by California Casualty | Auto Insurance Info, Helpful Tips, Safety |

When it comes to keeping you safe behind the wheel, nothing works harder than your brakes. They’re your car’s first line of defense against accidents, yet most drivers don’t think about them until something goes wrong—a squeak, a grind, or that sinking feeling when the pedal doesn’t respond like it should.

The good news? You don’t need to be a car expert to understand how brakes work or how to spot trouble before it turns into a safety issue. With a little knowledge, you can keep your brakes in top shape and give yourself peace of mind every time you drive.

How Do Brakes Actually Work?

At their core, brakes use one simple idea: friction. When you press your foot on the brake pedal, you’re triggering a hydraulic system—a system powered by fluid—that pushes brake pads or brake shoes against a spinning surface attached to your wheels. That pressure and friction are what slow your car down.

Think of it like riding a bicycle. When you squeeze the hand brakes, the pads press against the rim of the wheel, creating friction that makes the bike stop. Your car brakes work on the same principle, just on a larger and more powerful scale.

Most modern cars also have power-assisted brakes, which make it easier for you to press down, and an anti-lock braking system (ABS), which prevents the wheels from locking up during sudden stops. That keeps your car more stable and easier to steer in an emergency.

Disc vs. Drum: The Two Main Types of Brakes

Most vehicles on the road today use a hydraulic braking system with either disc brakes, drum brakes, or a combination of both.

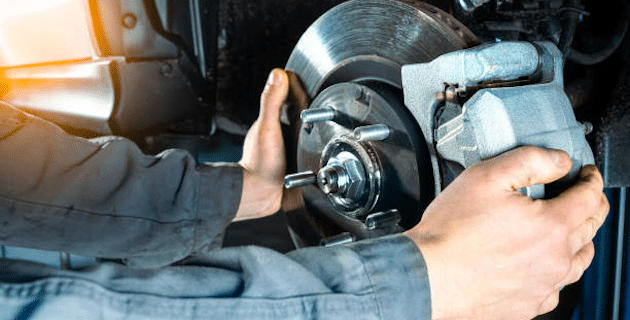

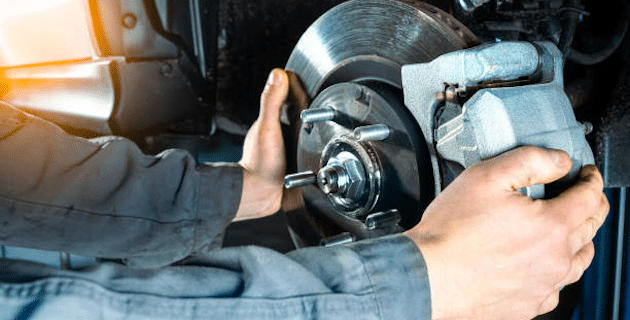

- Disc Brakes: These are the most common, especially on the front wheels (which handle most of the stopping power). A spinning disc, called a rotor, is clamped by a caliper holding brake pads. When you press the brake pedal, the pads squeeze the rotor, creating friction to slow the wheel.

- Drum Brakes: These are more often found on rear wheels. Inside the brake drum, brake shoes are pressed outward by pistons when you hit the brakes, rubbing against the drum to slow the car.

You don’t need to memorize the mechanics, but it helps to know that both systems rely on brake fluid, pads or shoes, and the principle of friction to get the job done.

Warning Signs Your Brakes Need Attention

Brakes give you plenty of signals before they fail completely. The key is to notice them early:

- Strange Noises: A squeal often means your brake pads are wearing thin. A grinding sound could mean the pads are worn down completely, with metal scraping against metal.

- Soft or Spongy Pedal: If the brake pedal sinks toward the floor or feels unusually soft, it may signal a leak in the brake system or air in the brake lines.

- Car Pulling to One Side When Braking: If your vehicle veers left or right when braking, it could be uneven brake wear, contaminated fluid, or a problem with the brake linings.

- Dashboard Warning Lights: Don’t ignore that glowing brake light. It’s your car’s way of asking for help.

If you notice any of these symptoms, it’s time to schedule a brake check before things get worse.

