by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

Being a first responder takes a lot of dedication, time, and training. You shouldn’t have to worry whether you have the right auto and home insurance. That’s why law enforcement and fire organizations have worked with California Casualty for decades to provide auto and home insurance to their members with exclusive benefits that are not available to the general public.

Here are 7 exclusive benefits for first responders from California Casualty:

- Waived Deductibles- California Casualty reduces the deductible up to $500 if your vehicle is vandalized or hit when parked where you work as a first responder.

- Personal Items in Your Vehicle- California Casualty includes $500 coverage for personal property (including turnout gear, safety equipment, and personal off-duty firearms) stolen from or damaged in your vehicle.

- Fallen Hero Benefit- California Casualty waives the insurance premium for the current year and the following year for the surviving spouse or partner of an insured firefighter or law enforcement officer who dies in the line of duty (not available in GA, MT, NH, TN and TX).

- Identity Protection- Each policy with California Casualty comes with FREE ID Theft protection and resolution services from CyberScout.

- Flexible Payment Options- Whether you like to pay one bill or do monthly installments, California Casualty lets you choose what works best for you. They also offer summer or holiday skip payment options so you can maximize your budget for the times when you need the money for other things.

- Insurance for Your Pets- Every auto insurance policy automatically includes up to $1,000 for vet bills if your pet is injured in a covered loss in your vehicle. California Casualty’s partner, Pets Best, also offers reduced rates for pet health insurance.

- Custom Parts and Accessories- California Casualty covers up to $2,000 for things you’ve added to your truck or van like custom rims, roll bars and furnishings (including pickup bed liners and covers).

Firefighter and Peace Officer associations have partnered with California Casualty because they have auto and home insurance policies tailored to best fit the lives of first responders. Be sure that you have all the coverage you need with the exclusive discounts you deserve. Contact a California Casualty adviser for a no-hassle policy review today, 1.866.704.8614 or https://www.calcas.com.

*All coverages may not be available in all states. In the case of any loss, the policy terms and conditions will apply.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

