by California Casualty | Auto Insurance Info, Safety |

When an emergency or natural disaster strikes, it’s important to have an emergency preparedness kit stocked and ready to go with basic items that meet your family’s particular needs. Building an emergency kit is quick and easy. Plus, it could save your life.

It is recommended that you pack enough items to last you (and each member of your family) at least 72 hours. Start with a sturdy backpack or duffel bag that can hold days worth of supplies. Be sure to put non-waterproof items going into your kit in air-tight plastic bags before putting them in your backpack or duffel. Below is a complete list of basic items that should be in your emergency kit and additional items that you could add based on your families needs.

Basic Items for Your Emergency Kit:

- Non-Perishable Food Items

- Toilet Paper

- Bottled Water

- First Aid Kit

- Personal Medications.

- Flashlight

- Cash & Credit Cards

- Multi-Tool with a Can Opener

- Wrench or Pliers Kit (to turn off gas/water lines)

- Extra Clothing.

- Blankets

- Disinfectant Wipes

- Matches or Lighters

- Important Documents (ex. deed/lease, passport, birth certificate, insurance policy, emergency contact information)

- Whistle (in case you get trapped).

- Batteries

- Extra Keys

- Extra Chargers

- Battery Powered NOAA Weather Radio

- Feminine Hygiene Products.

Download our Basic Emergency Kit Checklist Below:

Additional Items for Your Emergency Kit:

- Pet Food & Supplies (food, litter, collars/leashes)

- Baby Supplies (formula, diapers, rash cream).

- Non-Prescription Medication

- Liquid Bleach (to disinfect water and/or cuts).

- Paper/Plastic Cutlery

- Books & Board Games

- Rain Gear (umbrellas, ponchos, jackets)

- Work Gloves.

- Extra Set of Glasses

- Extra Shoes

- Scissors

- Maps.

Once you have your emergency kit assembled, put it in a secure, easy to reach spot inside your home. Be sure other members of your household are aware of the location of the safety kit. You should check your kit every 6 months to make sure all of your items are up-to-date and not expired.

This article is furnished by California Casualty. Get a quote by calling 1.800.800.9410 or visit www.calcas.com.

For more information please visit:

https://bit.ly/34kHvNi

by California Casualty | Homeowners Insurance Info, Safety |

Disaster can strike at ANY time during ANY season. So, each year we are here to remind you to prepare for disaster situations in your home and communities.

BE PREPARED: Before an emergency or natural disaster strikes, here are 10 things you can do:

- Plan and save for the unexpected financially.

- Sign up for emergency alerts in your area.

- Map out and practice using several different evacuation routes.

- Have a safe location planned for shelter if your town is evacuated.

- Plan for your pets and know where they will stay if you are evacuated. Here are some pet-friendly hotels.

- Have a plan where you and family members will meet and how you will communicate if you become separated.

- Create an emergency kit, that meets your family’s particular needs.

- Complete a home inventory and document all of your belongings (clothing, mattresses, bedding, kitchen appliances, furniture, electronics, etc.).

- Back up important phone contacts and photos physically or on The Cloud.

- Check your insurance coverage with an advisor, to make sure you’re adequately covered or add protection (ex. Home, Renters, Auto, Flood, Earthquake, Floater, and Umbrella).

BE READY: If you need to evacuate:

- To find local shelters download the FEMA app, text SHELTER and your ZIP code to 43362 (ex. SHELTER 12345), or visit the American Red Cross’ website.

- Contact California Casualty as soon as possible and save all receipts for living expenses, such as hotels, meals and other essentials.

- Monitor local media about conditions, further evacuations, or when it might be safe to return home.

BE SAFE: When you return home, there are many potential dangers, such as:

- Dangerous toxins, and debris

- Mold

- Gas leaks

- Electrical shock

- Poisonous snakes or other animals

- Structural instability and collapse

- Sewage and chemical tainted water

GET HELP: If you need recovery help afterward:

Though it is National Preparedness Month, it is important to remain prepared every month of the year. An emergency or natural disaster can strike at any time or place; and if it does, please remember, you are not alone. California Casualty is there when you need us most, to help make sure you and your family are covered.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Safety |

Keeping track of all our security passwords and codes is a pain. There’s one for the credit cards, a few for work, and a half dozen others for everything from the online bill paying to our social media accounts.

Since it’s become such hassle, all too many of us are using an easy-to-remember password that is making it very easy for cyber-crooks to breach our security and have access to our bank accounts and other important personal information. In the US alone there is a hacker attack every 39 seconds. That is why creating a strong password that is easy for you to remember, yet difficult for a hacker to guess is so important.

When you create a password to protect your personal information please avoid using:

- 123456

- password

- 123456789

- 12345678

- 12345

- 111111

- 1234567

- sunshine

- qwerty

- iloveyou

These passwords have been named “worst passwords of the year 2018” and many of them have been on the worst list for YEARS. Using these, and others like football, abc123, and 654321 (also on the list), means you are making it too easy for hackers and criminals to compromise your accounts.

So, what’s the key to creating a complex, secure password? Use one that employs 12 characters or more with a mix of symbols, letters, and numbers.

