by California Casualty | Auto Insurance Info |

Fall is a glorious time to take a drive and enjoy the changing colors. Be careful, it’s also a dangerous time for wildlife.

Accidents with deer and elk spike across the United States from October through December, with November the top month for deer-car crashes.

The Insurance Institute for Highway Safety estimates more than 1.5 million deer collisions take place every year in the U.S., causing over $1 billion in vehicle damage. The danger increases when your travel in rural areas where deer roam; just look at the scattered bumpers, grills and lights on the sides of the roadways.

The top ten states for deer-auto crashes in 2016 were:

- West Virginia

- Montana

- Pennsylvania

- Iowa

- South Dakota

- Wisconsin

- Minnesota

- Michigan

- Wyoming

- North Dakota

To reduce the risk of hitting deer or other wildlife:

- Don’t drive distracted

- Slow down

- Use high beams at night when there is no oncoming traffic

- Stay alert at dusk and dawn when deer tend to be most active

- Pay attention to wildlife warning signs

- Honk your horn to scare any deer off the road

- Break firmly and don’t swerve (many serious crashes occur when drivers lose control of their car or truck trying to avoid a deer)

If you hit a deer:

- Attempt to move your vehicle to the side of the road

- Use your hazard lights

- Call local law enforcement or the state patrol (especially if there are injuries, your car is not drivable or the animal remains in the road

- Don’t approach or attempt to move an injured animal (it can hurt you)

- Take photos of the crash, the damage to your vehicle, and the roadway where it occurred

- Fill out an accident report (some areas allow you to do it online)

- Contact your insurance company as soon as possible

by California Casualty | Auto Insurance Info |

Excitement is in the air as we get a chance to see the first full solar eclipse over the U.S. in decades. While many of us are thinking about protecting our eyes from damaging solar radiation, if you live in the area most affected by the eclipse or traveling to see it, you might want to make sure your auto and home insurance is up to date. Public safety groups are warning that the crush of millions of people coming to view the eclipse could pose some very serious issues. Here are some important things to consider so the shadow cast over the sun doesn’t lead to dark things for your insurance coverage:

- Be prepared for extremely heavy traffic and delays – being in a hurry to get somewhere may lead to frustration and a traffic crash

- Don’t drive distracted and be prepared for the many others around you who might be doing so as the moon obscures the sun

- Turn on headlights as the sunlight fades so others can see you

- Don’t pull off or stop on interstate highways or major thoroughfares where you could pose a safety hazard

- Never use or block the center median crossings on highways which are only for emergency vehicles

- Avoid pulling off on roadway shoulders and medians where a hot muffler could spark a grass fire

- Be aware of increased pedestrian traffic and people walking but not paying attention to traffic

- Make sure you have enough liability coverage if you are inviting or allowing others onto your property to view the eclipse

Before Monday’s great event, you should make sure that you have approved safety glasses to view the spectacle (there are numerous warnings about fake glasses), that you have stocked up on sunscreen, water, fuel and other essentials. Please find a safe place to watch it from.

by California Casualty | Auto Insurance Info |

The dog days of summer are considered the most dangerous time to be on the road. There are more of us driving, which can make too many of us hot under the collar. Whether is the heat, the traffic or the final push before school starts, a new study finds August is the month that puts you most at risk for encountering an angry, aggressive driver. It’s not just a theory; it was the top month for Instagram posts with #RoadRage.

Judging from the study, August is when we are most likely to encounter the pickup truck cutting across multiple lanes and tailgating drivers who don’t get out of the way, the guy who refuses to let you in at a merge, or the erratic driver weaving into other lanes while their attention is on their cell phone.

These crazed drivers are not only a nuisance, they are causing wrecks. Despite collision avoidance systems, accident rates in the U.S. are on the rise. Traffic experts warn that inattentive and aggressive driving is the cause for all too many crashes.

The best advice if you see one of these drivers with angry faces, often gesturing as they careen through our thoroughfares as if nobody else matters, is to avoid confrontations. Gesturing back or making eye contact can often lead to road rage.

So, what should you do?