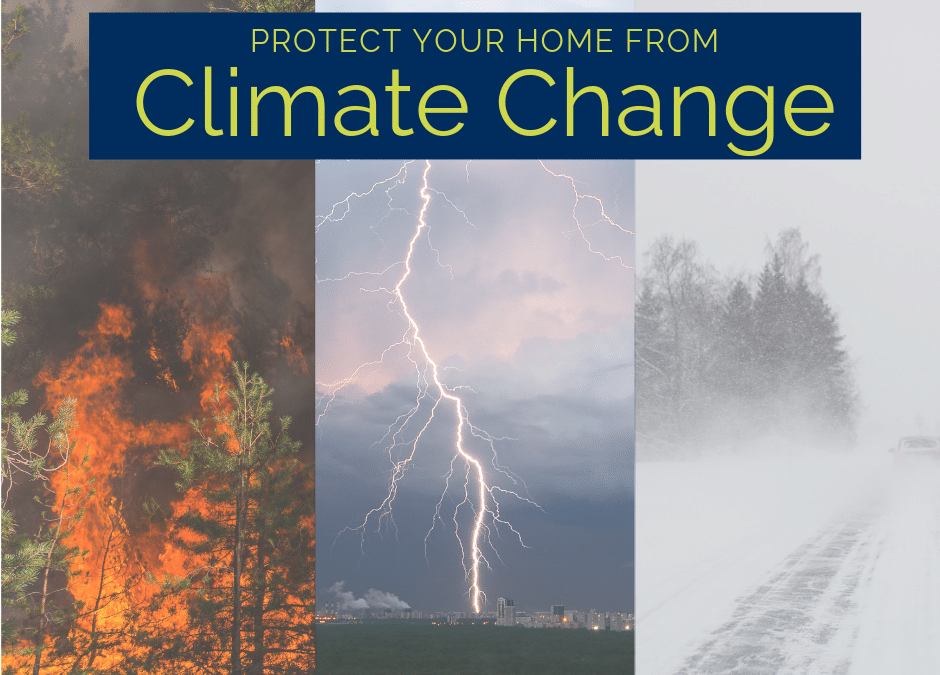

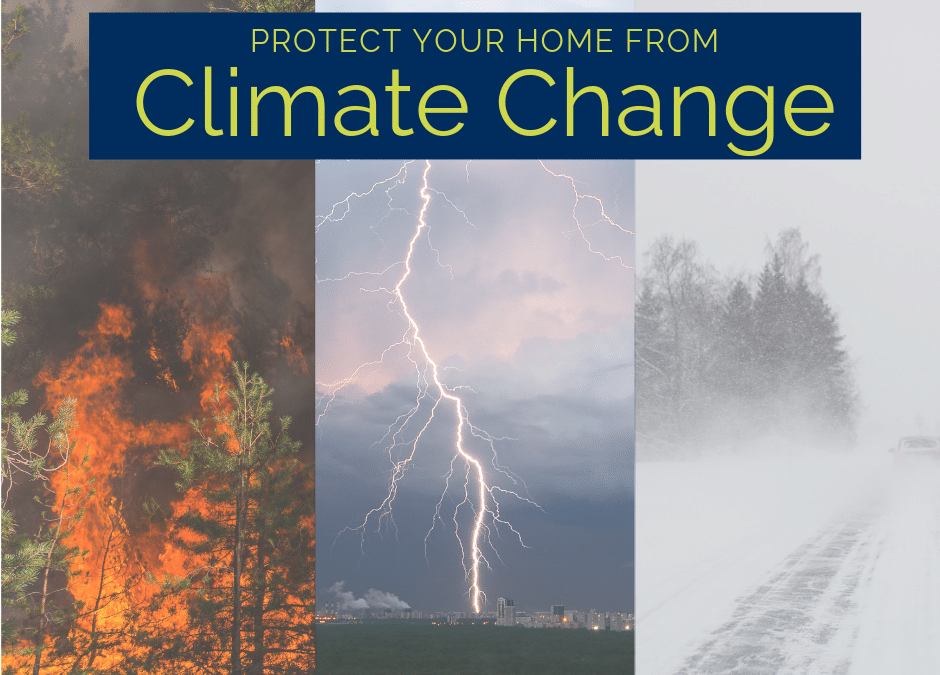

While there may be some debate about the cause, more and more people are accepting the fact that a changing climate is leading to extremely erratic weather with more intense storms, prolonged drought, and rising temperatures.

This has led to some of the most dramatic disasters in the U.S. Throughout these impressive weather swings, roofs have been damaged, homes flooded, trees toppled and vast acreage blackened. Many property owners are wondering what’s next and what they can do to safeguard their property?

Here are some important steps that you can take to help protect your property and your family from the major effects of climate change.

Storms

Snow and ice storms, hurricanes and spring/summer thunderstorms have become more intense. From record hail, tornado outbreaks, and torrential downpours; our homes and property are taking a beating.

When these storms hit, check and repair:

- Roofs and shingles

- Gutters and downspouts

- Decks and porches for loose, cracked or exposed wood

- Exterior for chipped or peeling paint, cracks, holes or exposed wood or siding

- Attics for evidence of leaks

- Basements or crawl spaces for damp areas and cracks

- Concrete slabs for cracks or shifting soil

- Chimneys for damage or dirty flues

- Trees and bushes for broken or weak trunks and branches, and removing any branches that overhang your home

Fire

Wildfires in much of the country have burned hotter and consumed more structures and acreage in recent years. Climate change has extended the fire season by an extra two months across the U.S.! In much of the South and West it begins in early spring, ending late fall.

Fire prevention experts recommend that anyone in or near a fire-prone area, especially what is called the Wildland Urban Interface (WUI), needs to take these steps to minimize their fire risk and help responding crews:

- Create at least a 100 foot defensible space area around homes and structures (200 feet or more may be needed on hillside areas)

- Keep combustible wood piles, propane tanks and other flammable materials 30 feet from homes and structures

- Remove weeds and dry shrubs near structures

- Keep laws trimmed and mowed

- Trim tree branches 10 feet up from the ground and remove any that overhang your home or other structures, and keep trees spaced 30 feet apart

- Install a fire resistant roof and deck

- Make sure your street name and address are visibly posted for emergency vehicles

- Clear flammable vegetation 10 feet from roads and five feet from driveways, and cut back overhanging branches on roads and drive ways

Keeping your home well maintained is essential to withstand the vagaries of weather. You can find more wildfire preparation tips here.

