collectibles. Your standard homeowners or renters insurance policy provides limited coverage of high dollar items. This is a good time to purchase scheduled personal property endorsements to cover your new valuable possessions for a higher amount.

- You’ve added on to your home or have remodeled. Improvements to your house mean there is more to protect. Contacting your insurance company is a good way to make sure that you have enough coverage. This also applies for a new gazebo, shed or pool, or hot tub.

- You’ve moved to a flood or earthquake prone area. Neither earthquake nor flood insurance is included with most homeowners or renters policies. You need to purchase separate flood or earthquake insurance. Keep in mind that flood insurance has a 30-day waiting period before it becomes effective.

- You’ve retired. This often means you are driving less, which could significantly reduce your insurance costs. Drivers over 55 also often get discounts from their insurance companies and you can further reduce your premiums by completing a driver safety course.

Knowing more about your insurance could save you money on your premiums and heartache in the event of a break-in or natural disaster.

If it is time for your auto or home insurance coverage review contact one of our customer care advisors today at 1.800.800.9410. A few minutes of your time will provide the appropriate protection, and we may even find you some extra savings!

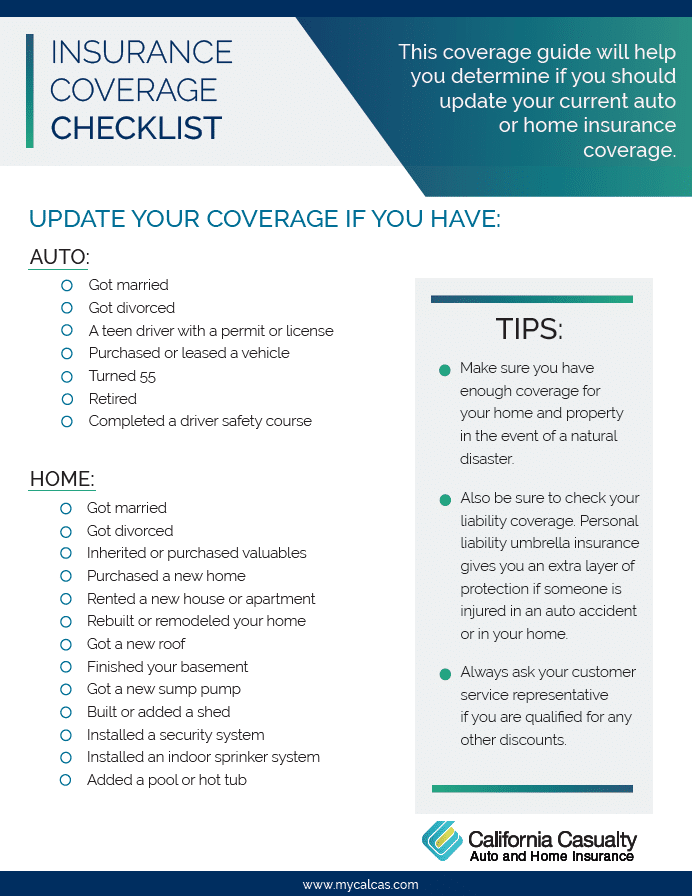

If you don’t know where to start to determine if it’s time for your policy review, download our free Insurance Coverage Checklist. Just click the image below for your free download!

by California Casualty | News |

High summer temperatures usually translate to high energy bills. But there are plenty of ways to stay cool and comfortable this summer while saving money.

Try adopting some or all of the 9 tips below. They’re good for your budget, the planet, and local power grids.

1. Plant Trees For Shade

Shady trees around your house can greatly reduce a “greenhouse effect” in your home by limiting the direct sunlight coming in through windows and beating down on the roof. Also, having shade over your air conditioning unit can increase its energy efficiency.

2. Be Thermostat-Smart

Some best practices: set your thermostat as high as comfortably possible (78 degrees is recommended) and raise it a bit when you’re away. Better yet, install a programmable thermostat for even more time- and energy-efficiency.

3. Lights Out!

Daytime lights give off heat, which accumulates over the day. Incandescent lights are the least efficient, with 90 percent of their energy given off as heat. Try gradually switching to more efficient lighting and consider lighting controls such as sensors and timers. In the meantime, turning off lights whenever leaving a room is always a good rule of thumb.