- Stay out of the left lane unless you are passing

- Follow the speed limit

- Don’t challenge them by speeding up or trying to block them

- Avoid eye contact

- Report them to authorities providing vehicle description, license plate number, location and direction of travel

And here are some defensive driving tips that can help you avoid aggressive drivers:

- Keep scanning the area ahead and behind you

- Drive with both hands on the wheel to better respond to dangers

- Avoid driving when tired or drowsy

- Wear your seatbelt

- Slow down in bad weather

- Have an escape plan

- Don’t follow too close

Teaching young drivers defensive driving tips is one of the best ways to prevent this type of aggressive behavior. Stay safe on the road!

by California Casualty | Auto Insurance Info |

As spring gives way to summer, it’s time to get your RV ready for heading to the mountains, camping or long road trips to visit family and friends. If you are getting your motor-home out of storage, here are some key steps that will keep you on the road and out of the repair shop.

- Check the exterior for cracks and missing or damaged seals

- Inspect and test the battery

- Examine and pressurize the tires

- Replace filters and replenish brake, coolant, transmission, hydraulic and washer fluids

- Clean, inspect and refill LP gas lines and appliances

- Test carbon monoxide and smoke detectors

- Flush and fill the water system looking for leaks, clarity and drink ability

- Check that all appliances are working

- Inspect sewer hoses and waste tank valves for cracks or sticking

Here is a list of important equipment and items you’ll want to make sure that you have:

- Proper extension cord with the correct amps

- Surge protector for variable campground electrical systems

- Drinking water approved hose

- Pressure regulator and water filter for variable campsite water pressures and contaminates

- Laser temperature tester to detect overheated brakes, tires and axles

Don’t forget routine maintenance practices for your RV or motorhome’s engine:

- Periodically check and test batteries for proper charging

- Make sure your cooling system has the proper anti-freeze/coolant and all belts, hoses and the water pump are properly working (never open a hot radiator cap; the liquid inside is a scalding 200 degrees or hotter)

- Check the air conditioning system for leaks and proper coolant

- Make sure the viscosity of your motor oil will stand up to hot weather days (10W-30 or 10W-40)

Consumer Reports advises that you should also have a basic safety kit that consists of:

- Cell phone and spare battery

- First aid kit

- Fire extinguisher

- Warning light or reflective triangles

- Tire gauge

- Jumper cables

- Foam sealant for flat tires

It’s never a bad idea to get a full maintenance check before heading out for your summer travels. Stay safe this summer!

