by California Casualty | In Your Community |

“California Casualty really cares about me and understands me,” said Windsor, California high school teacher Renee DuVander.

“California Casualty really cares about me and understands me,” said Windsor, California high school teacher Renee DuVander.

Renee wrote a glowing review of California Casualty on Facebook after the Kincade fire forced her to evacuate in October.

“Attention Teachers: California Casualty is amazing insurance…I reached out to my renter’s insurance (calcas.com) and asked about being reimbursed for my evacuation expenses. They covered everything! From fuel and food to socks and underwear (we didn’t pack enough). I started the claim on Wednesday and the money is in the bank today (Friday). The company takes care of teachers and I strongly encourage you to get a quote from them ASAP.”

Renee learned about California Casualty about 10 years ago when one of the company’s Field Marketing Managers made a school visit. At the time, Renee was struggling with the high cost of insuring her car.

“The California Casualty representative said ‘let me work out some numbers and see if it’s worth switching.’ When she was done, she cut my auto insurance in half. Ever since then, I have been California Casualty’s biggest fan. I want to share the great customer service and benefits with as many teachers as I can,” she added.

The claims help and guidance she received from California Casualty during her forced exodus cemented her positive feelings. “The claims representative, Ashley, was so nice and thorough. She talked me through everything and even coached me on how to submit my expenses and receipts. The electronic funds transfer was so fast, just two days, and that really relieved the stress of how was I going to pay for all of my evacuation costs.”

Renee’s message to other educators is that California Casualty is a company that treats each person as an individual, understands educators, and delivers on its promise to protect them.

“I knew California Casualty would take care of me, and they did. I want all of my teacher friends to enjoy the same customer service and benefits that I do, and that’s why I am spreading the word,” she said.

California Casualty has been a partner with CTA since 1951, providing auto and home/renters insurance to educators with special benefits tailored to the teaching profession. Learn more about this valuable CTA member benefit, and what California Casualty might do for you, at www.CTAMemberBenefits.org/calcas, or visit www.calcas.com/CTA.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Calcas Connection |

The Board of Trustees of the Independent College Fund of New Jersey has named Alina Fayerman to the Board. Alina will actively work with the trustees to provide marketing expertise and support for the State’s independent colleges and universities. The trustees secure funding to contribute to student success, lifelong learning, professional preparation, and technology initiatives at the state’s 14 member institutions.

Ms. Fayerman is an Account Relations Manager at California Casualty, working to build relationships with first responder, educator, and nurse affinity groups, which in turn offer California Casualty Auto and Home/Insurance to their members.

Alina’s expertise in marketing and relationship building will benefit students and the independent college and university institutions.

Alina is a native of New Jersey and graduated from Drew University with a Bachelor of Arts degree in Sociology. Alina received a scholarship to Drew University, and she felt compelled to give back so others might have the opportunity for higher education that she had.

For more information, please contact Alina Fayerman at 917.432.9043 or [email protected].

by California Casualty | Calcas Connection, In Your Community |

Working alongside you is extremely rewarding for all of us here at California Casualty. Given the chance, we are thrilled to tout the benefits of membership to your organizations, donate to your schools, surprise you with our giving program awards, and take part in ceremonies recognizing all that you do.

Partner Relations members Lisa Almeida, Jana Charles, Inez Morales, Norma Alfaro and Christy Forward at CTA Presidents Conference

The Partner Relations California team members had the opportunity to connect with CTA presidents and greet longtime friends as they attended and hosted events for the CTA Presidents Conference. In support of our partnership with CTA, it was the team’s goal to make a difference for CTA leaders and promote the value CTA membership provides.

“It’s an honor for us to be able to celebrate and recognize the incredible dedication our chapter leaders give to their association members,” said California Casualty AVP Lisa Almeida.

Attendees received fun giveaways, with one lucky participant winning a VIP trip to a San Francisco Giants baseball game and another winning two 3-day passes to Disneyland.

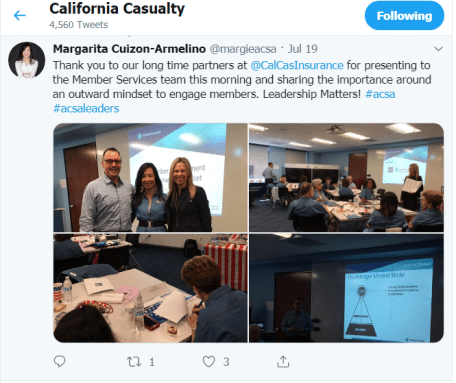

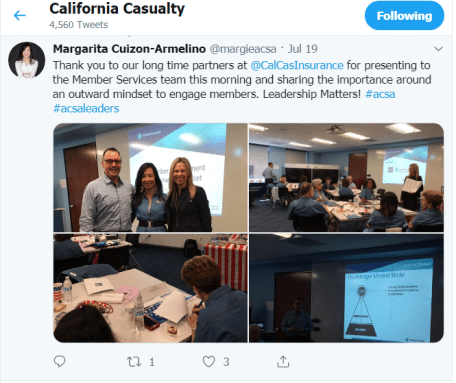

California Casualty’s Partner Relations members Jeff Meyers and Roxanne Dean had an exciting opportunity to share the Outward Mindset program – one of our company’s newest initiatives to improve communication with fellow employees and our customers – with the Member Services Staff of the Association of California School Administrators (ACSA).