To avoid having one of the worst passwords, follow these password creation tips:

- Create passwords with as many letters, symbols, numbers and mixed case letters as possible

- Use mnemonic tricks to remember your passwords

- Store your passwords in a safe place that’s not on your computer

- Use different and unique passwords for important accounts

- Set up your password recovery options and keep them up to date

The United States Computer Emergency Readiness Team, part of the U.S. Department of Homeland Security, says a secure password should look something like this: Il2pBb3x!. The sequence comes from, “I like to play basketball three times a week,” just changed to simple symbols. Or think of a word that only has significance to you, change a few letters to make them capital, make some letters into symbols, and add in a long number. Ex. m@VEr1cK5991

And, if that all seems too complicated, there are free online password generator internet sites that will do the hard work for you. But once you’ve created a nearly full-proof password, your work is still not done. Experts advise that passwords need to be changed often, possibly once a month or quarter.

California Casualty also offers an added layer of protection; every auto and home insurance policy comes with free ID Theft 911 protection, which comes with ID theft resolution service. Contact an advisor for more information or a free policy review at 1.866.704.8614 or visit www.calcas.com.

For more information visit:

https://bit.ly/33NnhLE

https://bit.ly/33SYkP4

https://bit.ly/33UV59O

https://bit.ly/2NCNyqD

https://bit.ly/33SZs5g

by California Casualty | Safety |

The hustle and bustle of the first days of the new school year can get a little crazy. Kids are racing to see their friends, buses are crisscrossing the area picking up and dropping off students and hurried parents are trying to drop their kids off before they have to head to work. Paying attention often goes by the wayside.

This is why it’s more important than ever to practice extreme caution around school zones and neighborhoods.

The National Safety Council warns that more children are hit by cars near schools than at any other location. That’s why they ask that drivers:

-

- Don’t double park because it blocks visibility

- Don’t load or unload children across the street from schools

- Carpool to reduce the number of vehicles at school

- Put down cell phones and other mobile devices

Other safety tips to prevent auto-pedestrian injuries around schools include:

-

- Not blocking crosswalks when stopped at a red light or making a turn forcing pedestrians to go around you; this could put them in the path of traffic

- Always stopping for school crossing guards

- Using extra caution to look out for children at bus stops, school zones, playgrounds and parks and in all residential areas

- Never passing a vehicle stopped for pedestrians

- Remembering that pedestrians have the right of way

And to prevent distracted walking and texting accidents, students are reminded to keep their head up and phone down and:

-

- Never walk while texting or talking on the phone

- Always move out of the way of others and stop on the sidewalk to text

- Never cross the street while using an electronic device

- Do not walk with headphones on

- Be aware of their surroundings

- Always walk on the sidewalk if one is available; if a child must walk on the street, he or she should face oncoming traffic

- Look left, right, then left again before crossing the street

- Cross only at crosswalks

Remember, the first days of school can be a dangerous time for excited students. Safety experts stress that we all need to slow down near school zones, wear seatbelts, leave early so we aren’t rushing and never drive distracted (texting, eating or drinking, horsing around with passengers or adjusting the radio or adjusting the navigation system).

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info, Safety |

Summertime is in full swing! However, along with summer heat is the threat of summer burglary. Nobody wants to return home to find someone has burglarized their hard-earned possessions.

Unfortunately, the U.S. Department of Justice warns that break-ins heat up during the summer months. Most of those are crimes of opportunity from criminals looking for an easy target like open windows or garage doors.

Here are some tips to prevent a summer burglary:

Make Your Home Less Vulnerable

- Trim back bushes or hedges that block visibility and give a thief areas to hide

- Install outdoor lighting

- Put indoor lights on timers

- Have a security system installed

- Get a dog

- Keep garage doors closed

- Always lock doors and windows

- Keep watch of your neighbors’ homes and ask they do the same for you

- Have a trusted friend, neighbor or relative make trips to your home or park a car in the driveway to make it look lived in while you are away

Don’t Advertise to Criminals

- Stop mail and newspaper deliveries if you are going away

- Arrange for any home deliveries to your neighbors when you are not home

- Don’t leave garbage cans out while you are away

- Never leave notes on doors telling someone you are out and when you will return

- Leave a radio or TV on while you are away

- Conceal valuables and don’t them visible from the outside

- Break down and conceal boxes for expensive items and electronics when putting out the trash (boxes for the new 60” HD TV or the latest computer are like shopping flyers for thieves)

- Don’t advertise on social media that you are going away to grandma’s house or a wonderful vacation (this goes for your children)

Protect Yourself

- Make a complete home inventory of your possessions to assist if you need to file a police report, speed up an insurance claim and help with a tax-loss write off

- Be sure to have an identity theft protection and recovery service if burglars get access to your personal or banking information

- Protect your possessions with homeowners or renters insurance

Not only do you feel violated after someone breaks into your home, but it can be expensive to fix the damage and replace items. That’s why you need homeowners and renters insurance. We can’t stop all criminals, but California Casualty is here to protect you with quality auto and home insurance with exclusive benefits not available to the general public. Every policy also comes with free ID theft protection. Call an adviser today for a policy comparison or review at 1.800.800.9410, or visit www.calcas.com.