Know Your Insurance

In the event of these extreme storms it is also critical that you understand your insurance and know:

- If your homeowners policy includes replacement cost or actual cash value,

- Whether you are covered for new additions, improvements or appliance and other upgrades,

- That a floater or scheduled personal property endorsement is needed to fully cover high value items such as fine art, furs, jewelry, silverware and musical instruments

Keep in mind: flood and earthquake insurance are not included with your home or renters policy. However when you have California Casualty, you can easily add each to your policy though our agency services program. Please contact: 1.877.652.2638 or [email protected] .

Another important coverage you should add to your policy is comprehensive coverage. Without it your vehicle won’t be protected if it is damaged or destroyed by a flood, fire or falling tree limb. To ask a customer service representative about adding comprehensive coverage please contact: 1.800.800.9410 or visit www.calcas.com

Lastly, make sure your belongings are also completely covered in the event of a storm or fire. If you haven’t completed a home inventory yet, now is the time to do it. Having a list and proof of the things you own will help you with reimbursement if your home or apartment is damaged by a natural disaster. For our free Home Inventory Guide click here.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

Car theft and robberies spike in the summer. Why? Because many vehicles are left for long hours in parking areas, restaurants, tourist attractions, and even at home for days at a time while many families go on vacation. That means, during these next few months, we all need to be a little more car-theft aware.

One of the best ways to prevent your vehicle from robbery or theft is to never leave your keys in the car; it’s like an open invitation to thieves. Seems simple enough, right? Unfortunately, thousands of Americans make this mistake every day. During the summer months, more people tend to leave their car or truck running with the air conditioning on while they make a quick stop.

The National Insurance Crime Bureau (NICB) reports there are about 700,000 vehicle thefts each year. 60,000 of those were a result of someone leaving their car running or their key fob inside. That means someone returns to find their vehicle missing about every 41- seconds in the U.S.

Top 10 Cities for Car Theft

NICB has compiled a list of the ten areas where the most vehicles were taken in 2017:

- Albuquerque, NM

- Anchorage, AK

- Bakersfield, CA

- Pueblo, CO

- Modesto, CA

- Redding, CA

- Stockton-Lodi, CA

- Wichita, KS

- Vallejo-Fairfield, CA

- Saint Joseph, MO

Even if your city isn’t on this list, no one is completely immune from car theft. Crooks are always on the prowl, however, there are steps you can take to help prevent becoming a car theft victim.

Protect yourself and your property

To help prevent the growth in vehicle thefts, the NCIB offers these important tips:

- Never leave your car running to keep it cool, even if it’s for a short period of time

- Lock your vehicle, set the alarm and take all keys or FOBS

- Do not leave the garage door opener in the vehicle, and if you do try to keep it hidden

- Remove all non-essential papers with your personal information from your vehicle

- Park in well-lit areas

- Install an immobilizer and tracking system

- Make sure your car alarm is working properly

- Take all valuables with you

- Make sure your windows are completely closed when you exit your vehicle

Remember, unless you have comprehensive coverage as part of your auto insurance, you are not protected against car theft. You will be stuck paying for the replacement or the repairs to your car or truck if it is recovered.

Now is a great time to contact a California Casualty advisor to make sure you have the right auto insurance for your driving needs. Give us a call today at 1.866.704.8614 or visit www.calcas.com.

This article is furnished by California Casualty, provider of auto and home insurance for educators, law enforcement officers, firefighters and nurses.

For more information, please visit:

https://bit.ly/2JXeqxM

by California Casualty | Auto Insurance Info |

June 20th Is National Dump the Pump Day, but what does it mean to “dump the pump”? Dump the Pump Day is a nationally recognized holiday to take a break from being behind the wheel and give transportation alternatives a try.