California Casualty’s Partner Relations members Jeff Meyers and Roxanne Dean had an exciting opportunity to share the Outward Mindset program – one of our company’s newest initiatives to improve communication with fellow employees and our customers – with the Member Services Staff of the Association of California School Administrators (ACSA).

Introduced by a member of the California Casualty Advisory Board, Outward Mindset training is presented to all employees in our company, from Executives to Sales, Service, Underwriting and Claims. The premise is that by getting past “out of the box” thinking, we can better serve our customers while enhancing working relationships throughout all levels of our company.

ACSA Member Benefits consultants were interested in learning how California Casualty uses the program to improve our effectiveness with partners, such as ACSA.

“From the first time I went through this workshop, I fell in love with the fundamental principles involved,” said Jeff. These principles are powerful for our work, and helping the groups that we work with.”

California Casualty has been a longtime partner with ACSA, providing the auto and home insurance program as well as engagement tools to encourage membership. “Thank you for sharing the importance of an outward mindset to engage members,” an ACSA member wrote.

School Lounge Makeover winner Mary (second from left) with California Casualty’s Stephanie Whitmore and NSEA representatives

To round out our educator community efforts in this issue of Connection, let us introduce you to our latest School Lounge Makeover winner. Mary G., an English teacher and the librarian at Palmer Public School in Palmer, Nebraska, was thrilled that the staff will finally have a place to relax and rejuvenate throughout the school day. We will highlight the revitalized lounge (which is being designed now) in the next edition of Connection.

And, 18 years after the terrible 9/11 attacks, California Casualty joined educators, law enforcement officers, firefighters, EMTs and the general public at 11 memorial stair climbs, remembering those who died while saving others. From Maryland to Missouri and Colorado to California, our employees climbed and supported other climbers with water, snacks, and encouragement. In partnership with the National Fallen Firefighters Foundation, California Casualty is a proud sponsor of the climbs and donates to the NFFF survivor’s fund.

“This experience was emotional and moving,” said Field Marketing Manager Katelyn Kassel. “The time and effort put into coordinating the events and getting all of the firefighters to come out is a true testament to how much these men and women love what they do. I love our company and what we stand for, and how we are able to protect our first responders,” she added.

Left: Sandra Clemmons-Butler and Jackie Jones at the National Capital Region 9/11 Climb, Washington, D.C.; Right: Debbie Harris and Lorelei Seip at the Yellow Springs, OH 9/11 Stair Climb; Bottom: the California Casualty 9/11 Stair Climb team at Red Rocks, CO.

You can see an inspirational video of our participation at the Red Rocks, Colorado stair climb at our LinkedIn page.

TAKEAWAY: Follow the many ways California Casualty celebrates all that you do at our Facebook page, www.facebook.com/CaliforniaCasualty.

by California Casualty | Calcas Connection, Good to Know |

It also protects your assets… if you have the right amount of coverage. In today’s world, having the right amount of auto insurance is imperative. The costs to repair vehicles are increasing, and many times accidents involve lawsuits.

If you do not have high enough liability limits and an accident victim chooses to pursue greater compensation for their injuries, your financial assets – such as your home, your savings, future earnings and even your retirement – are at risk. One serious crash could result in some serious financial distress, even bankruptcy. (Please read that again.)

How is that?

Well, your auto insurance is made up of the coverage limits you choose: Bodily Injury Liability (BI), Property Damage Liability (PD) and Uninsured Motorist Bodily Injury (UM).

The minimum liability insurance required varies by state, but generally, it looks something like this:

- $25,000 bodily injury liability per person

- $50,000 bodily injury liability per accident

- $25,000 property damage liability per accident

That means if the insured driver is at-fault in a crash, their insurance would pay up to $25,000 to each person in the other vehicle(s) for injuries – up to a total of $50,000, and pay up to $25,000 for the damage caused to the other vehicle(s), public property, etc.

That might sound like enough, but considering the high costs of medical care, the amount someone might suffer in lost wages, and that the average vehicle now retails for almost $40,000, the at-fault driver could pay out-of-pocket tens of thousands of dollars (or more) above what their insurance would cover.