Simple Brake Maintenance Tips

You don’t need to be a mechanic to stay on top of basic brake care. A little attention can go a long way toward preventing costly repairs and keeping you safe. Here are some practical steps:

- Check Brake Pads: Brake pads wear down over time. If they’re less than ¼ inch thick, it’s time to replace them. Worn pads reduce your stopping power and can damage other parts of the braking system.

- Watch for Grease or Debris: Brake pads should be clean and dry. Grease or oil on them can reduce friction, making it harder to stop.

- Brake Fluid: Your mechanic should check the level and condition of your brake fluid regularly. Fresh brake fluid is clear or light in color. Dark or dirty fluid should be replaced.

- Rotors and Drums: Look for signs of grooves, cracks, or warping. Depending on the severity, they may need to be resurfaced or replaced.

- Brake Lines: Over time, brake lines can develop leaks from corrosion or damage. Any leak in the system reduces braking power and must be fixed immediately.

A good rule of thumb is to have your brakes inspected at least once a year—or sooner if you notice any changes in how they feel or sound. The cost of regular maintenance is small compared to the expense (and stress) of major repairs, not to mention the potential consequences of an accident.

Brakes may not be the flashiest part of your car, but they’re among the most important. Knowing how they work, spotting warning signs early, and keeping up with maintenance can give you confidence on the road and keep you—and your passengers—safe.

Of course, even the best brakes can’t prevent every unexpected situation. That’s where the right insurance comes in. Just as your brakes protect you in the moment, good coverage protects you afterward—helping you recover from accidents, repairs, or losses. Together, brake care and the right insurance give you the peace of mind to enjoy the drive, knowing you’re fully protected.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Helpful Tips, Homeowners Insurance Info |

It only takes a moment—a forgotten candle, an overloaded outlet, a stray spark from the stove—for a cozy home to turn into a dangerous blaze. Every year, thousands of families face the devastating aftermath of house fires, many of which could have been prevented. Understanding the most common causes of home fires isn’t just smart—it’s essential. Here’s what you need to know to keep your loved ones safe and your home protected.

Cooking

A leading cause of house fires, unattended cooking is one of the biggest risks in the kitchen. Cooking fires can ignite in seconds, and flammable items like towels or food packaging can easily catch fire if placed too close to a hot burner.

How to prevent:

- Stay in the kitchen. Never leave food unattended when frying, grilling, or broiling. If you must leave, turn off the stove or oven.

- Use timers. Set a timer as a reminder that something is cooking, especially for longer tasks like baking or simmering.

- Clear the area. Keep oven mitts, paper towels, curtains, and wooden utensils away from burners.

- Turn pot handles inward. Prevent accidents by keeping handles turned toward the back of the stove.

- Avoid distractions. Don’t cook if you’re feeling drowsy or have consumed alcohol or sedating medications.

Heating

As temperatures drop, heating equipment becomes a top source of home fires. Space heaters, fireplaces, and wood-burning stoves can all spark danger if not used carefully.

How to prevent:

- Keep a safe distance. Maintain at least 3 feet of space between heaters and anything flammable—furniture, curtains, bedding, etc.

- Upgrade old equipment. Choose space heaters that turn off automatically when overheated or tipped over.

- Maintain chimneys and furnaces. Have them professionally inspected and cleaned annually.

- Dispose of fireplace ashes properly. Let ashes cool completely and place them in a metal container with a lid. Place them outside and away from your home.

- Use fire screens. Always use a sturdy screen or glass door in front of fireplaces.

Electrical

Modern homes rely on more electronics than ever—but faulty wiring or improper use of power and extension cords can lead to disaster.

How to prevent:

- Don’t overload outlets. Avoid using multi-plug adapters or plugging too many devices into one outlet.

- Inspect cords. Replace frayed, cracked, or damaged cords immediately.

- Pay attention to wattage. Always use light bulbs that match the fixture’s recommended wattage.

- Look for warning signs. Flickering lights, discolored outlets, burning smells, or frequent blown fuses are red flags.

- Upgrade protection. Install Arc Fault Circuit Interrupters (AFCIs) and surge protectors. Consider smart sensors that alert you to abnormal power use or overheating.

