by California Casualty | Calcas Connection, Consider This |

If you love the roar of a muscle car or the gleaming chrome of a restored classic – and have made your passion for owning one a reality – these important insurance facts pertain to you.

As you know, collectible vehicles are an investment. Some are now selling for hundreds of thousands of dollars. If something were to happen to your beloved ’57 T-bird convertible, ’69 Camaro Z28, or ’55 Mercedes 300SL Gullwing, you need full replacement value insurance coverage.

And the insurance you have on your every day, commuter vehicle doesn’t offer that. A typical auto insurance policy is based on actual cash value and depreciation, so the older your vehicle is, the less it is worth.

Some people don’t insure their collector vehicles because they store them or drive them so seldom, but that could be a big mistake.

Some people don’t insure their collector vehicles because they store them or drive them so seldom, but that could be a big mistake.

Classic car auto insurance pays the agreed value if the vehicle is damaged in a fire, flood or during transportation, or if it is stolen. It also covers the higher cost of repairs if someone scratches the paint or chrome, or steals a specialty part.

It’s true. Classic car insurance protects the vehicle for the full agreed value, meaning it covers these desirable cars and trucks for their increased worth.

Classic auto policies offer the same coverage options as standard insurance – liability, collision, comprehensive, and medical pay – while also protecting the vehicle’s true worth.

Here’s the best part, classic auto insurance usually costs less than standard auto insurance because classic and collector vehicles are normally driven less, are kept garaged, and owners typically maintain them better; therefore, they are considered a better risk.

Classic car policies do come with restrictions:

- The vehicle must be stored in a locked, safe garage or storage facility

- The insured vehicle is unique or at least 15 years old

- It is not used as a regular commute vehicle

- All drivers have a clean driving record

California Casualty’s Agency Services division offers insurance for collectible, classic, antique and exotic vehicles with:

- Protection for the full agreed value

- Adjustable deductibles

- Towing

- Coverage for lost or stolen parts

- Mileage plans

There are many choices to insure your classic vehicle. Our partner for classic car insurance is Condon Skelly. Unlike most classic insurance providers, Condon Skelly does not limit mileage or require seasonal coverage, while still offering competitive rates.

TAKEAWAY:

Contact one of California Casualty’s Agency Services advisors today to arrange insurance for your classic or collectible car at 1.877.421.8348 or visit www.calcas.com/classic-car-insurance

by California Casualty | Auto Insurance Info |

There is nothing like the roar of a muscle car engine or the gleam from highly polished chrome. Classic cars evoke memories of simpler times when good ole American cars ruled the roads. They are often crowd favorites in parades and events and usually attract appreciative stares from other drivers and pedestrians during automotive rallies. classic cars

For those who love classic and collectible vehicles, fall is typically the last hurrah each year to see them. Many owners know autumn is great time to take their baby out for a drive or exhibit at a car show. The weather is more predictable and most classic car owners want to get them out a few more times before waxing them up and garaging them for winter.

If you have one of these beauties, you probably know that they need special insurance coverage. If you’ve just gotten your first classic or exotic vehicle, here’s why you need a collector car policy.

Classic cars are an investment. And collector car insurance is the best way to cover the full value if something happened to a ’57 T-bird convertible, ’69 Camaro Z28, or ’55 Mercedes 300SL Gullwing – many of which are now valued into the hundreds of thousands of dollars.

Standard auto insurance is based on actual cash value and depreciation. Meaning the older your vehicle is, the less it is worth. On the other hand, collector car insurance protects the vehicle for the full agreed value. This means it covers these desirable cars and trucks for their increased worth. Just like regular car insurance, collector auto policies offer the same coverage options: liability, collision and comprehensive, and medical pay — while also paying the full value of the vehicle that you and your insurance provider have agreed to if the worse should occur.

Here’s the best part. Collectible auto insurance usually costs less than standard auto insurance because classic and collector vehicles are normally driven less, are kept garaged. Plus, owners typically maintain them better; therefore, they are considered a better risk.