The Insurance Information Institute recommends each person carry at least $100,000 bodily injury protection per person, $300,000 bodily injury protection per accident, and $50,000 for property damage. If you have a lot of assets (a home, investments, vacation property) and a higher earning potential, you should buy even more protection ($250,000, $500,000, $100,000).

Don’t forget uninsured and underinsured motorist coverage (UM). It’s estimated that one out of eight drivers has no insurance, with many others carrying minimal coverage. You’ll want higher limits to pay for any injuries and damage to your vehicle if you are hit by one of these drivers.

Insurance companies urge everyone to purchase as much liability insurance as they can afford, and we are no different.

As your insurance partner, California Casualty takes seriously our obligation to inform you about important insurance gaps, and to offer higher limits (that cost very little for the protection they provide).

TAKEAWAY:

Call one of our customer care representatives at 1.800.800.9410, option 3 to review your current policy limits and discuss your coverage amount options.

by California Casualty | Calcas Connection, Consider This |

If you love the roar of a muscle car or the gleaming chrome of a restored classic – and have made your passion for owning one a reality – these important insurance facts pertain to you.

As you know, collectible vehicles are an investment. Some are now selling for hundreds of thousands of dollars. If something were to happen to your beloved ’57 T-bird convertible, ’69 Camaro Z28, or ’55 Mercedes 300SL Gullwing, you need full replacement value insurance coverage.

And the insurance you have on your every day, commuter vehicle doesn’t offer that. A typical auto insurance policy is based on actual cash value and depreciation, so the older your vehicle is, the less it is worth.

Some people don’t insure their collector vehicles because they store them or drive them so seldom, but that could be a big mistake.

Some people don’t insure their collector vehicles because they store them or drive them so seldom, but that could be a big mistake.

Classic car auto insurance pays the agreed value if the vehicle is damaged in a fire, flood or during transportation, or if it is stolen. It also covers the higher cost of repairs if someone scratches the paint or chrome, or steals a specialty part.

It’s true. Classic car insurance protects the vehicle for the full agreed value, meaning it covers these desirable cars and trucks for their increased worth.

Classic auto policies offer the same coverage options as standard insurance – liability, collision, comprehensive, and medical pay – while also protecting the vehicle’s true worth.

Here’s the best part, classic auto insurance usually costs less than standard auto insurance because classic and collector vehicles are normally driven less, are kept garaged, and owners typically maintain them better; therefore, they are considered a better risk.

Classic car policies do come with restrictions:

- The vehicle must be stored in a locked, safe garage or storage facility

- The insured vehicle is unique or at least 15 years old

- It is not used as a regular commute vehicle

- All drivers have a clean driving record

California Casualty’s Agency Services division offers insurance for collectible, classic, antique and exotic vehicles with:

- Protection for the full agreed value

- Adjustable deductibles

- Towing

- Coverage for lost or stolen parts

- Mileage plans

There are many choices to insure your classic vehicle. Our partner for classic car insurance is Condon Skelly. Unlike most classic insurance providers, Condon Skelly does not limit mileage or require seasonal coverage, while still offering competitive rates.

TAKEAWAY:

Contact one of California Casualty’s Agency Services advisors today to arrange insurance for your classic or collectible car at 1.877.421.8348 or visit www.calcas.com/classic-car-insurance

by California Casualty | Behind the Scenes, Calcas Connection |

Who would have thought that an insurance company would focus on a strong social media presence? We did. After all, it’s a great way to connect with you.

Meet Chloe, our social media scientist.

Meet Chloe, our social media scientist.

On a daily basis, Chloe is the online heart of our organization; creating and sharing content, resources, and occasional “aww moments” that inform and entertain you.

“I love social media, and like the rest of the world, I am glued to my phone,” she said. “What attracted me to the job with California Casualty is the writing/blogging involved.”

Working out of our Leawood, Kansas office, Chloe is a Kansas girl who loves the Kansas City Chiefs. She and her fiance, Trevor, also love to travel, go to concerts, and hang out with their dog, Maverick, a 1-year-old border collie mix.

Originally from Cherokee, a small town in southeast Kansas that she describes as “a place with no stoplights, and a 30-minute drive to find a Walmart,” Chloe graduated from Pittsburg State University with a B.A. in Communication/Public Relations and a minor in Marketing. “Through college, I wrote for a blog and I loved it. I remember when my second post got published and there were 20,000 shares – I FREAKED OUT!”

Originally from Cherokee, a small town in southeast Kansas that she describes as “a place with no stoplights, and a 30-minute drive to find a Walmart,” Chloe graduated from Pittsburg State University with a B.A. in Communication/Public Relations and a minor in Marketing. “Through college, I wrote for a blog and I loved it. I remember when my second post got published and there were 20,000 shares – I FREAKED OUT!”