- Call an electrician. Have a licensed professional inspect your system if you suspect any issues.

Candles

While they add ambiance, candles can also add risk. An open flame left unattended is a leading cause of home fires.

How to prevent:

- Never leave a candle burning unattended. Always extinguish it when you leave the room or go to sleep.

- Watch placement. Keep candles at least 12 inches away from anything flammable—curtains, books, decorations.

- Use sturdy holders. Place candles on heat-resistant surfaces and avoid wobbly furniture.

- Keep away from pets and children. Curious hands and wagging tails can easily knock over a candle.

- Don’t burn to the bottom. Leave at least a half inch of wax in the container to prevent overheating and cracking.

Dryer Vents

Dryers are a common cause of home fires, and too often, the lint traps are the culprit. Making sure your lint trap is not too full will help.

How to prevent:

- Clean the lint filter after every load. Remove lint from around the dryer rim.

- Check the vent hose regularly. Make sure it’s not kinked or clogged. Make sure the outdoor vent flap opens when the dryer is on.

- Move flammable items. Move cardboard and cleaning supplies away from the dryer, especially when it is on.

Smoking

Careless smoking is another major contributor to home fires—especially when done indoors or near flammable materials.

How to prevent:

- Never smoke in bed or when drowsy. It makes it too tempting to skip safe disposal and it’s too easy to fall asleep.

- Use deep, sturdy ashtrays. Ensure cigarette butts are completely extinguished.

- Don’t toss butts in the trash. Dispose of them in a metal container or douse with water before discarding.

Preventing a fire doesn’t stop with avoiding hazards—it includes being prepared in case one does occur.

- Install smoke detectors. Place them on every level of your home, inside bedrooms, and outside sleeping areas. Test them monthly and change the batteries twice a year (when you change the clocks).

- Have an extinguisher on hand. Keep one in the kitchen and know how to use it. Check that it’s not expired.

- Keep flammable items out of reach. Store matches, lighters, and chemicals where children can’t access them.

- Follow these tips to fireproof your home. There’s a lot that you can do inside and outside.

- Create a fire escape plan. Practice it with your family so everyone knows how to exit quickly and safely.

Your home is one of your greatest investments. Make sure it is fully protected with the right insurance.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Helpful Tips |

Sunshine, salty air, and smooth sailing—now all you need is the perfect snack. Whether you’re captaining a cruiser or just along for the ride, the right munchies can make or break your day on the water. We’ve rounded up easy, packable boat snacks that won’t melt or make a mess. Cooler-friendly and one-hand-approved, these treats are made for smooth snacking, no matter how choppy the waters get.

When you’re planning a boat day, your snack strategy matters. You want food that’s simple, satisfying, and won’t leave sticky fingers or stains. Even better? Snacks that hydrate, energize, and keep everyone happy from dock to dock. Here are some smart picks and tasty ideas to keep you fueled and floating. Add them to the list of what you’re keeping in your boat this summer.

The Snackle Box: Tackle Hunger in Style

What’s better than a charcuterie board? A portable one that fits in a tackle box! The “snackle box” is the ultimate grab-and-go boat snack solution. Use a clean, compartmentalized tackle box to store bite-size snacks like:

- Cubed cheese

- Deli meats

- Baby carrots and sliced cucumbers

- Grapes or apple slices (toss in lemon juice to prevent browning)

- Trail mix or mixed nuts

- Hard-boiled eggs (pre-peeled)

Make it fun and colorful and be sure to keep it chilled in your cooler. Bonus: it’s easy to pass around and keeps everything in its place—no balancing acts needed.

PB&J Pinwheels: A Classic with a Twist

Take the beloved peanut butter and jelly sandwich to the next level with pinwheels that are perfect for one-handed snacking.

How to make them:

- Flatten sandwich bread with a rolling pin.

- Cut off the crusts.

- Spread peanut butter (or almond/sunflower butter) and jelly on the same slice.

- Roll it tightly, then slice into bite-size spirals.

- Secure with toothpicks and pack them in a sealed container.

You can also do a quick version using crackers—just top with PB&J for an easy snack.