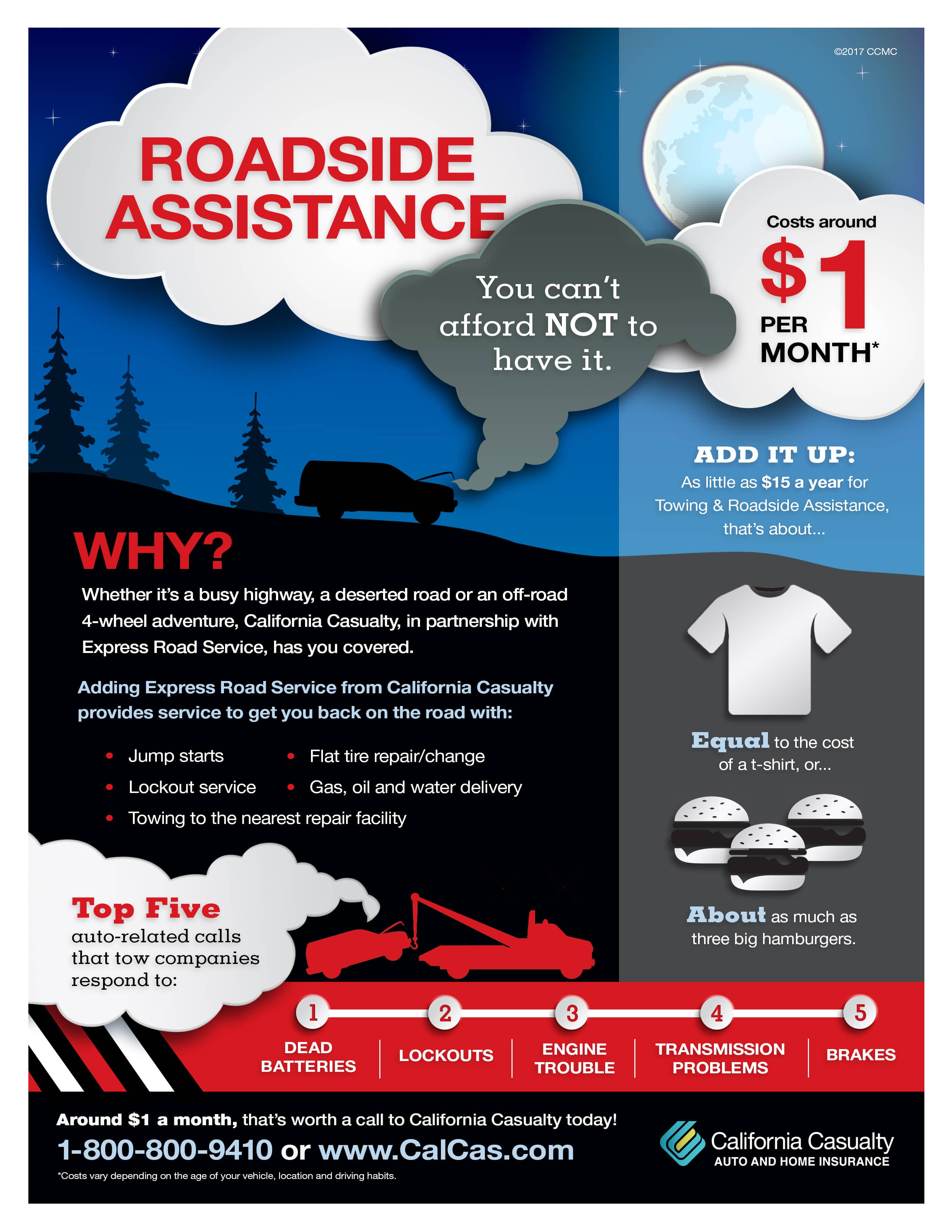

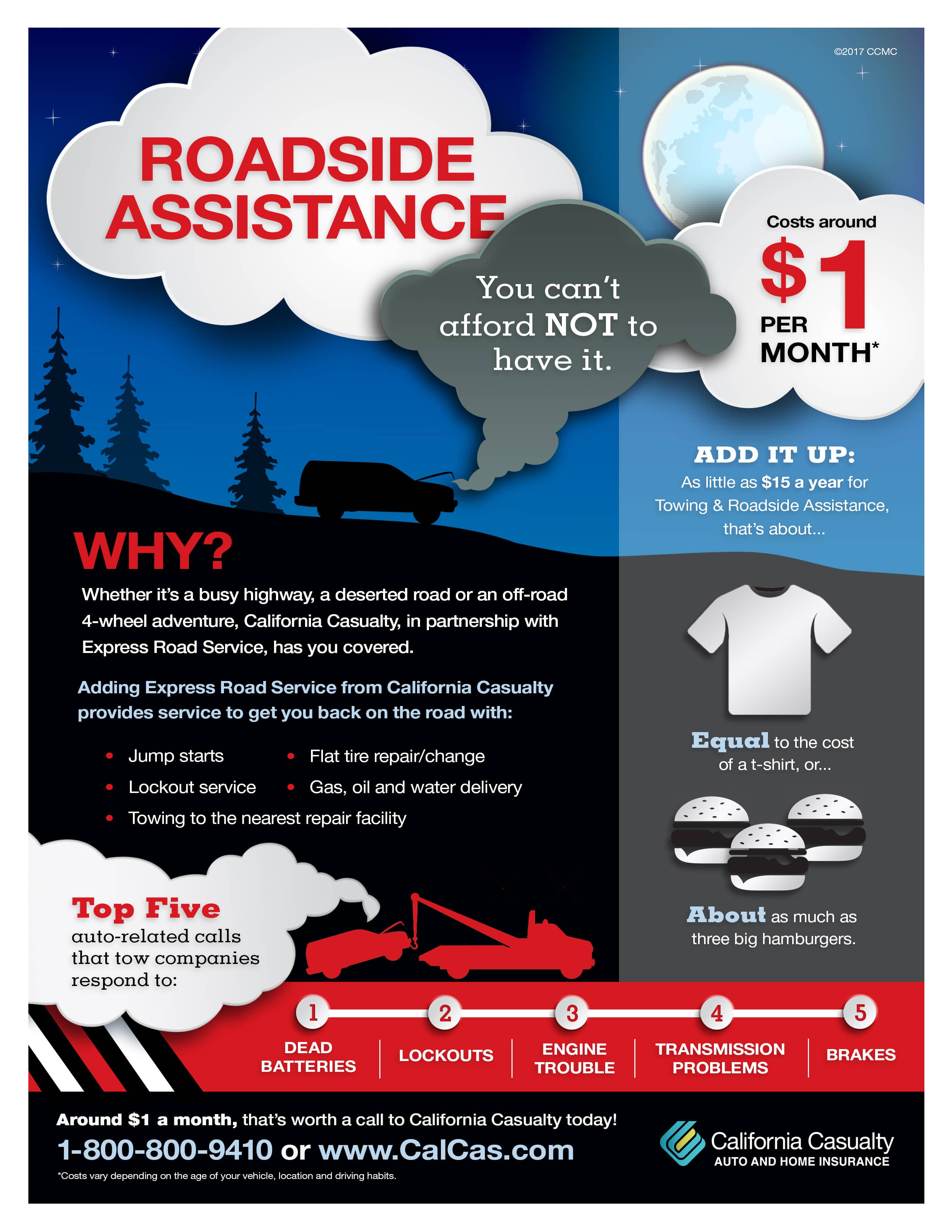

by California Casualty | Auto Insurance Info |

Express Road Service from California Casualty is just another way we’re there for you when you need us. Check out these amazing benefits for around $1/month.

by California Casualty | Auto Insurance Info |

It’s a good idea to do an occasional review of your auto and home insurance policies; you’ll sleep better at night knowing you are protected against expected surprises if you have a claim. You might also find savings if a traffic ticket falls off your record or you are driving an older vehicle with a decreased value.

If you’ve never had a review, here are seven examples of when you should contact your insurance adviser for one:

- You got married. Newlyweds often pay less for insurance than when they were single. You can also find discounts by combining your autos with one insurance company. You should ask if all those expensive new gifts you received might need extra protection.

- You got divorced. You probably are no longer sharing a vehicle and moved into a different residence. You’ll need to inform your insurance company to set up separate auto and home or renters insurance.

- Your teen got a driver’s permit or license. You need to let your insurance company know if they are driving your vehicles, or if you bought them one. Make sure that you take advantage of good student discounts and additional multi-vehicle savings.

- You bought or inherited valuables such as antiques, fine art, jewelry or other collectables. Your standard homeowners or renters insurance policy provides limited coverage of high dollar items. This is a good time to purchase scheduled personal property endorsements to cover your new valuable possessions.

- You’ve added on to your home or done extensive remodeling. Improvements to your house mean there is more to protect. Contacting your insurance company is a good way to make sure that you have enough coverage. This also applies for a new gazebo, shed or hot tub.

- You’ve gotten your first apartment. You need renters insurance to protect your possessions and to provide liability coverage. Many renters think their landlord’s insurance covers them (it doesn’t) or that they don’t have enough things to cover. Renters insurance is a great value, costing between $15 and $30 per month – compared to the expense of replacing electronics, beds, clothing, bicycles silverware, kitchen and cooking items, etc.

- You’ve retired. This often means you are driving less, which could significantly reduce your insurance costs. Drivers over 55 also often get discounts from their insurance companies and you can further reduce your premiums by completing a driver safety course.

Knowing more about your insurance could save you money on your premiums and heartache if you ever need to make a claim.