Her goal at California Casualty is to learn more about you and create posts that ignite your interest.

“Let’s face it, insurance can be confusing,” says Chloe. “I try to find facts and details that people may not know about their coverage – like how renters insurance can cost less than college textbooks or how you get free ID theft protection with your policy – anything to make the posts a little more interesting and entice readers to go to our blog to learn more.”

“However, I strongly believe that our insureds don’t want to just see just insurance facts on their feeds. While keeping insurance posts in the mix is important, I like to go with a ‘we get it’ strategy – highlighting that California Casualty understands that teachers work 10-plus hours a day and some days just want a funny classroom meme to make them smile; or that the media sometimes show first responders in a dark light, so here’s an officer breakdancing with a child or a firefighter bringing groceries to the elderly. When you understand the audience and what they want to see, you start seeing engagement go up.”

And, engagement on our various social media platforms is definitely up. Since Chloe took the reins, the numbers have shot up. “Our social engagement has more than doubled since Chloe came on board,” said California Casualty Social and Digital Marketing Manager, Demian Tallman.

Chloe finds it inspiring interacting with audiences across the platforms. “We are very active on all of our social media sites. We love to hear about the difference our policyholders are making in their departments, classrooms, and communities, and we would be happy to feature more of them.”

She also appreciates hearing from and interacting with many of you who have taken the opportunity, via the various social media platforms we offer, to say hi or share with others. One important follower gives Chloe a lot of feedback. It’s her mom, a dispatcher for a county sheriff’s department, who has taught Chloe firsthand about the stress and challenges of being called to work in the middle of the night because of violent storms or missing holidays because of work. “It taught me to have so much respect for dispatchers and their spouses.” Oh, and one of Chloe’s aunts is a high school science and astronomy teacher, who also gives her advice.

You will find many avenues to follow, learn about, and engage with California Casualty.

Chloe’s favorite is Facebook, where there are more than 120,000 followers, but she hopes that you will follow California Casualty on your favorite platform. “That way, they can keep up with news and helpful information pertaining to their professions, which are posted daily. Another cool thing we do on social media (and probably the favorite thing for our readers) is giveaways and contests.”

Here’s a list of where to find us:

Facebook: @CaliforniaCasualty

Twitter: @CalCasInsurance

Instagram: @CalCasInsurance

LinkedIn: @California Casualty (there’s a space between the words)

Pinterest: California Casualty

YouTube: CalCasInsurance

Spotify: Cal Cas

Chloe highlighted a couple of her – and your – favorite posts. One was about a nine-year-old boy who started a GoFundMe and raised $80,000 to purchase bulletproof vests for K9 dogs (“How could anyone not love that?”) that garnered hundreds of likes and shares and reached over 10,000 people. Another is a new page of educator printables, downloadable posters, and interactive activities that are free to use (https://mycalcas.com/printables-for-teachers/).

Chloe added this invitation: “Follow us and enjoy the fun.”

TAKEAWAY: Connect and share with Chloe and California Casualty at our blog, www.mycalcas.com, and scroll down on that page to find the various other social media available.

“California Casualty really cares about me and understands me,” said Windsor, California high school teacher Renee DuVander.

“California Casualty really cares about me and understands me,” said Windsor, California high school teacher Renee DuVander.

California Casualty’s Partner Relations members Jeff Meyers and Roxanne Dean had an exciting opportunity to share the Outward Mindset program – one of our company’s newest initiatives to improve communication with fellow employees and our customers – with the Member Services Staff of the Association of California School Administrators (ACSA).

California Casualty’s Partner Relations members Jeff Meyers and Roxanne Dean had an exciting opportunity to share the Outward Mindset program – one of our company’s newest initiatives to improve communication with fellow employees and our customers – with the Member Services Staff of the Association of California School Administrators (ACSA).

Some people don’t insure their collector vehicles because they store them or drive them so seldom, but that could be a big mistake.

Some people don’t insure their collector vehicles because they store them or drive them so seldom, but that could be a big mistake. Meet Chloe, our social media scientist.

Meet Chloe, our social media scientist. Originally from Cherokee, a small town in southeast Kansas that she describes as “a place with no stoplights, and a 30-minute drive to find a Walmart,” Chloe graduated from Pittsburg State University with a B.A. in Communication/Public Relations and a minor in Marketing. “Through college, I wrote for a blog and I loved it. I remember when my second post got published and there were 20,000 shares – I FREAKED OUT!”

Originally from Cherokee, a small town in southeast Kansas that she describes as “a place with no stoplights, and a 30-minute drive to find a Walmart,” Chloe graduated from Pittsburg State University with a B.A. in Communication/Public Relations and a minor in Marketing. “Through college, I wrote for a blog and I loved it. I remember when my second post got published and there were 20,000 shares – I FREAKED OUT!”