by California Casualty | Homeowners Insurance Info, Safety |

As the weather gets cooler, there is nothing cozier than curling up next to the fireplace with a cup of hot up of coffee and a good book.

Millions of people in the United States have fireplaces that they primarily use during the fall and winter to create a comfortable environment and to warm their homes. However, without the proper maintenance, a fireplace can turn from cozy to deadly in a matter of seconds.

On average over 22,000 chimney fires occur in the United States every year. That estimates to about 125 million dollars in damage to homes. Chimney fires are can be caused by stray sparks and high temperatures, however, most are caused dirty, unkept chimneys.

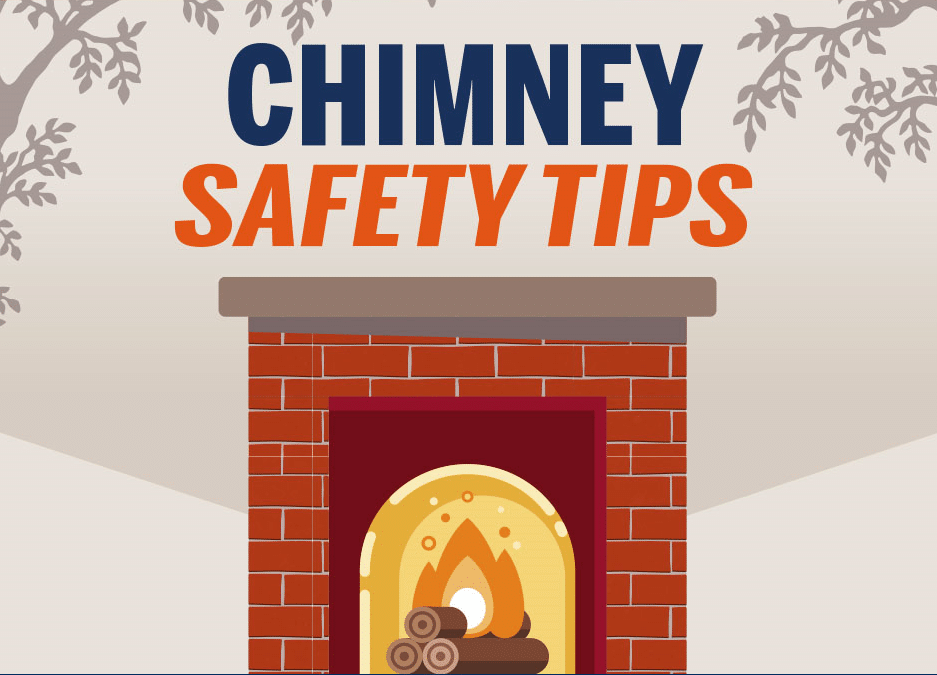

To prevent a chimney house-fire from happening follow these Chimney Safety Tips:

- Get your chimney cleaned yearly

- Cut and trim all overhanging branches

- Install a screencap on top of chimney

- Monitor the flue temperature

- Keep the fire screen closed

- Let ashes cool down

- Dispose of ashes far away from house

- Never burn trash or debris

- Only burn dry hardwood

- Keep firewood at least 30 ft. away

- Never leave chimney unattended

It is also important to make sure your smoke alarm and carbon monoxide alarms have batteries and are working properly. 2/3rds of fire deaths occur in homes with missing or non-functioning smoke alarms.

Install smoke and carbon monoxide alarms in every bedroom near doorways, outside each sleeping area, and on every level of your home near cooking devices and fireplaces.

Be safe this season, follow our chimney safety tips, and remember to have your chimney professionally cleaned and maintained before it’s first use to avoid a house fire.

For more safety tips click here.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

June through September is the peak of wedding season in the United States. Every year 2.1 million couples tie the knot. That breaks down to nearly 6,000 weddings a day!

If you have a special day coming up in the near future, be sure you make all of the appropriate changes to your personal documents, property, and information, so your new bride or groom is represented. These changes also include your insurance.

So, to make it quick and easy here are some insurance tips for newlyweds. Some could even end up saving you some money.

- Combine Your Insurance

If you have separate cars with different insurance companies, you’re eligible for discounts by putting both vehicles on the same policy. It also ensures that both drivers are covered no matter which car they use.

PRO TIP: You can save even more by bundling your autos with your home or renters insurance.

- Check for a Marriage Discount

Inform your insurance company of your marriage – most auto and home insurance companies offer important discounts for newlyweds. Men under the age of 25 are usually considered high risk drivers. However, once they marry, they often see a big drop in insurance premiums. Lower rates can also apply to those in domestic partnerships.