Pasta Salad in a Cup

Portion pasta salad into small, lidded containers for a satisfying, no-mess meal. Choose a pasta that holds its shape, like rotini or bowties, and toss with your favorite ingredients—think cherry tomatoes, olives, diced veggies, and cheese cubes. Keep it light with a vinaigrette dressing that won’t congeal in the cooler.

Muffins: Sweet or Savory

Muffins are an ideal boat snack—easy to hold, not too messy, and totally customizable. Try lemon poppy, blueberry, or even savory cheddar. Bake ahead using this master muffin recipe from Sally’s Baking Addiction and get creative with the mix-ins.

Walking Tacos: Boat Edition

Want something warm and hearty? Walking tacos are a hit for all ages. Prep the taco meat in advance (ground beef, turkey, or black beans with seasoning) and store it in a thermos to keep it hot.

What you’ll need:

- Single-serving chip bags, such as Fritos or Cool Ranch Doritos (avoid the regular variety which can stain orange)

- Taco meat in a thermos

- Small containers of shredded lettuce, cheese, diced tomatoes, olives and sour cream

When you’re ready to eat, crush the chips in the bag, then slice it open down the side. Spoon in the taco meat and let your guests add the toppings of their choice. The chip bag is the bowl—no plate required!

Thermos Dogs: Hot Dogs That Stay Hot

Yes, you can have hot dogs on a boat—without the grill! Just place cut-up hot dogs in a wide-mouth thermos and pour boiling water over them before sealing. By lunchtime, you’ll have warm dogs ready for buns or toothpicks. Simple and satisfying.

Cooler Treats & Hydration Hacks

A good cooler is your best boating buddy. Fill it with snacks that refresh and rehydrate, such as these that you can prepare the day before.

- Fruit kabobs: Skewer chunks of watermelon, pineapple, strawberries, and melon for a grab-and-go option.

- Frozen grapes: A naturally sweet, refreshing treat.

- DIY popsicles: Freeze lemonade with sliced fruit in plastic cups, insert popsicle sticks, and enjoy them as they melt.

- Water bottles: Freeze a few the night before—they’ll keep your cooler cold and melt into ice-cold drinks.

What to Skip

Some snacks just aren’t boat friendly. Avoid these to keep your deck—and your day—clean:

- Bananas: Call it superstition, but many boaters believe they bring bad luck. Better safe than sorry!

- Chocolate and sticky candies: They melt fast and make a mess.

- Stain culprits like red wine and Kool-Aid: One spill and your deck may never forgive you.

Pro Tips for Onboard Snack Success

- Storage matters: Use zip-top bags, silicone pouches, and plastic containers with tight lids.

- Pack extras: Boating builds appetites!

- Bring wipes and napkins: Even with tidy snacks, clean-up is a must.

- Stay shaded: Keep your cooler out of direct sun to maintain freshness.

- Bring plenty of water: Dehydration sneaks up quickly on the water.

Don’t Forget to Protect Your Boat

While you’re packing snacks and sunscreen, make sure your boat insurance is up to date, too. A good policy helps protect you, your passengers, and your vessel from unexpected mishaps—whether it’s a rogue wave or a run-in at the dock. California Casualty offers customizable coverage options for boat owners, so you can relax and enjoy every moment on the water. Smooth sailing and happy snacking!

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Pets, Safety |

Summer is here, and our four-legged friends are ready to make the most of it—soaking up the sun, chasing butterflies, and joining us for backyard barbecues and beach days. But while the season is packed with tail-wagging fun, it also brings a few hidden hazards that can sneak up on even the most watchful pet parents. From sizzling sidewalks to tempting picnic snacks, summertime can be trickier than it looks. Here’s how to keep your fur babies safe, healthy, and ready for all the warm-weather adventures ahead!

Barbecues, Picnics, and Parties

Nothing says summer like a backyard cookout—but it’s not always a pet-friendly affair. Popular BBQ foods like rib bones, corn on the cob, and watermelon rinds may seem harmless but can cause serious health issues, including choking and intestinal blockages. Onions, grapes, and alcohol are outright toxic to pets, and treats like ice cream and potato salad can upset sensitive stomachs. Also be mindful of wooden skewers and toothpicks, which can splinter and cause internal injuries if chewed or swallowed.