Transportation is the largest source of carbon emission in the United States. And it produces 30% of global warming emissions; however, if 1 in 5 Americans chose an alternate (or “clean”) form of transportation every day like – public transportation, riding bikes/electric scooters, carpooling, or walking – it would eliminate 20% of those carbon monoxide emissions. That is 2/3rds of all emissions!

There are all kinds of benefits to finding alternative transportation methods. So for one day avoid bumper to bumper traffic on the interstate and ditch your car for a more environmentally friendly commute.

Here are 5 reasons to “Dump the Pump” on June 20th:

- Reduces Your Carbon Footprint– A single car emits 6 to 9 tons of C02 each year. With more people switching to public transit, it ALONE can save 37 million metric tons of carbon emission yearly.

- Reduces Traffic Congestion– The more people using alternative forms of transportation, the fewer cars on the roadway. This can help you get to your destination much more quickly and efficiently.

- Safer than Driving– Transit trips are 10 times safer per mile, and you reduce your accident risk by 90%. If you are biking or walking, make sure to take the necessary safety precautions like wearing a helmet and avoiding major roadways.

- Saves You Money- Gas, maintenance, parking, and other expenses for vehicles add up every single day. Those totals can reach over $10,000 a year, and that’s not including unexpected repairs.

- Encourages Healthier Habits– Biking and walking improve physical fitness and promote healthy weight loss, coordination, and balance. Those who use clean forms of transportation like this get 3 times more physical activity, than those who don’t.

Even if it’s impossible for you to ride your bike or take public transportation every day, finding an alternative to driving for just one day still creates an impact and will make you feel good knowing you did your part. So, Dump the Pump on June 20th and see how it can benefit you.

For more information visit:

https://bit.ly/31IIEg3

https://bit.ly/31FcYZ8

https://bit.ly/2IqYEvL

https://bit.ly/2x7lvWA

by California Casualty | Auto Insurance Info, Safety |

May 24 is National Road Trip Day!

As May comes to a close, classes are ending, the days are getting longer, and temperatures are slowly beginning to rise. You know what else that means? Vacation. Summer is calling and many American families are planning to spend their free time on the road relaxing and enjoying the sun.

Traveling, in all forms, is at its peak in the summer months. Road tripping and RV-ing are currently on the rise, so much so that Fox News reports that 73% of Americans would rather road trip than fly. Aside from all of the scenic views that are available when traveling by vehicle, travelers feel a sense of freedom by land, with the knowledge that they can stop or change their destination at any point in time instead of following a strict schedule like you would in an airport.

Whether your destination is the beach, the mountains, or just the open road, it is critical that your vehicle is ready to make the journey with you. So before you jam all of your luggage in the trunk, be sure to check the following in preparation for your summer road trip adventure:

-

Periodically check and test batteries for proper charging. Summer heat drains batteries faster than the cold of winter.

-

Check the air conditioning system for leaks and proper coolant.

-

Check the tires for tread and proper inflation.

-

Be sure your cooling system has the proper anti-freeze/coolant and all belts, hoses and the water pump are properly working. Never open a hot radiator cap; the liquid inside is a scalding 200 degrees or hotter.

-

Verify the viscosity of your motor oil will stand up to hot weather days, 10W-30 or 10W-40.

-

Make sure the spare tire is inflated and there is a jack and tire changing tool.

-

Test your windshield wipers and change them if they are streaking.

Consumer Reports advises that, as well as checking your vehicle before leaving for your destination, you should also travel with a basic safety kit that consists of:

- Cell phone and spare battery

- First aid kit

- Fire extinguisher

- Warning light or reflective triangles

- Tire gauge

- Jumper cables

- Foam sealant for flat tires

We don’t like to think that things could go wrong on vacation, but you never know what you will run into on the open road and that is why it is important to be prepared. Here at California Casualty we proudly support our customers and want you all to have a fun and safe summer full of road trip adventures, so before you hit the road, make sure that you and your vehicle are adequately protected for the unexpected you may encounter far from home.

Current customers call a California Casualty advisor for an auto policy review at 1.800.800.9410 or visit mycalcas.com/customerservice. If you are not a customer please contact us 1.866.704.8614 or visit www.mycalcas.com to request a FREE Auto Insurance quote.