For more information visit:

https://bit.ly/2JXf93n

https://bit.ly/2YlWhDe

This article is furnished by California Casualty, providing auto and home insurance to teachers, law enforcement officers, firefighters and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info, Safety |

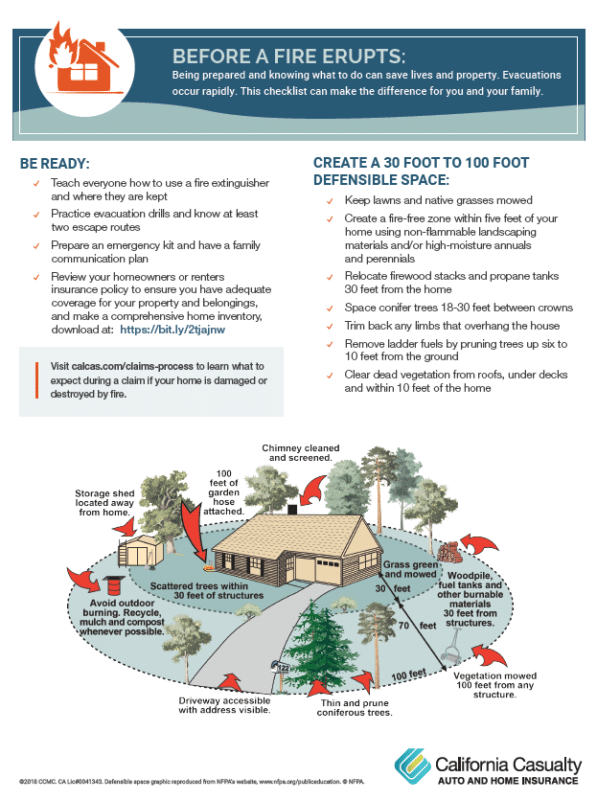

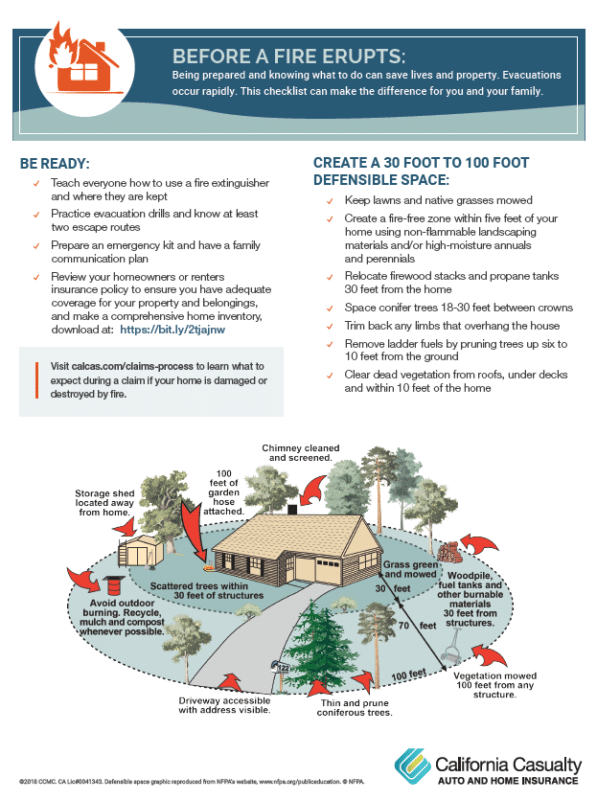

Wildfires seem to be burning faster and more intense than ever. The past few years have seen the largest and most destructive conflagrations in US history. Wildfire preparation tips are more important than ever.

Too many people have come back to find melted remnants of prized personal possessions; homes in ashes.

Here are five key wildfire preparation tips for your community or neighborhood:

- Create a home inventory. 60% of homeowners and renters have still not documented the things they own, which can cause post-fire/disaster headaches.

- Know where fire extinguishers are kept and teach everyone how to use them. Make them easily accessible in the event an of emergency.

- Have a family escape plan. Practice how you would exit your home from different rooms in the event of a fire and set a safe meeting point, away from the property, if you were to get separated.

- Prepare an emergency kit with important documents. Include copies of banking information, insurance policies, home mortgage and deeds, etc.

- Review and understand your insurance policy. Whether you are renting or owning, know what it pays and does not pay for. Get extra protection for collectibles and high-dollar possessions with a scheduled personal property endorsement.

While these are great wildfire preparation tips, there are several other things to keep in mind in you are effected :

- Contact your insurance company as soon as possible

- Secure the property from further damage

- Contact creditors, banks and appropriate agencies about credit cards, tax returns, Social Security cards or other papers that may have been scattered in the disaster

- Check your credit report to make sure nobody is using your personal information

- Be very wary of fly-by-night work crews and contractor fraud

Download and print your copy of these Wildfire Preparation Tips here.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters and nurses. Get a quote at 1.800.800.9410 or www.calcas.com.