- Increase Homeowner or Renters Coverage

Wedding presents are wonderful! You now have a new set of dishes, expensive new appliances, and other valuable items for your home. Don’t forget, these assets need to be covered. Talk to an insurance advisor to make sure you have enough coverage to protect all the things you own and to increase your liability protection. It’s also a great time to create an inventory of all the things you own to help you purchase the right insurance protection and make filing a claim much easier.

- Get Extra Protection for High-Value Items

That beautiful new wedding ring and special gifts like fine art or silverware may need scheduled personal property protection, often called a “floater,” to make sure they are covered for their full value. Most homeowners and renters policies will provide limited coverage for those items. Scheduled personal property coverage will also pay to replace a ring, without a deductible, even if it was misplaced or damaged in the disposal.

Just like marriage, California Casualty is a committed partner in helping with your auto and home insurance needs. One of our advisors can walk you through everything from combining your vehicles to completing a name change.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info, Safety |

It’s officially the best time of the year. Football season!

Everyone knows that football is not the same without watch parties and tailgates! You’ve got the cold drinks, the savory BBQ, and the big screen ready for friends and family to come over and watch your favorite teams all season long. However, there could be one thing missing. Homeowners or renters insurance.

Let’s face it, accidents happen. Especially when you have a rowdy crowd on your hands and your team is deep in the 4th quarter. Homeowners and renters insurance protects you if one of your guests stumbles into your flat screen and it falls to the floor. Or, if someone trips and crashes through that glass table in the living room. With the proper coverage, you won’t be penalized.

If something in your home gets broken or stolen while you have people over, your policy will cover it. But, if you have high-value items that could get damaged or go missing like jewelry, antiques, collectibles, or furs, you will need to add extra coverage – scheduled personal property. Accidents are inevitable, but the best way to avoid losing or having to replace your collectibles is to put them in a safe place, away from the crowd when you are hosting events. Think locked room or basement.

What if Someone Gets Hurt in My House?

Any time you are a host, especially for a high energy crowd, there’s the risk that someone may accidentally get injured. Whether it’s from a touchdown dance celebration or tripping on a rug, homeowners and renters insurance with personal liability coverage will cover it.

If you are serving alcohol, be aware, the Insurance Information Institute (III) warns that hosts can be liable if others are hurt by anyone driving from your party while intoxicated. It’s called the social host liability law. Personal liability coverage will also help in this situation by covering payments of medical bills and lawsuits from someone who was hurt on or off (leaving) your property. There are limits, so you talk to your insurance advisor about an umbrella policy, which will provide much greater coverage.

What Else Can I Do?

Here are some important hosting safety tips you can use during football season:

- Talk with your insurance advisor about any policy exclusions or limitations before you throw a party

- Install proper lighting inside and outside of your home

- Remove valuable items and objects that could cause tripping or falling

- Consider holding your getting together at a restaurant or bar instead

- Have someone sober in charge of monitoring guests

- Encourage the use of Uber and designated drivers

- Lock up pets in a separate location or outside

- Make guests who’ve had too much to drink turn over their keys

Make sure you’re on the winning team if you are hosting a football party. Contact a California Casualty advisor today to make sure your homeowners or renters insurance will protect you in a liability blitz. Call 1.866.704.8614 or visit www.calcas.com.

by California Casualty | Homeowners Insurance Info, Safety |

Disaster can strike at ANY time during ANY season. So, each year we are here to remind you to prepare for disaster situations in your home and communities.

BE PREPARED: Before an emergency or natural disaster strikes, here are 10 things you can do:

- Plan and save for the unexpected financially.

- Sign up for emergency alerts in your area.

- Map out and practice using several different evacuation routes.

- Have a safe location planned for shelter if your town is evacuated.

- Plan for your pets and know where they will stay if you are evacuated. Here are some pet-friendly hotels.

- Have a plan where you and family members will meet and how you will communicate if you become separated.

- Create an emergency kit, that meets your family’s particular needs.

- Complete a home inventory and document all of your belongings (clothing, mattresses, bedding, kitchen appliances, furniture, electronics, etc.).

- Back up important phone contacts and photos physically or on The Cloud.

- Check your insurance coverage with an advisor, to make sure you’re adequately covered or add protection (ex. Home, Renters, Auto, Flood, Earthquake, Floater, and Umbrella).