Remind your guests not to share their food with your pet. Instead offer pet-safe treats as an alternative. Supervise your furry friend closely, especially if they’re known for getting into mischief—or are particularly sociable.

Lawn and Pool Chemicals

Beautiful lawns and sparkling pools can hide serious dangers. Fertilizers, pesticides, and pool chemicals are harmful if ingested, inhaled, or absorbed through your pet’s paws. Always store chemicals securely, clean up spills right away, and keep pets off freshly treated grass. When possible, choose pet-safe products that reduce the risk while still maintaining your outdoor space.

Dangerous Plants

Gardening this summer? Be sure your landscaping isn’t a hidden health hazard. Azaleas, lilies, rhododendrons, tulips, and daffodils are just a few of the plants that can be toxic to pets. Ingesting them can lead to vomiting, seizures, heart issues, and even death. Before heading out on a walk or letting your pet explore the garden, brush up on which plants are safe. (Check out our pets and plants blog for a detailed guide.)

Itchy and Stinging Insects

Summer means bugs—and lots of them. Fleas, ticks, and mosquitos can make your pet miserable and may carry dangerous diseases like heartworm and Lyme disease. Bees, wasps, and fire ants also pose risks, especially to curious pets who like to sniff and paw at anything that moves.

To protect your pet:

- Use flea, tick, and heartworm preventatives

- Check daily for ticks, especially after walks in wooded or grassy areas.

- Eliminate standing water and trim overgrown plants to deter pests.

- Monitor your pet for signs of bites or stings, such as swelling, excessive scratching, or difficulty breathing. In the case of a severe allergic reaction, seek veterinary help immediately.

Heat and Humidity

High temperatures and humidity can quickly lead to heat exhaustion or heatstroke, especially for older pets, overweight pets, or breeds with short snouts like pugs and bulldogs. Signs of heatstroke include excessive panting, drooling, and dry gums (a sign of dehydration). Your pet also may appear lethargic.

Always provide shade and fresh water and avoid intense activity during the hottest parts of the day. Never leave your pet in a parked car—not even for a few minutes. On a 75-degree day, the temperature inside a vehicle can soar to 100 degrees in just 30 minutes.

Also, be cautious of hot pavement and sand. Use the hand test: place your hand on the sidewalk for seven seconds. If it’s too hot for your hand, it’s too hot for paws. And don’t forget about sunburn! Pets can get burned too—especially on ears, noses, and bellies. Use pet-safe sunscreen, never human sunscreen, to protect exposed areas.

The Beach and the Pool

Many dogs love the beach, but it can come with unexpected dangers. Hot sand can burn sensitive paw pads, and ingesting sand can lead to a dangerous bowel obstruction. Sand can also irritate your pet’s eyes if it gets lodged under their eyelids.

As for water safety, not all dogs are natural swimmers. Never force your pet into the water, and always use a pet lifejacket, especially if you’re on a boat or near deep water. After a swim, rinse your dog off to remove salt or chlorine.

Fireworks and Thunderstorms

The loud booms of summer storms and fireworks can terrify pets, causing stress, anxiety, or even escape attempts. Prepare a safe, quiet space indoors where your pet can retreat. You can also try anxiety wraps, pet pheromone sprays, and soft music or white noise. For severe anxiety, talk to your vet about possible calming medications. And always secure doors, gates, and windows in case your pet tries to bolt.

Traveling with Your Pet

Planning a road trip with your fur baby? Keep your pet secured in a well-ventilated carrier or use a pet seatbelt harness. Never leave them unattended in a parked vehicle. Bring along water, treats, and poop bags, and schedule regular breaks.

Make sure your pet is microchipped and wearing ID tags with up-to-date contact info—just in case you get separated. If you’re flying, be sure to review your airline’s pet policy or check out our blog on flying with pets for extra tips.

One More Layer of Protection

We love our pets and no matter how careful we are, accidents happen. Pet insurance can offer peace of mind, helping cover unexpected vet bills so you can focus on keeping your pet happy and healthy all summer long.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

The freedom of summer is calling, and for many teens, that means hitting the road—often for the first time without a parent in the passenger seat. With new jobs, beach days, late-night hangouts, and spontaneous road trips on the agenda, it’s easy to forget that driving comes with serious responsibility. For parents, this season is a crucial time to set clear expectations behind the wheel. From curfews to passengers to phone use, establishing ground rules now can help your teen build smart habits that last far beyond the summer.

Follow intermediate licensing laws in your state.

Most states have graduated driver licensing (GDL) programs designed to help teens gain experience behind the wheel while minimizing risks. These often include rules like curfews, limits on passengers, and restrictions on highway driving. Start by familiarizing yourself with your state’s laws at www.ghsa.org. Then, build on those requirements with your own family rules. For instance, you might allow only daylight driving for the first month, then gradually expand driving privileges as your teen demonstrates responsibility.

Establish a nighttime curfew.

Driving at night is inherently more dangerous due to decreased visibility and increased likelihood of encountering impaired drivers. Teens, who are still developing experience and judgment, are especially vulnerable. Even if your state allows nighttime driving, consider setting a curfew that keeps your teen off the road during high-risk hours—often between 9 p.m. and 6 a.m. You might also require that they log a certain number of supervised nighttime hours with you before being allowed to drive alone after dark.

Ban cell phone use while driving.

Distracted driving is a leading cause of accidents, and teens are especially susceptible. While some states ban any cell phone use for drivers under 18, it’s smart to create a zero-tolerance rule at home regardless of local laws. That means no texting, no scrolling, and ideally, no hands-free calls unless absolutely necessary. Consider installing monitoring apps that block texts and calls while driving, and most importantly, model good behavior yourself—your teen is watching.

Talk about speeding—and how to avoid it.

Speeding contributes to nearly a third of all fatal teen crashes. Stress the importance of following posted speed limits, adjusting for weather conditions, and maintaining safe following distances. Teach your teen the three-second rule for following other vehicles, and how to give extra space to large trucks. Encourage them to build in extra time when leaving for work or social plans so they’re never tempted to rush.

Enforce seat belt use—every ride, every time.

Seat belts save lives, plain and simple. Make it a non-negotiable rule: the car doesn’t move until everyone is buckled up. Remind your teen that they are responsible for their passengers’ safety, too. Unbelted passengers can become deadly projectiles in a crash—even in the back seat.

Address impaired driving before it happens.

Teens may face peer pressure to drink or ride with someone who’s been drinking. It’s essential to talk openly about these situations and offer a safe exit plan. Let your teen know they can always call you for a ride—no questions asked—if they’re ever in an unsafe situation. Emphasize that driving under the influence of any substance, including marijuana or even some medications, is never acceptable.

Being a safe driver also means being prepared. Make sure your teen knows how to check the gas gauge and fill up when needed—ideally before it dips below a quarter tank. Show them how to recognize warning lights, check tire pressure, and know what to do in case of a breakdown. A quick review of the vehicle’s manual can go a long way in empowering your teen behind the wheel.

Know your teen’s driving plans.

As your teen begins driving independently, stay in the loop. Ask them to let you know where they’re going, who they’ll be with, and when they plan to return. If plans change, they should update you before getting behind the wheel again. Keeping control of the car keys is one way to ensure that you stay informed.

Put it in writing.

Consider drafting a parent-teen driving agreement that outlines the rules and consequences clearly. This written commitment can serve as a helpful reminder and a great conversation starter. It also opens the door for regular check-ins to reassess the rules as your teen gains experience. Be sure to revisit the agreement periodically, especially if any violations or concerns arise.

Don’t forget the insurance.

Before your teen starts driving, make sure they are properly insured. In some cases, good student discounts and safe driving programs can help lower costs. Most importantly, you want to be sure your teen is covered in the event of an accident.

Summer driving can be a rite of passage for teens—and a nerve-wracking time for parents. But with the right rules and a foundation of open communication, you can help your teen navigate this new freedom safely. Remember, driving is a privilege that comes with responsibility. By setting clear expectations and modeling safe behavior yourself, you’re laying the groundwork for a lifetime of smart driving choices.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.