Where do you plan on traveling this summer? Or do you have a dream road trip destination? Comment below and give us ideas for our summer travels! And if you are wanting to hit the road, but need a little help as to where check out Fox New’s Top 15 things to do on America’s travel bucket list.

Happy Travels!

More information for this article can be found at:

https://fxn.ws/2Ev0SYm

https://bit.ly/2K2jq5Y

by California Casualty | Auto Insurance Info |

We see them every day. Someone drifting across lanes, running through stop signs or driving well below the speed limit while talking, texting or checking something on their smartphone. Someone driving distracted.

April is Distracted Driving Awareness Month, dedicated to educating and eliminating the scourge of inattentive drivers on America’s highways and byways. Unfortunately, too many of us are making bad decisions behind the wheel, and there is much more work to be done.

Five Most Distracted Cities

TrueMotion, a company that uses sensors and driving information to help make roads safer, analyzed the data from thousands of vehicles to determine the areas with the most distracted drivers in America. Their findings:

- St. Louis

- Phoenix

- Atlanta

- Salt Lake City

- Fort Worth

The states with the most distracted drivers were Mississippi, Georgia, Florida, Missouri and Louisiana.

Here’s the scary part – TrueMotion found drivers in the most distracted areas were not paying attention almost 20 percent of their time behind the wheel. You wouldn’t want to be a nearby pedestrian or driving next to them during one of their many lapses.

You Know the Danger

Let’s face it, every city has distracted drivers. They are not only a nuisance, but a danger to us and the ones that we love.

The problem of distracted driving continues to increase. Sixty percent of us admit to taking our eyes off the road to text, check social media or look up directions. The National Safety Council estimates that at least nine Americans die and 100 are injured every day in distracted driving crashes. One study found that 84 percent of us feel threatened when we see a driver concentrating on an electronic device, rather than traffic and the roadway. One recent study concluded that people talking on the phone while driving were as impaired as someone who tests for the legal limit of blood-alcohol.

What Can You Do?

Despite collision avoidance systems, the accident rate continues to climb. Traffic experts warn that inattentive and aggressive driving is the cause for all too many crashes. Here are some defensive driving tips that can help you avoid these drivers:

- Keep scanning the area ahead and behind you

- Drive with both hands on the wheel to better respond to dangers

- Don’t follow too close

- Slow down in bad weather

- Have an escape plan

- Avoid driving when tired or drowsy

You can also help stop distracted driving:

- Set a good example for others. Many teens say while their parents lecture them about texting or not paying attention while driving, their parents text or fiddle with phones while they drive

- Turn off phones or use the text and call blocker when driving

- Plan and review trip directions before driving, and pull over if you need to read or program navigation systems

- Create music or podcast lists before setting off on your drive

- Don’t drink, eat, or do other actions (grooming, turning to talk to others, etc.) that could be a distraction while driving

Teaching young drivers is one of the best ways to prevent this type of driving behavior. That’s why California Casualty is proud to be a major sponsor of Impact Teen Drivers, a nonprofit formed with the law enforcement and education groups that uses peer-to-peer tactics to educate teen and young adults about the dangers of distracted and reckless driving. Learn more at https://www.calcas.com/web/ccmc/impact-teen-drivers.

Experts recommend that everyone take a defensive driving course to learn these techniques. It can also help you get a discount on your auto insurance.

Before you hit the road, make sure you have adequate protection in case you encounter a distracted or aggressive driver. Call a California Casualty advisor today for an auto policy review, at 1.800.800.9410 or visit www.calcas.com.

Sources for this article:

https://www.nsc.org/road-safety/get-involved/distracted-driving-awareness-month

https://archive.unews.utah.edu/news_releases/drivers-on-cell-phones-are-as-bad-as-drunks/ https://gotruemotion.com/blog/the-most-distracted-cities-in-america/

https://www.distraction.gov/

https://www.drive-safely.net/defensive-driving-tips/

This article provided by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters and nurses. Get a quote at 1.800.800.9410 or www.calcas.com.