BE READY: If you need to evacuate:

- To find local shelters download the FEMA app, text SHELTER and your ZIP code to 43362 (ex. SHELTER 12345), or visit the American Red Cross’ website.

- Contact California Casualty as soon as possible and save all receipts for living expenses, such as hotels, meals and other essentials.

- Monitor local media about conditions, further evacuations, or when it might be safe to return home.

BE SAFE: When you return home, there are many potential dangers, such as:

- Dangerous toxins, and debris

- Mold

- Gas leaks

- Electrical shock

- Poisonous snakes or other animals

- Structural instability and collapse

- Sewage and chemical tainted water

GET HELP: If you need recovery help afterward:

Though it is National Preparedness Month, it is important to remain prepared every month of the year. An emergency or natural disaster can strike at any time or place; and if it does, please remember, you are not alone. California Casualty is there when you need us most, to help make sure you and your family are covered.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

Being a first responder takes a lot of dedication, time, and training. You shouldn’t have to worry whether you have the right auto and home insurance. That’s why law enforcement and fire organizations have worked with California Casualty for decades to provide auto and home insurance to their members with exclusive benefits that are not available to the general public.

Here are 7 exclusive benefits for first responders from California Casualty:

- Waived Deductibles- California Casualty reduces the deductible up to $500 if your vehicle is vandalized or hit when parked where you work as a first responder.

- Personal Items in Your Vehicle- California Casualty includes $500 coverage for personal property (including turnout gear, safety equipment, and personal off-duty firearms) stolen from or damaged in your vehicle.

- Fallen Hero Benefit- California Casualty waives the insurance premium for the current year and the following year for the surviving spouse or partner of an insured firefighter or law enforcement officer who dies in the line of duty (not available in GA, MT, NH, TN and TX).

- Identity Protection- Each policy with California Casualty comes with FREE ID Theft protection and resolution services from CyberScout.

- Flexible Payment Options- Whether you like to pay one bill or do monthly installments, California Casualty lets you choose what works best for you. They also offer summer or holiday skip payment options so you can maximize your budget for the times when you need the money for other things.

- Insurance for Your Pets- Every auto insurance policy automatically includes up to $1,000 for vet bills if your pet is injured in a covered loss in your vehicle. California Casualty’s partner, Pets Best, also offers reduced rates for pet health insurance.

- Custom Parts and Accessories- California Casualty covers up to $2,000 for things you’ve added to your truck or van like custom rims, roll bars and furnishings (including pickup bed liners and covers).

Firefighter and Peace Officer associations have partnered with California Casualty because they have auto and home insurance policies tailored to best fit the lives of first responders. Be sure that you have all the coverage you need with the exclusive discounts you deserve. Contact a California Casualty adviser for a no-hassle policy review today, 1.866.704.8614 or https://www.calcas.com.

*All coverages may not be available in all states. In the case of any loss, the policy terms and conditions will apply.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info |

The rush is on to get everything ready as students head back to college. If yours are moving into a place of their own, don’t forget to purchase renters insurance to protect all the special items that make their new place their home away from home.

Here are some important reasons why it is a necessity for your college student(s) to have renters insurance:

1. College kids have more these days: books, bicycles, TVs, computers, tablets, gaming systems, smartphones, sound systems, clothes, bedding, furniture, and kitchen items. Replacing those items if they were stolen, damaged or destroyed in a fire could add up to tens of thousands of dollars. Renters insurance also pays for temporary living expenses, like a hotel room, while their room or apartment is being repaired.

2. Once they move into a place of their own they usually need their own renters insurance policy. Most students who live in a dorm have personal property coverage under their parents’ homeowners insurance.

3. A landlord’s insurance policy won’t cover your student’s belongings. The landlord’s insurance protects the building and only pays to fix walls, roofs, etc., not any of your kid’s contents.

4. Renters insurance provides liability coverage if someone gets hurt at your student’s home/apartment. It helps pay for medical expenses and other costs, like legal fees, if the injured person sues.

5. Renters insurance a great value. On average, it costs between $10 and $20 a month, or about $200 a year. That’s less than most people spend each month for cell phones or their cable bill.

Policies from California Casualty also provide free ID theft protection from CyberScout, adding another layer of security in our modern world of social media, data breaches, and online trolls. Now is the time to find out how little renters insurance costs, and how it can cover your student’s belongings. Learn more by contacting an advisor today at 1.866.704.8614 or visit https://mycalcas.com/quote

This article is furnished by California Casualty. We specialize in providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses.