by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

Being a first responder takes a lot of dedication, time, and training. You shouldn’t have to worry whether you have the right auto and home insurance. That’s why law enforcement and fire organizations have worked with California Casualty for decades to provide auto and home insurance to their members with exclusive benefits that are not available to the general public.

Here are 7 exclusive benefits for first responders from California Casualty:

- Waived Deductibles- California Casualty reduces the deductible up to $500 if your vehicle is vandalized or hit when parked where you work as a first responder.

- Personal Items in Your Vehicle- California Casualty includes $500 coverage for personal property (including turnout gear, safety equipment, and personal off-duty firearms) stolen from or damaged in your vehicle.

- Fallen Hero Benefit- California Casualty waives the insurance premium for the current year and the following year for the surviving spouse or partner of an insured firefighter or law enforcement officer who dies in the line of duty (not available in GA, MT, NH, TN and TX).

- Identity Protection- Each policy with California Casualty comes with FREE ID Theft protection and resolution services from CyberScout.

- Flexible Payment Options- Whether you like to pay one bill or do monthly installments, California Casualty lets you choose what works best for you. They also offer summer or holiday skip payment options so you can maximize your budget for the times when you need the money for other things.

- Insurance for Your Pets- Every auto insurance policy automatically includes up to $1,000 for vet bills if your pet is injured in a covered loss in your vehicle. California Casualty’s partner, Pets Best, also offers reduced rates for pet health insurance.

- Custom Parts and Accessories- California Casualty covers up to $2,000 for things you’ve added to your truck or van like custom rims, roll bars and furnishings (including pickup bed liners and covers).

Firefighter and Peace Officer associations have partnered with California Casualty because they have auto and home insurance policies tailored to best fit the lives of first responders. Be sure that you have all the coverage you need with the exclusive discounts you deserve. Contact a California Casualty adviser for a no-hassle policy review today, 1.866.704.8614 or https://www.calcas.com.

*All coverages may not be available in all states. In the case of any loss, the policy terms and conditions will apply.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Calcas Connection |

You found the perfect company, sent over your resume and cover letter, and just got scheduled for an interview. Whether you’re a job-hunting pro or seeking a foothold in your new career, there’s often a mix of anticipation and anxiety about what to wear, what to say, and how to impress your potential employer.

So, we asked our Human Resource experts, what are the best practices that they recommend to nail an interview? Here are our California Casualty HR professional’s interview dos and don’ts:

First, don’t underestimate the importance of the initial phone interview. Many companies -California Casualty included- want to do a first interview over the phone. This is the first key step to get a face-to-face interview, and eventually the job.

DO:

- Find a quiet place with good reception

- Make sure your phone is charged

- Research the company

- Have your resume and notes in front of you

- Remember to keep it conversational, but always be professional

- Ask questions

DON’T:

- Have pets or kids in the room

- Use filler words like, “um” or “uh”

- Do anything besides sit and talk (EX. having a side conversation, watching TV, doing the dishes, going to the bathroom) *Yes, these have all happened.*

- Use profanity or slang

- Automatically assume you will get an in-person interview

If you get invited to the next step, congratulations! Now it is time for an interview at the actual company. It is important to put your best foot forward and make a good, lasting impression with your potential employer.

DO:

- Research the company and know what it does, its core beliefs and values, and how you might fit in

- Know what job you are interviewing for and if you will be a good fit

- Research “behavior-based interviews” (BBI)

- Practice answering other common interview questions

- Arrive early

- Dress professionally (even if the company tells you they have a casual dress code, remember you are not an employee -yet- and are there to impress)

- Bring a copy of your resume, cover letter, and any other requested documents or forms that you were asked to bring or complete

- Be aware of your posture and non-verbal communication

- Utilize eye contact

- Be articulate and concise, and confident in your answers

- Prepare and ask questions about the company or the specific job

DON’T:

- Arrive late

- Use slang, inappropriate language, or bad grammar

- Slouch or fidget

- Talk negatively about your current or past job and coworkers

- Share too much personal information

- Lie about past experiences or qualifications

- Completely dominate the conversation

- Make your first question about pay, sick time, or vacation

- Show signs of panic when you don’t know an answer to a question

- Be afraid to ask the interviewer to clarify a question

And lastly, don’t doubt yourself, you’ve got this! 🙂

At California Casualty, we serve American Heroes who are committed to making their communities better: educators, law enforcement officers, firefighters, and nurses. We are always looking for motivated individuals who are dedicated to providing a higher level of service to those who serve their communities. We invite you to learn more about exciting opportunities on our career page, https://www.calcas.com/careers.

by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

While there may be some debate about the cause, more and more people are accepting the fact that a changing climate is leading to extremely erratic weather with more intense storms, prolonged drought, and rising temperatures.

This has led to some of the most dramatic disasters in the U.S. Throughout these impressive weather swings, roofs have been damaged, homes flooded, trees toppled and vast acreage blackened. Many property owners are wondering what’s next and what they can do to safeguard their property?

Here are some important steps that you can take to help protect your property and your family from the major effects of climate change.

Storms

Snow and ice storms, hurricanes and spring/summer thunderstorms have become more intense. From record hail, tornado outbreaks, and torrential downpours; our homes and property are taking a beating.

When these storms hit, check and repair:

- Roofs and shingles

- Gutters and downspouts

- Decks and porches for loose, cracked or exposed wood

- Exterior for chipped or peeling paint, cracks, holes or exposed wood or siding

- Attics for evidence of leaks

- Basements or crawl spaces for damp areas and cracks

- Concrete slabs for cracks or shifting soil

- Chimneys for damage or dirty flues

- Trees and bushes for broken or weak trunks and branches, and removing any branches that overhang your home

Fire

Wildfires in much of the country have burned hotter and consumed more structures and acreage in recent years. Climate change has extended the fire season by an extra two months across the U.S.! In much of the South and West it begins in early spring, ending late fall.

Fire prevention experts recommend that anyone in or near a fire-prone area, especially what is called the Wildland Urban Interface (WUI), needs to take these steps to minimize their fire risk and help responding crews:

- Create at least a 100 foot defensible space area around homes and structures (200 feet or more may be needed on hillside areas)

- Keep combustible wood piles, propane tanks and other flammable materials 30 feet from homes and structures

- Remove weeds and dry shrubs near structures

- Keep laws trimmed and mowed

- Trim tree branches 10 feet up from the ground and remove any that overhang your home or other structures, and keep trees spaced 30 feet apart

- Install a fire resistant roof and deck

- Make sure your street name and address are visibly posted for emergency vehicles

- Clear flammable vegetation 10 feet from roads and five feet from driveways, and cut back overhanging branches on roads and drive ways

Keeping your home well maintained is essential to withstand the vagaries of weather. You can find more wildfire preparation tips here.

Know Your Insurance

In the event of these extreme storms it is also critical that you understand your insurance and know:

- If your homeowners policy includes replacement cost or actual cash value,

- Whether you are covered for new additions, improvements or appliance and other upgrades,

- That a floater or scheduled personal property endorsement is needed to fully cover high value items such as fine art, furs, jewelry, silverware and musical instruments

Keep in mind: flood and earthquake insurance are not included with your home or renters policy. However when you have California Casualty, you can easily add each to your policy though our agency services program. Please contact: 1.877.652.2638 or [email protected] .

Another important coverage you should add to your policy is comprehensive coverage. Without it your vehicle won’t be protected if it is damaged or destroyed by a flood, fire or falling tree limb. To ask a customer service representative about adding comprehensive coverage please contact: 1.800.800.9410 or visit www.calcas.com

Lastly, make sure your belongings are also completely covered in the event of a storm or fire. If you haven’t completed a home inventory yet, now is the time to do it. Having a list and proof of the things you own will help you with reimbursement if your home or apartment is damaged by a natural disaster. For our free Home Inventory Guide click here.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Calcas Connection, In Your Community |

High Marks From Educators

The National Education Association Representative Assembly is an exciting and important gathering for the country’s educators. Every year, delegates from districts and states meet to share stories, learn new ideas, and set the agenda for tackling issues impacting public education. California Casualty continued our tradition of joining NEA Member Benefits to attend the conference and share the value of NEA membership.

This year’s RA was extra special. Not only were we able to connect with delegates from around the country, but the Member Benefits area was within earshot of the actual assembly. Brian Goodman, California Casualty AVP of Field Relations, was impressed as he witnessed the incredible dedication and energy of getting the NEA business done. “I was humbled and awed by all the organization and passion that went into the Assembly,” he said.

We work hard to honor your dedication to the teaching profession and your commitment to students and the community. It was gratifying for the California Casualty Partner Relations team to get a chance to greet many attendees who stopped by to say hello and spend time with the people they consider friends and cohorts. “We get members who have such an affinity for their local Field Marketing Manager that they want to say hello and share how close they feel with the Field team member they work with. These relationships are very real, and the delegates want us to know how proud they are of that partnership,” noted Brian.

An example of that appreciation comes from Ohio Education Association Regional Director Cristina Munoz-Nedrow, who shared how much she loves working with California Casualty’s Ohio Field Marketing Manager, Sharlie Trentman. “Sharlie has done an amazing job of building relationships with my staff in the field to promote the benefits of California Casualty. Just as important, she has built relationships with the local leaders and members in my region. I am always amazed at the number of members she knows and those who know her when I am at an event with Sharlie. She is a great ambassador for California Casualty and is always poised, professional and knowledgeable when attending local, regional or state level OEA events. I look forward to working with Sharlie for years to come, and want you to know that I so appreciate the work she does.”

Brian added that other NEA regional delegates dropped by to let us know how happy they are with California Casualty and all the company does for them. “They are very proud of the decision to be insured with California Casualty and want to say thanks.”

The working relationship between California Casualty and NEA Member Benefits pays dividends, especially for growing NEA membership. “Our Field team works as ambassadors for NEA Member Benefits, promoting the value and power of the organization. This partnership is strong, built on trust, respect, and a long history of providing exceptional insurance for educators,” Brian said.

Taking A Ride With First Responders

It’s not often the general public gets to experience the reality of being a firefighter or test out some of their tools. That’s why our New Jersey Account Relations Manager, Alina Fayerman, considers herself fortunate after spending an afternoon with the Wyckoff Fire Department. Alina always appreciates the opportunity to meet with the men and women who wear a uniform, but this visit was special. Bergen County’s new Fire Coordinator, Joseph Alvarez, invited Alina take a test ride in the department’s recently updated bucket ladder. Alina said it was a thrill to experience such an important piece of equipment for fighting fires and rescuing people. Alina also got to show off her special fire chief helmet.

TAKEAWAY:

We love hearing your California Casualty stories. Share them at our Facebook page, www.facebook.com/CaliforniaCasualty, or tell your colleagues and family about our exceptional service and have them visit www.calcas.com to learn more about what we do and how we serve you.

by California Casualty | Educators |

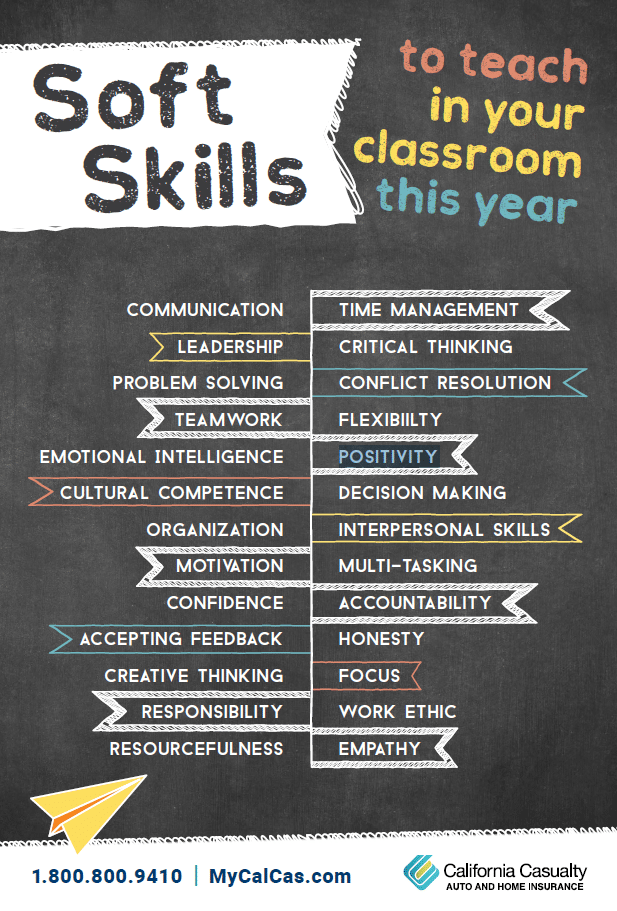

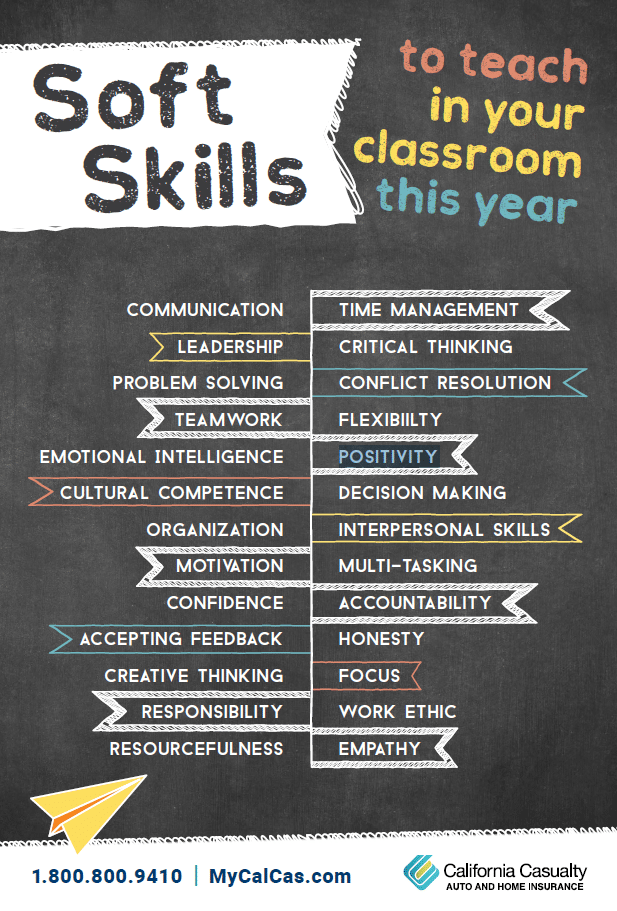

Soft Skills are very important non-academic skills that kids need to learn to help them throughout their lives. There are many ways teachers can incorporate soft skills to teach in the classroom. This can range from problem solving exercises, practicing mindfulness, to group communication with other students. soft skills printable

Download our free Soft Skills printable below. Use it to hang up in your classroom to make sure your students are continuously working on their soft skills. Additionally, you could even develop activities around each skill and have students share examples of each soft skill they use with with friends, family, and even in the classroom!

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.