Collector car policies do come with restrictions:

- The vehicle must be stored in a locked, safe garage or storage facility

- The insured vehicle is at least 15 or 25 years old

- Limits on the miles it can be driven

- It is not used as a regular commute vehicle

- All drivers have a clean driving record

Some people don’t insure their collector vehicles because they store it or drive it so seldom, but that could be a big mistake. Classic car auto insurance pays the agreed value if the vehicle is damaged in a fire, flood, or during transportation, or if it is stolen. It also covers the higher cost of repairs if someone scratches the paint or chrome, or steals a specialty part.

Here are some important things to consider when purchasing collector car insurance:

- Choose a carrier that specializes in classic car coverage

- Pay attention to the fine print, exclusions and restrictions

- Maintain coverage when you are storing your vehicle

- Review your coverage each year to reflect any increase in value

There are many choices to insure your classic vehicle. California Casualty offers collector vehicle insurance through our partner, Condon Skelly. Unlike most classic insurance providers, Condon Skelly does not limit mileage or require seasonal coverage, while still offering competitive rates.

California Casualty is ready to help keep your beautiful baby protected and on the road. Contact one of our advisors today to arrange insurance for your classic or collectible car at 1.866.704.8614 or visit www.calcas.com/classic-car-insurance.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters and nurses.

by California Casualty | Auto Insurance Info, Pets, Safety |

Our pets are precious members of the family. We take them on adventures and shower them with treats and love. However, when it comes to disaster situations, our fur babies are often an after-thought, and sadly, many suffer and are left behind when a natural disaster hits.

September is National Preparedness Month. Each year we are reminded to prepare ourselves for emergency disasters in our home and communities. So, while you get your emergency plans in place, don’t forget to include your animals!

Take these actions and precautions before a calamity strikes to put your mind at ease and save your pet’s life.

- Have an evacuation plan that includes your pet and it’s necessities. Include food, leash, medications, a blanket (with your scent), water, and copies of vet records and vaccinations.

- Bring your pet inside. If you need to evacuate, have a crate or duffel on hand that you can easily transport them in.

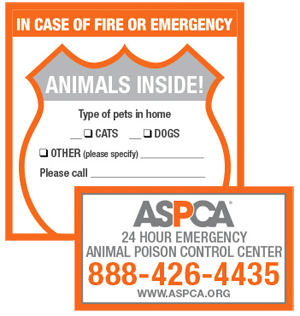

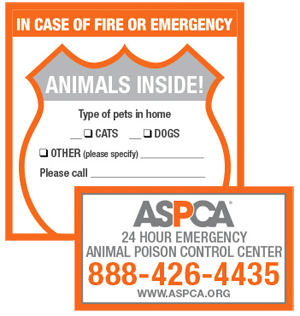

- Place a rescue alert sticker on home door or window. This should be visible to rescuers, in case you are unable to get home. Available online, at pet stores, veterinarians, or from the ASPCA.

- Microchip your pets and update collar tags. Make sure the microchip is registered and up-to-date with your current information.

- Keep in mind many evacuation shelters do not take pets. Research pet-friendly hotels, shelters, and family/friends who will take in you and your pet in a disaster.

- Carry recent pictures of your pet. In case you get separated, keep a good photo of them sitting and standing for size/coat reference.

Having a disaster preparation plan in place for your pets will play a key role in saving their life in the event of an emergency. If you need help putting a plan in place, contact BringFido’s Canine Concierge. They will contact hotels and shelters across the nation to help you find somewhere for your pet. Plus, they will even give you advice on disaster preparation for pets!

Remember, pets can sense anxiety and become nervous, especially during high stress times like emergencies. It is important to give them TLC and let them know they will be ok.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. In the event of a disaster know you and your pet are taken care of by adding Pet Insurance by Pets Best to your existing California Casualty policy and save up to 90% on all emergency vet bills. Get a quote at 1.866.704.8614 or www.calcas.com.

For more information visit:

https://bit.ly/34xLENY

https://bit.ly/34qK2Ft

https://bit.ly/2MTAldi

by California Casualty | Homeowners Insurance Info, Safety |

Disaster can strike at ANY time during ANY season. So, each year we are here to remind you to prepare for disaster situations in your home and communities.

BE PREPARED: Before an emergency or natural disaster strikes, here are 10 things you can do:

- Plan and save for the unexpected financially.

- Sign up for emergency alerts in your area.

- Map out and practice using several different evacuation routes.

- Have a safe location planned for shelter if your town is evacuated.

- Plan for your pets and know where they will stay if you are evacuated. Here are some pet-friendly hotels.

- Have a plan where you and family members will meet and how you will communicate if you become separated.

- Create an emergency kit, that meets your family’s particular needs.

- Complete a home inventory and document all of your belongings (clothing, mattresses, bedding, kitchen appliances, furniture, electronics, etc.).

- Back up important phone contacts and photos physically or on The Cloud.

- Check your insurance coverage with an advisor, to make sure you’re adequately covered or add protection (ex. Home, Renters, Auto, Flood, Earthquake, Floater, and Umbrella).

BE READY: If you need to evacuate:

- To find local shelters download the FEMA app, text SHELTER and your ZIP code to 43362 (ex. SHELTER 12345), or visit the American Red Cross’ website.

- Contact California Casualty as soon as possible and save all receipts for living expenses, such as hotels, meals and other essentials.

- Monitor local media about conditions, further evacuations, or when it might be safe to return home.

BE SAFE: When you return home, there are many potential dangers, such as:

- Dangerous toxins, and debris

- Mold

- Gas leaks

- Electrical shock

- Poisonous snakes or other animals

- Structural instability and collapse

- Sewage and chemical tainted water

GET HELP: If you need recovery help afterward:

Though it is National Preparedness Month, it is important to remain prepared every month of the year. An emergency or natural disaster can strike at any time or place; and if it does, please remember, you are not alone. California Casualty is there when you need us most, to help make sure you and your family are covered.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info |

Spring is here. As we look forward to longer, warmer days, it’s a good time to look around your home or apartment and identify the elements that might pose a danger to you or others. You might also eliminate conditions that could cause unnecessary damage.

Here are five simple things that can make your home or apartment safer.

1. Prevent break-ins.

Did you know break-ins increase in the spring and summer? The Justice Department says a home in the U.S. is burglarized every 20 seconds. Many of these are crimes of opportunity from thieves looking for an easy target. Simply locking doors and windows, not leaving garage doors open and installing extra lighting and a security system can reduce the risk. Trimming back bushes from around the home, having a dog and joining a neighborhood watch group are also good ways to deter a burglar.

2. Fire-proof your home.

Many of us may not know that fires burn hotter and faster than in the past. New tests show the open floor plans of modern homes, synthetic furniture and tons of electronics can cause a spark or a flame to flash into a major blaze in just three to five minutes. It’s important that we eliminate clutter, install smoke detectors on all levels of the home and in all bedrooms, have fire extinguishers available, and have an escape plan. It’s also essential to create defensible space around your home in case of a wildfire. Remember, too, that smoking materials are the leading cause of fire deaths.

3. Eliminate trips and falls.

While you can’t prevent all of them, you can make certain that stairs are in good repair with firm handrails, toys, newspapers and other clutter are picked up, rugs have a non-skid backing and bathrooms and showers have safety handles and no-slip bathmats. Adequate lighting inside and outside also helps. Not only will these actions protect your family, but they help prevent you from being sued if someone hurt themselves at your home or apartment.

4. Prepare for natural disasters.

This is the beginning of storm season. Do you have a safe area in case there is a tornado or earthquake? Do you know your risk for flood, fire or weather events? Now is the time to make certain your home is as disaster proof as possible, that you have an evacuation and communications plan, and prepare an emergency kit with extra food, water, medicines, etc.

5. Check appliances, pipes and wires.

Water from broken pipes, loose fittings and clogged drains can cause serious damage to your home. Inspect the backs of refrigerators, washers and other water sources for cracked pipes or rusted connectors. Frayed wires and clogged vents can cause fires, as can fireplaces and heaters that haven’t been cleaned and checked.

No matter how well you plan, you need home or renters insurance to protect your most valuable asset and your possessions. Homeowners and renters insurance also provide temporary housing and additional living costs while your home is repaired, as well as liability protection in case you get sued. Don’t forget that earthquakes and floods are not covered under your homeowner or renters insurance. You need separate policies for those.

Some people don’t insure their collector vehicles because they store them or drive them so seldom, but that could be a big mistake.

Some people don’t insure their collector vehicles because they store them or drive them so seldom, but that could be a big mistake.