4. Check Your Filters

Clean or replace air conditioning filters at least once per month. This is one of the quickest ways to lower your energy bill, as a clean AC system uses less energy and has a longer life span.

5. Draw the Shades

Drawing your windows’ shades, blinds or curtains keeps direct sunlight — a concentrated heat source — out. Make it a habit to do this when you’re out of the house. Even when you’re home, drawing the shades in rooms that stay empty or aren’t used often will make a difference.

6. Use Fans

Whether ceiling, table, floor, or wall-mounted, fans create a wind-chill effect that can lower the “real feel” of air temps by 6-7 degrees. No need to leave them on in empty rooms though, as fans cool people, not the air itself.

7. Seal Those Leaks

They’re invisible but can wreak havoc on your energy bill. Check throughout your home for gaps and leaks and repair them with caulking or weather stripping to keep cool air from escaping and hot air from entering. While you’re at it, check your ducts — according to the U.S. Department of Energy, air loss through ducts accounts for about 30 percent of an AC unit’s energy consumption.

8. Maintain Your AC

Besides changing the filters, have a professional do regular maintenance annually, which can more than pay for itself in terms of long-term energy savings.

9. Be Mindful of Appliances

Running your appliances (oven, dryer, stove, dishwasher) can build up a lot of heat in the house and send your AC into overdrive. Try to stagger appliance use and see which you can run at night. If you’re due to replace any of them, check out Energy Star-qualified products. Consider air-drying clothes and dishes, and cook on the grill rather than on the stove to reduce in-home heat.

With a few simple hacks and a new habit or two, you can be well on your way to staying cool while saving some cash this summer.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, News |

We have amazing employees at California Casualty. The Employee Spotlight is a new series aiming to highlight those talented individuals that make up our successful company culture and community. From human resource recruiters and learning and development trainers to claims adjusters, marketers, customer support specialists, partner relations, sales representatives, and beyond; each week, we’ll highlight a new team member, so you can get to know us better and see how our employees make us who we are as a company.

This edition of the Employee Spotlight will feature our Inbound Sales Representative, Kevin DeSousa

Kevin is a newer employee at CalCas, he’s almost been with us for a year and is based in our Colorado office.

Let’s get to learn Kevin!

What made you want to work as a Sales Representative at California Casualty?

I really just enjoy talking to people. It feels great when you’re also assisting a customer with a necessity such as insurance.

What is your favorite part about your job?

Besides knowing that we’re helping our teachers, law enforcement officers, firefighters, and nurses! I enjoy really getting to know our customers, I talk to each person on the phone like I’m talking to one of my family members. I don’t want to under-insure my family and I also don’t want to over-insure my family; I want to make sure that everyone is paying for what they need to help take the best care of themselves as possible.

What have you learned in your position at California Casualty?

I have learned so much. Since getting hired on, I have a completely newfound respect for the insurance industry. Before it was just thinking that my car/house is covered from damage if something were to happen. But now, it’s much more than that, knowing what all the numbers mean and why certain people need certain coverages -not everyone needs the same coverage. Literally, within my first month here, I went home and redid my own insurance and made sure that I was covered correctly.

What are your favorite activities to do outside of the office?

I enjoy my family and my church family. Anytime we can all get together that is a good day!

I love going camping and enjoying the wilderness, I would say I go fishing, but I have yet to catch anything this season, so we’ll just skip that….

I have also enjoy working on updating my house and working in my yard with my small farm.

Anything else you would like the audience to know about you?

Been married 10yrs in August; we have an 8-year-old boy and a 4-year-old girl.

I am originally from New Hampshire and a HUGE Patriots Fan

I own a lot of animals on my small farm I have: 2 Dogs (1 Grand Pyrenees and 1 Husky), 7 Chickens, 3 Ducks, 1 Bearded Dragon, 2 Hermit Crabs, and 2 Guinea Pigs.

I am 100% Portuguese; for my childhood summer vacation most kids would go to Disney; I would go to the Azores and I LOVED it.

If you want to learn more about Kevin or are interested in a career at California Casualty, connect with him on LinkedIn! Or visit our careers page at https://www.calcas.com/careers